|

What is Technical Analysis |

| << BEYOND FUNDAMENTAL ANALYSIS |

| Indicators with Economic Justification >> |

Investment

Analysis & Portfolio Management

(FIN630)

VU

Lesson

# 8

TECHNICAL

ANALYSIS

Technical

analysis is entirely different from

the fundamental approach to "security

analysis".

Consider

the following quotations from

popular press articles on technical

analysis:

"Engage

a technical analyst in a conversation about his art,

and you soon feel

you're in the

shadowy

saloon from Star Wars, where

freakish aliens lounge about

speaking strange

languages."

"Spend

some time with a technical

analyst and you almost need

a Technical-to-English

translation

guide. Conversations art full of

references to support and resistance

levels, Fibonacci

retracements,

double bottoms and moving

averages."

Although

the technical approach to common stock

selection is the oldest approach (dating

back to

the

late 1800s), it remains controversial.

The techniques discussed in this

chapter appear at

first

glance

to have considerable merit, because

they seem intuitive plausible,

but they have

been

severely

challenged in the last three

decades by evidence supporting the

Efficient Market

Hypothesis.

Despite Burton Malkiel's (a well -

known proponent of efficient markets)

admission

that

"the market is not a perfect

random walk," the-extensive

evidence concerning the efficiency

of

the

market has challenged the

validity of technical analysis

and -the likelihood of its

success.

Those

learning about investments will in all

likelihood be exposed to technical

analysis,

because

numerous investors, investment / advisory firms,

and the popular press talk

about it and use

it.

Furthermore, it may produce

some insights into dimension

of the market. In fact, technical

analysis

is becoming increasingly interrelated

with behavioral finance, a

popular field of

study

today.

In effect, technical indicators are

being used to measure investor

emotions.

Even if this

approach is incorrect, many

investors act as if it were

correct. Therefore, the prudent

course

of action is to study this topic, or

indeed any other recommended

approach to making

investing

decisions, and try to make

an objective evaluation of its

validity and usefulness. At

the very

least,

an informed investor will be in a Better

position to understand what is

being said, or

claimed,

and

better able to judge the

validity of the

claims.

Although

technical analysis can be

applied to bonds, currencies

and commodities as well as

to

common

stocks, technical analysis typically

involves the aggregate stock

market, industry

sectors,

or

individual common stocks.

What

is Technical Analysis?

Technical

analysis can be defined as the use of

specific market-generated data for

the analysis of

both

aggregate stock prices

(market indices or industry

averages) and individual

stocks. Martin J.

Pring,

in his book Technical Analysis,

states:

"The

technical approach to investing is essentially a

reflection of the idea that prices move in

trends

which

are determined by the changing attitudes

of investors towards a variety of

economic,

monetary,

political and psychological forces.

The art of technical

analysis for it is an art is to

identify

trend

changes at an early stage and to

maintain an investment posture

until the weight of the

evidence

indicates

that the trend is

reversed."

Technical

analysis is sometimes called

market or internal analysis,

because it utilizes the record

of

the

market itself to attempt to

assess the demand for,

and supply of, shares of a

stock or the entire

59

Investment

Analysis & Portfolio Management

(FIN630)

VU

market.

Thus, technical analysts believe that

the market itself is its own

best source of data--as

they

say, "let the market tell

its own story." The theory

of technical analysis is that the

price

movement

of a security captures all

the information about that

security.

Economics

teaches us that prices are

determined by the interaction of demand

and. supply.

Technicians do

not disagree, but argue

that it is extremely difficult to

assess all the factors

that

influence

demand and supply. Since

not all investors are in

agreement on price, the

determining

factor at

any point in time is the net

demand (or lack thereof) for a

stock based on how

many

investors

are optimistic or pessimistic. Furthermore,

once the balance of investors

becomes

optimistic

(pessimistic), this mood is

likely to continue for the near

term and can be detected

by

various

technical indicators. As the chief market

technician of one New York

firm says, "All I

care

about

is how people feel about

those particular stocks as shown by

their putting money in and

taking

their

money out."

Technical

analysis is based on published market data as

opposed to fundamental data,

such as

earnings,

sales, growth rates, or government

regulations. Market data primarily

include the price of

a

stock or a market index and

volume data (number of shares

traded). Many technical

analysts

believe

that only such market data,

as opposed to fundamental data, are

relevant. For example, they

argue

that accounting data are

subject to all types of limitations

and ambiguities, an

argument.

Recall that in

fundamental analysis, the dividend

discount model and the

multiplier mode

produce

an

estimate of a stock's intrinsic

value, which is then

compared to the market

price.

Fundamentalists

believe that their data,

properly evaluated, can be

used to estimate the

intrinsic

value

of a stock. Technicians, on the other

hand, believe that it is

extremely difficult to

estimate

intrinsic

value and virtually

impossible to obtain and analyze good

information consistently. In

particular,

they are dubious about the

value to be derived from an

analysis of published financial

statements.

Instead, they focus on market data as an

indication of the forces of supply

and demand

for a

stock or the market.

Technicians

believe that the process by

which prices adjust to new

information is one of a

gradual

adjustment toward

a new (equilibrium) price. As the

stock adjusts from its old

equilibrium level to

its

new level, the price tends

to move in a trend. The central concern

is not why the change

is

taking

place, but rather the very

fact that it is taking place

at all. Technical analysts

believe that

stock

prices show identifiable trends

that can be exploited by investors.

They seek to identify

changes

in the direction of a stock and take a

position in the stock to take

advantage of the trend.

The

following points summarize

technical analysis:

1. Technical

analysis is based on published

market data and focuses on

internal factors by

analyzing

movements in the aggregate

market, industry average, or

stock. In contrast,

fundamental

analysis focuses on economic and

political factors, which are

external to

the

market itself.

2.

The focus of technical

analysis is on identifying changes in

the direction of stock

prices which

tend to

move in trends as the stock

price adjusts to a new

equilibrium level. These

trends

can

be analyzed, and changes in trends

detected, by studying the action of

price

movements

and trading volume across

time. The emphasis is on likely

price changes.

3.

Technicians, attempt to assess the

overall situation concerning stocks by

analyzing

technical

indicators, such as breadth of market

data, market sentiment, momentum,

and

other

indicators.

60

Investment

Analysis & Portfolio Management

(FIN630)

VU

Perhaps

the bottom line can be stated

as: Stock prices (either for

the market or individual

stocks)

tend to

move in trends, and these

trends take time to unfold.

Such trends can be spotted

by careful

analysis,

and acted upon by buying and

selling.

A

framework for Technical

Analysis:

Technical

analysis can be applied to

both an aggregate of prices

(the market as a whole or

industry

averages)

and individual stocks.

Technical analysis includes the use of

graphs (charts) and

technical

indicators.

Price

and volume are the primary

tools of the pure technical analyst, and the chart is

the most

important

mechanism for displaying

this information. Technicians believe

that the forces of

supply

and demand result in

particular patterns of price behavior,

the most important of which

is

the trend or

overall direction in price. Using a

chart, the technician hopes to identify

trends and

patterns

in stock prices that provide trading

signals.

Volume

data are used to gauge the

general in the market and to

help assess its trends. The

evidence

seems

to suggest that rising (falling)

stock prices are usually

associated with rising

(falling)

volume.

If stock prices rose but

volume activity did not keep

pace, technicians would be

skeptical

about

the upward trend. An upward surge on contracting

volume would be particularly

suspected.

A

downside movement from some

pattern or holding point

accompanied by heavy volume

would

be

taken as a bearish

sign.

We

first consider stock price

and volume technique, often

referred to as charting. However,

technical

analysis has evolved over

time, so that today it is much more

than the charting of

individual

stocks or the market. In particular Technical

indicators are used to

assess market

conditions

(breadth) and investors'

sentiments. It also includes "contrary

analysis" which is an

intellectual

process more than a

technique. The idea behind

contrary is go against the crowd

when

those

in the crowd start thinking

alike.

Charts

of Price Patterns:

To

assess individual stock-price movements, technicians

generally rely on charts or

graphs of

price

movements and on relative strength

analysis. The charting of

price patterns is one of

the

classic

technical analysis techniques. Technicians

believe that stock prices

move in trends, with

price

changes forming patterns

that can be recognized and

categorized. By visually assessing

the

forces

of supply and demand,

technicians hope to be able to predict

the likely direction of

future

movements.

The most basic measure of a

stock's direction is the trendline,

which simply shows

the direction the

stock is moving. If demand is

increasing more rapidly than

supply and the

stock

shows

successively higher low points, it is in

an uptrend. Consistently lower highs indicate

that

supply

is increasing more rapidly,

and the stock is in a downtrend.

Obviously, investors seek to

buy

in an

uptrend and sell on a downtrend.

Technicians

seek to identify certain

signals in a chart of stock prices,

and use certainly

terminology

to

describe the events. A

support level is the level

of price (or, more

correctly, a price range) at

which

a

technician expects a significant increase

in the demand for a stock.

In other words, a lower

bound

on

price where it is expected that buyers

will act, supporting the

price and preventing

additional price

declines.

A resistance level, on the other

hand, is the level of price

(range) at which a technician

expects

a

significant increase in the supply of a

stock. In other words, an

upper bound on price where

sellers are

expected

to act, providing a resistance to any

further rise in

price.

Support

levels tend to develop when

profit taking causes a

reversal in a stock's price

following an

increase;

investors who did not

purchase earlier are now

willing to buy at this

price, which becomes

a

61

Investment

Analysis & Portfolio Management

(FIN630)

VU

support

level. Resistance levels tend to

develop after a stock

declines from a higher level.

Investors are

waiting to

sell the stocks at a certain

recovery point. At certain price levels,

therefore, a significant

increase

in supply occurs, and the

price will encounter

resistance moving beyond this

level.

As

noted, a trendline is a line drawn on a

chart to identify a trend. If a

trend exhibits support

and

resistance

levels simultaneously that appear to be well

defined, the trend lines

are referred to as

channel

lines,

and price is said to move

between the upper channel

line and the lower channel

line.

Momentum

is

used to indicate the speed

with which prices are

changing, and a number of

measures

of momentum

exist, referred to as momentum

indicators. When a change in

direction occurs in a

short-term

trend, technicians say that a

reversal has occurred. A

correction occurs when the

reversal

involves

only a partial retracing of

the prior movement. Corrections

may be followed by periods

of

consolidations

with the initial trend

resuming following the

consolidation..

Technical

analysts rely primarily on

line charts, bar charts,

and point-and-figure charts,

although

other

types of charts are also

used, such as candlestick

charts.

Bar

Charts:

One

of the most popular charts

in technical analysis bar

charts, are plotted with

price on the vertical

axis

and

time on the horizontal axis.

Each day's price movements

is represented by a vertical bar

whose top

(bottom)

represents the high (low)

price for the

day.

(A

small, horizontal tick is

often used to design the

closing price for the

day). The bottom of a bar

chart

usually

shows the trading volume for

each day, permitting the

simulations observation of noth

price and

volume activity.

The Wall Street Journal

carries a bar chart of the

Dow Jones Averages each

day on the

page

with New York Stock

Exchange (NYSE)

quotations.

The

technician using charts will

search for patterns in the

chart that can be used to

predict future price

moves.

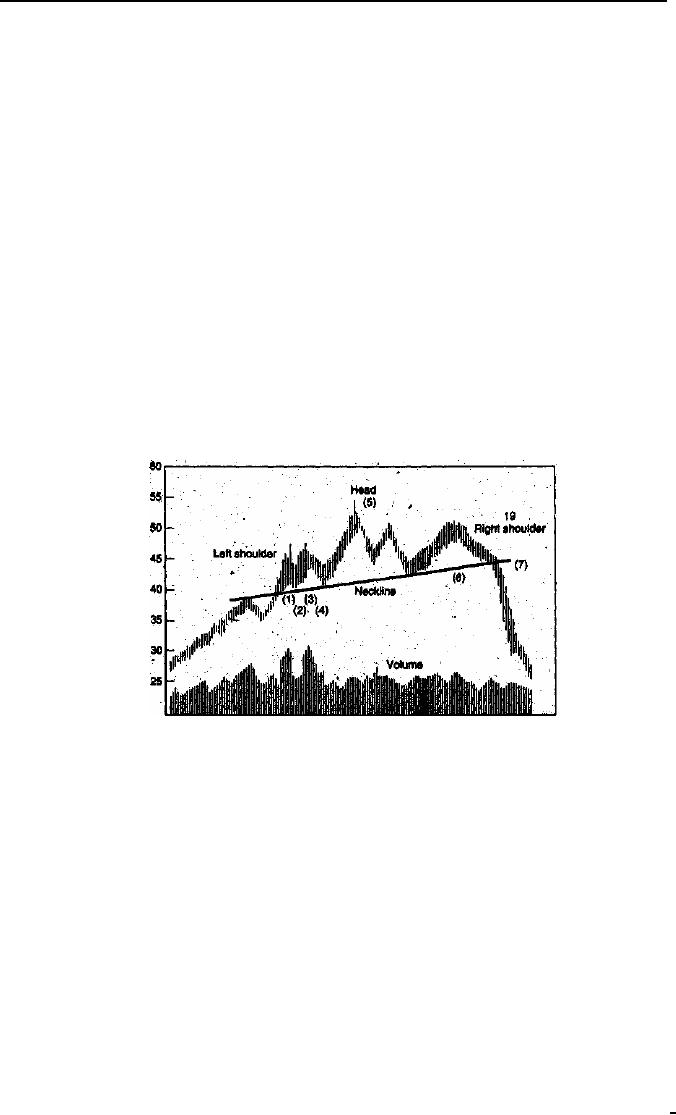

The strong uptrend occurring

over period of months. This

trend ended with a rally on

high

volume

that forms parts of the

left shoulder of a famous

chart pattern called a Head

and Shoulders

patterns.

The

left shoulder shows

initially strong demand followed by a

reaction on lower volume (2), and then

a

second

rally, with strong volume;

carrying prices still higher

(3). Profit taking again causes

prices to fall

to

the so-called neckline (4),

thus completes the left

shoulder. A rally occurs,

but this time on

low

volume,

and again prices sink

back to the neckline. This

is the head (5). The last

step is the formation

of

the

right shoulder, which occurs

with light volume (6). Growing

weakness can be identified as

the price

approaches

the neckline. As an be seen, a

downside breakout occurs on

heavy volume, which

technicians

consider to be sell

signal.

62

Investment

Analysis & Portfolio Management

(FIN630)

VU

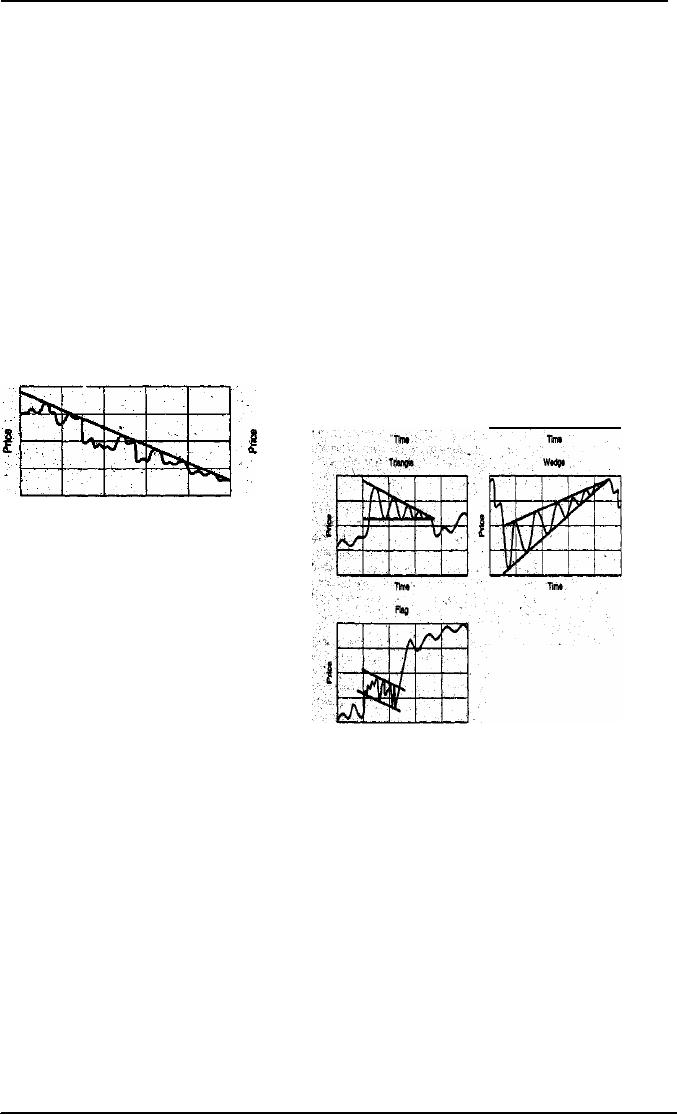

Technicians

have considered a very large

number of such patterns.

Some of the possible

patterns include

flags,

pennants, gaps (of more

than one type), triangles of

various types (e.g.,

symmetrical, ascending,

descending,

and inverted), the inverted

saucer or dome, the triple

op, the compound fulcrum,

the rising

(and

falling) wedge, the

broadening bottom, the

duplex horizontal. Rectangles,

and the inverted V.

Obviously,

numerous patterns are

possible and can usually be

found on a chart of stock

prices. It is also

obvious

that most, if not all, of

these patterns are much

easier to identify in hindsight

than at the time

they

are

actually occurring.

Point-and-Figure

Charts:

Technicians

also use point-and-figure charts,

types of charts are more

complex in that they show

only

significant price changes,

and volume is not shown at

all. The user determines

what a

significant

price change is and what

constitutes a price reversal {$2, $3, $4, and so

forth).

Although

the horizontal axis still

depicts time, specific calendar time is

not particularly

important

with the passage of time is basically

ignored. (Some chartists do show the

month in

which

changes occur.)

These

are the most important

price patterns for investors

who want to temper their

hunches

and

the timing of their buy and

sell decisions with solid

empirical data.

An X is

typically used to show upward movements,

whereas an O is used for

downward

movements.

Each X or O on a particular chart

may represent Rs. 1 movements,

Rs. 2

movements,

Rs. 5 movements, and so on,

depending on how much movement is

considered

significant

for that stock. An X or O is recorded

only when the price

moves by the specified amount.

Moving

Average:

A Moving

Average is a

smoothed presentation of underlying

historical data. Each

data

point

is the arithmetic average of a

portion of the previous

data. A ten-day moving

average

measures

the average over the

previous ten days.

Regardless of the time

period used, each

day a

new observation is included in

the calculation and the

oldest is dropped, so a constant

number

of points are always being

averaged.

63

Investment

Analysis & Portfolio Management

(FIN630)

VU

Advocates

of moving average in the

stock selection believe that

changes in the slope of

the

line

are important. A stock whose

twenty-day moving average

has been trending up

might

become

a candidate for sale if the

line turns downward.

64

Table of Contents:

- INTRODUCTION OF INVESTMENT

- THE ROLE OF THE CAPITAL MARKETS

- THE NASDAQ STOCK MARKET

- Blue Chip Stocks, Income Stock, Cyclical Stocks, Defensive Stocks

- MARKET MECHANICS

- FUNDAMENTAL STOCK ANALYSIS

- BEYOND FUNDAMENTAL ANALYSIS

- What is Technical Analysis

- Indicators with Economic Justification

- Dow Theory

- VALUATION PHILOSOPHIES

- Ratio Analysis

- INVESTMENT RATIOS

- Bottom-Up, Top-Down Approach to Fundamental Analysis

- The Industry Life Cycle

- COMPANY ANALYSIS

- Analyzing a Company’s Profitability

- Objective of Financial Statements

- RESEARCH PHILOSPHY

- What Is An Investment Company

- Exchange-Traded Funds (ETFs)

- COMMON STOCK: ANALYSIS AND STRATEGY

- THE EFFICIENT MARKET HYPOTHESIS (EMH)

- Behavioral Finance

- MARKET INDEXES

- POPULAR INDEXES

- BOND PRINCIPLES

- BOND PRICING AND RETURNS

- Accrued Interest

- BOND RISKS

- UNDERSTANDING RISK AND RETURN

- TYPES & SOURCES OF RISK

- Measuring Risk

- ANALYZING PORTFOLIO RISK

- Building a Portfolio Using Markowitz Principles

- Capital Market Theory: Assumptions, The Separation Theorem

- Risk-Free Asset, Estimating the SML

- Formulate an Appropriate Investment Policy

- EVALUATION OF INVESTMENT PERFORMANCE

- THE ROLE OF DERIVATIVE ASSETS

- THE FUTURES MARKET

- Using Futures Contracts: Hedgers

- Financial Futures: Short Hedges, Long Hedges

- Risk Management, Risk Transfer, Financial Leverage

- OVERVIEW