|

types of vouchers, Carrying forward the balance of an account |

| << THE ACCOUNTING EQUATION |

| ILLUSTRATIONS: Ccarrying Forward of Balances >> |

Financial

Accounting (Mgt-101)

VU

Lesson-13

LEARNING

OBJECTIVE

After

studying this lecture, you should be able

to:

· Understand

different types of

vouchers.

· How

to book entry in voucher.

· Carrying

forward the balance of an

account.

VOUCHER

In

book keeping, voucher is the first

document to record an entry. Normally three

types of vouchers are

used.

i-e.:

· Receipt

voucher

· Payment

voucher

· Journal

voucher

RECEIPT

VOUCHER

Receipt

voucher is used to record cash or bank

receipt. Receipt vouchers

are of two types.

i-e.

· Cash

receipt voucher

· Bank

receipt voucher

Cash

receipt voucher denotes receipt of

cash; bank receipt voucher indicates

receipt of cheque or

demand

draft.

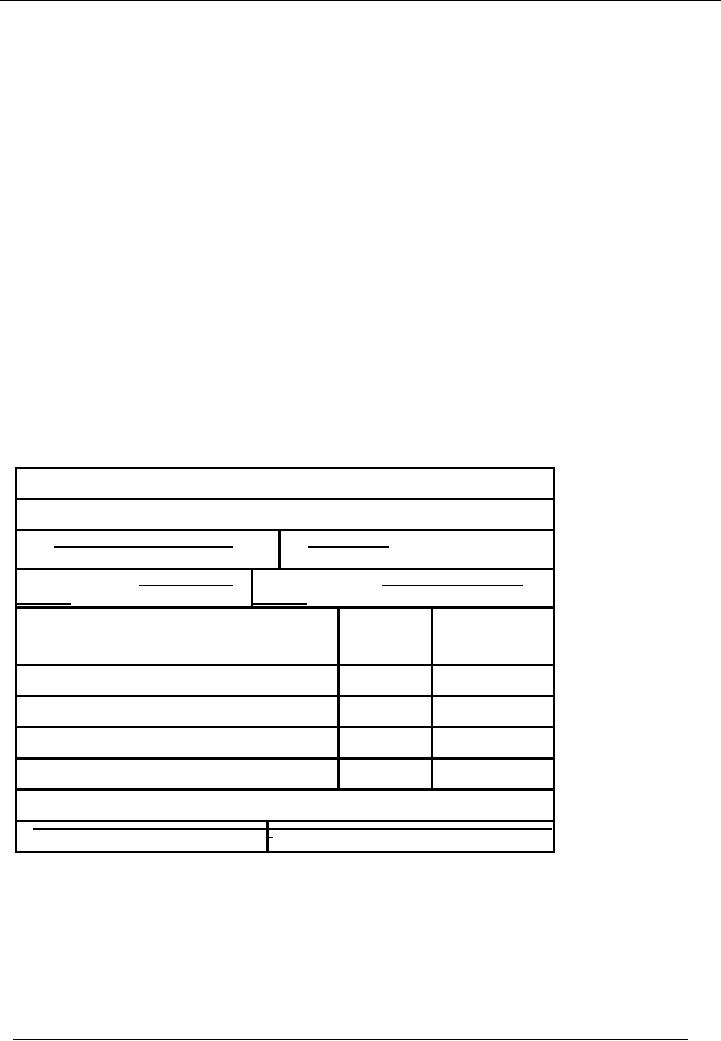

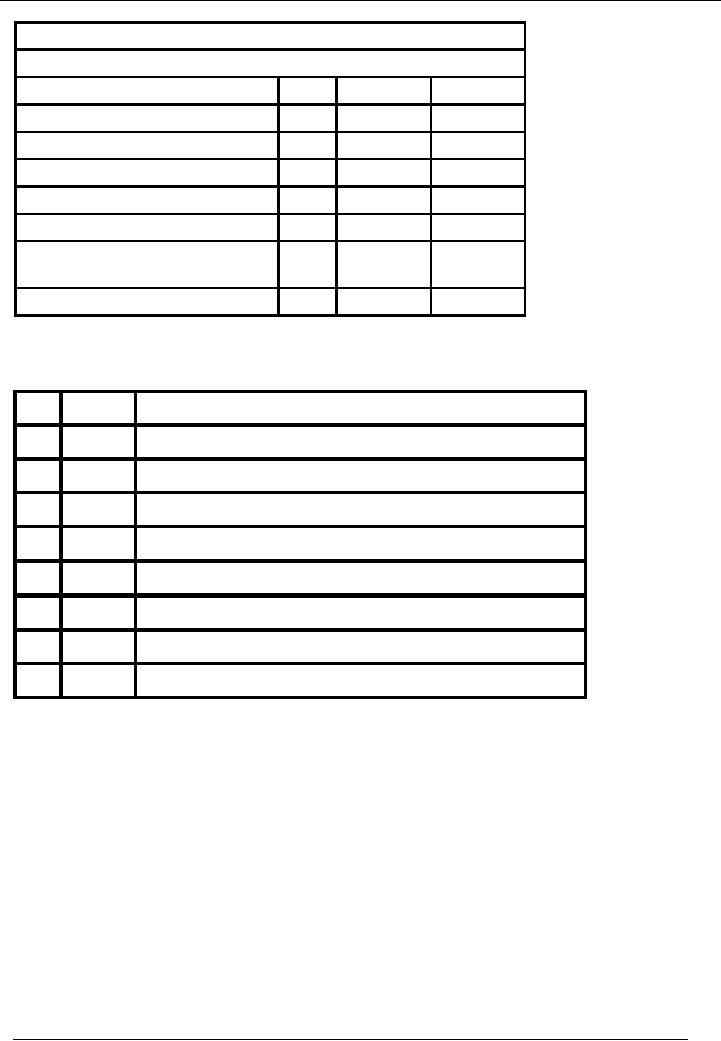

Standard format of cash

receipt voucher is given below:

Name of the

Organization

Bank

Receipt / Cash Receipt OR

Receipt

Voucher

Date:

No:

Description

/ Title:

Cash /

Bank code:

Description

/

Code

Credit

Title

of Account

#

Amount

Total:

Narration:

Prepared

By:

Checked

By:

94

Financial

Accounting (Mgt-101)

VU

PAYMENT

VOUCHER

Payment

voucher is used to record a payment of

cash or cheque. Payment

vouchers are of two types.

i.e.

· Cash

Payment voucher

· Bank

Payment voucher

Cash

Payment voucher denotes Payment of

cash, bank Payment voucher indicates

payment by cheque or

demand

draft. Standard format of

cash Payment voucher is given

below:

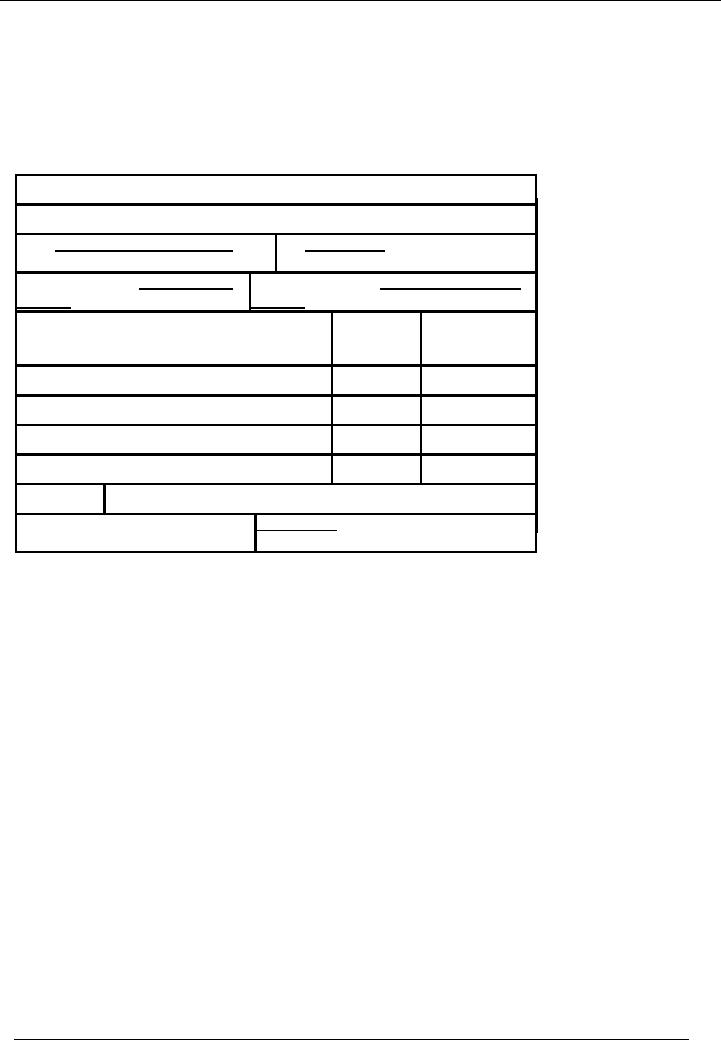

Name of the

Organization

Bank

Payment / Cash Payment OR

Payment

Voucher

No:

Date:

Description

/ Title:

Cash /

Bank code:

Description

/

Code

Credit

Title

of Account

#

Amount

Total:

Naration

Prepared

By:

Checked

By:

95

Financial

Accounting (Mgt-101)

VU

JOURNAL

VOUCHER

Journal

voucher is used to record transactions

that do not affect cash or bank.

Standard format of

journal

voucher is given

hereunder:

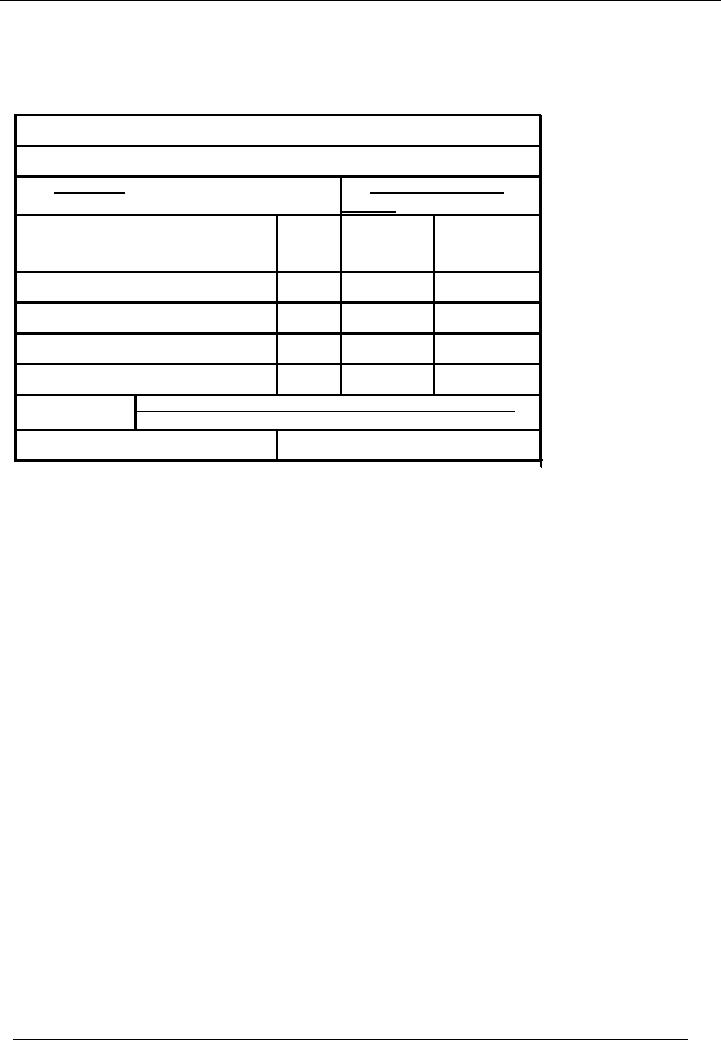

Name Of

Organization

Journal

Voucher

Date:

No:

Description

Code

Debit

Credit

Amount

#

Amount

Total:

Narration:

Prepared

By:

Checked

by:

HOW TO

CARRY FORWARD A

BALANCE

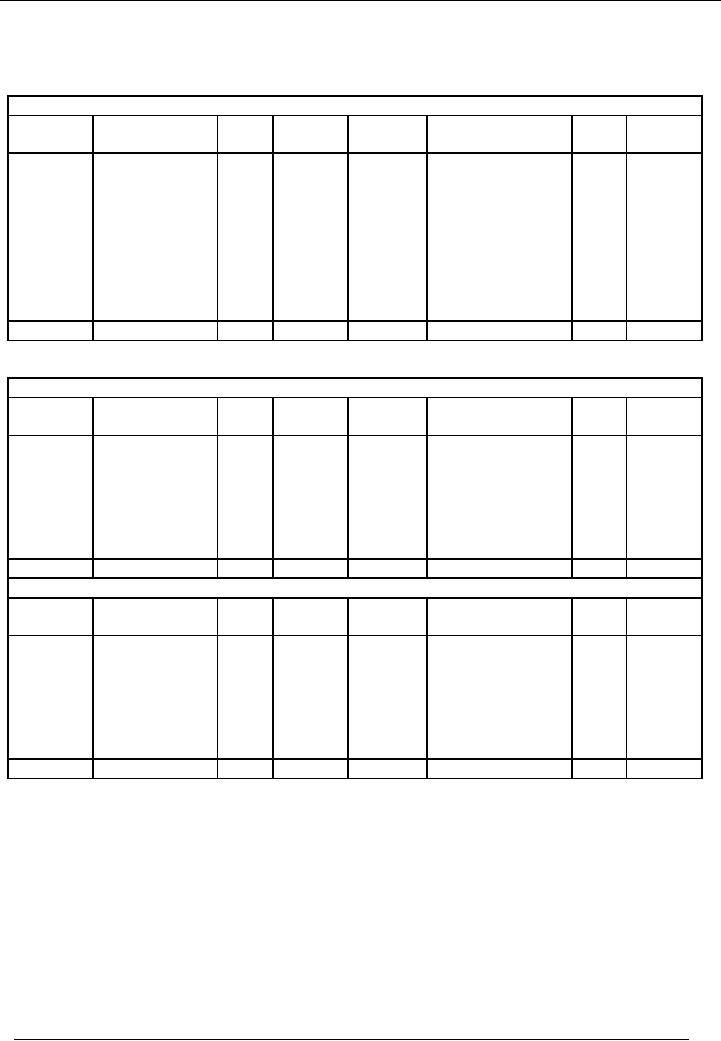

It is

already mentioned that in `T'

account, at the end of accounting

period, if one side is

greater than the

other

side, balancing figure will

be written on the lesser side as

balance. For instance, if amount on

debit side

is

greater than the amount on credit side,

the balancing figure is written on the

credit side as balance & it is

known

as Debit

Balance. On the

other hand, if amount on the credit side

is greater than that of amount

on

the

debit side, the balance is

shown on the debit side. It is

called the Credit

Balance.

At the

start of next accounting

period, these balances are

carried forward. Debit

balance is written on the

credit

side, but it is the excess of

debit side over the credit

side, when it is carried

forward, it is written on the

debit

side. For example, ledger

account of cash is given below:

96

Financial

Accounting (Mgt-101)

VU

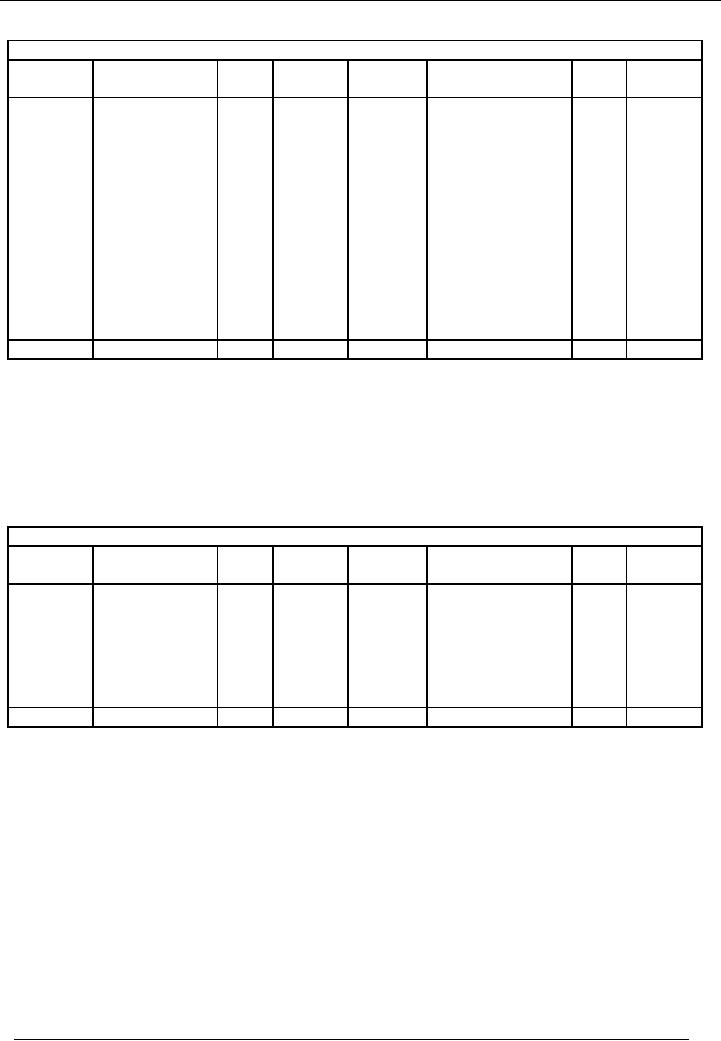

Cash

Account

Account

code # 1

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

1-3-02

Commenced

02

150,000

5-3-02

Office

furniture

03

2,000

business

purchased

13-3-02

Goods

sold

07

12,000

7-3-02

Goods

purchased

04

9,000

250

21-3-02

Received

from

10-3-02

Carriage

paid

05

7,000

debtors

08

25,000

21-3-02

Paid

to creditors

06

2,500

23-3-02

Paid

salaries

09

3,000

25-3-02

Paid

rent

10

29-3-02

Paid

for stationery

11

2,000

BALANCE

161,250

Total

187,000

Total

187,000

This

cash account is showing the

balance of Rs. 161,250 on the credit

side. This balance is excess

of debit

side

over the credit side and, therefore, is

called the debit

balance. When

it is carried

forward it is

written

on the

debit side because debit

side of the cash account is

greater & Rs. 161,250 is the

balancing amount of

the

debit side of cash account.

So, it is an asset & it will be

used for further expenses in

the forth coming

period.

This

is another example of accrued

expenses:

Accrued

Expenses Account

Account

code # 13

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

31-3-02

Accrued

utility

12

5,000

bills

BALANCE

5,000

Total

5,000

Total

5,000

In this

account, balance is written on the

debit side & it is called the credit

balance. As this balance

represents

excess of credit side over

debit side, when it is carried

forward it is

again written on the credit

side.

It can

also be explained like

this:

· Debit

balance when carried forward, is written

on the debit side

· Credit

balance when carried forward, is written

on the credit

side

This

is further explained with the help of the

following solved

illustration:

ILLUSTRATION

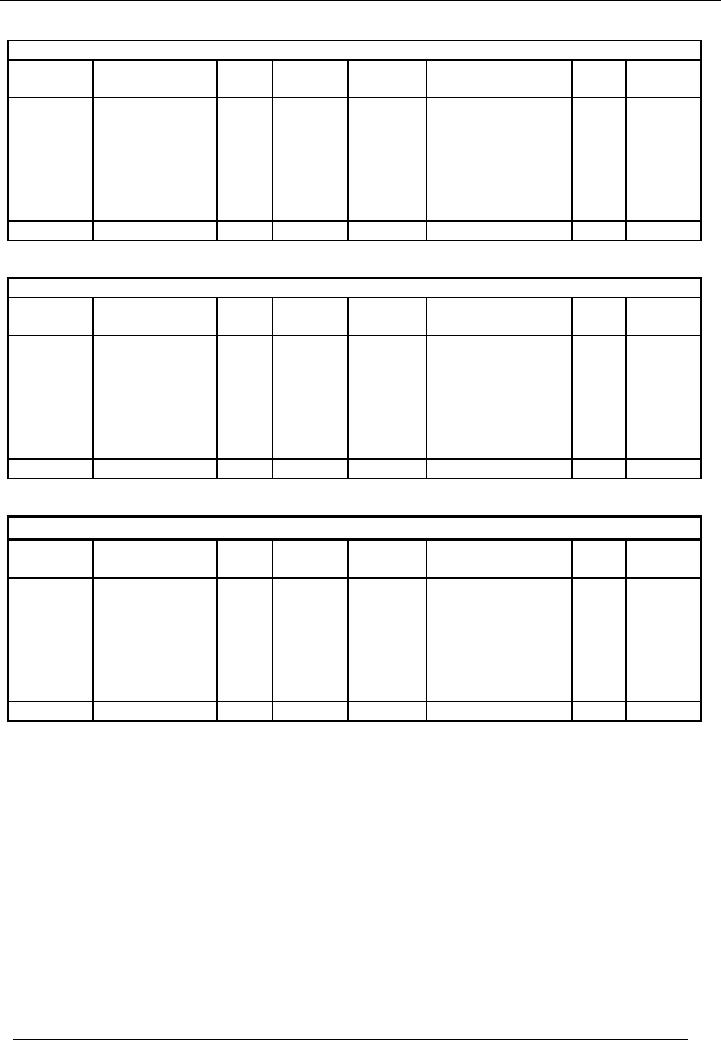

Following

is the trial balance of Saeed &

sons for the month ended

January 31, 2002

97

Financial

Accounting (Mgt-101)

VU

Saeed

& Sons.

Trial

Balance As On ( January 31,

2002)

Title

of Account

Code

Dr.

Rs.

Cr.

Rs.

Cash

Account

01

55,000

Accrued

expense Account

02

10,000

Bank

Account

03

25,000

Loan

Account

04

100,000

Furniture

Account

05

20,000

Office

Equipment

06

10,000

Total

110,000

110,000

In the

month of February, following

transactions took

place:

No.

Date

Particulars

01

Feb

07

They

purchased stationery worth of Rs.

5,000

02

Feb

10

They paid

their first installment of loan Rs.

10,000

03

Feb

12

They

received a cheque from a

customer of Rs. 5,000

04

Feb

17

Accrued

expenses of Rs. 5,000 are

paid.

05

Feb

20

They

purchased furniture of Rs.

1,000

06

Feb

23

Office

equipment of Rs. 2,000 is

sold

07

Feb

25

Staff

salaries are paid by cheque

Rs. 10,000

08

Feb

28

Sold

goods for cash

Rs.2,000

98

Financial

Accounting (Mgt-101)

VU

SOLUTION

The

ledger accounts of Saeed &

Sons will bear the following

changes:

Cash

Account

Account

code # 1

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

1-2-02

Balance

c/f

55,000

7-2-02

Stationery

10

5,000

23-2-02

Sold

office

06

2,000

purchased

equipment

10-2-02

Loan

paid

04

10,000

28-2-02

Sold

goods

01

2,000

17-2-02

Accrued

expenses

02

paid

5,000

Furniture

05

purchased

1,000

Balance

c/d

38,000

Total

59,000

Total

59,000

Accrued

Expenses

Account

code # 2

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

17-2-02

Accrued

01

5,000

1-1-02

Balance

c/f

10,000

expenses

paid

Balance

c/d

5,000

Total

10,000

Total

10,000

Bank

Account

Account

code # 3

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

17-2-02

Balance

c/f

01

25,000

25-2-02

Salaries

paid

10,000

12-2-02

Cheque

received

07

5,000

Balance

c/d

20,000

Total

30,000

Total

30,000

99

Financial

Accounting (Mgt-101)

VU

Loan

Account

Account

code # 4

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

10-2-02

Installment

paid

01

10,000

Balance

c/f

100,000

Balance

c/d

90,000

Total

100,000

Total

100,000

Furniture

Account

Account

code # 5

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

10-2-02

Balance

c/f

20,000

23-2-02

20-2-02

Furniture

01

1,000

purchased

Balance

c/d

21,000

Total

21,000

Total

21,000

Office

Equipment Account

Account

code # 6

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

10-2-02

Balance

c/f

10,000

Office

Equipment

01

2,000

sold

Balance

c/d

8,000

Total

10,000

Total

10,000

Balance

c/f is balance carried forward &

balance c/d is balance Carried

down.

100

Table of Contents:

- Introduction to Financial Accounting

- Basic Concepts of Business: capital, profit, budget

- Cash Accounting and Accrual Accounting

- Business entity, Single and double entry book-keeping, Debit and Credit

- Rules of Debit and Credit for Assets, Liabilities, Income and Expenses

- flow of transactions, books of accounts, General Ledger balance

- Cash book and bank book, Accounting Period, Trial Balance and its limitations

- Profit & Loss account from trial balance, Receipt & Payment, Income & Expenditure and Profit & Loss account

- Assets and Liabilities, Balance Sheet from trial balance

- Sample Transactions of a Company

- Sample Accounts of a Company

- THE ACCOUNTING EQUATION

- types of vouchers, Carrying forward the balance of an account

- ILLUSTRATIONS: Ccarrying Forward of Balances

- Opening Stock, Closing Stock

- COST OF GOODS SOLD STATEMENT

- DEPRECIATION

- GROUPINGS OF FIXED ASSETS

- CAPITAL WORK IN PROGRESS 1

- CAPITAL WORK IN PROGRESS 2

- REVALUATION OF FIXED ASSETS

- Banking transactions, Bank reconciliation statements

- RECAP

- Accounting Examples with Solutions

- RECORDING OF PROVISION FOR BAD DEBTS

- SUBSIDIARY BOOKS

- A PERSON IS BOTH DEBTOR AND CREDITOR

- RECTIFICATION OF ERROR

- STANDARD FORMAT OF PROFIT & LOSS ACCOUNT

- STANDARD FORMAT OF BALANCE SHEET

- DIFFERENT BUSINESS ENTITIES: Commercial, Non-commercial organizations

- SOLE PROPRIETORSHIP

- Financial Statements Of Manufacturing Concern

- Financial Statements of Partnership firms

- INTEREST ON CAPITAL AND DRAWINGS

- DISADVANTAGES OF A PARTNERSHIP FIRM

- SHARE CAPITAL

- STATEMENT OF CHANGES IN EQUITY

- Financial Statements of Limited Companies

- Financial Statements of Limited Companies

- CASH FLOW STATEMENT 1

- CASH FLOW STATEMENT 2

- FINANCIAL STATEMENTS OF LISTED, QUOTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES