|

THE DATA OF MACROECONOMICS (Continued…):How to construct the CPI |

| << THE DATA OF MACROECONOMICS (Continued…):Components of Expenditures |

| NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES >> |

Macroeconomics

ECO 403

VU

LESSON

06

THE DATA OF

MACROECONOMICS (Continued...)

Other

Measures of Income

Net

National Product (NNP) =

·

GNP

Depreciation

National

Income (NI) =

·

NNP

Indirect Business

Taxes

Personal

Income (PI) =

·

NI

Corporate Profits

Social Insurance

Contributions

Net Interest

+

Dividends

+

Govt. Transfers to

Individuals

+

Personal Interest

Income

Disposable

Personal Income (DPI) =

·

PI

- Tax

CONSUMER

PRICE INDEX (CPI)

A

measure of the overall level

of prices

·

Published

by the Federal Bureau

of Statistics

·

Used

to

·

·

track

changes in the

typical

household's cost of

living

·

adjust

many contracts for

inflation

(i.e.

"COLAs":

Cost of Living

Adjustments)

·

allow

comparisons of dollar figures

from different years

How

to construct the

CPI

1.

Survey consumers to determine

composition of the typical

consumer's "basket" of

goods.

2.

Every month, collect data on

prices of all items in the

basket; compute cost of

basket

3.

CPI in any month

equals

Cost

of basket in that month

100

×

Cost

of basket in base

period

CPI:

an example

The

basket contains 20 pizzas

and 10 compact discs.

Prices:

Pizza

CDs

2000

$10

$15

2001

$11

$15

2002

$12

$16

2003

$13

$15

16

Macroeconomics

ECO 403

VU

For

each year, compute

·

the

cost of the basket

·

the

CPI (use 2000 as the

base year)

·

the

inflation rate from the

preceding year

Cost

of

inflation

basket

CPI

rate

2000

$350

100.0

N.A.

2001

370

105.7

5.7%

2002

400

114.3

8.1%

2003

410

117.1

2.5%

Understanding

the CPI

Example

with 3 goods

For

good i = 1, 2, 3

Ci

= the amount of good i in

the CPI's basket

Pit

= the price of good i in

month t

Et

= the cost of the CPI

basket in month t

Eb

= cost of the basket in the

base period

Et

CPI

in month t =

100

×

Eb

P1tC1 +

P2tC2 + P3tC3

=

100

×

Eb

⎡⎛

C1 ⎞

⎛

C3 ⎞

⎤

⎛

C2 ⎞

=

100

× ⎢⎜

⎟ P1t +

⎜ ⎟ P2t +

⎜ ⎟ P3t ⎥

⎢⎝

Eb ⎠

⎝

Eb ⎠

⎝

Eb ⎠

⎥

⎣

⎦

The

CPI is a weighted average of

prices.

The

weight on each price

reflects that good's

relative importance in the

CPI's basket.

Note

that the weights remain

fixed over time.

Reasons

why the CPI may overstate

inflation

Substitution

bias: The

CPI uses fixed

weights,

·

so

it cannot reflect consumers'

ability to substitute toward

goods whose relative

prices

have

fallen.

CPI

uses fixed weights.

Introduction

of new goods: The

introduction of new goods

makes consumers

better

·

off

and, in effect, increases

the real value of the

dollar. But it does not

reduce the CPI,

because

the CPI uses fixed

weights.

Unmeasured

changes in quality: Quality

improvements increase the

value of the

·

dollar,

but are often not

fully measured.

CPI

vs. GDP deflator

prices

of capital goods

·

included

in GDP deflator (if produced

domestically)

·

excluded

from CPI

prices

of imported consumer

goods

·

included

in CPI

·

excluded

from GDP deflator

the

basket of goods

17

Macroeconomics

ECO 403

VU

CPI:

fixed

·

GDP

deflator: changes every

year

·

CATEGORIES

OF THE POPULATION

Employed

·

working

at a paid job

Unemployed

·

not

employed but looking for a

job

Labor

force

·

the

amount of labor available

for producing goods and

services; all employed

plus

unemployed

persons

Not

in the labor

force

·

not

employed, not looking for

work.

Two

important labor force

concepts

unemployment

rate

·

percentage

of the labor force that is

unemployed

Unemployment

Rate = Number of Unemployed x

100

Labor

Force

labor

force participation

rate

·

the

fraction of the adult

population that `participates' in

the labor force

Labor-Force

Participation Rate =

Labor

Force x 100

Adult

Population

Suppose

·

the

population increases by 1%

·

the

labor force increases by

3%

·

the

number of unemployed persons

increases by 2%

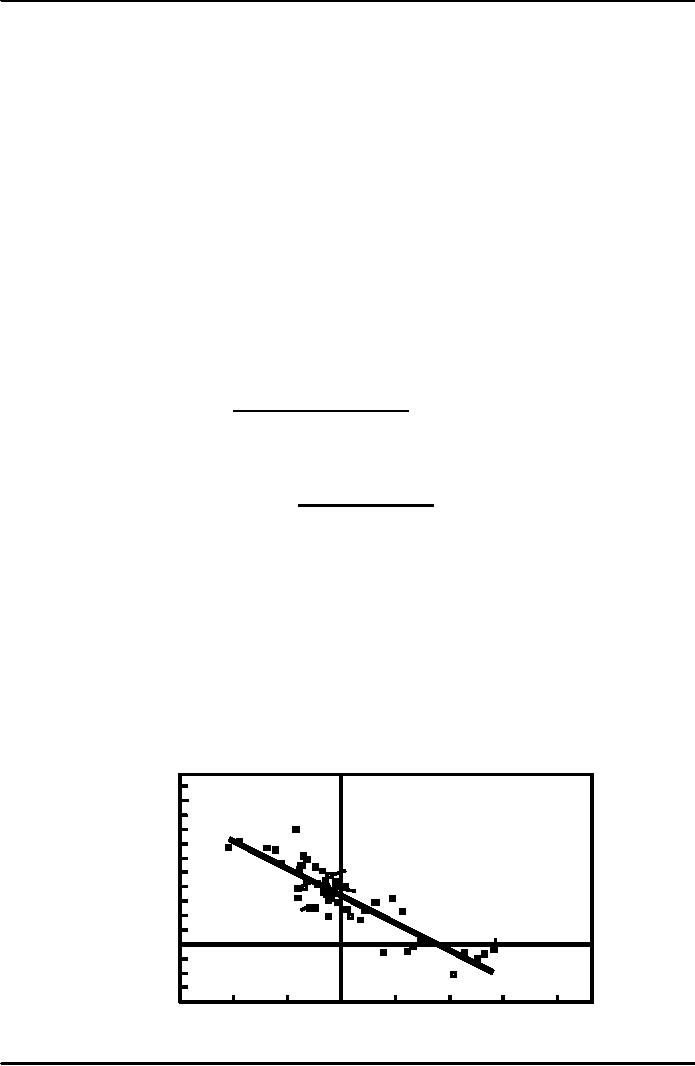

Okun's

Law

·

One

would expect a negative

relationship between unemployment

and real GDP.

·

This

relationship is clear in the

data...

Percentage

Change in Real GDP = 3% - 2 *

(change in the Unemployment

rate)

Okun's

Law states

that a

one-percent

decrease in

unemployment

is

Percentage

associated

with two

change

in

percentage

points of

real

GDP

additional

growth in real

10

GDP

8

1951

1984

6

2000

4

1999

2

1993

1975

0

-

1982

0

1

2

3

4

-

-

-

Change

in

unemployment

rate

18

Table of Contents:

- INTRODUCTION:COURSE DESCRIPTION, TEN PRINCIPLES OF ECONOMICS

- PRINCIPLE OF MACROECONOMICS:People Face Tradeoffs

- IMPORTANCE OF MACROECONOMICS:Interest rates and rental payments

- THE DATA OF MACROECONOMICS:Rules for computing GDP

- THE DATA OF MACROECONOMICS (Continued…):Components of Expenditures

- THE DATA OF MACROECONOMICS (Continued…):How to construct the CPI

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- MONEY AND INFLATION:The Quantity Equation, Inflation and interest rates

- MONEY AND INFLATION (Continued…):Money demand and the nominal interest rate

- MONEY AND INFLATION (Continued…):Costs of expected inflation:

- MONEY AND INFLATION (Continued…):The Classical Dichotomy

- OPEN ECONOMY:Three experiments, The nominal exchange rate

- OPEN ECONOMY (Continued…):The Determinants of the Nominal Exchange Rate

- OPEN ECONOMY (Continued…):A first model of the natural rate

- ISSUES IN UNEMPLOYMENT:Public Policy and Job Search

- ECONOMIC GROWTH:THE SOLOW MODEL, Saving and investment

- ECONOMIC GROWTH (Continued…):The Steady State

- ECONOMIC GROWTH (Continued…):The Golden Rule Capital Stock

- ECONOMIC GROWTH (Continued…):The Golden Rule, Policies to promote growth

- ECONOMIC GROWTH (Continued…):Possible problems with industrial policy

- AGGREGATE DEMAND AND AGGREGATE SUPPLY:When prices are sticky

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND IN THE OPEN ECONOMY:Lessons about fiscal policy

- AGGREGATE DEMAND IN THE OPEN ECONOMY(Continued…):Fixed exchange rates

- AGGREGATE DEMAND IN THE OPEN ECONOMY (Continued…):Why income might not rise

- AGGREGATE SUPPLY:The sticky-price model

- AGGREGATE SUPPLY (Continued…):Deriving the Phillips Curve from SRAS

- GOVERNMENT DEBT:Permanent Debt, Floating Debt, Unfunded Debts

- GOVERNMENT DEBT (Continued…):Starting with too little capital,

- CONSUMPTION:Secular Stagnation and Simon Kuznets

- CONSUMPTION (Continued…):Consumer Preferences, Constraints on Borrowings

- CONSUMPTION (Continued…):The Life-cycle Consumption Function

- INVESTMENT:The Rental Price of Capital, The Cost of Capital

- INVESTMENT (Continued…):The Determinants of Investment

- INVESTMENT (Continued…):Financing Constraints, Residential Investment

- INVESTMENT (Continued…):Inventories and the Real Interest Rate

- MONEY:Money Supply, Fractional Reserve Banking,

- MONEY (Continued…):Three Instruments of Money Supply, Money Demand