|

The Aggregate Demand For Wheat:NETWORK EXTERNALITIES |

| << Income & Substitution Effects:Determining the Market Demand Curve |

| Describing Risk:Unequal Probability Outcomes >> |

Microeconomics

ECO402

VU

Lesson

12

The

Aggregate Demand For

Wheat

The

demand for U.S. wheat is

comprised of domestic demand

and export demand.

The

domestic demand for wheat is

given by the equation:

QDD = 1700 -

107P

The

export demand for wheat is

given by the equation:

QDE = 1544 -

176P

Domestic

demand is relatively price

inelastic (-0.2), while

export demand is more price

elastic

(-0.4).

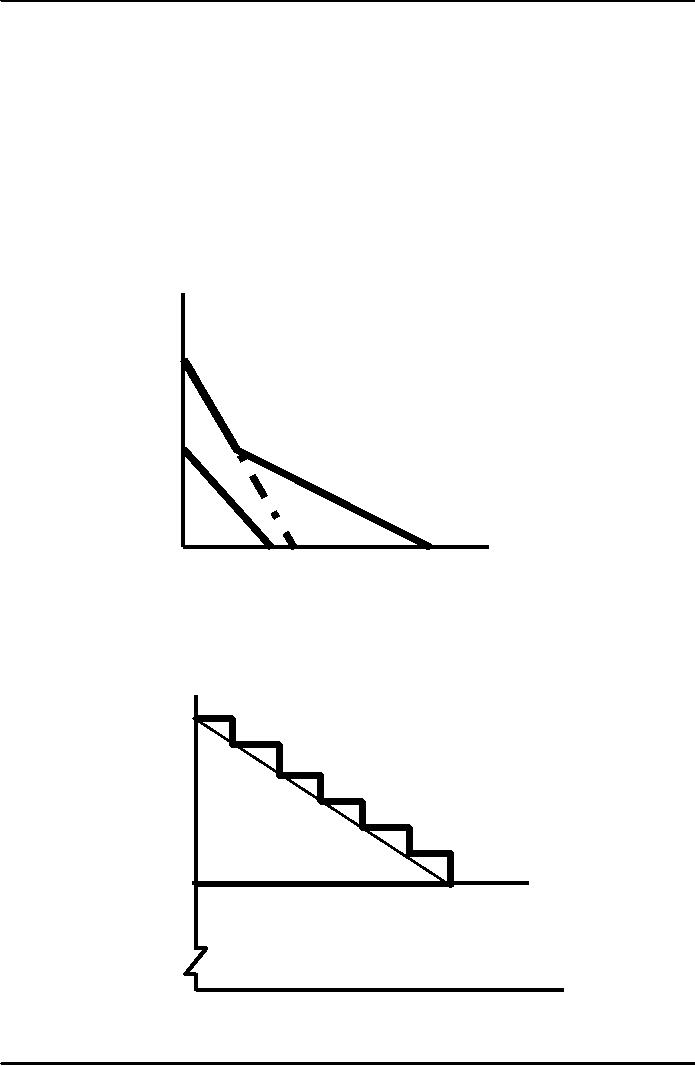

Price

($/bushel)

20

18

Total

world demand is

16

A

the

horizontal sum of the

domestic

demand AB

and

14

export

demand CD.

12

10

C

E

8

Total

Demand

6

4

Export

Demand

Domestic

Demand

2

Wheat(millio

F

D

B

n

bushels/yr.)

0

1000

2000

3000

4000

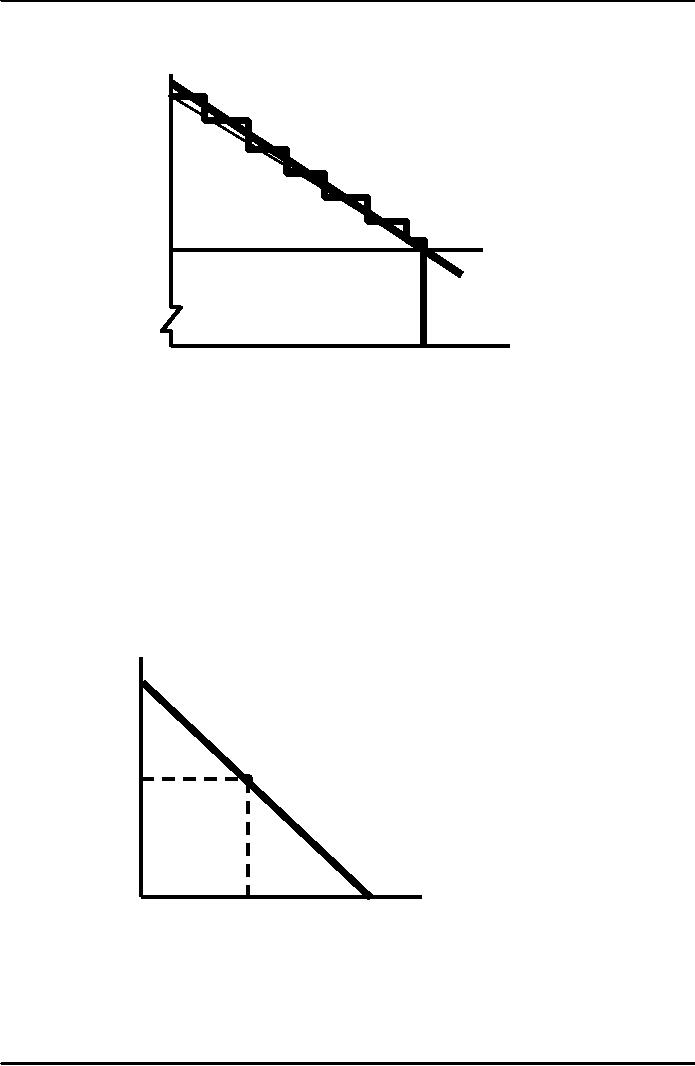

Consumer

Surplus

Consumer

Surplus

The difference

between the maximum amount a

consumer is willing to pay

for a good

and

the amount actually

paid.

Price

The

consumer surplus

($

per

20

of

purchasing 6 concert

ticket)

tickets

is the sum of the

19

surplus

derived from

each

one individually.

18

17

16

Consumer

Surplus

15

6

+ 5 + 4 +3

+

2 + 1 = 21

Market

Price

14

13

Rock

Concert Tickets

0

1

2

3

4

5

6

58

Microeconomics

ECO402

VU

The

stepladder demand curve can

be converted into a straight-line

demand curve by

making

the

units of the good

smaller.

Price

20

Consumer

Surplus

($

per

for

the Market Demand

ticket)

19

18

17

16

Consumer

Surplus

15

1/2x(20- 14)x6,500= $19,500

14

Market

13

Demand

Actual

Expenditur

0

Rocket

concert tickets

1

2

3

4

5

6

Combining

consumer surplus with the

aggregate profits that

producers obtain we can

evaluate:

1)

Costs and benefits of

different market

structures

2)

Public policies that alter

the behavior of consumers

and firms

An

Example: The Value of Clean

Air

Air

is free in the sense that we

don't pay to breathe

it.

Question:

Are the benefits of cleaning

up the air worth the

costs?

People

pay more to buy houses

where the air is

clean.

Data

for house prices among

neighborhoods of Lahore and

Rawalpindi were compared

with

the

various air

pollutants.

The

shaded area gives

the

2000

consumer

surplus generated

($Value

when

air pollution is

per

puma

reduced

by 5 parts per 100

of

reduction)

million

of nitrous oxide at

a

cost of $1000 per

part

reduced.

A

1000

NOX

(pphm)

Pollution

0

10

5

Reduction

59

Microeconomics

ECO402

VU

NETWORK

EXTERNALITIES

Up

to this point we have

assumed that people's

demands for a good are

independent of one

another.

If

fact, a person's demand may

be affected by the number of

other people who

have

purchased

the good.

If

this is the case, a network

externality exists.

Network

externalities can be positive or

negative.

A

positive

network externality exists if

the quantity of a good

demanded by a consumer

increases

in response to an increase in purchases

by other consumers.

Negative

network externalities are

just the opposite.

The

Bandwagon Effect

This is the

desire to be in style, to have a

good because almost everyone

else

has

it, or to indulge in a

fad.

This is the

major objective of marketing

and advertising campaigns

(e.g. toys,

clothing).

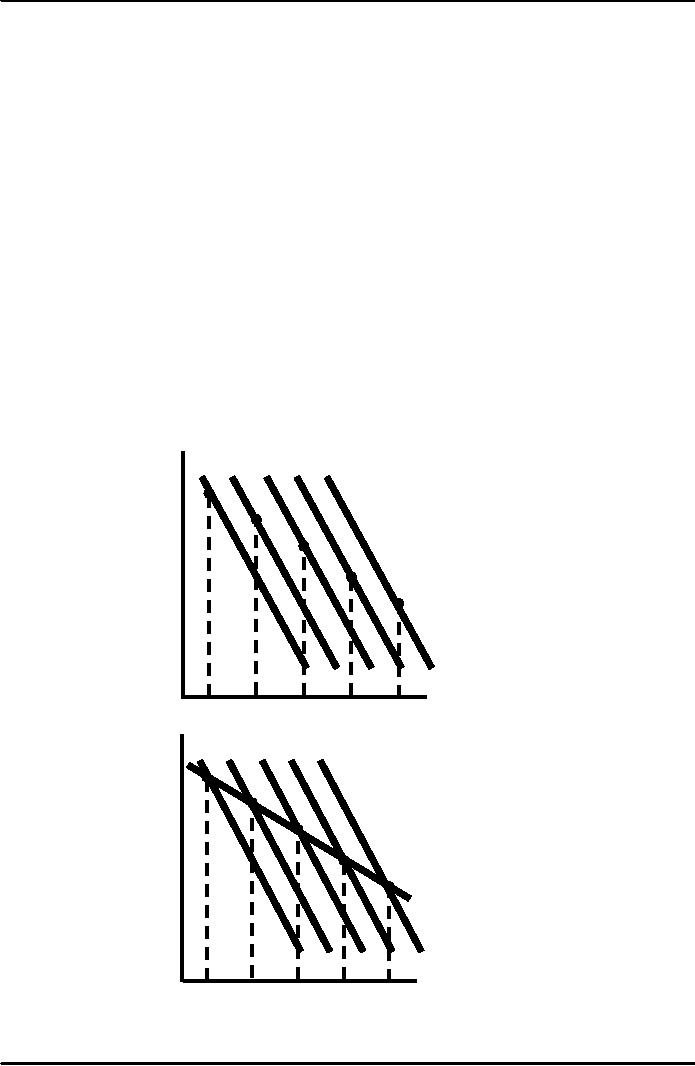

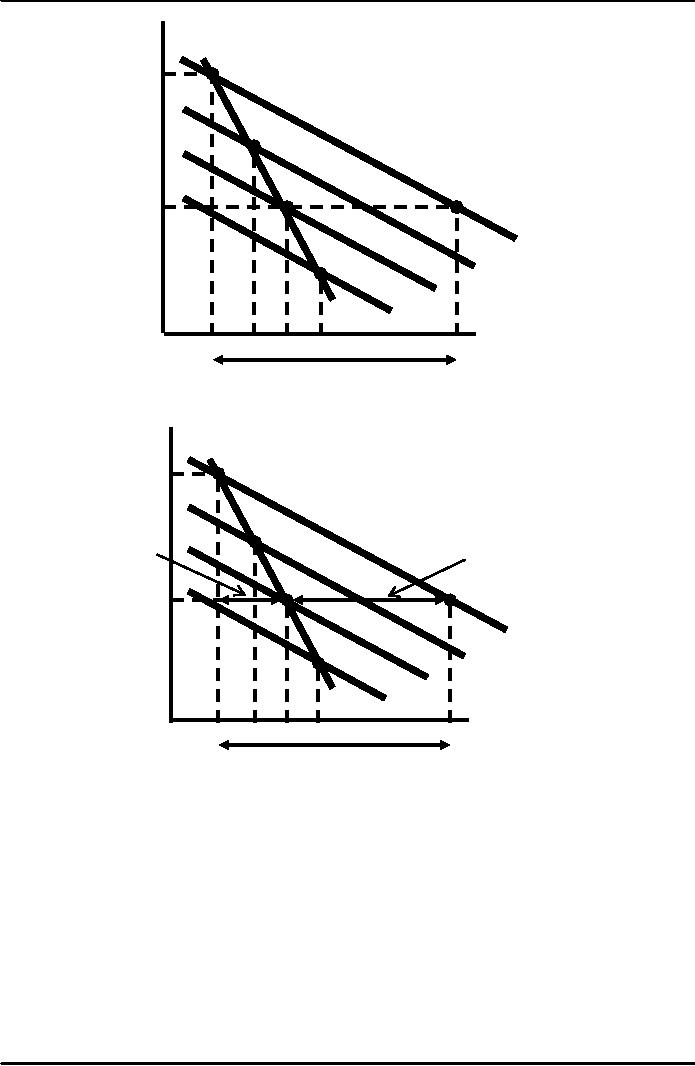

Positive

Network Externality: Bandwagon

Effect

Price

D2

D4 D60 D8

D100

When

consumers believe

more

($

per

people

have purchased the

unit)

product,

the demand curve

shifts

further

to the the right .

Quantity

(thousands

per month)

20

40

60

80

100

Price

D20

D40 D60 D80

D100

The

market demand

($

per

curve

is found by joining

unit)

the

points on the

individual

demand

curves. It is relatively

more

elastic.

Demand

Quantity

(thousands

per month)

20

40

60

80

100

60

Microeconomics

ECO402

VU

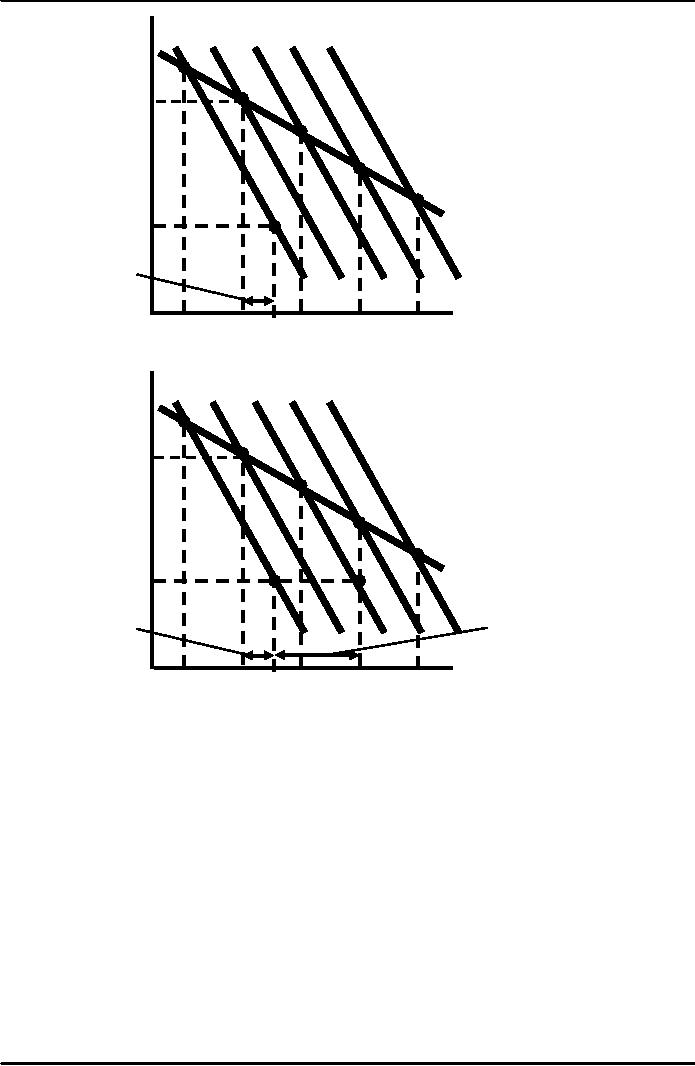

Price

D20

D40 D60 D80

D100

($

per

Suppose

the price falls

unit)

from

$30 to $20. If there

were

no bandwagon effect,

quantity

demanded would

only

increase to 48,000

$30

Demand

$20

Pure

Price

Effect

Quantity

(thousands

per month)

20

40

48

60

80

100

Price

D20

D40 D60 D80

D100

But

as more people buy

($

per

the

good, it becomes

unit)

stylish

to own it and

the

quantity demanded

increases

further.

$30

Demand

$20

Bandwagon

Pure

Price

Effect

Effect

Quantity

40

48 60

(thousands

per month)

20

80

100

The

Snob Effect

If the network

externality is negative, a

snob

effect exists.

The

snob

effect refers to

the desire to own exclusive

or unique goods.

The

quantity demanded of a "snob"

good is higher the fewer

the people who own

it.

61

Microeconomics

ECO402

VU

Price

Originally

demand is D2,

($

per

Demand

when

consumers think 2000

unit)

people

have bought a good.

$30,000

However,

if consumers think

4,000

people

have bought the

good,

demand

shifts from D2 to

D6 and its

snob

value has been

reduced.

$15,000

D2

D4

D6

D8

Quantity

(thousands

per

month)

2

4

6

8

14

Pure

Price Effect

Demand

Price

The

demand is less elastic

and

($

per unit)

as

a snob good its value is

greatly

$30,000

reduced

if more people own

it.

Sales decrease as a

result.

Examples:

Rolex watches and

long

lines

at the ski lift.

Net

Effect

Snob

Effect

$15,000

D2

D4

D6

D8

Quantity

(thousands

per

month)

2

4

6

8

14

Pure

Price Effect

Network

Externalities and the

Demands

for

Computers and Fax

Machines

Examples

of Positive Feedback

Externalities

Mainframe

computers: 1954 -

1965

Microsoft

Windows PC operating

system

Fax-machines

and e-mail

62

Table of Contents:

- ECONOMICS:Themes of Microeconomics, Theories and Models

- Economics: Another Perspective, Factors of Production

- REAL VERSUS NOMINAL PRICES:SUPPLY AND DEMAND, The Demand Curve

- Changes in Market Equilibrium:Market for College Education

- Elasticities of supply and demand:The Demand for Gasoline

- Consumer Behavior:Consumer Preferences, Indifference curves

- CONSUMER PREFERENCES:Budget Constraints, Consumer Choice

- Note it is repeated:Consumer Preferences, Revealed Preferences

- MARGINAL UTILITY AND CONSUMER CHOICE:COST-OF-LIVING INDEXES

- Review of Consumer Equilibrium:INDIVIDUAL DEMAND, An Inferior Good

- Income & Substitution Effects:Determining the Market Demand Curve

- The Aggregate Demand For Wheat:NETWORK EXTERNALITIES

- Describing Risk:Unequal Probability Outcomes

- PREFERENCES TOWARD RISK:Risk Premium, Indifference Curve

- PREFERENCES TOWARD RISK:Reducing Risk, The Demand for Risky Assets

- The Technology of Production:Production Function for Food

- Production with Two Variable Inputs:Returns to Scale

- Measuring Cost: Which Costs Matter?:Cost in the Short Run

- A Firmís Short-Run Costs ($):The Effect of Effluent Fees on Firmsí Input Choices

- Cost in the Long Run:Long-Run Cost with Economies & Diseconomies of Scale

- Production with Two Outputs--Economies of Scope:Cubic Cost Function

- Perfectly Competitive Markets:Choosing Output in Short Run

- A Competitive Firm Incurring Losses:Industry Supply in Short Run

- Elasticity of Market Supply:Producer Surplus for a Market

- Elasticity of Market Supply:Long-Run Competitive Equilibrium

- Elasticity of Market Supply:The Industryís Long-Run Supply Curve

- Elasticity of Market Supply:Welfare loss if price is held below market-clearing level

- Price Supports:Supply Restrictions, Import Quotas and Tariffs

- The Sugar Quota:The Impact of a Tax or Subsidy, Subsidy

- Perfect Competition:Total, Marginal, and Average Revenue

- Perfect Competition:Effect of Excise Tax on Monopolist

- Monopoly:Elasticity of Demand and Price Markup, Sources of Monopoly Power

- The Social Costs of Monopoly Power:Price Regulation, Monopsony

- Monopsony Power:Pricing With Market Power, Capturing Consumer Surplus

- Monopsony Power:THE ECONOMICS OF COUPONS AND REBATES

- Airline Fares:Elasticities of Demand for Air Travel, The Two-Part Tariff

- Bundling:Consumption Decisions When Products are Bundled

- Bundling:Mixed Versus Pure Bundling, Effects of Advertising

- MONOPOLISTIC COMPETITION:Monopolistic Competition in the Market for Colas and Coffee

- OLIGOPOLY:Duopoly Example, Price Competition

- Competition Versus Collusion:The Prisonersí Dilemma, Implications of the Prisoners

- COMPETITIVE FACTOR MARKETS:Marginal Revenue Product

- Competitive Factor Markets:The Demand for Jet Fuel

- Equilibrium in a Competitive Factor Market:Labor Market Equilibrium

- Factor Markets with Monopoly Power:Monopoly Power of Sellers of Labor