|

THE ACCOUNTING EQUATION |

| << Sample Accounts of a Company |

| types of vouchers, Carrying forward the balance of an account >> |

Financial

Accounting (Mgt-101)

VU

Lesson-12

THE

ACCOUNTING EQUATION

Resources

in the business = Resources

supplied by the

owner

In

accounting, terms are used

to describe things. The amount of

resources supplied by the owner is

called

capital. The

actual resources which are

in the business are called

assets. This

means that the

accounting

equation

above, when the owner has supplied all

the resources, can be shown

as:

Assets=Capital

Usually,

people, other than the owner

has supplied some of the assets.

Liabilities

are

the name given to the

amounts

owing to these people for

these assets. The equation

has now changed

to:

Assets=Capital

+ Liabilities

It can

be seen that two sides of

the equation will have the same

totals. This is because we are

dealing with

the

same thing with two

different points of view. It

is:

Resources

in the business = Resources:

who supplied them

Assets

= Capital + Liabilities

It is a

fact that total of each

side will always equal

one another, and this will

always be true no matter

how

many

transactions there may be.

The actual assets, capital

and liabilities may change,

but the total of the

assets

will always equal to the

total of capital and

liabilities.

Assets

consist of property of all kinds,

such as buildings, machinery, stocks of

goods and motor

vehicles.

Also

benefits such as debts owned by customers

and the amount of money in the bank

accounts are

included.

Liabilities

consist of money owing for

goods supplied to the business and

for expenses. Also loans

made to

the

firm are included.

Capital is

often called the owner's net

worth.

Working

capital

Working

capital of the business is the net value

of current assets & current

liabilities.

Current

assets are

the resources of the business that

are expected to be received

within 12 months in an

accounting

period.

Current

liabilities are

the amount owing to the business that is

expected to be paid within one

year in a

financial

year.

So,

working capital is the net of what is

receivable in an accounting year &

what is payable in that year

or:

Working

Capital = Current Assets

Current Liabilities

For

instance, current assets of the business

worth Rs.100,000 & current

liabilities of the business has

the

value

of Rs. 75,000. Then working

capital is Rs.

25,000.

i.e.,

(100,000-75,000).

83

Financial

Accounting (Mgt-101)

VU

STOCK

Stock

is termed as "value of goods

available to the business that

are ready for sale".

For accounting

purposes,

stock is of two

types:

· Opening

stock

· Closing

stock

Opening

stock is the

value of goods available for

sale in the beginning of an accounting

year. For purpose

of financial

reporting, opening stock is

added to the purchases for the

year to become a part of cost

of

goods

sold. As this is

available in the beginning of the year, it is

assumed that it will be

consumed in the

accounting

year. That is why; it becomes a

part of cost

of goods sold.

Stock of previous year is the

opening

stock

in present year.

Closing

stock is the

value of goods unsold at the end of

accounting year. For

purposes of making financial

statements,

it is deducted from cost of

goods sold & is shown as an

asset in the balance

sheet. As this is

the

value

of goods that are yet to be

sold, so it cannot be included in cost of

goods sold. That is why it

is

deducted

from cost of good sold. On

the other hand, its benefit

will be received in the next

accounting year,

so it is

shown as an asset in the balance

sheet.

Now,

the

contents of cost of goods

sold are:

Opening

stock

Plus:

purchases

Plus:

Freight/ carriage paid on

purchases

Less:

closing stock

For

instance, opening stock of a

business worth Rs. 15,000,

business purchased goods of

Rs. 12,000 for the

year

& also paid Rs. 1,500 as

carriage on purchases. The

value of closing stock at the

end of the year is

Rs.

10,000.

Then, value of closing stock

is calculated as under:

Opening

stock

15,000

Add:

purchases

12,000

Add:

carriage on purchase

1,500

Less:

closing stock

(10,000)

Cost

of goods sold

18,500

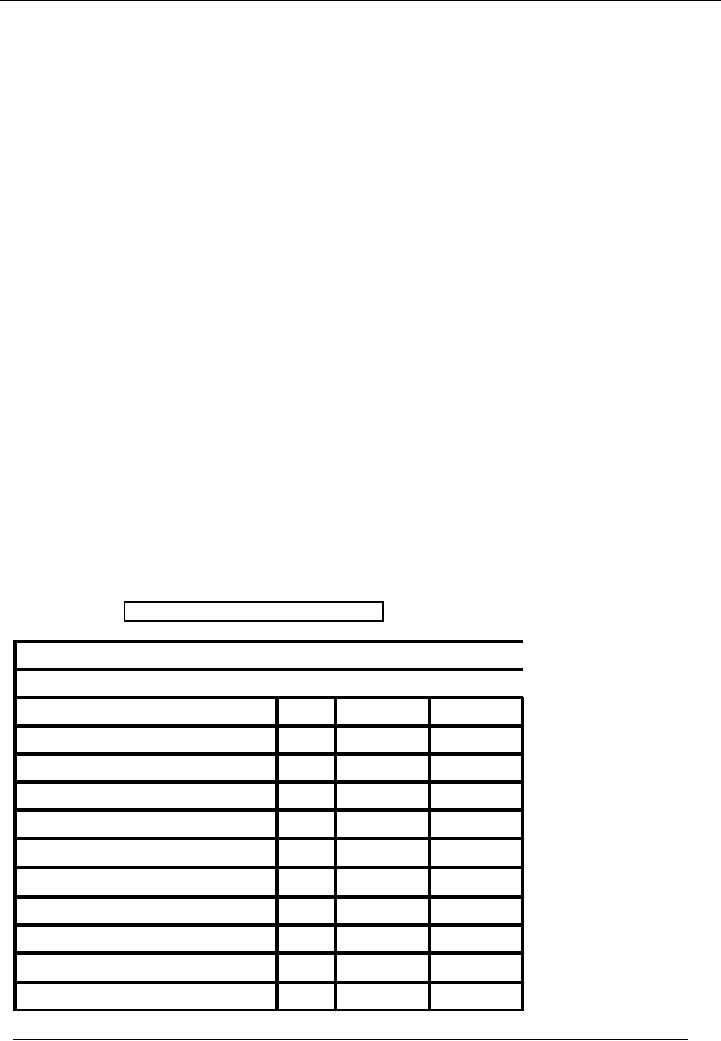

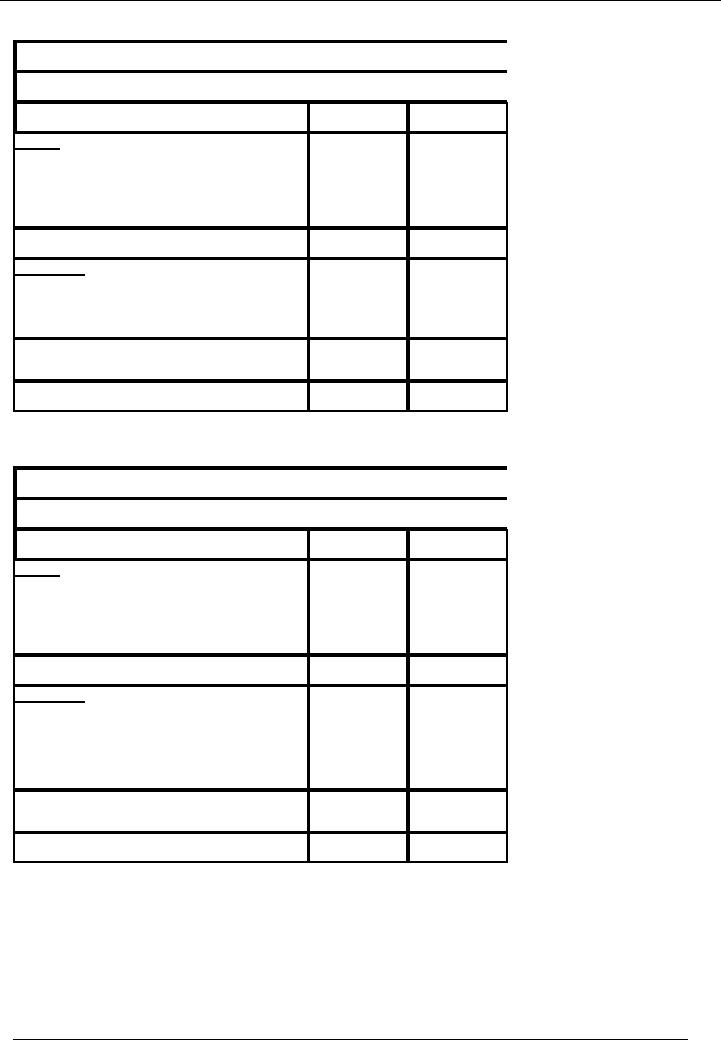

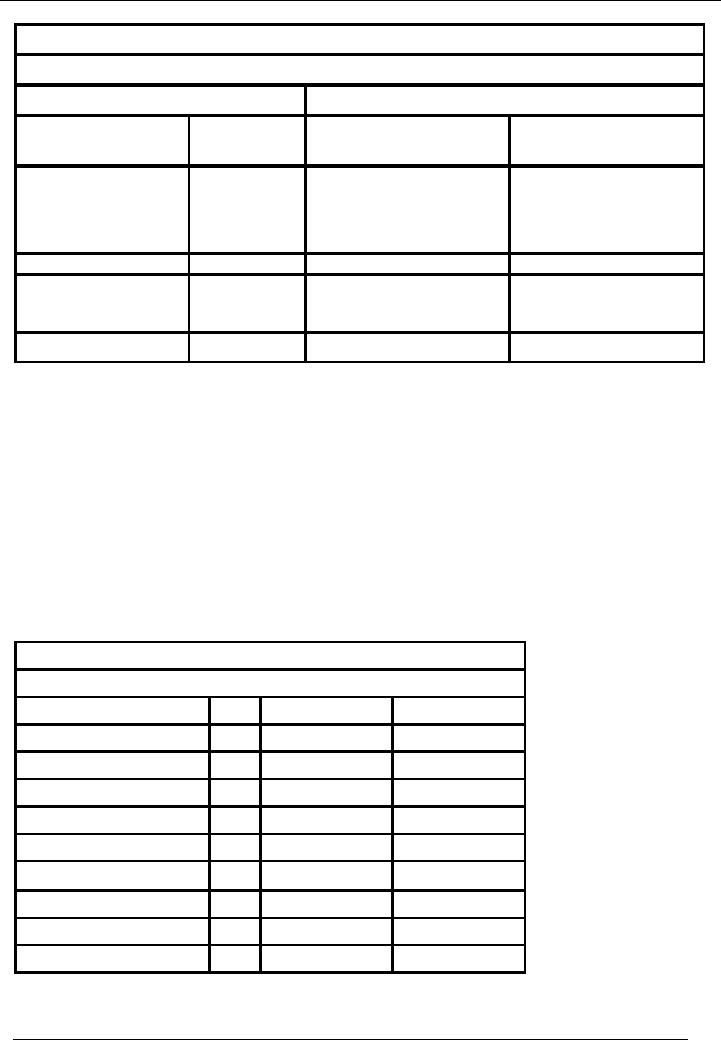

Ali

Traders

Trial

Balance As On January 31,

20--

Title

of Account

Code

Dr.

Rs.

Cr.

Rs.

Cash

Account

01

35,000

Bank

Account

02

130,000

Capital

Account

03

200,000

Furniture

Account

04

15,000

Vehicle

Account

05

50,000

Purchases

Account

06

60,000

Mr. A

(Creditor)

07

15,000

Sales

08

95,000

Mr. B

(Debtor)

09

15,000

Salaries

10

5,000

84

Financial

Accounting (Mgt-101)

VU

Expenses

11

20,000

Expenses

Payable

12

20,000

Total

330,000

330,000

The

Accounting Equation.

Assets

= Capital + Liabilities

Assets

= 35,000+130,000+15,000+50,000+15,000= 245,000

Capital =

200,000

Liabilities

= 15,000 + 20,000 =

35,000

Capital +

Liabilities = 235,000

We ignore the

Net Profit Rs.10000 (Net

profit is added in capital

account)

When

we added Net profit in

capital then;

Assets

= Capital + Liabilities

245000

= 210000+35000

245000

= 245000

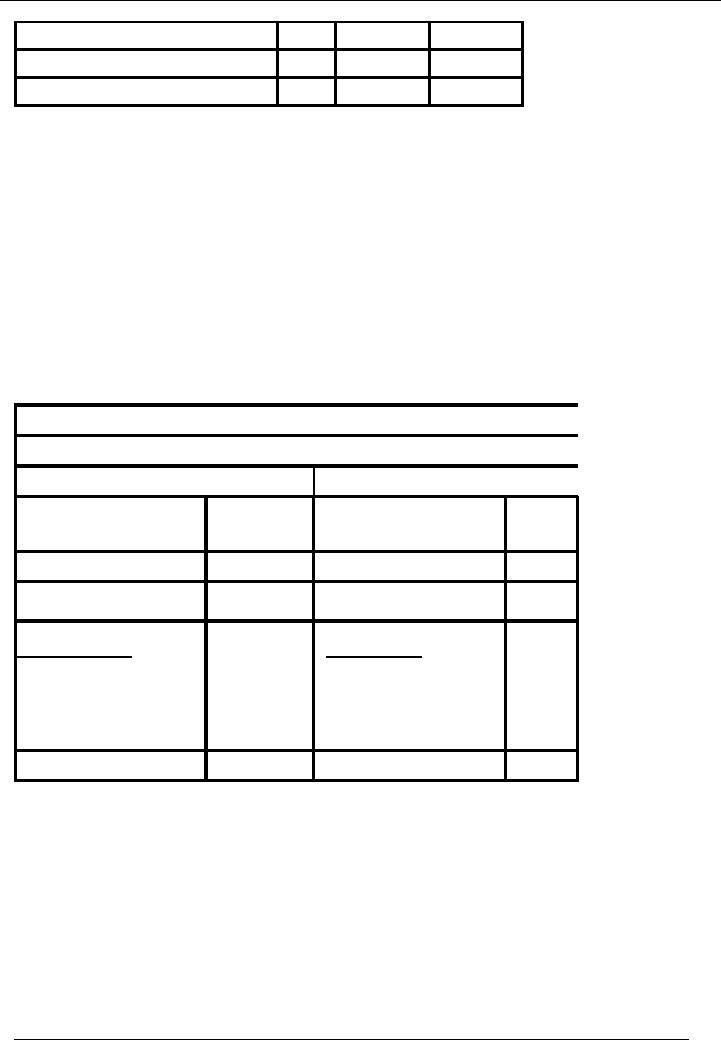

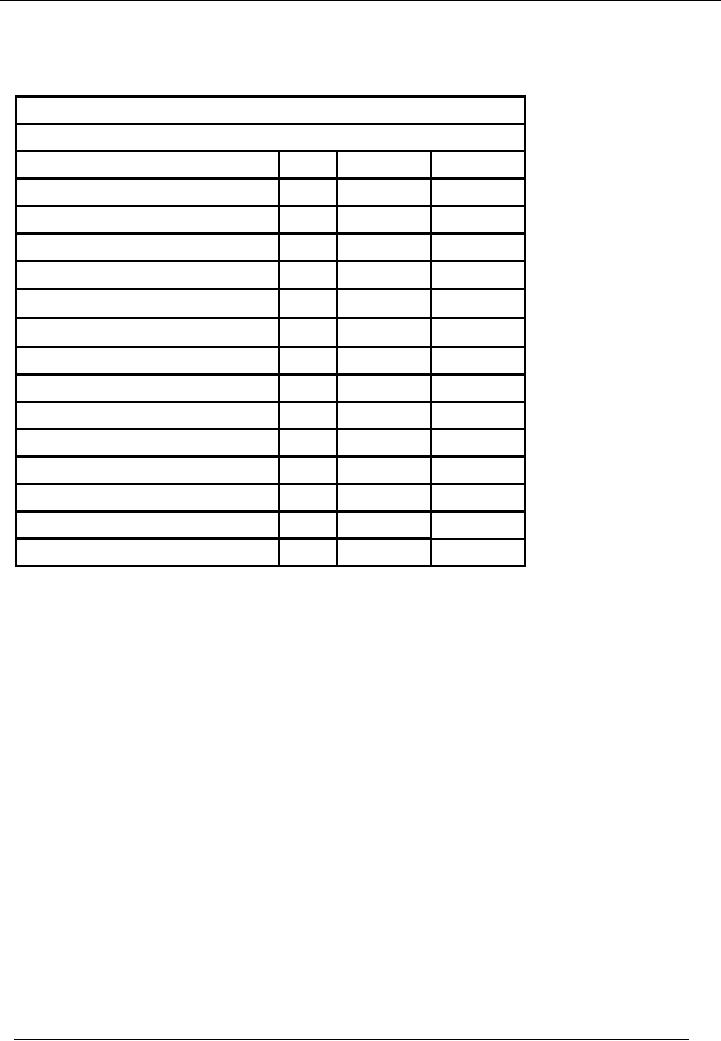

Account

form Balance Sheet

Name of the

Entity (Ali traders)

Balance

Sheet As At (January 31,

20--)

Liabilities

Assets

Particulars

Amount

Rs.

Particulars

Amount

Rs.

Capital

200.000

Fixed Assets

65,000

Profit

and Loss Account

10,000

Furniture

15,000

50000

210,000

Vehicle

Current

Liabilities

Current

Assets

Mr.

A

15,000

Mr.

B

15,000

Exp.

payable

20,000

35,000

Bank

130,000

180,000

Cash

35,000

Total

245,000

Total

245,000

85

Financial

Accounting (Mgt-101)

VU

Report

form Balance Sheet

Ali

traders

Balance

Sheet As At January 31,

20--

Particulars

Amount

Rs.

Amount

Rs.

Assets

Fixed

Assets

65,000

Current

Assets

180,000

Total

245,000

Liabilities

Capital

200,000

Profit

and Loss Account

10,000

210,000

Current

Liabilities

35,000

Total

245,000

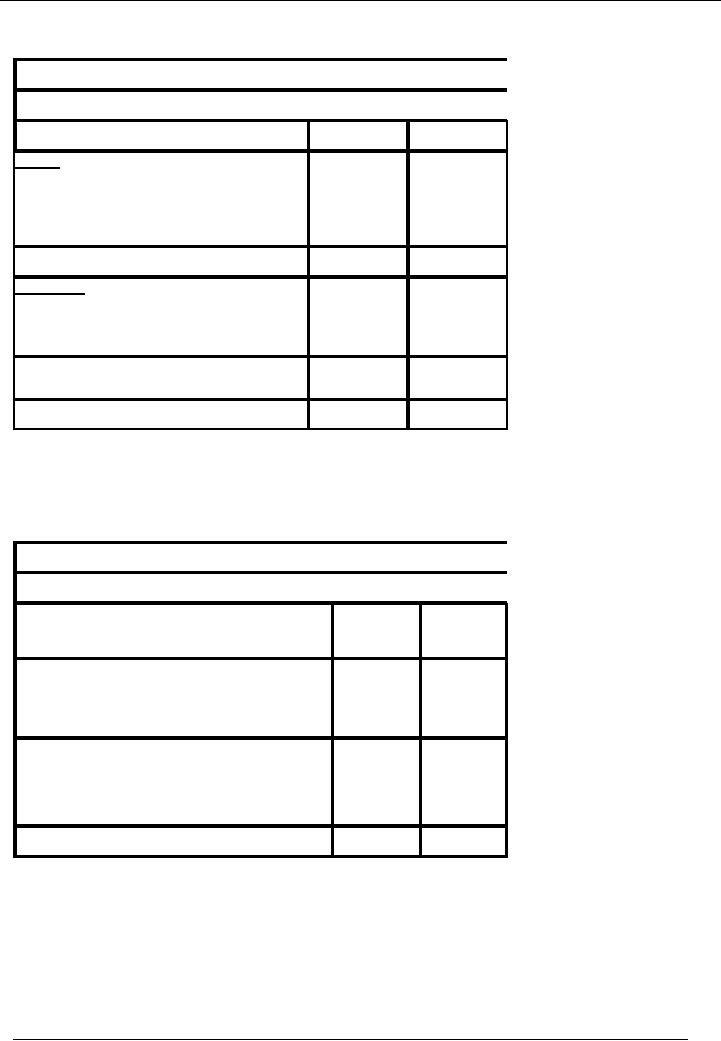

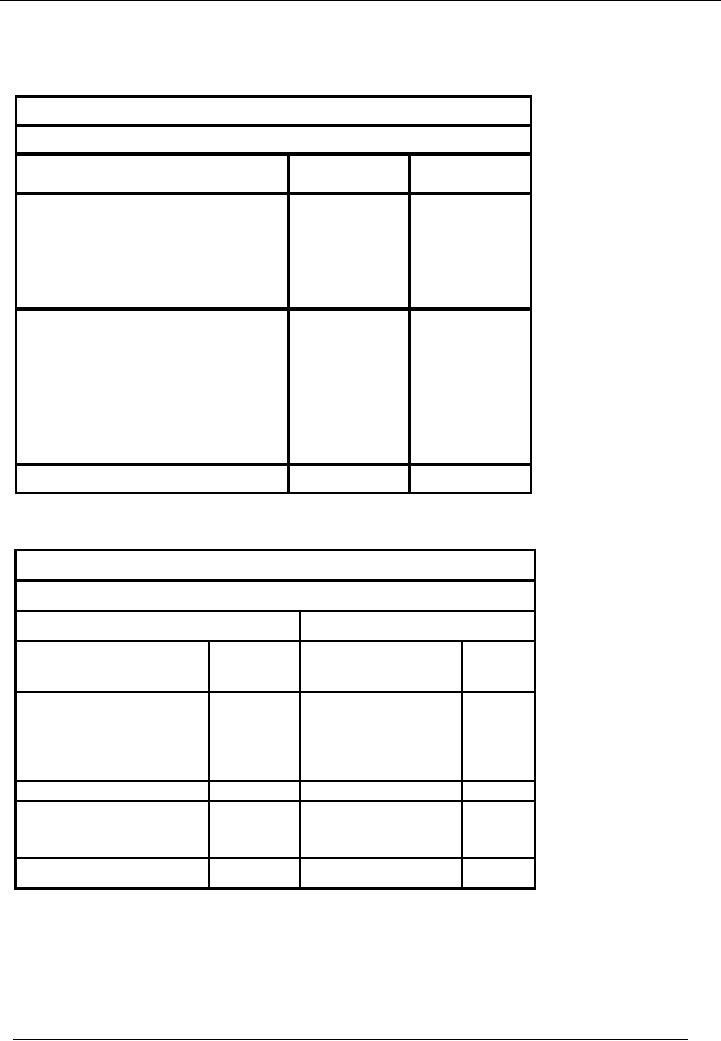

Treatment of

closing stock

If

closing stock is Rs.10000

then;

Name of the

Entity (Ali Traders)

Profit

and Loss Account for the

Month Ending January 31,

20--

Particulars

Amount

Amount

Rs.

Rs.

Income

/ Sales / Revenue

95,000

Less:

Cost of Goods Sold (

60,000 - 1,000 )

(59,000)

(59,000)

Gross

Profit

36,000

Less:

Administrative Expenses

(25,000)

(25,000)

Net

Profit

11,000

86

Financial

Accounting (Mgt-101)

VU

Ali

traders

Balance

Sheet As At January 31,

20--

Particulars

Amount

Rs.

Amount

Rs.

Assets

Fixed

Assets

65,000

Current

Assets (180,000

+ 1,000)

181,000

Total

246,000

Liabilities

Capital

200,000

Profit

and Loss Account

11,000

210,000

Current

Liabilities

35,000

Total

246,000

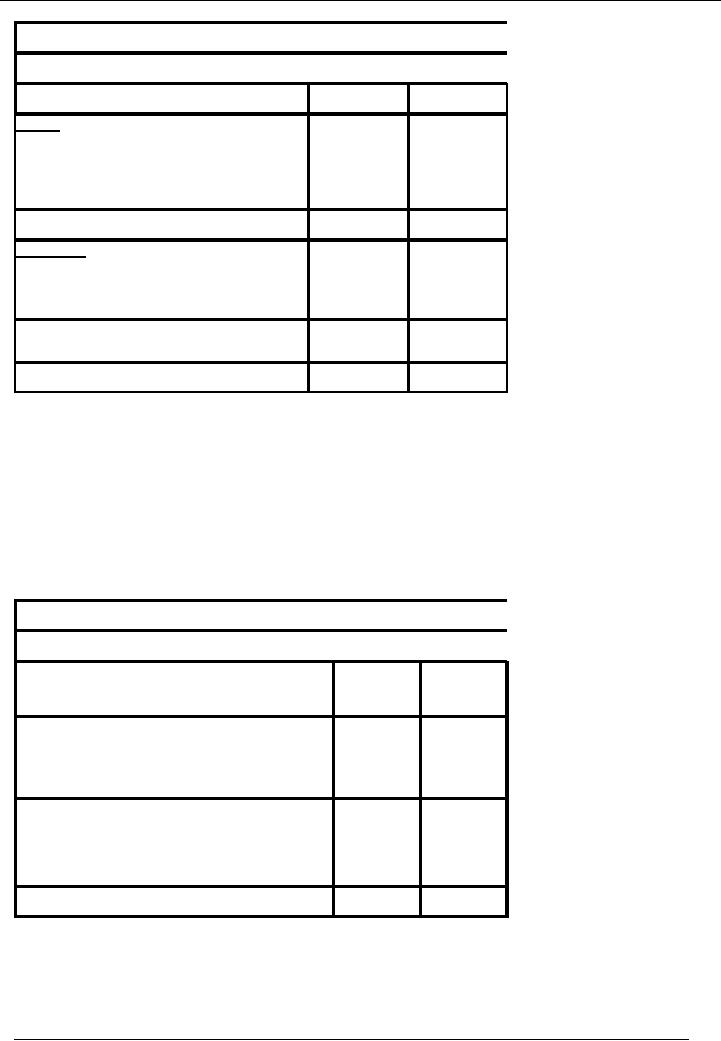

Treatment of

Depreciation

In

Profit and Loss Account it

is considered as expense and in

Balance Sheet it is deducted

from the

concerned

asset.

If

useful life of an asset is 50

month and considered that

there is no residual value

then,

·

Dividing

total cost by life of the

asset.

·

Rs.65,000

/ 50 months = Rs.1,300 monthly

charge

Name of the

Entity (Ali Traders)

Profit

and Loss Account for the

Month Ending January 31,

20--

Particulars

Amount

Amount

Rs.

Rs.

Income

/ Sales / Revenue

95,000

Less:

Cost of Goods Sold (

60,000-1,000 )

59,000

(59,000)

Gross

Profit

36,000

Less:

Administrative Expenses

25,000

Depreciation

1,300

(26,300)

Net

Profit

9,700

87

Financial

Accounting (Mgt-101)

VU

Ali

traders

Balance

Sheet As At January 31,

20--

Particulars

Amount

Rs.

Amount

Rs.

Assets

Fixed

Assets (65,000

1,300)

63,700

Current

Assets (180,000 +

1,000)

181,000

Total

244,700

Liabilities

Capital

200,000

Profit

and Loss Account

9,700

209,700

Current

Liabilities

35,000

Total

244,700

Distribution

of Profits / Drawing

Ali

traders

Balance

Sheet As At January 31,

20--

Particulars

Amount

Rs.

Amount

Rs.

Assets

Fixed

Assets (65,000

1300)

63,700

Current

Assets (181,000

- 5,000)

176,000

Total

239,700

Liabilities

Capital

200,000

Profit

and Loss Account

9,700

Drawing

(5,000)

204,700

Current

Liabilities

35,000

Total

239,700

88

Financial

Accounting (Mgt-101)

VU

Illustration

Consider

the trial balance given

hereunder:

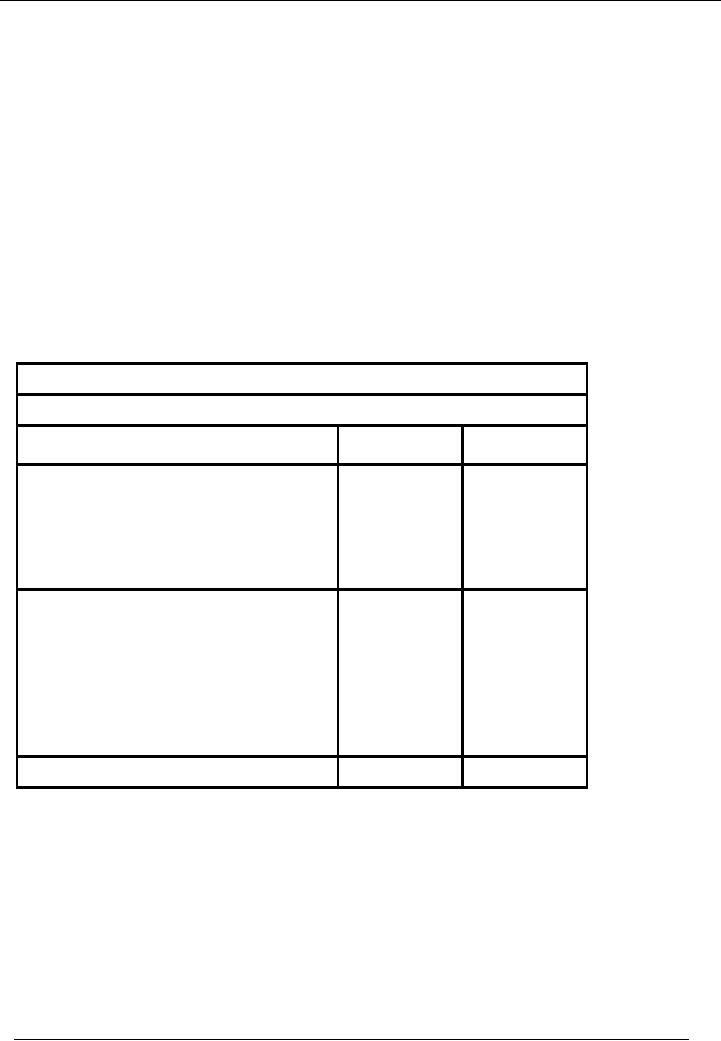

Saeed

& co.

Trial

Balance As On ( January 31,

2002)

Title

of Account

Code

Dr.

Rs.

Cr.

Rs.

Cash

Account

01

161,250

Capital

Account

02

150,000

Furniture

Account

03

2,000

Purchases

Account

04

16,000

Carriage

on purchase account

05

250

Salim&

co. (Creditor)

06

0

Sales

07

37,000

Usman

& co. (Debtor)

08

0

Salaries

09

2,500

sRent

10

3,000

Stationery

11

2,000

Utility

billst

12

5,000

Accrued

expenses

13

5,000

Total

192,000

192,000

89

Financial

Accounting (Mgt-101)

VU

(This

trial balance is extracted

from the solved illustration, in

lecture 11)

Let's

say, the value of closing

stock at the end of the period is

Rs. 2,000. Then profit &

loss account will

bear

the

following change.

Saeed

& Co.

Profit &

Loss Account for the

period ended January 31,

2002

Particulars

Amount

Amount

Rs.

Rs.

37,000.

Income

/ Sales / Revenue (See

Note

16,250

2,000

(14,250)

#1)

Less:

Cost of Goods Sold

Closing

stock

Gross

Profit

22,750.

Less:

Admin. Expenses

(12,500)

(See

Note # 2)

Net

Profit/ (Loss)

10,250

Its

effect in the balance sheet is as

follows:

Saeed

& Co.

Balance

Sheet As At January 31,

2002

Liabilities

Assets

Particulars

Amount

Particulars

Amount

Rs.

Rs.

Capital

150,000

Fixed Assets

Profit and

Loss Account

10,250

Furniture

Account

2,000

160,250

Current

Liabilities

Current

Assets

Accrued

Expenses

5,000

Cash

161,250

Closing

Stock

2,000

Total

165,250

Total

165,250

This is a

practical demonstration of the treatment of closing

stock. But, we are not

mentioning the journal

entry

of closing stock at this stage. It

will be discussed in detail, when we will

study the topic of fixed

assets.

DEPRECIATION

Depreciation

is the method of charging cost of

fixed assets to the profit &

loss account as an

expense.

Fixed

Assets are those assets

which are:

90

Financial

Accounting (Mgt-101)

VU

· Of

long life

· To be

used in the business

· Not

bought with the main purpose

of resale.

When

an expense is incurred, it is charged to

profit & loss account of the

same accounting period in

which it

has

incurred. Fixed assets are

used for longer period of time.

Now, the question is how to charge a

fixed

asset

to profit & loss account.

For this purpose, estimated

life of the asset is determined.

Estimated life is the

number of

years in which a fixed asset

is expected to be used. Then,

total cost of the asset is

divided by total

number of

estimated years. The value,

so determined, is called `depreciation

for that year' and is

charged to

profit

& loss account. The same

amount is deducted from total

cost of fixed asset. The net

amount (after

deducting

depreciation) is called ``Written Down

Value''.

For

instance, an asset has a

cost of Rs. 150,000. It is

expected to be used for ten

years. Depreciation to be

charged

to profit & loss account is

Rs. 15,000, i-e. cost of

asset/estimated life. In this case, it

will be

150,000/10

= 15,000.

That

is why depreciation is called an

accounting estimate.

To

understand its accounting

treatment, consider the above mentioned

illustration

Let's

suppose the useful life of

furniture is five years.

Then, depreciation for the year

will be (2,000/5 =

400).

Now,

the profit & loss account

will show the following

picture:

Saeed

& Co.

Profit &

Loss Account for the

year ended January 31,

2002

Particulars

Amount

Amount

Rs.

Rs.

37,000.

Income

/ Sales / Revenue (See Note

#1)

Less:

Cost of Goods

Sold

(16,250)

Gross

Profit

20,750.

Less:

Admin. Expenses + Depreciation

12,500

+ 400

(12,900)

Net

Profit/ (Loss)

9,850

Balance

sheet will look like

this:

91

Financial

Accounting (Mgt-101)

VU

Saeed

& Sons

Balance

Sheet As At January 31,

2002

Liabilities

Assets

Particulars

Amount

Particulars

Amount

Rs.

Rs.

Capital

150,000

Fixed Assets

Profit and

Loss Account

9,850

Furniture

Account

2,000

Less:

depreciation

(400)

159,850

1,600

Current

Liabilities

Current

Assets

Accrued

Expenses

5,000

Cash

161,250

Closing

Stock

2,000

Total

164,850

Total

164,850

Treatment of

depreciation is practically demonstrated at this

point. Its journal entry

will be discussed in

detail, when we

cover the topic `Fixed

Assets'.

DRAWING

Capital is the

cash or kind invested by the owner of the

business. Sometimes, the owner wants to

take cash

or

kind out of the business for

personal use. This is known as

drawing.

Any money taken out as

drawings

will reduce

capital.

The

capital account is very important

account. To stop it getting full of

small details, cash items of

drawings

are

not entered in the capital

account. Instead, a drawing account is

opened, and all transactions

are entered

there.

Sometimes

goods are also taken by the

owner of the business. These are

also known as

drawings.

To

understand the accounting treatment of

drawings, look into the

following trial

balance:

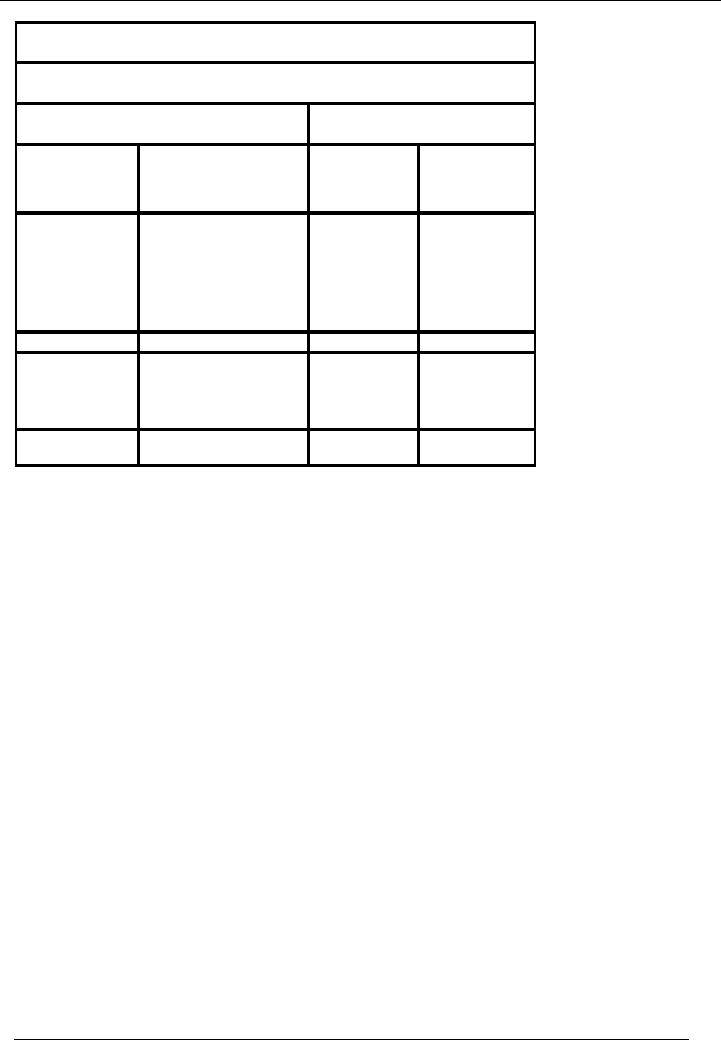

Saeed

& co.

Trial

Balance As On ( January 31,

2002)

Title

of Account

Code

Dr.

Rs.

Cr.

Rs.

Cash

Account

01

161,250

Capital

Account

02

160,000

Furniture

Account

03

2,000

Drawings

04

10,000

Profit

& loss account

05

8,250

Salim&

co. (Creditor)

06

0

Usman

& co. (Debtor)

07

0

Accrued

expenses

08

5,000

Total

173,250

173,250

BALANCE

SHEET

92

Financial

Accounting (Mgt-101)

VU

Saeed

& Sons

Balance

Sheet As At January 31,

2002

Liabilities

Assets

Particulars

Amount

Particulars

Amount

Rs.

Rs.

Capital

160,000

Fixed

Assets

Profit and

Loss

8,250

Furniture

2,000

Account

(10,000)

Account

Less:

Drawings

158,250

Current

Current

Liabilities

5,000

Assets

161,250

Accrued

Expenses

Cash

Total

163,250

Total

163,250

93

Table of Contents:

- Introduction to Financial Accounting

- Basic Concepts of Business: capital, profit, budget

- Cash Accounting and Accrual Accounting

- Business entity, Single and double entry book-keeping, Debit and Credit

- Rules of Debit and Credit for Assets, Liabilities, Income and Expenses

- flow of transactions, books of accounts, General Ledger balance

- Cash book and bank book, Accounting Period, Trial Balance and its limitations

- Profit & Loss account from trial balance, Receipt & Payment, Income & Expenditure and Profit & Loss account

- Assets and Liabilities, Balance Sheet from trial balance

- Sample Transactions of a Company

- Sample Accounts of a Company

- THE ACCOUNTING EQUATION

- types of vouchers, Carrying forward the balance of an account

- ILLUSTRATIONS: Ccarrying Forward of Balances

- Opening Stock, Closing Stock

- COST OF GOODS SOLD STATEMENT

- DEPRECIATION

- GROUPINGS OF FIXED ASSETS

- CAPITAL WORK IN PROGRESS 1

- CAPITAL WORK IN PROGRESS 2

- REVALUATION OF FIXED ASSETS

- Banking transactions, Bank reconciliation statements

- RECAP

- Accounting Examples with Solutions

- RECORDING OF PROVISION FOR BAD DEBTS

- SUBSIDIARY BOOKS

- A PERSON IS BOTH DEBTOR AND CREDITOR

- RECTIFICATION OF ERROR

- STANDARD FORMAT OF PROFIT & LOSS ACCOUNT

- STANDARD FORMAT OF BALANCE SHEET

- DIFFERENT BUSINESS ENTITIES: Commercial, Non-commercial organizations

- SOLE PROPRIETORSHIP

- Financial Statements Of Manufacturing Concern

- Financial Statements of Partnership firms

- INTEREST ON CAPITAL AND DRAWINGS

- DISADVANTAGES OF A PARTNERSHIP FIRM

- SHARE CAPITAL

- STATEMENT OF CHANGES IN EQUITY

- Financial Statements of Limited Companies

- Financial Statements of Limited Companies

- CASH FLOW STATEMENT 1

- CASH FLOW STATEMENT 2

- FINANCIAL STATEMENTS OF LISTED, QUOTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES