|

TESTING THE PURCHASES SYSTEM |

| << Control Procedures over Purchases and Payables |

| TESTING THE PAYROLL SYSTEM >> |

Fundamentals

of Auditing ACC 311

VU

Lesson

26

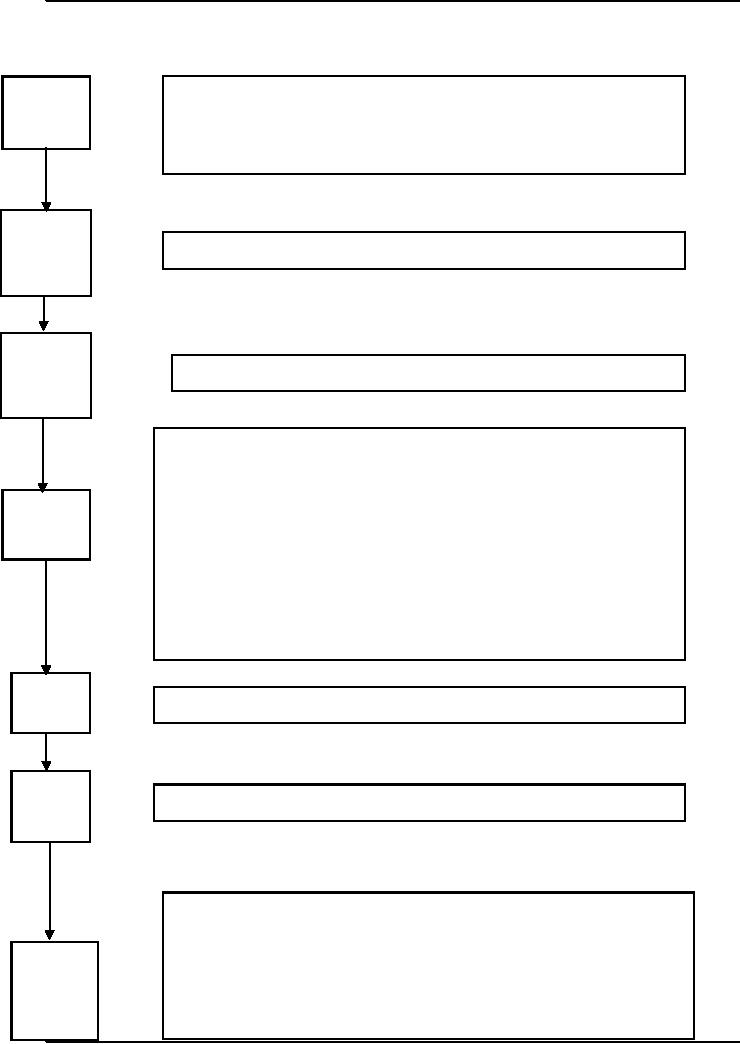

TESTING

THE PURCHASES SYSTEM

Test

for:

Purchase

(i)

Evidence of a sequence check.

Order

(ii)

Evidence of approval.

(iii)

Adherence to authority

limits

Goods

Test f o r

evidence of a sequence check

Received

Note

Goods

Test f o r

evidence of a sequence check.

Returned

Note

Test

for:

1.

Serial

numbering

2. Evidence of

sequence check

Purchase

3. Evidence of

matching purchase invoices with goods received notes and

purchase

Invoice

orders.

4. Evidence of

checking casts, extensions and tax

treatment

5. Evidence of

account coding.

6.

Initialing of

invoice grid for work

done.

7. Approval

of purchase invoice for further

processing.

Credit

Note

Test

for evidence of matching credit notes to

goods returned notes

Payables

Test

for evidence of authorization of

adjustments to payables ledge

ledger

Text

for:

(i)

Evidence of

review of reconciliation of purchase ledger

listing.

Payables

(ii)

Evidence of

authorization of adjustments to purchase ledger

control account.

Ledger

control

93

Fundamentals

of Auditing ACC 311

VU

CONTROL

OBJECTIVES

The

control objectives in respect of a

wages and salaries system

are as follows:

(a)

Payment of wages and

salaries should be made only

in respect of the client's authorized

employees.

(b)

Payment should be made at

authorized rates of

pay.

(c)

Wages and salaries payments

should be in accordance with

records of work performed,

e.g. time, output,

commissions

on sales.

(d)

Payroll and payroll deductions (tax

and social security) should

be calculated accurately.

(e)

Payment should be made to

the correct

employees.

(f)

Liabilities to the tax authorities

for tax and social

security should be properly

recorded.

94

Table of Contents:

- AN INTRODUCTION

- AUDITORSí REPORT

- Advantages and Disadvantages of Auditing

- OBJECTIVE AND GENERAL PRINCIPLES GOVERNING AN AUDIT OF FINANCIAL STATEMENTS

- What is Reasonable Assurance

- LEGAL CONSIDERATION REGARDING AUDITING

- Appointment, Duties, Rights and Liabilities of Auditor

- LIABILITIES OF AN AUDITOR

- BOOKS OF ACCOUNT & FINANCIAL STATEMENTS

- Contents of Balance Sheet

- ENTITY AND ITS ENVIRONMENT AND ASSESSING THE RISKS OF MATERIAL MISSTATEMENT

- Business Operations

- Risk Assessment Procedures & Sources of Information

- Measurement and Review of the Entityís Financial Performance

- Definition & Components of Internal Control

- Auditing ASSIGNMENT

- Benefits of Internal Control to the entity

- Flow Charts and Internal Control Questionnaires

- Construction of an ICQ

- Audit evidence through Audit Procedures

- SUBSTANTIVE PROCEDURES

- Concept of Audit Evidence

- SUFFICIENT APPROPRIATE AUDIT EVIDENCE AND TESTING THE SALES SYSTEM

- Control Procedures over Sales and Debtors

- Control Procedures over Purchases and Payables

- TESTING THE PURCHASES SYSTEM

- TESTING THE PAYROLL SYSTEM

- TESTING THE CASH SYSTEM

- Controls over Banking of Receipts

- Control Procedures over Inventory

- TESTING THE NON-CURRENT ASSETS

- VERIFICATION APPROACH OF AUDIT

- VERIFICATION OF ASSETS

- LETTER OF REPRESENTATION VERIFICATION OF LIABILITIES

- VERIFICATION OF EQUITY

- VERIFICATION OF BANK BALANCES

- VERIFICATION OF STOCK-IN-TRADE AND STORE & SPARES

- AUDIT SAMPLING

- STATISTICAL SAMPLING

- CONSIDERING THE WORK OF INTERNAL AUDITING

- AUDIT PLANNING

- PLANNING AN AUDIT OF FINANCIAL STATEMENTS

- Audits of Small Entities

- AUDITORíS REPORT ON A COMPLETE SET OF GENERAL PURPOSE FINANCIALSTATEMENTS

- MODIFIED AUDITORíS REPORT