|

SUBSIDIARY BOOKS |

| << RECORDING OF PROVISION FOR BAD DEBTS |

| A PERSON IS BOTH DEBTOR AND CREDITOR >> |

Financial

Accounting (Mgt-101)

VU

Lesson-26

SUBSIDIARY

BOOKS

A number of books

are opened in connection with

control accounts to reduce the

volume of general

ledger.

These

books are called `Subsidiary

Books'.

It is

important to note that only

credit sales/purchases become part of

control accounts.

Cash

sales/purchases

are not included in the control

accounts.

SUBSIDIARY

BOOKS FOR

SALES/DEBTORS

Three

subsidiary books are maintained in case

of sales / debtors.

· Sales

Journal / Sales Day Book

individual invoice wise

sales are recorded in this

Journal. This

book

serves as source for all the

recording of Credit sales.

· Sales

Return / Return Inward Journal if volume

of returns is also high then,

these are also

recorded

in a

separate register.

· Debtors

Ledger this ledger maintains

record of individual

debtor.

The

information flows to the debtors

control account in the general

ledger as follows:

Opening

balance of

List

of debtors balances drawn up to the end

of previous period.

debtors

This

also confirms with the aggregate

balance of the debtors

ledger.

Credit

Sales

Individual

credit sale is recorded in the sales

journal. Periodical total

of this

journal is posted into the

debtors control

account.

Sales

Return

In

case, the transaction volume of

sales return is high, then

these are

recorded

in the sales return journal.

The total is posted in

the

debtors

control account periodically.

Cheques

/ Cash

List

of receipts is extracted from

cash and bank book. Or a

separate

Received

column is

maintained in cash and bank books for

this purpose.

Closing

Balance

This

is the balancing figure. It can also be

checked with the total

of

balances

in debtors' ledger.

173

Financial

Accounting (Mgt-101)

VU

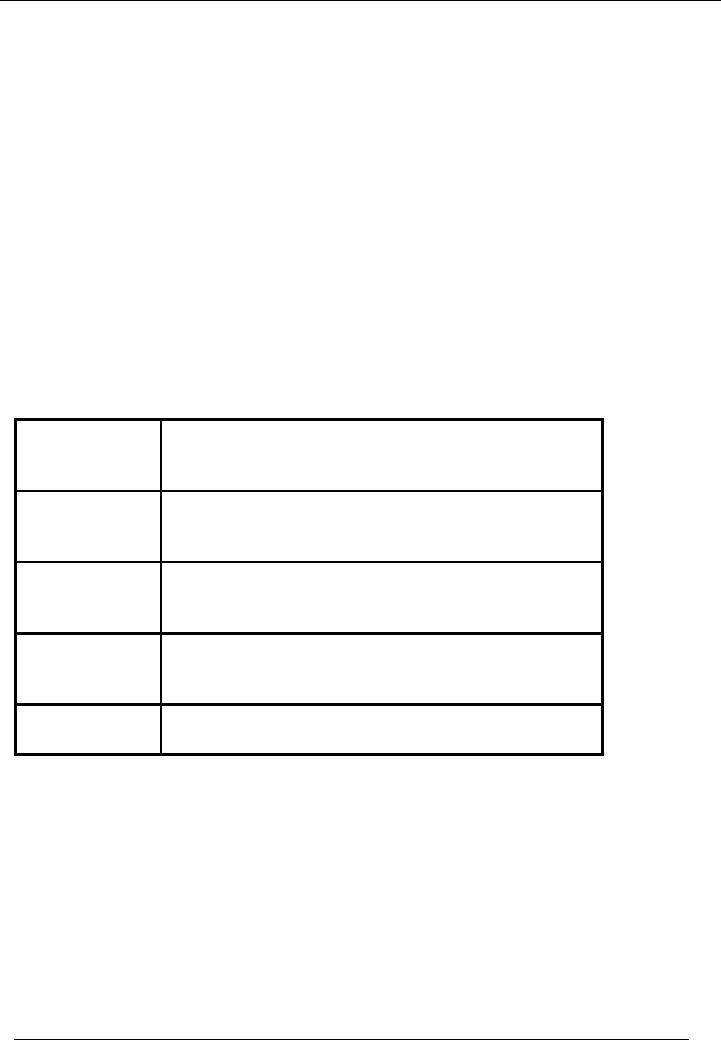

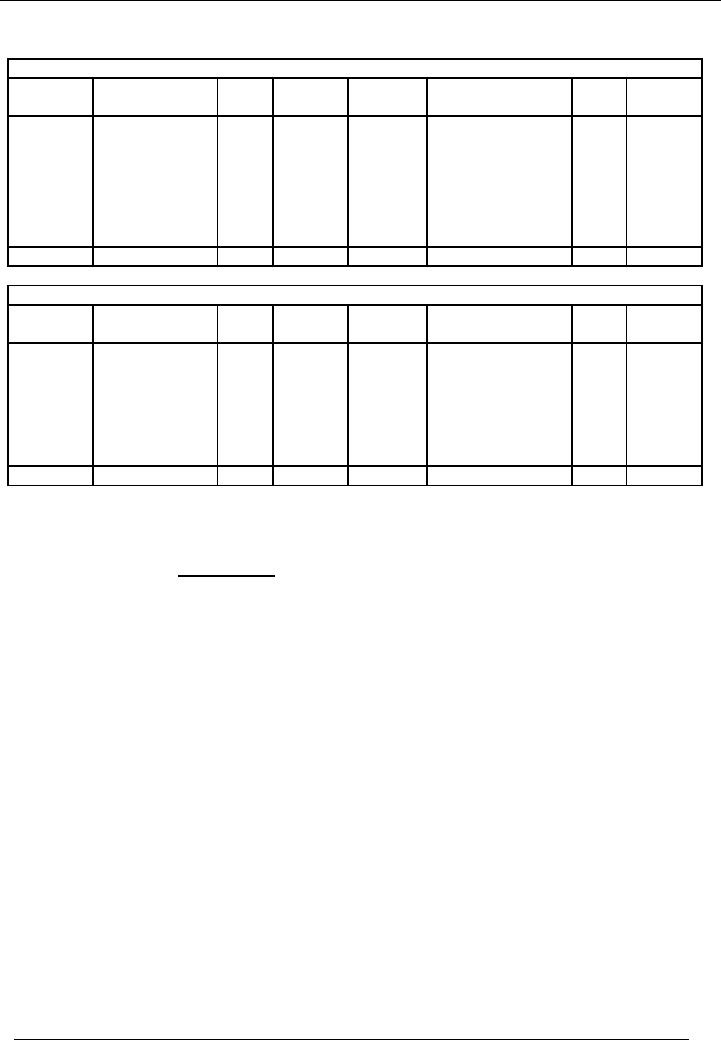

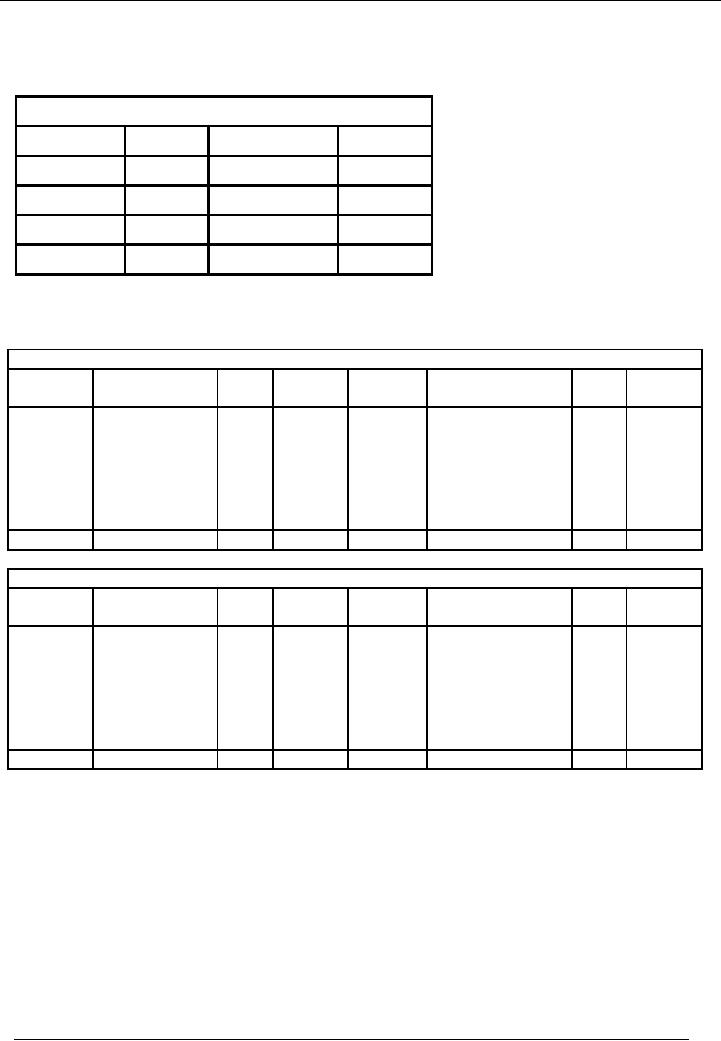

EXAMPLE

# 1

Let's

suppose that the sales

journal provides the following record

for the month of March,

2002:

Sales

Journal

Date

Invoice

#

Name /

Debtor

Amount

Mar

01, 2002

01

A

10,000

Mar

15, 2002

02

B

15,000

Mar

31, 2002

03

C

20,000

Total

45,000

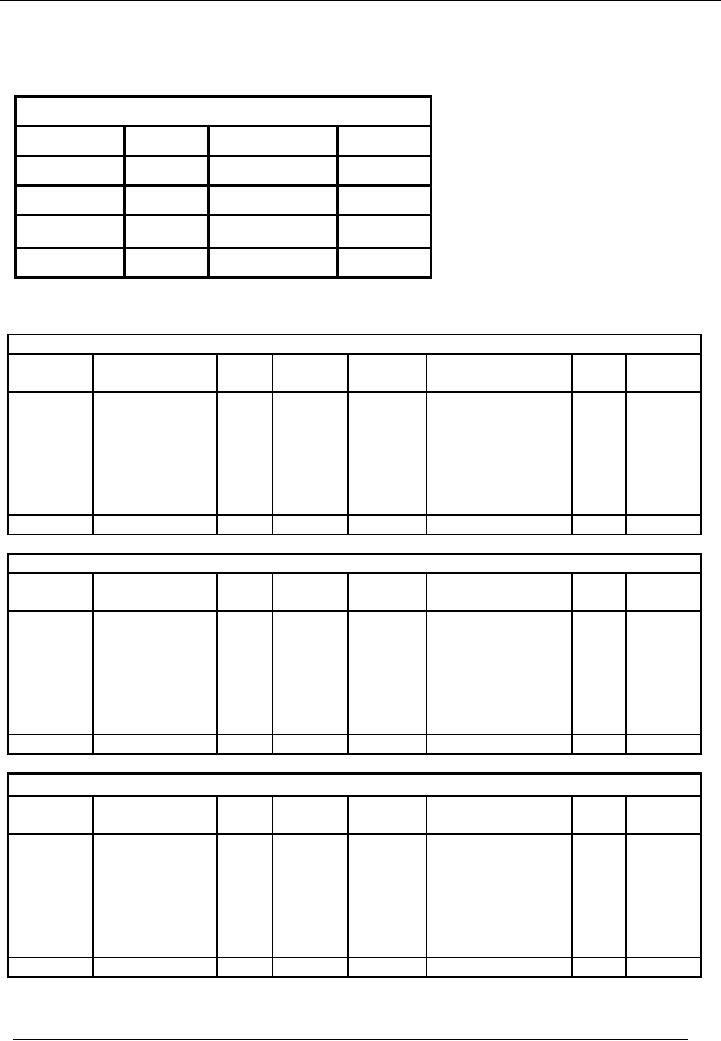

The

above mentioned record will be

posted in the personal ledger

accounts of A, B & C (Debtors

ledger

account)

in the following manner:

A's

Account

Account

code----

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

01/03

10,000

Balance

b/d

10,000

Total

10,000

Total

10,000

B's

Account

Account

code----

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

15/03

15,000

Balance

b/d

15,000

Total

15,000

Total

15,000

C's

Account

Account

code----

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

31/03

20,000

Balance

b/d

20,000

Total

20,000

Total

20,000

174

Financial

Accounting (Mgt-101)

VU

In the

general ledger, the amount of total

sales will be booked in the

following manner:

Sales

Account

Account

code----

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

31/03

Total

sales for the

45,000

month

of march,

2002

Balance

b/d

45,000

Total

45,000

Total

45,000

Debtors

Control Account

Account

code----

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

31/03

Total

sales for

45,000

the

month of

march,

2002

Balance

b/d

45,000

Total

45,000

Total

45,000

Now if

we total the balance of three

accounts of the debtors' ledger on Mar

31, 2002:

A

10,000

B

15,000

C

20,000

Total

45,000

It

will be the same as the balance in the

debtors control account of the

general ledger.

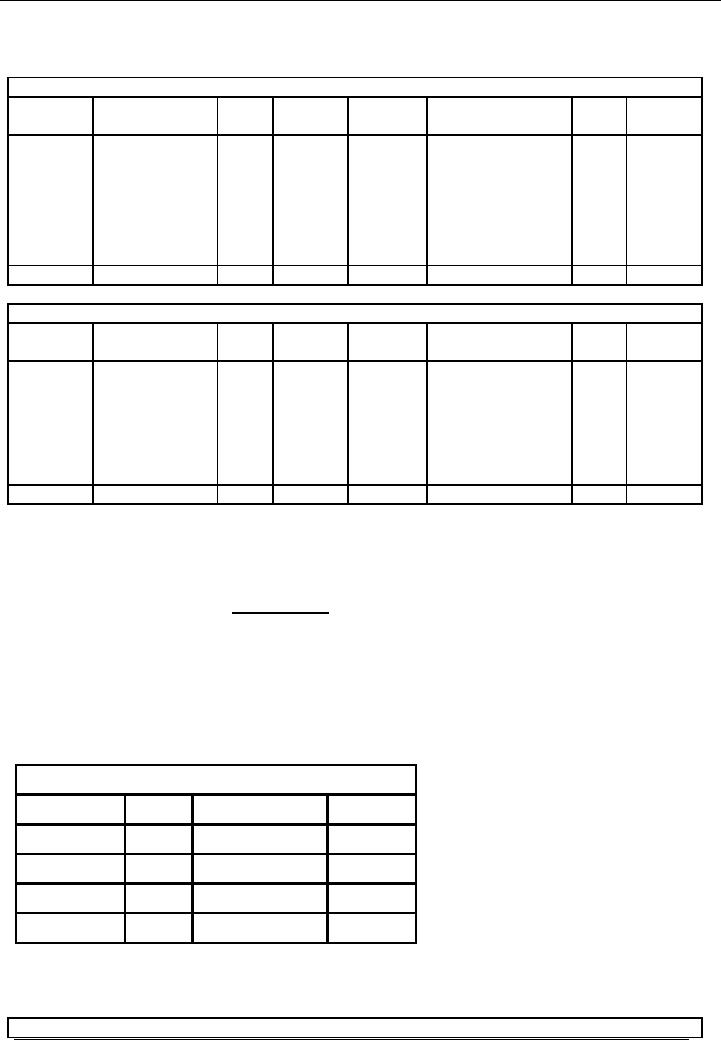

RECORDING

OF SALES RETURN

Let's

say that sales return

journal for the month of

March, 2002 give the following

record:

Sales

Journal

Date

Name /

Debtor

Amount

Jan

15, 20--

A

1,000

Jan

20, 20--

B

2,000

Jan

25, 20--

C

3,000

Total

6,000

The

above mentioned record will be

posted in the personal ledger

accounts of A, B & C (Debtors

ledger

account)

in the following manner:

A's

Account

Account

code----

175

Financial

Accounting (Mgt-101)

VU

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

01/03

10,000

15/03

1,000

Balance

b/d

9,000

Total

10,000

Total

10,000

B's

Account

Account

code----

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

15/03

15,000

20/03

2,000

Balance

b/d

13,000

Total

15,000

Total

15,000

C's

Account

Account

code----

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

31/03

20,000

25/03

3,000

Balance

b/d

17,000

Total

20,000

Total

20,000

176

Financial

Accounting (Mgt-101)

VU

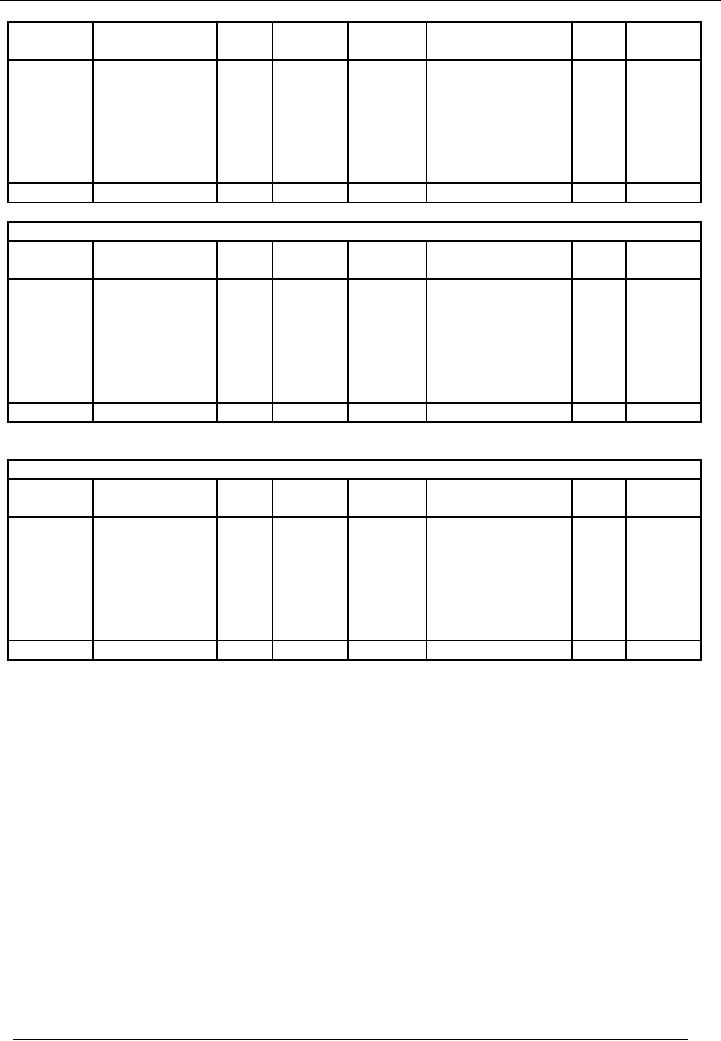

In the

general ledger, the amount of total

sales return will be booked

in the following manner:

Sales

Account

Account

code----

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

Total

sales

6,000

31/03

Total

sales for the

45,000

return

for the

month

of march,

month

of

2002

march,

2002

Balance

b/d

39,000

Total

45,000

Total

45,000

Debtors

Control Account

Account

code----

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

31/03

Total

sales for

45,000

Total

sales return

6,000

the

month of

for

the month of

march,

2002

march,

2002

Balance

b/d

39,000

Total

45,000

Total

45,000

Again

if we total the balance of three

accounts of the debtors ledger on

Mar 31,2002:

A

9,000

B

13,000

C

17,000

Total

39,000

It

will be the same as the balance in the

debtors control account of the

general ledger.

RECEIPTS

FROM DEBTORS

Here, we

need a total figure of

receipts from debtors. Therefore, when

control accounts are used,

we

maintain

cash and bank books with

separate pages for receipts

and payments i.e. two column

cash/bank

books

are not used. On the

receipts side of the cash

and bank book, a column is added in

which receipts

from

debtors are separately noted. This type

of cash / bank book is also

called multi column cash /

bank

book.

177

Financial

Accounting (Mgt-101)

VU

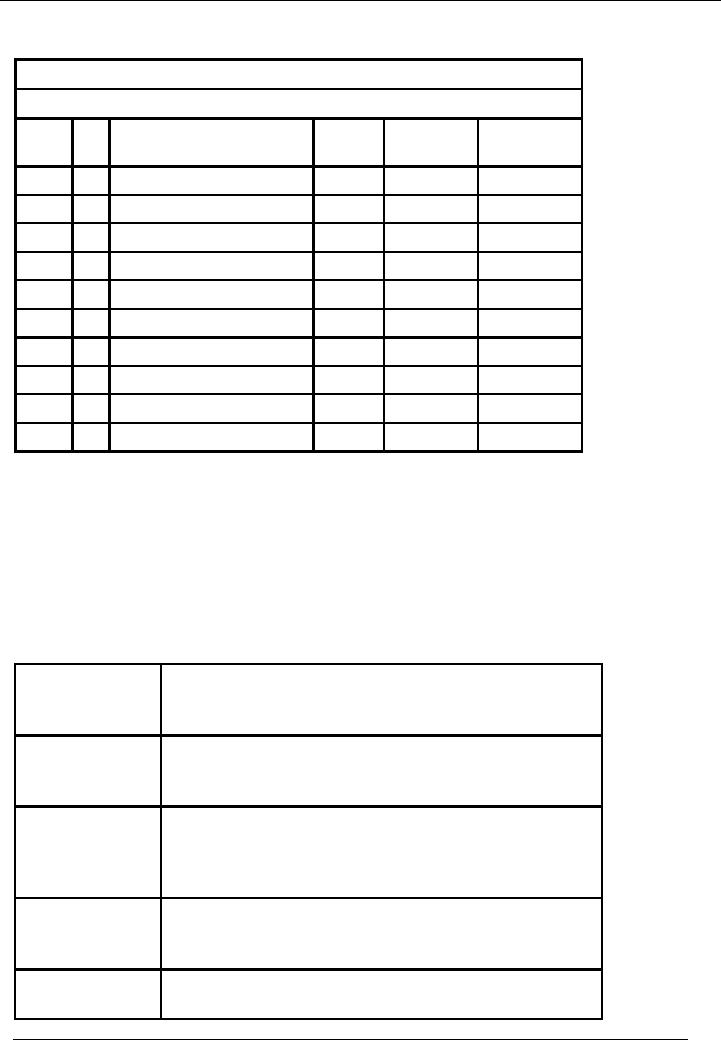

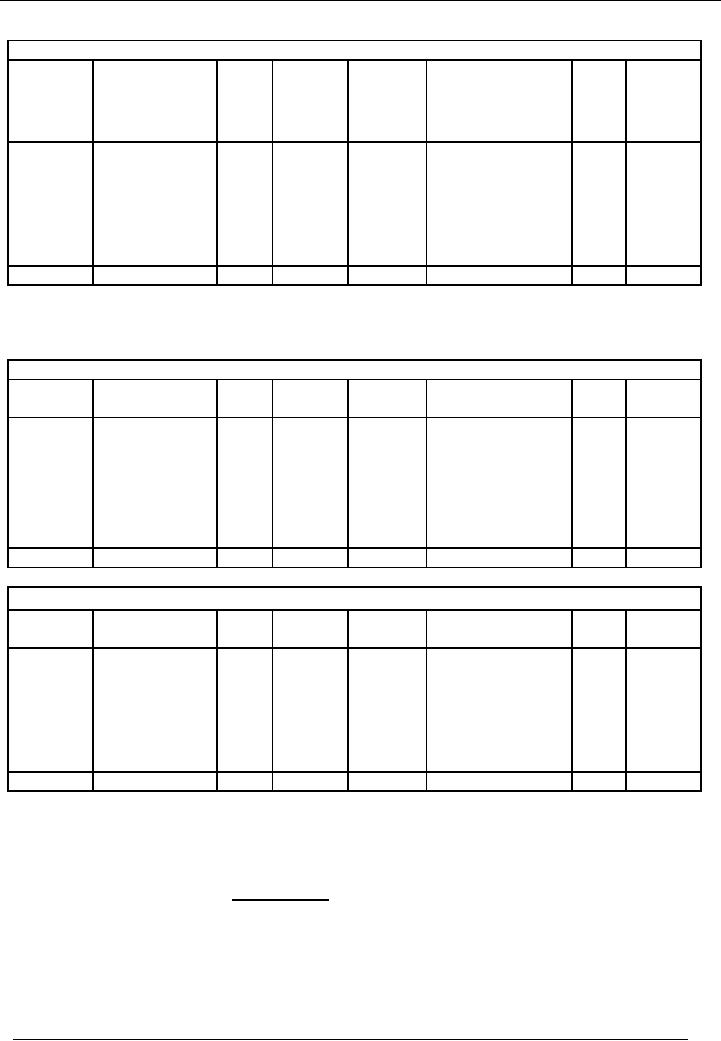

A

sample of the receipt side of

cash / bank book is given

hereunder:

Cash /

Bank Book

Receipt

Side

Date

No

Narration /

Ledger

Receipt

Receipt

from

Particulars

Code

Amount

Debtors

10,000

500

Received

from A

5,000

5,000

300

Received

from B

2,500

2,500

Received

from A

1,000

1,000

Received

from C

1,500

1,500

950

1,000

Total

22,750

9,000

SUBSIDIARY

BOOKS FOR

PURCHASES/CREDITORS

Recording

of creditors is similar to debtors.

The subsidiary books maintained in case

of purchases /

creditors

are:

· Purchase

Journal / Purchase Day Book

individual purchases are

recorded in this Journal.

· Purchase

Return / Return outward Journal If the volume of

returns is also high, then

these

are

also recorded in a separate

register.

· Creditors

Ledger this ledger maintains

record of individual

creditors.

The

information flows to the creditor

control account in the general

ledger as follows:

Opening

balance of

List

of creditor balances drawn up to the end

of previous period.

creditors

This

also confirms with the aggregate

balance of the creditors

ledger.

Credit

Purchases

Individual

credit purchase is recorded in the

purchase journal.

Total

of this

journal is posted into the

creditors control

account

periodically.

Purchase

Return

In

case the transaction volume of

purchase return is high,

then,

these

are recorded in the purchase

return journal. Periodically, the

total

is posted in the creditors control

a/c.

Cheques

/ Cash Paid List of payments

is extracted from cash and

bank book. Or a

separate

column is maintained in cash and bank books

for this

purpose.

Closing

Balance

This

is the balancing figure. It can also be

checked with the total

of

balances

in creditors' ledger.

178

Financial

Accounting (Mgt-101)

VU

EXAMPLE

# 2

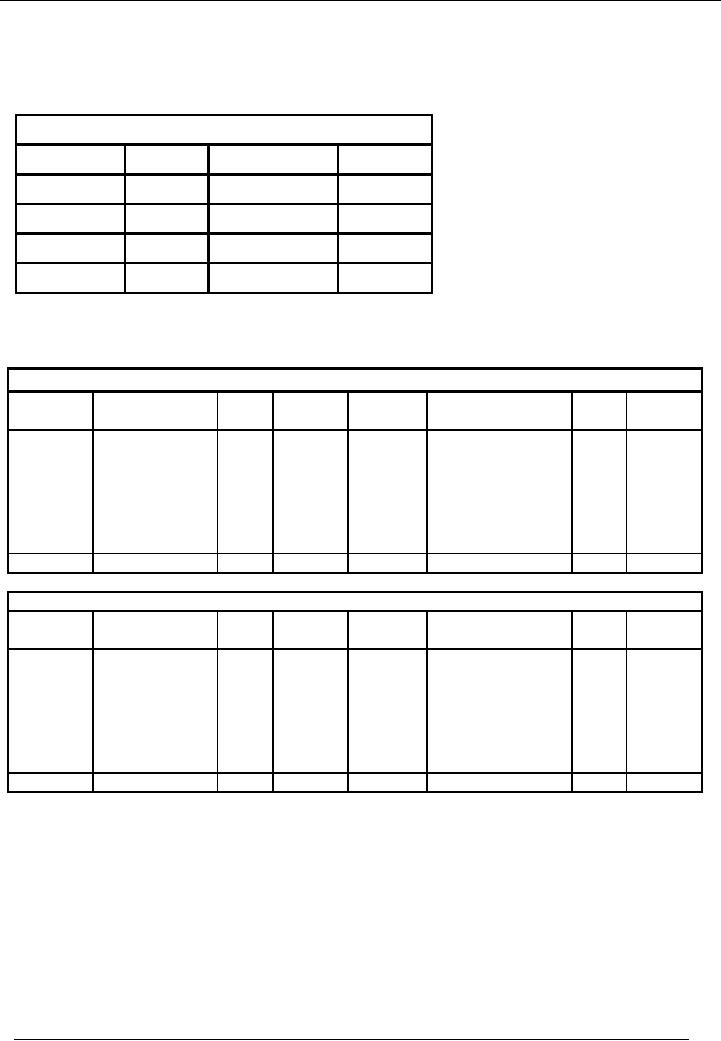

Let's

consider the following data

for the month of March,

2002:

Purchase

Journal

Date

Name /

Debtor

Amount

Mar

01, 2002

X

5,000

Mar

10, 2002

Y

10,000

Mar

25, 2002

Z

15,000

Total

30,000

The

above mentioned record will be

posted in the personal ledger

accounts of X, Y & Z (Creditors

ledger

account)

in the following manner:

X's

Account Account code----

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

5,000

01/03

5,000

Balance

b/d

Total

5,000

Total

5,000

Y's

Account Account code----

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

10,000

10/03

Balance

b/d

10,000

Total

10,000

Total

10,000

179

Financial

Accounting (Mgt-101)

VU

Z's

Account Account code----

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

25/03

15,000

Balance

b/d

15,000

Total

15,000

Total

15,000

In the

general ledger, the amount of total

purchases will be booked in the

following manner:

Purchases

Account

Account

code----

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

31/03

Total

purchases

30,000

for

the month

of

march, 2002

Balance

b/d

30,000

Total

30,000

Total

30,000

Creditors

Control Account

Account

code----

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

31/03

Total

purchases for

30,000

the

month of

march,

2002

Balance

b/d

30,000

Total

30,000

Total

30,000

Now,

if we total the balance of three

accounts of the creditor's ledger on Mar

31, 2002:

X

5,000

Y

10,000

Z

15,000

Total

30,000

It

will be the same as the balance in the

creditors control account of the

general ledger.

180

Financial

Accounting (Mgt-101)

VU

RECORDING

OF PURCHASE RETURN

Let's

say that the purchase return

journal show the following picture

for the month of March,

2002:

Purchase

Return Journal

Date

Name /

Debtor

Amount

Mar

01, 2002

X

500

Mar

10, 2002

Y

1,000

Mar

25, 2002

Z

1,500

Total

3,000

The

above mentioned record will be

posted in the personal ledger

accounts of X, Y & Z (Creditors

ledger

account)

in the following manner:

X's

Account Account code----

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

01/03

500

01/03

5,000

Balance

b/d

4,500

Total

5,000

Total

5,000

Y's

Account Account code----

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

10/03

1,000

10/03

10,000

Balance

b/d

9,000

Total

10,000

Total

10,000

181

Financial

Accounting (Mgt-101)

VU

Z's

Account Account code----

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

25/03

1,500

25/03

15,000

Balance

b/d

13,500

Total

15,000

Total

15,000

In the

general ledger, the amount of total

purchases will be booked in the

following manner:

Purchases

Account

Account

code----

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

31/03

Total

purchases

30,000

31/03

Total

purchases

3,000

for

the month

return

for the

of

march, 2002

month

of march,

2002

Balance

b/d

27,000

Total

30,000

Total

30,000

Creditors

Control Account

Account

code----

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

31/03

Total

purchases

3,000

31/03

Total

purchases for

30,000

return

for the

the

month of

month

of

march,

2002

march,

2002

Balance

b/d

27,000

Total

30,000

Total

30,000

Now,

if we total the balance of three

accounts of the creditor's ledger on Mar

31, 2002:

X

4,500

Y

9,000

Z

13,500

Total

27,000

It

will be the same as the balance in the

creditors control account of the

general ledger.

PAYMENT

TO CREDITORS

182

Financial

Accounting (Mgt-101)

VU

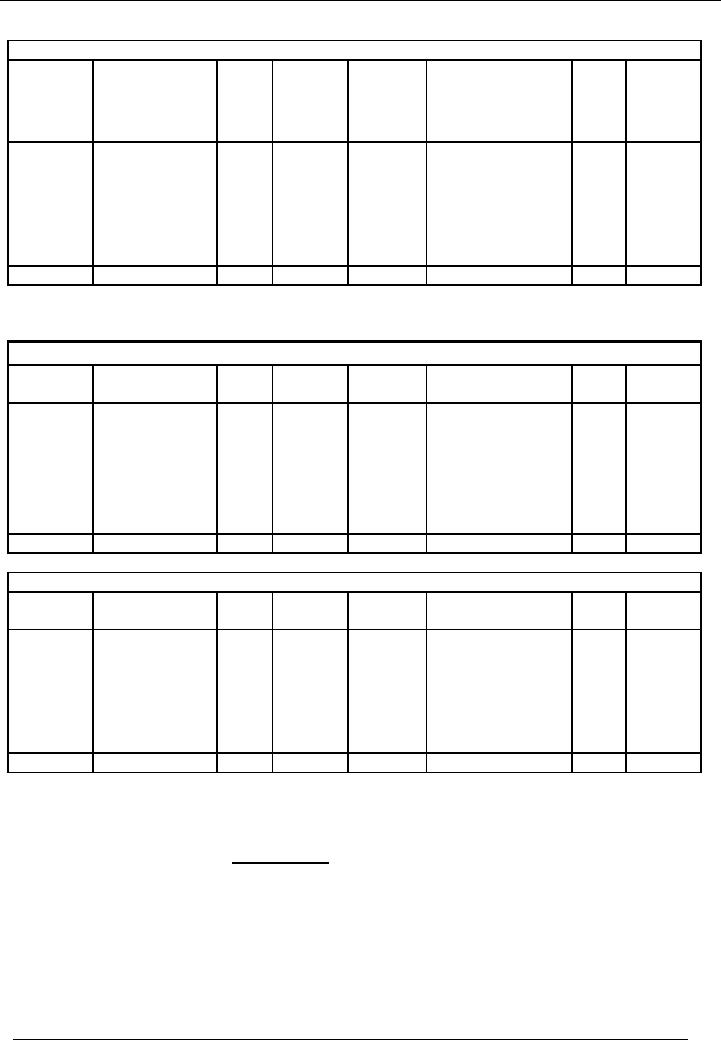

Here, we

need a total figure of

payment to creditors. Therefore, when

control accounts are used,

we

maintain

cash and bank books with

separate pages for receipts

and payments i.e. two column

cash/bank

books

are not used. On the payment

side of the cash and bank

book, a column is added in which

payments

to

creditors are separately noted. This type

of cash / bank book is also

called multi column cash /

bank

book.

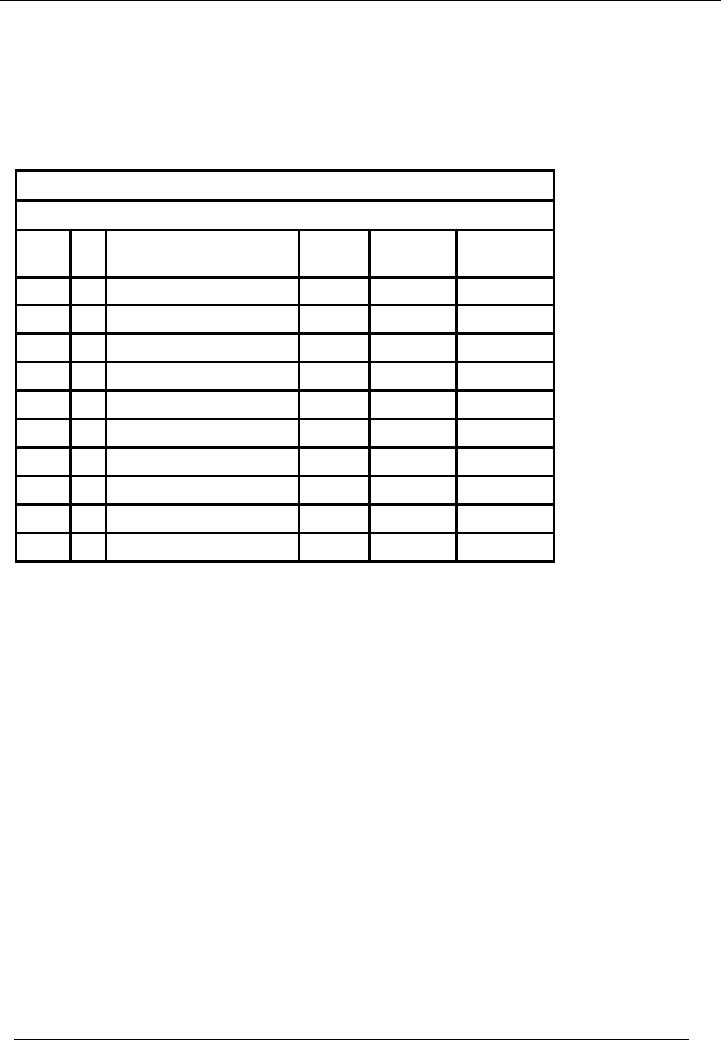

A

sample of the payment side of

cash / bank book is given

hereunder:

Cash /

Bank Book

Payment

Side

Date

No

Narration /

Ledger

Payment

Payment

to

Particulars

Code

Amount

Creditors

500

5,000

Received

from A

2,500

2,500

3,000

Received

from B

1,500

1,500

1,000

Received

from C

1,500

1,500

1,950

1,500

Total

18,450

5,500

183

Table of Contents:

- Introduction to Financial Accounting

- Basic Concepts of Business: capital, profit, budget

- Cash Accounting and Accrual Accounting

- Business entity, Single and double entry book-keeping, Debit and Credit

- Rules of Debit and Credit for Assets, Liabilities, Income and Expenses

- flow of transactions, books of accounts, General Ledger balance

- Cash book and bank book, Accounting Period, Trial Balance and its limitations

- Profit & Loss account from trial balance, Receipt & Payment, Income & Expenditure and Profit & Loss account

- Assets and Liabilities, Balance Sheet from trial balance

- Sample Transactions of a Company

- Sample Accounts of a Company

- THE ACCOUNTING EQUATION

- types of vouchers, Carrying forward the balance of an account

- ILLUSTRATIONS: Ccarrying Forward of Balances

- Opening Stock, Closing Stock

- COST OF GOODS SOLD STATEMENT

- DEPRECIATION

- GROUPINGS OF FIXED ASSETS

- CAPITAL WORK IN PROGRESS 1

- CAPITAL WORK IN PROGRESS 2

- REVALUATION OF FIXED ASSETS

- Banking transactions, Bank reconciliation statements

- RECAP

- Accounting Examples with Solutions

- RECORDING OF PROVISION FOR BAD DEBTS

- SUBSIDIARY BOOKS

- A PERSON IS BOTH DEBTOR AND CREDITOR

- RECTIFICATION OF ERROR

- STANDARD FORMAT OF PROFIT & LOSS ACCOUNT

- STANDARD FORMAT OF BALANCE SHEET

- DIFFERENT BUSINESS ENTITIES: Commercial, Non-commercial organizations

- SOLE PROPRIETORSHIP

- Financial Statements Of Manufacturing Concern

- Financial Statements of Partnership firms

- INTEREST ON CAPITAL AND DRAWINGS

- DISADVANTAGES OF A PARTNERSHIP FIRM

- SHARE CAPITAL

- STATEMENT OF CHANGES IN EQUITY

- Financial Statements of Limited Companies

- Financial Statements of Limited Companies

- CASH FLOW STATEMENT 1

- CASH FLOW STATEMENT 2

- FINANCIAL STATEMENTS OF LISTED, QUOTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES