|

SALARY AND ITS COMPUTATION EXERCISES 3 |

| << SALARY AND ITS COMPUTATION EXERCISES 2 |

| Tax treatment of Gratuity >> |

Taxation

Management FIN 623

VU

MODULE

6

LESSON

6.28

SALARY

AND ITS COMPUTATION

Exercise

9:

Computation

of taxable income and tax thereon in

respect of Mr. Yasir (a salaried

individual) for the tax

year

2007 from the following

information/data:

MTS

Rs20,000--2000--30,000

Basic

salary

Rs

20,000 pm

Accommodation

provided by the employer to Mr. Yasir. He

is entitled to house rent

allowance@50% of

basic

salary.

Motor

vehicle provided partly for

official and partly for

personal use. Cost of vehicle to the

employer

was Rs

1,000,000.

Flying

allowance provided, Mr. Yasir is

working for a Pakistani

Airline Rs 400,000

Concessional

Loan of Rs 1 million provided by employer

@ of markup of 4% per anum (bench

mark

rate

for tax year 2007 is 9% per

annum).

Solution

to Exercise 9:

Tax

payer: Mr. Yasir

Tax

year: 2007

Residential

Status: Resident

NTN:

000111

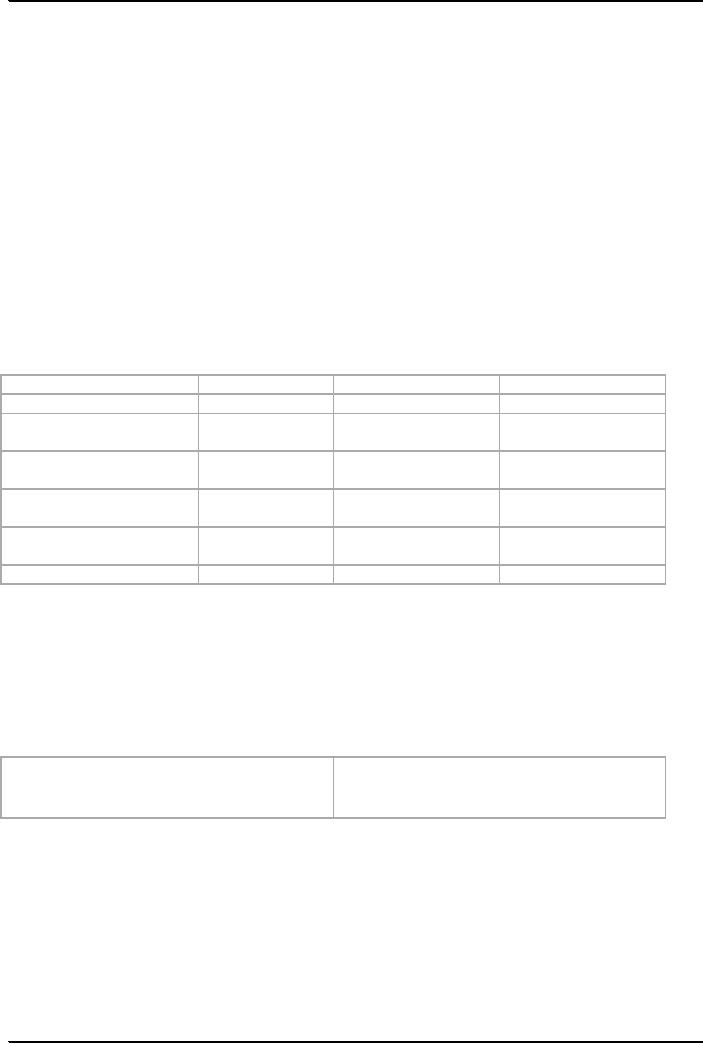

Computation

of taxable income and tax

thereon:

In

Rs

Particulars

Total

income

Exempt

Income

Taxable

Income

Salary

240,000

Nil

240,000

Accommodation

---

---

120,000

Refer

(note-1)

Motor

Vehicle for personal

---

---

50,000

use,

Refer (note-2)

Flying

allowance

---

---

---

Refer

(note-3)

Concessional

loan

---

---

50,000

Refer

(note-4)

Total

460,000

Tax

liability:

Tax

rate of 3.5% percent as given at

serial #7 for taxable income

exceeding Rs 400,000 up to Rs

500,000

Income

tax payable:

460,000

x 3.5%= Rs.16,100

Note

1: Accommodation --

Amount that would have

been otherwise provided under

terms of

employment

but in no case less than 45% of

MTS or basic salary.

Note

2:

Valuation

of Conveyance

Partly

for personal and partly for

official use

5%

of

cost or 5%

of

FMV of Vehicle, in case of

lease

Note

3:

Flying

allowance

Flying

allowance shall be taxed @

2.5% of amount received as a separate

block of income under sub

clause

1 of

part 3 of second

schedule.

Note

4:

Bench

mark rate for tax year

2007 is 9%

Loan

provided at the rate of mark-up of

4%

Amount

added back 1,000,000 x 5%=

Rs.50,000

Exercise

10:

Computation

of taxable income and tax thereon in

respect of Mr. Yasir (a salaried

individual) for the tax

year

2007 from the following

information/data:

MTS

Rs

30,000-2000-50,000

46

Taxation

Management FIN 623

VU

Basic

Salary

Rs

40,000 pm

Accommodation

provided by the employer. Mr. Yasir is

entitled to house rent

allowance @50% of basic

salary.

Employer

provided motor vehicle to Mr. Yasir

exclusively for official

use. Cost of the vehicle

is

Rs.800,000.

Mr.

Yasir paid Zakat amounting Rs 5,000

during the tax year

2007.

The

said employee paid donations amounting

Rs. 10,000 to a charitable

institution duly approved by

CBR.

Solution

to Exercise 10:

Tax

payer: Mr. Yasir

Tax

year: 2007

Residential

Status: Resident

NTN:

000111

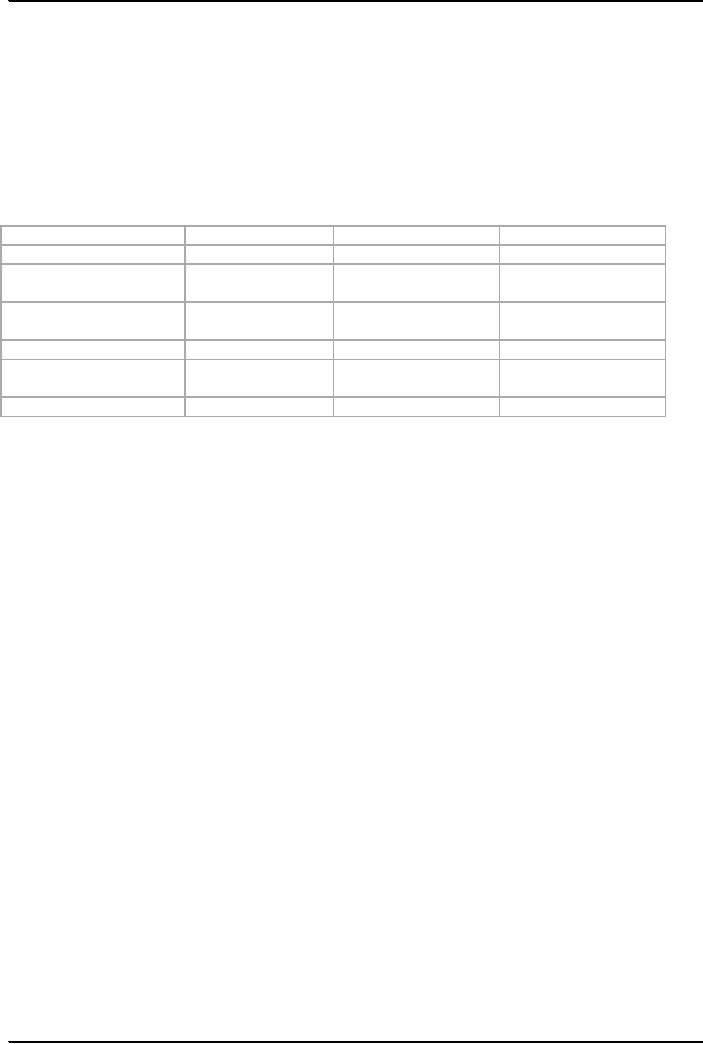

Computation

of taxable income and tax

thereon:

In

Rs

Particulars

Total

income

Exempt

Income

Taxable

Income

Salary

480,000

Nil

480,000

Accommodation

---

---

240,000

Refer

(note-1)

Motor

Vehicle

---

---

---

Refer

(note-2)

Sub

Total

720,000

Zakat

paid by Mr. Yasir

(5,000)

(Deductible

allowance)

Total

taxable income

Rs.

715,000

Tax

liability:

Tax

rate of 7.50% percent as given at

serial #10 for taxable

income exceeding Rs.700,000 up to

Rs.850,000

Income

tax payable: 715,000

x 7.5%= Rs.53,625

Computation

of tax credit on

Donation:

A/B x

C

53625/715,000 x

10,000=Rs.750

Income

tax payable

=

53625 750=

Rs.52,875

(C 30% of

taxable income shall be:

715,000 x 30%=214500. Hence C taken as

Rs.10,000)

Note

1: Accommodation --

Amount that would have

been otherwise provided under

terms of

employment

but in no case less than 45% of

MTS or basic salary.

Note

2: Motor vehicle--provided

for official use since

motor vehicle is provided

exclusively for

official

use,

no add-back shall be made

towards the salary income of the

employee.

Exercise

11- Consolidated

exercise.

Compute

taxable income & tax thereon for tax

year 2007 in respect of Mr.

Yasir, a salaried

individual.

MTS

Rs30,000-2,500-50,000

a.

Basic salary,

Rs.

420,000pa

b.

Salary received from former

employer

Rs

200,000

c.

Salary received from

prospective employer

Rs

100,000

d. Tax

liability of employee paid by the

employer

Rs

40,000

e.

Voluntary payments made by

employee.

Rs

80,000

f. Mr.

Yasir incurred the expenses during the tax

year on account of personal

car Rs. 40,000 and

on

renovation

of his house

Rs.100,000

g.

Leave pay

Rs.20,000

h.

Medical allowance

Rs.60,000

i.

Free hospitalization services received

under the term of employment.

Rs.100,000

j.

Extra duty Allowance

Rs.15,000

k.

Bonuses received

Rs.40,000

l.

Utilities provided by the employer

Rs.30,000

m. T.A

/D.A reimbursed on account of official

assignments.

Rs

40,000

n.

Golden handshake payments

received

Rs

1,600,000

Average

rate of tax for last 3 years

was 25%, 20%, 15%.

47

Taxation

Management FIN 623

VU

o.

Donation paid by the employee to a

charitable institution duly approved by

CBR

Rs.

40,000

p.

Deduction of tax at source

Rs.

224,000

Solution

to Exercise 11:

Tax

payer: Mr. Yasir

Tax

year: 2007

Residential

Status: Resident

NTN:

000111

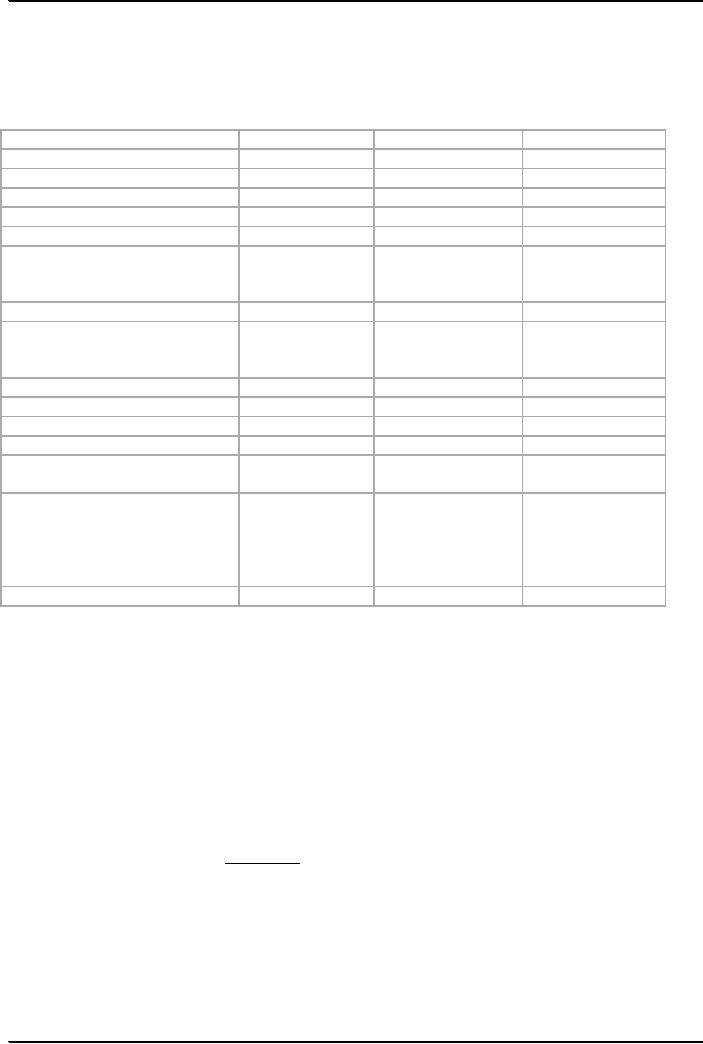

Computation

of taxable income and tax

thereon:

In

Rs

Particulars

Total

income

Exempt

Income

Taxable

Income

Salary

420,000

Nil

420,000

Salary

from former employer

200,000

Nil

200,000

Salary

from prospective employer

100,000

Nil

100,000

Tax

liability paid by employer

40,000

Nil

40,000

Voluntary

payments

80,000

Nil

80,000

Expenses

incurred (deductions

---

---

---

not

admissible to salaried

individuals)

Leave

pay

20,000

Nil

20,000

Medical

allowance

60,000

Nil

60,000

(Exemption

not allowed since

free

hospitalization

services provided)

Free

hospitalization

100,000

100,000

Nil

Extra

duty allowance

15,000

Nil

15,000

-Bonuses

received

40,000

Nil

40,000

-

Utilities

30,000

Nil

30,000

TA/DA

for official purpose

40,000

40,000

Nil

Golden

handshake amount of Rs

1,600,000

1,600,000

can be taxed @average

rate

of tax of last 3 years i.e.;

25+

20+15/3=

20%

--not

advisable

Total

taxable income

2,605,000

Tax

liability:

Tax

rate of 16% percent as given at serial

#17 for taxable income

exceeding Rs.2,000,000 up to

Rs.

3,150,000

Income

tax payable:

2,605,000

x 17%= Rs. 442,850

Computation

of tax credit on Donation:

A/B x

C

442,850/2,605,000 x

40,000 = Rs. 6,800

Income

tax payable

=

442,850 6,800 =

436,050

(C

is2,605,000 x 30%=781,500. Hence C is

taken as Rs.40,000)

Salary

and Its Computation

Tax

Payable=

Rs.

436,050

Deduction

at source =

Rs.

224,000

Tax

Payable =

Rs.

212,050

48

Table of Contents:

- AN OVERVIEW OF TAXATION

- What is Fiscal Policy, Canons of Taxation

- Type of Taxes, Taxation Management

- BASIC FEATURES OF INCOME TAX

- STATUTORY DEFINITIONS

- IMPORTANT DEFINITIONS

- DETERMINATION OF LEGAL STATUS OF A PERSON

- HEADS OF INCOME

- Rules to Prevent Double Derivation of Income and Double Deductions

- Agricultural Income

- Computation of Income, partly Agricultural,

- Foreign Government Officials

- Exemptions and Tax Concessions

- RESIDENTIAL STATUS & TAXATION 1

- RESIDENTIAL STATUS & TAXATION 2

- Important Points Regarding Income

- Geographical Source of Income

- Taxation of Foreign-Source Income of Residents

- Exercises on Determination of Income 1

- Exercises on Determination of Income 2

- SALARY AND ITS COMPUTATION

- Definition of Salary

- Significant points regarding Salary

- Tax credits on Charitable Donations

- Investment in Shares

- SALARY AND ITS COMPUTATION EXERCISES 1

- SALARY AND ITS COMPUTATION EXERCISES 2

- SALARY AND ITS COMPUTATION EXERCISES 3

- Tax treatment of Gratuity

- Gratuity Exercise

- PROVIDENT FUND

- Exemptions on Business income, Treatment of Speculation Business

- Deductions Allowed & Not Allowed

- Deductions: Special Provisions, Depreciation

- Methods of Accounting

- Taxation of Resident Company

- Taxation of Companies: Exercises

- Computation of Capital Gain

- Disposals Not Chargeable To Tax

- TAX RETURNS & ASSESSMENT OF INCOME UNIVERSAL SELF ASSESSMENT SCHEME

- Normal Assessment, USAS, Provisional Assessment, Best Judgment Assessment

- ADVANCE TAX COLLECTION & RECOVERY OF TAX PENALTIES & PROSECUTION

- What is Value Added Tax (VAT)?

- SALES TAX

- SALES TAX RETURNS