|

Problems Solving |

| << COMPANY ACCOUNTS 2 |

| COMPANY ACCOUNTS >> |

Advance

Financial Accounting

(FIN-611)

VU

LESSON

# 22

Solved

Problems

Q.

1

Simple

Co. has been trading for a

number of years manufacturing

domestic

appliances.

Its trial balance for the

year ending 31 August 2005 is noted

below, along

with

some additional

information.

Simple

Co.

Trial

Balance

As at

31st August

2005

Dr.

Cr

(Rs.

000)

(Rs.

000)

Sales

14,345

Opening

inventories

1,456

Purchases

4,239

Manufacturing

wages

2,386

Other

manufacturing costs

646

Selling

and distribution costs

1,895

Administration

costs

998

Interest

expense

400

Interim

dividend paid

900

Long-term

investments

900

Non-current

assets at cost

6,579

Depreciation

2,756

Trade

receivables

1,923

Prepayments

489

Staff

loans

12

Bank

and cash balances

267

450

Bank

overdraft

534

Trade

payables

Accruals

123

3,000

Debenture

redeemable in 2009

Two million

ordinary shares of 25 paisa

each

500

Share

premium

250

Retained

profits: 1 September 2004

1,132

23,090

23,090

Additional

Information:

1.

Closing inventories have

been counted and valued at

Rs. 978,000.

2.

The tax charge for the

year has been estimated at

Rs. 879,000.

3. An

interim dividend of 45 paisa

per share was paid. A

final dividend of 75

paisa

per share has been

proposed.

4. All

other routine adjustments

have been made (e.g.

depreciation, bad

debts).

5.

Transfer Rs. 600,000 to debenture

redemption reserve.

102

Advance

Financial Accounting

(FIN-611)

VU

Required:

Prepare

Simple Co.'s income

statement, balance sheet and

statement of changes in

equity

for the year ending 31 August

2005.

Solution

Simple

Co.

Income

statement

For

the year ending 31st August 2005

Rs.

000

Sales

14,345

Cost

of sales

(7,749)

Gross

profit

6,596

Sales and

distribution

(1,895)

Administration

(998)

Profit

from operations

3,703

Interest

received/paid and similar

items

(400)

Profit

before tax

3,303

Income

tax expense

(879)

Profit

for the year

2,424

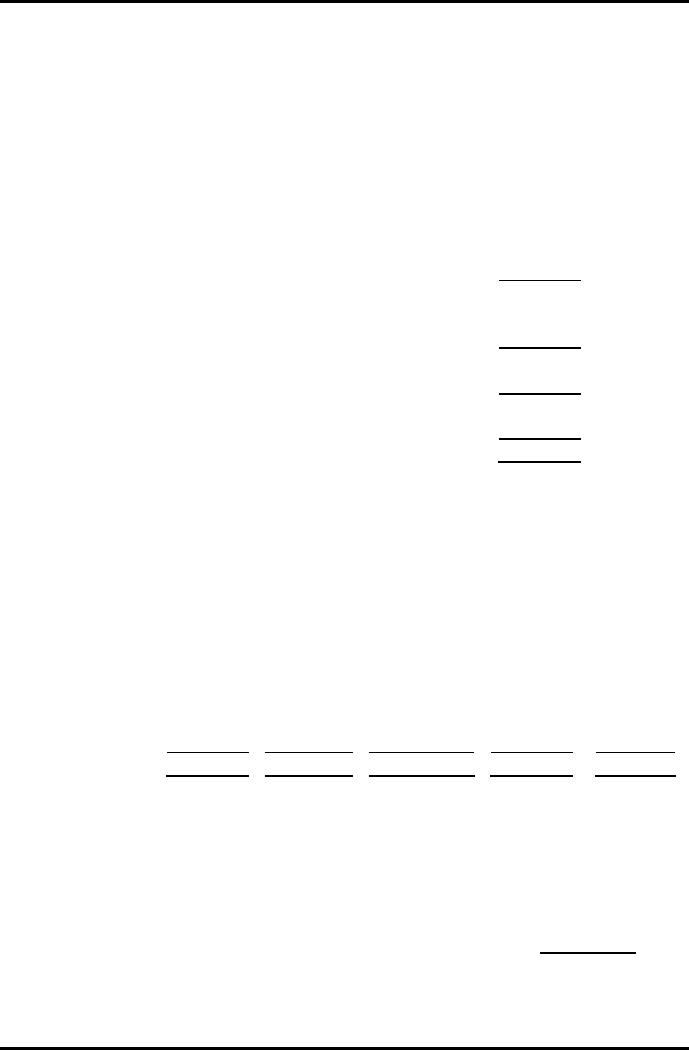

Statement

of changes in equity

Year

ending 31st

August

2005

Shares

Shares

Debenture

Retaine

Total

capital

premiu

redemptio

d

(Rs.000

(Rs.000)

m

n

reserve

earning

)

(Rs.000)

(Rs.000)

s

(Rs.000)

Opening

500

250

1,132

1,882

2,424

2,424

Profit

for the year

Transfer

to

600

(600)

-

reserve

(900)

(900)

Dividends

Closing

500

250

600

2,056

3,406

Simple

Co.

Balance

Sheet

As at

31st August

2005

Assets

(Rs.

000)

(Rs.

000)

Non-current

assets

Investments

600

Tangible

non-current assets

Note

2

3,823

4,723

Current

Assets

Inventories

978

Trade

& other receivable

(1,923+12)

1,935

103

Advance

Financial Accounting

(FIN-611)

VU

Prepayments

489

Cash

267

3,669

Total

Assets

8,392

Equity

and Liabilities

Equity

Share

capital

500

250

Share

premium

Debenture

redemption

600

reserve

2,056

Retained

earnings

Total

Equity

3,406

Non-Current

Liabilities

3,000

Current

Liabilities

Bank

overdrafts

450

Trade

and other payables

534

Accruals

123

Income

tax

879

1,986

Total

Equity and

Liabilities

8,392

*

Notes to the

Accounts

Note

1 Dividend

Rs.

000

Interim

dividend paid of 45 paisa

per

900

share

Final

dividend proposed of 75 paisa

per

1,500

share

Note

2 Tangible non-current

assets

Rs.

000

Cost

or valuation

6,579

Depreciation

(2,756)

Net

book value

3,823

(W1)

Cost of Sales

Rs.

000

Opening

inventories

1,456

Purchases

4,239

Manufacturing

wages

2,386

Other

manufacturing costs

646

Less:

closing inventories

(978)

7,749

104

Advance

Financial Accounting

(FIN-611)

VU

Q.

2

Straight

Co. has been trading for a

number of years manufacturing steel

girders. Its

trial

balance for the year-ending

31st March 2006 is noted

below, along with

some

additional

information.

Straight

Co.

Trial

Balance

As at

31st March

2006

Dr.

Cr

(Rs.

000)

(Rs.

000)

Sales

28,353

Opening

inventories

3,206

Purchases

8,162

Manufacturing

wages

7,333

Other

manufacturing costs

974

Selling

and distribution costs

2,020

Administration

costs

835

Investment

income

246

Interest

paid on the bank

overdraft

50

Interim

dividend

800

Long-term

investment

2,885

Fixed

assets at cost

15,753

Depreciation

4,396

Trade

receivables

2,967

Prepayments

132

Staff

loans

23

Bank

and cash balances

110

Bank

overdraft

1,978

Trade

payables

756

Accruals

423

10%

Debenture redeemable in 2005

3,000

Four

million ordinary shares of 50 paisa

each

2,000

Share

premium

300

Retained

profits: 1st

April 2005

3,598

45,050

Additional

Information:

1.

Closing

inventories have been

counted and valued at Rs.

1,263,000.

2.

The

tax charge for the year

has been estimated at Rs.

1,924,000.

3.

A

final dividend of sixty

paisa per share has

been proposed.

4.

No

interest has been paid or

charged on the debenture.

The debenture was

raised

on 1st April 2005. This

will have to be accrued

for.

5. All

other routine adjustments

have been made (e.g.

depreciation, bad

debts).

105

Advance

Financial Accounting

(FIN-611)

VU

Required:

Prepare

Straight Co. income

statement, balance sheet and

statement of changes in

equity

for the year ending 31st March 2006. You should answer

in Rs. 000s.

Solution

Straight

Co.

Income

Statement

For

the year ending on 31st March 2006

Rs.

000

Sales

28,353

Cost

of sales

(18,412)

Gross

profit

9,941

Sales and

distribution

(2,020)

Administration

(635)

Profit

from operations

7,286

Investment

income

Note

2

(104)

Profit

before tax

7,182

Income

tax expense

(1,924)

Profit

for the year

5,258

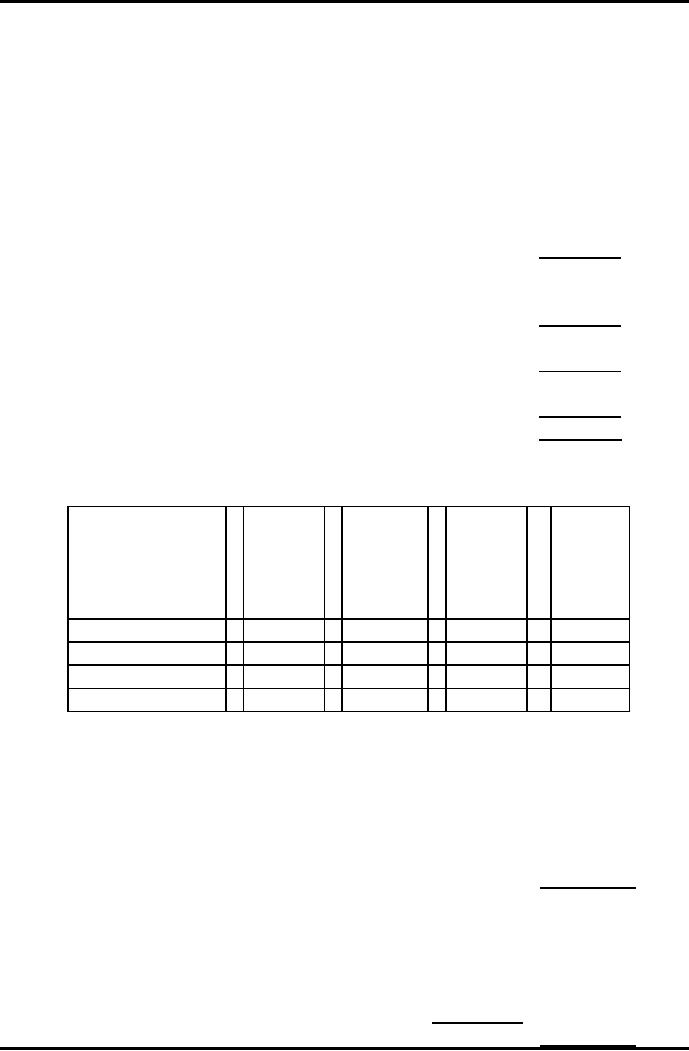

Statement

of changes in equity

Year

ending 31st

March

2006

Shares

Retaine

Total

Shares

capital

premiu

d

(Rs.000

m

earning

)

(Rs.000)

(Rs.000)

s

(Rs.000)

Opening

2,000

300

3,598

5,898

Profit

for the year

--

--

5,258

5,258

Dividends

--

--

(800)

(800)

Closing

2,000

300

8,056

10,356

Straight

Co.

Balance

Sheet

As at

31st March

2006

(Rs.

000)

(Rs.

000)

Assets

Non-current

assets

2,885

Investments

Tangible

non-current assets

Note

3

11,357

14,242

Current

Assets

1,263

Inventories

Trade

& other receivable

(2,967+23)

2,990

Prepayments

132

Cash

110

4,495

106

Advance

Financial Accounting

(FIN-611)

VU

Total

Assets

18,737

Equity

and Liabilities

Equity

Share

capital

2,000

300

Share

premium

Retained

earnings

8,056

Total

Equity

10,356

Non-Current

Liabilities

3,000

Current

Liabilities

Bank

overdrafts

1,978

Trade

and other payables

756

Accruals

(300

+ 423)

723

Income

tax

1,924

5,381

Total

Equity and

Liabilities

19,737

*

Notes to the

Accounts

Note

1 Dividend

Rs.

000

Interim

dividend paid of 20 paisa

per

800

share

Final

dividend proposed of 60 paisa

per

2,400

share

Note

2 Interest received and

similar items

Rs.

000

Investment

income

246

Debenture

interest expense (Rs. 3,000

@

(300)

10%)

Bank

interest expense

(50)

Net

book value

(104)

Note

3 Tangible non-current

assets

Rs.

000

Cost

or valuation

15,753

Depreciation

(4,396)

Net

book value

11,357

107

Advance

Financial Accounting

(FIN-611)

VU

(W1)

Cost of Sales

Rs.

000

Opening

inventories

3,206

Purchases

8,162

Manufacturing

wages

7,333

Other

manufacturing costs

974

Less:

closing inventories

(1,263)

18,412

108

Table of Contents:

- ACCOUNTING FOR INCOMPLETE RECORDS

- PRACTICING ACCOUNTING FOR INCOMPLETE RECORDS

- CONVERSION OF SINGLE ENTRY IN DOUBLE ENTRY ACCOUNTING SYSTEM

- SINGLE ENTRY CALCULATION OF MISSING INFORMATION

- SINGLE ENTRY CALCULATION OF MARKUP AND MARGIN

- ACCOUNTING SYSTEM IN NON-PROFIT ORGANIZATIONS

- NON-PROFIT ORGANIZATIONS

- PREPARATION OF FINANCIAL STATEMENTS OF NON-PROFIT ORGANIZATIONS FROM INCOMPLETE RECORDS

- DEPARTMENTAL ACCOUNTS 1

- DEPARTMENTAL ACCOUNTS 2

- BRANCH ACCOUNTING SYSTEMS

- BRANCH ACCOUNTING

- BRANCH ACCOUNTING - STOCK AND DEBTOR SYSTEM

- STOCK AND DEBTORS SYSTEM

- INDEPENDENT BRANCH

- BRANCH ACCOUNTING 1

- BRANCH ACCOUNTING 2

- ESSENTIALS OF PARTNERSHIP

- Partnership Accounts Changes in partnership firm

- COMPANY ACCOUNTS 1

- COMPANY ACCOUNTS 2

- Problems Solving

- COMPANY ACCOUNTS

- RETURNS ON FINANCIAL SOURCES

- IASBíS FRAMEWORK

- ELEMENTS OF FINANCIAL STATEMENTS

- EVENTS AFTER THE BALANCE SHEET DATE

- PROVISIONS, CONTINGENT LIABILITIES AND CONTINGENT ASSETS

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 1

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 2

- BORROWING COST

- EXCESS OF THE CARRYING AMOUNT OF THE QUALIFYING ASSET OVER RECOVERABLE AMOUNT

- EARNINGS PER SHARE

- Earnings per Share

- DILUTED EARNINGS PER SHARE

- GROUP ACCOUNTS

- Pre-acquisition Reserves

- GROUP ACCOUNTS: Minority Interest

- GROUP ACCOUNTS: Inter Company Trading (P to S)

- GROUP ACCOUNTS: Fair Value Adjustments

- GROUP ACCOUNTS: Pre-acquistion Profits, Dividends

- GROUP ACCOUNTS: Profit & Loss

- GROUP ACCOUNTS: Minority Interest, Inter Co.

- GROUP ACCOUNTS: Inter Co. Trading (when there is unrealized profit)

- Comprehensive Workings in Group Accounts Consolidated Balance Sheet