|

PREFERENCES TOWARD RISK:Reducing Risk, The Demand for Risky Assets |

| << PREFERENCES TOWARD RISK:Risk Premium, Indifference Curve |

| The Technology of Production:Production Function for Food >> |

Microeconomics

ECO402

VU

Lesson

15

Reducing

Risk

Three

ways consumers attempt to

reduce risk are:

1)

Diversification

2)

Insurance

3)

Obtaining more

information

Diversification

Suppose a firm

has a choice of selling air

conditioners, heaters, or

both.

The probability

of it being hot or cold is

0.5.

The firm

would probably be better off

by diversification.

Income

from Sales of

Appliances

Hot

Weather

Cold

Weather

Air

conditioner sales

$30,000

$12,000

Heater

sales

12,000

30,000

*

0.5 probability of hot or

cold weather

If

the firm sells only

heaters or air conditioners

their income will be either

$12,000 or

$30,000.

Their

expected income would

be:

1/2($12,000) +

1/2($30,000) = $21,000

If

the firm divides their

time evenly between

appliances their air

conditioning and

heating

sales

would be half their original

values.

If

it were hot, their expected

income would be $15,000 from

air conditioners and

$6,000

from

heaters, or $21,000.

If

it were cold, their expected

income would be $6,000 from

air conditioners and

$15,000

from

heaters, or $21,000.

With

diversification, expected income is

$21,000 with no risk

Firms

can reduce risk by

diversifying among a variety of

activities that are not

closely

related.

Stock

Market

How can

diversification reduce the

risk of investing in the

stock market?

Can

diversification eliminate the

risk of investing in the

stock market?

Insurance

Risk averse

are willing to pay to avoid

risk.

If the cost of

insurance equals the

expected loss, risk averse

people will buy

enough

insurance

to recover fully from a

potential financial

loss.

73

Microeconomics

ECO402

VU

The

Decision to Insure

Insurance

Burglary

No

Burglary

Expected

Standard

(Pr

= .1)

(Pr

= .9)

Wealth

Deviation

No

$40,000

$50,000

$49,000

$9,055

Yes

49,000

49,000

49,000

0

While

the expected wealth is the

same, the expected utility

with insurance is

greater

because

the marginal utility in the

event of the loss is greater

than if no loss

occurs.

Purchases

of insurance transfers wealth

and increases expected

utility.

The

Law of Large Numbers

Although single

events are random and

largely unpredictable, the

average outcome of

many

similar events can be

predicted.

Examples

A single coin

toss vs. large number of

coins

Whom will

have a car wreck vs.

the number of wrecks for a

large group of

drivers

Assume:

10% chance of a

$10,000 loss from a home

burglary

Expected loss =

.10 x $10,000 = $1,000 with

a high risk (10% chance of a

$10,000 loss)

100 people

face the same

risk

Then:

$1,000 premium

generates a $100,000 fund to

cover losses

Actuarial

Fairness

∑

When the

insurance premium = expected

payout

The

Value of Title Insurance

When Buying a

House

A

Scenario:

Price of a

house is $200,000

5% chance that

the seller does not

own the house

Risk

neutral buyer would

pay:

(.

95 [ 200 , 000 ] +

. 05

[ 0 ] = 190 ,

000

Risk

averse buyer would pay

much less

By

reducing risk, title

insurance increases the

value of the house by an

amount far greater

than

the premium.

Value

of Complete Information

The difference

between the expected value

of a choice with complete

information and

the

expected value when

information is incomplete.

Suppose

a store manager must

determine how many fall

suits to order:

100 suits

cost $180/suit

50 suits cost

$200/suit

The price of

the suits is $300

Suppose

a store manager must

determine how many fall

suits to order:

Unsold suits

can be returned for half

cost.

The

probability of selling each

quantity is .50.

74

Microeconomics

ECO402

VU

The

Decision to Insure

Expected

Sale

of 50

Sale

of 100

Profit

1.

Buy 50 suits

$5,000

$5,000

$5,000

2.

Buy 100 suits

1,500

12,000

6,750

With

incomplete information:

Risk Neutral:

Buy 100 suits

Risk Averse:

Buy 50 suits

The

expected value with complete

information is $8,500.

8,500 =

.5(5,000) + .5(12,000)

The

expected value with

uncertainty (buy 100 suits)

is $6,750.

The

value of complete information is

$1,750, or the difference

between the two (the

amount

the

store owner would be willing

to pay for a marketing

study).

An

Example

Per capita

packed milk consumption has

fallen over the

years

The milk

producers engaged in market

research to develop new

sales strategies to

encourage

the consumption of packed

milk.

Findings

Packed milk

demand is seasonal with the

greatest demand in the

summer

Ep

is negative

and small

EI

is positive

and large

Milk

advertising increases sales

most in the summer.

Allocating

advertising based on this

information in Karachi increased

sales by Rs. 400,000

and

profits by 9%.

The

cost of the information was

relatively low, while the

value was

substantial.

The

Demand for Risky

Assets

Assets

Something that

provides a flow of money or

services to its

owner.

The

flow of money or services

can be explicit (dividends) or

implicit (capital gain).

Capital

Gain

An increase in

the value of an asset, while

a decrease is a capital

loss.

Risky

& Riskless Assets

Risky

Asset

∑

Provides an

uncertain flow of money or

services to its

owner.

∑

Examples

Apartment

rent, capital gains,

corporate bonds, stock

prices

Riskless

Asset

∑

Provides a

flow of money or services

that is known with

certainty.

∑

Examples

Short-term

government bonds, short-term

certificates of deposit

75

Microeconomics

ECO402

VU

Asset

Returns

Return on an

Asset

The

total monetary flow of an

asset as a fraction of its

price.

Real Return of

an Asset

The

simple (or nominal) return

less the rate of

inflation.

Asset

Returns

Monetary

Flow

Asset

Return =

Purchase

Price

Flow

$100/yr.

Asset

Return =

=

=

10%

Bond

Price

$1,000

Expected

vs. Actual Returns

Expected

Return

∑

Return

that an asset should earn on

average

Actual

Return

∑

Return

that an asset earns

Higher returns

are associated with greater

risk.

The risk-averse

investor must balance risk

relative to return

Risk

and Budget Line

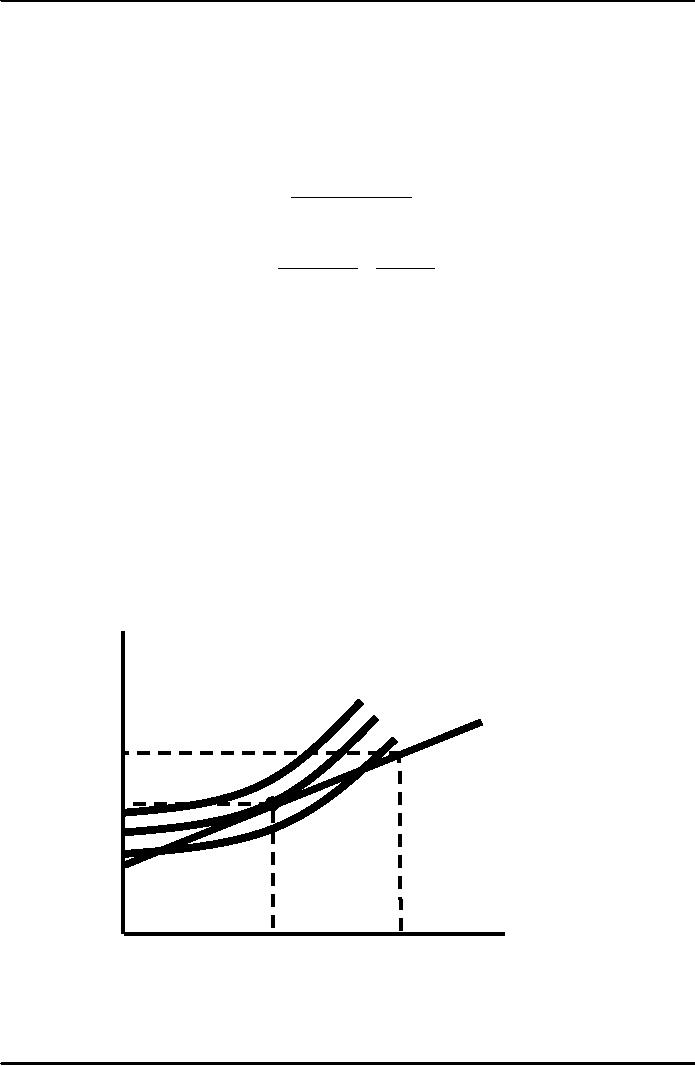

Expected

return, RP,

increases as risk

increases.

The

slope is the price of risk

or the risk-return

trade-off.

Choosing

Between Risk and

Return

U2 is

the optimal choice of

those

obtainable,

since it gives the highest

return

Expected

for

a given risk and is tangent

to the budget

Return,

Rp

line.

U3

U2

Budget

Line

U1

Rm

R*

Rf

σm

σm

σ∗

σ*

Standard

Deviation of

0

Return,

σp

76

Microeconomics

ECO402

VU

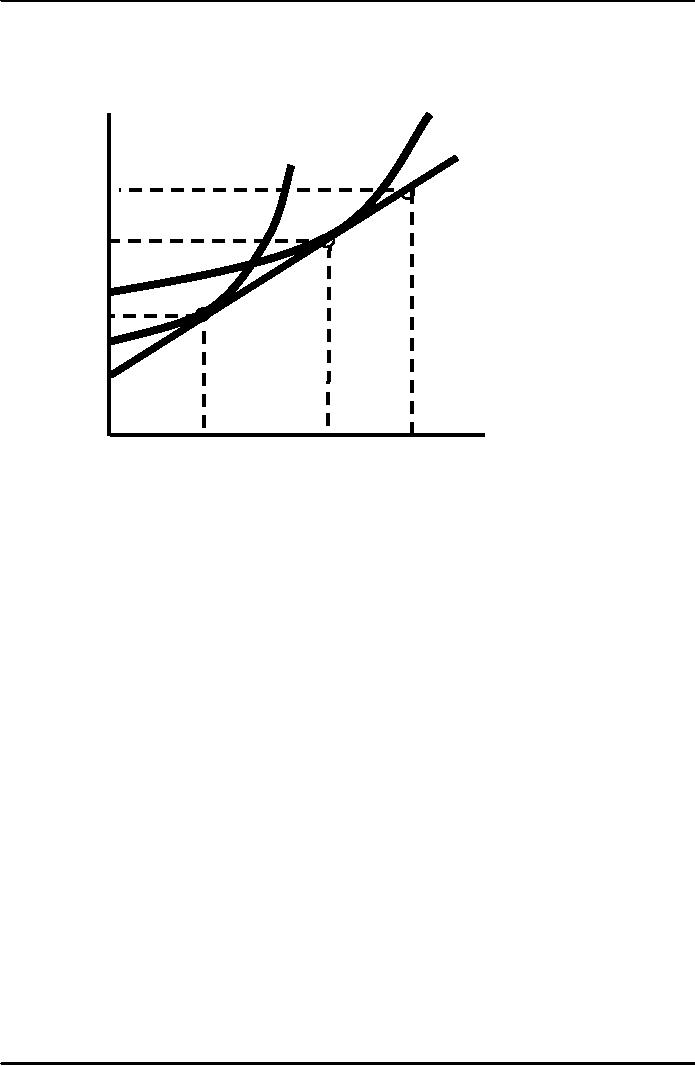

The

Choices of Two Different

Investors

UB

Expected

Return,Rp

UA

Budget

line

Rm

Given

the same budget

RB

line,

investor A

chooses

low

return-low risk,

while

investor B

chooses

high return-

RA

high

risk.

Rf

Standard

Deviation

σA

σB

σm

0

of

Return σP

77

Table of Contents:

- ECONOMICS:Themes of Microeconomics, Theories and Models

- Economics: Another Perspective, Factors of Production

- REAL VERSUS NOMINAL PRICES:SUPPLY AND DEMAND, The Demand Curve

- Changes in Market Equilibrium:Market for College Education

- Elasticities of supply and demand:The Demand for Gasoline

- Consumer Behavior:Consumer Preferences, Indifference curves

- CONSUMER PREFERENCES:Budget Constraints, Consumer Choice

- Note it is repeated:Consumer Preferences, Revealed Preferences

- MARGINAL UTILITY AND CONSUMER CHOICE:COST-OF-LIVING INDEXES

- Review of Consumer Equilibrium:INDIVIDUAL DEMAND, An Inferior Good

- Income & Substitution Effects:Determining the Market Demand Curve

- The Aggregate Demand For Wheat:NETWORK EXTERNALITIES

- Describing Risk:Unequal Probability Outcomes

- PREFERENCES TOWARD RISK:Risk Premium, Indifference Curve

- PREFERENCES TOWARD RISK:Reducing Risk, The Demand for Risky Assets

- The Technology of Production:Production Function for Food

- Production with Two Variable Inputs:Returns to Scale

- Measuring Cost: Which Costs Matter?:Cost in the Short Run

- A Firmís Short-Run Costs ($):The Effect of Effluent Fees on Firmsí Input Choices

- Cost in the Long Run:Long-Run Cost with Economies & Diseconomies of Scale

- Production with Two Outputs--Economies of Scope:Cubic Cost Function

- Perfectly Competitive Markets:Choosing Output in Short Run

- A Competitive Firm Incurring Losses:Industry Supply in Short Run

- Elasticity of Market Supply:Producer Surplus for a Market

- Elasticity of Market Supply:Long-Run Competitive Equilibrium

- Elasticity of Market Supply:The Industryís Long-Run Supply Curve

- Elasticity of Market Supply:Welfare loss if price is held below market-clearing level

- Price Supports:Supply Restrictions, Import Quotas and Tariffs

- The Sugar Quota:The Impact of a Tax or Subsidy, Subsidy

- Perfect Competition:Total, Marginal, and Average Revenue

- Perfect Competition:Effect of Excise Tax on Monopolist

- Monopoly:Elasticity of Demand and Price Markup, Sources of Monopoly Power

- The Social Costs of Monopoly Power:Price Regulation, Monopsony

- Monopsony Power:Pricing With Market Power, Capturing Consumer Surplus

- Monopsony Power:THE ECONOMICS OF COUPONS AND REBATES

- Airline Fares:Elasticities of Demand for Air Travel, The Two-Part Tariff

- Bundling:Consumption Decisions When Products are Bundled

- Bundling:Mixed Versus Pure Bundling, Effects of Advertising

- MONOPOLISTIC COMPETITION:Monopolistic Competition in the Market for Colas and Coffee

- OLIGOPOLY:Duopoly Example, Price Competition

- Competition Versus Collusion:The Prisonersí Dilemma, Implications of the Prisoners

- COMPETITIVE FACTOR MARKETS:Marginal Revenue Product

- Competitive Factor Markets:The Demand for Jet Fuel

- Equilibrium in a Competitive Factor Market:Labor Market Equilibrium

- Factor Markets with Monopoly Power:Monopoly Power of Sellers of Labor