|

Financial

Management MGT201

VU

Lesson

22

PORTFOLIO

RISK ANALYSIS AND EFFICIENT

PORTFOLIO MAPS

Learning

Objectives:

After

going through this lecture,

you would be able to have an

understanding of the following

topics

·

Portfolio

Risk Analysis & Efficient

Portfolio Maps

Before

starting the new concepts we

should recap what we have

studied in the previous

lecture.

Recap:

Portfolio

is a Collection of Investments in different

Stocks, Bonds, other Securities or a mix

of

all.

Its objective is to invest in

Different Un-Correlated Stocks in

order to minimize overall

Risk &

Maximize

Portfolio Return. It is mentioned

that individuals and

companies maintain the portfolio

in

order

to reduce to reduce the

risk

There

are 2 Types of Stock

Risk

Total

Stock Risk = Diversifiable + Market

Risk

Diversification

means expanding the number of investments

which cover different kinds

of

stocks.

We can reduce the risk as random

events in one industry can

be off set by the random effects

in

the

other industry. This way

you can reduce the company

pacific or unique risk. The

market risk arises

because

of micro economic or large scale factors

such as market interest rate, inflation

etc. These factors

have

virtually identical effect on the

share prices. For example, in

event of a war stick market

go down

in

value which means almost

every share went

down.7

Stocks

are a good number for

diversification. 40

Stocks

are enough for Minimizing

Total Risk

Calculating

Expected 2-Stock Portfolio Return &

Risk

Expected

Portfolio Return = rP * = xA rA + xB

rB

Portfolio

Risk is generally not a

simple weighted average.

Up

to this point we only look

at the portfolio which has

only two stocks.

Interpreting

2-Stock Portfolio Risk

Formula:

=

√

XA2

σ

A 2

+XB2

σ

B 2

+ 2

(XA

XB

σ A

σ

B

AB)

is

coefficient of correlation which

states that how muck the

investments are correlated.

Here,

The

risk of investing in any one

share can be reduced if we

invest in other shares also.

There have been

several

experiment studies that show

that if you invest in

approximately 40 different

uncorrelated

different

shares of different companies

then you can entirely

eliminate the company pacific portion

of

the

risk. Even if you can

not diversify across 40

different companies but if

you diversify just across

7

different

shares from different

companies then you can

still you can reduce

most of the diversifiable

risk.

No

matter what we do we can not

eliminate the market risk

that market risk become the

minimum risk

we

have to live with in our

portfolio. The important

thing then to remember is

that how this risk

will

effected

when we talk about portfolio

of two stocks or more. The

Correlation coefficient needs to

be

understood

in order to understand the risk and

return.

Correlation

Coefficient (

AB

or "Ro"):

Risk

of a Portfolio of only 2 Stocks A & B

depends on the Correlation between those

2 stocks.

The

value of Ro is between -1.0 and

+1.0

If

Ro = 0 then Investments are Uncorrelated

& Risk Formula simplifies to

Weighted Average

Formula.

If

Ro = + 1.0 then Investments are

Perfectly Positively Correlated and

this means that

Diversification

does not reduce

Risk.

If

Ro

= - 1.0, it

means that Investments are

Perfectly Negatively Correlated and the

Returns (or Prices

or

Values) of the 2 Investments move in

Exactly Opposite directions. In this

Ideal Case, All Risk can

be

diversified

away. For example, if the

price of one stock increases by

50% then the price of another

stock

goes

down by 50%.

In

Reality, Overall Ro for most

Stock Markets is about Ro = +

0.6.it

is very rough rule of thumb.

It

means

that correlations are not

completely perfect and you

should remember that if the

correlation

coefficient

is +1.0 then it is not possible to

reduce the diversifible

risk.

This

means that increasing the number of Investments in the

Portfolio can reduce some

amount of risk

but

not all risk

94

Financial

Management MGT201

VU

Portfolio

Risk - Example

Recap

Complete

2-Stock Investment Portfolio

Data:

Value

(Rs) Exp Return (%)

Risk (Std Dev)

Stock

A

30

20

20%

Stock

B

70

10

5%

Total

Value = 100

Correlation

Coeff Ro = + 0.6

2-Stock

Portfolio Risk

Calculation:

=

√

XA2

σ

A 2

+XB2

σ

B 2

+ 2

(XA

XB

σ A

σ

B

AB)

=

{0.0036 + 0.001225 + 0.00252}

0.5

=

0.0857= 8.57%

·

2-Stock Portfolio Return

Calculation:

rP* = x

A

r

A

+ x

B

r

B

= 6 + 7 =

13%

Interpretation

of Result:

The

Portfolio Risk for our

Basket of 2 Investments is

+8.57

% (if

Ro = + 0.6). What does

this

mean?

Bell

Curve Assumption: If we

assume a Normal Probability

Distribution, then there is a

68.26%

chance

that our future Portfolio

Return will be somewhere between

(rP*- σ

)

and (rP*+ σ

)

i.e.

between

(13% -8.57%) and (13%

+8.57%) or between +4.43% and

+21.57%

Portfolio

Risk lies between the Individual Risks of

the 2 Investments i.e

σ

Stock

B < σ

P

<

σ

Stock

A or 5% < 8.57% < 20% (if

Ro = +0.6)

You

can also come up with more

accurate outcome about the actual value

of the return on the portfolio

after

1 year if you take a larger

range for the standard

deviation. So, if you are

taking about the range

from

-2 sigma to +2 sigma towards then there

is likelihood that actual rate of return

of the portfolio is

somewhere

in between the two standard

deviation.

Note:

If Ro = -

0.6 (Negative Correlation)

then Portfolio Risk = + 4.8%

which is lower than

both

Individual

Investments!!

Now,

we consider the case of negatively

correlated investments.

Negatively

Correlated Investments

2-Stock

Investment Portfolio

Data:

Exp

Indiv Return (ri)

Indiv Risk (Std

Devi

)

Stock

A 20%

20%

Stock

B

10%

5%

Correlation

Coeff Ro = - 0.6

Portfolio

Risk & Return Table (for

Different Portfolio

Mixes):

Fraction

of Stock A

Portfolio

Risk Exp Portfolio Return

(rP*)

100%

20%

20%

80%

15%

18% = 0.8(20) +

0.2(10)

50%

9%

15%

= 0.5(20) + 0.5(10)

30%

4.8%

13%

15%

3.4%

11.5%

0%(i.e.

100% Stock B) 5%

10%

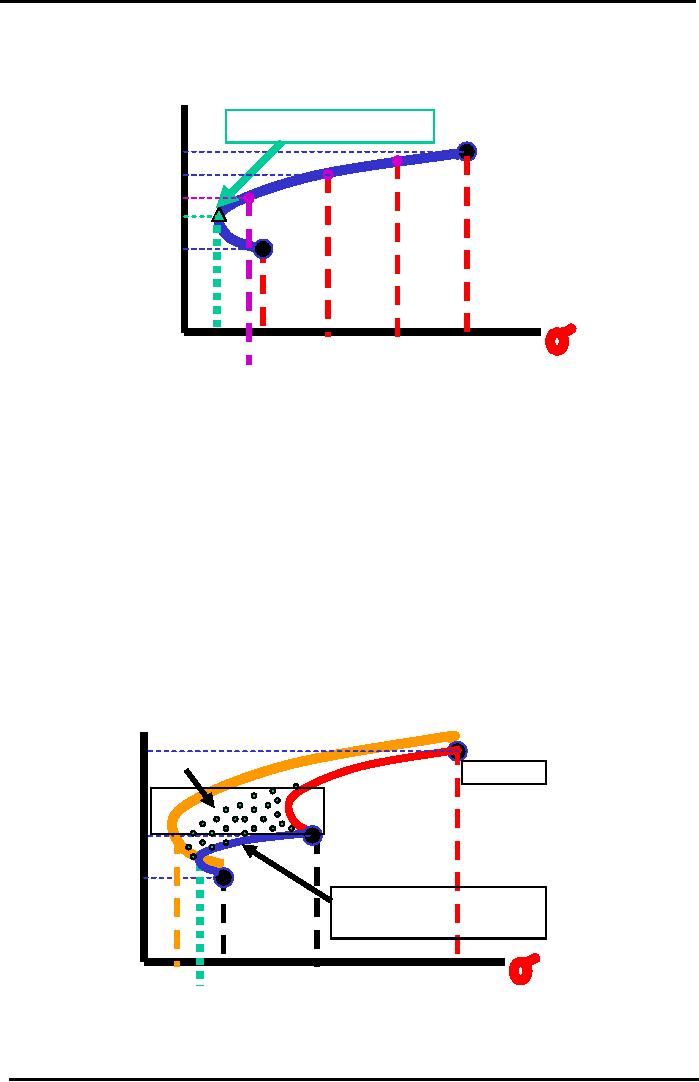

Efficient

Portfolio Map

95

Financial

Management MGT201

VU

Efficient

Portfolio Map

Shows

All Combinations of 2-Stock

Portfolio

Negative

Correlation (Ro =

-0.6)

rP*

Point

of Minimum

Portfolio

20%

Risk

Stock

A

Return

(100%

A &

15%

80%A

50%A

0%

B)

13%

30%A

11.5%

15%A

10%

Stock

B

(0%

A &

100%

B)

3.4%

5%

20%

9%

15%

P

Portfolio

Risk

4.8%

Efficient

Portfolio Interpretation

Efficient

Portfolio Map for 2-Stock

Portfolio shows all possible

Efficient Combinations

(Mixes)

of

stocks.

Efficient

Portfolios:

Efficient

Portfolios are those whose

Risk & Return values match the

ones computed using

Theoretical

Probability Formulas. The Incremental

Risk Contribution of a New

Stock to a Fully

Diversified

Portfolio of 40 Un-Correlated Stocks

will be the Market Risk

Component of the New

Stock

only.

The Diversifiable Risk of the

New Stock would be entirely

offset by random movements in the

other

40 stocks. Adding a New

Stock to the existing Portfolio

will create more Efficient

Portfolio

Curves.

The New Stock will

contribute its own

Incremental Risk and Return to the

Portfolio.

rP

* = xA rA + xB rB +

xC

rC (3

Stocks)

Efficient

Portfolio Maps

3-Stock

Portfolio

Negative

Correlation

rP*

Efficient

Frontier for

Portfolio

30%

3-Stock

Portfolio

Stock

C

Return

20%

Stock

A

10%

Stock

B

Old

Efficient Frontier

for

2-Stock

Portfolio of A & B

40%

2.5%

5%

20%

P

Portfolio

Risk

3.4%

96

Financial

Management MGT201

VU

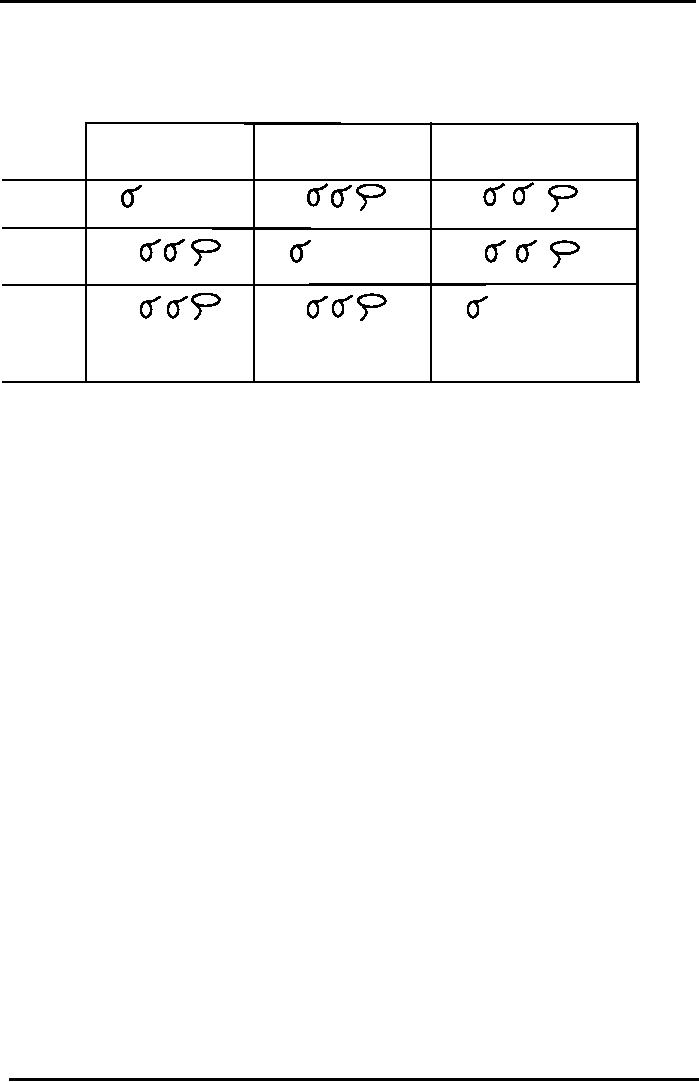

Now,

if we add another stock in the portfolio we can

take a look

3-Stock

Portfolio Risk

Formula

3x3

Matrix Approach

Stock

A

Stock

B

Stock

C

XA2

2

Stock

XA

XB

XA

XC

A

A

B

AB

A

C

AC

A

XB2

2

Stock

XB

XA

XB

XC

B

A

BA

B

B

C

BC

B

XC2

2

Stock

XC

XA

XC

XB

C

A

CA

C

B

CB

C

C

To

compute the Portfolio

Variance for a

3-Stock Portfolio, just add up

all the terms in

every

box.

To compute the Portfolio Risk (Standard

Deviation), simply take the

Square Root of the

Variance.

You

can extend this Matrix

Approach to calculate the Risk

for a Portfolio consisting of

any

number

of stocks.

Terms

in Boxes on Diagonal (Top Left to

Bottom Right) are called

"VARIANCE"

terms

associated

with

individual magnitude of risk

for each stock.

Terms

in all other (or

NON-DIAGONAL) Boxes are called

"COVARIANCE"

terms

which account for

affect

of one stock's movement on another stock's

movement.

97

Table of Contents:

- INTRODUCTION TO FINANCIAL MANAGEMENT:Corporate Financing & Capital Structure,

- OBJECTIVES OF FINANCIAL MANAGEMENT, FINANCIAL ASSETS AND FINANCIAL MARKETS:Real Assets, Bond

- ANALYSIS OF FINANCIAL STATEMENTS:Basic Financial Statements, Profit & Loss account or Income Statement

- TIME VALUE OF MONEY:Discounting & Net Present Value (NPV), Interest Theory

- FINANCIAL FORECASTING AND FINANCIAL PLANNING:Planning Documents, Drawback of Percent of Sales Method

- PRESENT VALUE AND DISCOUNTING:Interest Rates for Discounting Calculations

- DISCOUNTING CASH FLOW ANALYSIS, ANNUITIES AND PERPETUITIES:Multiple Compounding

- CAPITAL BUDGETING AND CAPITAL BUDGETING TECHNIQUES:Techniques of capital budgeting, Pay back period

- NET PRESENT VALUE (NPV) AND INTERNAL RATE OF RETURN (IRR):RANKING TWO DIFFERENT INVESTMENTS

- PROJECT CASH FLOWS, PROJECT TIMING, COMPARING PROJECTS, AND MODIFIED INTERNAL RATE OF RETURN (MIRR)

- SOME SPECIAL AREAS OF CAPITAL BUDGETING:SOME SPECIAL AREAS OF CAPITAL BUDGETING, SOME SPECIAL AREAS OF CAPITAL BUDGETING

- CAPITAL RATIONING AND INTERPRETATION OF IRR AND NPV WITH LIMITED CAPITAL.:Types of Problems in Capital Rationing

- BONDS AND CLASSIFICATION OF BONDS:Textile Weaving Factory Case Study, Characteristics of bonds, Convertible Bonds

- BONDS’ VALUATION:Long Bond - Risk Theory, Bond Portfolio Theory, Interest Rate Tradeoff

- BONDS VALUATION AND YIELD ON BONDS:Present Value formula for the bond

- INTRODUCTION TO STOCKS AND STOCK VALUATION:Share Concept, Finite Investment

- COMMON STOCK PRICING AND DIVIDEND GROWTH MODELS:Preferred Stock, Perpetual Investment

- COMMON STOCKS – RATE OF RETURN AND EPS PRICING MODEL:Earnings per Share (EPS) Pricing Model

- INTRODUCTION TO RISK, RISK AND RETURN FOR A SINGLE STOCK INVESTMENT:Diversifiable Risk, Diversification

- RISK FOR A SINGLE STOCK INVESTMENT, PROBABILITY GRAPHS AND COEFFICIENT OF VARIATION

- 2- STOCK PORTFOLIO THEORY, RISK AND EXPECTED RETURN:Diversification, Definition of Terms

- PORTFOLIO RISK ANALYSIS AND EFFICIENT PORTFOLIO MAPS

- EFFICIENT PORTFOLIOS, MARKET RISK AND CAPITAL MARKET LINE (CML):Market Risk & Portfolio Theory

- STOCK BETA, PORTFOLIO BETA AND INTRODUCTION TO SECURITY MARKET LINE:MARKET, Calculating Portfolio Beta

- STOCK BETAS &RISK, SML& RETURN AND STOCK PRICES IN EFFICIENT MARKS:Interpretation of Result

- SML GRAPH AND CAPITAL ASSET PRICING MODEL:NPV Calculations & Capital Budgeting

- RISK AND PORTFOLIO THEORY, CAPM, CRITICISM OF CAPM AND APPLICATION OF RISK THEORY:Think Out of the Box

- INTRODUCTION TO DEBT, EFFICIENT MARKETS AND COST OF CAPITAL:Real Assets Markets, Debt vs. Equity

- WEIGHTED AVERAGE COST OF CAPITAL (WACC):Summary of Formulas

- BUSINESS RISK FACED BY FIRM, OPERATING LEVERAGE, BREAK EVEN POINT& RETURN ON EQUITY

- OPERATING LEVERAGE, FINANCIAL LEVERAGE, ROE, BREAK EVEN POINT AND BUSINESS RISK

- FINANCIAL LEVERAGE AND CAPITAL STRUCTURE:Capital Structure Theory

- MODIFICATIONS IN MILLAR MODIGLIANI CAPITAL STRUCTURE THEORY:Modified MM - With Bankruptcy Cost

- APPLICATION OF MILLER MODIGLIANI AND OTHER CAPITAL STRUCTURE THEORIES:Problem of the theory

- NET INCOME AND TAX SHIELD APPROACHES TO WACC:Traditionalists -Real Markets Example

- MANAGEMENT OF CAPITAL STRUCTURE:Practical Capital Structure Management

- DIVIDEND PAYOUT:Other Factors Affecting Dividend Policy, Residual Dividend Model

- APPLICATION OF RESIDUAL DIVIDEND MODEL:Dividend Payout Procedure, Dividend Schemes for Optimizing Share Price

- WORKING CAPITAL MANAGEMENT:Impact of working capital on Firm Value, Monthly Cash Budget

- CASH MANAGEMENT AND WORKING CAPITAL FINANCING:Inventory Management, Accounts Receivables Management:

- SHORT TERM FINANCING, LONG TERM FINANCING AND LEASE FINANCING:

- LEASE FINANCING AND TYPES OF LEASE FINANCING:Sale & Lease-Back, Lease Analyses & Calculations

- MERGERS AND ACQUISITIONS:Leveraged Buy-Outs (LBO’s), Mergers - Good or Bad?

- INTERNATIONAL FINANCE (MULTINATIONAL FINANCE):Major Issues Faced by Multinationals

- FINAL REVIEW OF ENTIRE COURSE ON FINANCIAL MANAGEMENT:Financial Statements and Ratios