|

MONEY:Money Supply, Fractional Reserve Banking, |

| << INVESTMENT (Continued…):Inventories and the Real Interest Rate |

| MONEY (Continued…):Three Instruments of Money Supply, Money Demand >> |

Macroeconomics

ECO 403

VU

LESSON

44

MONEY

Money

Supply

·

Earlier,

we introduced the concept of

money supply in a highly

simplified way.

·

We

defined quantity of money as

the number of rupees held by

public, and assumed

that

central

bank controls the supply of

money by increasing or decreasing

the number of

rupees

in circulation through open-market

operations.

·

Although

a good approximation, this

definition omits the role of

banking system in

determining

the money supply.

·

Here,

we'll see that the

money supply is determined

not only by the Central

Bank, but also

by

the behavior of households

(which hold money) and

banks (where money is

held).

·

Recall,

the Money supply includes

both currency in the hand of

public and deposits

at

banks

that households use on

demand for

transactions.

M=C+D

Where

M

---> Money Supply

C

---> Currency

D

---> Demand

Deposits

100%

Reserve Banking

·

Imagine

a world without banks, where

all the money takes

the form of currency, and

the

quantity

of money is simply the

amount of currency that

public holds (assume

$1,000).

·

Now

a new bank comes in and

accepts deposits but does

not make loans. Its

only purpose

is

to provide a safe place for

depositors to keep

money

The

deposits that banks have

received but have not

lent out are called

reserves.

Some

Reserves are held in the

vaults of local banks but

most are held at the

central bank.

Consider

the case where all

deposits are held as

reserves: banks accept

deposits, place the

money

in reserve, and leave the

money there until the

depositor makes a withdrawal or

writes

a

check against the

balance.

In

a 100% reserve banking

system, all deposits are

held in reserve and thus

the banking

system

does not affect the

supply of money.

·

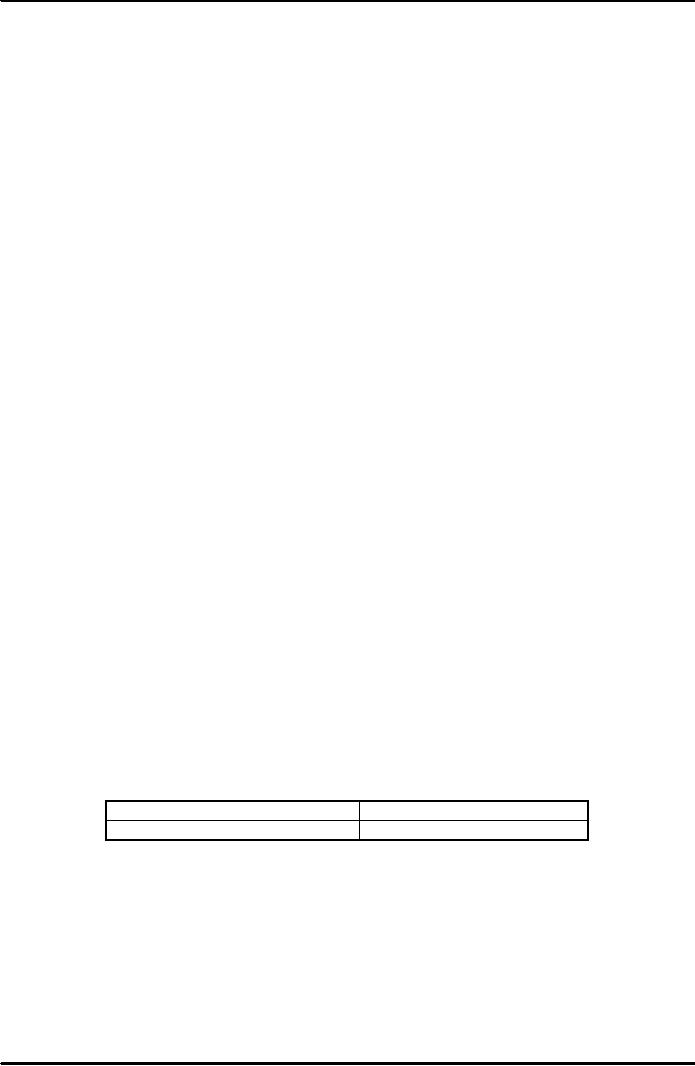

Suppose

that households deposit the

economy's entire $1,000 in

First bank. This

bank's

balance

sheet will look

like:

Assets

Liabilities

Reserves

$1,000

Deposits

$1,000

·

The

bank is not making loans so

it is not earning profit

rather a small fee to cover

its cost.

·

The

money supply in the economy

before and after the

creation of bank remains the

same,

i.e.

$1,000. So 100% reserve

deposit does not affect

money supply in

economy

Fractional

Reserve Banking

·

Now,

if the banks start to use

some of their deposits to

make loans (e.g. to

households for

house

finance and to firms for

capital finance), they can

charge interest on the

loans.

200

Macroeconomics

ECO 403

VU

·

The

banks must keep some

reserve on hand so that

reserves are available

whenever

depositors

want to make

withdrawals.

·

As

long as the amount of new

deposits approximately equals

the amount of withdrawals,

a

bank

need not keep all

its deposits in

reserves.

·

Note:

a reserve-deposit

ratio is the

fraction of deposits kept in

reserve. Excess

reserves

are

reserves above the reserve

requirement.

·

Fractional-reserve

banking, a system

under which banks keep

only a fraction of

their

deposits

in reserve. In a system of fractional

reserve banking, banks

create money.

201

Table of Contents:

- INTRODUCTION:COURSE DESCRIPTION, TEN PRINCIPLES OF ECONOMICS

- PRINCIPLE OF MACROECONOMICS:People Face Tradeoffs

- IMPORTANCE OF MACROECONOMICS:Interest rates and rental payments

- THE DATA OF MACROECONOMICS:Rules for computing GDP

- THE DATA OF MACROECONOMICS (Continued…):Components of Expenditures

- THE DATA OF MACROECONOMICS (Continued…):How to construct the CPI

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- MONEY AND INFLATION:The Quantity Equation, Inflation and interest rates

- MONEY AND INFLATION (Continued…):Money demand and the nominal interest rate

- MONEY AND INFLATION (Continued…):Costs of expected inflation:

- MONEY AND INFLATION (Continued…):The Classical Dichotomy

- OPEN ECONOMY:Three experiments, The nominal exchange rate

- OPEN ECONOMY (Continued…):The Determinants of the Nominal Exchange Rate

- OPEN ECONOMY (Continued…):A first model of the natural rate

- ISSUES IN UNEMPLOYMENT:Public Policy and Job Search

- ECONOMIC GROWTH:THE SOLOW MODEL, Saving and investment

- ECONOMIC GROWTH (Continued…):The Steady State

- ECONOMIC GROWTH (Continued…):The Golden Rule Capital Stock

- ECONOMIC GROWTH (Continued…):The Golden Rule, Policies to promote growth

- ECONOMIC GROWTH (Continued…):Possible problems with industrial policy

- AGGREGATE DEMAND AND AGGREGATE SUPPLY:When prices are sticky

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND IN THE OPEN ECONOMY:Lessons about fiscal policy

- AGGREGATE DEMAND IN THE OPEN ECONOMY(Continued…):Fixed exchange rates

- AGGREGATE DEMAND IN THE OPEN ECONOMY (Continued…):Why income might not rise

- AGGREGATE SUPPLY:The sticky-price model

- AGGREGATE SUPPLY (Continued…):Deriving the Phillips Curve from SRAS

- GOVERNMENT DEBT:Permanent Debt, Floating Debt, Unfunded Debts

- GOVERNMENT DEBT (Continued…):Starting with too little capital,

- CONSUMPTION:Secular Stagnation and Simon Kuznets

- CONSUMPTION (Continued…):Consumer Preferences, Constraints on Borrowings

- CONSUMPTION (Continued…):The Life-cycle Consumption Function

- INVESTMENT:The Rental Price of Capital, The Cost of Capital

- INVESTMENT (Continued…):The Determinants of Investment

- INVESTMENT (Continued…):Financing Constraints, Residential Investment

- INVESTMENT (Continued…):Inventories and the Real Interest Rate

- MONEY:Money Supply, Fractional Reserve Banking,

- MONEY (Continued…):Three Instruments of Money Supply, Money Demand