|

GROUP ACCOUNTS: Pre-acquistion Profits, Dividends |

| << GROUP ACCOUNTS: Fair Value Adjustments |

| GROUP ACCOUNTS: Profit & Loss >> |

Advance

Financial Accounting

(FIN-611)

VU

LESSON

# 41

GROUP

ACCOUNTS

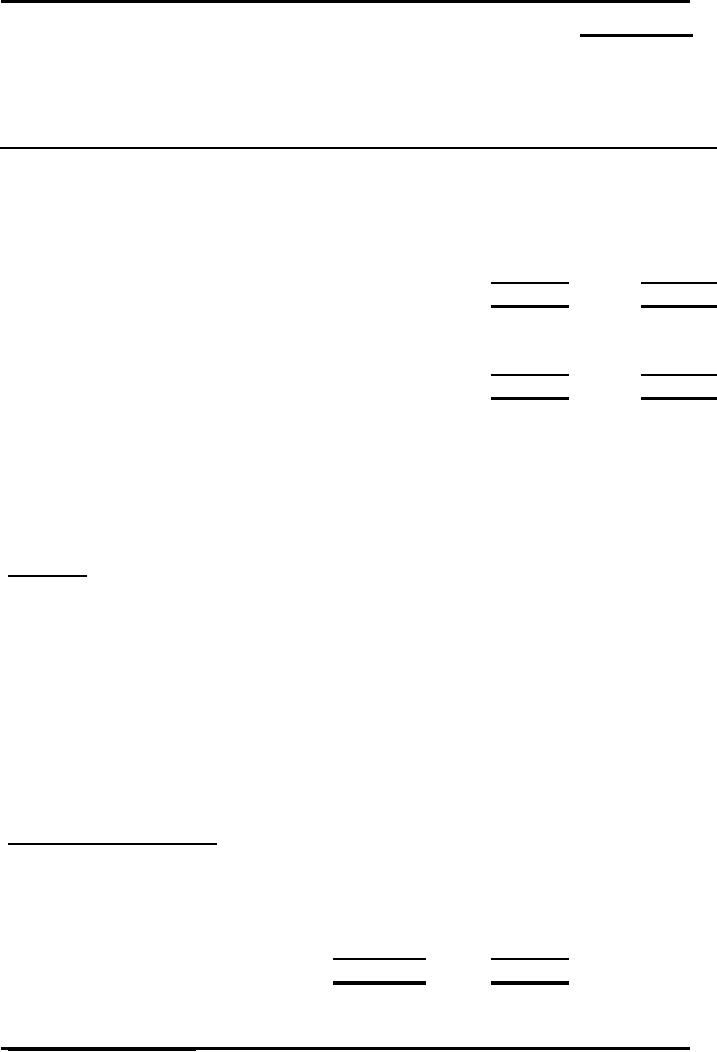

Example

- [ Case xiii ] Pre-acquistion Profits,

Dividends

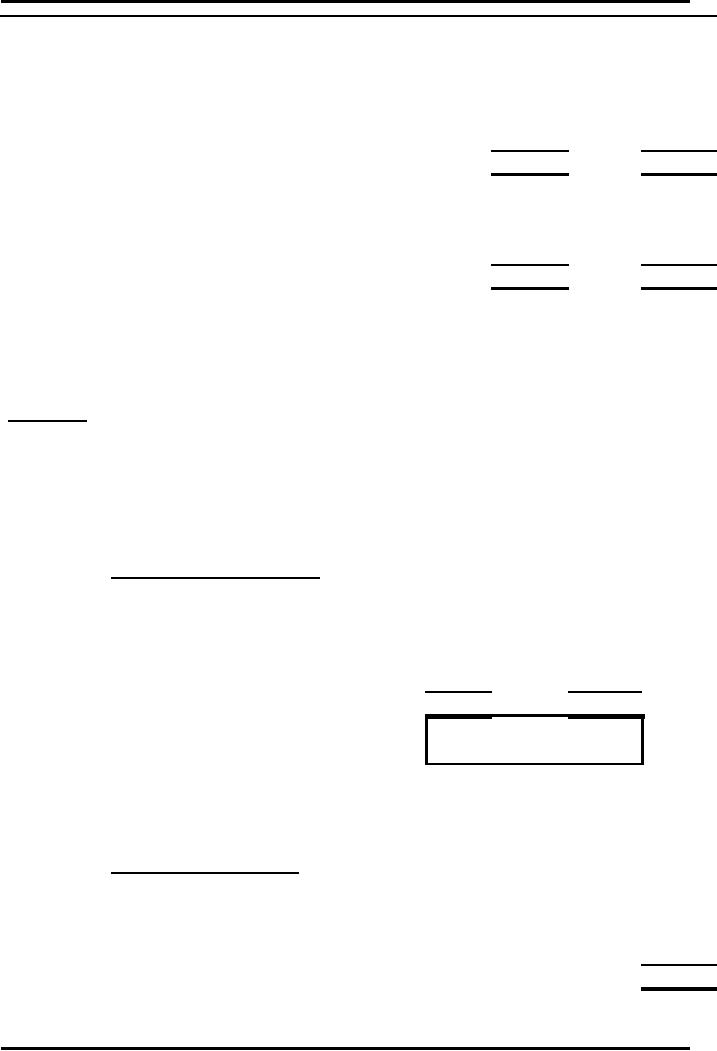

Balance

Sheet as on 31st December

2008

P

S

Rs.

Rs.

Fixed

Assets

3,500

1,450

Investment

in S.

2,180

2,700

1,250

Current

Assets

8,380

2,700

Share

Capital (ordinary shares of

Rs.1 each).

5,000

1,000

Reserves

3,380

1,700

8,380

2,700

The

Parent Co. (P) acquired 800

of the 1,000 Re.1 ordinary

shares of the Subsidary

Co.

(S)

on 1st January 2008 for Rs.2,500.

S's balance sheet at 31

December 2007 showed a

payable

ordinary dividend of Rs.400 and

reserves of Rs.1,200. Goodwill has

been

impaired

by Rs. 105.

Hint:

Share

of P Co in the dividend payable out of

the preacquisition profit is

Rs. 320 being 80%

Prepare

the Consolidated Balance

Sheet as at

Required:

31/12/2008.

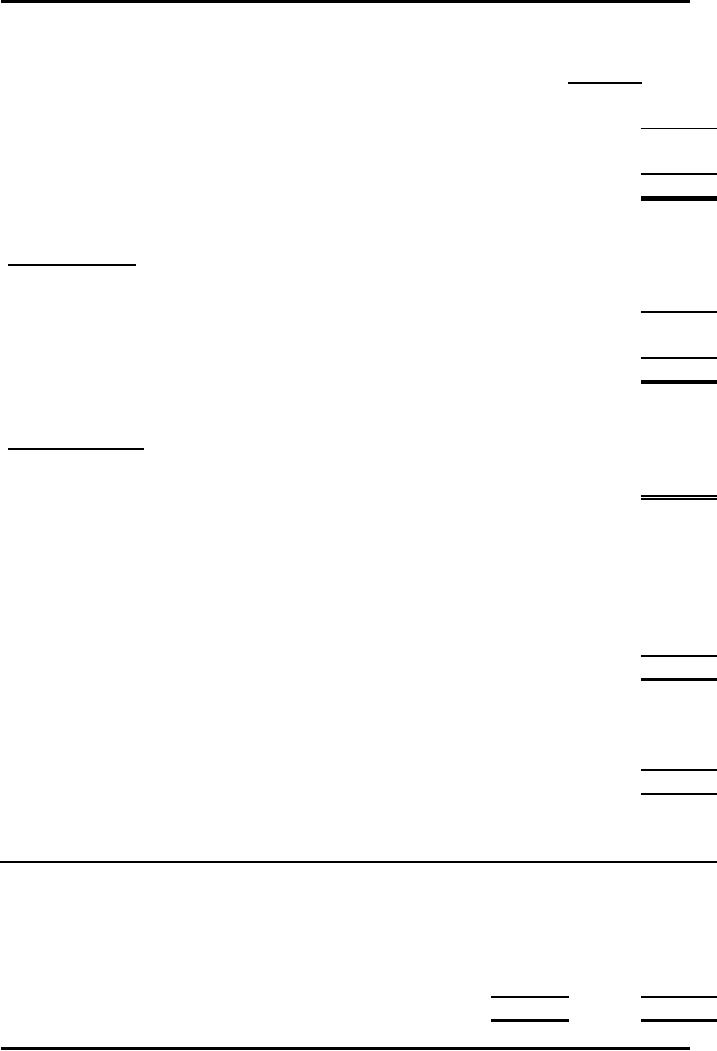

Solution

- [ Case xv ]

Workings

W-1

Determine

the % of holding by dividing

the number of equity

shares

acquired with the total number of

shares of the

H%

1

subsidiary

company

%age

representing the minority interest is

very simple to

MI%

0

calculate,

just subtract H% from 100

W-2

Analysis

of Equity of S Co

Pre-

Post-

acquisition

acquisition

Share

Capital

1,000

Nil

Reserves

1,200

500

2,200

500

W-3

Calculation

of goodwill

214

Advance

Financial Accounting

(FIN-611)

VU

Rupees

Cost

of investment

2,500

Dividend

out of pre-acquisition profits

-320

2,180

Pre

acquisition equity of S Co. to

the extent of H% (2,200x

80%)

-1,760

Goodwill

420

Impairment

loss

105

315

W-4

Group

Reserves

All

reserves of P Co

3,380

400

Post

acquisition reserves of S Co to the

extent of H% (500 x

80%)

3,780

Impairment

loss of goodwill

-105

3,675

W-5

Minority

Interest

Owners'

equity of Subsidiary Company to

the extent of MI% (2,700

x

20%)

540

Consolidated

Balance Sheet

As at 31

December 2005

Rs.

Fixed

Assets

4,950

Goodwill

315

Current

Assets

3,950

9,215

Share

Capital

5,000

3,675

Reserves

Minority

Interest

540

9,215

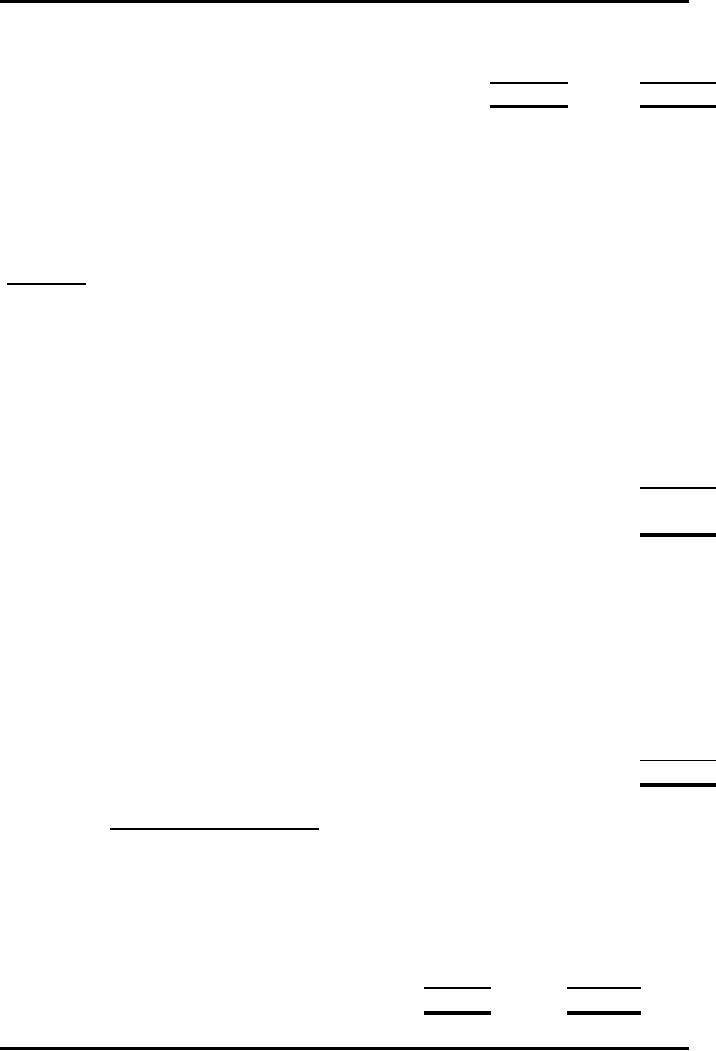

Example

- [ Case xiv ] Acquisition during

the year

Balance

Sheet as on 31st December

2008

P

S

Rs.

Rs.

Fixed

Assets

5,500

4,500

Investment

in S.

4,000

Current

Assets

2,500

1,500

12,000

6,000

215

Advance

Financial Accounting

(FIN-611)

VU

Share

Capital

8,000

3,000

Reserves

2,500

2,008

Current

Liabilities

1,500

1,000

12,000

6,008

The

Parent Co. (P) acquired

80% shares of the Subsidary

Co. (S) on 1st October

2008. S's

reserves

on 31 December 2007 were worth Rs.1,200.

(Assume that profits of S

accrue

evenly

throughout the year).

Prepare

the Consolidated Balance

Sheet as at

31/12/2008.

Required:

Solution

- [ Case xiv]

Working

W-1

Reserves

of S Co on 31-12-

2008

2,000

Reserves

of S Co on 1-1-

2008

1,200

Profit

for the year ending on

31-12-

2008

800

W-2

Profit

for the year 2008 representing

the pre-acquisition

period

from

1-1-2008 to 30-09-2008 (9 months)

800

x

9/12

600

Profit

for the year 2008 representing

the post-acquisition

period

from

1-10-2008 to 31-12-2008 (3

months)

800 x

3/12

200

800

W-3

Analysis

of Equity of S Co

Pre-acquisition

Post-acquisition

Share

Capital

3,000

Nil

Reserves

as on

1-1-2008

1,200

from

1-1-2008 to 30-9-

2008

600

200

4,800

200

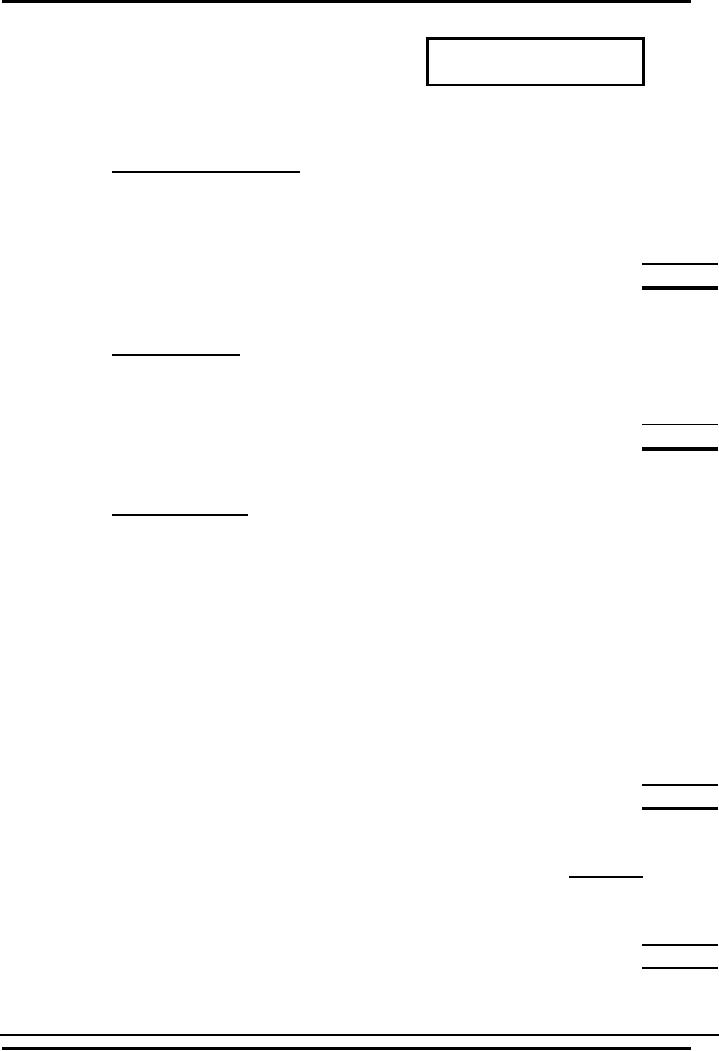

216

Advance

Financial Accounting

(FIN-611)

VU

H%

1

160

3,840

MI%

0

960

40

Minority

Interest Rs.

1,000

W-4

Calculation

of goodwill

Rupees

Cost

of investment

4,000

Pre

acquisition equity of S Co. to

the extent of

H%

-3,840

160

Goodwill

W-5

Group

Reserves

All

reserves of P Co

2,500

Post

acquisition reserves of S Co to the

extent

200

x

of

H%

80%

160

2,660

W-6

Minority

Interest

Owners'

equity of Subsidiary Company to

the extent of

MI%

Rs.

5,000 x

20%

1,000

Consolidated

Balance Sheet

As at 31

December 2008

Rs.

Fixed

Assets

10,000

160

Goodwill

Current

Assets

4,000

14,160

Share

Capital

8,000

2,660

Reserves

10,660

Minority

Interest

1,000

11,660

Current

Liabilities

2,500

14,160

Example

- [ Case xv] Negative

Goodwill

217

Advance

Financial Accounting

(FIN-611)

VU

Balance

Sheet as on 31st December

2008

P

S

Rs.

Rs.

Fixed

Assets

1,000

600

400

Investment

in S.

Current

Assets

300

200

1,700

800

Share

Capital

1,200

500

Reserves

400

200

Current

Liabilities

100

100

1,700

800

The

Parent Co. (P) acquired

80% shares of the Subsidary

Co. (S) on 1st January

2008

when

it's reserves were worth

Rs.120.

Prepare

the Consolidated Balance

Sheet as at

31/12/2008.

Required:

Solution

- [ Case xv]

Working

W-1

Analysis

of Equity of S Co

Pre-acquisition

Post-acquisition

Share

Capital

500

Nil

120

80

Reserves

620

80

H%

1

496

64

MI%

0

124

16

Minority

Interest

140

W-2

Calculation

of goodwill

Rupees

Cost

of investment

400

Pre

acquisition equity of S Co. to

the extent of

H%

-496

-96

Negative

Goodwill

W-3

218

Advance

Financial Accounting

(FIN-611)

VU

Group

Reserves

All

reserves of P Co

400

Post

acquisition reserves of S Co to the

extent

80

x

of

H%

80%

64

464

Add

Negative Goodwill

96

W-4

560

Minority

Interest

Owners'

equity of Subsidiary Company to

the extent of

MI%

Rs.

700 x 20%

140

Consolidated

Balance Sheet

As at 31

December 2008

Rs.

Fixed

Assets

1,600

Goodwill

0

Current

Assets

500

2,100

Share

Capital

1,200

560

Reserves

1,760

Minority

Interest

140

1,900

Current

Liabilities

200

2,100

219

Table of Contents:

- ACCOUNTING FOR INCOMPLETE RECORDS

- PRACTICING ACCOUNTING FOR INCOMPLETE RECORDS

- CONVERSION OF SINGLE ENTRY IN DOUBLE ENTRY ACCOUNTING SYSTEM

- SINGLE ENTRY CALCULATION OF MISSING INFORMATION

- SINGLE ENTRY CALCULATION OF MARKUP AND MARGIN

- ACCOUNTING SYSTEM IN NON-PROFIT ORGANIZATIONS

- NON-PROFIT ORGANIZATIONS

- PREPARATION OF FINANCIAL STATEMENTS OF NON-PROFIT ORGANIZATIONS FROM INCOMPLETE RECORDS

- DEPARTMENTAL ACCOUNTS 1

- DEPARTMENTAL ACCOUNTS 2

- BRANCH ACCOUNTING SYSTEMS

- BRANCH ACCOUNTING

- BRANCH ACCOUNTING - STOCK AND DEBTOR SYSTEM

- STOCK AND DEBTORS SYSTEM

- INDEPENDENT BRANCH

- BRANCH ACCOUNTING 1

- BRANCH ACCOUNTING 2

- ESSENTIALS OF PARTNERSHIP

- Partnership Accounts Changes in partnership firm

- COMPANY ACCOUNTS 1

- COMPANY ACCOUNTS 2

- Problems Solving

- COMPANY ACCOUNTS

- RETURNS ON FINANCIAL SOURCES

- IASBíS FRAMEWORK

- ELEMENTS OF FINANCIAL STATEMENTS

- EVENTS AFTER THE BALANCE SHEET DATE

- PROVISIONS, CONTINGENT LIABILITIES AND CONTINGENT ASSETS

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 1

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 2

- BORROWING COST

- EXCESS OF THE CARRYING AMOUNT OF THE QUALIFYING ASSET OVER RECOVERABLE AMOUNT

- EARNINGS PER SHARE

- Earnings per Share

- DILUTED EARNINGS PER SHARE

- GROUP ACCOUNTS

- Pre-acquisition Reserves

- GROUP ACCOUNTS: Minority Interest

- GROUP ACCOUNTS: Inter Company Trading (P to S)

- GROUP ACCOUNTS: Fair Value Adjustments

- GROUP ACCOUNTS: Pre-acquistion Profits, Dividends

- GROUP ACCOUNTS: Profit & Loss

- GROUP ACCOUNTS: Minority Interest, Inter Co.

- GROUP ACCOUNTS: Inter Co. Trading (when there is unrealized profit)

- Comprehensive Workings in Group Accounts Consolidated Balance Sheet