|

ELEMENTS OF FINANCIAL STATEMENTS |

| << IASBíS FRAMEWORK |

| EVENTS AFTER THE BALANCE SHEET DATE >> |

Advance

Financial Accounting

(FIN-611)

VU

LESSON

# 26

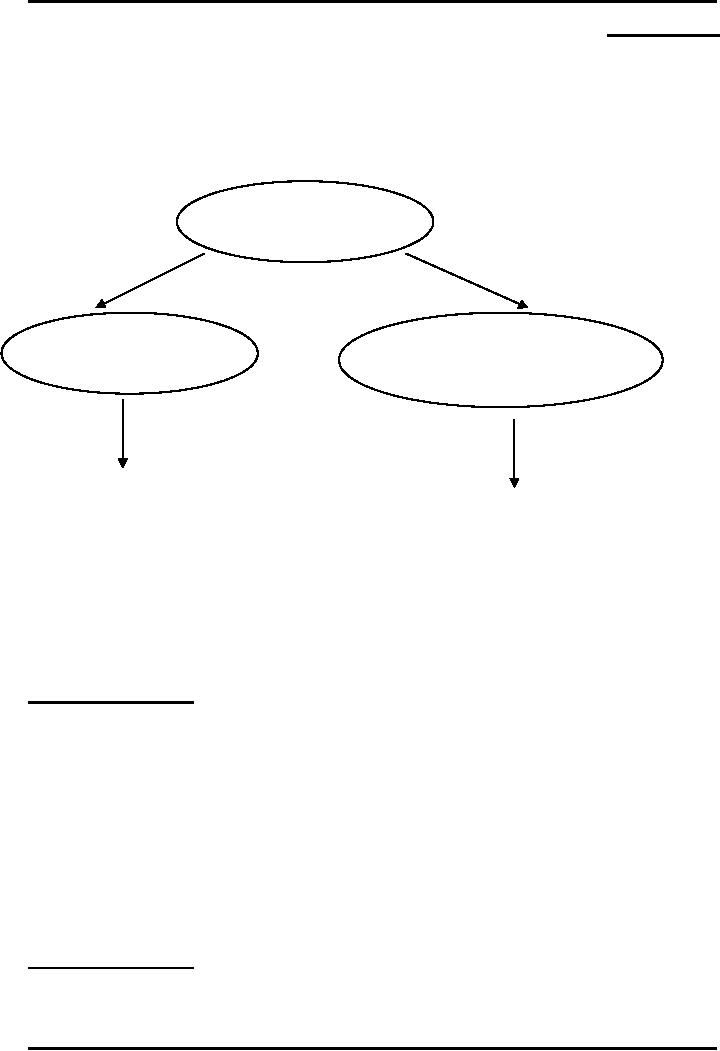

ELEMENTS

OF FINANCIAL STATEMENTS

Financial

information of an entity are

classified into five main heads,

these main heads

are

elements of financial

statements.

Elements

of financial statements

Measurement

of financial

Measurement

of financial

position

through balance sheet

performance

through income statement

Assets

Liabilities

Incomes

Equity

Expenses

Assets:

These

are the resources in control

of the entity as a result of

past events and from

which future

economic benefits are

expected to flow to the

entity.

Points

to remember:

1.

Resources in control

2.

Past event

3.

Future inflow

Liabilities:

These

are the present obligations

of the entity arising from

past events, the

settlement

of which is

expected to result in an outflow from the

entity of resources

embodying

economic

benefits.

Points

to remember:

1.

Present obligation

2.

Past event

3.

Future outflow

130

Advance

Financial Accounting

(FIN-611)

VU

Equity:

Equity

represents residual interest in

the assets of the entity

after deducting all

its

liabilities.

Points

to remember:

1.

Equity contributed

2.

Reserves created

Incomes:

Incomes

establish increases in economic

benefits during the accounting

period in the

form of

inflows or enhancements of assets or

decreases of liabilities that result

in

increases

in equity other than those

relating to contributions from equity

participants.

Incomes

include:

1.

Revenue

a. Sales of

goods

b. Sales of

services

c.

Returns on investments

2.

Gains

a.

Disposal of assets at a value higher than

its carrying amount

b.

Discharge of liabilities at a value

lesser than its carrying

amount

Expenses:

Expenses

establish decreases in economic

benefits during the accounting

period in the

form of

outflows or decrease in assets or

incurrence of liabilities that

result in

decreases

in equity, other than those

relating to distributions to equity

participants.

Expenses

include:

1.

Revenue Expenses

a.

Expenses that arise in the

course of ordinary activities of an

entity.

2.

Losses

a.

Disposal of assets at a value lesser than

its carrying amount

b.

Discharge of liabilities at a value

higher than its carrying

amount

Measurement

of the Elements of Financial

Statements

A

number of different measurement

bases are employed to

different degrees and

combinations

in

financial statements. These

include:

131

Advance

Financial Accounting

(FIN-611)

VU

1.

Historical Cost

Assets

are recorded at the amount of

cash paid to acquire them.

Sometimes the terms

cash

equivalents or fair value at

acquisition will be used

instead.

Liabilities

are recorded at the proceeds

received in exchange for the

obligation on the

date

of transaction.

2.

Current Cost

Assets

are carried at their current

purchase price.

Liabilities

are carried at the

undiscounted amount currently required to

settle them.

3.

Realizable Value

Assets

are carried at the amount,

which could currently be obtained by an

orderly

disposal.

Liabilities

are carried at their

settlement values, the amount to be

paid to satisfy them

in

the normal course of

business.

4.

Present Value

Assets

are carried at the present

discounted value of the future

net cash inflows

that

the

item is expected to generate in

the normal course of

business.

The

most common measurement

basis adopted by the entity

in preparing financial

statements

is historical cost. This is usually

combined with other bases.

132

Table of Contents:

- ACCOUNTING FOR INCOMPLETE RECORDS

- PRACTICING ACCOUNTING FOR INCOMPLETE RECORDS

- CONVERSION OF SINGLE ENTRY IN DOUBLE ENTRY ACCOUNTING SYSTEM

- SINGLE ENTRY CALCULATION OF MISSING INFORMATION

- SINGLE ENTRY CALCULATION OF MARKUP AND MARGIN

- ACCOUNTING SYSTEM IN NON-PROFIT ORGANIZATIONS

- NON-PROFIT ORGANIZATIONS

- PREPARATION OF FINANCIAL STATEMENTS OF NON-PROFIT ORGANIZATIONS FROM INCOMPLETE RECORDS

- DEPARTMENTAL ACCOUNTS 1

- DEPARTMENTAL ACCOUNTS 2

- BRANCH ACCOUNTING SYSTEMS

- BRANCH ACCOUNTING

- BRANCH ACCOUNTING - STOCK AND DEBTOR SYSTEM

- STOCK AND DEBTORS SYSTEM

- INDEPENDENT BRANCH

- BRANCH ACCOUNTING 1

- BRANCH ACCOUNTING 2

- ESSENTIALS OF PARTNERSHIP

- Partnership Accounts Changes in partnership firm

- COMPANY ACCOUNTS 1

- COMPANY ACCOUNTS 2

- Problems Solving

- COMPANY ACCOUNTS

- RETURNS ON FINANCIAL SOURCES

- IASBíS FRAMEWORK

- ELEMENTS OF FINANCIAL STATEMENTS

- EVENTS AFTER THE BALANCE SHEET DATE

- PROVISIONS, CONTINGENT LIABILITIES AND CONTINGENT ASSETS

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 1

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 2

- BORROWING COST

- EXCESS OF THE CARRYING AMOUNT OF THE QUALIFYING ASSET OVER RECOVERABLE AMOUNT

- EARNINGS PER SHARE

- Earnings per Share

- DILUTED EARNINGS PER SHARE

- GROUP ACCOUNTS

- Pre-acquisition Reserves

- GROUP ACCOUNTS: Minority Interest

- GROUP ACCOUNTS: Inter Company Trading (P to S)

- GROUP ACCOUNTS: Fair Value Adjustments

- GROUP ACCOUNTS: Pre-acquistion Profits, Dividends

- GROUP ACCOUNTS: Profit & Loss

- GROUP ACCOUNTS: Minority Interest, Inter Co.

- GROUP ACCOUNTS: Inter Co. Trading (when there is unrealized profit)

- Comprehensive Workings in Group Accounts Consolidated Balance Sheet