|

Elasticities of supply and demand:The Demand for Gasoline |

| << Changes in Market Equilibrium:Market for College Education |

| Consumer Behavior:Consumer Preferences, Indifference curves >> |

Microeconomics

ECO402

VU

LESSON

5

Elasticities

of supply and

demand

Other

Demand Elasticities

Income

elasticity of demand measures

the percentage change in

quantity

demanded

resulting from a one percent

change in income.

The

income elasticity of demand

is:

ΔQ/Q

I

ΔQ

EI =

=

ΔI/I

Q

ΔI

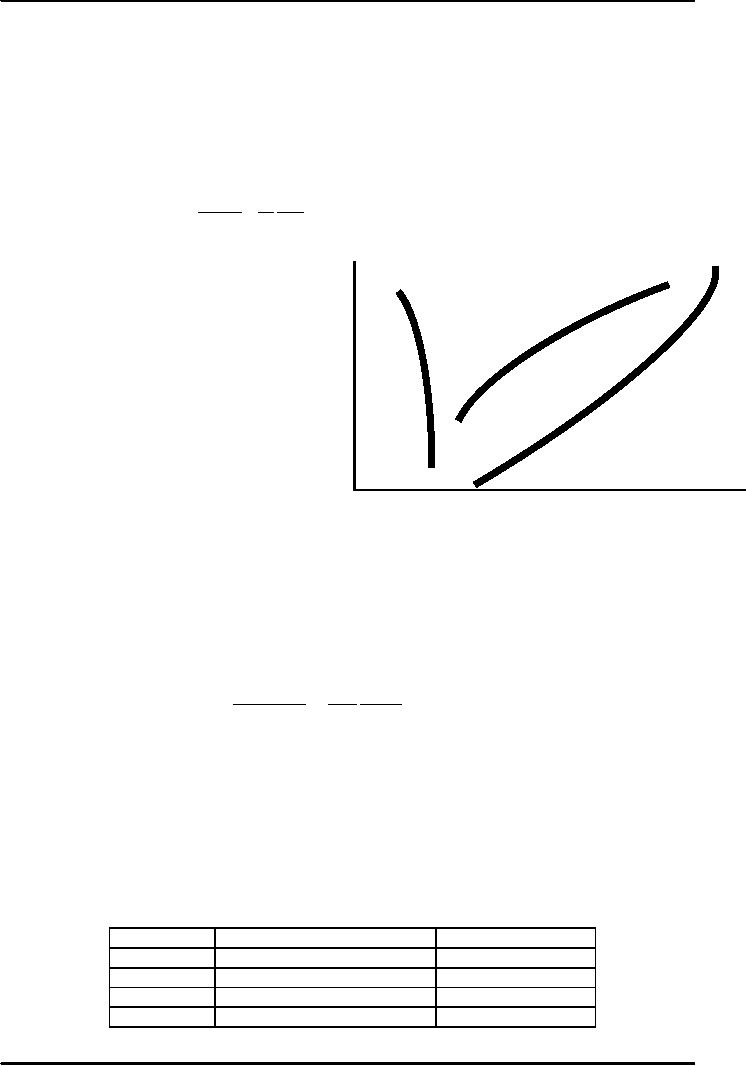

Income

Elasticity of Demand

Quantity

for:

Income

Elasticity

Demanded

Normal

goods

less

than 1 (but

greater

than 0)

Superior

goods

Normal

goods

Inferior

goods

Negative

Income

Income

Elasticity

Elasticity

Inferior

greater

than 1

goods

superior

goods

Money

Income

Other

Demand Elasticities

Cross

elasticity of demand measures

the percentage change in the

quantity

demanded

of one good that results

from a one percent change in

the price of

another

good.

For

example consider the

substitute goods, butter and

margarine.

The

cross elasticity of demand

is:

ΔQb/Qb

Pm ΔQb

EQbPm

=

=

ΔPm/Pm

Qb ΔPm

Cross

elasticity for substitutes is

positive

Cross

elasticity for complements is

negative

♦

Price

elasticity of supply

measures

the percentage change in

quantity supplied resulting

from a 1

percent

change in price.

The

elasticity is usually positive

because price and quantity

supplied are directly

related.

We

can refer to elasticity of

supply with respect to

interest rates, wage

rates,

and

the cost of raw

materials.

Price

($)

Quantity

Demanded

Quantity

Supplied

60

22

14

80

20

16

100

18

18

120

16

20

16

Microeconomics

ECO402

VU

Recall

ΔQ/Q

P

ΔQ

EP =

=

ΔP/P

Q

ΔP

Elasticity

of demand when price is $80

is

Ep

= 80/20 x -2/20 =

-0.40

Elasticity

of demand when price is $100

is

Ep

= 100/18 x -2/20 =

-0.56

Elasticity

of supply when price is $80

is

Ep

= 80/16 x 2/20 = 0.50

Elasticity

of supply when price is $100

is

Ep

= 100/18 x 2/20 =

0.56

The

Market for Wheat

1981

Supply Curve for

Wheat

QS =

1,800

+ 240P

1981

Demand Curve for

Wheat

QD =

3,550 -

266P

Equilibrium:

Q S = Q D

1,

800 +

240P

= 3,

550 -

266P

506P

= 1,

750

P

= 3.46

/ bushel

Q

= 1,

800 +

(240)(3.46)

=

2,

630 million bushels

P

ΔQD

3.46

EP =

=

(-2.66)

=

-.035

Inelastic

D

Q

ΔP

2,

630

P

ΔQS

3.46

EP =

=

(2.40)

=

.032

Inelastic

S

Q

ΔP

2,

630

Assume

the price of wheat is

$4.00/bushel

QD = 3,

550 -

(266)(4.00)

=

2,

486

4.00

QP =

(-266)

=

-0.43

D

2,

486

Supply

(Qs)

Demand

(Qd)

Equilibrium

Price

Qs

= Qd

1981

1800

+ 240P

3550

266P

1800

+ 240P = 3550

266P

506P

= 1750

P1981 =

$3.46 / bushel

1998

1944

+ 207P

3244

283P

1944

+207P = 3244

283P

P1998 =

$2.65 / bushel

Short-Run

Versus Long-Run

Elasticities

Price

elasticity of demand varies

with the amount of time

consumers have to

respond

to

a price.

Most

goods and services:

Short-run

elasticity is less than

long-run elasticity. (e.g.

gasoline, Drs.)

Other

Goods (durables):

Short-run

elasticity is greater than

long-run elasticity (e.g.

automobiles)

17

Microeconomics

ECO402

VU

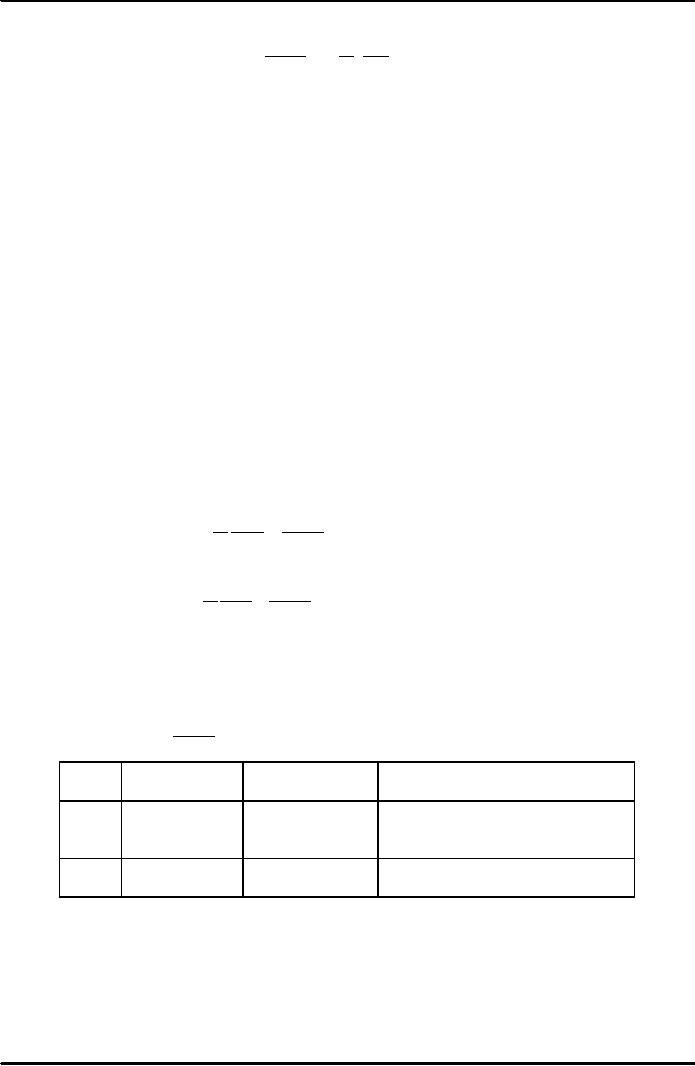

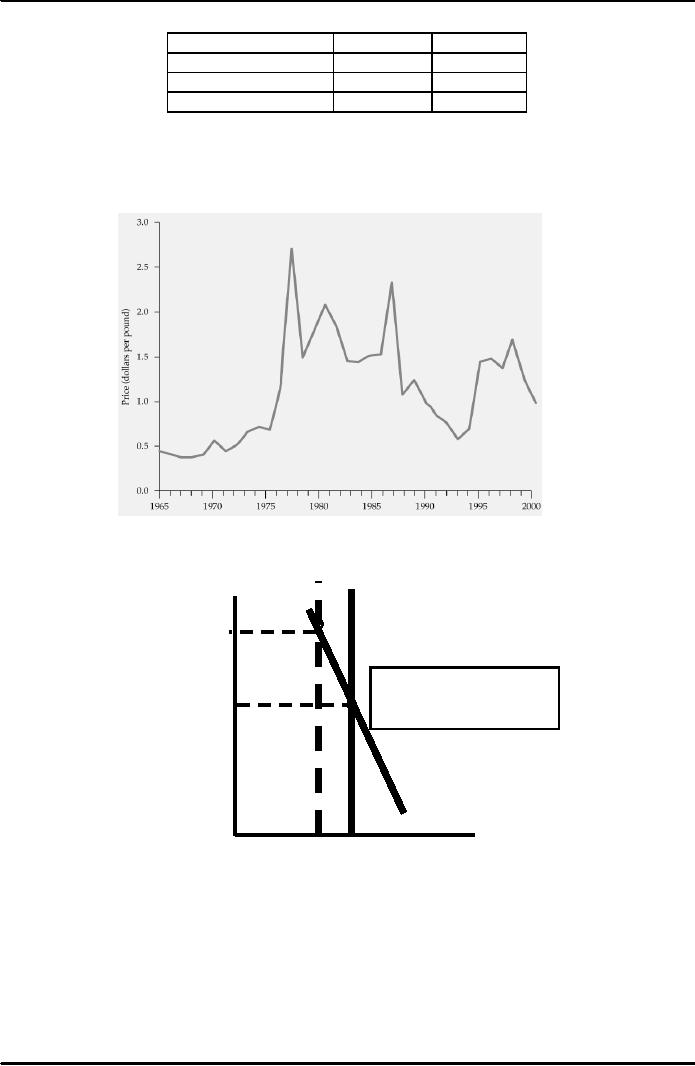

Gasoline:

Short-Run and Long-Run

Demand Curves

DSR

Price

People

tend to

drive

smaller and

more

fuel efficient

cars

in the long-run

Gasoline

DLR

Quantity

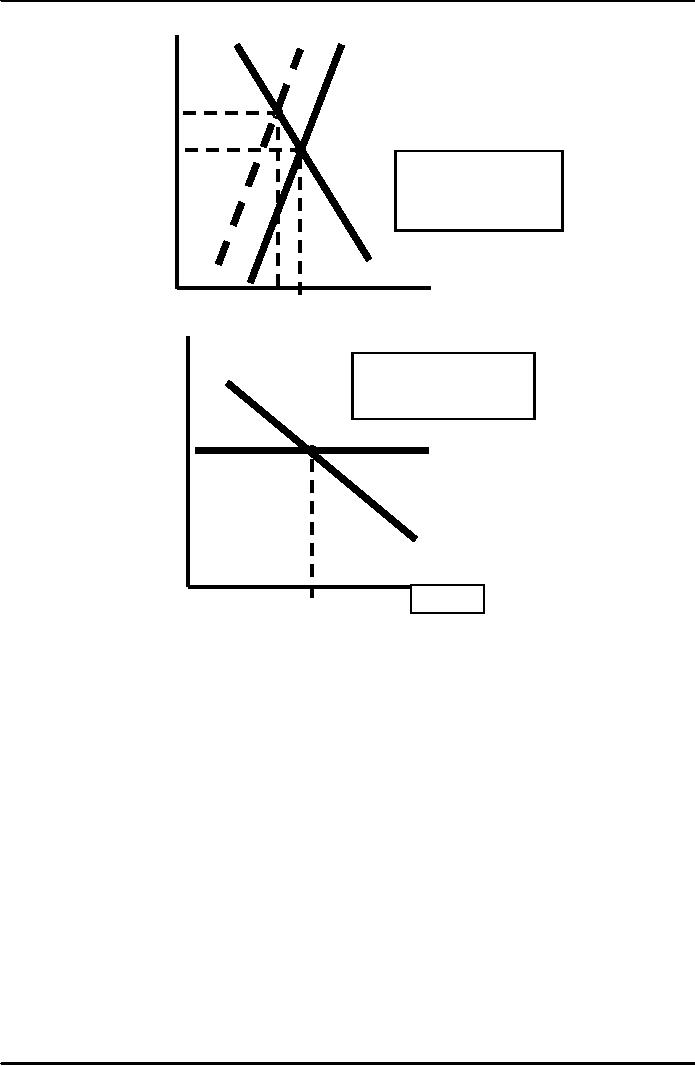

Automobiles:

Short-Run and Long-Run

Demand Curves

DLR

Price

People

may put off

immediate

consumption,

but

eventually older cars

must

be replaced.

Automobiles

DSR

Quantity

Income

elasticity also varies with

the amount of time consumers

have to respond to an

income

change.

Most

goods and services:

Income

elasticity is greater in the

long-run than in the short

run.

Higher

incomes may be converted

into bigger cars so the

income

elasticity

of demand for gasoline

increases with time.

Other

Goods (durables):

Income

elasticity is less in the

long-run than in the

short-run.

Originally,

consumers will want to hold

more cars.

Later,

purchases will only to be to

replace old cars.

Gasoline

and Automobiles are

complementary goods.

Gasoline

The

long-run price and income

elasticities are larger than

the short-run

elasticities.

Automobiles

The

long-run price and income

elasticities are smaller

than the short-run

elasticities.

18

Microeconomics

ECO402

VU

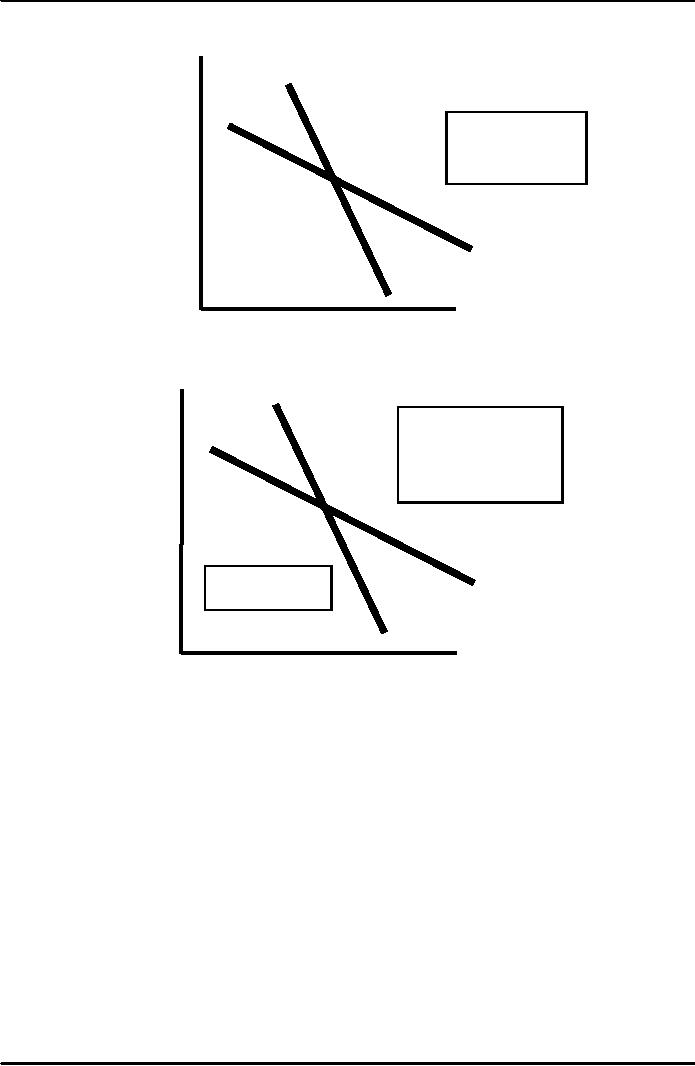

The

Demand for

Gasoline

Years

Following price or income

change

Elasticity

1

2

3

4

5

6

Price

-0.11

-0.22

-0.32

-0.49

-0.82

-1.17

Income

0.07

0.13

0.20

0.32

0.54

0.78

The

Demand for

Automobiles

Years

Following price or income

change

Elasticity

1

2

3

4

5

6

Price

-1.20

-0.93

-0.75

-0.55

-0.42

-0.40

Income

3.00

2.33

1.88

1.38

1.02

1.00

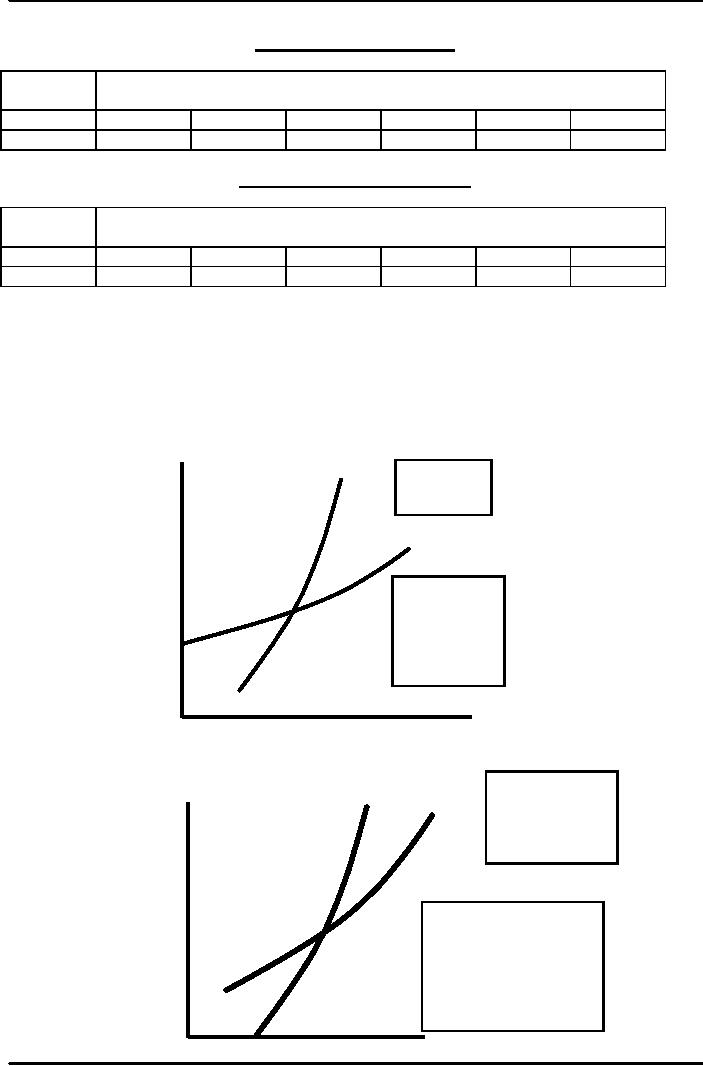

Supply

Most

goods and services:

∑

Long-run

price elasticity of supply is

greater than short-run

price

elasticity

of supply.

Other

Goods (durables,

recyclables):

∑

Long-run

price elasticity of supply is

less than short-run price

elasticity of

supply

SSR

Price

Primary

Copper:

Short-Run

and

Long-Run

Supply

Curves

SLR

Due

to limited

capacity,

firms are

limited

by output

constraints

in the

short-run.

In the

long-run,

they can

expand.

Quantity

Secondary

SL

SS

Copper:

Short-Run

Pric

and

Long-Run

Supply

Curves

Price

increases

provide

an incentive

to

convert scrap

copper

into new supply.

In

the long-run, this

stock

of scrap copper

begins

to fall.

Quantity

19

Microeconomics

ECO402

VU

Supply

of Copper

Price

Elasticity of:

Short

Run

Long

run

Primary

Supply

0.20

1.60

Secondary

Supply

0.43

0.31

Total

Supply

0.25

1.50

Weather

in Brazil and the price of

Coffee in New

York

Elasticity

explains why coffee prices

are very volatile.

Due to

the differences in supply

elasticity in the long-run

and short run.

S'

S

A

freeze or drought

Price

decreases

the

Coffee

supply

P1

Short-Run

1)

Supply is completely

inelastic

P0

2)

Demand is relatively

inelastic

3)

Very large change in

price

D

Quantity

Q1

Q0

20

Microeconomics

ECO402

VU

S

S'

Price

P2

P0

Intermediate-Run

1)

Supply and demand

are

more

elastic

2)

Price falls back to

P2.

3)

Quantity falls to Q2

D

Quantity

Q2 Q0

Price

Long-Run

1

Supply is extremely

elastic.

2)

Price falls back to

P0.

3)

Quantity increase to Q0.

S

P0

D

Quantity

Q0

21

Table of Contents:

- ECONOMICS:Themes of Microeconomics, Theories and Models

- Economics: Another Perspective, Factors of Production

- REAL VERSUS NOMINAL PRICES:SUPPLY AND DEMAND, The Demand Curve

- Changes in Market Equilibrium:Market for College Education

- Elasticities of supply and demand:The Demand for Gasoline

- Consumer Behavior:Consumer Preferences, Indifference curves

- CONSUMER PREFERENCES:Budget Constraints, Consumer Choice

- Note it is repeated:Consumer Preferences, Revealed Preferences

- MARGINAL UTILITY AND CONSUMER CHOICE:COST-OF-LIVING INDEXES

- Review of Consumer Equilibrium:INDIVIDUAL DEMAND, An Inferior Good

- Income & Substitution Effects:Determining the Market Demand Curve

- The Aggregate Demand For Wheat:NETWORK EXTERNALITIES

- Describing Risk:Unequal Probability Outcomes

- PREFERENCES TOWARD RISK:Risk Premium, Indifference Curve

- PREFERENCES TOWARD RISK:Reducing Risk, The Demand for Risky Assets

- The Technology of Production:Production Function for Food

- Production with Two Variable Inputs:Returns to Scale

- Measuring Cost: Which Costs Matter?:Cost in the Short Run

- A Firmís Short-Run Costs ($):The Effect of Effluent Fees on Firmsí Input Choices

- Cost in the Long Run:Long-Run Cost with Economies & Diseconomies of Scale

- Production with Two Outputs--Economies of Scope:Cubic Cost Function

- Perfectly Competitive Markets:Choosing Output in Short Run

- A Competitive Firm Incurring Losses:Industry Supply in Short Run

- Elasticity of Market Supply:Producer Surplus for a Market

- Elasticity of Market Supply:Long-Run Competitive Equilibrium

- Elasticity of Market Supply:The Industryís Long-Run Supply Curve

- Elasticity of Market Supply:Welfare loss if price is held below market-clearing level

- Price Supports:Supply Restrictions, Import Quotas and Tariffs

- The Sugar Quota:The Impact of a Tax or Subsidy, Subsidy

- Perfect Competition:Total, Marginal, and Average Revenue

- Perfect Competition:Effect of Excise Tax on Monopolist

- Monopoly:Elasticity of Demand and Price Markup, Sources of Monopoly Power

- The Social Costs of Monopoly Power:Price Regulation, Monopsony

- Monopsony Power:Pricing With Market Power, Capturing Consumer Surplus

- Monopsony Power:THE ECONOMICS OF COUPONS AND REBATES

- Airline Fares:Elasticities of Demand for Air Travel, The Two-Part Tariff

- Bundling:Consumption Decisions When Products are Bundled

- Bundling:Mixed Versus Pure Bundling, Effects of Advertising

- MONOPOLISTIC COMPETITION:Monopolistic Competition in the Market for Colas and Coffee

- OLIGOPOLY:Duopoly Example, Price Competition

- Competition Versus Collusion:The Prisonersí Dilemma, Implications of the Prisoners

- COMPETITIVE FACTOR MARKETS:Marginal Revenue Product

- Competitive Factor Markets:The Demand for Jet Fuel

- Equilibrium in a Competitive Factor Market:Labor Market Equilibrium

- Factor Markets with Monopoly Power:Monopoly Power of Sellers of Labor