|

COMPARISON OF FINANCIAL STATEMENTS |

| << INTRODUCTION TO SUBJECT |

| TIME VALUE OF MONEY >> |

Corporate

Finance FIN 622

VU

Lesson

02

COMPARISON

OF FINANCIAL STATEMENTS

Often

it becomes very difficult to compare

financial statements of two or more

business entities due to

i)

Size

ii)

Functional

currency.

However,

we can overcome these

problems by utilizing two effective

tools of comparison. These

tools can

be

used for comparing performance of

single entity over period of

time and to compare two or

more

entities.

1)

COMMON SIZE

STATEMENTS

2)

RATIO ANALYSIS

1)

COMMON SIZE

STATEMENTS

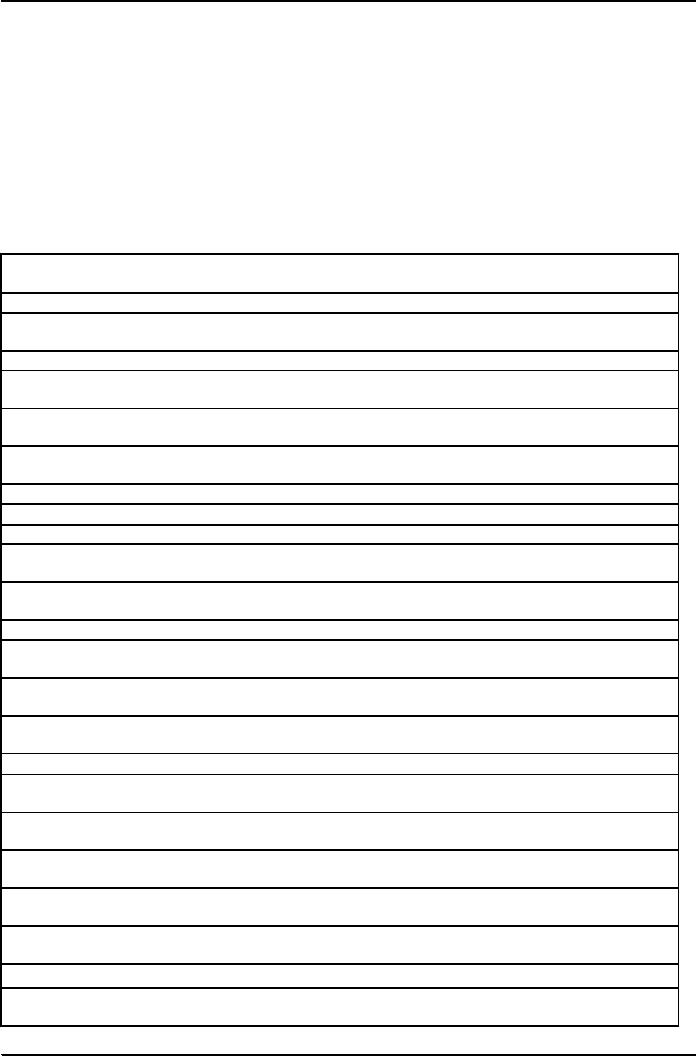

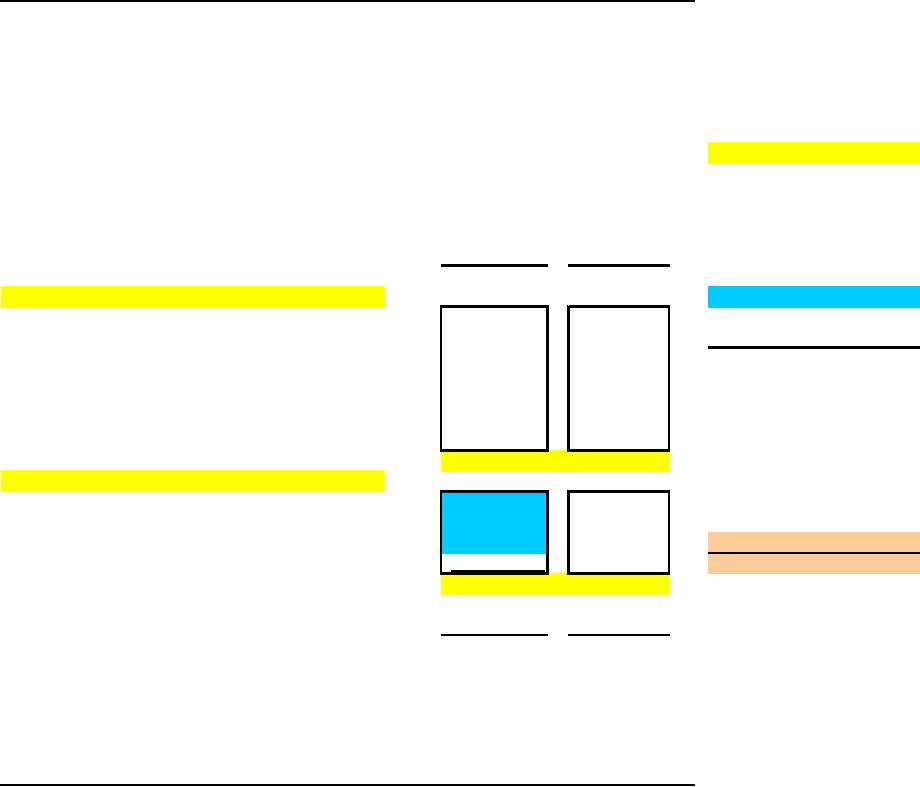

BALANCE

SHEET

AS AT 30

JUNE 2003

2003

2002

2003

2002

%

age

RUPEES

RUPEES

%age

OPERATING

ASSETS

62.87

60.73

Fixed

assets (at cost less

accumulated depreciation)

125,138,737

109,101,363

6.36

10.31

DEFERRED

COST

12,653,681

18,514,377

LONG

TERM DEPOSITS (against

Lease)

2,930,337

827,737

1.47

0.46

140,722,755

128,443,477

CURRENT

ASSETS

Stores

& spares

7,347,476

11,215,891

3.69

6.24

11.37

10.70

Stocks

-do-

22,628,137

19,231,731

1.08

1.79

Trade

debtors

2,149,858

3,211,998

Advances,

deposits, prepayments

and

13.11

9.71

other

receivables

26,089,950

17,450,008

Cash

and bank balances

107,524

110,421

0.05

0.06

100.00

100.00

58,322,945

51,220,049

CURRENT

LIABILITIES

Current

maturity portion of lease

liability

(6,794,240)

(2,821,322)

3.41

1.57

(8,004,000)

4.02

-

Current

maturity portion of Long Term

Loans

-

(6,760,139)

(19,270,244)

3.40

10.73

Short term

borrowings

(30,831,550)

(44,786,359)

15.49

24.93

Creditors,

accruals and other

liabilities

(52,389,929)

(66,877,925)

NET

CURRENT ASSETS

5,933,016

(15,657,876)

TOTAL

ASSETS LESS CURRENT

LIABILITIES

146,655,771

112,785,601

3

Corporate

Finance FIN 622

VU

LONG

TERM LIABILITIES

(1,692,510)

0.85

-

Deferred

Income

-

(37,056,700)

(21,693,585)

18.62

12.07

Due to

directors and

relatives

(926,457)

(926,457)

0.47

0.52

Provident

fund trust and gratuity

payable

(27,828,000)

(47,500,000)

13.98

26.44

Long

term loans

Dealers

& Distributors securities

(23,871,350)

(19,398,600)

11.99

10.80

Long

term portion of leasehold

assets

(12,710,887)

(1,936,847)

6.39

1.08

(104,085,904)

(91,455,489)

TOTAL

NET ASSETS

42,569,867

21,330,112

REPRESENTED

BY :

39,800,000

(30.04)

(22.15)

Share

capital

59,800,000

(27,457,311)

(29,697,066)

13.79

16.53

Profit

& (loss) account

8,227,178

(4.13)

(4.58)

Surplus

on revaluation of fixed assets

8,227,178

Share

deposit money

2,000,000

3,000,000

(1.00)

(1.67)

42,569,867

21,330,112

The

annexed notes form an integral

part of these

accounts.

(199,045,700)

(112,785,601) 100.00

100.00

LAHORE

DATED

Take

the balance sheet first. Instead of

putting rupee values in

balance sheet, we place %age

against each

line

item with regard to total

asset. The total assets

are taken as 100 and

every line item relationship

with

total

assets expressed in %age is

placed against it. Take a

look at the attached Common Size

balance sheet.

During

2002 total assets were

60.73% of total assets and

that has been increased to

62.87% of total assets

in

2003.

Every line-item on asset

side is expressed as % of total

assets. You are now in a

position to compare

financial

statements over a period of time to

know what developments have

been made over time.

4

Corporate

Finance FIN 622

VU

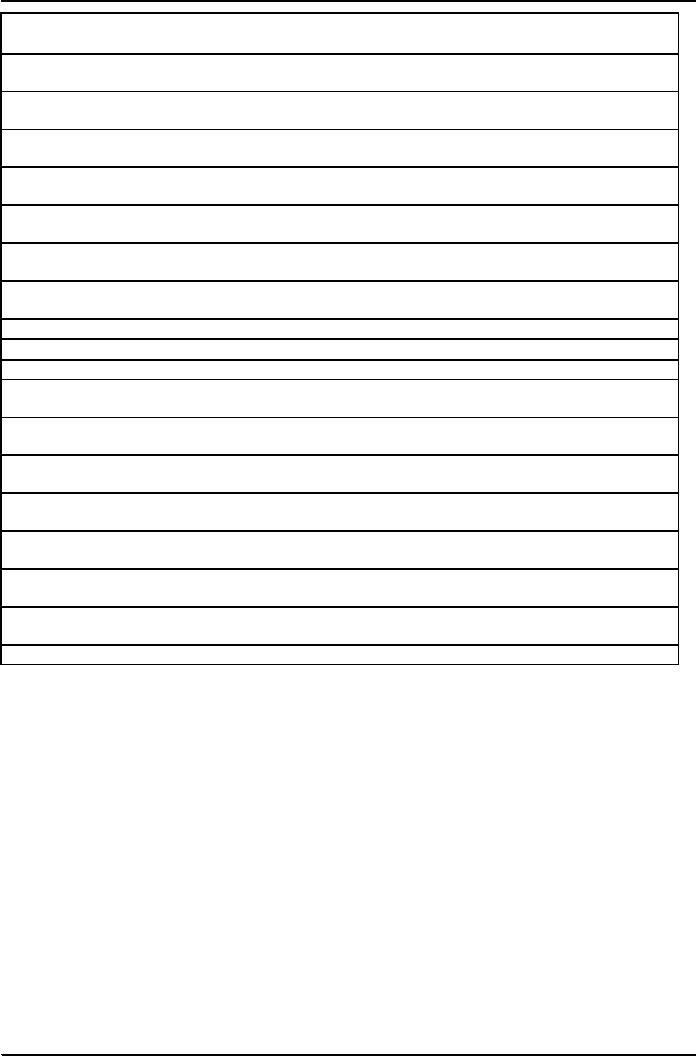

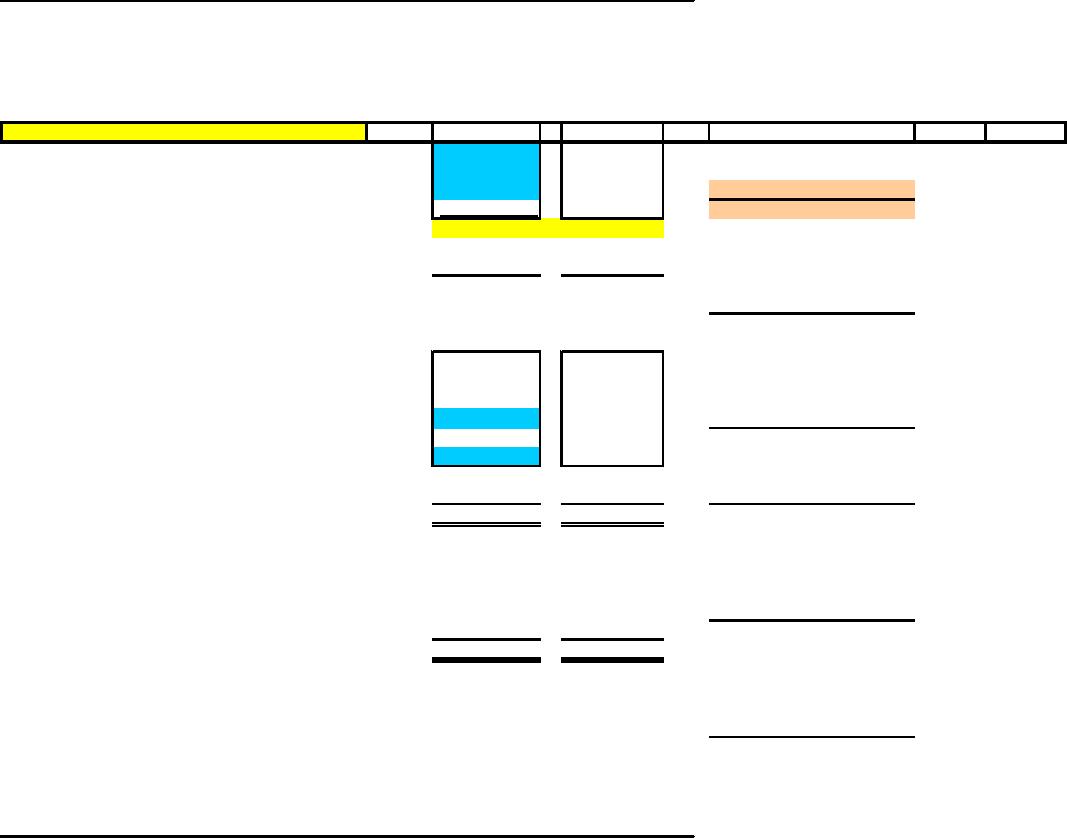

PROFIT

AND LOSS ACCOUNT

FOR

THE PERIOD ENDED 30TH JUNE,

2003.

2003

2002

2003

2002

RUPEES

RUPEES

SALES

116,811,832

109,030,501

100.00

100.00

COST

OF SALES

(60,117,579)

(58,812,941)

(51.47)

(53.94)

48.53

46.06

GROSS

PROFIT

56,694,253

50,217,560

(56,105,424)

(53,414,839)

OPERATING

EXPENSES

(8,691,429)

(9,173,201)

(7.44)

(8.41)

Administrative

(37,385,642)

(31,684,350)

(32.01)

(29.06)

Selling,

distribution and

amortization

Financial

charges

(10,028,353)

(12,557,288)

(8.59)

(11.52)

OPERATING

PROFIT/(LOSS)

588,828

(3,197,279)

2,387,106

360,873

2.04

0.33

OTHER

INCOME/(LOSS)

2,975,934

(2,836,406)

PROFIT/(LOSS)

BEFORE TAXATION

(148,797)

-

(0.13)

-

WORKERS

PROFIT PARTICIPATION

2,827,137

(2,836,406)

2.42

(2.43)

PROFIT/(L0SS)

BEFORE TAXATION

PROVISION

FOR TAXATION

(587,382)

(545,152)

(0.50)

(0.50)

PROFIT/(L0SS)

AFTER TAXATION

2,239,755

(3,381,558)

(29,697,066)

(26,315,508)

PROFIT/(LOSS)

BROUGHT FORWARD

PROFIT/(LOSS)

CARRIED OVER TO

(27,457,311)

(29,697,066)

BALANCE

SHEET

In

common size income statement

every line item is expressed as

%age of sales. In other

words, cost of

sales,

operating expenses and net income

add up to 100%. Let look at

the Common Size Income

Statement.

Cost

of Sales in 2002 was 53.94%

of sales, which dropped to

51.47% in 2003. This is a favorable

symptom

because

any reduction in cost will

lead to increase in profit.

This is confirmed when we

look at the gross

profit.

In 2002 GP was 46.06% of

sales and that increased to

48.53% in 2003. The

comparison here

reveals

that

company has improved it

performance over the year

2002.

Base

Year Analysis: Common

Size analysis is also known

as Vertical Analysis. Base

year analysis is another

tool

of comparing performance and is also

known as Horizontal

Analysis.

5

Corporate

Finance FIN 622

VU

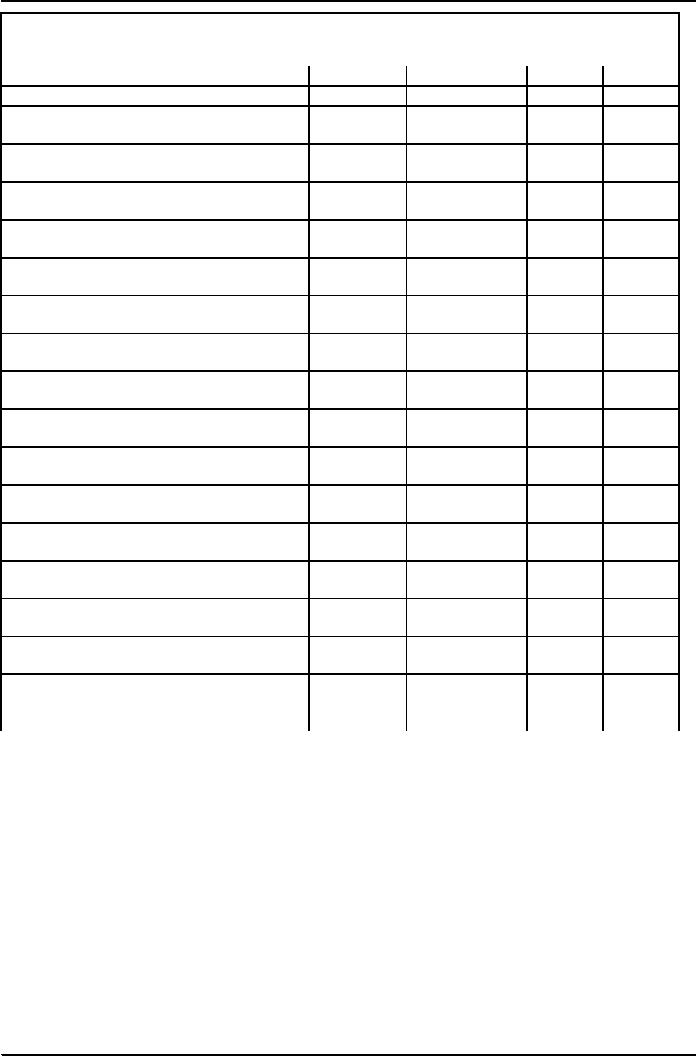

BASE

YEAR /HORIZONTAL ANALYSIS

BALANCE

SHEET

EXAMPLE

HORIZONTAL ANALYSIS

BASE

YEAR

ASSETS

2006

2005

2004

2003

2002

2001

FIXED

ASSETS

145,000.00

125,000.00

100,000.00

160,000.00

155,000.00

145,000.00

160.00

155.00

145.00

145.00

125.00

100.00

55,000.00

56,000.00

CURRENT

ASSETS

50,000.00

58,000.00

70,000.00

65,000.00

140.00

130.00

112.00

116.00

110.00

100.00

TOTAL

ASSETS

230,000.00

220,000.00

201,000.00

203,000.00

180,000.00

150,000.00

153.33

146.67

134.00

135.33

120.00

100.00

CAPITAL

&

LIABILITIES

CURRENT

LAIBILITIES

22,000.00

21,500.00

19,000.00

17,000.00

16,000.00

15,000.00

146.67

143.33

126.67

113.33

106.67

100.00

LONG

TERM

LIABILITIES

15,000.00

13,000.00

12,000.00

11,500.00

10,500.00

10,000.00

150.00

130.00

120.00

115.00

105.00

100.00

EQUITY

193,000.00

185,500.00

170,000.00

174,500.00

153,500.00

125,000.00

154.40

148.40

136.00

139.60

122.80

100.00

TOTAL

CAPITAL

&

LIABILITIES

230,000.00

220,000.00

201,000.00

203,000.00

180,000.00

150,000.00

153.33

146.67

134.00

135.33

120.00

100.00

In this

case, performance is compared over,

say, five years period.

The earliest year or the

first year is taken

as

base year and every

line item in the balance sheet of

base year is taken as 100%.

In the subsequent years

amounts

of every line item are

expressed as %age of base

year amount.

You

can see the Base Year analysis

example from the attached

balance sheet. Comparison is being

made

from

the year 2001 to 2006; therefore, the

earliest year i.e., 2001 is

labeled as base year. Total

fixed assets in

2001

were Rs. 100,000/- expressed

as 100% (cell H9: in blue font). In

year 2005 the total investment

in

fixed

assets has risen to Rs.

155,000/-, which is 155% of base

year amount (Rs. 100,000).

This means that

from

2002 to 2005, 55% investment of base

year amount has been injected in

fixed assets and that

further

increased

to 60% at the end of year

2006.

2) Ratios

Analysis:

This is another

widely acknowledged and used

comparison tool for

financial managers. A ratio is

a

relationship

between two or more line

items expressed in %age or number of

times. Financial ratios

are

useful

indicators of a firm's performance and

financial situation. Most ratios can be

calculated from

information

provided by the financial statements. Financial

ratios can be used to

analyze trends and to

6

Corporate

Finance FIN 622

VU

compare

the firm's financials to those of

other firms. In some cases,

ratio analysis can predict

future

bankruptcy.

Financial

ratios can be classified

according to the information they

provide.

7

Corporate

Finance FIN 622

VU

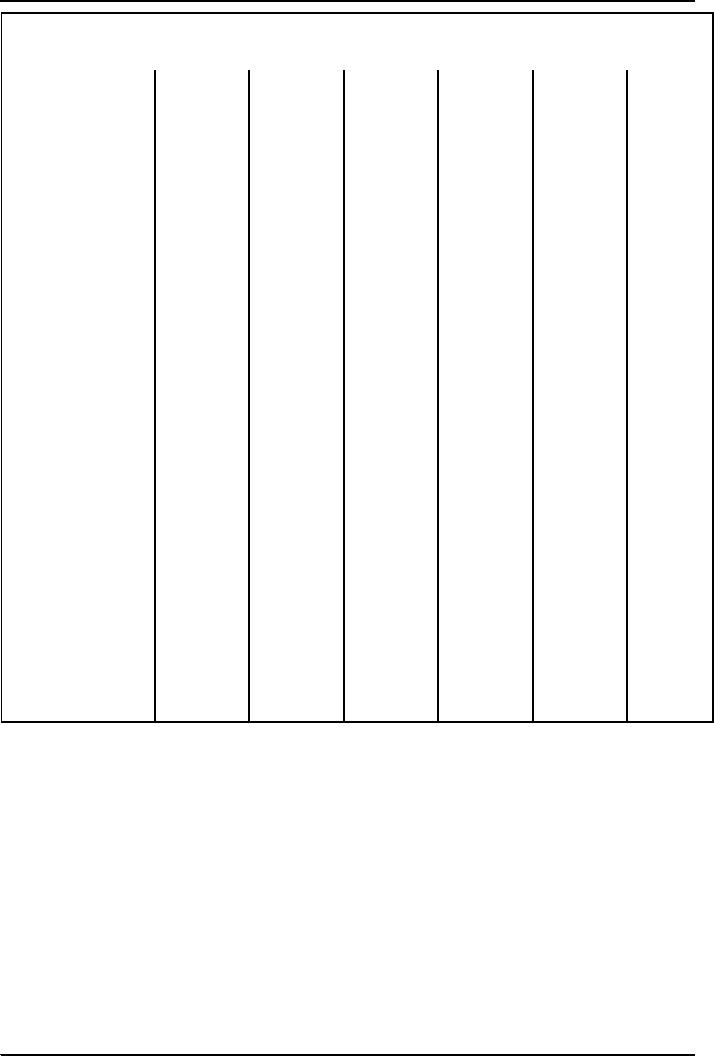

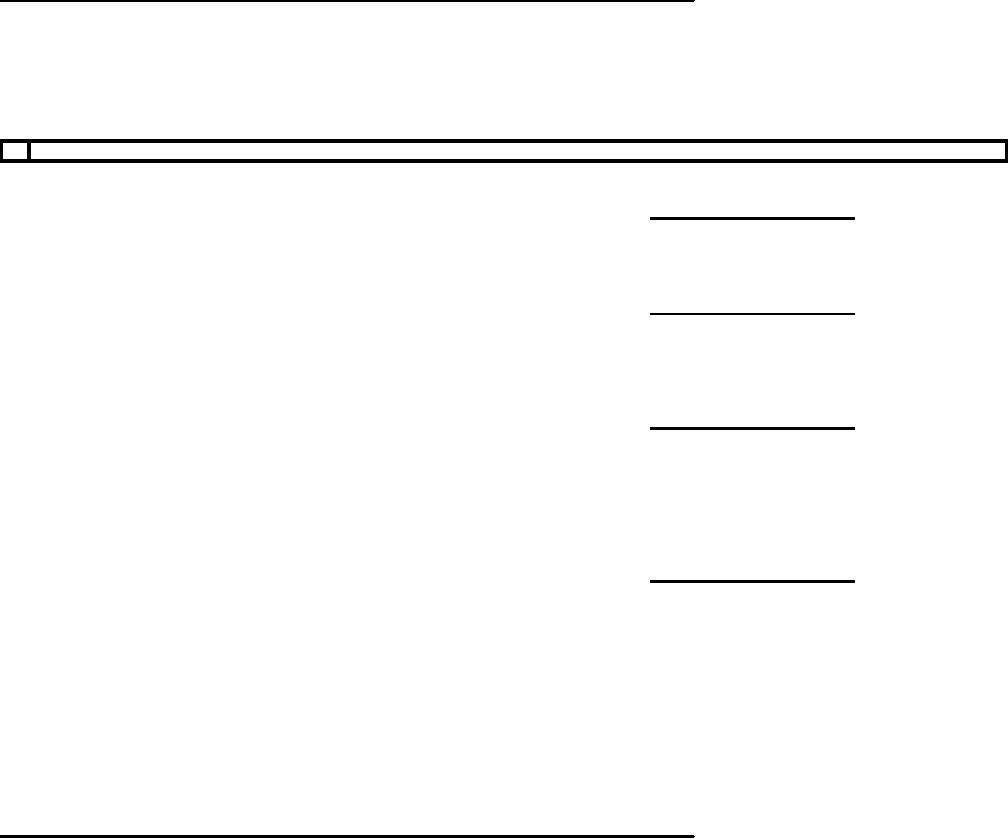

BALANCE

SHEET

AS AT 30 JUNE

2003

NOTES

2003

2002

2003

2002

RUPEES

RUPEES

CURRENT

RATIO

1.11

0.77

OPERATING

ASSETS

Fixed

assets (at cost less accumulated

depreciation)

3

125,138,737

109,101,363

QUICK

RATIO

(0.54)

(0.31)

DEFERRED

COST

4

12,653,681

18,514,377

LONG

TERM DEPOSITS (against

Lease)

2,930,337

827,737

TOTAL

DEBT RATIO

140,722,755

128,443,477

CURRENT

ASSETS

=Total

Debt/Total Assets

0.31

0.40

OR

Stores

& spares

7,347,476

11,215,891

Total

Assets - Equity

0.79

0.88

Stocks

5

22,628,137

19,231,731

Total

Assets

Trade

debtors

6

2,149,858

3,211,998

Advances,

deposits, prepayments

and

DEBT -

EQUITY RATIO

other

receiveables

7

26,089,950

17,450,008

Cash

and bank balances

8

107,524

110,421

=Total

Debt / Equity

(1.46)

(3.35)

58,322,945

51,220,049

CURRENT

LIABILITIES

Current

maturity portion of lease

liability

9

(6,794,240)

(2,821,322)

TIMES

INTEREST EARNED

Current

maturity portion of Long

Term Loans

(8,004,000)

-

Short

term borrowings

10

(6,760,139)

(19,270,244)

Earning

before Tax

0.30

0.23

(30,831,550)

Creditors,

accruals and other

liabilities

11

(44,786,359)

Interest

Expense

(52,389,929)

(66,877,925)

NET

CURRENT ASSETS

5,933,016

(15,657,876)

INVENTORY

TURNOVER

8

Corporate

Finance FIN 622

VU

CURRENT

LIABILITIES

2003

2002

2003

2002

Current

maturity portion of lease

liability

9

(6,794,240)

(2,821,322)

TIMES

INTEREST EARNED

Current

maturity portion of Long

Term Loans

(8,004,000)

-

Short

term borrowings

10

(6,760,139)

(19,270,244)

Earning

before Tax

0.30

0.23

(30,831,550)

(44,786,359)

Interest

Expense

Creditors,

accruals and other

liabilities

11

(52,389,929)

(66,877,925)

NET

CURRENT ASSETS

5,933,016

(15,657,876)

INVENTORY

TURNOVER

TOTAL

ASSETS LESS CURRENT

LIABILITIES

146,655,771

112,785,601

Cost

of Good Sold

(2.87)

(3.06)

Avg.

Inventory

LONG

TERM LIABILITIES

Deferred

Income

(1,692,510)

-

Due to

directors and

relatives

(37,056,700)

(21,693,585)

A/R

TURNOVER

Provident

fund trust and gratuity

payable

12

(926,457)

(926,457)

Long

term loans

13

(27,828,000)

(47,500,000)

Sales

54.33

33.94

Dealers&Distributors

securities

14

(23,871,350)

(19,398,600)

Account

Receivable

Long

term portion of leasehold

assets

(12,710,887)

(1,936,847)

(104,085,904)

(91,455,489)

Avg

Collection Period

365

6.72

10.75

TOTAL

NET ASSETS

42,569,867

0

21,330,112

A R

Turnover

REPRESENTED

BY :

Share

capital (5,980,000)

15

59,800,000

39,800,000

PAYABLE

TURNOVER

Profit

& (loss) account

(27,457,311)

(29,697,066)

Surplus

on revaluation of fixed assets

8,227,178

8,227,178

Cost

of Good Sold

(2.42)

(1.61)

Share

deposit money

2,000,000

3,000,000

Trade

Creditors

42,569,867

21,330,112

The

annexed notes form an

integral part of these

accounts.

NET

PROFIT RATIO

LAHORE

-

DATED

Net

Income

2.420

(2.601)

Sales

9

Corporate

Finance FIN 622

VU

2003

2002

2003

2002

NET

PROFIT RATIO

-

Net

Income

2.420

(2.601)

Sales

RETURN

ON ASSETS

11 CREDITORS,

ACCRUED AND OTHER

LIABILITIES

Net

Income

2.259

(2.5998)

Creditors

24,820,277.00

36,565,866.00

Total

Assets

Advances

from customers

57,178.00

17,650.00

Accrued

liabilities

2,710,813.00

2,847,749.00

Accrued

interest on secured

loans

1,200,010.00

2,844,012.00

RETURN

ON EQUITY

Sales

tax payable

1,571,414.00

1,800,396.00

Income

tax payable -

employees

12,131.00

15,920.00

Net

Income

6.64

(13.30)

Other

liabilities

310,930.00

694,766.00

Equity

WPPF

Payable

148,796.71

-

30,831,549.71

44,786,359.00

MARKET

RATIOS

Earning

Per Share

Net

Income

0.47

(0.71)

Total

Shares (O/S)

10

Corporate

Finance FIN 622

VU

The

following types of ratios

frequently are used:

1. Short Term

Solvency or Working Capital

ratios

2.

Long term solvency

ratios

3.

Asset management turnover

ratios

4.

Profitability ratios

5.

Market value ratios

Short

Term Solvency or Working

Capital ratios:

These

ratios provide information

about a firm's ability to

meet its short-term financial

obligations. They are of

particular

interest to those extending short-term credit to the

firm. Two frequently-used liquidity

ratios are the

current

ratio (or working capital

ratio) and the quick

ratio.

The

current ratio is the ratio of current

assets to current liabilities:

Current Ratio =

Current Assets/Current Liabilities

Keeping

the comparison purpose in our

mind, you can see that in

the attached balance sheet this

ratio improved in

2003

over 2002. Normally, this

ratio is expressed as 0.77:1meaning

that current assets are 77% of current

liabilities in

2002.

This was improved at the end

of year 2003 when our

current assets were more

than liabilities. The ratio

in

2003

is 1.11:1.

Short-term

creditors prefer a high current

ratio since it reduces their

risk. Shareholders may prefer a lower

current

ratio

so that more of the firm's

assets are working to grow the

business. Typical values for the current

ratio vary by

firm

and industry. For example, firms in

cyclical industries may maintain a higher

current ratio in order to

remain

solvent

during downturns. One drawback of the current

ratio is that inventory may

include many items that

are

difficult

to liquidate quickly and

that have uncertain liquidation

values. The quick ratio is

an alternative measure of

liquidity

that does not include

inventory in the current assets. The

quick ratio is defined as

follows:

Quick

Ratio = (Current Assets Inventory)/

Current Liabilities

This

ratio also shows the investment level in

inventories. Excessive investment in inventories is

often considered as

inefficient

use of resources.

The

current assets used in the quick

ratio are cash, accounts

receivable, and notes

receivable. These assets

essentially

are

current assets less inventory.

The quick ratio often is

referred to as the acid test.

Asset

Turnover Ratios:

Asset

turnover ratios indicate of how

efficiently the firm utilizes

its assets. They sometimes

are referred to as

efficiency

ratios, asset utilization

ratios, or asset management

ratios. Two commonly used

asset turnover ratios

are

receivables

turnover and inventory

turnover.

Receivables

turnover is an indication of how

quickly the firm collects

its accounts receivables and

is defined as

follows:

Receivables

Turnover = Annual Credit

Sales / Accounts Receivable

The

receivables turnover often is reported in

terms of the number of days that credit

sales remain in

accounts

receivable before they are collected.

This number is known as the collection

period.

The

collection period also can

be written as:

Average

Collection Period = 365 / Receivables

Turnover

Another

major asset turnover ratio is

inventory turnover. It is the cost of

goods sold in a time

period

divided

by the average inventory level during

that period:

Inventory

Turnover = Cost of Goods

Sold/Inventory

The

variations in formula of inventory

turnover relates to the denominator as

some financial managers

take

closing

inventory value and other

prefer to have average

inventory, which we can work

out by adding

opening

and closing inventories and

dividing by 2.

The

inventory turnover often is reported as

the inventory period, which is the number

of days worth of

inventory

on hand, calculated by dividing the

inventory by the average daily cost of

goods sold:

Inventory

Period = Annual Cost of Goods

Sold / Average

Inventory

The

inventory period also can be

written as:

Inventory

Period = 365/Inventory Turnover

11

Corporate

Finance FIN 622

VU

Other

asset turnover ratios include

fixed asset turnover and

total asset turnover.

Leverage

or Long term solvency

Ratios

Financial

leverage ratios provide an

indication of the long-term solvency of

the firm. Unlike liquidity

ratios

that

are concerned with short-term

assets and liabilities, financial

leverage ratios measure the extent

to

which

the firm is using long term

debt.

The

debt ratio is defined as

total debt divided by total

assets:

Debt

Ratio = Total Debt/Total

Assets

The

debt-to-equity ratio is total

debt divided by total

equity:

Debt-to-Equity

Ratio = Total Debt/Total

Equity

Debt

ratios depend on the classification of

long-term leases and on the

classification of some items as

long-

term

debt or equity. The times

interest earned ratio

indicates how well the

firm's earnings can cover

the

interest

payments on its debt. This

ratio also is known as the

interest coverage and is

calculated as follows:

Interest

Coverage = EBIT/Interest

Charges

Where

EBIT = Earnings before Interest

and Taxes Profitability

Ratios Profitability ratios

offer several

different

measures of the success of the firm at

generating profits.

The

gross profit margin is a

measure of the gross profit

earned on sales. The gross

profit margin

considers

the

firm's cost of goods sold,

but does not include other

costs. It is defined as

follows:

Gross

Profit Margin = Sales - Cost

of Goods Sold/Sales

Return on

assets is a measure of how

effectively the firm's assets

are being used to generate

profits. It is

defined

as:

Return on

Assets = Net Income/Total

Assets

Return on

equity is the bottom line

measure for the shareholders,

measuring the profits earned

for each

dollar

invested in the firm's stock. Return on

equity is defined as follows:

Return on

Equity = Net

Income/Equity

Market

Ratios:

Earning

Per Share:

This

explains the portion of net income

attributable to one common share. It is

calculated as:

EPS =

net income / No. of O/S

shares

P/E

ratio = price per

share/EPS

Market

to Book Value:

= MV

per share/BV per

share

Use

and Limitations of Financial

Ratios

Attention

should be given to the following issues

when using financial

ratios:

A

reference point is needed. To be

meaningful, most ratios must be

compared to historical values of

the

same

firm, the firm's forecasts, or

ratios of similar firms.

Most

ratios by themselves are not

highly meaningful. They should be viewed as

indicators, with several of

them combined to

paint a picture of the firm's

situation.

Year-end

values may not be

representative. Certain account balances

that are used to calculate

ratios may

increase

or decrease at the end of the accounting

period because of seasonal

factors. Such changes

may

distort

the value of the ratio. Average

values should be used when they

are available. Ratios are

subject to

the

limitations of accounting methods.

Different accounting choices

may result in significantly

different

ratio

values.

12

Table of Contents:

- INTRODUCTION TO SUBJECT

- COMPARISON OF FINANCIAL STATEMENTS

- TIME VALUE OF MONEY

- Discounted Cash Flow, Effective Annual Interest Bond Valuation - introduction

- Features of Bond, Coupon Interest, Face value, Coupon rate, Duration or maturity date

- TERM STRUCTURE OF INTEREST RATES

- COMMON STOCK VALUATION

- Capital Budgeting Definition and Process

- METHODS OF PROJECT EVALUATIONS, Net present value, Weighted Average Cost of Capital

- METHODS OF PROJECT EVALUATIONS 2

- METHODS OF PROJECT EVALUATIONS 3

- ADVANCE EVALUATION METHODS: Sensitivity analysis, Profitability analysis, Break even accounting, Break even - economic

- Economic Break Even, Operating Leverage, Capital Rationing, Hard & Soft Rationing, Single & Multi Period Rationing

- Single period, Multi-period capital rationing, Linear programming

- Risk and Uncertainty, Measuring risk, Variability of return–Historical Return, Variance of return, Standard Deviation

- Portfolio and Diversification, Portfolio and Variance, Risk–Systematic & Unsystematic, Beta – Measure of systematic risk, Aggressive & defensive stocks

- Security Market Line, Capital Asset Pricing Model – CAPM Calculating Over, Under valued stocks

- Cost of Capital & Capital Structure, Components of Capital, Cost of Equity, Estimating g or growth rate, Dividend growth model, Cost of Debt, Bonds, Cost of Preferred Stocks

- Venture Capital, Cost of Debt & Bond, Weighted average cost of debt, Tax and cost of debt, Cost of Loans & Leases, Overall cost of capital – WACC, WACC & Capital Budgeting

- When to use WACC, Pure Play, Capital Structure and Financial Leverage

- Home made leverage, Modigliani & Miller Model, How WACC remains constant, Business & Financial Risk, M & M model with taxes

- Problems associated with high gearing, Bankruptcy costs, Optimal capital structure, Dividend policy

- Dividend and value of firm, Dividend relevance, Residual dividend policy, Financial planning process and control

- Budgeting process, Purpose, functions of budgets, Cash budgets–Preparation & interpretation

- Cash flow statement Direct method Indirect method, Working capital management, Cash and operating cycle

- Working capital management, Risk, Profitability and Liquidity - Working capital policies, Conservative, Aggressive, Moderate

- Classification of working capital, Current Assets Financing – Hedging approach, Short term Vs long term financing

- Overtrading – Indications & remedies, Cash management, Motives for Cash holding, Cash flow problems and remedies, Investing surplus cash

- Miller-Orr Model of cash management, Inventory management, Inventory costs, Economic order quantity, Reorder level, Discounts and EOQ

- Inventory cost – Stock out cost, Economic Order Point, Just in time (JIT), Debtors Management, Credit Control Policy

- Cash discounts, Cost of discount, Shortening average collection period, Credit instrument, Analyzing credit policy, Revenue effect, Cost effect, Cost of debt o Probability of default

- Effects of discounts–Not effecting volume, Extension of credit, Factoring, Management of creditors, Mergers & Acquisitions

- Synergies, Types of mergers, Why mergers fail, Merger process, Acquisition consideration

- Acquisition Consideration, Valuation of shares

- Assets Based Share Valuations, Hybrid Valuation methods, Procedure for public, private takeover

- Corporate Restructuring, Divestment, Purpose of divestment, Buyouts, Types of buyouts, Financial distress

- Sources of financial distress, Effects of financial distress, Reorganization

- Currency Risks, Transaction exposure, Translation exposure, Economic exposure

- Future payment situation – hedging, Currency futures – features, CF – future payment in FCY

- CF–future receipt in FCY, Forward contract vs. currency futures, Interest rate risk, Hedging against interest rate, Forward rate agreements, Decision rule

- Interest rate future, Prices in futures, Hedging–short term interest rate (STIR), Scenario–Borrowing in ST and risk of rising interest, Scenario–deposit and risk of lowering interest rates on deposits, Options and Swaps, Features of opti

- FOREIGN EXCHANGE MARKET’S OPTIONS

- Calculating financial benefit–Interest rate Option, Interest rate caps and floor, Swaps, Interest rate swaps, Currency swaps

- Exchange rate determination, Purchasing power parity theory, PPP model, International fisher effect, Exchange rate system, Fixed, Floating

- FOREIGN INVESTMENT: Motives, International operations, Export, Branch, Subsidiary, Joint venture, Licensing agreements, Political risk