|

Charging Costs of Inventory to Income Statement |

| << Notes to Financial Statements |

| First-in-First - out (FIFO), Last-in-First-Out (LIFO) >> |

Financial

Statement Analysis-FIN621

VU

Lesson-19

NOTES

TO FINANCIAL STATEMENTS

(Continued)

Charging

Costs of Inventory to Income

Statement

This

is also known as cost flows

of inventory. Inventory units

may be acquired at

different

costs because of different

purchase dates or different suppliers.

Question is: Which of

these

costs

are to be used as "cost of

goods sold"?

Purchase/

→

Balance

sheet → sale

of goods → cost

of →

Income

Manufacture

current assets.

Good

Statement

Cost

of inventory

sold

(?)

Measuring

"cost of goods sold"

involves valuation and pricing of

Inventory and this is

determined

by Inventory Accounting

Policies.

As on

example consider that 2 ACs were

purchased in January @ Rs.20, 000

each, and 3

@

Rs.25, 000 each in February.

One AC was sold in March.

What would be the cost of

goods sold:

Rs.20,

000 or Rs.25, 000?

Two

approaches can be adopted in this

case i.e. specific

identification and cost-flow

assumptions.

Either is acceptable but an approach

once selected, is to be applied

consistently.

In

specific identification approach, the

Units are identified

specifically, which

clearly

shows

as to which particular unit is

being sold and what was

its cost, which would be

its "cost of goods

sold".

A Note

on the Impact of Inventory

Levels on Net

Income

Fluctuations

in inventory levels can

cause profit variations when

inventory is valued according

to

GAAP

standards. GAAP standards

require that all

manufacturing costs must be

capitalized in inventory

regardless

of whether the costs are

variable or fixed.

The

inclusion of fixed costs in

the unit cost causes

profits to rise as inventory levels

raise because the

fixed

cost in inventory is stored on the

balance sheet instead of being

carried over to the

income

statement.

When the inventory level

falls, this fixed cost

that has been stored on the

balance sheet is

moved

over to the income statement thereby

causing net profit to

fall.

To

illustrate this phenomenon I first

present a one month income

statement constructed using

only

variable

costs in inventory (in this

case, materials only).

Sales

$1,837,380

Cost

of materials

458,000

Margin

1,379,380

Expenses

Labor

224,000

Overhead

344,288

Depreciation

270,000

69

Financial

Statement Analysis-FIN621

VU

Administrative

210,000

Marketing

175,000

Total

expenses

1,223,288

Profit

before taxes

156,092

Income

taxes @ 35%

54,632

Net

Profit

$101,460

Computation

of Unit Values

Sales

Flow

Valves

Pumps

Controllers

Total

Units

7,500

12,500

4,000

24,000

Selling

Price $57.78

$81.26

$97.07

$1,837,380

20.00

22.00

458,000

Material

cost 16.00

Unit

margin 41.78

61.26

75.07

Total

margin

$313,350

$765,750

$300,280

$1,379,380

Next

I show two income statements for

two months with the

identical sales as in the first

income

statement

that uses only variable

costs in inventory. However, in

these two income statements

the

inventory

levels change; in the Month 1

statement the inventory of Valves

rises by 1,000 units, and

in

the

Month 2 statement Valve

inventory falls by 1,000

units.

Month

1

Flow

Valves

Pumps

Controllers

Total

Unit

Sales

7,500

12,500

4,000

24,000

Units

Produced

8,500

12,500

4,000

25,000

Ending

Inv.

1,000

0

0

1,000

Unit

cost

37.75

48.87

100.57

Sales

Price

$57.78

$81.26

$97.07

Dollar

sales

433,350

1,015,750

388,280

1,837,380

Income

Statement

Sales

$1,837,380

Cost

of goods sold

Begin

inv.

0

Costs

added

Materials

474,000

Labor

155,600

Overhead

682,688

Total

costs added

1,312,288

Goods

available

1,312,288

Ending

inv.

1,000

37,749

Cost

of goods sold

1,274,539

Gross

Profit

562,841

70

Financial

Statement Analysis-FIN621

VU

Administrative

210,000

Marketing

175,000

Total

expenses

385,000

Profit

before taxes

177,841

Income

taxes @ 35%

62,244

Net

Profit

$115,597

Month

2

Flow

Valves

Pumps

Controllers

Total

Unit

Sales

7,500

12,500

4,000

24,000

Units

Produced

6,500

12,500

4,000

23,000

Unit

cost

37.75

48.87

100.57

Sales

Price

$57.78

$81.26

$97.07

Dollar

sales

433,350

1,015,750

388,280

1,837,380

Income

Statement

Sales

$1,837,380

Cost

of goods sold

Begin

inv.

37,749

Costs

added

Materials

442,000

Labor

155,600

Overhead

682,688

Total

costs added

1,280,288

Goods

available

1,318,037

Ending

inv.

0

0

Cost

of goods sold

1,318,037

Gross

Profit

519,343

Administrative

210,000

Marketing

175,000

Total

expenses

385,000

Profit

before taxes

134,343

Income

taxes @ 35%

47,020

Net

Profit

$87,323

71

Financial

Statement Analysis-FIN621

VU

Notice

how the net incomes changed

from one month to the next even

though sales remained the

same.

This

example used activity based

costs for costing the

units of product, but any

costing method that

assigns

fixed costs to units will

give the same result.

To more

clearly show why the incomes

differ, consider the following table

that shows variable

unit

costs

and the unit fixed costs

assigned to the units by the ABC

costing system.

Flow

Valves

Pumps

Controllers

ABC

unit cost

$37.75

$48.87

$100.57

20.00

22.00

Unit

variable cost

16.00

Fixed

cost per unit

21.75

28.87

78.57

Times

x

Inventory

change in units

1,000

Equals--Difference

in pre$21,749

tax

income

Profit

before

taxes--unit$156,092

variable

costs

Profit

before

taxes--ABC177,841

unit

costs Month 1

Difference

in profit

before(21,749)

taxes

Profit

before

taxes--unit$156,092

variable

costs

Profit

before

taxes--ABC134,343

unit

costs Month 2

Difference

in profit

before$21,749

taxes

The

difference between the net income before

taxes for the income

statement with variable

costs and the

one

with the ABC costs is always

explained by the unit change in

inventory multiplied by the

fixed

overhead per

unit.

Inventory

Errors and Financial

Statements

Income

statement effects.

An

incorrect inventory balance

causes an error in the

calculation of cost of goods

sold and,

therefore,

an error in the calculation of

gross profit and net

income. Left unchanged, the

error has

the

opposite effect on cost of

goods sold, gross profit,

and net income in the

following accounting

period

because the first accounting

period's ending inventory is

the second period's

beginning

inventory.

The total cost of goods

sold, gross profit, and

net income for the

two periods will be

correct,

but the allocation of these

amounts between periods will be

incorrect. Since

financial

statement

users depend upon accurate statements,

care must be taken to ensure that

the inventory

balance

at the end of each

accounting period is correct.

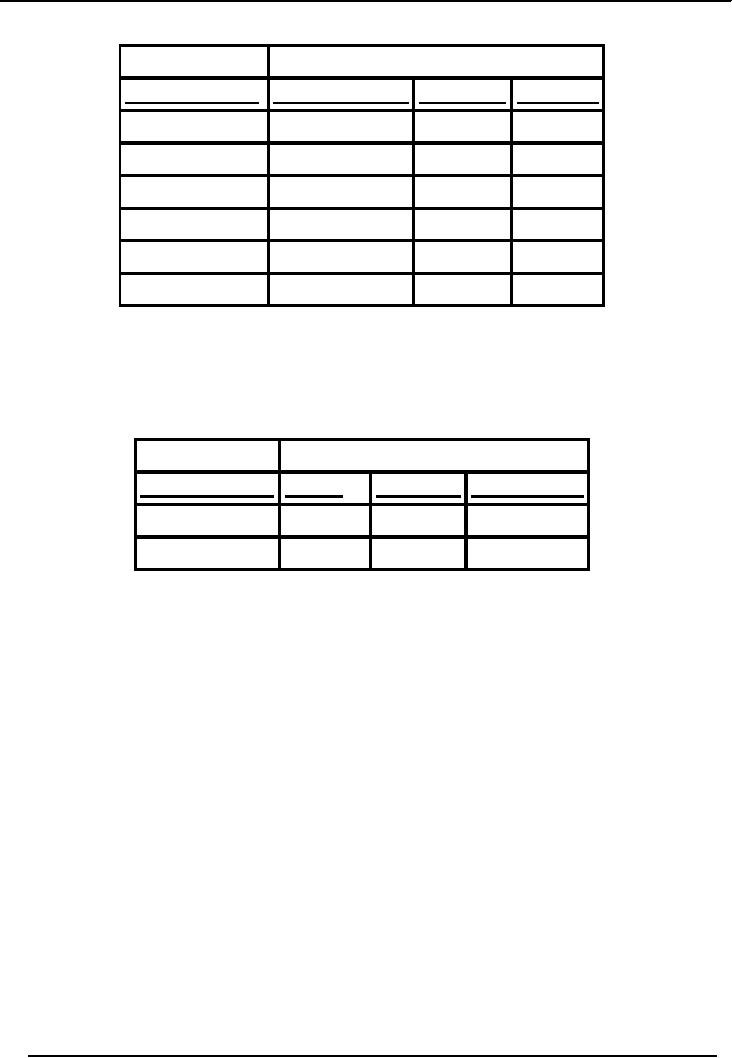

The chart below identifies

the effect that

an

incorrect inventory balance

has on the income

statement

72

Financial

Statement Analysis-FIN621

VU

Impact

of Error on

Error

in Inventory Cost of Goods

Sold Gross Profit Net

Income

Ending

Inventory

Understated

Overstated

Understated

Understated

Overstated

Understated

Overstated

Overstated

Beginning

Inventory

Understated

Understated

Overstated

Overstated

Overstated

Overstated

Understated

Understated

Balance

sheet effects.

An

incorrect inventory balance

causes the reported value of

assets and owner's equity on

the

balance

sheet to be wrong. This

error does not affect

the balance sheet in the

following accounting

period,

assuming the company

accurately determines the

inventory balance for that

period.

Impact

of Error on

Error

in Inventory Assets =

Liabilities

+ Owner's Equity

Understated

Understated No

Effect

Understated

Overstated

Overstated

No

Effect

Overstated

Financial

Statements with

Inventory

The

statement of owner's equity

and the statement of cash

flows are the same for

merchandising

and

service companies. Except

for the inventory account,

the balance sheet is also

the same. But a

merchandising

company's income statement

includes categories that

service enterprises do not

use.

A

single-step income statement

for a merchandising company

lists net sales under

revenues and

the

cost of goods sold under

expenses.

73

Table of Contents:

- ACCOUNTING & ACCOUNTING PRINCIPLES

- Dual Aspect of Transactions

- Rules of Debit and Credit

- Steps in Accounting Cycle

- Preparing Balance Sheet from Trial Balance

- Business transactions

- Adjusting Entry to record Expenses on Fixed Assets

- Preparing Financial Statements

- Closing entries in Accounting Cycle

- Income Statement

- Balance Sheet

- Cash Flow Statement

- Preparing Cash Flows

- Additional Information (AI)

- Cash flow from Operating Activities

- Operating Activities’ portion of cash flow statement

- Cash flow from financing Activities

- Notes to Financial Statements

- Charging Costs of Inventory to Income Statement

- First-in-First - out (FIFO), Last-in-First-Out (LIFO)

- Depreciation Accounting Policies

- Accelerated-Depreciation method

- Auditor’s Report, Opinion, Certificate

- Management Discussion & Analyses (MD&A)

- TYPES OF BUSINESS ORGANIZATIONS

- Incorporation of business

- Authorized Share Capital, Issued Share Capital

- Book Values of equity, share

- SUMMARY

- SUMMARY

- Analysis of income statement and balance sheet:

- COMMON –SIZE AND INDEX ANALYSIS

- ANALYSIS BY RATIOS

- ACTIVITY RATIOS

- Liquidity of Receivables

- LEVERAGE, DEBT RATIOS

- PROFITABILITY RATIOS

- Analysis by Preferred Stockholders

- Efficiency of operating cycle, process

- STOCKHOLDERS’ EQUITY SECTION OF THE BALANCE SHEET 1

- STOCKHOLDERS’ EQUITY SECTION OF THE BALANCE SHEET 2

- BALANCE SHEET AND INCOME STATEMENT RATIOS

- Financial Consultation Case Study

- ANALYSIS OF BALANCE SHEET & INCOME STATEMENT

- SUMMARY OF FINDGINS