|

Cash flow from Operating Activities |

| << Additional Information (AI) |

| Operating Activities’ portion of cash flow statement >> |

Financial

Statement Analysis-FIN621

VU

Lesson-15

FINANCIAL

STATEMENTS

(Continued)

Cash

flow from Operating

Activities

Study

computation of net sales, cost of

goods sold and interest expense

etc. On Income

Statement.

Cash

received from customers;

Cash received from sales on

cash = Net Sales;

Cash

received

from sales on credit/on

account =

Net

sales increase in Accounts

Receivable or Net

sales

+ decrease in Accounts Receivable.

Increase/decrease in Accounts Receivable

is observed from

beginning

and ending/closing balances, appearing on

Balance Sheet.

(A1

No:1): Cash received from

customers = 900,000

30,000

=

Rs.870,000

A1

No:2

Cash

dividend received = Dividends Revenue

=Rs.3,000: Divided Revenue is based on

cash, so

whatever

Dividend Revenue is being received,

that in cash Inflows.

Cash

interest received=Interest Revenue + Decrease in

Interest Receivable, or Interest

Revenue

Increase in Interest Receivable =

6000 + 1000 = 7000

Interest

& Dividend received = 3,000 +

7,000 = 10,000

Cash

Inflow from operating

activities would be: Cash

from customers + interest &

dividends

receivable

= 870,000 + 10,000 = Rs.

880,000

CASH

FLOW STATEMENT CONTD.........

QUESTION

# 1

You

are given the Balance Sheet of

ABC Limited as at June 30,

2001 and June 30,

2002 and its

Profit

and

Loss Account for the year

ended June 30 2002.

Required

You

are required to prepare Cash

Flow Statement for the given

period.

ABC

Ltd

Balance

Sheet As At June 30

2002

2002

Rs.

2001

Rs.

Rs.

`000

Rs.

`000

Building

at Cost

181,000

140,000

Accumulated

Depreciation

36,000

30,000

Written

Down Value

145,000

110,000

Plant

and Machinery cost

83,000

90,000

Accumulated

Depreciation

36,000

35,000

Written

Down Value

47,000

55,000

56

Financial

Statement Analysis-FIN621

VU

Total

Fixed Assets at WDV

192,000

165,000

Long

Term Investment

17,000

10,000

Current

Assets

Debtors

30,000

21,000

Stock

25,000

40,000

Short

Term Deposits

18,000

15,000

Cash

and Bank

30,000

24,000

103,000

100,000

Current

Liabilities

Creditors

15,000

12,000

Proposed

Dividend

18,000

16,000

Tax

Payable

9,000

8,000

42,000

36,000

Working

Capital

61,000

64,000

Net

Assets Employed

270,000

239,000

Financed

By

Share

Capital

180,000

160,000

Share

Premium Account

17,000

12,000

General

Reserve

23,000

20,000

Accumulated

Profit and Loss

34,000

27,000

Share

Holders' Equity

254,000

219,000

Term

Finance Certificates

16,000

20,000

Total

270,000

239,000

57

Financial

Statement Analysis-FIN621

VU

ABC

Ltd

Profit

and Loss Account For

the Year Ended June 30

2002

Rs.

`000

300,000

Sales

(231,000)

Cost

of Sales

Gross

Profit

69,000

Other

Income

4,000

73,000

Less:

Administrative Expenses

Director's

Remuneration

4,000

Depreciation

on Building

6,000

Loss

on Sale of Machinery

2,000

Other

Administrative Expenses

12,000

24,000

Less:

Selling Expenses

10,000

Less:

Mark up on TFC

2,000

36,000

Profit

for the Year Before

Tax

37,000

Provision

for tax

9,000

Profit

after tax

28,000

Acc.

Profit Brought

Forward

27,000

55,000

Appropriation

Transfer

to Reserve

3,000

Proposed

Dividend

18,000

21,000

Accumulated

Profit Carried

Forward

34,000

Additional

Information

1.

Other income include

dividend on Long Term

Investment

2.

Cost of goods sold includes

depreciation for the year on

machinery Rs. 5,000.

3.

Accumulated Depreciation on the machine

disposed off amounts to Rs.

4,000.

58

Financial

Statement Analysis-FIN621

VU

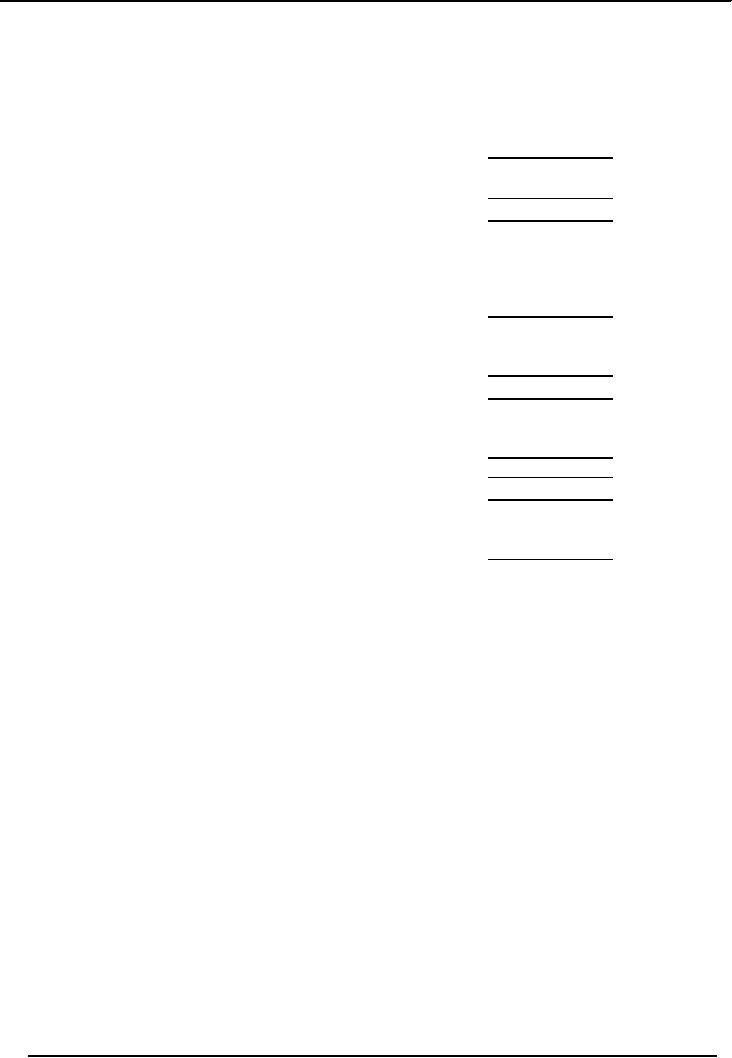

SOLUTION

ABC

Ltd

Cash

Flow Statement For the Year

Ended June 30 2002

Note

Rs.

`000

Net

Profit Before Tax

37,000

Adjustment

of Non Cash Items

Depreciation

11,000

Loss

on Sale of Machinery

2,000

Markup

on TFC

2,000

52,000

Less:

Other Income

(4,000)

Operating

Profit Before Working

Capital

Changes

48,000

Working

Capital Changes

Reduction

in Stock

15,000

Increase

in Creditors

3,000

Increase

in Debtors

(9,000)

9,000

Cash

Flow from Operations

57,000

Markup

on TFC Paid

(2,000)

Tax

Paid

1

(8,000)

Net

Cash Flow From Operating

Activities

47,000

Cash

Flow From Investing

Activities

Dividend

Received

4,000

Payment to

Acquire Investments 2

(7,000)

Purchase

of Fixed Assets

(Building)

3

(41,000)

Receipt

from Sale of Assets

4

1,000

Net

Cash Flow From Investing

Activities

(43,000)

Cash

Flow From Financing

Activities

Issue

of Ordinary Shares

20,000

Share

Premium Account

5,000

Dividend

Paid

5

(16,000)

Repayment of

TFC

6

(4,000)

Net

Cash Flow From Financing

Activities

5,000

Net

Increase / (Decrease) in Cash

and

Cash

Equivalents During The

Year

9,000

O/B

of Cash and Cash

Equivalents

39,000

C/B of

Cash and Cash Equivalents

48,000

59

Financial

Statement Analysis-FIN621

VU

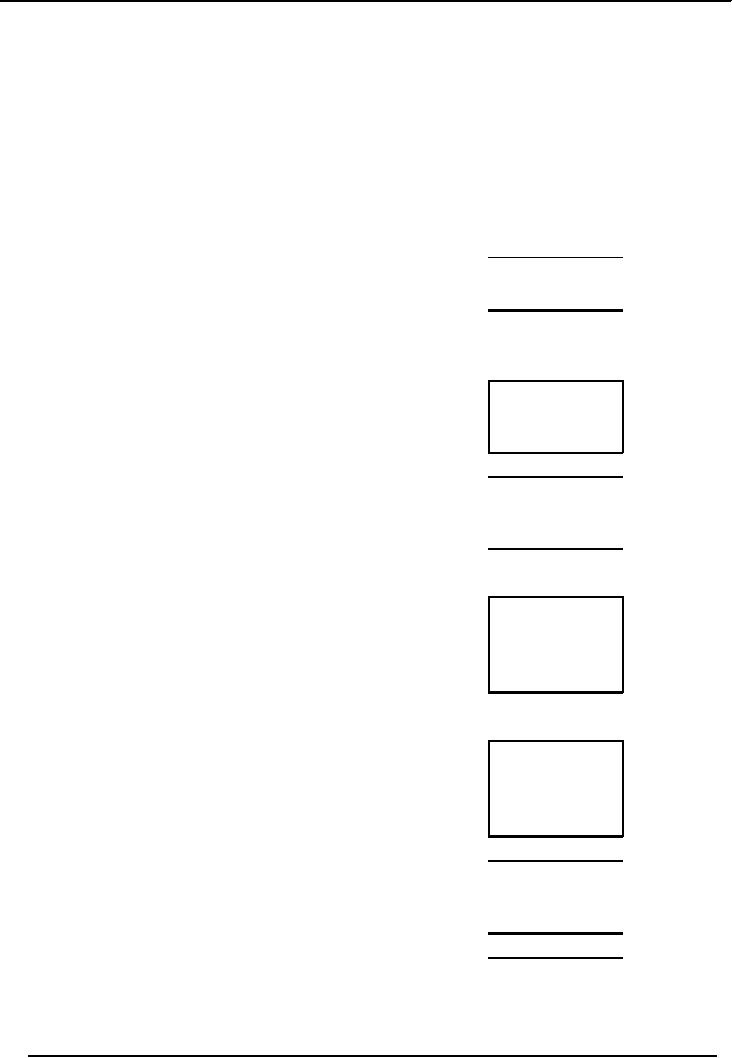

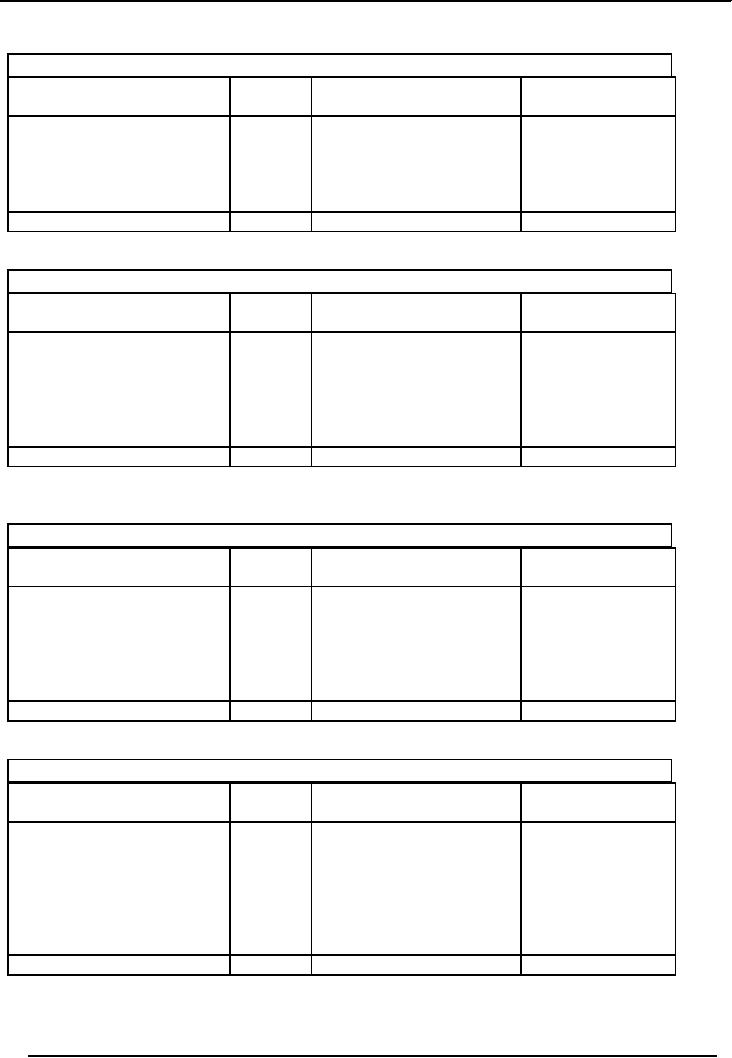

Note #

1

Tax

Paid

Provision

for Tax

Account

Code --------

Particulars

Amount

Particulars

Amount

Dr.

(Rs.)

Cr.

(Rs.)

Cash

8,000

Bal.

B/F

8,000

Balance

c/f

9,000

For

the year

9,000

Total

17,000

Total

17,000

Note #

2

Payments to

Acquire Investments

Investment

Account

Code --------

Particulars

Amount

Particulars

Amount

Dr.

(Rs.)

Cr.

(Rs.)

10,000

Bal.

B/F

7,000

Cash

17,000

Bal.

C/F

Total

17,000

Total

17,000

Note #

3

Purchase

of Fixed Assets

Building

Cost

Account

Code --------

Particulars

Amount

Particulars

Amount

Dr.

(Rs.)

Cr.

(Rs.)

140,000

Bal.

B/F

41,000

Cash

181,000

Bal.

C/F

Total

181,000

Total

181,000

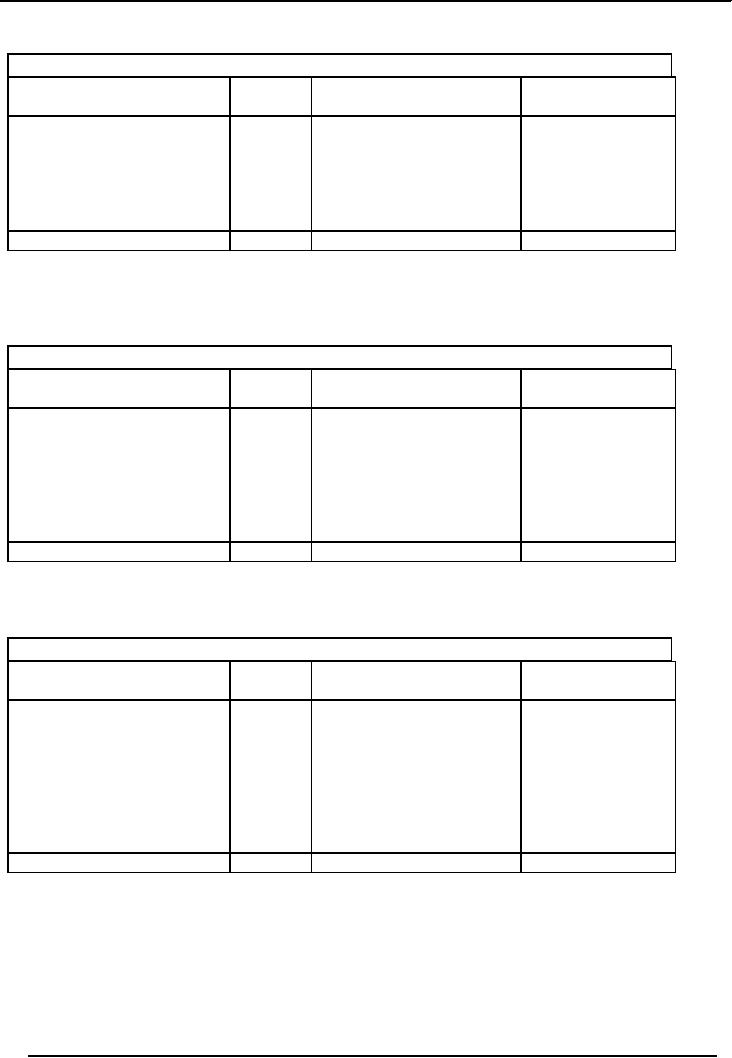

Note #

4

Sale

Proceed of Machinery

Machinery

at Cost

Account

Code --------

Particulars

Amount

Particulars

Amount

Dr.

(Rs.)

Cr.

(Rs.)

7,000

90,000

Disposal

A/c

Bal.

B/F

83,000

Bal.

C/F

Total

90,000

Total

90,000

60

Financial

Statement Analysis-FIN621

VU

Disposal

of asset

Account

Code --------

Particulars

Amount

Particulars

Amount

Dr.

(Rs.)

Cr.

(Rs.)

4,000

7,000

Accumulated

Dep.

Cost

2,000

Loss

on Sale

1,000

Sale

Proceed

Total

7,000

Total

7,000

Note #

5

Dividend

Payable

Dividend

Payable

Account

Code --------

Particulars

Amount

Particulars

Amount

Dr.

(Rs.)

Cr.

(Rs.)

16,000

O/B

16,000

Cash

18,000

For

the Year

18,000

C/B

Total

34,000

Total

34,000

Note #

6

Repayment

of TFC

TFC

Account

Account

Code --------

Particulars

Amount

Particulars

Amount

Dr.

(Rs.)

Cr.

(Rs.)

20,000

O/B

4,000

Cash

16,000

C/B

Total

20,000

Total

20,000

61

Table of Contents:

- ACCOUNTING & ACCOUNTING PRINCIPLES

- Dual Aspect of Transactions

- Rules of Debit and Credit

- Steps in Accounting Cycle

- Preparing Balance Sheet from Trial Balance

- Business transactions

- Adjusting Entry to record Expenses on Fixed Assets

- Preparing Financial Statements

- Closing entries in Accounting Cycle

- Income Statement

- Balance Sheet

- Cash Flow Statement

- Preparing Cash Flows

- Additional Information (AI)

- Cash flow from Operating Activities

- Operating Activities’ portion of cash flow statement

- Cash flow from financing Activities

- Notes to Financial Statements

- Charging Costs of Inventory to Income Statement

- First-in-First - out (FIFO), Last-in-First-Out (LIFO)

- Depreciation Accounting Policies

- Accelerated-Depreciation method

- Auditor’s Report, Opinion, Certificate

- Management Discussion & Analyses (MD&A)

- TYPES OF BUSINESS ORGANIZATIONS

- Incorporation of business

- Authorized Share Capital, Issued Share Capital

- Book Values of equity, share

- SUMMARY

- SUMMARY

- Analysis of income statement and balance sheet:

- COMMON –SIZE AND INDEX ANALYSIS

- ANALYSIS BY RATIOS

- ACTIVITY RATIOS

- Liquidity of Receivables

- LEVERAGE, DEBT RATIOS

- PROFITABILITY RATIOS

- Analysis by Preferred Stockholders

- Efficiency of operating cycle, process

- STOCKHOLDERS’ EQUITY SECTION OF THE BALANCE SHEET 1

- STOCKHOLDERS’ EQUITY SECTION OF THE BALANCE SHEET 2

- BALANCE SHEET AND INCOME STATEMENT RATIOS

- Financial Consultation Case Study

- ANALYSIS OF BALANCE SHEET & INCOME STATEMENT

- SUMMARY OF FINDGINS