|

MARGINAL UTILITY AND CONSUMER CHOICE:COST-OF-LIVING INDEXES |

| << Note it is repeated:Consumer Preferences, Revealed Preferences |

| Review of Consumer Equilibrium:INDIVIDUAL DEMAND, An Inferior Good >> |

Microeconomics

ECO402

VU

Lesson

9

MARGINAL

UTILITY AND CONSUMER

CHOICE

Marginal

utility

measures the

additional satisfaction obtained

from consuming one

additional unit of a

good.

Marginal

Utility: An Example

The marginal

utility derived from

increasing from 0 to 1 units of

food might be 9

Increasing from

1 to 2 might be 7

Increasing from

2 to 3 might be 5

Observation:

Marginal utility is

diminishing

Diminishing

Marginal Utility

The principle

of diminishing marginal utility

states that as more and

more of a good is

consumed,

consuming additional amounts

will yield smaller and

smaller additions to

utility.

Relationship

of Total and Marginal

Utility

Diminishing

Marginal Utility:

An

Example

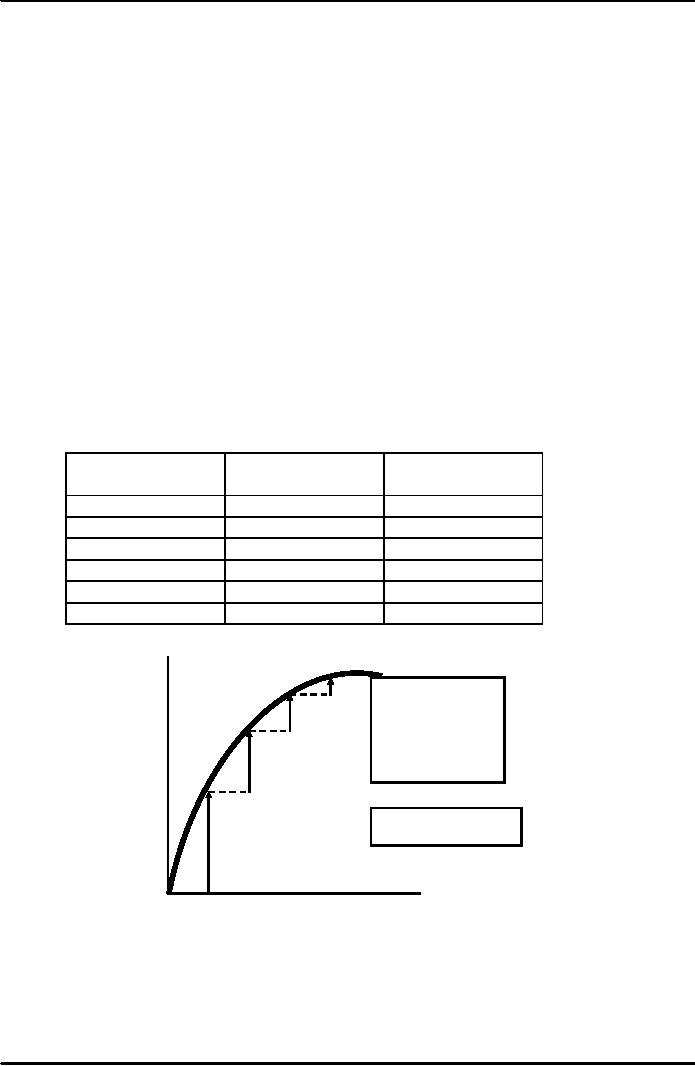

Quantity

of good

Total

utility

Marginal

utility

consumed

0

0

1

4

4

2

7

3

3

9

2

4

10

1

5

10

0

Utility

TU

10

1

Total

utility of

consuming

a certain

2

amount

is equal to

the

sum of the

marginal

utilities up

3

to

the point

5

Total

utility increases

at

a decreasing rate

4

2

3

4

5

Quantity

0

1

41

Microeconomics

ECO402

VU

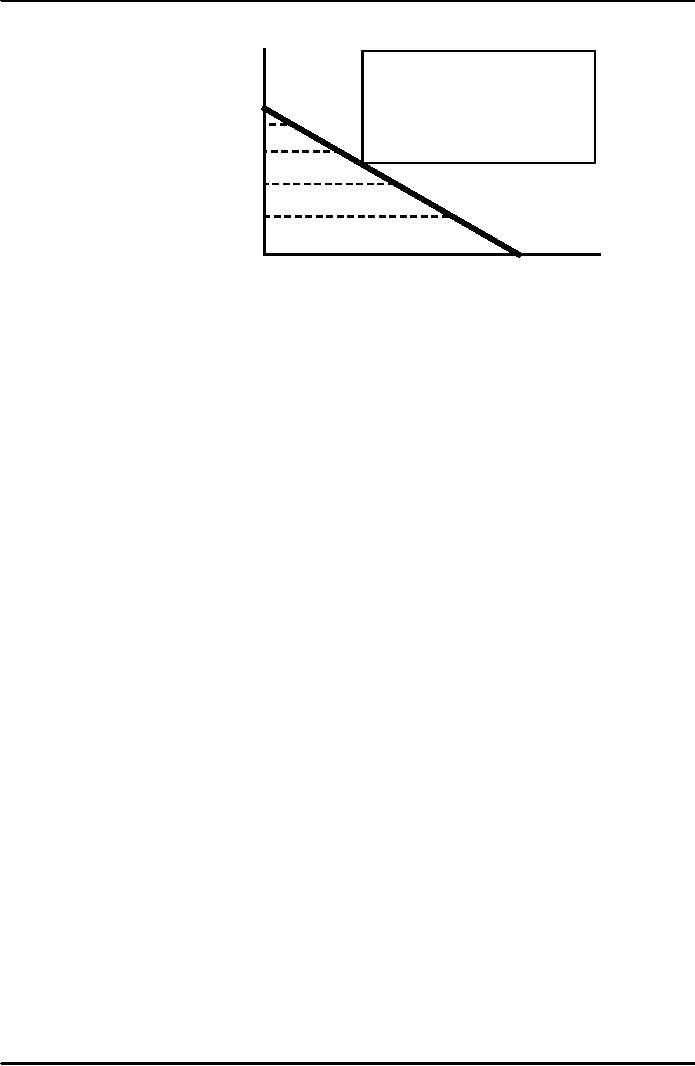

Marginal

Utility

The

fact that total

utility

increases

at a decreasing

5

rate

is shown by negative

4

slope

of marginal utility

curve

3

2

1

MU

2

3

4

5

Quantity

0

1

Marginal

Utility and

Consumer

Choice

Marginal

Utility and the Indifference

Curve

If consumption

moves along an indifference

curve, the additional

utility derived from

an

increase

in the consumption of one

good, food (F), must

balance the loss of utility

from

the

decrease in the consumption in

the other good, clothing

(C).

Formally:

0

= MUF (ΔF) + MUC (ΔC)

Rearranging:

-

(ΔC/ ΔF) =

MUF /

MUC

Because:

-

( ΔC

/ ΔF ) = MRS

of F

for C

MRS

=

MUF/MUC

When

consumers maximize satisfaction

the:

MRS

=

PF/PC

Since

the MRS is also equal to the

ratio of the marginal

utilities of consuming F and C,

it

follows

that:

MUF/MUC

=

PF/PC

Which

gives the equation for

utility maximization?

MU

F /

PF =

MU

C /

PC

Total

utility is maximized when

the budget is allocated so

that the marginal utility

per dollar

of

expenditure is the same for

each good.

This

is referred to as the equal

marginal principle.

42

Microeconomics

ECO402

VU

Gasoline

Rationing

In 1974 and

again in 1979, the

government imposed price

controls on gasoline.

This resulted

in shortages and gasoline

was rationed.

Non-price

rationing is an alternative to market

rationing.

Under one

form everyone has an equal

chance to purchase a rationed

good.

Gasoline is

rationed by long lines at

the gas pumps.

Rationing

hurts some by limiting the

amount of gasoline they can

buy.

This

can be seen in the following

model.

It

applies to a woman with an

annual income of

$20,000.

Spending

on

other

With

a limit of

A

goods

($) 20,000

2,000

gallons,

D

the

consumer moves

18,00

to

a lower

C

indifference

curve

15,00

(lower

level of utility).

U

U

B

Gasoline

2,00

5,00

20,00

(gallons

per year)

COST-OF-LIVING

INDEXES

The

CPI is calculated each year

as the ratio of the cost of

a typical bundle of

consumer

goods

and services today in

comparison to the cost

during a base period.

Example

Two sisters,

Raheela and Sarah, have

identical preferences.

Sarah began

college in 1987 with a $500

discretionary budget.

In 1997,

Raheela started college and

her parents promised her a

budget that was

equivalent

in purchasing power.

Price

of books

$20/book

$100/book

Number

of books

15

6

Price

of food

$2.00/lb

$2.20/lb

Pounds

of food

100

300

Expenditure

$500

$1,260

·

Sarah'

Expenditure

·

$500=100

lbs of food x $2.00/lb +15

books x $20/book

·

Raheela'

Expenditure for Equal

Utility

·

$1,260=300

lbs of food x $2.20/lb +6

books x $100/book

43

Microeconomics

ECO402

VU

·

The

ideal cost-of-living adjustment

for Raheela is $760.

·

The

ideal cost-of-living index is

$1,260/$500 = 2.52 or

252.

·

This

implies a 152% increase in

the cost of living.

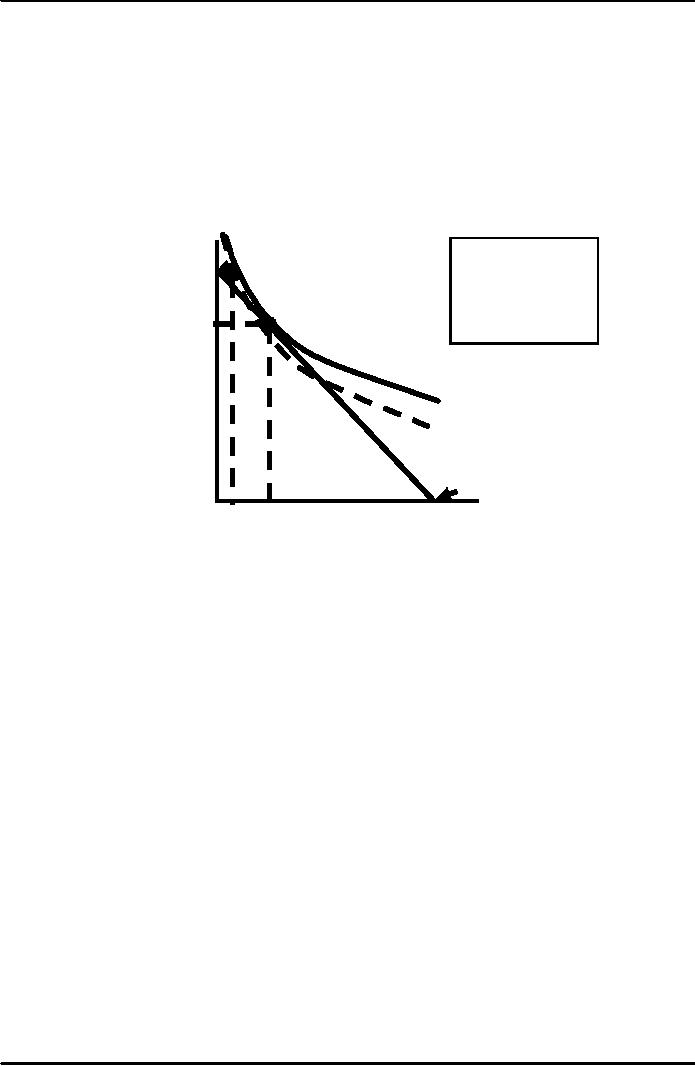

Books

(per

For

Raheela to achieve

quarter)

the

same level of utility

U1

25

as

Sarah, with the

higher

prices,

her budget must

20

be

sufficient to allow

her

to

consume the bundle

A

15

shown

by point B.

10

B

5

l2

l1

Food

(lb./quarter)

0

50 100 200 250 300

350 400 450 500

550 600

The

ideal cost of living index

represents the cost of

attaining a given level of

utility at current

(1997)

prices relative to the cost

of attaining the same

utility at base (1987)

prices.

To

do this on an economy-wide basis

would entail large amounts

of information.

Price

indexes, like the CPI,

use a fixed consumption

bundle in the base period.

Called a

Laspeyres

price index.

The

Laspeyres index tells

us:

The amount of

money at current year prices

that an individual requires to

purchase the

bundle

of goods and services that

was chosen in the base

year divided by the cost

of

purchasing

the same bundle at base

year prices.

Calculating

Raheela's Laspeyres cost of

living index

Setting the

quantities of goods in 1997

equal to what were bought by

her sister, but

setting

their prices at their 1997

levels result in an expenditure

of

$1,720

(100 x 2.20 + 15 x

$100)

Her

cost of living adjustment

would now be $1,220.

The

Laspeyres index is:

$1,720/$500

= 344.

This

overstates the true

cost-of-living increase.

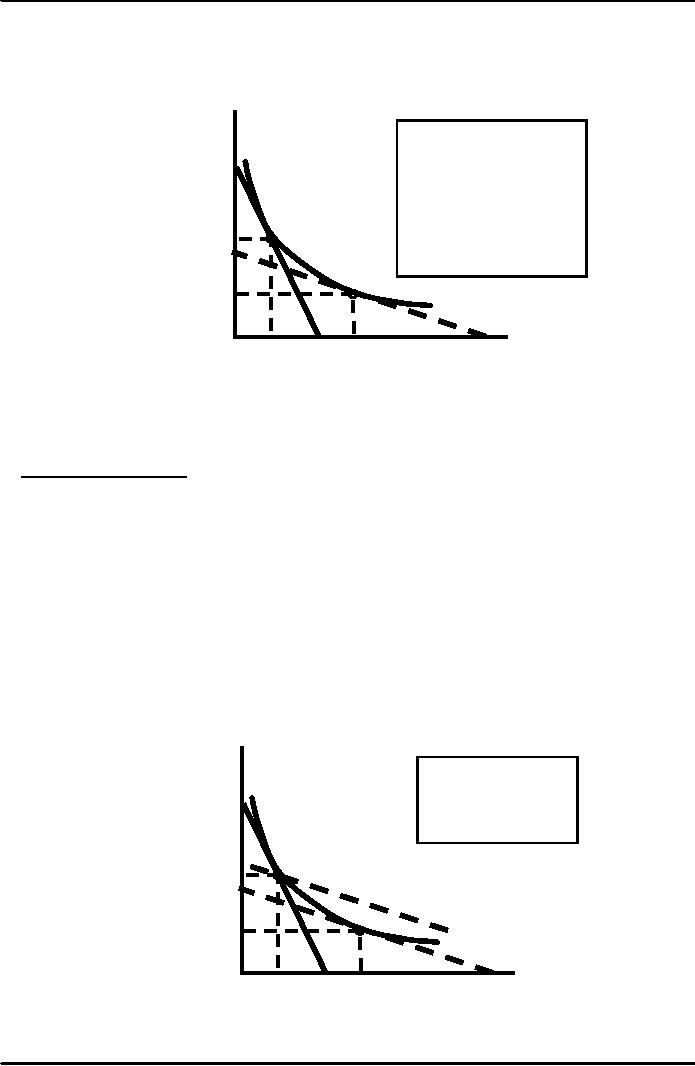

Books

(per

quarter)

Using

the Laspeyres

index

results in the

U1

25

budget

line shifting

up

from I2 to I3.

20

A

15

10

B

l3

5

l2

l1

Food

(lb./quarter)

0

50 100 200 250 300

350 400 450 500

550 600

44

Microeconomics

ECO402

VU

What

Do You Think?

Does the

Laspeyres index always

overstate the true

cost-of-living index?

Yes!

The Laspeyres

index assumes that consumers

do not alter their

consumption patterns

as

prices change.

By increasing

purchases of those items

that have become relatively

cheaper, and

decreasing

purchases of the relatively

more expensive items

consumers can achieve

the

same level of utility

without having to consume

the same bundle of

goods.

The

Paasche Index

Calculates the

amount of money at current-year

prices that an individual

requires to

purchase

a current bundle of goods

and services divided by the

cost of purchasing

the

same

bundle in the base

year.

Comparing

the Two Indexes

Suppose:

Two goods:

Food (F) and Clothing

(C)

Comparing

the Two Indexes

Let:

·

P & P be current

year prices

Ft

Ct

·

P & P be

base year prices

Fb

Cb

·

F & C be current

year quantities

t

t

·

F & C be base

year quantities

b

b

Both indexes

involve ratios that involve

today's current year prices,

PFt and PCt.

However, the

Laspeyres index relies on

base year consumption, Fb and

Cb.

Whereas, the

Paasche index relies on

today's current consumption,

Ft and Ct

.

Then

a comparison of the Laspeyres

and Paasche indexes gives

the following

equations:

LI

= --P-Ft-F-b----P-Ct-Cb----

-

- - + - - ---

PFb Fb

+ PCb Cb

PI

= --P---F--+---C----------

-

Ft - t

- P -t Ct

PFb Ft

+ PCb Ct

Sarah

(1990)

·

Cost of

base-year bundle at current

prices equals

$1,720

(100 lbs x $2.20/lb + 15

books x $100/book)

·

Cost of

same bundle at base year

prices is

$500

(100 lbs x $2.00/lb + 15

books x $20/book)

Sarah

(1990)

$1,

720

LI

=

=

344

$500

·

Cost of

buying current year bundle

at current year prices

is

$1,260

(300 lbs x $2.20/lb + 6

books x $100/book)

45

Microeconomics

ECO402

VU

·

Cost of

the same bundle at base

year prices is

$720

(300 lbs x $2/lb + 6 books x

$20/book)

$1,260

PI

=

=

175

$720

The

Paasche index will

understate the cost of

living because it assumes

that the individual

will

buy the current year

bundle in the base

year.

46

Table of Contents:

- ECONOMICS:Themes of Microeconomics, Theories and Models

- Economics: Another Perspective, Factors of Production

- REAL VERSUS NOMINAL PRICES:SUPPLY AND DEMAND, The Demand Curve

- Changes in Market Equilibrium:Market for College Education

- Elasticities of supply and demand:The Demand for Gasoline

- Consumer Behavior:Consumer Preferences, Indifference curves

- CONSUMER PREFERENCES:Budget Constraints, Consumer Choice

- Note it is repeated:Consumer Preferences, Revealed Preferences

- MARGINAL UTILITY AND CONSUMER CHOICE:COST-OF-LIVING INDEXES

- Review of Consumer Equilibrium:INDIVIDUAL DEMAND, An Inferior Good

- Income & Substitution Effects:Determining the Market Demand Curve

- The Aggregate Demand For Wheat:NETWORK EXTERNALITIES

- Describing Risk:Unequal Probability Outcomes

- PREFERENCES TOWARD RISK:Risk Premium, Indifference Curve

- PREFERENCES TOWARD RISK:Reducing Risk, The Demand for Risky Assets

- The Technology of Production:Production Function for Food

- Production with Two Variable Inputs:Returns to Scale

- Measuring Cost: Which Costs Matter?:Cost in the Short Run

- A Firm’s Short-Run Costs ($):The Effect of Effluent Fees on Firms’ Input Choices

- Cost in the Long Run:Long-Run Cost with Economies & Diseconomies of Scale

- Production with Two Outputs--Economies of Scope:Cubic Cost Function

- Perfectly Competitive Markets:Choosing Output in Short Run

- A Competitive Firm Incurring Losses:Industry Supply in Short Run

- Elasticity of Market Supply:Producer Surplus for a Market

- Elasticity of Market Supply:Long-Run Competitive Equilibrium

- Elasticity of Market Supply:The Industry’s Long-Run Supply Curve

- Elasticity of Market Supply:Welfare loss if price is held below market-clearing level

- Price Supports:Supply Restrictions, Import Quotas and Tariffs

- The Sugar Quota:The Impact of a Tax or Subsidy, Subsidy

- Perfect Competition:Total, Marginal, and Average Revenue

- Perfect Competition:Effect of Excise Tax on Monopolist

- Monopoly:Elasticity of Demand and Price Markup, Sources of Monopoly Power

- The Social Costs of Monopoly Power:Price Regulation, Monopsony

- Monopsony Power:Pricing With Market Power, Capturing Consumer Surplus

- Monopsony Power:THE ECONOMICS OF COUPONS AND REBATES

- Airline Fares:Elasticities of Demand for Air Travel, The Two-Part Tariff

- Bundling:Consumption Decisions When Products are Bundled

- Bundling:Mixed Versus Pure Bundling, Effects of Advertising

- MONOPOLISTIC COMPETITION:Monopolistic Competition in the Market for Colas and Coffee

- OLIGOPOLY:Duopoly Example, Price Competition

- Competition Versus Collusion:The Prisoners’ Dilemma, Implications of the Prisoners

- COMPETITIVE FACTOR MARKETS:Marginal Revenue Product

- Competitive Factor Markets:The Demand for Jet Fuel

- Equilibrium in a Competitive Factor Market:Labor Market Equilibrium

- Factor Markets with Monopoly Power:Monopoly Power of Sellers of Labor