|

Microeconomics

ECO402

VU

Lesson

28

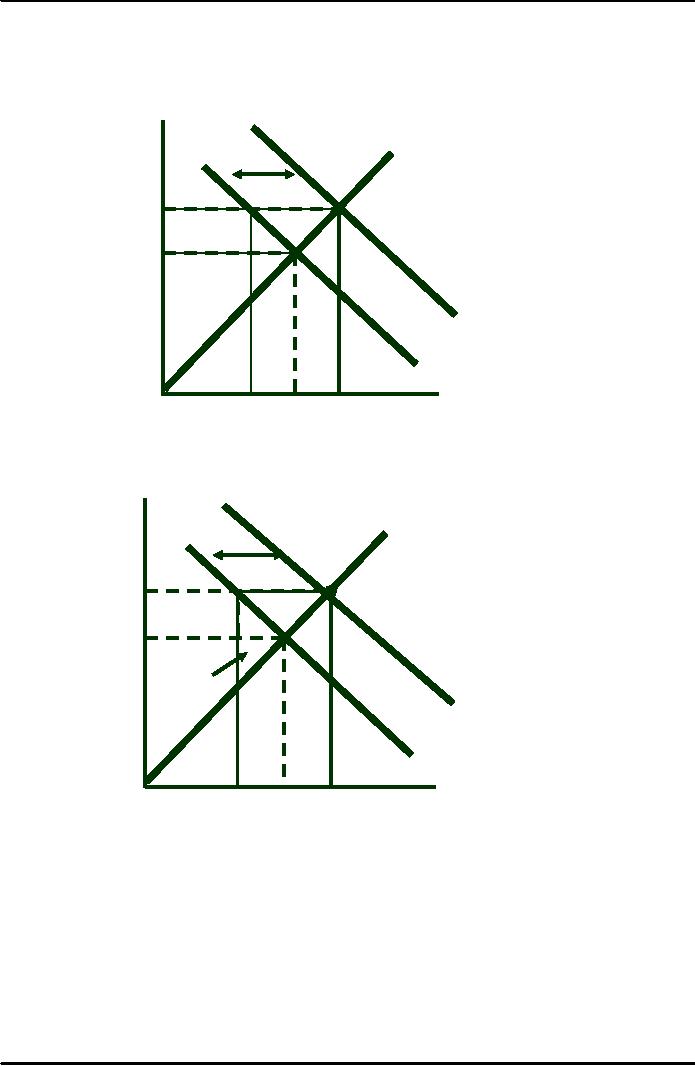

Price

Supports

Price

S

Q

To

maintain a price Ps

the

government buys

quantity

Qg .

The

change in

P

consumer

surplus = -A

- B,

D

A

and

the change in

producer

B

surplus

is A

+ B + D

P

D+

D

Quantity

Q

Q

Q

The

cost to the

government

is the

speckled

rectangle

Price

Ps(Q2-Q1)

S

Q

Total

welfare loss

Ps

A

D

D-(Q2-Q1)ps

B

P0

Total

Welfare

Loss

D+

D

Quantity

Q0

Q2

Q1

Question:

Is there a

more efficient way to

increase farmer's income by

A

+ B + D?

Price

Supports and Production

Quotas

Production

Quotas

The government

can also cause the

price of a good to rise by

reducing supply.

What

is the impact of controlling

entry into the taxicab

market?

134

Microeconomics

ECO402

VU

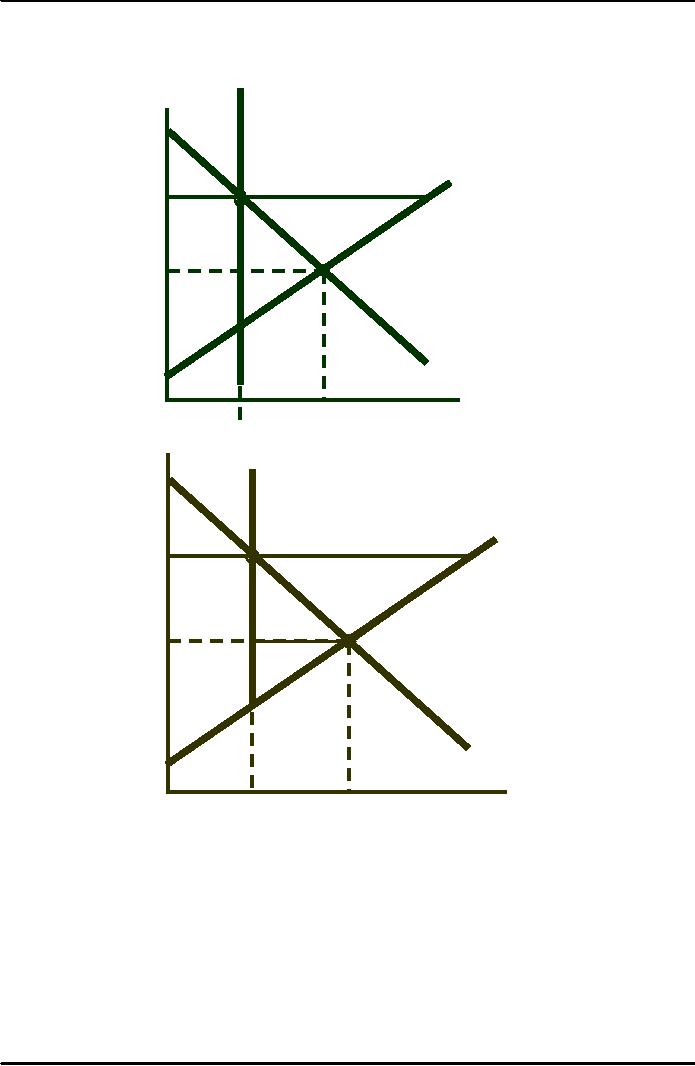

Supply

Restrictions

S

Supply

restricted to

·

Price

Q1

'

·

Supply

shifts to S'

@

Q1

S

P

S

D

P

·CS

reduced by A

+ B

C

·Change

in PS = A

- C

D

Q

Q

Quantity

·P

S

Price

is

maintained with

s

and

incentive

S

·Cost

to government = B

+ C + D

P

A

D

B

P

C

D

Q

Q

Quantity

ĆPS =A - C + B + C +

D

=A

+ B + D.

The

change in consumer and

producer surplus is the same

as with price

supports.

Ćwelfare = -A - B

+ A + B + D - B - C - D = -B - C.

Questions:

How could

the government reduce the

cost and still subsidize

the farmer?

Which is more

costly: supports or acreage

limitations?

135

Microeconomics

ECO402

VU

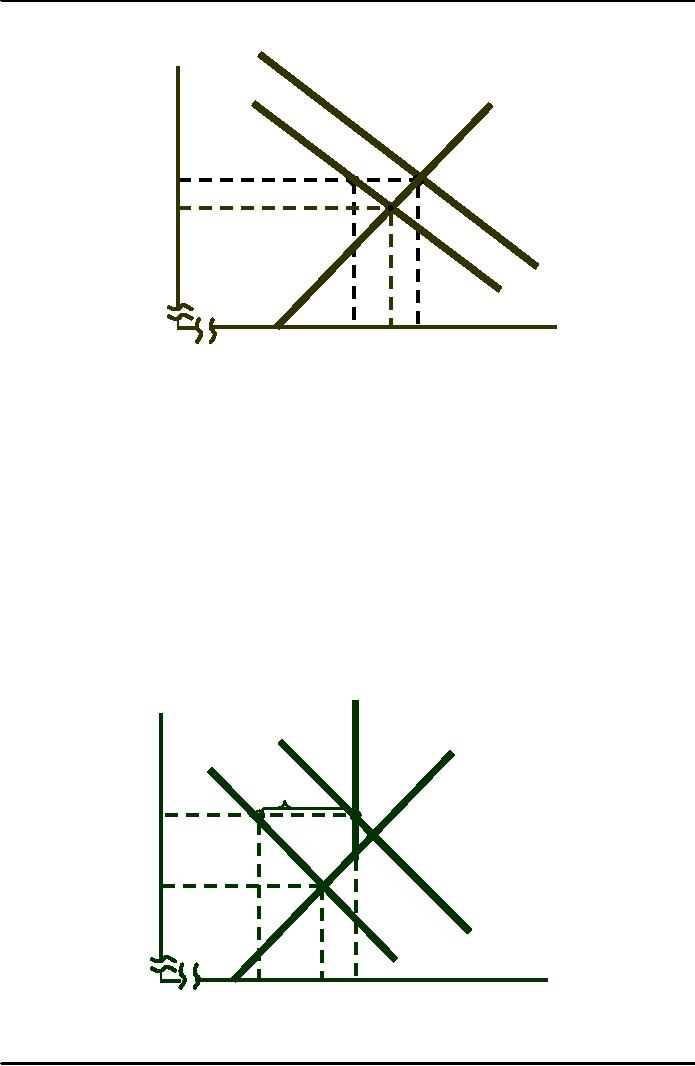

The

Wheat Market in

1981

·AB consumer loss

Pric

e

S

·ABC producer

gain

By

buying 122

million

bushels

Q

the

government

P0 =

$3.70

increased

the

C

A

market-clearing

B

P0 =

$3.46

price.

D

+ Qg

D

1,800

2,56

2,6302,68

Quantity

Supporting

the Price of

Wheat

1981

Change in

consumer surplus=(-A

-B)

A

= (3.70 - 3.46)(2,566) = $616

million

B

= (1/2)(3.70 - 3.46)(2,630 -

2,566)

=

$8 million

·

Change in

consumer surplus: -$624

million.

Cost to the

government:

$3.70

x 122 million bushels = $452

million

Total

cost = $624 + 452 = $1,076

million

Total

gain = A

+ B + C = $638

million

Government

also paid 30 cents/bushel =

$806 million

The

Wheat Market in

1985

S

Price

S

Q

To

increase the

price

to $3.20, the

government

bought

P0 =

466

million bushels

$3.20

and

imposed

a

production quota

of

2,425 bushels.

P0 =

$1.80

D+

D

1,80

1,95

2,23

2,42

Quantity

136

Microeconomics

ECO402

VU

1985

Government

Purchase:

·

Government cost

= $3.20 x 466 =

$1,491million

·

80 cent

subsidy = .80 x 2,425 =

$1,940 million

·

Total

cost = $3.5 billion

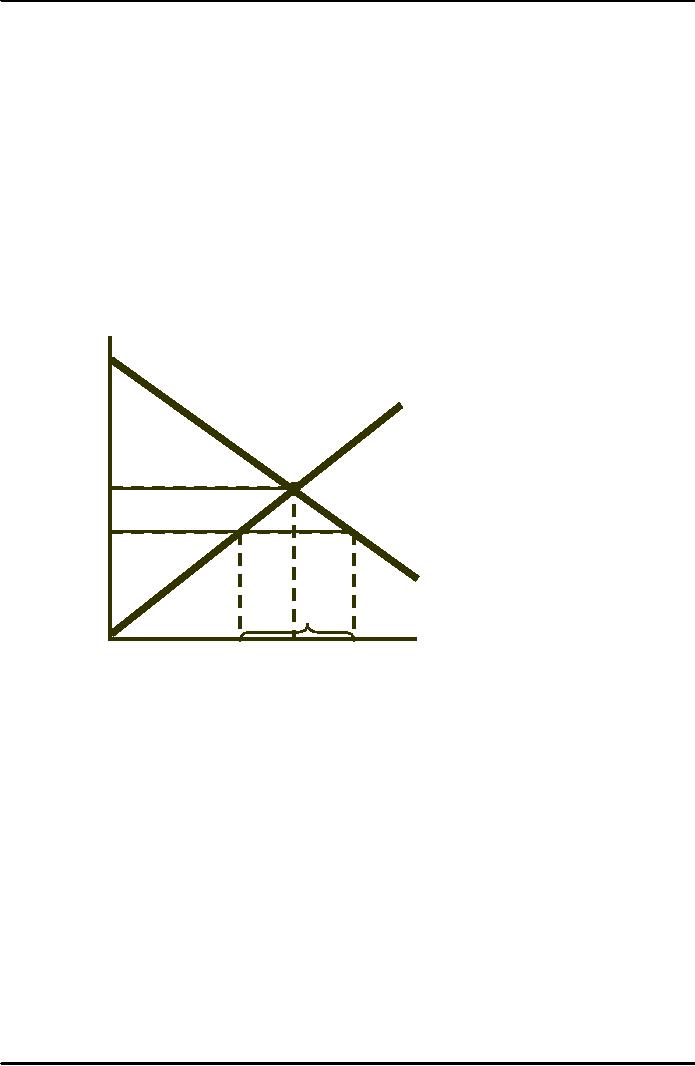

Import

Quotas and

Tariffs

Many

countries use import quotas

and tariffs to keep the

domestic price of a product

above

world

levels

Import

Tariff or Quota That

Eliminates Imports

In

a free market, the

Price

domestic

price equals the

world

price PW.

S

By

eliminating imports,

the

price is increased to

PO. The

gain is area A.

The

loss

to consumers A

+ B + C,

P0

so

the deadweight loss

is

B +

C.

A

B

C

PW

How

high would

D

a

tariff have

to

be to get the

Import

same

result?

QD

QS

Q0

Quantity

The

increase in price can be

achieved by a quota or a

tariff.

Area

A is again the gain to

domestic producers.

The

loss to consumers is A + B + C +

D.

If

a tariff is used the

government gains D, so the

net domestic product loss is

B + C.

If

a quota is used instead,

rectangle D becomes part of

the profits of foreign

producers, and

the

net domestic loss is B + C +

D.

Question:

Would a

country be better off or

worse off with a quota

instead of a tariff?

137

Table of Contents:

- ECONOMICS:Themes of Microeconomics, Theories and Models

- Economics: Another Perspective, Factors of Production

- REAL VERSUS NOMINAL PRICES:SUPPLY AND DEMAND, The Demand Curve

- Changes in Market Equilibrium:Market for College Education

- Elasticities of supply and demand:The Demand for Gasoline

- Consumer Behavior:Consumer Preferences, Indifference curves

- CONSUMER PREFERENCES:Budget Constraints, Consumer Choice

- Note it is repeated:Consumer Preferences, Revealed Preferences

- MARGINAL UTILITY AND CONSUMER CHOICE:COST-OF-LIVING INDEXES

- Review of Consumer Equilibrium:INDIVIDUAL DEMAND, An Inferior Good

- Income & Substitution Effects:Determining the Market Demand Curve

- The Aggregate Demand For Wheat:NETWORK EXTERNALITIES

- Describing Risk:Unequal Probability Outcomes

- PREFERENCES TOWARD RISK:Risk Premium, Indifference Curve

- PREFERENCES TOWARD RISK:Reducing Risk, The Demand for Risky Assets

- The Technology of Production:Production Function for Food

- Production with Two Variable Inputs:Returns to Scale

- Measuring Cost: Which Costs Matter?:Cost in the Short Run

- A Firm’s Short-Run Costs ($):The Effect of Effluent Fees on Firms’ Input Choices

- Cost in the Long Run:Long-Run Cost with Economies & Diseconomies of Scale

- Production with Two Outputs--Economies of Scope:Cubic Cost Function

- Perfectly Competitive Markets:Choosing Output in Short Run

- A Competitive Firm Incurring Losses:Industry Supply in Short Run

- Elasticity of Market Supply:Producer Surplus for a Market

- Elasticity of Market Supply:Long-Run Competitive Equilibrium

- Elasticity of Market Supply:The Industry’s Long-Run Supply Curve

- Elasticity of Market Supply:Welfare loss if price is held below market-clearing level

- Price Supports:Supply Restrictions, Import Quotas and Tariffs

- The Sugar Quota:The Impact of a Tax or Subsidy, Subsidy

- Perfect Competition:Total, Marginal, and Average Revenue

- Perfect Competition:Effect of Excise Tax on Monopolist

- Monopoly:Elasticity of Demand and Price Markup, Sources of Monopoly Power

- The Social Costs of Monopoly Power:Price Regulation, Monopsony

- Monopsony Power:Pricing With Market Power, Capturing Consumer Surplus

- Monopsony Power:THE ECONOMICS OF COUPONS AND REBATES

- Airline Fares:Elasticities of Demand for Air Travel, The Two-Part Tariff

- Bundling:Consumption Decisions When Products are Bundled

- Bundling:Mixed Versus Pure Bundling, Effects of Advertising

- MONOPOLISTIC COMPETITION:Monopolistic Competition in the Market for Colas and Coffee

- OLIGOPOLY:Duopoly Example, Price Competition

- Competition Versus Collusion:The Prisoners’ Dilemma, Implications of the Prisoners

- COMPETITIVE FACTOR MARKETS:Marginal Revenue Product

- Competitive Factor Markets:The Demand for Jet Fuel

- Equilibrium in a Competitive Factor Market:Labor Market Equilibrium

- Factor Markets with Monopoly Power:Monopoly Power of Sellers of Labor