|

Microeconomics

ECO402

VU

Lesson

26

The

Industry's Long-Run Supply

Curve

Long-Run

Elasticity of Supply

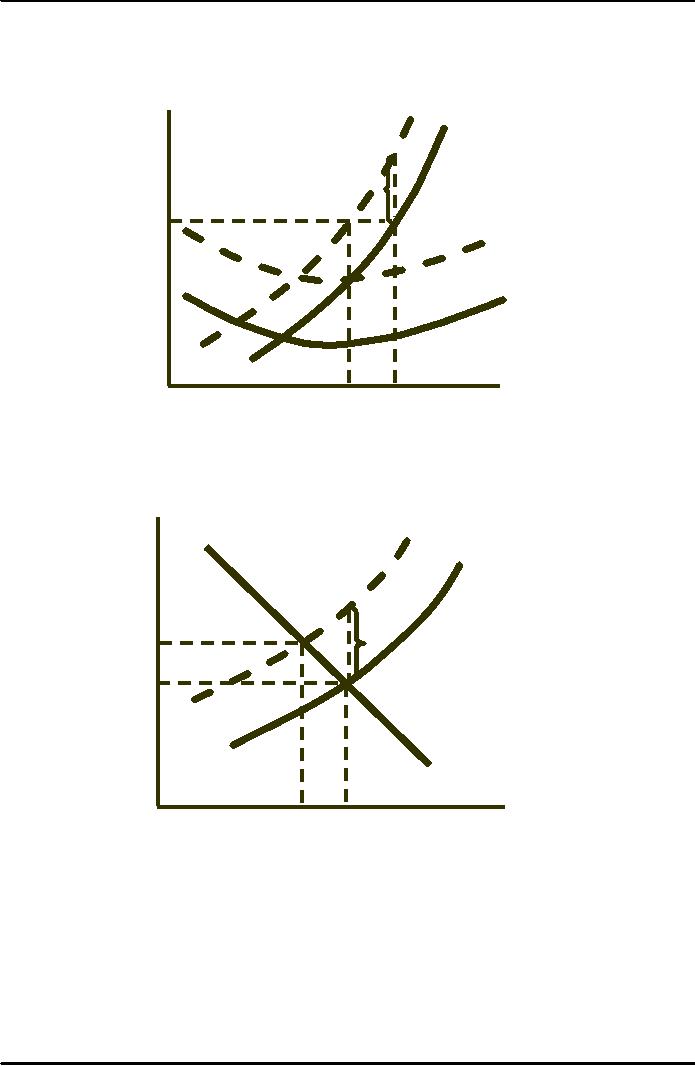

1)

Constant-cost industry

·

Long-run

supply is horizontal

·

Small

increase in price will

induce an extremely large

output increase

·

Long-run

supply elasticity is infinitely

large

·

Inputs

would be readily

available

2)

Increasing-cost industry

·

Long-run

supply is upward-sloping and

elasticity is positive

·

The slope

(elasticity) will depend on

the rate of increase in

input cost

·

Long-run

elasticity will generally be

greater than short-run

elasticity of supply

The

Industry's Long-Run Supply

Curve

Question:

Describe the

long-run elasticity of supply in a

decreasing -cost

industry.

The

Long-Run Supply of

Housing

Scenario

1: Owner-occupied housing

Suburban or

rural areas

National market

for inputs

Questions

Is this an

increasing or a constant-cost

industry?

What would

you predict about the

elasticity of supply?

Scenario

2: Rental property

Urban

location

High-rise

construction cost

Questions

Is this an

increasing or a constant-cost

industry?

What would

you predict about the

elasticity of supply?

The

Industry's Long-Run Supply

Curve

The

Effects of a Tax

In an earlier

chapter we studied how firms

respond to taxes on an

input.

Now, we will

consider how a firm responds

to a tax on its

output.

126

Microeconomics

ECO402

VU

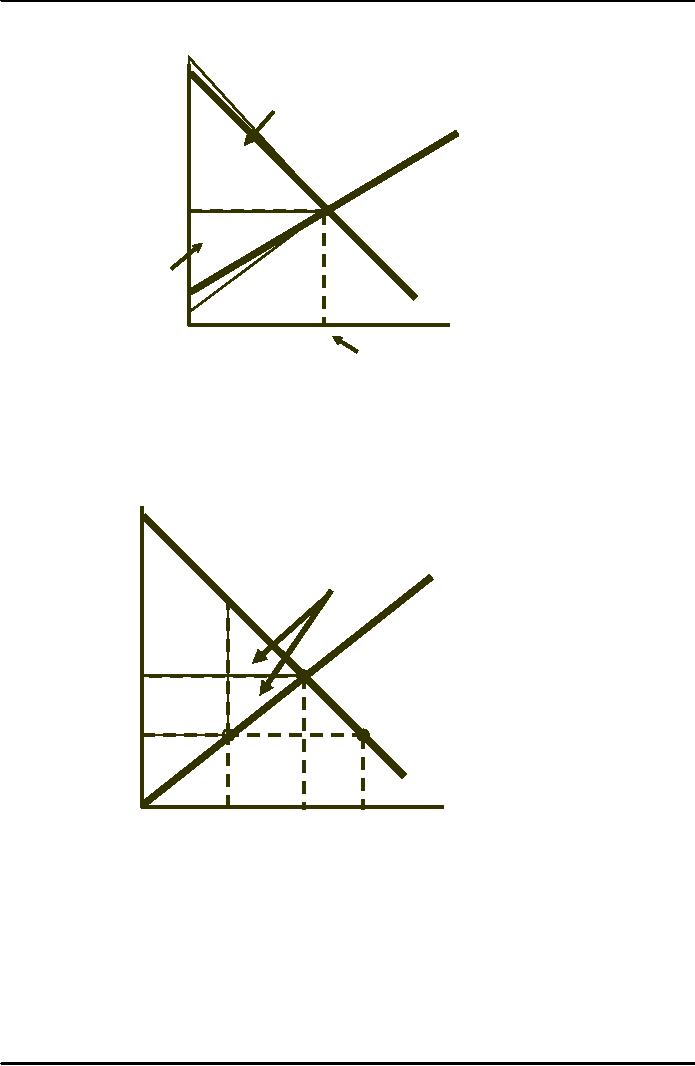

Effect

of an Output Tax on a Competitive

Firm's Output

Price

MC2 =

MC1 + tax

The

firm will

MC

reduce

output to

($

per

An

output tax

the

point at which

unit

of

raises

the firm's

the

marginal cost

output)

marginal

cost by the

plus

the tax equals

amount

of the tax.

the

price.

t

P

AVC

AVC

q

q

Output

Effect

of

an

Output

Tax on Industry

Output

Price

S2 =

S1 + t

($

per

unit

of

S

output)

t

P

Tax

shifts S1 to S2 and

P

output

falls to Q2.

Price

increases

to P2.

D

Q

Q

Output

Evaluating

the

Gains & Losses from

Government Policies:

Consumer

& Producer Surplus

Review

Consumer

surplus is the

total benefit or value that

consumers receive beyond

what

they

pay for the

good.

Producer

surplus is the

total benefit or revenue

that producers receive

beyond what it

cost

to produce a good.

127

Microeconomics

ECO402

VU

Price

Consumer

Surplus

S

5

Between

0 and Q0

producers

receive

Producer

a

net gain from

Surplus

selling

each product--

producer

surplus.

D

0

Q

Quantity

Consumer

To

determine the welfare effect

of a governmental policy we can

measure the gain or loss

in

consumer

and producer surplus.

Welfare

Effects

Gains and

losses caused by government

intervention in the

market.

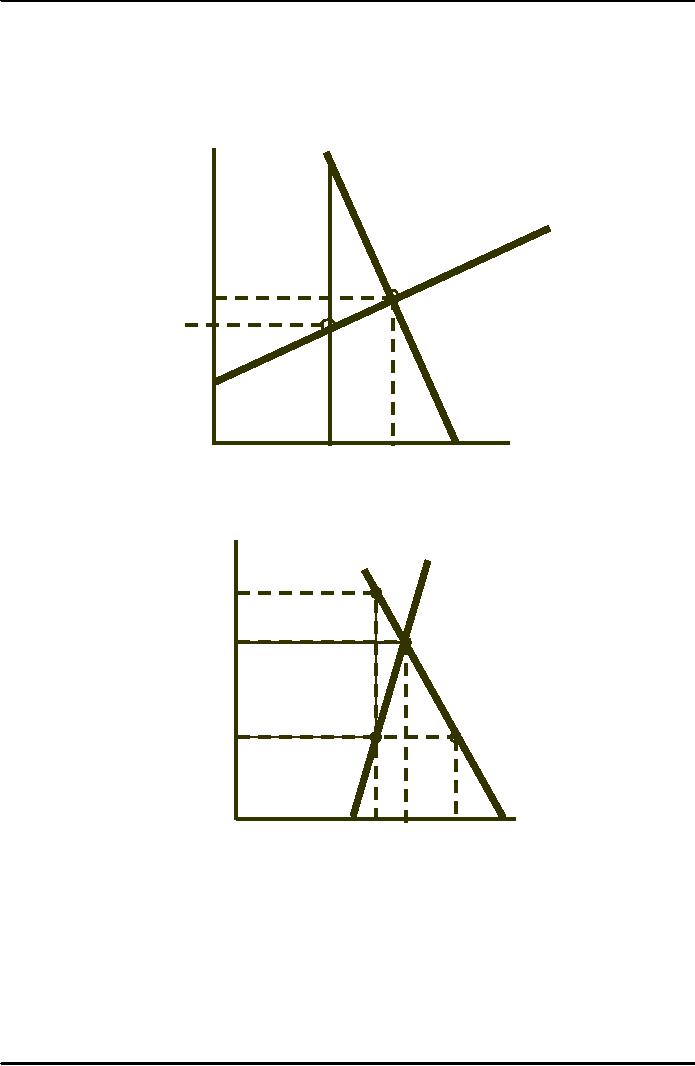

Suppose

the government

imposes

a price ceiling Pmax

Price

which

is below the

Market-clearing

price P0.

S

Deadweight

The

gain to consumers is

the

difference between

the

rectangle A

and

the

triangle

B.

B

P0

C

A

The

loss to producers is

the

sum of rectangle A

and

Pmax

triangle

C. Triangle

B

and

C togethermeasure

the

deadweight loss.

D

Q1

Q0

Q2

Quantity

Change

in

consumer

& producer surplus from

price controls

Observations:

The total

loss is equal to area B +

C.

The total

change in surplus = (A - B) + (-A - C) =

-B - C

The

deadweight

loss is the

inefficiency of the price

controls or the loss of the

producer

surplus

exceeds the gain from

consumer surplus.

128

Microeconomics

ECO402

VU

Observation

Consumers can

experience a net loss in

consumer surplus when the

demand is

sufficiently

inelastic

Effect

of Price Controls When

Demand Is Inelastic

If

demand is sufficiently

inelastic,

triangle B

can

D

Price

be

larger than rectangle

A

and

the consumer

suffers

a net loss from

S

price

controls.

P0

C

Example

A

Pmax

Oil

price controls

and

gasoline shortages

Quantity

Q2

Q1

Price

($/mcf)

D

S

The

gain to consumers

is

2.4

rectangle

A minus

triangle

B,

and the loss

B

to

2.0

producers

is rectangle

A

A

plus

triangle C.

C

(Pmax)1.0

30

Quantity

(Tcf)

0

5

15

1

10

20

25

Price

Controls and Natural Gas

Shortages

129

Microeconomics

ECO402

VU

The

Efficiency of a Competitive

Market

When

do competitive markets generate an

inefficient allocation of resources or

market

failure?

1)

Externalities

·

Costs or

benefits that do not show up

as part of the market price

(e.g. pollution)

2)

Lack of Information

·

Imperfect

information prevents consumers

from making utility-maximizing

decisions.

Government

intervention in these markets

can increase

efficiency.

Government

intervention without a market

failure creates inefficiency or

deadweight loss.

130

Table of Contents:

- ECONOMICS:Themes of Microeconomics, Theories and Models

- Economics: Another Perspective, Factors of Production

- REAL VERSUS NOMINAL PRICES:SUPPLY AND DEMAND, The Demand Curve

- Changes in Market Equilibrium:Market for College Education

- Elasticities of supply and demand:The Demand for Gasoline

- Consumer Behavior:Consumer Preferences, Indifference curves

- CONSUMER PREFERENCES:Budget Constraints, Consumer Choice

- Note it is repeated:Consumer Preferences, Revealed Preferences

- MARGINAL UTILITY AND CONSUMER CHOICE:COST-OF-LIVING INDEXES

- Review of Consumer Equilibrium:INDIVIDUAL DEMAND, An Inferior Good

- Income & Substitution Effects:Determining the Market Demand Curve

- The Aggregate Demand For Wheat:NETWORK EXTERNALITIES

- Describing Risk:Unequal Probability Outcomes

- PREFERENCES TOWARD RISK:Risk Premium, Indifference Curve

- PREFERENCES TOWARD RISK:Reducing Risk, The Demand for Risky Assets

- The Technology of Production:Production Function for Food

- Production with Two Variable Inputs:Returns to Scale

- Measuring Cost: Which Costs Matter?:Cost in the Short Run

- A Firmâs Short-Run Costs ($):The Effect of Effluent Fees on Firmsâ Input Choices

- Cost in the Long Run:Long-Run Cost with Economies & Diseconomies of Scale

- Production with Two Outputs--Economies of Scope:Cubic Cost Function

- Perfectly Competitive Markets:Choosing Output in Short Run

- A Competitive Firm Incurring Losses:Industry Supply in Short Run

- Elasticity of Market Supply:Producer Surplus for a Market

- Elasticity of Market Supply:Long-Run Competitive Equilibrium

- Elasticity of Market Supply:The Industryâs Long-Run Supply Curve

- Elasticity of Market Supply:Welfare loss if price is held below market-clearing level

- Price Supports:Supply Restrictions, Import Quotas and Tariffs

- The Sugar Quota:The Impact of a Tax or Subsidy, Subsidy

- Perfect Competition:Total, Marginal, and Average Revenue

- Perfect Competition:Effect of Excise Tax on Monopolist

- Monopoly:Elasticity of Demand and Price Markup, Sources of Monopoly Power

- The Social Costs of Monopoly Power:Price Regulation, Monopsony

- Monopsony Power:Pricing With Market Power, Capturing Consumer Surplus

- Monopsony Power:THE ECONOMICS OF COUPONS AND REBATES

- Airline Fares:Elasticities of Demand for Air Travel, The Two-Part Tariff

- Bundling:Consumption Decisions When Products are Bundled

- Bundling:Mixed Versus Pure Bundling, Effects of Advertising

- MONOPOLISTIC COMPETITION:Monopolistic Competition in the Market for Colas and Coffee

- OLIGOPOLY:Duopoly Example, Price Competition

- Competition Versus Collusion:The Prisonersâ Dilemma, Implications of the Prisoners

- COMPETITIVE FACTOR MARKETS:Marginal Revenue Product

- Competitive Factor Markets:The Demand for Jet Fuel

- Equilibrium in a Competitive Factor Market:Labor Market Equilibrium

- Factor Markets with Monopoly Power:Monopoly Power of Sellers of Labor