|

Microeconomics

ECO402

VU

Lesson

21

Production

with Two Outputs--Economies of

Scope

Economies of

scope exist when the

joint output of a single

firm is greater than the

output

that

could be achieved by two

different firms each

producing a single

output.

Examples:

Chicken

farm--poultry and

eggs

Automobile

company--cars and

trucks

University--Teaching

and research

What

are the advantages of joint

production?

Consider an

automobile company producing

cars and tractors

Advantages

1)

Both use capital and

labor.

2)

The firms share management

resources.

3)

Both use the same

labor skills and type of

machinery.

Production:

Firms must

choose how much of each to

produce.

The alternative

quantities can be illustrated

using product transformation

curves.

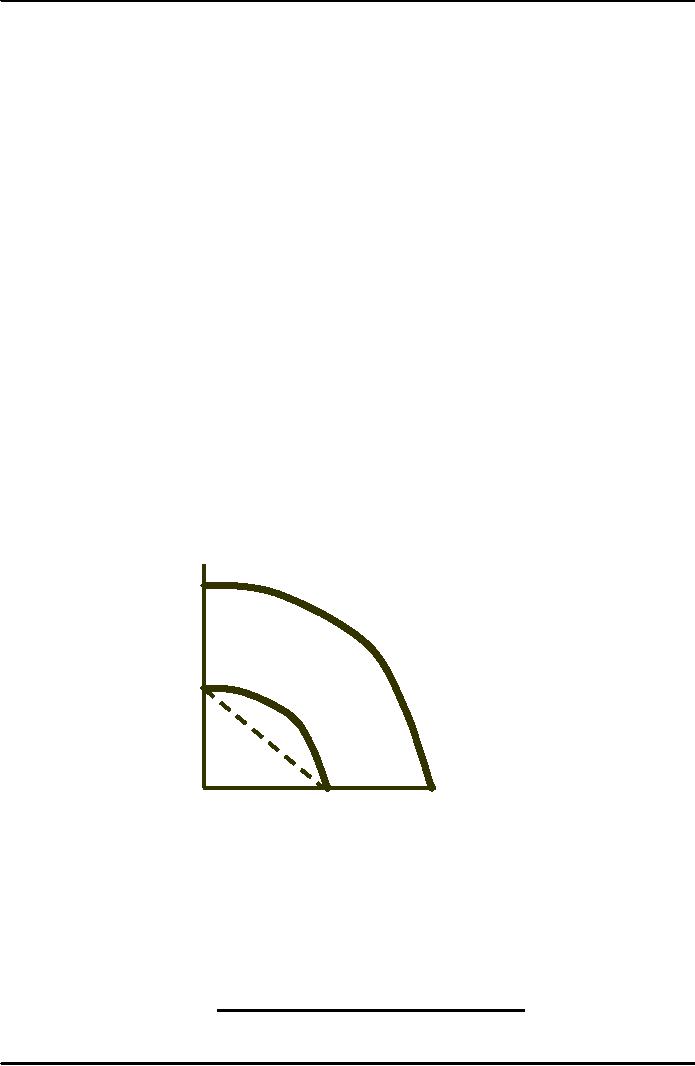

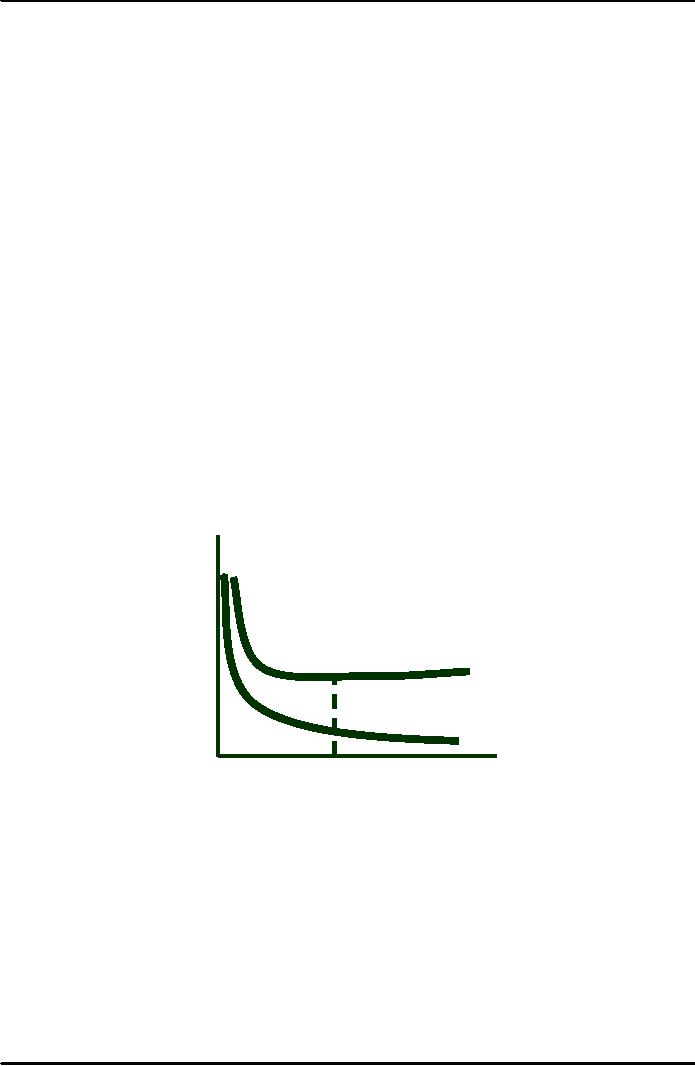

Product

Transformation Curve

Each

curve shows

Number

combinations

of output

of

tractors

with

a given

combination

of

L &

K.

O1 illustrates a

low

O2

level

of output. O2

illustrates

a higher level

of

output with two

times

as

much labor and

O1

capital.

Number

of cars

Observations

Product

transformation curves are

negatively sloped

Constant

returns exist in this

example

Since the

production transformation curve is

concave is joint production

desirable?

There is no

direct relationship between

economies of scope and

economies of scale.

May experience

economies of scope and

diseconomies of scale

May have

economies of scale and not

have economies of

scope

The

degree

of economies of scope measures

the savings in cost and

can be written:

C(

Q

1 ) +

C

(

Q

2 ) -

C

(

Q

1 , Q

2 )

SC

=

C

(

Q

1, Q

2 )

106

Microeconomics

ECO402

VU

C(Q1) is

the cost of producing Q1

C(Q2) is

the cost of producing Q2

C(Q1Q2)

is the joint cost of

producing both

products

Interpretation:

If SC > 0 -- Economies of

scope

If SC < 0 -- Diseconomies

of scope

Issues

Truckload

versus less than truck

load

Direct versus

indirect routing

Length of

haul

Economies

of Scope in the Trucking

Industry

Questions:

Economies of

Scope

Are

large-scale, direct hauls

cheaper and more profitable

than individual hauls

by

small

trucks?

Are there

cost advantages from

operating both direct and

indirect hauls?

Empirical

Findings

An analysis of

105 trucking firms examined

four distinct

outputs.

Short

hauls with partial

loads

Intermediate

hauls with partial

loads

Long

hauls with partial

loads

Hauls

with total loads

Results

SC = 1.576

for reasonably large

firm

SC = 0.104

for very large

firms

Interpretation

Combining

partial loads at an intermediate

location lowers cost

management

difficulties

with very large

firms.

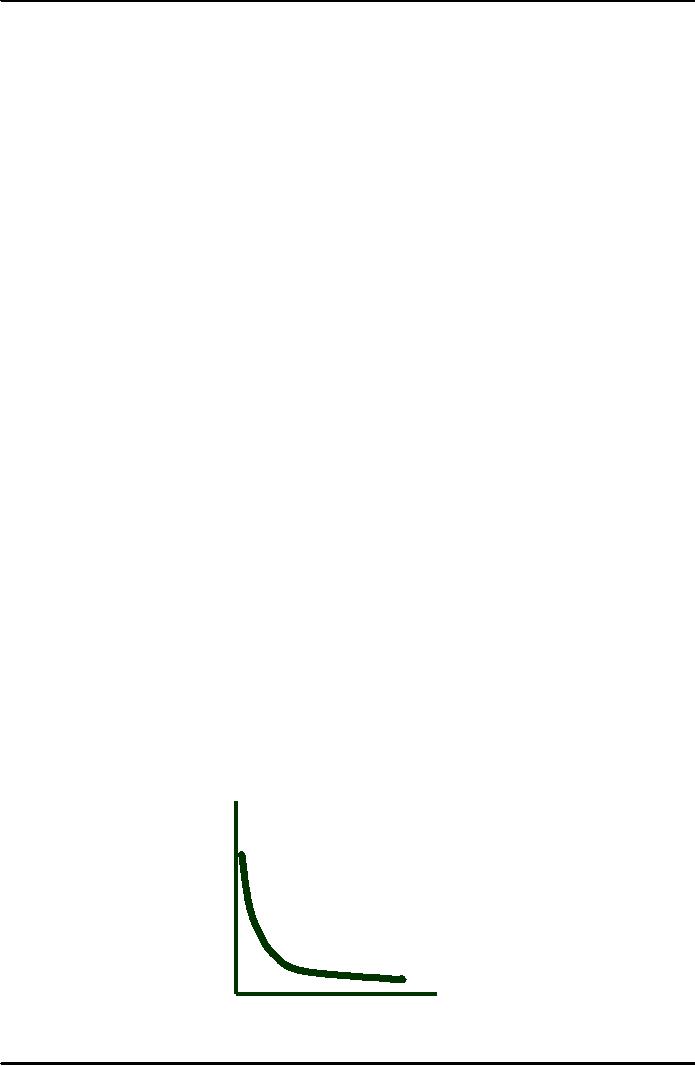

Dynamic

Changes in Costs--The Learning

Curve

The

learning

curve measures

the impact of worker's

experience on the costs

of

production.

It

describes the relationship

between a firm's cumulative

output and amount of

inputs

needed

to produce a unit of

output.

Hours

of labor

per

machine lot

10

8

6

4

2

Cumulative

number of

machine

lots produced

0

20

30

40

50

10

107

Microeconomics

ECO402

VU

The

horizontal axis measures the

cumulative number of hours of

machine tools the firm

has

produced

The

vertical axis measures the

number of hours of labor

needed to produce each

lot.

The

learning curve in the figure

is based on the

relationship:

L

= A + BN-β

If

N=1

L equals A + B

and this measures labor

input to produce the first

unit of output

If

β = 0

Labor input

remains constant as the

cumulative level of output

increases, so there is no

learning

If

β > 0 and N

increases

L approaches A,

and A represent minimum

labor input/unit of output

after all learning

has

taken place.

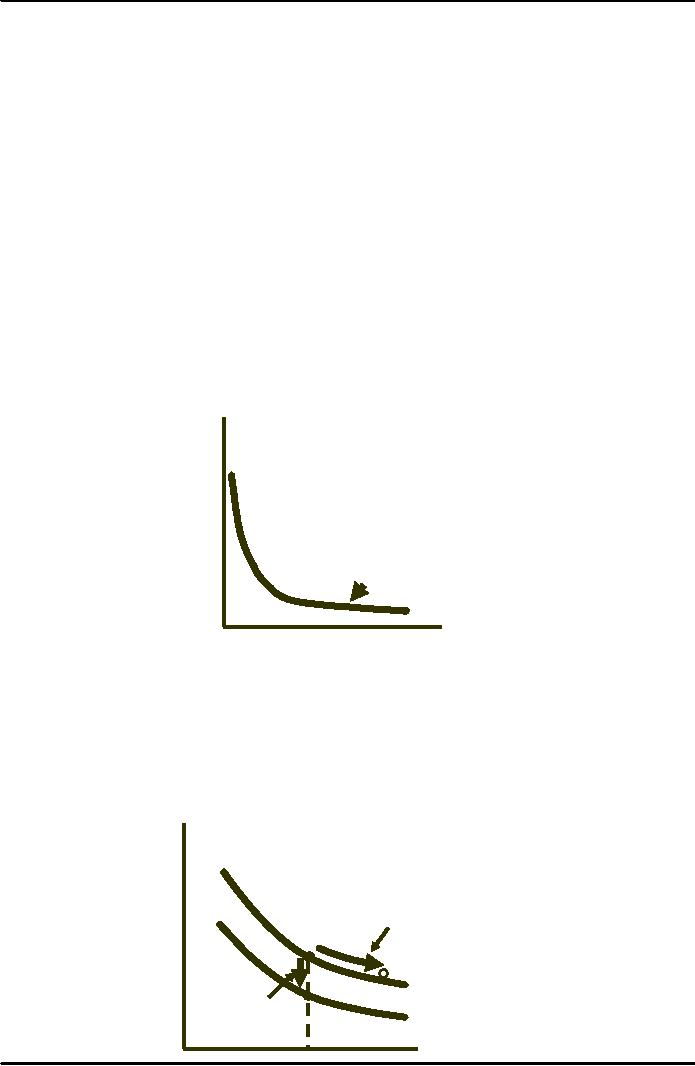

The

larger β:

The more

important the learning

effect.

The

chart shows a sharp

drop

Hours

of labor

in

lots to a cumulative amount

of

per

10

20,

then small savings at

machine

lot

higher

levels.

8

Doubling

cumulative output

causes

a

20% reduction in the

difference

6

between

the input required

and

minimum

attainable input

requirement

4

β

=

0.31

2

Cumulative

number

of

machine lots

0

50

20

30

10

40

produced

Observations

1)

New firms may experience a

learning curve, not

economies of scale.

2)

Older firms have relatively

small gains from

learning.

Economies

of Scale Versus

Learning

Cost

($

per unit

of

output)

Economies

of

Scale

A

B

AC1

Learning

C

AC2

Output

108

Microeconomics

ECO402

VU

Predicting

the Labor Requirements of

Producing a Given

Output

Cumulative

Output

Per-Unit

Labor Requirement

Total

Labor

(N)

for

each 10 units of Output

(L)

Requirement

10

1.00

10.0

20

.80

18.0

(10.0 + 8.0)

30

.70

25.0

(18.0 + 7.0)

40

.64

31.4

(25.0 + 6.4)

50

.60

37.4

(31.4 + 6.0)

60

.56

43.0

(37.4 + 5.6)

70

.53

48.3

(43.0 + 5.3)

80

and over

.51

53.4

(48.3 + 5.1)

The

learning curve

implies:

1)

The labor requirement falls

per unit.

2)

Costs will be high at first

and then will fall

with learning.

3)

After 8 years the labor

requirement will be 0.51 and

per unit cost will be

half

what

it

was in the first year of

production?

Learning

Curve in Practice

Scenario

A new firm

enters the chemical

processing industry.

Do

they:

1)

Produce a low level of

output and sell at a high

price?

2)

Produce

a high level of output and

sell at a low price?

How

would the learning curve

influence your

decision?

The

Empirical Findings

Study of 37

chemical products

Average

cost fell 5.5% per

year

For each

doubling of plant size,

average production costs

fall by 11%

For each

doubling of cumulative output,

the average cost of

production falls by

27%

Which

is more important, the

economies of scale or learning

effects?

Other

Empirical Findings

In the

semi-conductor industry a study of

seven generations of DRAM

semiconductors

from

1974-1992 found learning

rates averaged 20%.

In the

aircraft industry the

learning rates are as high

as 40%.

Applying

Learning Curves

109

Microeconomics

ECO402

VU

1)

To

determine if it is profitable to enter an

industry.

2)

To

determine when profits will

occur based on plant size

and cumulative

output.

Estimating

and Predicting

Cost

Estimates

of future costs can be

obtained from a cost

function, which relates the

cost of

production

to the level of output and

other variables that the

firm can control.

Suppose

we wanted to derive the

total cost curve for

automobile production.

Total

Cost Curve for the

Automobile Industry

Variable

General

Motors

cost

Nissa

Toyot

Hond

Volvo

For

Chrysle

Quantity

of Cars

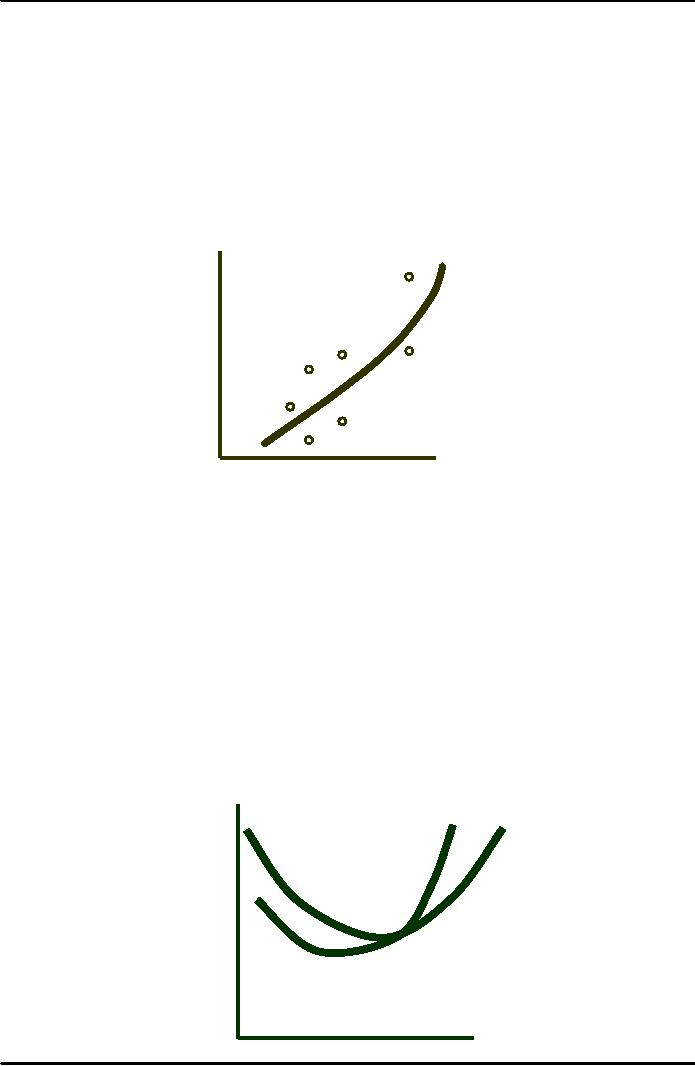

Estimating

and Predicting

Cost

A

linear cost function (does

not show the U-shaped

characteristics) might

be:

β Q

=

VC

The

linear cost function is

applicable only if marginal

cost is constant.

Marginal cost

is represented by β.

If

we wish to allow for a

U-shaped average cost curve

and a marginal cost that is

not

constant,

we might use the quadratic

cost function:

=

β Q

+ γ Q

2

VC

If

the marginal cost curve is

not linear, we might use a

cubic cost function:

VC

=

β Q

+ γ Q

+δQ

2

3

Cost

($

per unit)

MC

= β + 2γ Q + 3δ Q2

=

β + γQ

+

δQ

2

AVC

Output

(per

time period)

110

Microeconomics

ECO402

VU

Cubic

Cost Function

Difficulties

in Measuring Cost

1)

Output data may represent an

aggregate of different type of

products.

2)

Cost data may not

include opportunity

cost.

3)

Allocating cost to a particular

product may be difficult

when there is more than

one

product

line.

Cost

Functions and the

Measurement of Scale

Economies

Scale Economy

Index (SCI)

�

EC

= 1, SCI = 0:

no economies or diseconomies of

scale

�

EC

> 1, SCI is

negative: diseconomies of

scale

�

EC

< 1, SCI is

positive: economies of

scale

Cost

Functions for Electric

Power

Scale

Economies in the Electric

Power Industry

Output

(million kwh)

43

338

1109

2226

5819

Value

of SCI, 1955

.41

.26

.16

.10

.04

Average

Cost of Production in the

Electric Power

Industry

Average

Cost

(dollar/1000

kwh)

6.5

6.0

1955

A

5.5

5.0

1970

6

24

12

18

30

36

Output

(billions of kwh)

Findings

Decline in

cost

�

Not due to

economies of scale

�

Was caused

by:

Lower input

cost (coal & oil)

Improvements in

technology

A

Cost Function for the

Savings and Loan

Industry

The

empirical estimation of a long-run

cost function can be useful

in the restructuring of

the

savings

and loan industry in the

wake of the savings and

loan collapse in the

1980s.

Data

for 86 savings and loans

for 1975 & 1976 in six

western states

111

Microeconomics

ECO402

VU

Q = total assets

of each S&L

LAC = average

operating expense

Q & TC are

measured in hundreds of millions of

dollars

Average

operating cost are measured

as a percentage of total

assets.

A

quadratic long-run average

cost function was estimated

for 1975:

LAC

=

2.38

- 0.6153Q +

0.0536Q

2

Minimum

long-run average cost

reaches its point of minimum

average total cost when

total

assets

of the savings and loan

reach $574 million.

Average

operating expenses are 0.61%

of total assets.

Almost

all of the savings and

loans in the region being

studied had substantially

less than

$574

million in assets.

Questions

1)

What are the implications of

the analysis for expansion

and mergers?

2)

What are the limitations of

using these results?

112

Table of Contents:

- ECONOMICS:Themes of Microeconomics, Theories and Models

- Economics: Another Perspective, Factors of Production

- REAL VERSUS NOMINAL PRICES:SUPPLY AND DEMAND, The Demand Curve

- Changes in Market Equilibrium:Market for College Education

- Elasticities of supply and demand:The Demand for Gasoline

- Consumer Behavior:Consumer Preferences, Indifference curves

- CONSUMER PREFERENCES:Budget Constraints, Consumer Choice

- Note it is repeated:Consumer Preferences, Revealed Preferences

- MARGINAL UTILITY AND CONSUMER CHOICE:COST-OF-LIVING INDEXES

- Review of Consumer Equilibrium:INDIVIDUAL DEMAND, An Inferior Good

- Income & Substitution Effects:Determining the Market Demand Curve

- The Aggregate Demand For Wheat:NETWORK EXTERNALITIES

- Describing Risk:Unequal Probability Outcomes

- PREFERENCES TOWARD RISK:Risk Premium, Indifference Curve

- PREFERENCES TOWARD RISK:Reducing Risk, The Demand for Risky Assets

- The Technology of Production:Production Function for Food

- Production with Two Variable Inputs:Returns to Scale

- Measuring Cost: Which Costs Matter?:Cost in the Short Run

- A Firm’s Short-Run Costs ($):The Effect of Effluent Fees on Firms’ Input Choices

- Cost in the Long Run:Long-Run Cost with Economies & Diseconomies of Scale

- Production with Two Outputs--Economies of Scope:Cubic Cost Function

- Perfectly Competitive Markets:Choosing Output in Short Run

- A Competitive Firm Incurring Losses:Industry Supply in Short Run

- Elasticity of Market Supply:Producer Surplus for a Market

- Elasticity of Market Supply:Long-Run Competitive Equilibrium

- Elasticity of Market Supply:The Industry’s Long-Run Supply Curve

- Elasticity of Market Supply:Welfare loss if price is held below market-clearing level

- Price Supports:Supply Restrictions, Import Quotas and Tariffs

- The Sugar Quota:The Impact of a Tax or Subsidy, Subsidy

- Perfect Competition:Total, Marginal, and Average Revenue

- Perfect Competition:Effect of Excise Tax on Monopolist

- Monopoly:Elasticity of Demand and Price Markup, Sources of Monopoly Power

- The Social Costs of Monopoly Power:Price Regulation, Monopsony

- Monopsony Power:Pricing With Market Power, Capturing Consumer Surplus

- Monopsony Power:THE ECONOMICS OF COUPONS AND REBATES

- Airline Fares:Elasticities of Demand for Air Travel, The Two-Part Tariff

- Bundling:Consumption Decisions When Products are Bundled

- Bundling:Mixed Versus Pure Bundling, Effects of Advertising

- MONOPOLISTIC COMPETITION:Monopolistic Competition in the Market for Colas and Coffee

- OLIGOPOLY:Duopoly Example, Price Competition

- Competition Versus Collusion:The Prisoners’ Dilemma, Implications of the Prisoners

- COMPETITIVE FACTOR MARKETS:Marginal Revenue Product

- Competitive Factor Markets:The Demand for Jet Fuel

- Equilibrium in a Competitive Factor Market:Labor Market Equilibrium

- Factor Markets with Monopoly Power:Monopoly Power of Sellers of Labor