|

Macroeconomics

ECO 403

VU

LESSON

09

NATIONAL

INCOME: WHERE IT COMES FROM AND WHERE IT

GOES

(Continued...)

Government

spending, G

�

G

includes government spending on

goods and services.

�

G

excludes transfer

payments

�

Assume

government spending and

total taxes are

exogenous:

The

market for goods &

services

Summarizing

the Discussion so

far:

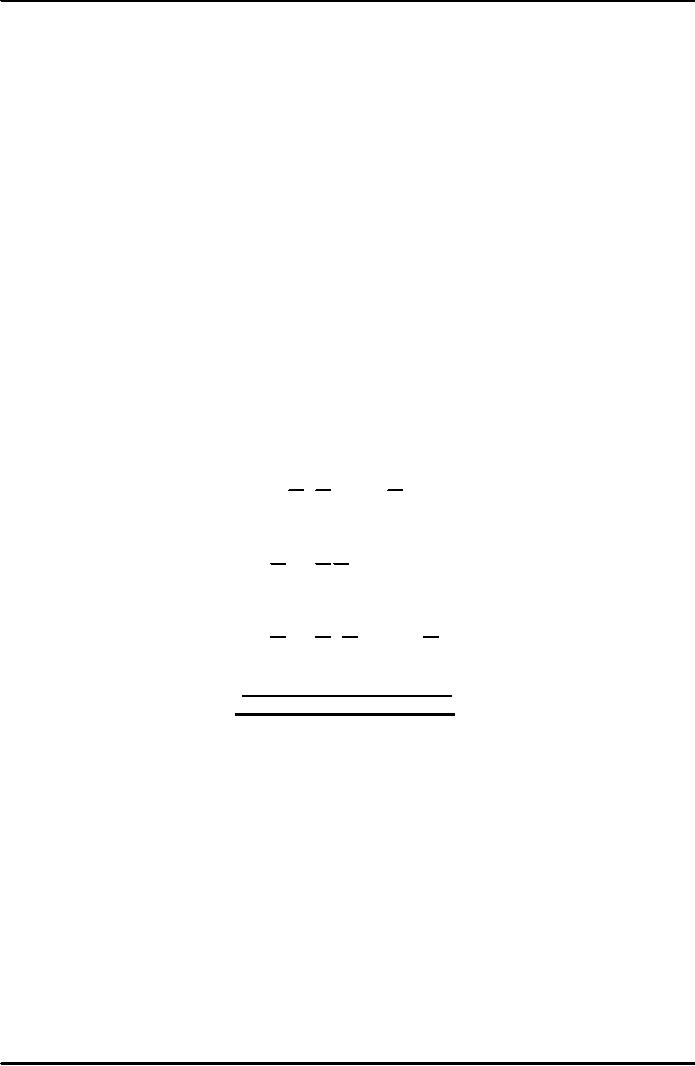

Y=C+I+G

C

= C(Y - T)

I

= I(r)

G=G

T=T

Market

for goods &

services

Agg.

Demand:

C(Y

- T) + I(r) + G

Agg.

Supply:

Y

= F(K, L)

Equilibrium:

Y

= C(Y - T) + I (r) + G

The

real interest rate

adjusts

to

equate demand with

supply.

The

loanable funds

market

A

simple supply-demand model of

the financial system.

One

asset:

"loanable

funds"

demand

for funds:

investment

supply

of funds: saving

"price"

of funds:

real

interest rate

27

Macroeconomics

ECO 403

VU

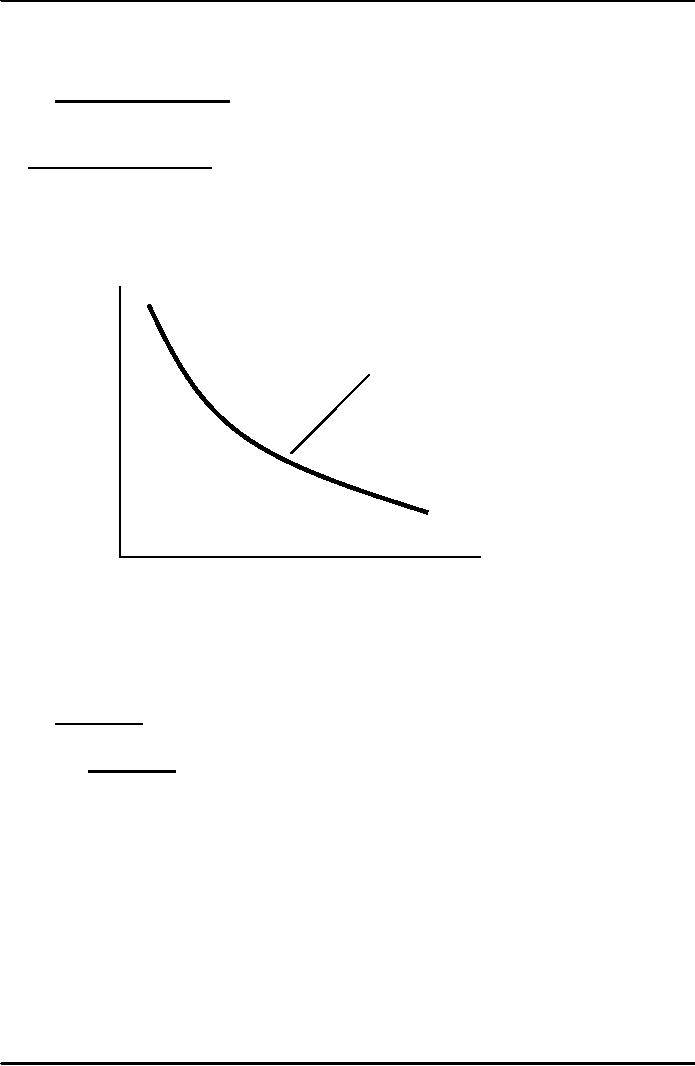

Demand

for funds:

Investment

The

demand for loanable

funds:

�

Comes

from investment:

Firms

borrow to finance spending on

plant & equipment, new

office buildings,

etc.

Consumers

borrow to buy new

houses.

�

Depends

negatively on r , the "price" of

loanable funds (the cost of

borrowing).

Loanable

funds demand

curve

r

The

investment curve is also

the

demand

curve for loanable

funds.

I

(r)

I

Supply

of funds: Saving

The

supply of loanable funds

comes from saving:

�

Households

use their saving to make

bank deposits, purchase

bonds and other

assets.

These

funds become available to

firms to borrow to finance

investment spending.

�

The

government may also

contribute to saving if it does

not spend all of the

tax

revenue

it receives.

Types

of saving

�

Private

saving = (Y T) C

�

Public

saving =

TG

�

National

saving,

S

=

private saving + public

saving

=

(Y T) C + T G

=

Y

C G

28

Macroeconomics

ECO 403

VU

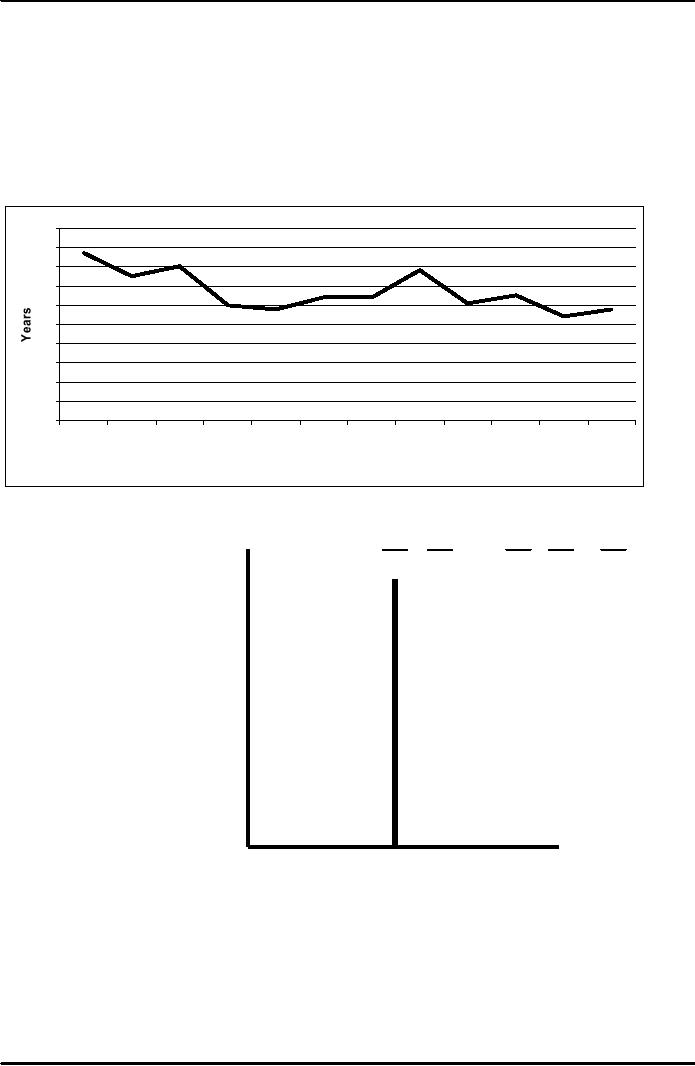

Digression:

Budget

surpluses and

deficits

�

When

T > G,

budget

surplus = (T

G)

= public saving

�

When

T <

G,

budget

deficit = (G

T)

and public saving is

negative.

�

When

T =

G,

budget is balanced and

public saving = 0.

Budget

Deficit of Pakistan

(as

% of GDP)

10

9

8

7

6

5

4

3

2

1

0

1990-91

1991-92 1992-93 1993-94

1994-95 1995-96 1996-97

1997-98 1998-99 1999-00

2000-01 2001-02

%

Loanable

funds supply

curve

r

S

= Y C(Y - T) - G

National

saving does

not

depend on r,

so

the supply curve is

vertical.

S,

I

29

Macroeconomics

ECO 403

VU

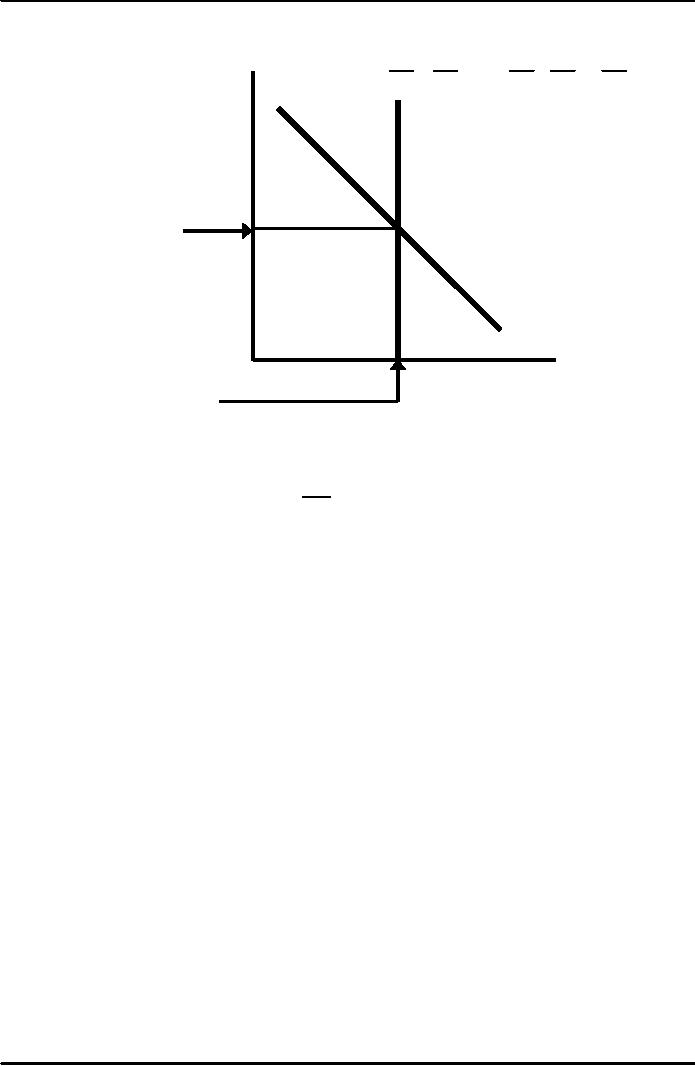

Loanable

funds market

equilibrium

r

S

= Y C(Y - T) - G

Equilibrium

real

interest

rate

I

(r )

S,

I

Equilibrium

level of

investment

The

special role of r

r

adjusts to equilibrate the

goods market and the

loanable funds market

simultaneously:

If

L.F. market in equilibrium,

then

S=I

(Y

C

G) =

I

Rewriting

as:

Y

= C + I + G (goods market

equilibrium)

Thus,

Equilibrium

in Loanable funds

Market

Equilibrium

in goods Market

Digression:

mastering models

To

learn a model well, be sure

to know:

1.

Which of its variables are

endogenous and which are

exogenous.

2.

For each curve in the

diagram, know

definition

intuition

for slope

all

the things that can

shift the curve

3.

Use the model to analyze

the effects of each item in

2c.

30

Macroeconomics

ECO 403

VU

Mastering

the loanable funds

model

1.

Things that shift the

saving curve

�

Public

saving

�

Fiscal

policy: changes in G or T

�

Private

saving

�

Preferences

�

Tax

laws that affect

saving

Now

you try...

�

Draw

the diagram for the

loanable funds model.

�

Suppose

the tax laws are

altered to provide more

incentives for private

saving.

�

What

happens to the interest rate

and investment?

�

(Assume

that T doesn't

change)

31

Table of Contents:

- INTRODUCTION:COURSE DESCRIPTION, TEN PRINCIPLES OF ECONOMICS

- PRINCIPLE OF MACROECONOMICS:People Face Tradeoffs

- IMPORTANCE OF MACROECONOMICS:Interest rates and rental payments

- THE DATA OF MACROECONOMICS:Rules for computing GDP

- THE DATA OF MACROECONOMICS (Continued…):Components of Expenditures

- THE DATA OF MACROECONOMICS (Continued…):How to construct the CPI

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- MONEY AND INFLATION:The Quantity Equation, Inflation and interest rates

- MONEY AND INFLATION (Continued…):Money demand and the nominal interest rate

- MONEY AND INFLATION (Continued…):Costs of expected inflation:

- MONEY AND INFLATION (Continued…):The Classical Dichotomy

- OPEN ECONOMY:Three experiments, The nominal exchange rate

- OPEN ECONOMY (Continued…):The Determinants of the Nominal Exchange Rate

- OPEN ECONOMY (Continued…):A first model of the natural rate

- ISSUES IN UNEMPLOYMENT:Public Policy and Job Search

- ECONOMIC GROWTH:THE SOLOW MODEL, Saving and investment

- ECONOMIC GROWTH (Continued…):The Steady State

- ECONOMIC GROWTH (Continued…):The Golden Rule Capital Stock

- ECONOMIC GROWTH (Continued…):The Golden Rule, Policies to promote growth

- ECONOMIC GROWTH (Continued…):Possible problems with industrial policy

- AGGREGATE DEMAND AND AGGREGATE SUPPLY:When prices are sticky

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND IN THE OPEN ECONOMY:Lessons about fiscal policy

- AGGREGATE DEMAND IN THE OPEN ECONOMY(Continued…):Fixed exchange rates

- AGGREGATE DEMAND IN THE OPEN ECONOMY (Continued…):Why income might not rise

- AGGREGATE SUPPLY:The sticky-price model

- AGGREGATE SUPPLY (Continued…):Deriving the Phillips Curve from SRAS

- GOVERNMENT DEBT:Permanent Debt, Floating Debt, Unfunded Debts

- GOVERNMENT DEBT (Continued…):Starting with too little capital,

- CONSUMPTION:Secular Stagnation and Simon Kuznets

- CONSUMPTION (Continued…):Consumer Preferences, Constraints on Borrowings

- CONSUMPTION (Continued…):The Life-cycle Consumption Function

- INVESTMENT:The Rental Price of Capital, The Cost of Capital

- INVESTMENT (Continued…):The Determinants of Investment

- INVESTMENT (Continued…):Financing Constraints, Residential Investment

- INVESTMENT (Continued…):Inventories and the Real Interest Rate

- MONEY:Money Supply, Fractional Reserve Banking,

- MONEY (Continued…):Three Instruments of Money Supply, Money Demand