|

NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…) |

| << NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES |

| NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…) >> |

Macroeconomics

ECO 403

VU

LESSON

08

NATIONAL

INCOME: WHERE IT COMES FROM AND WHERE IT

GOES

(Continued...)

Marginal

product of labor (MPL)

def:

The

extra output the firm

can produce using an

additional unit of labor

(holding other

inputs

fixed):

MPL

= F (K,

L

+1)

F (K,

L)

Diminishing

marginal returns

�

As

a factor input is increased,

its marginal product falls

(other things equal).

�

Intuition:

↑L while

holding K fixed

⇒

fewer

machines per worker

⇒

lower

productivity

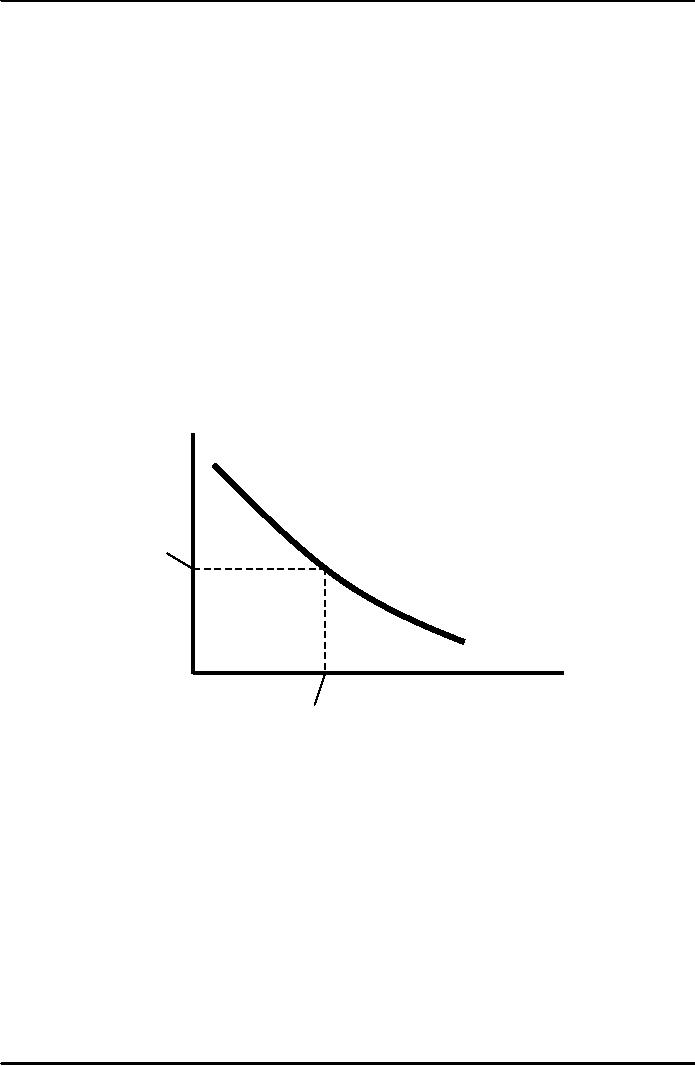

MPL

and

the demand for

labor

Units

of

output

Each

firm hires labor up to

the

point

where MPL = W/P

Real

wage

MPL,

Labor

demand

Units

of labor,

L

Quantity

of labor

demanded

Determining

the rental rate

We

have just seen that MPL =

W/P

The

same logic shows that MPK =

R/P:

�

diminishing

returns to capital: MPK ↓

as K

↑

�

MPK

curve is the firm's demand

curve

for

renting capital.

�

Firms

maximize profits by choosing

K

such

that MPK = R/P.

24

Macroeconomics

ECO 403

VU

The

Neoclassical Theory of

Distribution

�

states

that each factor input is

paid its marginal

product

�

accepted

by most economists

How

income is distributed:

Total

labor income = W/P x L = MPL

x L

Total

capital income = R/P x K = MPK x

K

If

production functions has a

constant return to scale,

then

Y

= MPL x L + MPK x K

Outline

of model

A

closed economy, market-clearing

model

Supply

side

�

Factor

markets (supply, demand,

price)

[Done]

�

Determination

of output/income

[Done]

Demand

side

�

Determinants

of C,

I,

and G

[Next]

Equilibrium

�

Goods

market

�

Loanable

funds market

Demand

for goods &

services

Components

of aggregate demand:

C

= consumer demand for g &

s

I

= demand for investment

goods

G

= government demand for g &

s

(Closed

economy: no NX)

Consumption,

C

�

def:

disposable

income is total income minus

total taxes:

YT

�

Consumption

function: C = C (Y T)

Shows

that ↑(Y

T) ⇒

↑C

Consumption,

C

�

Def:

The marginal

propensity to consume is the

increase in C caused by a

one-unit

increase

in disposable income.

25

Macroeconomics

ECO 403

VU

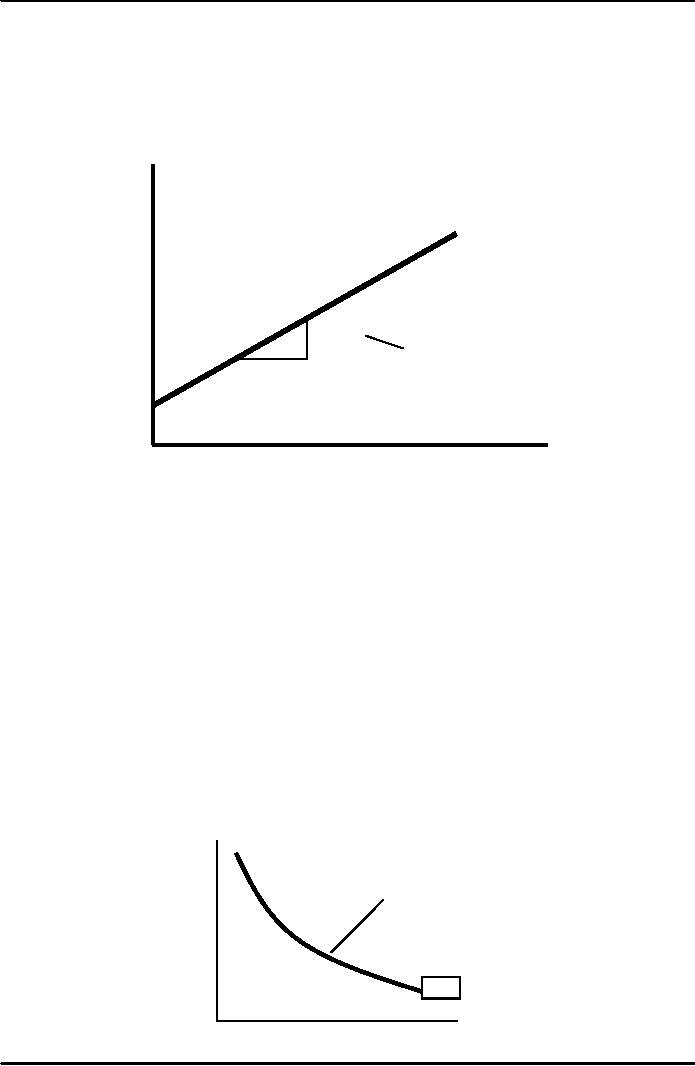

The

consumption function

C

C

(Y T )

The

slope of the

consumption

MPC

function

is the MPC.

1

YT

Investment,

I

�

The

investment function is

I

= I (r )

Where

r denotes the real interest

rate, the nominal interest

rate corrected for

inflation.

Investment,

I

The

real interest rate is

�

-

the cost of borrowing

-

the opportunity cost of

using one's own funds to

finance investment

spending.

So,

↑r

⇒ ↓I

�

The

investment function

r

Spending

on investment

goods

is

a downward-sloping

function

of the real

interest

rate

I

(r

I

26

Table of Contents:

- INTRODUCTION:COURSE DESCRIPTION, TEN PRINCIPLES OF ECONOMICS

- PRINCIPLE OF MACROECONOMICS:People Face Tradeoffs

- IMPORTANCE OF MACROECONOMICS:Interest rates and rental payments

- THE DATA OF MACROECONOMICS:Rules for computing GDP

- THE DATA OF MACROECONOMICS (Continued…):Components of Expenditures

- THE DATA OF MACROECONOMICS (Continued…):How to construct the CPI

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- MONEY AND INFLATION:The Quantity Equation, Inflation and interest rates

- MONEY AND INFLATION (Continued…):Money demand and the nominal interest rate

- MONEY AND INFLATION (Continued…):Costs of expected inflation:

- MONEY AND INFLATION (Continued…):The Classical Dichotomy

- OPEN ECONOMY:Three experiments, The nominal exchange rate

- OPEN ECONOMY (Continued…):The Determinants of the Nominal Exchange Rate

- OPEN ECONOMY (Continued…):A first model of the natural rate

- ISSUES IN UNEMPLOYMENT:Public Policy and Job Search

- ECONOMIC GROWTH:THE SOLOW MODEL, Saving and investment

- ECONOMIC GROWTH (Continued…):The Steady State

- ECONOMIC GROWTH (Continued…):The Golden Rule Capital Stock

- ECONOMIC GROWTH (Continued…):The Golden Rule, Policies to promote growth

- ECONOMIC GROWTH (Continued…):Possible problems with industrial policy

- AGGREGATE DEMAND AND AGGREGATE SUPPLY:When prices are sticky

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND IN THE OPEN ECONOMY:Lessons about fiscal policy

- AGGREGATE DEMAND IN THE OPEN ECONOMY(Continued…):Fixed exchange rates

- AGGREGATE DEMAND IN THE OPEN ECONOMY (Continued…):Why income might not rise

- AGGREGATE SUPPLY:The sticky-price model

- AGGREGATE SUPPLY (Continued…):Deriving the Phillips Curve from SRAS

- GOVERNMENT DEBT:Permanent Debt, Floating Debt, Unfunded Debts

- GOVERNMENT DEBT (Continued…):Starting with too little capital,

- CONSUMPTION:Secular Stagnation and Simon Kuznets

- CONSUMPTION (Continued…):Consumer Preferences, Constraints on Borrowings

- CONSUMPTION (Continued…):The Life-cycle Consumption Function

- INVESTMENT:The Rental Price of Capital, The Cost of Capital

- INVESTMENT (Continued…):The Determinants of Investment

- INVESTMENT (Continued…):Financing Constraints, Residential Investment

- INVESTMENT (Continued…):Inventories and the Real Interest Rate

- MONEY:Money Supply, Fractional Reserve Banking,

- MONEY (Continued…):Three Instruments of Money Supply, Money Demand