|

MONEY (Continued…):Three Instruments of Money Supply, Money Demand |

| << MONEY:Money Supply, Fractional Reserve Banking, |

Macroeconomics

ECO 403

VU

LESSON

45

MONEY

(Continued...)

How

does the Central Bank

control the money

supply?

1)

Open Market

Operations

2)

Changing the Reserve

Requirements

3)

Changing Discount

rate

Three

Instruments of Money

Supply

�

Open

market operations are the

purchase and sale of

government bonds by the

central

bank.

When the

central bank buys bonds

from public, the money it

pays for the

bonds

increases

the monetary base and

thus increase the money

supply

When the

central bank sells the

bonds to the public, the

money it receives

reduces

monetary

base and hence reduce

money supply

�

Reserve

requirements are central

banks regulations that

impose on banks a

minimum

reserve-deposit

ratio.

An increase in

reserve requirements raises

reserve deposit ratio and

thus lowers the

money

multiplier and the money

supply

�

The

Discount rate is the

interest rates that central

bank charges when it lends

to the banks.

�

Banks

borrow from central bank

when they find themselves

with too few reserves to

meet

reserve

requirements. The lower the

discount rate, the cheaper

are borrowed reserves

and

more

demands for such

loans

�

Hence

a reduction in discount rate

raises the monetary base

and the money

supply.

�

Although

these instrument give

central bank substantial

power to influence the the

money

supply,

yet it can't do it perfectly.

Bank discretion in conditioning

business can cause

the

money

supply to change the way

central bank did not

anticipate.

Excessive

Reserves

No limit on the

amount of bank borrowings

from discount window

Money

Demand

Classical

Theory of Money

Demand

�

The

Quantity Theory of Money

assumes that the demand

for real money balances

is

directly

proportional to income,

(M/P)

d = kY

�

Where

k is a constant measuring how

much people want to hold

for every dollar of

income.

Keynesian

Theory of Money

Demand

�

It

presents a more realistic

money demand function where

the demand for real

money

balances

depends on i and Y:

(M/P)

d = L (i, Y)

�

Recall,

that money serves three

functions

202

Macroeconomics

ECO 403

VU

1.

Unit of Account

2.

A store of value

3.

A medium of Exchange

�

The

first function can not by

itself generate any demand

for money, because we

can

quote

prices in any currency

without holding any amount

of it. So we shall focus on

the

rest

of the two functions as we

look at theories of money

demand

Portfolio

Theories of Money

Demand

�

Theories

of money demand that

emphasize the role of money

as a store of value are

called

portfolio

theories. According to these

theories, people hold money

as part of their

portfolio

of

assets.

�

The

key point is that money

offers a different combination of

risk and return than

other

assets,

particularly a safe return

(nominal). While other

assets may fall in both

real and

nominal

terms.

�

These

theories predict that demand

for money should depend on

the risk and return

offered

by

money and other

assets.

�

Also

money demand should depend

on total wealth, because

wealth measures the size

of

portfolio

to be allocated among money

and other assets.

�

So

we may write the money

demand function as

(M/P)

d = L (rs,

rb, �e, W)

Where

rs =

expected real return on

stock

rb =

expected real return on

bonds

�e

= expected

inflation rate

W = real

wealth

�

If

rs or

rb rises, money demand

reduces, because other

assets become more

attractive

�

A

rise in �e

also

reduces the money demand

because money becomes less

attractive

�

An

increase in W raises money

demand because higher wealth

means higher

portfolio.

�

Money

Demand Function L(i,Y): A

useful simplification:

Uses

real income Y as proxy for

real wealth W

Nominal

interest rate i = rb + �e

�

Are

these theories useful for

studying money

demand?

�

The

answer depends on which

measure of money are we

using.

203

Macroeconomics

ECO 403

VU

Symbol

Assets

included

C

Currency

M1

C

+ demand deposits, travelers'

checks, other checkable

deposits

M2

M1

+ small time deposits,

savings deposits, money

market mutual funds,

money

market

deposit accounts

M3

M2

+ large time deposits,

repurchase agreements, institutional

money market

mutual

fund balances

�

Economists

say that M1 is a dominated

asset: as a store of value, it

exists alongside

other

assets

that are always

better.

�

Thus

it is not optimal for people

to hold money as part of

their portfolio and

portfolio theories

cannot

explain the demand for

these dominated forms of

money

�

But

these theories would be more

plausible if we adopt a broader

measure of money like

M2.

Transactions

Theories of Money

Demand

�

Theories

which emphasize the role

money as a medium of exchange

acknowledge that

money

is a dominated assets and

stress that people hold

money, unlike other assets,

to

make

purchases.

�

These

theories best explain why

people hold narrow measure

of money as opposed to

holding

assets that dominate

them.

�

These

theories take many forms

depending on how one models

the process of

obtaining

money

and making transactions

assuming

Money has

the cost of earning a low

rate of return

Money

makes transactions more

convenient

�

One

prominent model to explain

the money demand function is

Baumol-Tobin Model

developed

in 1950.

Baumol-Tobin

Model of Cash

Management

�

This

model analyzes the cost

and benefits of holding

money.

Benefit:

Convenience (much less trips

to banks)

Costs:

foregone interest on money

had it been deposited in a

savings account

�

Example:

A person

plans to spend Y dollars

over the course of an year

(assuming constant

price

levels

and real spending). What

should be the optimal size

of cash balances for

him?

�

Possibilities

Withdraw Y

dollars at the beginning of

the year and gradually

spend the money

balance

averaging

Y/2 over the

year

Draw Y/2 at the

beginning of year, spend it in

six months then draw

the rest Y/2 to be

spent

in next � year. Average

balance = Y/4

Generalizing: money

holding vary between Y/N and

zero, averaging Y/(2N),

where N is

the

number of trips to

bank

204

Macroeconomics

ECO 403

VU

�

One

implication of the Baumol-Tobin

model is that any change in

the fixed cost of going

to

the

bank F alters the money

demand function-- that is,

it changes the quantity of

money

demanded

for a given interest rate

and income.

A

Closer Look at Money

Creation

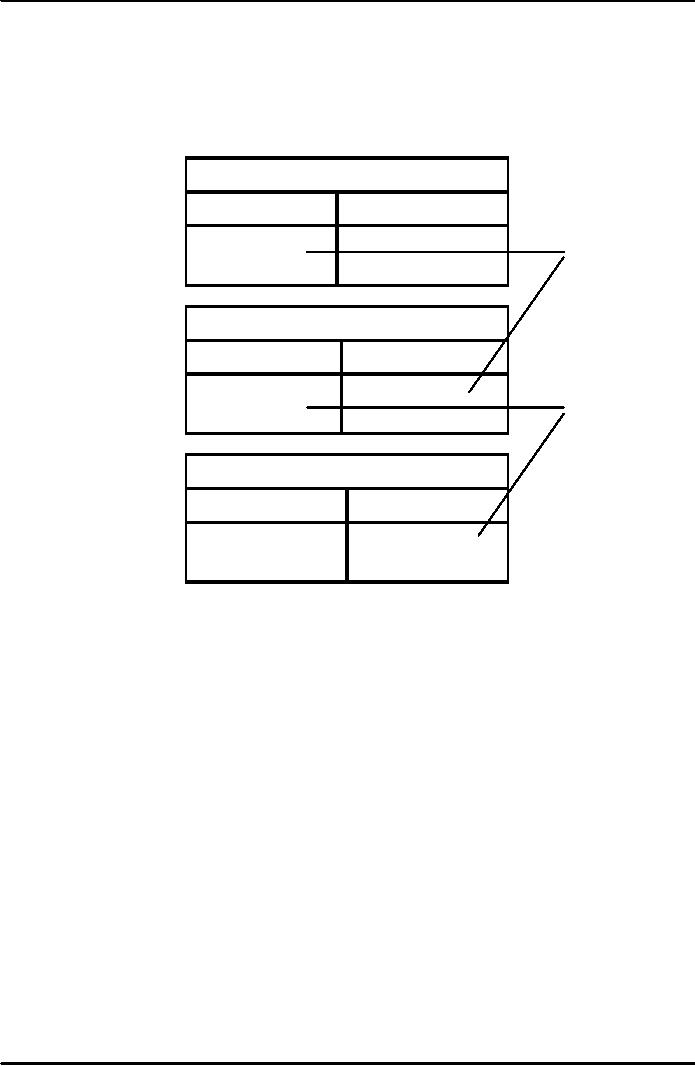

Assume

each bank maintains a

reserve-deposit

ratio (rr) of 20%

and that the initial

deposit is

$1000.

First

bank Balance Sheet

Assets

Liabilities

Reserve

$200

Deposits

$1,000

Loans

$800

Second

bank Balance Sheet

Assets

Liabilities

Reserve

$160

Deposits

$800

Loans

$640

Third

bank Balance Sheet

Assets

Liabilities

Reserve

$128

Deposits

$640

Loans

$512

Mathematically,

the amount of money the

original $1000 deposit

creates is:

Original

Deposit

=

$1000

=

(1-rr) �

$1000

First

bank Lending

=

(1-rr)2 �

$1000

Second

bank Lending

=

(1-rr)3 �

$1000

Third

bank Lending

=

(1-rr)4 �

$1000

Fourth

bank Lending

:

:

-----------------------------------------------------------------

=

[1 + (1-rr) + (1-rr) 2+ (1-rr) 3+...]

�

$1000

Total

Money Supply

=

(1/rr) �

$1000

=

(1/.2) �

$1000

=

$5000

�

The

banking system's ability to

create money is the primary

difference between banks

and

other

financial institutions.

�

Financial

markets have the important

function of transferring the

economy's resources

from

households

(who wish to save some of

their income for the

future) to those households

and

firms

that wish to borrow to buy

investment goods to be used in

future production

�

The

process of transferring funds

from savers to borrowers is

called financial

intermediation.

205

Macroeconomics

ECO 403

VU

A

model of Money

supply

�

Three

exogenous variables:

The

monetary

base B is the

total number of dollars held

by the public as

currency

�

C

and by the banks as reserves

R.

The

reserve-deposit

ratio rr is the

fraction of deposits D

that

banks hold in

�

reserve

R.

The

currency-deposit

ratio cr is the

amount of currency C people

hold as a

�

fraction

of their holdings of demand

deposits D.

Definitions

of money supply and monetary

base:

M

= C+D

B

= C+R

Solving

for M as a function of 3 exogenous

variables:

M/B

= C/D + 1

C/D

+ R/D

Making

substitutions for the

fractions above, we

obtain:

M=

cr + 1

xB

cr

+ rr

Lets

call this money multiplier,

m

So

M=m�B

Because

the monetary base has a

multiplied effect on the

money supply, the monetary

base is

sometimes

called high-powered

money.

�

An

Example

Suppose,

monetary base B is $500

billion, the reserve deposit

ratio rr is 0.1 and

currency

deposit ratio cr is

0.6

The money

multiplier is:

0.6

+ 1 =

2.3

m=

0.6

+ 0.1

And the money

supply is:

M

= 2.3 x $ 500 billion =

$1,150 billion

Let's

go back to our three

exogenous variables to see

how their changes cause

the money

supply

to change:

1.

The money supply M is

proportional to the monetary

base B. So, an increase in

the

monetary

base increases the money

supply by the same

percentage.

2.

The lower the

reserve-deposit ratio rr (R/D),

the more loans banks

make, and the

more

money

banks create from every

dollar of reserves.

3.

The lower the

currency-deposit ratio cr (C/D) ,

the fewer dollars of the

monetary base

the

public holds as currency,

the more base dollars

banks hold in reserves, and

the

more

money banks can create.

Thus a decrease in the

currency-deposit ratio

raises

the

money multiplier and the

money supply.

206

Table of Contents:

- INTRODUCTION:COURSE DESCRIPTION, TEN PRINCIPLES OF ECONOMICS

- PRINCIPLE OF MACROECONOMICS:People Face Tradeoffs

- IMPORTANCE OF MACROECONOMICS:Interest rates and rental payments

- THE DATA OF MACROECONOMICS:Rules for computing GDP

- THE DATA OF MACROECONOMICS (Continued…):Components of Expenditures

- THE DATA OF MACROECONOMICS (Continued…):How to construct the CPI

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- MONEY AND INFLATION:The Quantity Equation, Inflation and interest rates

- MONEY AND INFLATION (Continued…):Money demand and the nominal interest rate

- MONEY AND INFLATION (Continued…):Costs of expected inflation:

- MONEY AND INFLATION (Continued…):The Classical Dichotomy

- OPEN ECONOMY:Three experiments, The nominal exchange rate

- OPEN ECONOMY (Continued…):The Determinants of the Nominal Exchange Rate

- OPEN ECONOMY (Continued…):A first model of the natural rate

- ISSUES IN UNEMPLOYMENT:Public Policy and Job Search

- ECONOMIC GROWTH:THE SOLOW MODEL, Saving and investment

- ECONOMIC GROWTH (Continued…):The Steady State

- ECONOMIC GROWTH (Continued…):The Golden Rule Capital Stock

- ECONOMIC GROWTH (Continued…):The Golden Rule, Policies to promote growth

- ECONOMIC GROWTH (Continued…):Possible problems with industrial policy

- AGGREGATE DEMAND AND AGGREGATE SUPPLY:When prices are sticky

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND IN THE OPEN ECONOMY:Lessons about fiscal policy

- AGGREGATE DEMAND IN THE OPEN ECONOMY(Continued…):Fixed exchange rates

- AGGREGATE DEMAND IN THE OPEN ECONOMY (Continued…):Why income might not rise

- AGGREGATE SUPPLY:The sticky-price model

- AGGREGATE SUPPLY (Continued…):Deriving the Phillips Curve from SRAS

- GOVERNMENT DEBT:Permanent Debt, Floating Debt, Unfunded Debts

- GOVERNMENT DEBT (Continued…):Starting with too little capital,

- CONSUMPTION:Secular Stagnation and Simon Kuznets

- CONSUMPTION (Continued…):Consumer Preferences, Constraints on Borrowings

- CONSUMPTION (Continued…):The Life-cycle Consumption Function

- INVESTMENT:The Rental Price of Capital, The Cost of Capital

- INVESTMENT (Continued…):The Determinants of Investment

- INVESTMENT (Continued…):Financing Constraints, Residential Investment

- INVESTMENT (Continued…):Inventories and the Real Interest Rate

- MONEY:Money Supply, Fractional Reserve Banking,

- MONEY (Continued…):Three Instruments of Money Supply, Money Demand