|

INVESTMENT (Continued…):Financing Constraints, Residential Investment |

| << INVESTMENT (Continued…):The Determinants of Investment |

| INVESTMENT (Continued…):Inventories and the Real Interest Rate >> |

Macroeconomics

ECO 403

VU

LESSON

42

INVESTMENT

(Continued...)

The

Stock Market and Tobin's

q

�

The

term stock refers to the

shares in the ownership of

corporations

�

Stock

market is the market in

which these shares are

traded.

�

The

Nobel-Prize-winning economist James

Tobin proposed that firms

base their

investment

decisions on the following

ratio, which is now called

Tobin's

q:

q=

Market

Value of Installed

Capital

Replacement

Cost of Installed

Capital

The

numerator of Tobin's q is the

value of the economy's

capital as determined by

the

�

stock

market. The denominator is

the price of capital as if it

were purchased today.

Tobin

conveyed that net investment

should depend on whether q is

greater or less than

�

1.

�

If q

>1, then firms can

raise the value of their

stock by increasing

capital,

�

if q <

1, the stock market values

capital at less than its

replacement cost and

thus,

firms will not replace

their capital stock as it

wears out.

Tobin's

q and neo-classical model

are closely related, since

Tobin's q measures

the

�

expected

future profitability as well as

the current

profitability.

If

the MPK exceeds cost of

capital, the firms are

earning profits on their

installed

�

capital,

making rental firms

desirable to own, raising

market value of stocks of

such

firms,

implying a high value of

q

The

Stock market as an Economic

Indicator

�

Although

the volatility of stock

market can give false

signals about the future of

economy,

yet

one should not ignore

the link between the

two.

�

Changes

in stock market often

reflect changes in GDP. whenever

stock market

experiences

a

substantial decline, we should be

ready for an upcoming

recession.

�

Why

do stock prices and economic

activity tend to fluctuate

together?

�

Tobin's

q and AD-AS Model

Suppose there

occurs a fall in stock

prices. Since replacement

cost of capital is

stable,

this

will result in a fall in

Tobin's q, reflecting investors'

pessimism about the current

or

future

profitability of capital.

�

Some

Additional Reasons

A fall in stock

prices makes people poorer,

depressing their spending,

resulting in

reduced

aggregate demand

Fall in stock

prices reflect bad news

about technological progress

and economic growth,

resulting

in slow expansion of natural

rate of output.

Financing

Constraints

�

When

a firm wants to invest in

new capital, e.g. by

building a new factory, it

raises the funds

in

financial markets by

Obtaining

loans from banks

Selling bonds

to public

Selling shares

in future profits on stock

market

�

Neo

classical model assumes that

if a firm is willing to pay

cost of capital, financial

markets

will

make the funds

available.

195

Macroeconomics

ECO 403

VU

�

But

sometimes firms face

Financing constraints, limiting

the amount of funds they

can raise

from

financial market.

�

So

the amount a firm can

spend on new capital goods

is limited to the amount it is

currently

earning.

�

For

example, a recession reduces

employment, rental price of

capital and profits. If the

firm

expects

the recession to be short

lived, it will continue

investing for long term

profitability,

thus

having a small effect on

Tobin's q.

�

So

the firm that can

raise funds in financial

markets will face a small

effect of recession on

the

investment.

�

While

incase of firms facing

constraints, the fall in

current profits restrict the

spending on

new

capital goods and may

prevent such firms from

making profitable

investment.

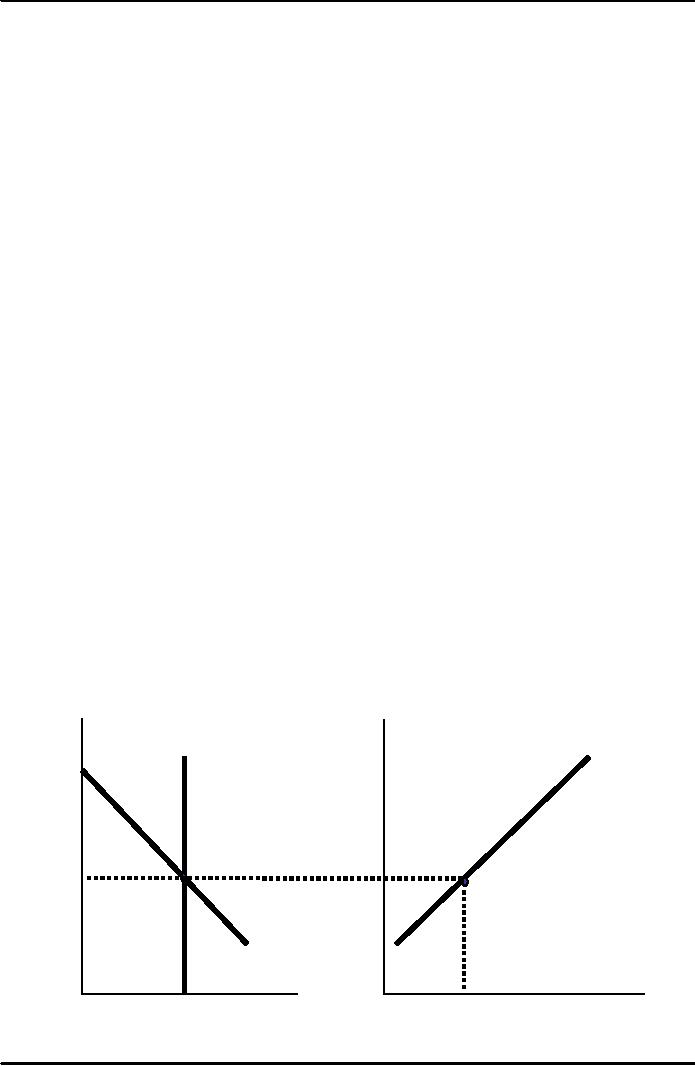

Residential

Investment

We

will now consider the

determinants of residential investment by

looking at a simple

model

of

the housing market.

Residential investment includes

the purchase of new housing

both by

people

who plan to live in it

themselves and by landlords

who plan to rent it to

others.

To

keep things simple, we shall

assume that all housing is

owner-occupied.

There

are two parts to the

model:

1)

The market for the

existing stock of houses

determines the equilibrium

housing price

2)

The housing price determines

the flow of residential

investment.

�

The

relative price of housing

adjusts to equilibrate supply

and demand for the

existing stock

of

housing capital.

�

Construction

firms buy materials and

hire labor to build the

houses and then sell

them at

market

price.

�

Their

costs depend on the overall

price level P while their

revenue depends on the price

of

houses

PH.

�

The

Higher the PH,

the greater incentive to

build house.

Market

for Housing

Supply

of New Housing

PH/P

Relative

S

Price

of

housing

PH/P

D

Stock

of housing capital, KH

Flow

of residential investment, IH

196

Macroeconomics

ECO 403

VU

�

This

model of residential investment is

much similar to q theory of

business fixed

investment,

which states that business

fixed investment depends on

the market price of

installed

capital relative to its

replacement cost, which in

turn depends on expected

profits

from

owning installed

capital

�

The

residential investment depends on

the relative price of

housing, which in turn

depends

on

demand for housing,

depending on the imputed

rent that individuals expect

to receive

from

their housing

197

Table of Contents:

- INTRODUCTION:COURSE DESCRIPTION, TEN PRINCIPLES OF ECONOMICS

- PRINCIPLE OF MACROECONOMICS:People Face Tradeoffs

- IMPORTANCE OF MACROECONOMICS:Interest rates and rental payments

- THE DATA OF MACROECONOMICS:Rules for computing GDP

- THE DATA OF MACROECONOMICS (Continued…):Components of Expenditures

- THE DATA OF MACROECONOMICS (Continued…):How to construct the CPI

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- MONEY AND INFLATION:The Quantity Equation, Inflation and interest rates

- MONEY AND INFLATION (Continued…):Money demand and the nominal interest rate

- MONEY AND INFLATION (Continued…):Costs of expected inflation:

- MONEY AND INFLATION (Continued…):The Classical Dichotomy

- OPEN ECONOMY:Three experiments, The nominal exchange rate

- OPEN ECONOMY (Continued…):The Determinants of the Nominal Exchange Rate

- OPEN ECONOMY (Continued…):A first model of the natural rate

- ISSUES IN UNEMPLOYMENT:Public Policy and Job Search

- ECONOMIC GROWTH:THE SOLOW MODEL, Saving and investment

- ECONOMIC GROWTH (Continued…):The Steady State

- ECONOMIC GROWTH (Continued…):The Golden Rule Capital Stock

- ECONOMIC GROWTH (Continued…):The Golden Rule, Policies to promote growth

- ECONOMIC GROWTH (Continued…):Possible problems with industrial policy

- AGGREGATE DEMAND AND AGGREGATE SUPPLY:When prices are sticky

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND IN THE OPEN ECONOMY:Lessons about fiscal policy

- AGGREGATE DEMAND IN THE OPEN ECONOMY(Continued…):Fixed exchange rates

- AGGREGATE DEMAND IN THE OPEN ECONOMY (Continued…):Why income might not rise

- AGGREGATE SUPPLY:The sticky-price model

- AGGREGATE SUPPLY (Continued…):Deriving the Phillips Curve from SRAS

- GOVERNMENT DEBT:Permanent Debt, Floating Debt, Unfunded Debts

- GOVERNMENT DEBT (Continued…):Starting with too little capital,

- CONSUMPTION:Secular Stagnation and Simon Kuznets

- CONSUMPTION (Continued…):Consumer Preferences, Constraints on Borrowings

- CONSUMPTION (Continued…):The Life-cycle Consumption Function

- INVESTMENT:The Rental Price of Capital, The Cost of Capital

- INVESTMENT (Continued…):The Determinants of Investment

- INVESTMENT (Continued…):Financing Constraints, Residential Investment

- INVESTMENT (Continued…):Inventories and the Real Interest Rate

- MONEY:Money Supply, Fractional Reserve Banking,

- MONEY (Continued…):Three Instruments of Money Supply, Money Demand