|

INVESTMENT (Continued…):The Determinants of Investment |

| << INVESTMENT:The Rental Price of Capital, The Cost of Capital |

| INVESTMENT (Continued…):Financing Constraints, Residential Investment >> |

Macroeconomics

ECO 403

VU

LESSON

41

INVESTMENT

(Continued...)

The

Cost of Capital

Total

cost of capital = iPK -

ΔPK +

δPK

=

PK (i

- ΔPK/PK +δ)

The

cost of capital depends upon

the price of capital, the

interest rate, rate

of

change

of capital prices and the

depreciation rate.

�

Assuming

price of capital goods rises

with the prices of other

goods, so

ΔPk/Pk =

overall inflation rate,

�

Since,

r

= i - �,

Cost

of Capital = Pk(r

+δ)

�

To

express the cost of capital

relative to other goods in

the economy.

�

The

real cost of capital-- the

cost of buying and renting

out a unit of capital

measured in

terms

of the economy's output

is:

Real

Cost of Capital = (PK /

P) (r +δ)

Where

r

⇒

the

real interest rate

PK / P

⇒ the

relative price of capital.

The

Determinants of Investment

�

Now

consider a rental firm's

decision about whether to

increase or decrease its

capital

stock.

For each unit of capital,

the firm earns real

revenue R/P and bears

the real cost

(PK

/P)

(r+δ).

�

The

real profit per unit of

capital is

Profit

rate = Revenue - Cost

=

R/P - (PK /P)

(r+δ).

�

Because

real rental price equals

the marginal product of

capital, we can write the

profit rate

as

Profit

rate = MPK - (PK / P) (r +δ)

�

The

change in the capital stock,

called net investment

depends on the difference

between

the

MPK and the cost of

capital.

If the MPK

exceeds the cost of capital,

firms will add to their

capital stock.

192

Macroeconomics

ECO 403

VU

If the MPK falls

short of the cost of

capital, they let their

capital stock shrink.

Thus:

ΔK = In [MPK - (PK / P )(r +

δ)]

Where

In (

) is the function showing

how much net investment

responds to the

incentive

to

invest.

The

Investment Function

�

We can

now derive the investment

function in the neoclassical

model of investment.

Total

spending

on business fixed investment is

the sum of net investment

and the replacement

of

depreciated

capital.

�

The

investment function

is:

I

= In [MPK

- (PK / P) (r +δ)] +δ

K

�

This

model shows why investment

depends on the real interest

rate.

�

A decrease in

the real interest rate

lowers the cost of capital.

It therefore raises the

amount of

profit

from owning the capital

and increases the incentive

to accumulate more

capital.

�

Similarly an

increase in real interest

rate raises cost of capital

and leads the firms to

reduce

their

investment.

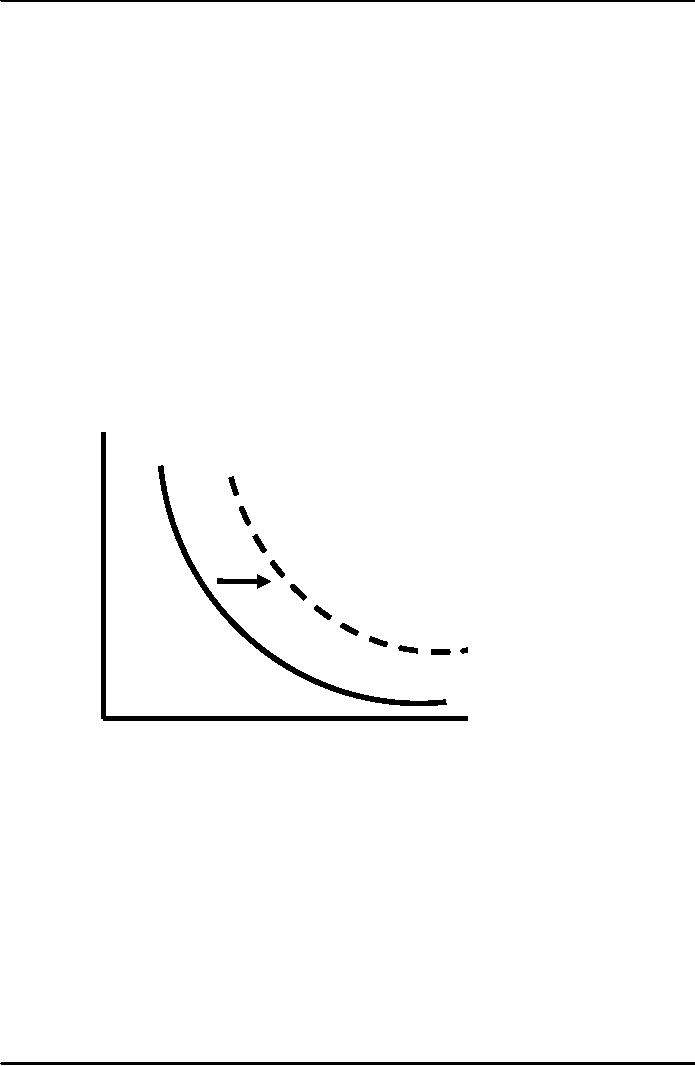

Real

interest

rate,

r

Investment,

I

I

as r ,hence the downward

slope of the investment

function. Also, an outward

shift in the

investment

function may be a result of an

increase in the marginal

product of capital. e.g.

a

technological

Innovation

�

Finally,

we consider what happens as

this adjustment of the

capital stock continues

over

time.

If

the marginal product begins

above the cost of capital,

the capital stock will

rise and

�

the

marginal product will

fall.

If

the marginal product of

capital begins below the

cost of capital, the capital

stock will

�

fall

and the marginal product

will rise.

�

Eventually,

as the capital stock

adjusts, the MPK approaches

the cost of capital.

�

When

the capital stock reaches a

steady state level, we can

write:

193

Macroeconomics

ECO 403

VU

MPK

= (PK / P) (r + δ)

�

Thus,

in the long run, the MPK

equals the real cost of

capital. The speed of

adjustment

toward

the steady state depends on

how quickly firms adjust

their capital stock, which

in

turn

depends on how costly it is to

build, deliver and install

new capital.

Taxes

and Investment

�

Tax

laws influence the firms'

incentives to accumulate the

capital in many ways.

�

Sometimes

policymakers change the tax

laws in order to shift the

investment function

and

influence

aggregate demand.

�

Here

we discuss two of the most

important provisions of corporate

taxes:

Corporate

Income Tax

Investment Tax

Credit

�

Corporate

income tax is a tax on

corporate profits, and its

effect on investment depends

on

how

the law defines profit

for the purpose of

taxation.

�

Suppose,

at first, the law

says:

Profit

rate = R/P - (PK /P)

(r+δ)

�

In

this case, even though

firms would be sharing a

fraction of their income

with the

government,

it would still be rational

for them to invest if

R/P

> (PK /P) (r+δ)

�

But

in reality the definition of

law is quite different than

this.

Treatment of

depreciation

�

Theoretically:

current value of

depreciation

�

Tax laws:

depreciation at historical

cost

�

The

Investment Tax Credit is a tax

provision that encourages

the accumulation of capital.

It

reduces

a firms taxes by a certain

amount for each unit of

money spent on capital

goods.

�

Since the

firm recoups part of its

expenditures on new capital in

lower taxes, the

credit

reduces

the effective purchase price

of a unit of capital Pk. Thus reducing the

cost of capital

and

raising investment.

Swedish

Investment Funds

System

�

Tax

incentives for investment

are one tool policy

makers can use to control

aggregate

demand.

�

For

example, an increase in the

investment tax credit

reduces the cost of capital

, shifts

investment

function upward, and raises

the aggregate demand.

�

From

mid-50s to mid-70s the govt.

of Sweden attempted to control

aggregate demand by

encouraging

or discouraging investment, through a

system called Investment

Fund

subsidized

investment

�

In

case of economic slowdown,

the authorities offered a

temporary investment subsidy,

and

in

case of economic recovery,

revoked it.

�

Eventually

subsidy became a permanent

feature of Swedish tax

policy.

194

Table of Contents:

- INTRODUCTION:COURSE DESCRIPTION, TEN PRINCIPLES OF ECONOMICS

- PRINCIPLE OF MACROECONOMICS:People Face Tradeoffs

- IMPORTANCE OF MACROECONOMICS:Interest rates and rental payments

- THE DATA OF MACROECONOMICS:Rules for computing GDP

- THE DATA OF MACROECONOMICS (Continued…):Components of Expenditures

- THE DATA OF MACROECONOMICS (Continued…):How to construct the CPI

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- MONEY AND INFLATION:The Quantity Equation, Inflation and interest rates

- MONEY AND INFLATION (Continued…):Money demand and the nominal interest rate

- MONEY AND INFLATION (Continued…):Costs of expected inflation:

- MONEY AND INFLATION (Continued…):The Classical Dichotomy

- OPEN ECONOMY:Three experiments, The nominal exchange rate

- OPEN ECONOMY (Continued…):The Determinants of the Nominal Exchange Rate

- OPEN ECONOMY (Continued…):A first model of the natural rate

- ISSUES IN UNEMPLOYMENT:Public Policy and Job Search

- ECONOMIC GROWTH:THE SOLOW MODEL, Saving and investment

- ECONOMIC GROWTH (Continued…):The Steady State

- ECONOMIC GROWTH (Continued…):The Golden Rule Capital Stock

- ECONOMIC GROWTH (Continued…):The Golden Rule, Policies to promote growth

- ECONOMIC GROWTH (Continued…):Possible problems with industrial policy

- AGGREGATE DEMAND AND AGGREGATE SUPPLY:When prices are sticky

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND IN THE OPEN ECONOMY:Lessons about fiscal policy

- AGGREGATE DEMAND IN THE OPEN ECONOMY(Continued…):Fixed exchange rates

- AGGREGATE DEMAND IN THE OPEN ECONOMY (Continued…):Why income might not rise

- AGGREGATE SUPPLY:The sticky-price model

- AGGREGATE SUPPLY (Continued…):Deriving the Phillips Curve from SRAS

- GOVERNMENT DEBT:Permanent Debt, Floating Debt, Unfunded Debts

- GOVERNMENT DEBT (Continued…):Starting with too little capital,

- CONSUMPTION:Secular Stagnation and Simon Kuznets

- CONSUMPTION (Continued…):Consumer Preferences, Constraints on Borrowings

- CONSUMPTION (Continued…):The Life-cycle Consumption Function

- INVESTMENT:The Rental Price of Capital, The Cost of Capital

- INVESTMENT (Continued…):The Determinants of Investment

- INVESTMENT (Continued…):Financing Constraints, Residential Investment

- INVESTMENT (Continued…):Inventories and the Real Interest Rate

- MONEY:Money Supply, Fractional Reserve Banking,

- MONEY (Continued…):Three Instruments of Money Supply, Money Demand