|

INVESTMENT:The Rental Price of Capital, The Cost of Capital |

| << CONSUMPTION (Continued…):The Life-cycle Consumption Function |

| INVESTMENT (Continued…):The Determinants of Investment >> |

Macroeconomics

ECO 403

VU

LESSON

40

INVESTMENT

�

Investment

is the most volatile

component of GDP. When expenditure on

goods and

services

fall during a recession,

much of the decline is

usually due to a drop in

investment

spending.

�

Economists

study investment to better

understand the fluctuations in

the economy's output

of

goods and services.

�

The

models of GDP, such as IS-LM

model, were based on a

simple investment

function

relating

investment to real interest

rate: I = I(r)

�

That

function states that an

increase in the real

interest rate reduces

Investment.

�

Here

we look more closely at the

theory behind this

investment function.

Three

types of Investment

Spending

�

We

shall build models of each

type of investment to explain

the fluctuations in the

economy.

Also

these models will shed

light on the questions such

as:

Why is

investment negatively related to

the interest rate?

What

causes investment function to

shift?

Why does

investment rise during booms

and fall during

recessions?

Business

Fixed Investment

�

The

largest piece of investment

spending (about � of total) is

business fixed

investment

Business:

these investment goods are

bought by firms for use in

future production.

Fixed:

This spending is for capital

that will stay put

for a while (as opposed

for inventory

investment)

�

Business

Fixed investment includes

everything from fax machines

to factories, computers

to

company cars

The

standard model of business

fixed investment is called

the neoclassical

model of

investment.

It

examines the benefits and

costs of owning capital

goods. Here are

three

variables

that shift

investment:

1)

The marginal product of

capital

2)

The interest rate

3)

Tax rules

�

To

develop the model, imagine

that there are two

kinds of firms:

1.

Production firms that

produce goods and services

using the capital that

they

rent

2.

Rental firms that make

all the investments in the

economy.

In

reality, however, most firms

perform both

functions

The

Rental Price of

Capital

�

A

typical production firm

decides how much capital to

rent by comparing the cost

and

benefit

of each unit of

capital.

�

The

firm rents Capital at a

rental rate R and sells

its output at a price

P

�

The

real cost of a unit of

capital to the production

firm is R/P

�

The

real benefit of a unit of

capital is the marginal

product of capital, MPK (the

extra output

produced

with one more unit of

capital)

�

MPK

falls as the amount of

capital rises

189

Macroeconomics

ECO 403

VU

�

So,

to maximize profit, the firm

rents capital until the MPK

falls to:

MPK

= R/P

�

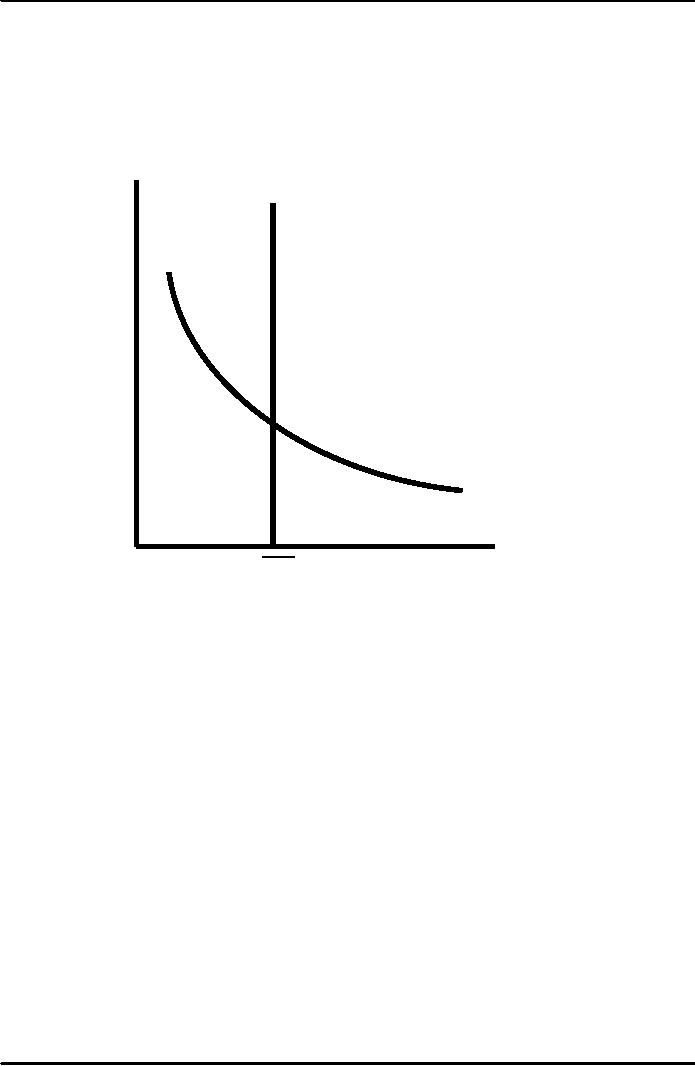

Hence

MPK determines the downward

sloping demand curve for

capital for a firm

�

While

at point in time, the amount

of capital in an economy is fixed, so

supply curve is fixed

�

The

real rental price of capital

adjusts to equilibrate the

demand for capital and

the fixed

supply.

Capital

supply

Real

rental

price,

R/P

Capital

demand (MPK)

K

Capital

stock, K

The

Cobb-Douglas production function

serves as a good approximation of

how the

�

actual

economy turns capital and

labor into goods and

services.

The

Cobb-Douglas production function

is:

�

Y

= AKαL1-α

Where

Y

⇒

is

output

K

⇒

capital

L

⇒

labor

A

⇒

a

parameter measuring the

level of technology

α

⇒

a

parameter between 0 and 1

that measures capital's

share of output.

The

marginal product of capital

(MPK) for the Cobb-Douglas

production function

is:

�

MPK

= αA (L/K)

1-α

Because

the real rental price

(R/P) equals MPK in equilibrium, we

can write:

�

R/P

= αA (L/K)

1-α

This

expression identifies the

variables that determine the

real rental price.

�

It

shows the following:

�

The

lower the stock of capital,

the higher the real

rental price of

capital

�

The

greater the amount of labor

employed, the higher the

real rental price of

capitals

�

The

better the technology, the

higher the real rental

price of capital.

190

Macroeconomics

ECO 403

VU

Events

that reduce the capital

stock, or raise employment, or

improve the technology,

raise

the

equilibrium real rental

price of capital.

The

Cost of Capital

�

The

Rental firms, just like

car rental firms merely

buy capital goods and

rent them out.

�

Let's

consider the benefit and

cost of owning

capital.

The

benefit of owning capital is

the real rental price of

capital R/P for each

unit of capital

it

owns and rents

out.

For

each period of time that a

firm rents out a unit of

capital, the rental firm

bears three costs:

1.

Interest on their loans,

which equals the purchase

price of a unit of capital PK

times the

interest

rate, i, so iPK

2.

The cost of the loss or

gain on the price of capital

denoted as -ΔPK

3.

Depreciation

δ

defined as

the fraction of value lost

per period because of the

wear and

tear,

so δPK

�

Therefore,

Total

cost of capital = iPK -

ΔPK +

δPK

Or

=

PK (i

- ΔPK/PK +δ)

The

cost of capital depends upon

the price of capital, the

interest rate, rate of

change

of

capital prices and the

depreciation rate.

�

Example:

A Car rental company

Buys cars

for Rs.1, 000,000 each

and rents them out to

other businesses

If it faces an

interest rate i of 10% p.a.

so the interest cost,

iPk = Rs.100, 000

p.a.

Car

prices are rising @ 6% per

year, so excluding maintenance

costs the firm gets

a

capital

gain, ΔPk =

Rs.60,000 p.a

Cars

depreciate @ 20% p.a. so

loss due to wear and

tear,

δPk =

Rs.200, 000

�

So,

Total

cost of capital = iPK -

ΔPK +

δPK

=

100,000 60,000

+200,000

=

Rs.240, 000

Summary

�

Investment

Business

Fixed Investment

�

Rental Price

of Capital

�

Cost of

Capital

191

Table of Contents:

- INTRODUCTION:COURSE DESCRIPTION, TEN PRINCIPLES OF ECONOMICS

- PRINCIPLE OF MACROECONOMICS:People Face Tradeoffs

- IMPORTANCE OF MACROECONOMICS:Interest rates and rental payments

- THE DATA OF MACROECONOMICS:Rules for computing GDP

- THE DATA OF MACROECONOMICS (Continued…):Components of Expenditures

- THE DATA OF MACROECONOMICS (Continued…):How to construct the CPI

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- MONEY AND INFLATION:The Quantity Equation, Inflation and interest rates

- MONEY AND INFLATION (Continued…):Money demand and the nominal interest rate

- MONEY AND INFLATION (Continued…):Costs of expected inflation:

- MONEY AND INFLATION (Continued…):The Classical Dichotomy

- OPEN ECONOMY:Three experiments, The nominal exchange rate

- OPEN ECONOMY (Continued…):The Determinants of the Nominal Exchange Rate

- OPEN ECONOMY (Continued…):A first model of the natural rate

- ISSUES IN UNEMPLOYMENT:Public Policy and Job Search

- ECONOMIC GROWTH:THE SOLOW MODEL, Saving and investment

- ECONOMIC GROWTH (Continued…):The Steady State

- ECONOMIC GROWTH (Continued…):The Golden Rule Capital Stock

- ECONOMIC GROWTH (Continued…):The Golden Rule, Policies to promote growth

- ECONOMIC GROWTH (Continued…):Possible problems with industrial policy

- AGGREGATE DEMAND AND AGGREGATE SUPPLY:When prices are sticky

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND IN THE OPEN ECONOMY:Lessons about fiscal policy

- AGGREGATE DEMAND IN THE OPEN ECONOMY(Continued…):Fixed exchange rates

- AGGREGATE DEMAND IN THE OPEN ECONOMY (Continued…):Why income might not rise

- AGGREGATE SUPPLY:The sticky-price model

- AGGREGATE SUPPLY (Continued…):Deriving the Phillips Curve from SRAS

- GOVERNMENT DEBT:Permanent Debt, Floating Debt, Unfunded Debts

- GOVERNMENT DEBT (Continued…):Starting with too little capital,

- CONSUMPTION:Secular Stagnation and Simon Kuznets

- CONSUMPTION (Continued…):Consumer Preferences, Constraints on Borrowings

- CONSUMPTION (Continued…):The Life-cycle Consumption Function

- INVESTMENT:The Rental Price of Capital, The Cost of Capital

- INVESTMENT (Continued…):The Determinants of Investment

- INVESTMENT (Continued…):Financing Constraints, Residential Investment

- INVESTMENT (Continued…):Inventories and the Real Interest Rate

- MONEY:Money Supply, Fractional Reserve Banking,

- MONEY (Continued…):Three Instruments of Money Supply, Money Demand