|

CONSUMPTION (Continued…):The Life-cycle Consumption Function |

| << CONSUMPTION (Continued…):Consumer Preferences, Constraints on Borrowings |

| INVESTMENT:The Rental Price of Capital, The Cost of Capital >> |

Macroeconomics

ECO 403

VU

LESSON

39

CONSUMPTION

(Continued...)

John

Maynard Keynes and the

Consumption Function

The

consumption function exhibits

three properties that Keynes

conjectured.

1.

The marginal propensity to

consume c is between zero

and one.

2.

The average propensity to

consume falls as income

rises.

3.

Consumption is determined by current

income.

Simon

Kuznets and the Consumption

Puzzle

�

The

failure of the secular-stagnation

hypothesis and the findings

of Kuznets both

indicated

that

the average propensity to

consume is fairly constant

over time.

�

This

presented a puzzle: why did

Keynes' conjectures hold up

well in the studies

of

household

data and in the studies of

short time-series, but fail

when long time series

were

examined?

Irving

Fisher and Intertemporal

Choice

�

The

economist Irving Fisher

developed the model with

which economists analyze

how

rational,

forward-looking consumers make

intertemporal choices-- that

is, choices

involving

different periods of

time.

�

The

model illuminates

the

constraints consumers

face,

�

the

preferences they have,

and

�

how

these constraints and

preferences together determine

their choices about

�

consumption

and saving.

When

consumers are deciding how

much to consume today versus

how much to consume

in

the

future, they face an

intertemporal

budget constraint,

which

measures the total

resources

available for consumption

today and in the future.

The generalization

is:

C2

Y2

C1

+

r

+

1+r

=

Y1 +

1

Franco

Modigliani and the

life-cycle Hypothesis

In

the 1950's, Franco

Modigliani, Ando and

Brumberg used Fisher's model

of consumer

behavior

to study the consumption

function. One of their goals

was to study the

consumption

puzzle.

According to Fisher's model,

consumption depends on a person's

lifetime income.

Modigliani

emphasized that income varies

systematically over people's

lives and that saving

allows

consumers to move income

from those times in life

when income is high to those

times

when

income is low. This

interpretation of consumer behavior

formed the basis of his

life-

cycle

hypothesis.

The

Hypothesis

�

Most

people plan to stop working

at about age 65, and

they expect their incomes to

fall

when

they retire, but don't

want a drop in standard of

living characterized by

consumption.

�

Suppose

a consumer expects to live

another T years, has wealth

of W and expects to

earn

income

Y until she retires R years

from now.

What

level of consumption will

the consumer choose to have

a smooth consumption

over

her life?

185

Macroeconomics

ECO 403

VU

The

Life-cycle Consumption

Function

�

The

Lifetime resources of consumer

for T years are wealth W

and lifetime earnings of R x

Y

(assuming

interest rate to be

zero).

�

To

have smoothest consumption

over lifetime, she divides

such that

C

= (W + RY) / T

or

C

= (1 / T)W + (R / T)Y

�

If

she expects T = 50 and R =

30, then the consumption

function will be

C

= 1 / 50W + 30/50Y or

C

= 0.02W + 0.6Y

�

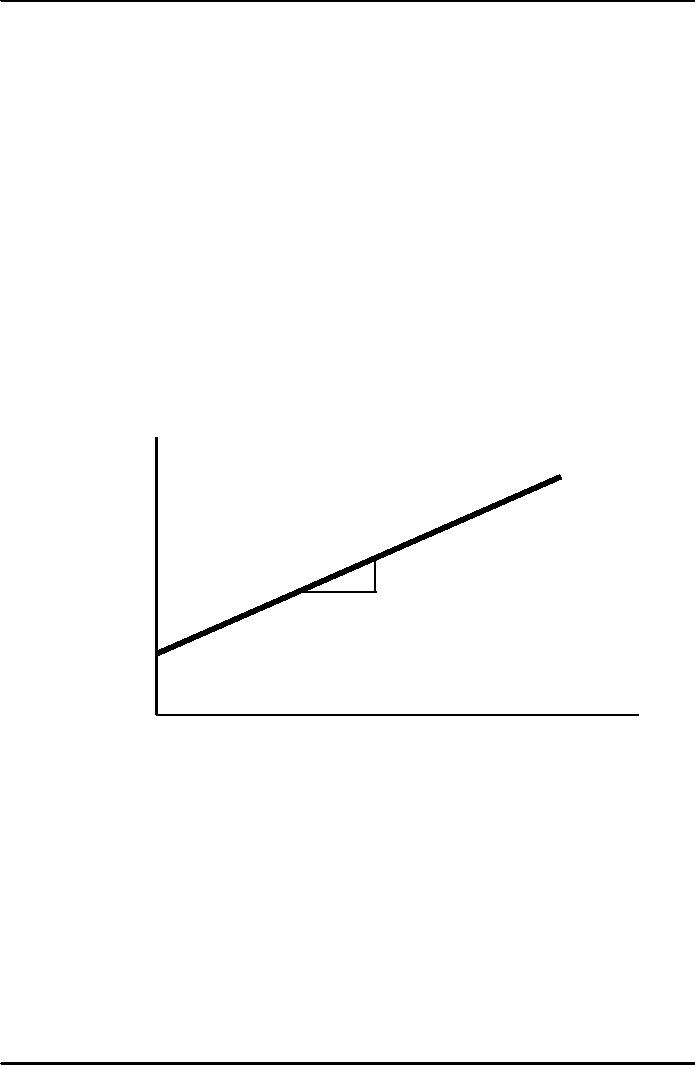

Generalizing

for Aggregate Consumption

function of the

economy:

C

= αW + βY

Where,

α = MPC out of

Wealth

β

= MPC

out of Income

Consumption,

C

β

1

αW

Income,

Y

Solving

the Consumption

Puzzle

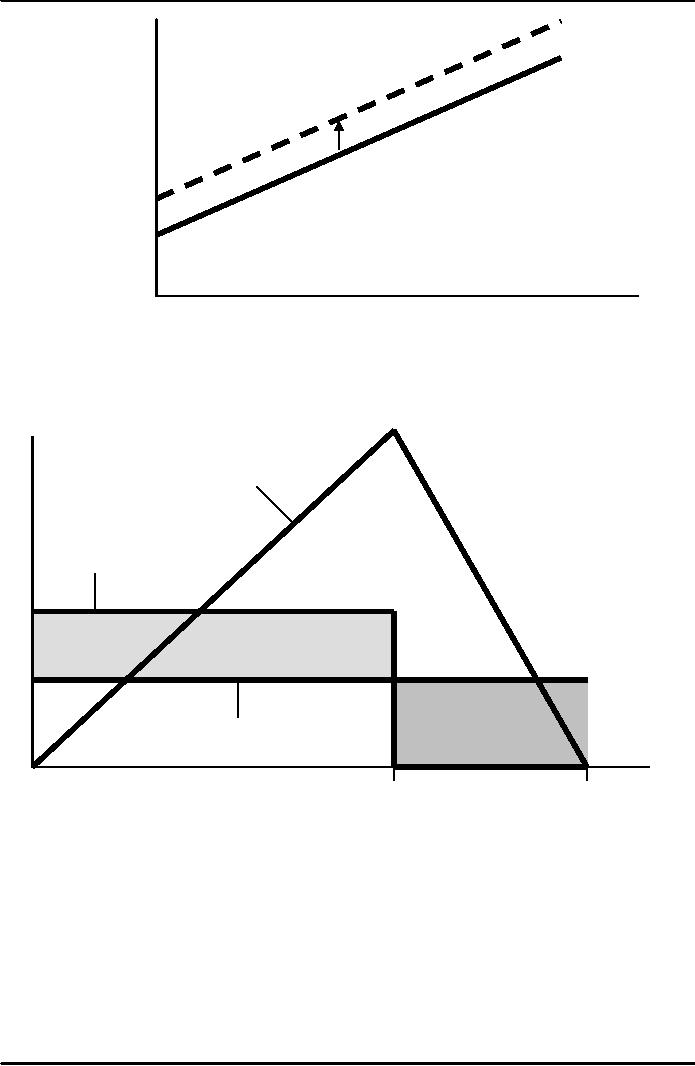

�

According

to Life-cycle consumption

function,

APC

= C/Y = α

(W/Y) +

β

�

Because,

in short periods, wealth

does not vary

proportionately with incomes,

High incomes

corresponds

to Low APC.

�

But

over longer periods, wealth

and incomes grow together,

resulting in constant W/Y

ratio

and

hence a constant APC

186

Macroeconomics

ECO 403

VU

Consumption,

C

αW2

αW1

Income,

Y

The

Upward Shift prevents the

APC from falling as income

increases. Thus solving

Keynes's

puzzle

Consumption,

Income and Wealth over

Life-cycle

$

Wealth

Income

Savings

Dissavings

Consumption

Retirement

End

of

Begins

Life

Consumption

and Saving of

Elderly

�

Research

findings show that elderly

people do not dissave as

much as the life cycle

model

predicts.

�

In

other words, the elderly do

not run down their

wealth as quickly as one

would expect if

they

were trying to smooth their

consumption over their

remaining years of

life.

�

Reasons

They are

concerned about unpredictable

expenses. Additional saving

that rises from

uncertainty

is called precautionary saving.

This may be due to expecting

a long life and

to

plan for a longer period of

retirement.

187

Macroeconomics

ECO 403

VU

�

It is not

completely persuasive considering

the availability of annuity

schemes of

insurance

companies and public health

insurance plans.

They may

want to leave bequests to

their children

Milton

Friedman and the

Permanent-Income Hypothesis

�

In

1957, Milton Friedman

proposed the permanent-income

hypothesis to explain

consumer

behavior.

�

Its

essence is that current

consumption is proportional to permanent

income. Friedman's

permanent-income

hypothesis complements Modigliani's

life-cycle hypothesis: both

use

Fisher's

theory of the consumer to

argue that consumption

should not depend on

current

income

alone.

But

unlike the life-cycle

hypothesis, which emphasizes

that income follows a

regular pattern

over

a person's lifetime, the

permanent-income hypothesis emphasizes

that people

experience

random and temporary changes

in their incomes from year

to year.

Friedman

suggested that we view

current income Y as the sum

of two components,

permanent

income YP and transitory

income YT.

Y

= YP + YT

�

Permanent

Income is the part of income

that people expect to

persist in the

future.

�

Transitory

income is the part of income

that people do not expect to

persist.

�

Friedman

reasoned that consumption

should depend primarily on

permanent income

because

consumers use savings and

borrowings to smooth consumption in

response to

transitory

changes in income.

�

Friedman

approximation of consumption function

is:

C

= αYP

�

While

Average propensity to consume

is:

APC

= C/Y = αYP /Y

When Y >

YP, APC Falls

When Y <

YP, APC rises

Robert

Hall and the Random-Walk

Hypothesis

Robert

Hall was first to derive

the implications of rational

expectations for consumption.

He

showed

that if the permanent-income

hypothesis is correct and if

consumers have

rational

expectations,

then changes in consumption

over time should be

unpredictable. When

changes

in

a variable are unpredictable,

the variable is said to

follow a random

walk.

According

to Hall, the combination of

the permanent-income hypothesis

and rational

expectations

implies that consumption

follows a random

walk.

188

Table of Contents:

- INTRODUCTION:COURSE DESCRIPTION, TEN PRINCIPLES OF ECONOMICS

- PRINCIPLE OF MACROECONOMICS:People Face Tradeoffs

- IMPORTANCE OF MACROECONOMICS:Interest rates and rental payments

- THE DATA OF MACROECONOMICS:Rules for computing GDP

- THE DATA OF MACROECONOMICS (Continued…):Components of Expenditures

- THE DATA OF MACROECONOMICS (Continued…):How to construct the CPI

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- MONEY AND INFLATION:The Quantity Equation, Inflation and interest rates

- MONEY AND INFLATION (Continued…):Money demand and the nominal interest rate

- MONEY AND INFLATION (Continued…):Costs of expected inflation:

- MONEY AND INFLATION (Continued…):The Classical Dichotomy

- OPEN ECONOMY:Three experiments, The nominal exchange rate

- OPEN ECONOMY (Continued…):The Determinants of the Nominal Exchange Rate

- OPEN ECONOMY (Continued…):A first model of the natural rate

- ISSUES IN UNEMPLOYMENT:Public Policy and Job Search

- ECONOMIC GROWTH:THE SOLOW MODEL, Saving and investment

- ECONOMIC GROWTH (Continued…):The Steady State

- ECONOMIC GROWTH (Continued…):The Golden Rule Capital Stock

- ECONOMIC GROWTH (Continued…):The Golden Rule, Policies to promote growth

- ECONOMIC GROWTH (Continued…):Possible problems with industrial policy

- AGGREGATE DEMAND AND AGGREGATE SUPPLY:When prices are sticky

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND IN THE OPEN ECONOMY:Lessons about fiscal policy

- AGGREGATE DEMAND IN THE OPEN ECONOMY(Continued…):Fixed exchange rates

- AGGREGATE DEMAND IN THE OPEN ECONOMY (Continued…):Why income might not rise

- AGGREGATE SUPPLY:The sticky-price model

- AGGREGATE SUPPLY (Continued…):Deriving the Phillips Curve from SRAS

- GOVERNMENT DEBT:Permanent Debt, Floating Debt, Unfunded Debts

- GOVERNMENT DEBT (Continued…):Starting with too little capital,

- CONSUMPTION:Secular Stagnation and Simon Kuznets

- CONSUMPTION (Continued…):Consumer Preferences, Constraints on Borrowings

- CONSUMPTION (Continued…):The Life-cycle Consumption Function

- INVESTMENT:The Rental Price of Capital, The Cost of Capital

- INVESTMENT (Continued…):The Determinants of Investment

- INVESTMENT (Continued…):Financing Constraints, Residential Investment

- INVESTMENT (Continued…):Inventories and the Real Interest Rate

- MONEY:Money Supply, Fractional Reserve Banking,

- MONEY (Continued…):Three Instruments of Money Supply, Money Demand