|

CONSUMPTION:Secular Stagnation and Simon Kuznets |

| << GOVERNMENT DEBT (Continued…):Starting with too little capital, |

| CONSUMPTION (Continued…):Consumer Preferences, Constraints on Borrowings >> |

Macroeconomics

ECO 403

VU

LESSON

37

CONSUMPTION

John

Maynard Keynes and the

Consumption Function

The

consumption function was

central to Keynes' theory of

economic fluctuations presented

in

The

General Theory in

1936.

�

Keynes

conjectured that the

marginal

propensity to consume-- the

amount

consumed

out of an additional dollar of

income-- is between zero and

one. He claimed

that

the fundamental law is that

out of every dollar of

earned income, people

will

consume

part of it and save the

rest.

�

Keynes

also proposed the average

propensity to consume-- the

ratio of consumption

to

income-- falls as income

rises.

�

Keynes

also held that income is

the primary determinant of

consumption and that

the

interest

rate does not have an

important role.

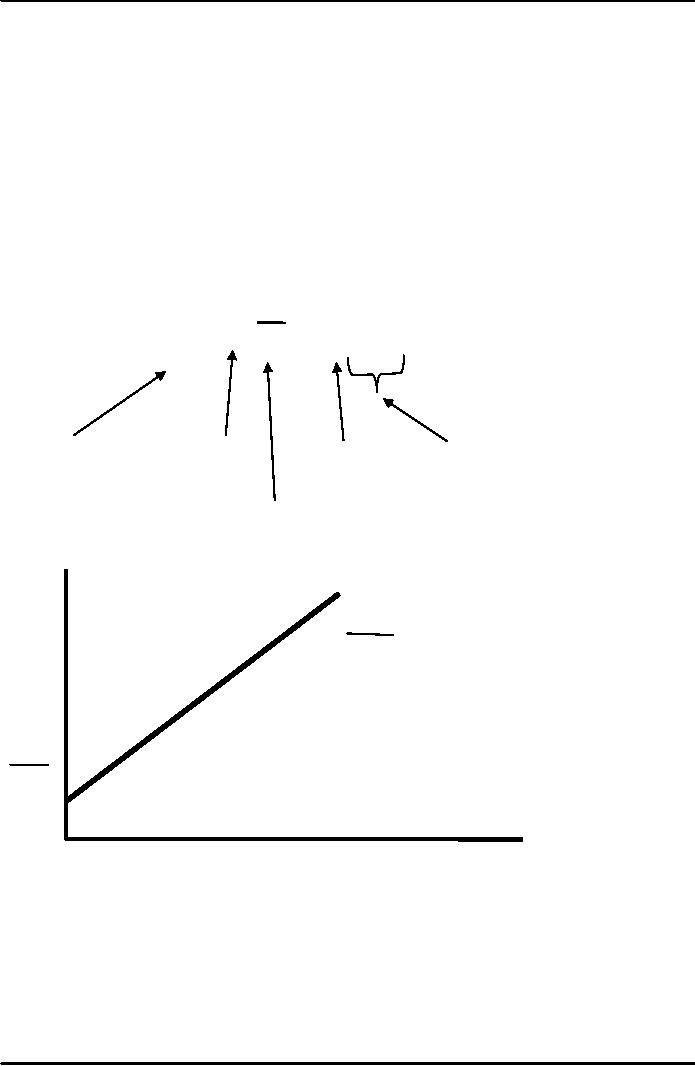

The

Consumption Function

C

= C + cY

income

depends

Marginal

consumption

on

Propensity

to

spending

by

consume

(MPC)

households

Autonomous

consumption

C

C

= C + cY

C

Y

This

consumption function exhibits

three properties that Keynes

conjectured.

1.

The marginal propensity to

consume c is between zero

and one.

2.

The average propensity to

consume falls as income

rises.

3.

Consumption is determined by current

income.

173

Macroeconomics

ECO 403

VU

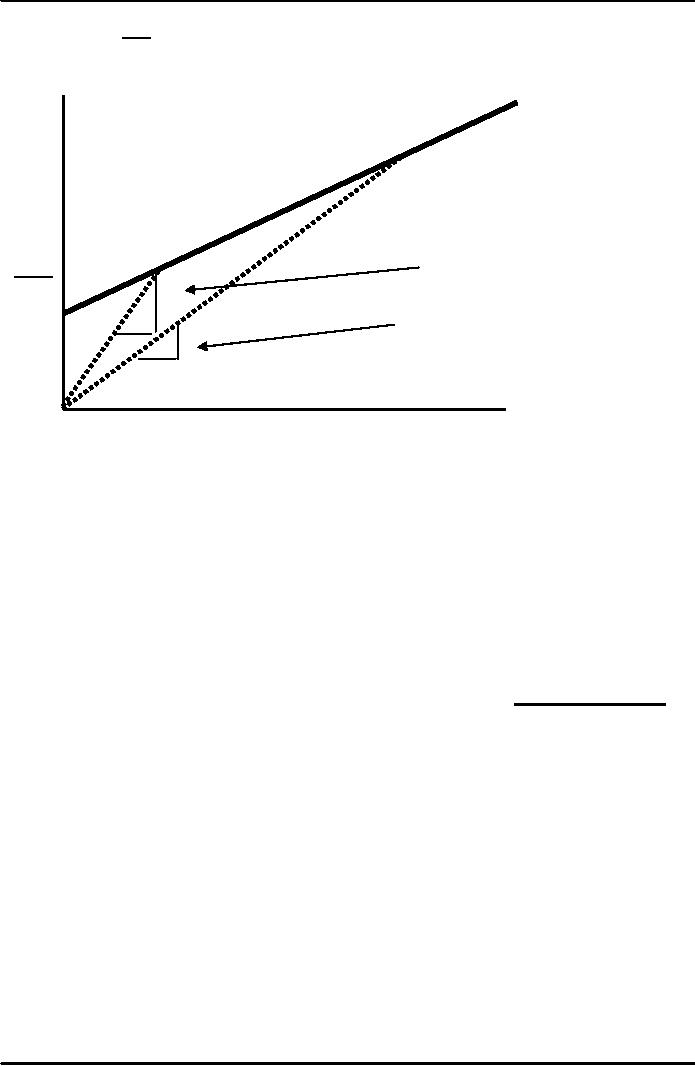

Average

Propensity to Consume

APC

= C/Y = C/Y + c

As

Y rises, C/Y falls, and so

the average propensity to

consume C/Y falls. Notice

that the

interest

rate is not included in this

function.

C

APC1

C

APC2

1

1

Y

Marginal

Propensity to Consume

�

To

understand the marginal

propensity to consume (MPC),

consider a shopping

scenario.

A

person who loves to shop

probably has a large MPC,

let's say (.99).

This

means

that for every extra

rupee

he or she earns after tax

deductions, he or

she

spends 99 paisas of

it.

�

The MPC

measures the sensitivity of

the change in one variable

(C) with respect to a

change

in the other variable

(Y).

Secular

Stagnation and Simon

Kuznets

�

During

World War II, on the

basis of Keynes' consumption

function, economists

predicted

that the economy would

experience what they called

secular

stagnation, a

long

depression of infinite duration--

unless fiscal policy was

used to stimulate

aggregate

demand.

�

It

turned out that the

end of the war did

not throw the U.S.

into another depression,

but

it

did suggest that Keynes'

conjecture that the average

propensity to consume

would

fall

as income rose appeared not

to hold.

�

Simon

Kuznets constructed new

aggregate data on consumption

and investment

dating

back to 1869 and whose

work would later earn a

Nobel Prize.

�

He

discovered that the ratio of

consumption to income was

stable over time,

despite

large

increases in income; again,

Keynes' conjecture was

called into question.

�

This

brings us to the

puzzle...

Consumption

Puzzle

�

The

failure of the secular-stagnation

hypothesis and the findings

of Kuznets both

indicated

that

the average propensity to

consume is fairly constant

over time. This presented

a

puzzle:

why did Keynes' conjectures

hold up well in the studies

of household data and

in

the

studies of short time-series,

but fail when long

time series were

examined?

174

Macroeconomics

ECO 403

VU

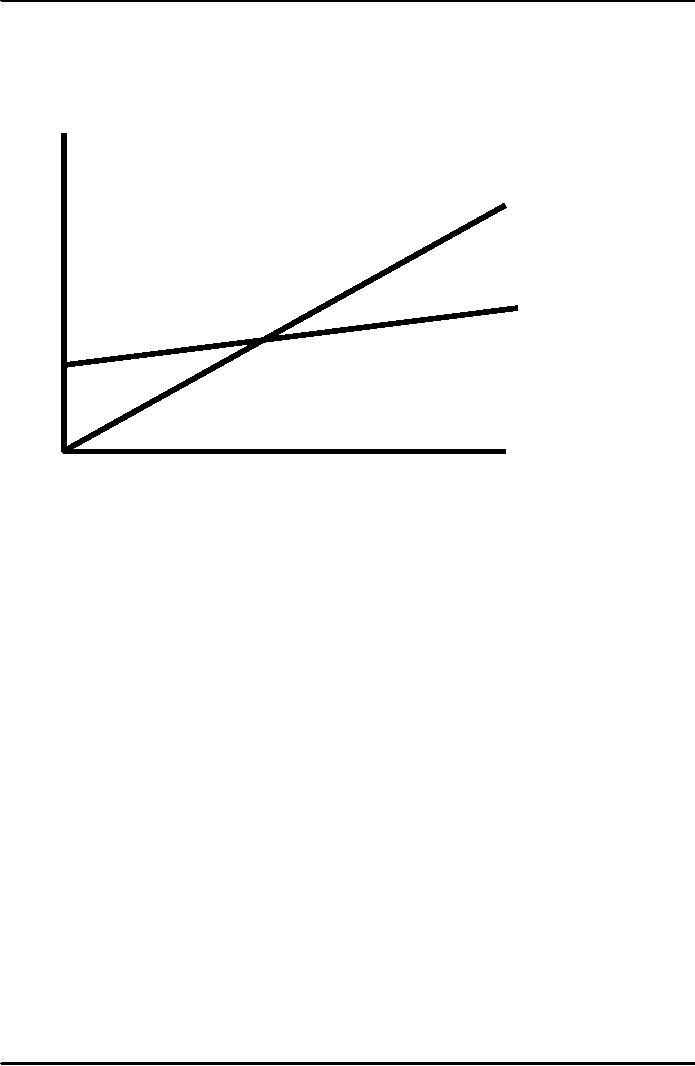

Studies

of household data and short

time-series found a relationship

between consumption

and

income similar to the one

Keynes conjectured-- this is

called the short-run

consumption

function.

But,

studies using long

time-series found that the

APC did not vary

systematically with

income-

-this

relationship is called the

long-run consumption

function.

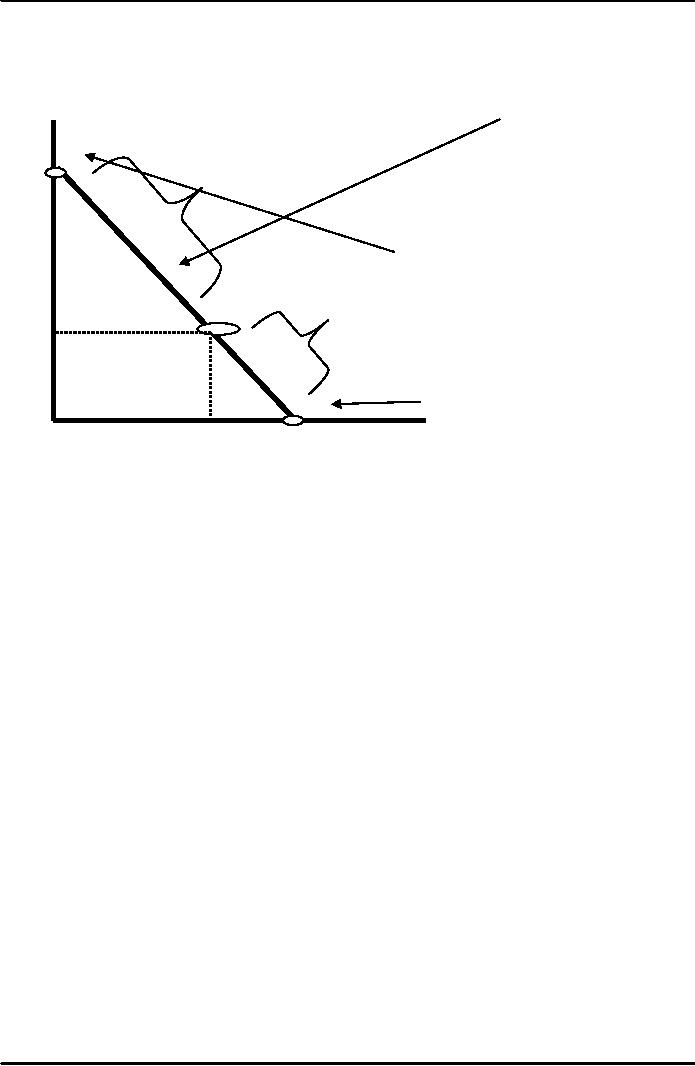

C

Long-run

consumption function

(constant

APC)

Short-run

consumption

function

(falling APC)

Y

Irving

Fisher and Intertemporal

Choice

�

The

economist Irving Fisher

developed the model with

which economists analyze

how

rational,

forward-looking consumers make

intertemporal choices-- that

is, choices

involving

different periods of

time.

�

The

model illuminates

the

constraints consumers

face,

�

the

preferences they have,

and

�

how

these constraints and

preferences together determine

their choices about

�

consumption

and saving.

When

consumers are deciding how

much to consume today versus

how much to consume

in

the

future, they face an intertemporal

budget constraint, which

measures the total

resources

available

for consumption today and in

the future.

Consumer's

Budget Constraint

�

Consider

the decision facing a

consumer who lives for

two periods (representing

youth &

age)

�

He

earns Income Y1,

Y2 and consumes C1,

C2 in both periods

respectively (adjusted

for

inflation)

�

The

savings in the first period

will be

S

= Y1

C1

�

In

the second period

175

Macroeconomics

ECO 403

VU

C2 = (1 + r) S +

Y2

Where

r is the real interest

rate.

�

Remember

S can represent either

saving or borrowing and the

equations hold in

both

cases.

If C1 <

Y1

consumer

is saving

S>0

If C1 >

Y1

consumer

is borrowing

S<0

�

Assume:

r

(borrowing) = r (saving)

Combining

the two equations:

C2 = (1 +

r)(Y1

C1) +

Y2

Rearranging

(1

+ r)C1 +

C2 = (1 + r) Y1 + Y2

�

Dividing

both sides by 1 + r

C2

Y2

C1

+

r

+

1+r

=

Y1 +

1

So

we can say that

�

The

consumer's budget constraint

implies that if the interest

rate is zero, the

budget

constraint

shows that total consumption

in the two periods equals

total income in the

two

periods. In the usual case

in which the interest rate

is greater than zero,

future

consumption

and future income are

discounted by a factor of 1 + r.

�

This

discounting

arises

from the interest earned on

savings. Because the

consumer

earns

interest on current income

that is saved, future income

is worth less than

current

income.

�

Also,

because future consumption is

paid for out of savings

that have earned

interest,

future

consumption costs less than

current consumption.

The

factor 1/(1+r) is the price

of second-period consumption measured in

terms of first-

�

period

consumption; it is the amount of

first-period consumption that

the consumer

must

forgo to obtain 1 unit of

second-period consumption.

Here

are the combinations of

first-period and second-period

consumption the consumer

can

choose.

176

Macroeconomics

ECO 403

VU

Second-

period

consumption

Consumer's

budget

constraint

B

Saving

Vertical

intercept is

(1+r)Y1 +

Y2

A

Borrowing

Y2

Horizontal

intercept is

C

Y1 +

Y2/(1+r)

Y1

First-period

consumption

If

he chooses a point between A

and B, he consumes less than

his income in the first

period

and

saves the rest for

the second period. If he

chooses between A and C, he

consumes more

that

his income in the first

period and borrows to make

up the difference.

177

Table of Contents:

- INTRODUCTION:COURSE DESCRIPTION, TEN PRINCIPLES OF ECONOMICS

- PRINCIPLE OF MACROECONOMICS:People Face Tradeoffs

- IMPORTANCE OF MACROECONOMICS:Interest rates and rental payments

- THE DATA OF MACROECONOMICS:Rules for computing GDP

- THE DATA OF MACROECONOMICS (Continued…):Components of Expenditures

- THE DATA OF MACROECONOMICS (Continued…):How to construct the CPI

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- MONEY AND INFLATION:The Quantity Equation, Inflation and interest rates

- MONEY AND INFLATION (Continued…):Money demand and the nominal interest rate

- MONEY AND INFLATION (Continued…):Costs of expected inflation:

- MONEY AND INFLATION (Continued…):The Classical Dichotomy

- OPEN ECONOMY:Three experiments, The nominal exchange rate

- OPEN ECONOMY (Continued…):The Determinants of the Nominal Exchange Rate

- OPEN ECONOMY (Continued…):A first model of the natural rate

- ISSUES IN UNEMPLOYMENT:Public Policy and Job Search

- ECONOMIC GROWTH:THE SOLOW MODEL, Saving and investment

- ECONOMIC GROWTH (Continued…):The Steady State

- ECONOMIC GROWTH (Continued…):The Golden Rule Capital Stock

- ECONOMIC GROWTH (Continued…):The Golden Rule, Policies to promote growth

- ECONOMIC GROWTH (Continued…):Possible problems with industrial policy

- AGGREGATE DEMAND AND AGGREGATE SUPPLY:When prices are sticky

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND IN THE OPEN ECONOMY:Lessons about fiscal policy

- AGGREGATE DEMAND IN THE OPEN ECONOMY(Continued…):Fixed exchange rates

- AGGREGATE DEMAND IN THE OPEN ECONOMY (Continued…):Why income might not rise

- AGGREGATE SUPPLY:The sticky-price model

- AGGREGATE SUPPLY (Continued…):Deriving the Phillips Curve from SRAS

- GOVERNMENT DEBT:Permanent Debt, Floating Debt, Unfunded Debts

- GOVERNMENT DEBT (Continued…):Starting with too little capital,

- CONSUMPTION:Secular Stagnation and Simon Kuznets

- CONSUMPTION (Continued…):Consumer Preferences, Constraints on Borrowings

- CONSUMPTION (Continued…):The Life-cycle Consumption Function

- INVESTMENT:The Rental Price of Capital, The Cost of Capital

- INVESTMENT (Continued…):The Determinants of Investment

- INVESTMENT (Continued…):Financing Constraints, Residential Investment

- INVESTMENT (Continued…):Inventories and the Real Interest Rate

- MONEY:Money Supply, Fractional Reserve Banking,

- MONEY (Continued…):Three Instruments of Money Supply, Money Demand