|

GOVERNMENT DEBT (Continued…):Starting with too little capital, |

| << GOVERNMENT DEBT:Permanent Debt, Floating Debt, Unfunded Debts |

| CONSUMPTION:Secular Stagnation and Simon Kuznets >> |

Macroeconomics

ECO 403

VU

LESSON

36

GOVERNMENT

DEBT (Continued...)

Traditional

view of govt.

debt.

How

would a tax cut and

budget deficit affect the

economy and the economic

well-being of the

country?

�

A

tax cut stimulates consumer

spending and reduces

national saving. The

reduction in

saving

raises the interest rate,

which crowds out

investment.

�

The Solow

growth model shows that

lower investment leads to a

lower steady-state

capital

stock and lower

output.

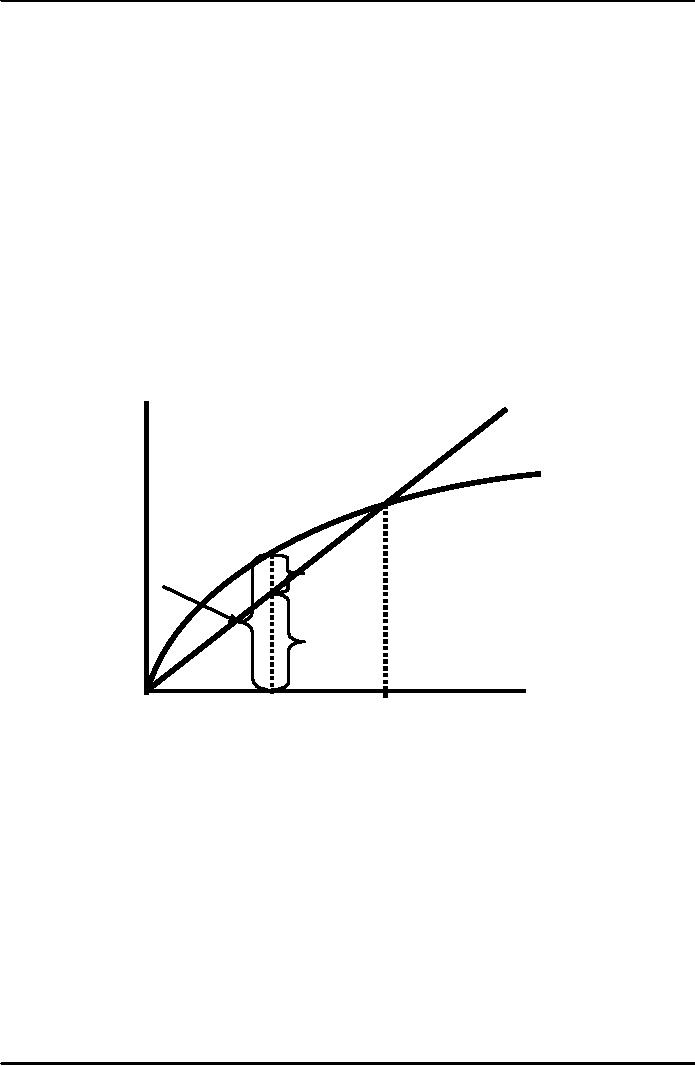

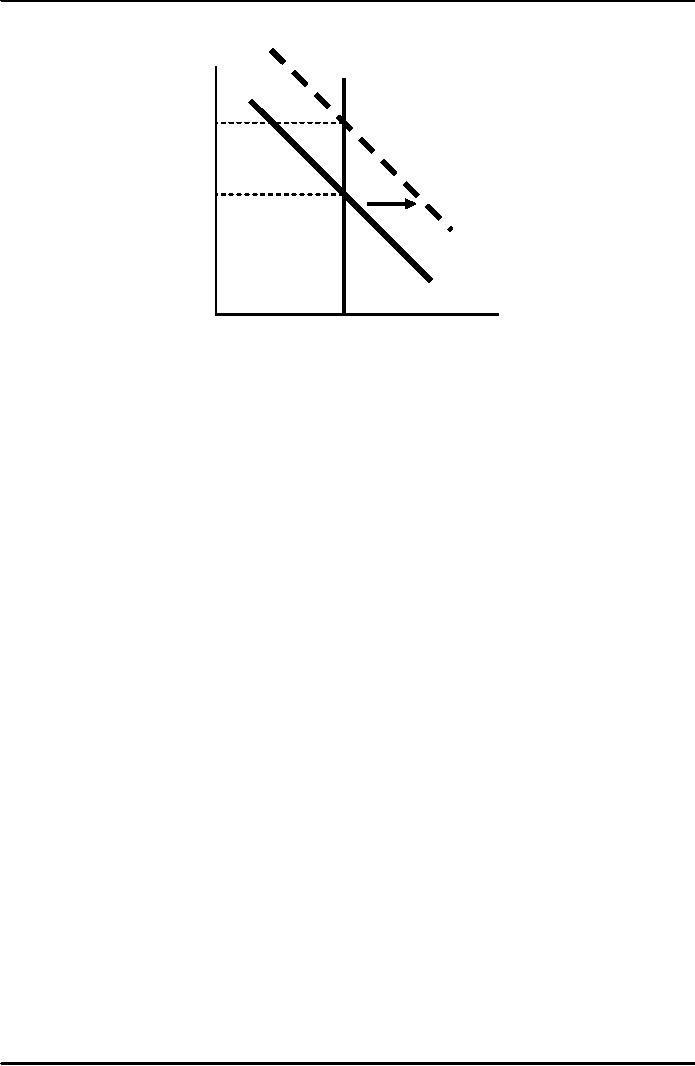

Solow

Growth Model

Change

in capital stock= investment

depreciation

Δk =

i

δk

Since

i = sf (k),

this becomes:

Δk =

s f(k)

δk

Solow

Growth Model

Investment

and

Δk =

sf (k)

-

δk

depreciation

δK

sf

(k)

Δk

investment

depreciation

k1

k*

Capital

per

worker,

k

The

economy will then have

less capital than the

Golden Rule steady-state

which will

�

mean

lower consumption and lower

economic well-being.

167

Macroeconomics

ECO 403

VU

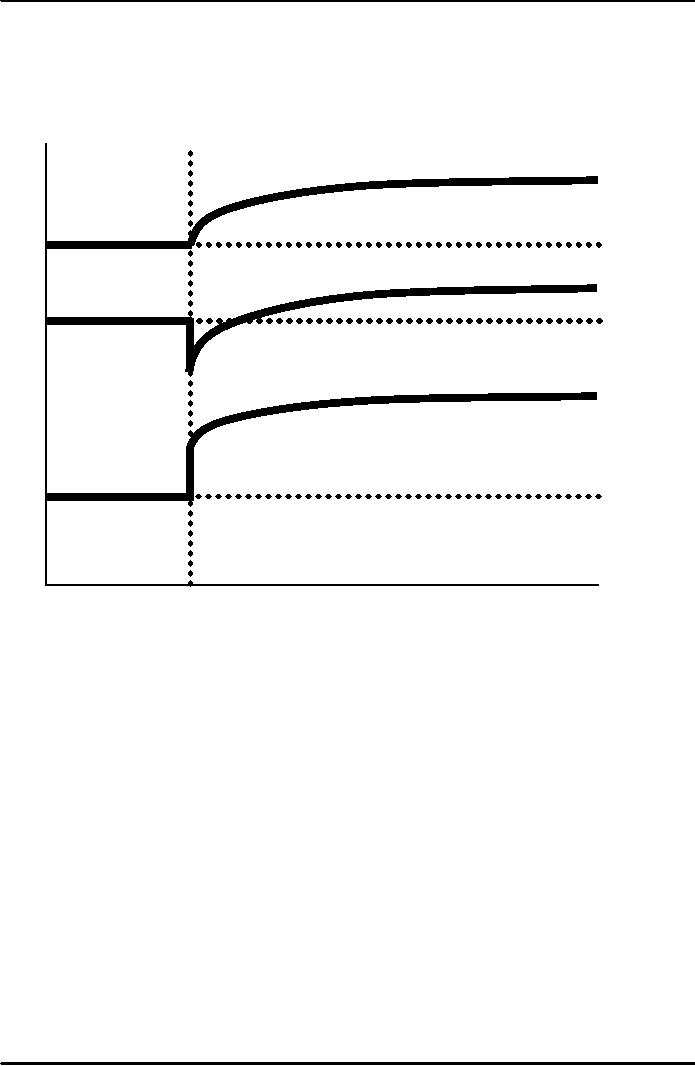

Starting

with too little

capital

If

K* < K* gold, then increasing c* requires an increase in

s.

Future

generations enjoy higher

consumption, but the current

one experiences an initial

drop

in

consumption.

y

c

i

time

t0

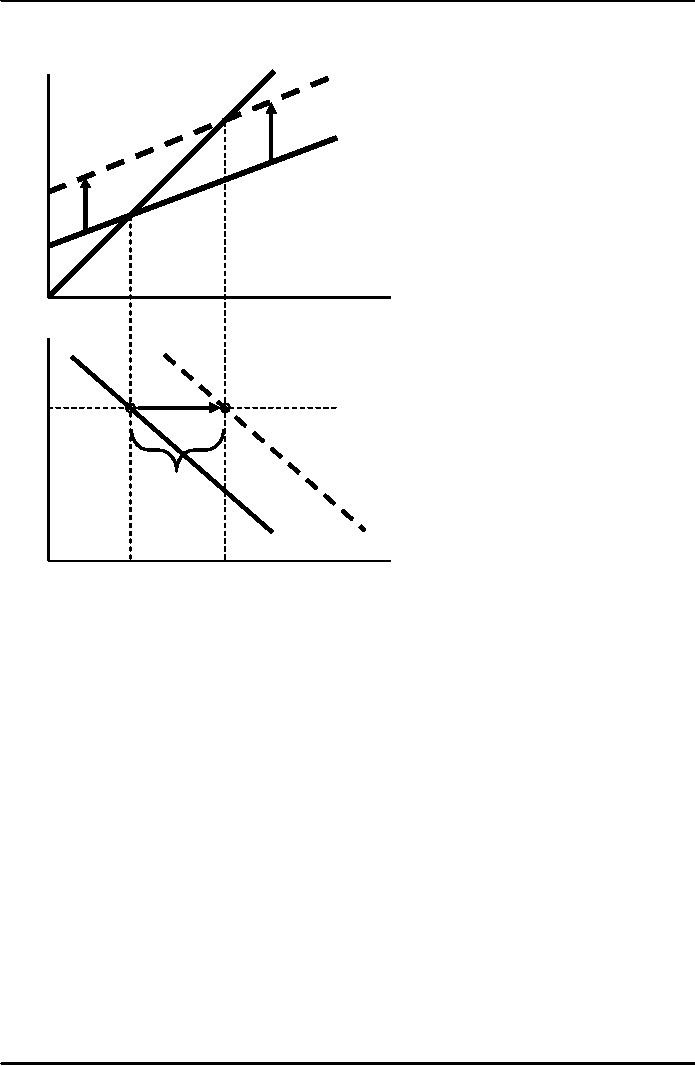

Then

we analyze the short-run

impact of the policy change

via the IS-LM

model.

�

A

Tax Cut

�

We

Have C = C (Y -T)

At

any value of r, ↓T⇒↑C ⇒

↑E ⇒ ↑Y

...so

the IS curve shifts to the

right. The horizontal

distance of the IS shift

equals

ΔY = MPC/(1

MPC) ΔT

168

Macroeconomics

ECO 403

VU

E

=Y

E

E

=C2+I

(r1 )+G

E

=C1 +I

(r1 )+G

Y

Y1

Y2

r

r1

ΔY

IS2

IS1

Y

Y1

Y2

Next,

we can see how international

trade affects this policy

change. When national

�

saving

falls, people borrow from

abroad, causing a trade

deficit. It also causes the

local

currency

to appreciate.

169

Macroeconomics

ECO 403

VU

International

Trade

S2

I(r*)

ε

S1

I(r*)

ε2

ε1

NX(ε )

NX

NX

1

NX

2

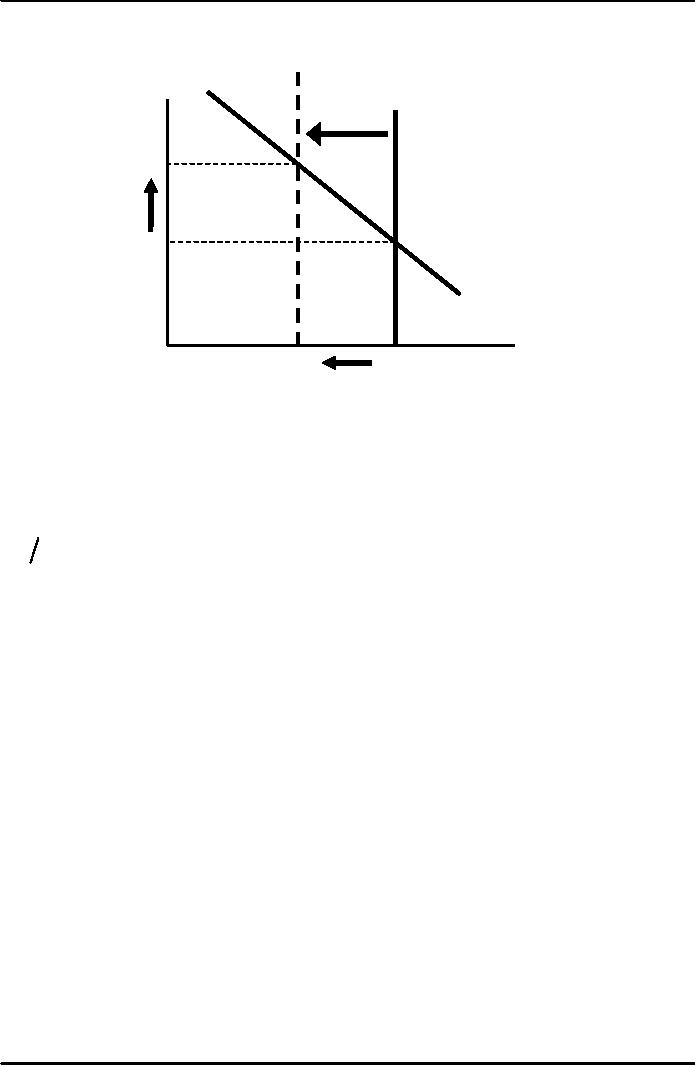

The

Mundell-Fleming model shows

that the appreciation and

the resulting fall in

net

�

exports

reduce the short-run

expansionary effect of the

fiscal change.

Mundell-Fleming

Model

Y

= C

(Y

- T

) +

I

(r

*) +

G

+ NX

(e

)

M

P = L

(r

*,Y

)

At

any given value of

e, a fiscal

expansion increases Y, shifting

IS*

to

the right. Results: Δe >

0,

ΔY =

0

170

Macroeconomics

ECO 403

VU

e

LM*1

e2

e1

IS*2

IS*1

Y

Y1

The

Ricardian View of Government

Debt

�

Forward-looking

consumers perceive that

lower taxes now mean

higher taxes later,

leaving

consumption

unchanged. "Tax cuts are

simply tax

postponements."

�

When

the government borrows to

pay for its current

spending (higher G),

rational

consumers

look ahead to the future

taxes required to support

this debt.

�

Another

view

Govt.

borrows Rs. 1,000 from a

citizen to give him a Rs.

1,000 tax cut (similar to

as

giving

him a Rs. 1,000 govt.

bond as a gift)

On one

side the government owes

him Rs. 1,000 plus

interest. On the other side,

he

owes

Rs. 1,000 plus

interest.

Overall no

change in citizen's wealth

because the value of the

bond is offset by the

value

of the future tax

liability

�

General

Principal (Ricardian

equivalence)

Government

Debt is equivalent to future

taxes

If consumers

are forward looking, future

taxes are equivalent to

current taxes

So

�

Financing

govt. by debt is equivalent to

financing it by taxes.

Consumers

and Future Taxes

�

The

essence of the Ricardian

view is that when people

choose their consumption,

they

rationally

look ahead to the future

taxes implied by government

debt. But, how

forward-

looking

are consumers?

�

Defenders

of the traditional view of

government debt believe that

the prospect of

future

taxes

does not have as large an

influence on current consumption as

the Ricardian

view

assumes.

171

Macroeconomics

ECO 403

VU

Myopia

�

Ricardian

view assumes that people

are rational when making

decisions. When the

govt.

borrows

to pay for current spending,

rational consumers look

ahead to anticipate the

future

taxes

required to support this

debt.

�

Traditional

view is that people are

myopic, meaning that they

see a decrease in taxes

in

such

a way that their current

consumption increases because of

this new "wealth."

They

don't

see that when expansionary

fiscal policy is financed

through bonds, they will

just have

to

pay more taxes in the

future since bonds are

just a tax-postponements.

Borrowing

Constraints

�

The

Ricardian view assumes that

consumers base their

spending not only on current

but

on

their lifetime income, which

includes both current and

expected future

income.

�

Advocates

of the traditional view

argue that current

consumption is more important

than

lifetime

income for those consumers

who face borrowing

constraints, which

are limits on

how

much an individual can

borrow from financial

institutions.

�

A

person who wants to consume

more than his current

income must borrow. If he

can't

borrow

to finance his current

consumption, his current

income determines what he

can

consume,

regardless of his future

income. So, a debt-financed

tax cut raises

current

income

and thus consumption, even

though future income is

lower.

�

In essence,

when a government cuts

current taxes and raises future

taxes, it is giving

tax

payers

a loan.

Future

Generations

�

According

to traditional view of government

debt, consumers expect the

implied future taxes

to

fall not of them but on

future generations. This

behavior raises the lifetime

resources of

the

current generation as well as

their consumption.

�

In

essence, the debt-financed

tax cut stimulates the

consumption because it gives

the

current

generation the opportunity to

consume at the expense of

the next generation

172

Table of Contents:

- INTRODUCTION:COURSE DESCRIPTION, TEN PRINCIPLES OF ECONOMICS

- PRINCIPLE OF MACROECONOMICS:People Face Tradeoffs

- IMPORTANCE OF MACROECONOMICS:Interest rates and rental payments

- THE DATA OF MACROECONOMICS:Rules for computing GDP

- THE DATA OF MACROECONOMICS (Continued…):Components of Expenditures

- THE DATA OF MACROECONOMICS (Continued…):How to construct the CPI

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- MONEY AND INFLATION:The Quantity Equation, Inflation and interest rates

- MONEY AND INFLATION (Continued…):Money demand and the nominal interest rate

- MONEY AND INFLATION (Continued…):Costs of expected inflation:

- MONEY AND INFLATION (Continued…):The Classical Dichotomy

- OPEN ECONOMY:Three experiments, The nominal exchange rate

- OPEN ECONOMY (Continued…):The Determinants of the Nominal Exchange Rate

- OPEN ECONOMY (Continued…):A first model of the natural rate

- ISSUES IN UNEMPLOYMENT:Public Policy and Job Search

- ECONOMIC GROWTH:THE SOLOW MODEL, Saving and investment

- ECONOMIC GROWTH (Continued…):The Steady State

- ECONOMIC GROWTH (Continued…):The Golden Rule Capital Stock

- ECONOMIC GROWTH (Continued…):The Golden Rule, Policies to promote growth

- ECONOMIC GROWTH (Continued…):Possible problems with industrial policy

- AGGREGATE DEMAND AND AGGREGATE SUPPLY:When prices are sticky

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND IN THE OPEN ECONOMY:Lessons about fiscal policy

- AGGREGATE DEMAND IN THE OPEN ECONOMY(Continued…):Fixed exchange rates

- AGGREGATE DEMAND IN THE OPEN ECONOMY (Continued…):Why income might not rise

- AGGREGATE SUPPLY:The sticky-price model

- AGGREGATE SUPPLY (Continued…):Deriving the Phillips Curve from SRAS

- GOVERNMENT DEBT:Permanent Debt, Floating Debt, Unfunded Debts

- GOVERNMENT DEBT (Continued…):Starting with too little capital,

- CONSUMPTION:Secular Stagnation and Simon Kuznets

- CONSUMPTION (Continued…):Consumer Preferences, Constraints on Borrowings

- CONSUMPTION (Continued…):The Life-cycle Consumption Function

- INVESTMENT:The Rental Price of Capital, The Cost of Capital

- INVESTMENT (Continued…):The Determinants of Investment

- INVESTMENT (Continued…):Financing Constraints, Residential Investment

- INVESTMENT (Continued…):Inventories and the Real Interest Rate

- MONEY:Money Supply, Fractional Reserve Banking,

- MONEY (Continued…):Three Instruments of Money Supply, Money Demand