|

AGGREGATE SUPPLY (Continued…):Deriving the Phillips Curve from SRAS |

| << AGGREGATE SUPPLY:The sticky-price model |

| GOVERNMENT DEBT:Permanent Debt, Floating Debt, Unfunded Debts >> |

Macroeconomics

ECO 403

VU

LESSON

34

AGGREGATE

SUPPLY (Continued...)

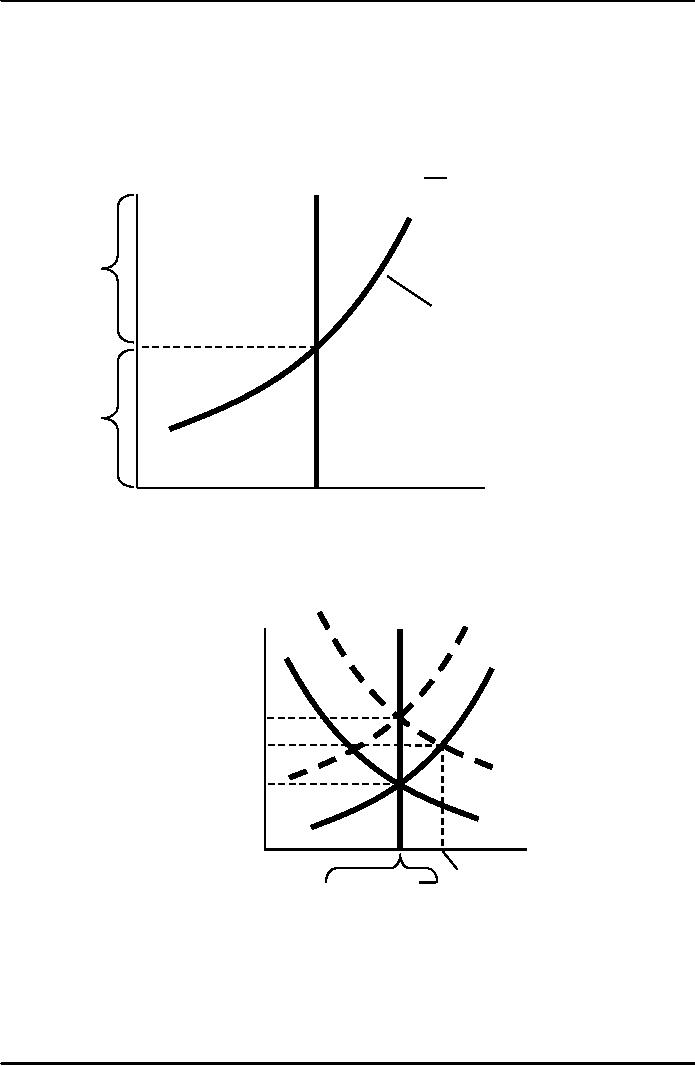

Three

Models of Aggregate

Supply

Each

of the three models of

aggregate supply imply the

relationship summarized by the

SRAS

curve

& equation

P

LRAS

Y

=

Y

+

α(

-

P

)

e

P

>

Pe

P

SRAS

Pe

=

P

<P

e

P

Y

Y

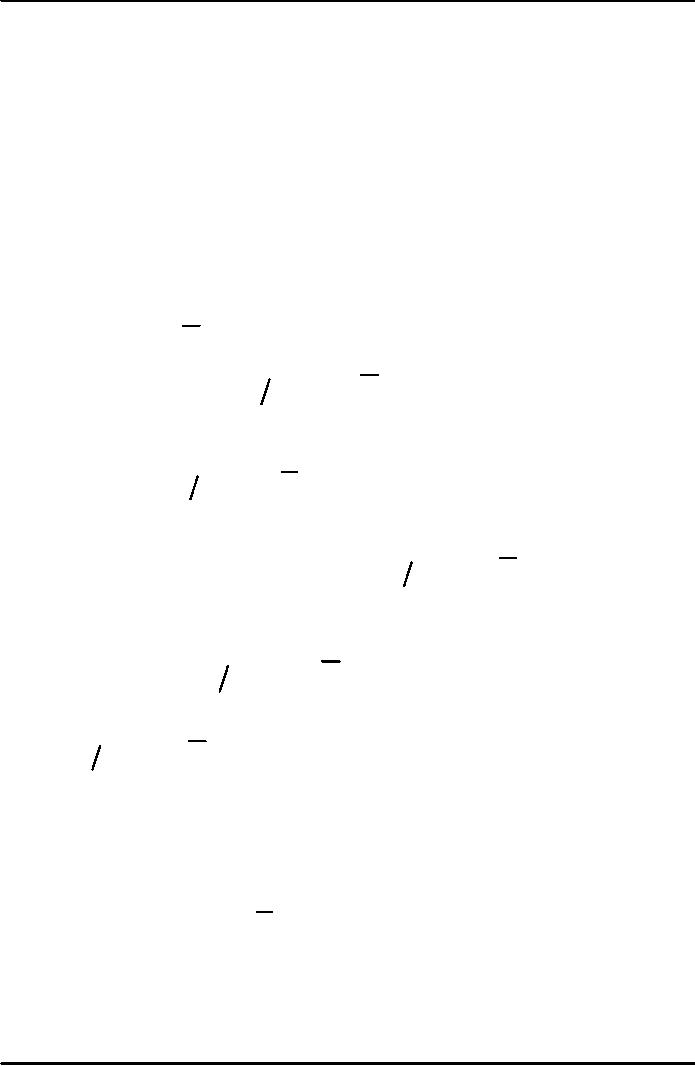

Suppose

a positive AD

shock

moves output above its

natural rate and P

above

the level people

had

expected. Over time, P

e rises,

SRAS

shifts

up, and output returns to

its natural rate.

SRAS2

P

LRAS

SRAS1

e

P3 =

P

P2

AD2

e

e

P

2 =

P

1 =

P1

AD1

Y

Y

2

=Y

1 =

Y

Y

3

Inflation,

Unemployment, and the

Phillips Curve

The

Phillips curve states that

�

depends

on

�

Expected

inflation, �e

158

Macroeconomics

ECO 403

VU

�

Cyclical

unemployment: the deviation of

the actual rate of

unemployment from the

natural

rate

�

Supply

shocks, ν

�

= �

e

- β (u

- u

n ) +

ν

Where

β

>

0 is an exogenous constant.

Deriving

the Phillips Curve from

SRAS

The

Philips curve in its modern

form states that the

inflation rate depends on

three forces:

�Expected inflation.

�The deviation of

unemployment from the

natural rate, called

cyclical unemployment.

�Supply shocks.

We

can drive the Philips

curve from our equation

for aggregate supply.

Y

= Y

+ α (P

- P

e )

(1)

According

to aggregate supply

equation:

P

= P

e + ( 1 α

)

(Y -Y

)

(2)

Here

are the three steps.

First, add to the right-hand

side of the equation a

supply shock v to

represent

exogenous events (such as

change in world's oil

prices) that alter the

price level and

shift

the short run aggregate

supply curve:

P

= P

e + ( 1 α

)

(Y -Y

) +

ν

(3)

Next,

to go from the price level

to inflation rates, subtract

last year's price level P

-1

from

both

sides of equation to

obtain

(P

- P-1

) =

( P

e - P-1

) +

(1 α

)

(Y -Y

) +

ν

(4)

The

term on the left hand

side is the difference

between current price level

and last years

price

level,

which is inflation. The term

on the right hand side is

the difference between the

expected

price

level and last years

price level, which is

expected inflation.

Therefore,

�

= �

e

+ ( 1 α

)

(Y -Y

) +

ν

(5)

Now

to go from output to unemployment,

recall Okun's law which

gives a relationship

between

two

variables. We can write this

as

(1

α

)

(Y -Y

) =

- β (u

- u

n )

(6)

Using

this Okun's law

relationship, we can substitute

left-hand side value in

equation number

5,

and we obtain

e

n

�

= �

- β (u

- u

) +

ν

(7)

The

Phillips Curve and SRAS

Y

= Y

+ α (P

- P

e )

SRAS:

�

= �

e

- β (u

- u

n ) +

ν

Phillips

curve:

�

SRAS

curve:

output

is related to unexpected movements in

the price level

159

Macroeconomics

ECO 403

VU

�

Phillips

curve:

unemployment

is related to unexpected movements in

the inflation rate

Adaptive

expectations

�

Adaptive

expectations: an approach that

assumes people form their

expectations of future

inflation

based on recently observed

inflation.

�

A

simple example:

Expected

inflation = last year's

actual inflation

�

e

= � -1

Then,

theP.C.becomes

�

n

�

= �

-1 -

β (u

- u

) +

ν

Inflation

inertia

�

In

this form, the Phillips

curve implies that inflation

has inertia:

In the

absence of supply shocks or

cyclical unemployment, inflation

will continue

indefinitely

at its current rate.

Past

inflation influences expectations of

current inflation, which in

turn influences the

wages

& prices that people

set.

Two

causes of rising & falling

inflation

�

Cost-push

inflation: inflation resulting

from supply shocks. Adverse

supply shocks

typically

raise

production costs and induce

firms to raise prices,

"pushing" inflation

up.

�

Demand-pull

inflation: inflation resulting

from demand shocks. Positive

shocks to aggregate

demand

cause unemployment to fall

below its natural rate,

which "pulls" the inflation

rate

up.

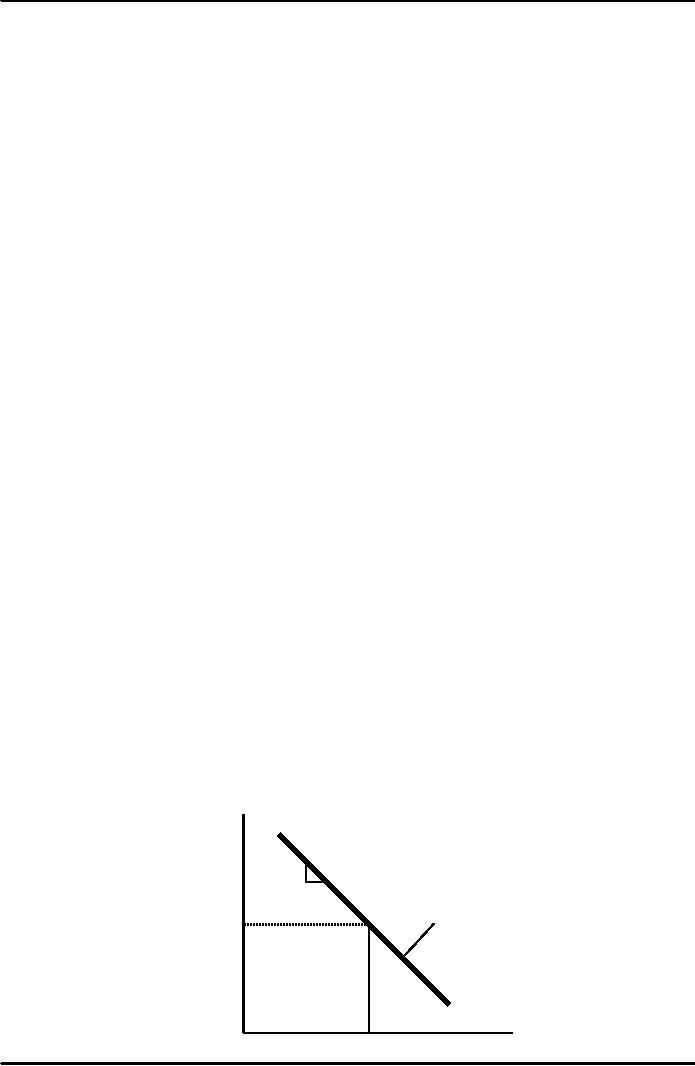

Graphing

the Phillips

curve

In

the short run, policymakers

face a trade-off between � and

u.

�

β

1

The

short-run Phillips

e

�

ν

+

Curve

u

un

160

Macroeconomics

ECO 403

VU

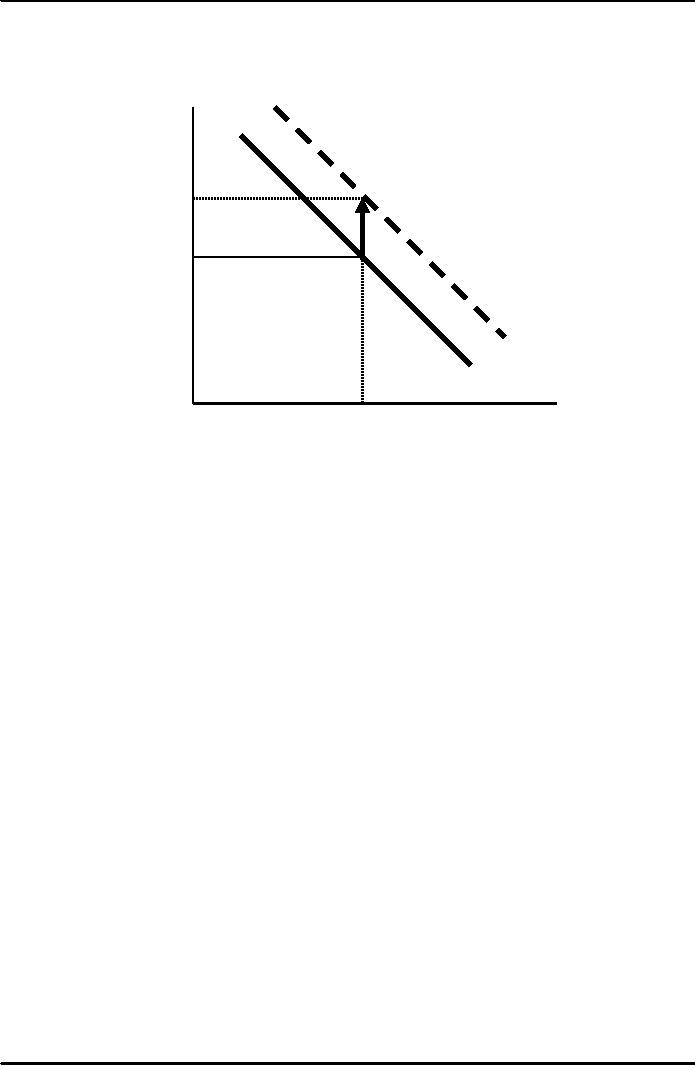

Shifting

the Phillips

curve

People

adjust their expectations

over time, so the tradeoff

only holds in the short

run. e.g., an

increase

in �e

shifts

the short-run P.C.

upward.

�

�

e

+ν

e

�1 +ν

u

un

The

sacrifice ratio

�

To

reduce inflation, policymakers

can

contract

aggregate demand,

causing

unemployment

to rise above the natural

rate.

�

The

sacrifice ratio measures the

percentage of a year's real

GDP that must be foregone

to

reduce

inflation by 1 percentage

point.

�

Estimates

vary, but a typical one is

5.

�

Suppose

policymakers wish to reduce

inflation from 6 to 2 percent. If

the sacrifice ratio is

5,

then

reducing inflation by 4 points

requires a loss of 4�5 = 20 percent

of one year's GDP.

�

This

could be achieved several

ways, e.g.

Reduce GDP by

20% for one

year

Reduce GDP by

10% for each of two

years

Reduce GDP by

5% for each of four

years

�

The

cost of disinflation is lost GDP.

One could use Okun's

law to translate this cost

into

unemployment.

Rational

expectations

Ways

of modeling the formation of

expectations:

�

Adaptive

expectations:

People

base their expectations of

future inflation on recently

observed inflation.

�

Rational

expectations:

People

base their expectations on

all available information,

including information

about

current

a& prospective future

policies.

161

Macroeconomics

ECO 403

VU

Painless

disinflation?

�

Proponents

of rational expectations believe

that the sacrifice ratio

may be very small:

�

Suppose

u = u n and �

= �e

= 6%, and

suppose the central bank

announces that it will

do

whatever

is necessary to reduce

inflation

from

6 to 2 percent as soon as

possible.

�

If

the announcement is credible,

then �e

will

fall, perhaps by the full 4

points.

�

Then,

�

can

fall without an increase in

u.

The

natural rate

hypothesis

Our

analysis of the costs of

disinflation, and of economic

fluctuations in the

preceding

chapters,

is based on the natural rate

hypothesis:

Changes

in aggregate demand affect

output and employment only

in the short run.

In

the long run, the

economy returns to the

levels of output, employment,

and unemployment

described

by the classical

model

An

alternative hypothesis:

hysteresis

�

Hysteresis:

the

long-lasting influence of history on

variables such as the

natural rate

of

unemployment.

�

Negative

shocks may increase u n, so

economy may not fully

recover:

The

skills of cyclically unemployed

workers deteriorate while

unemployed, and they

cannot

find a job when the

recession ends.

Cyclically

unemployed workers may lose

their influence on wage-setting;

insiders

(employed

workers) may then bargain

for higher wages for

themselves. Then, the

cyclically

unemployed "outsiders" may

become structurally unemployed

when the

recession

ends.

162

Table of Contents:

- INTRODUCTION:COURSE DESCRIPTION, TEN PRINCIPLES OF ECONOMICS

- PRINCIPLE OF MACROECONOMICS:People Face Tradeoffs

- IMPORTANCE OF MACROECONOMICS:Interest rates and rental payments

- THE DATA OF MACROECONOMICS:Rules for computing GDP

- THE DATA OF MACROECONOMICS (Continued…):Components of Expenditures

- THE DATA OF MACROECONOMICS (Continued…):How to construct the CPI

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- MONEY AND INFLATION:The Quantity Equation, Inflation and interest rates

- MONEY AND INFLATION (Continued…):Money demand and the nominal interest rate

- MONEY AND INFLATION (Continued…):Costs of expected inflation:

- MONEY AND INFLATION (Continued…):The Classical Dichotomy

- OPEN ECONOMY:Three experiments, The nominal exchange rate

- OPEN ECONOMY (Continued…):The Determinants of the Nominal Exchange Rate

- OPEN ECONOMY (Continued…):A first model of the natural rate

- ISSUES IN UNEMPLOYMENT:Public Policy and Job Search

- ECONOMIC GROWTH:THE SOLOW MODEL, Saving and investment

- ECONOMIC GROWTH (Continued…):The Steady State

- ECONOMIC GROWTH (Continued…):The Golden Rule Capital Stock

- ECONOMIC GROWTH (Continued…):The Golden Rule, Policies to promote growth

- ECONOMIC GROWTH (Continued…):Possible problems with industrial policy

- AGGREGATE DEMAND AND AGGREGATE SUPPLY:When prices are sticky

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND IN THE OPEN ECONOMY:Lessons about fiscal policy

- AGGREGATE DEMAND IN THE OPEN ECONOMY(Continued…):Fixed exchange rates

- AGGREGATE DEMAND IN THE OPEN ECONOMY (Continued…):Why income might not rise

- AGGREGATE SUPPLY:The sticky-price model

- AGGREGATE SUPPLY (Continued…):Deriving the Phillips Curve from SRAS

- GOVERNMENT DEBT:Permanent Debt, Floating Debt, Unfunded Debts

- GOVERNMENT DEBT (Continued…):Starting with too little capital,

- CONSUMPTION:Secular Stagnation and Simon Kuznets

- CONSUMPTION (Continued…):Consumer Preferences, Constraints on Borrowings

- CONSUMPTION (Continued…):The Life-cycle Consumption Function

- INVESTMENT:The Rental Price of Capital, The Cost of Capital

- INVESTMENT (Continued…):The Determinants of Investment

- INVESTMENT (Continued…):Financing Constraints, Residential Investment

- INVESTMENT (Continued…):Inventories and the Real Interest Rate

- MONEY:Money Supply, Fractional Reserve Banking,

- MONEY (Continued…):Three Instruments of Money Supply, Money Demand