|

AGGREGATE DEMAND IN THE OPEN ECONOMY:Lessons about fiscal policy |

| << AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…) |

| AGGREGATE DEMAND IN THE OPEN ECONOMY(Continued…):Fixed exchange rates >> |

Macroeconomics

ECO 403

VU

LESSON

30

AGGREGATE

DEMAND IN THE OPEN

ECONOMY

The

Mundell-Fleming Model

The

Mundell-Fleming model portrays

the relationship between the

nominal exchange rate and

the

economy output.

It

is an extension of IS-LM

model.

�

Key

assumption:

Small

open economy with perfect

capital mobility.

r

= r* (given)

�

Goods

market equilibrium-the IS*

curve:

Y

= C

(Y

- T

) +

I

(r

*) +

G

+ NX

(e

)

Where:

e

=

nominal exchange rate

=

foreign currency per unit of

domestic currency (e.g. 110

yen per dollar)

The

IS*

curve:

Goods Market

Equilibrium

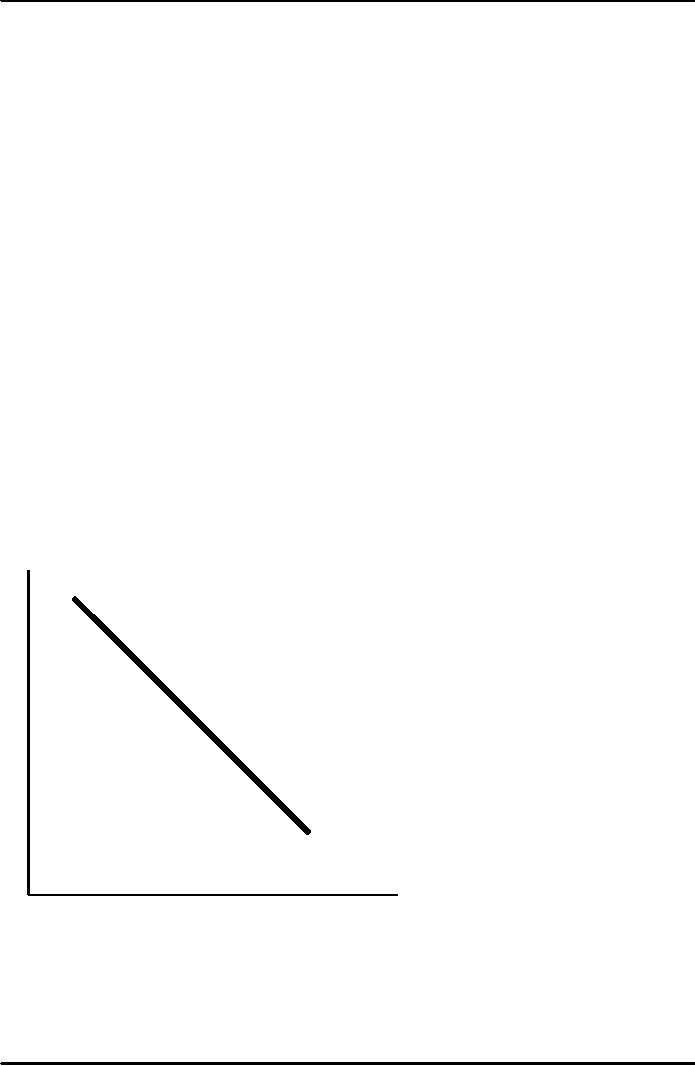

The

IS* curve is drawn for a

given value of r*.

Intuition

for the slope:

↓

e

⇒ ↑ NX

⇒ ↑ Y

e

IS*

Y

141

Macroeconomics

ECO 403

VU

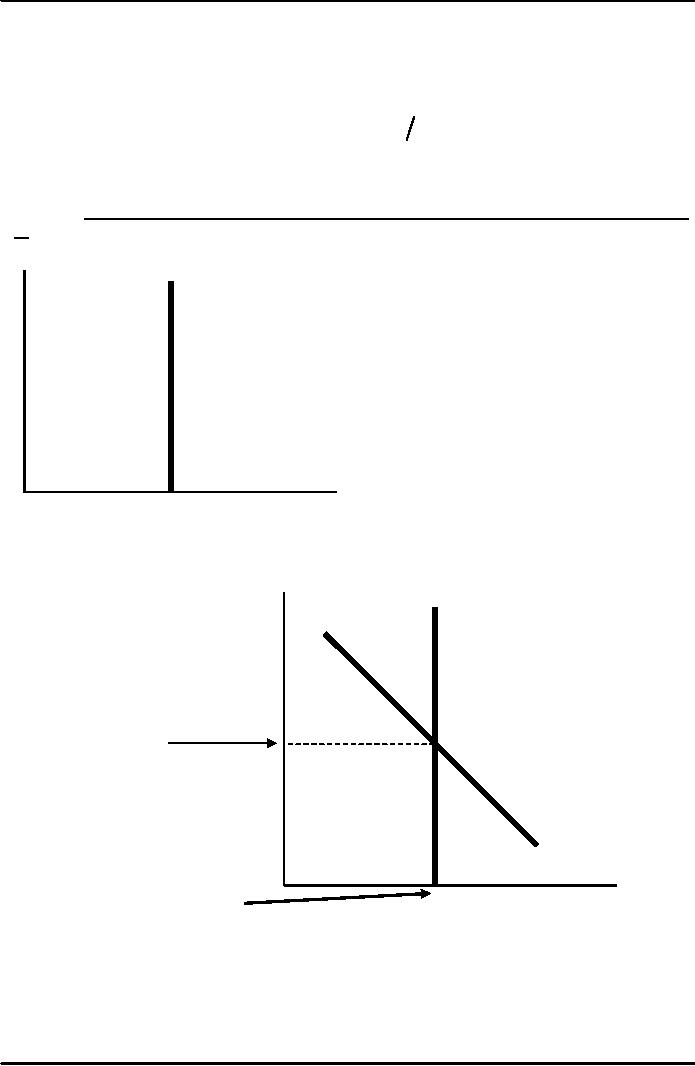

The

LM*

curve:

Money Market

Equilibrium

M

P = L

(r

*,Y

)

The

LM*

curve

�

Is drawn for a

given value of r*

�

Is vertical

because:

given

r*, there is only one

value of Y that equates

money demand with supply,

regardless of

e.

e

LM*

Y

Equilibrium

in the Mundell-Fleming

Model

e

LM*

equilibrium

exchange

rate

IS*

equilibrium

Y

level

of

income

Floating

& fixed exchange

rates

�

In

a system of floating exchange

rates,

e

is allowed to fluctuate in response to

changing economic

conditions.

142

Macroeconomics

ECO 403

VU

�

In

contrast, under fixed

exchange rates,

the

central bank trades domestic

for foreign

currency

at a predetermined price.

�

We

now consider fiscal,

monetary, and trade policy:

first in a floating exchange

rate system,

then

in a fixed exchange rate

system.

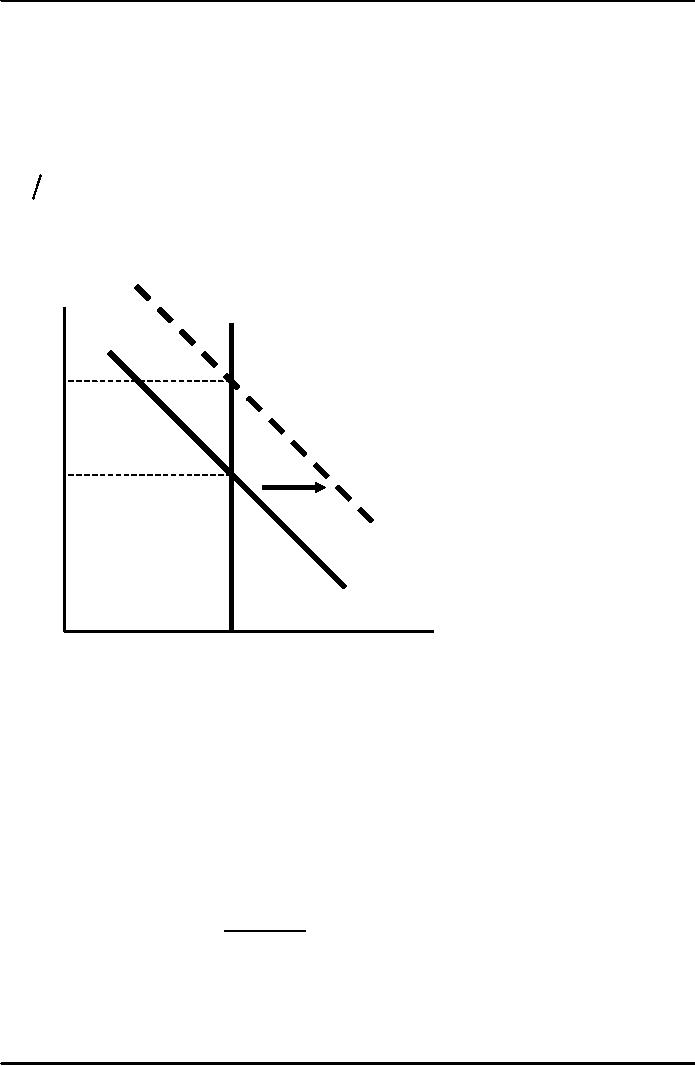

Fiscal

policy under floating

exchange rates

Y

= C

(Y

- T

) +

I

(r

*) +

G

+ NX

(e

)

M

P = L

(r

*,Y

)

At

any given value of e, a

fiscal expansion increases

Y,

shifting

IS*

to the right.

e

LM*1

e2

e1

IS*2

IS*1

Y

Y1

Results:

Δe >

0, ΔY =

0

Lessons

about fiscal

policy

�

In

a small open economy with

perfect capital mobility,

fiscal policy is utterly

incapable of

affecting

real GDP.

�

"Crowding

out"

�

Closed

economy:

Fiscal

policy crowds out investment

by causing the interest rate

to rise.

�

Small

open economy:

Fiscal

policy crowds out net

exports by causing the

exchange rate to

appreciate.

143

Macroeconomics

ECO 403

VU

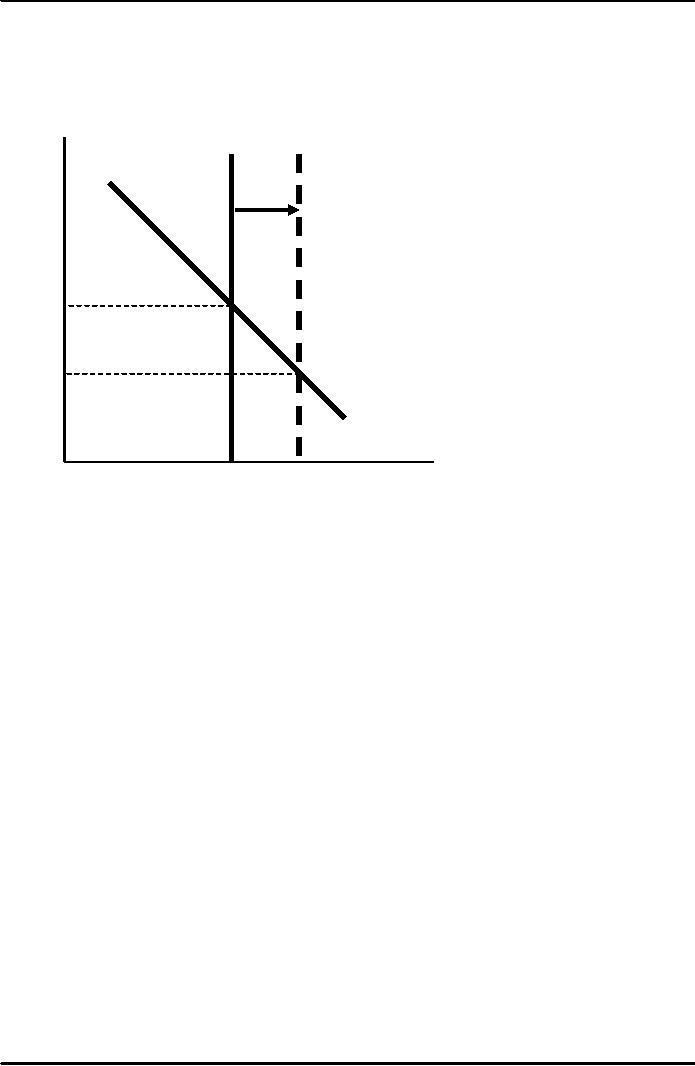

Monetary

Policy under floating

exchange rates

An

increase in M shifts LM*

right because Y must rise to

restore equilibrium in the

money

market.

e

LM*2

LM*1

e1

e2

IS*1

Y

Y1

Y2

Results:

Δe

<

0, ΔY

>

0

Lessons

about monetary

policy

�

Monetary

policy affects output by

affecting one (or more) of

the components of

aggregate

demand:

↑M ⇒

↓r

⇒

↑I

⇒

↑Y

Closed

economy:

Small

open economy: ↑M ⇒

↓e

⇒

↑NX

⇒

↑Y

Expansionary

monetary policy does not

raise world aggregate

demand, it shifts demand

from

foreign

to domestic products.

Thus,

the increases in income and

employment at home come at

the expense of losses

abroad.

144

Table of Contents:

- INTRODUCTION:COURSE DESCRIPTION, TEN PRINCIPLES OF ECONOMICS

- PRINCIPLE OF MACROECONOMICS:People Face Tradeoffs

- IMPORTANCE OF MACROECONOMICS:Interest rates and rental payments

- THE DATA OF MACROECONOMICS:Rules for computing GDP

- THE DATA OF MACROECONOMICS (Continued…):Components of Expenditures

- THE DATA OF MACROECONOMICS (Continued…):How to construct the CPI

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- MONEY AND INFLATION:The Quantity Equation, Inflation and interest rates

- MONEY AND INFLATION (Continued…):Money demand and the nominal interest rate

- MONEY AND INFLATION (Continued…):Costs of expected inflation:

- MONEY AND INFLATION (Continued…):The Classical Dichotomy

- OPEN ECONOMY:Three experiments, The nominal exchange rate

- OPEN ECONOMY (Continued…):The Determinants of the Nominal Exchange Rate

- OPEN ECONOMY (Continued…):A first model of the natural rate

- ISSUES IN UNEMPLOYMENT:Public Policy and Job Search

- ECONOMIC GROWTH:THE SOLOW MODEL, Saving and investment

- ECONOMIC GROWTH (Continued…):The Steady State

- ECONOMIC GROWTH (Continued…):The Golden Rule Capital Stock

- ECONOMIC GROWTH (Continued…):The Golden Rule, Policies to promote growth

- ECONOMIC GROWTH (Continued…):Possible problems with industrial policy

- AGGREGATE DEMAND AND AGGREGATE SUPPLY:When prices are sticky

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND IN THE OPEN ECONOMY:Lessons about fiscal policy

- AGGREGATE DEMAND IN THE OPEN ECONOMY(Continued…):Fixed exchange rates

- AGGREGATE DEMAND IN THE OPEN ECONOMY (Continued…):Why income might not rise

- AGGREGATE SUPPLY:The sticky-price model

- AGGREGATE SUPPLY (Continued…):Deriving the Phillips Curve from SRAS

- GOVERNMENT DEBT:Permanent Debt, Floating Debt, Unfunded Debts

- GOVERNMENT DEBT (Continued…):Starting with too little capital,

- CONSUMPTION:Secular Stagnation and Simon Kuznets

- CONSUMPTION (Continued…):Consumer Preferences, Constraints on Borrowings

- CONSUMPTION (Continued…):The Life-cycle Consumption Function

- INVESTMENT:The Rental Price of Capital, The Cost of Capital

- INVESTMENT (Continued…):The Determinants of Investment

- INVESTMENT (Continued…):Financing Constraints, Residential Investment

- INVESTMENT (Continued…):Inventories and the Real Interest Rate

- MONEY:Money Supply, Fractional Reserve Banking,

- MONEY (Continued…):Three Instruments of Money Supply, Money Demand