|

AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…) |

| << AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…) |

| AGGREGATE DEMAND IN THE OPEN ECONOMY:Lessons about fiscal policy >> |

Macroeconomics

ECO 403

VU

LESSON

29

AGGREGATE

DEMAND AND AGGREGATE SUPPLY

(Continued...)

IS-LM

and Aggregate

Demand

�

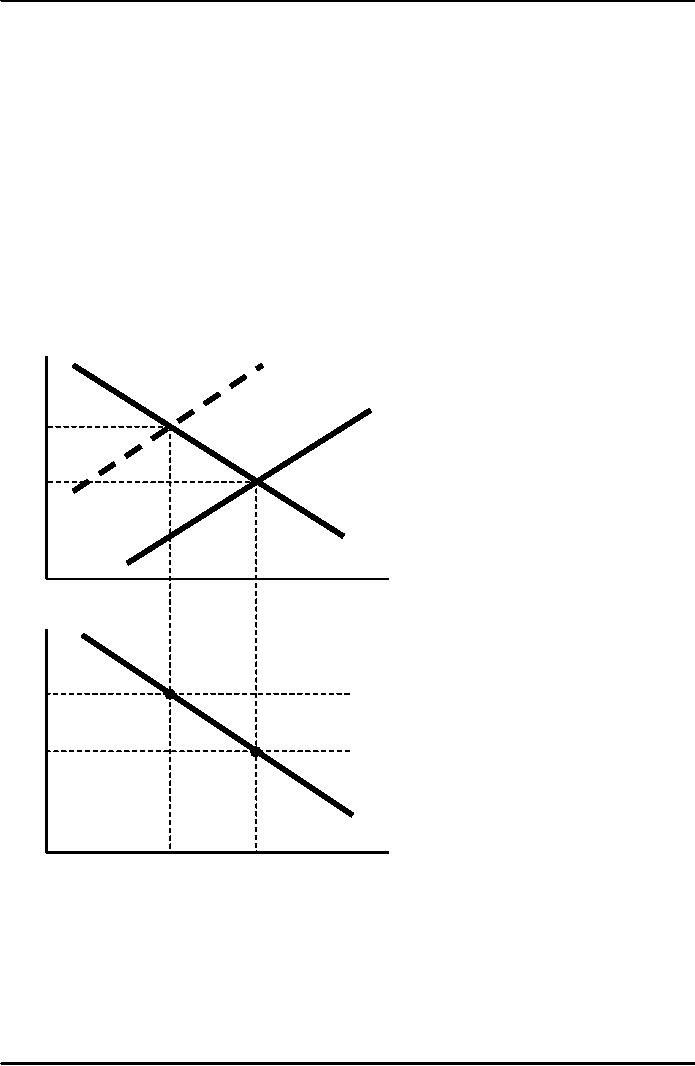

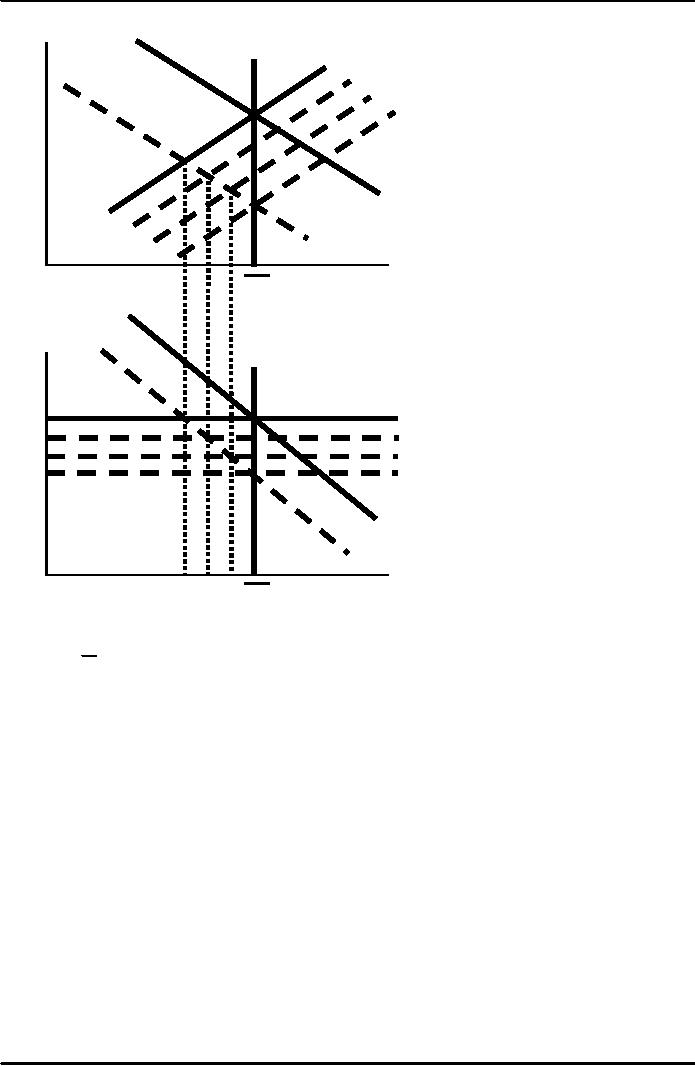

So

far, we've been using

the IS-LM

model

to analyze the short run,

when the price

level

is assumed fixed.

�

However, a

change in P would shift the

LM curve

and therefore affect

Y.

�

The

aggregate demand curve

captures this relationship

between P and Y

Deriving

the AD

curve

Intuition

for slope of AD

curve:

↑P

⇒

↓(M/P)

⇒

LM shifts

left

⇒

↑r

⇒

↓I

⇒

↓Y

LM(P2)

r

LM(P1)

r2

r1

IS

Y1

Y

Y2

P

P2

P1

AD

Y

Y2

Y1

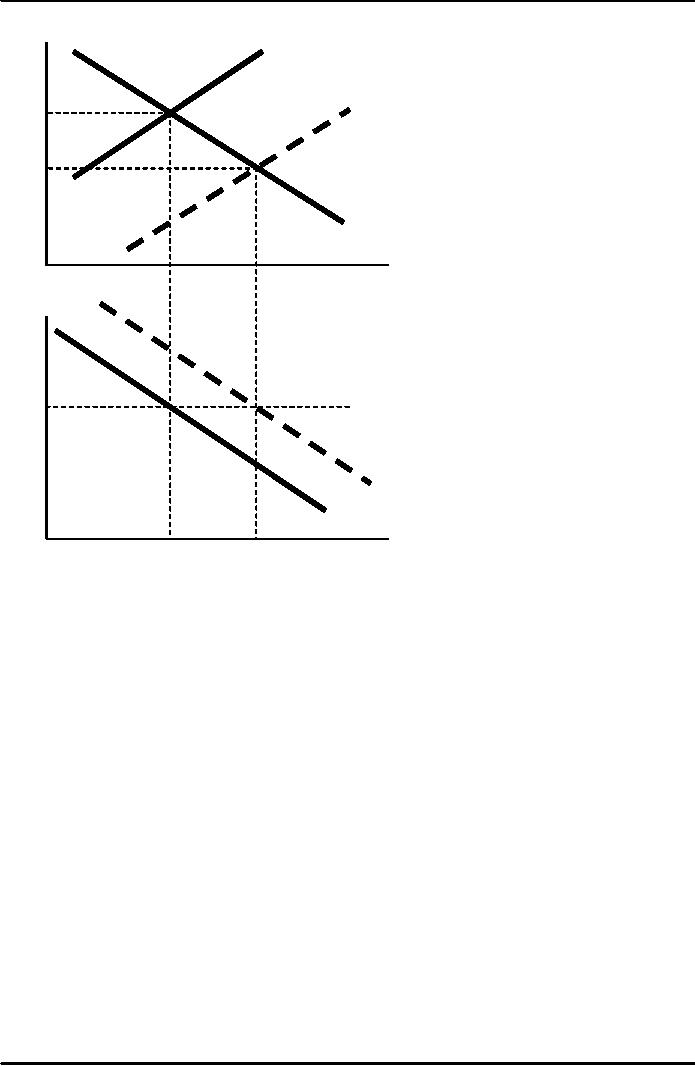

Monetary

policy and the AD

curve

The

central bank can increase

aggregate demand:

↑M ⇒

LM shifts

right

⇒

↓r

⇒

↑I

⇒

↑Y at

each value of P

132

Macroeconomics

ECO 403

VU

LM(M1/P1)

r

LM(M2/P1)

r1

r2

IS

Y2

Y

Y1

P

P1

AD2

AD1

Y

Y1

Y2

Fiscal

policy and the AD

curve

Expansionary

fiscal policy (↑G and/or

↓T)

increases aggregate

demand:

↓T ⇒

↑C

⇒

IS

shifts right

⇒

↑Y at

each value of P

133

Macroeconomics

ECO 403

VU

r

LM

r2

r1

IS2

IS1

Y2

Y

Y1

P

P1

AD2

AD1

Y

Y2

Y1

IS-LM

and

AD-AS

in

the short run & long

run

Recall:

The

force that moves the

economy from the short

run to the long run is

the gradual

adjustment

of prices.

In

the short-run

equilibrium,

then

over time, the

price

if

level

will

Y>Y

Rise

Y<Y

Fall

Y=Y

remain

constant

134

Macroeconomics

ECO 403

VU

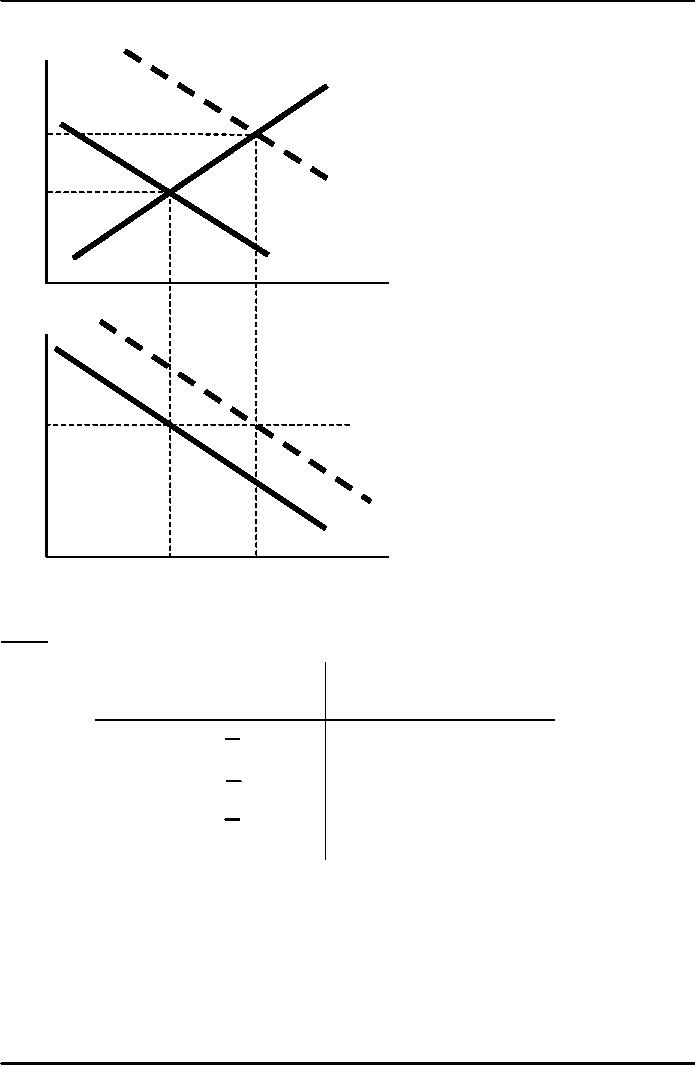

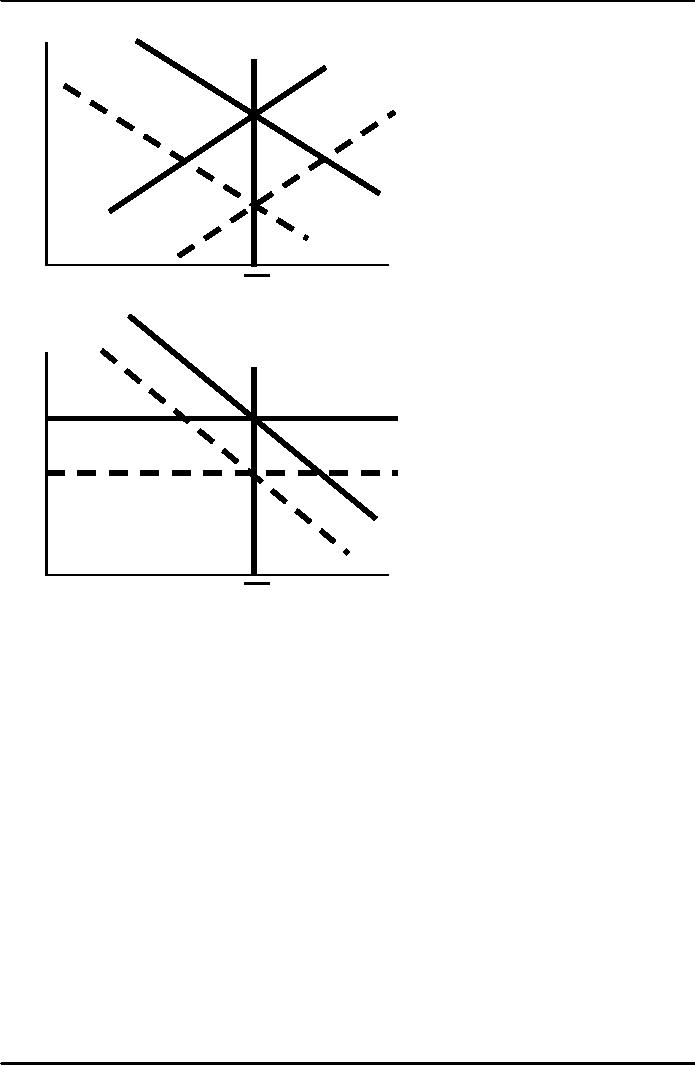

The

SR and LR effects of an IS

shock

A

negative IS shock shifts IS

and AD left, causing Y to

fall.

LRAS

r

LM(P1)

IS1

IS2

Y

Y

P

LRAS

SRAS1

P1

AD1

AD2

Y

Y

In

the new short-run

equilibrium, Y < Y.

Over

time, P gradually falls,

which causes

�

SRAS

to

move down

�

M/P to

increase, which causes

LM to

move down

135

Macroeconomics

ECO 403

VU

r

LRAS

LM(P2)

IS1

IS2

Y

Y

P

LRAS

SRAS1

P1

SRAS2

P2

AD1

AD2

Y

Y

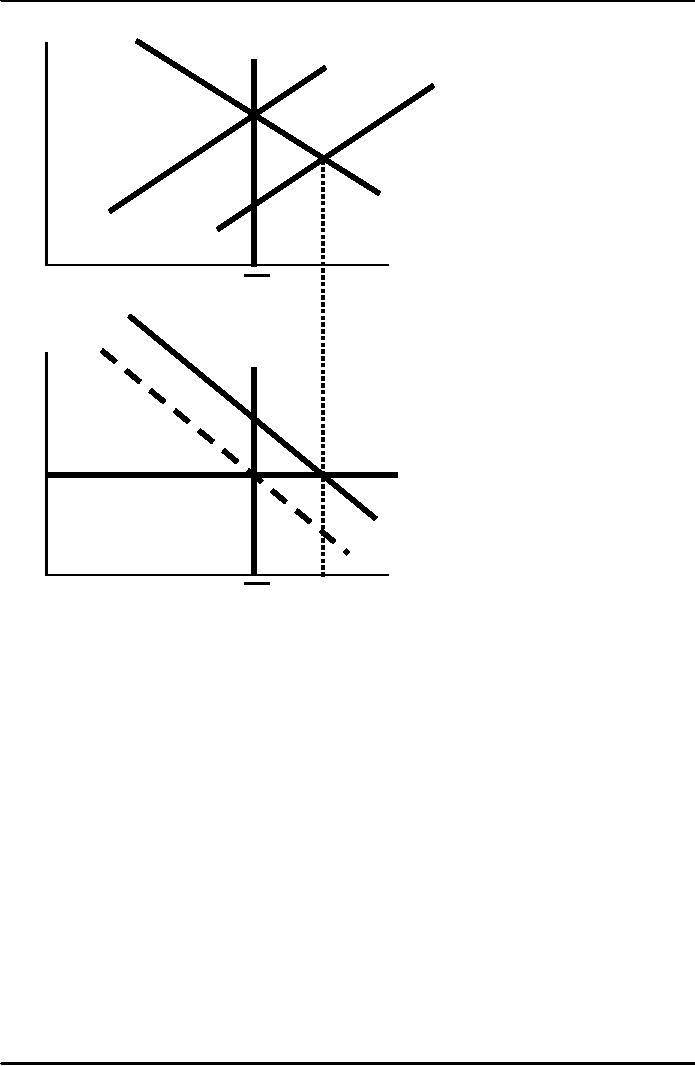

This

process continues until

economy reaches a long-run

equilibrium with Y = Y.

136

Macroeconomics

ECO 403

VU

r

LRAS

LM(P1)

LM(P2)

IS1

IS2

Y

Y

P

LRAS

SRAS1

P1

SRAS2

P2

AD1

AD2

Y

Y

Short

Run Impacts

Now

it's time to determine the

effects on the variables in

the economy.

Y

+,

because Y moved

P

0,

because prices are sticky in

the SR.

+,

because a +ΔY leads to a

rise in r as IS slides along

the LM curve.

r

+,

because a + ΔY increases

the level of consumption (↑C=C(↑Y-T)).

C

I

, since r increased, the

level of investment

decreased.

Long

Run Impacts

Y

0,

because rising P shifts LM to

left, returning Y to Y* as required by

long-run LRAS.

P

+,

in order to eliminate the

excess demand at P0.

+,

reflecting the leftward

shift in LM due to + ΔP

r

C

0,

since both Y and T are

back to their initial levels

(C=C(Y-T))

, since r has risen

even more due to the +

ΔP.

I

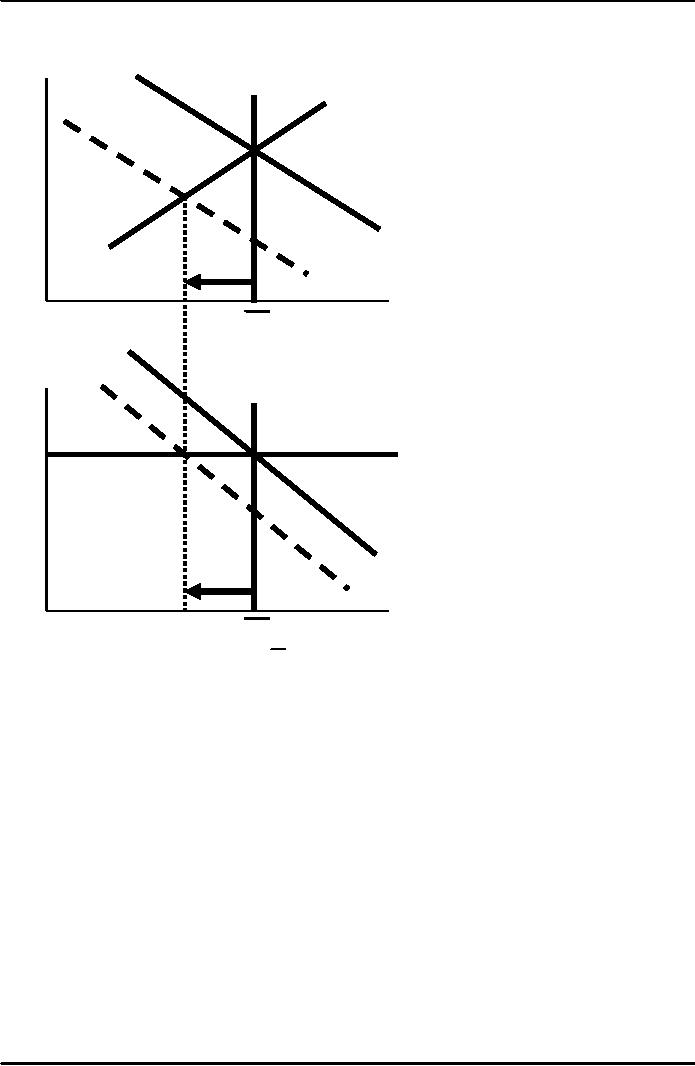

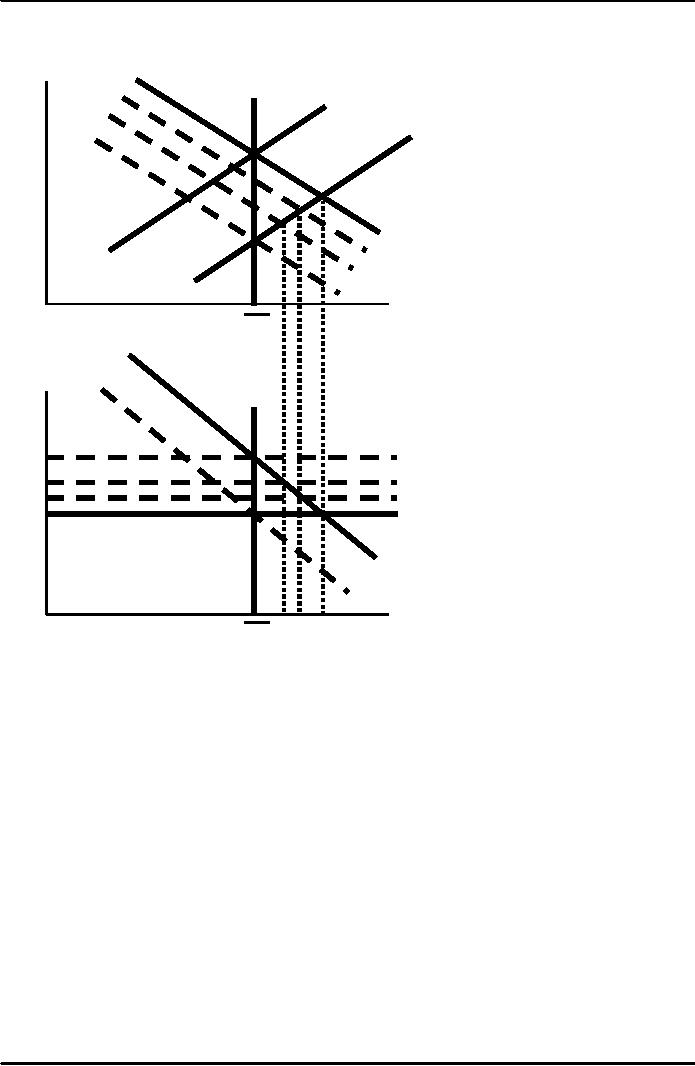

Analyze

SR & LR effects of ΔM

�

We

Have IS-LM and AD-AS

diagrams as shown

here.

�

Suppose

central bank increases

M.

137

Macroeconomics

ECO 403

VU

LM(M1/P1)

r

LRAS

LM(M2/P1)

IS1

Y

Y

P

LRAS

SRAS1

P1

AD2

AD1

Y

Y

138

Macroeconomics

ECO 403

VU

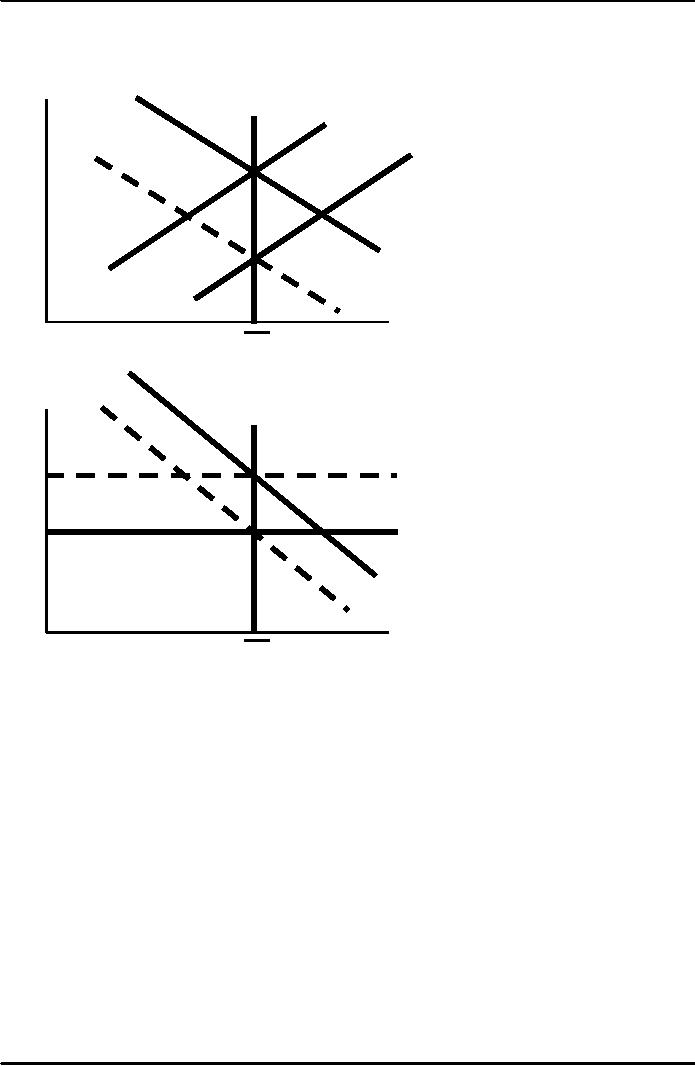

�

The

Graph below Shows the

Short run effects of the

change in M and what happens

in

the

transition from the short

run to the long

run.

LM(M1/P1)

r

LRAS

LM(M2/P1)

IS1

IS2

Y

Y

P

LRAS

SRAS2

P1

SRAS1

AD2

AD1

Y

Y

139

Macroeconomics

ECO 403

VU

�

The

new long-run equilibrium

values of the endogenous

variables as compared to

their

initial

values

LM(M1/P1)

r

LRAS

LM(M2/P1)

IS1

IS2

Y

Y

P

LRAS

SRAS2

P1

SRAS1

AD2

AD1

Y

Y

Short

Run Impacts

Now

it's time to determine the

effects on the variables in

the economy.

Y

+,

because Y moved

P

0,

because prices are sticky in

the SR.

-,

because a +ΔY leads to a

decrease in r as LM slides along

the IS curve.

r

+,

because a + ΔY increases

the level of consumption (↑C=C(↑Y-T)).

C

I

+

, since r decreased, the

level of investment

increased.

Long

Run Impacts

Y

0,

because rising P shifts LM to

left, returning Y to Y* as required by

long-run LRAS.

P

+,

in order to eliminate the

excess demand at P0.

0,

reflecting the leftward

shift in LM due to + ΔP restoring r to

its original level

r

C

0,

since both Y and T are

back to their initial levels

(C=C(Y-T))

I

0

, since Y or r has not changed.

Notice

that the only LR impact of

an increase in the money

supply was an increase in the

price

level.

140

Table of Contents:

- INTRODUCTION:COURSE DESCRIPTION, TEN PRINCIPLES OF ECONOMICS

- PRINCIPLE OF MACROECONOMICS:People Face Tradeoffs

- IMPORTANCE OF MACROECONOMICS:Interest rates and rental payments

- THE DATA OF MACROECONOMICS:Rules for computing GDP

- THE DATA OF MACROECONOMICS (Continued…):Components of Expenditures

- THE DATA OF MACROECONOMICS (Continued…):How to construct the CPI

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- MONEY AND INFLATION:The Quantity Equation, Inflation and interest rates

- MONEY AND INFLATION (Continued…):Money demand and the nominal interest rate

- MONEY AND INFLATION (Continued…):Costs of expected inflation:

- MONEY AND INFLATION (Continued…):The Classical Dichotomy

- OPEN ECONOMY:Three experiments, The nominal exchange rate

- OPEN ECONOMY (Continued…):The Determinants of the Nominal Exchange Rate

- OPEN ECONOMY (Continued…):A first model of the natural rate

- ISSUES IN UNEMPLOYMENT:Public Policy and Job Search

- ECONOMIC GROWTH:THE SOLOW MODEL, Saving and investment

- ECONOMIC GROWTH (Continued…):The Steady State

- ECONOMIC GROWTH (Continued…):The Golden Rule Capital Stock

- ECONOMIC GROWTH (Continued…):The Golden Rule, Policies to promote growth

- ECONOMIC GROWTH (Continued…):Possible problems with industrial policy

- AGGREGATE DEMAND AND AGGREGATE SUPPLY:When prices are sticky

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND IN THE OPEN ECONOMY:Lessons about fiscal policy

- AGGREGATE DEMAND IN THE OPEN ECONOMY(Continued…):Fixed exchange rates

- AGGREGATE DEMAND IN THE OPEN ECONOMY (Continued…):Why income might not rise

- AGGREGATE SUPPLY:The sticky-price model

- AGGREGATE SUPPLY (Continued…):Deriving the Phillips Curve from SRAS

- GOVERNMENT DEBT:Permanent Debt, Floating Debt, Unfunded Debts

- GOVERNMENT DEBT (Continued…):Starting with too little capital,

- CONSUMPTION:Secular Stagnation and Simon Kuznets

- CONSUMPTION (Continued…):Consumer Preferences, Constraints on Borrowings

- CONSUMPTION (Continued…):The Life-cycle Consumption Function

- INVESTMENT:The Rental Price of Capital, The Cost of Capital

- INVESTMENT (Continued…):The Determinants of Investment

- INVESTMENT (Continued…):Financing Constraints, Residential Investment

- INVESTMENT (Continued…):Inventories and the Real Interest Rate

- MONEY:Money Supply, Fractional Reserve Banking,

- MONEY (Continued…):Three Instruments of Money Supply, Money Demand