|

AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…) |

| << AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…) |

| AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…) >> |

Macroeconomics

ECO 403

VU

LESSON

28

AGGREGATE

DEMAND AND AGGREGATE SUPPLY

(Continued...)

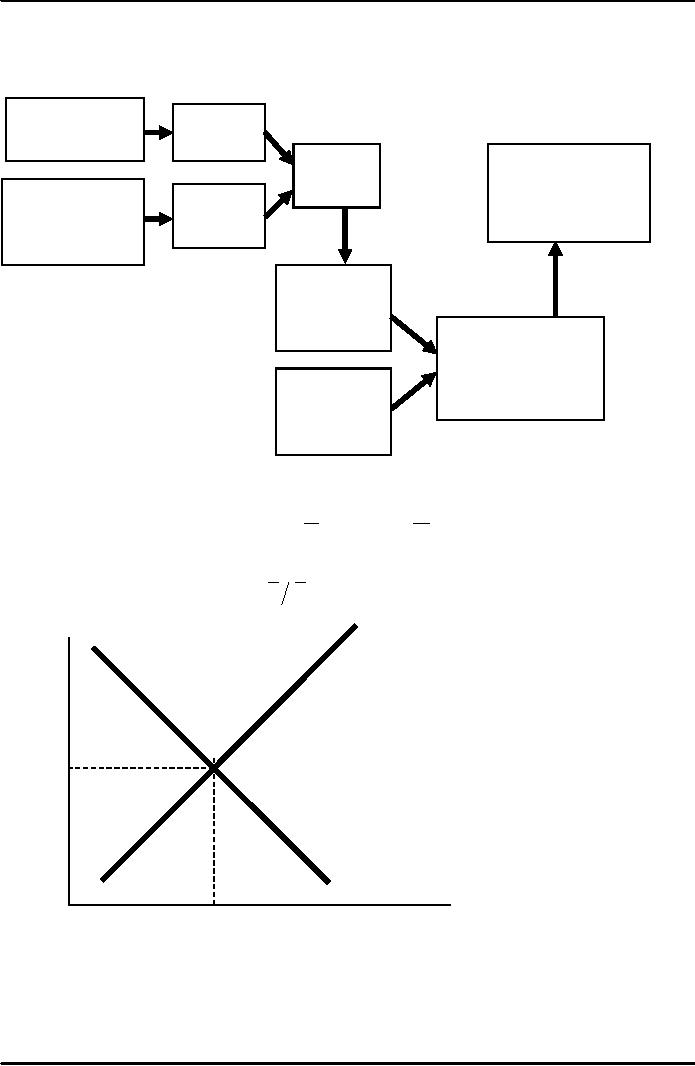

The

Big Picture

Keynesian

IS

Cross

curve

Explanation

of

IS-LM

model

short-run

Theory

of

fluctuations

LM

curve

Liquidity

Preference

Aggregate.

demand

curve

Model

of aggregate

demand

and

aggregate

supply

Aggregate.

supply

curve

Equilibrium

in the IS-LM

Model

The

IS curve represents equilibrium in

the goods market.

Y

= C

( -T

) + I

(r )

+ G

Y

The

LM curve

represents money market

equilibrium

M

P = L

(r ,Y

)

LM

r

r1

IS

Y

Y1

The

intersection determines the

unique combination of Y and r

that satisfies equilibrium in

both

markets.

122

Macroeconomics

ECO 403

VU

Policy

analysis with the IS-LM

Model

Policymakers

can affect macroeconomic

variables with

�

fiscal

policy: G

and/or

T

�

monetary

policy: M

We

can use the IS-LM

model

to analyze the effects of

these policies.

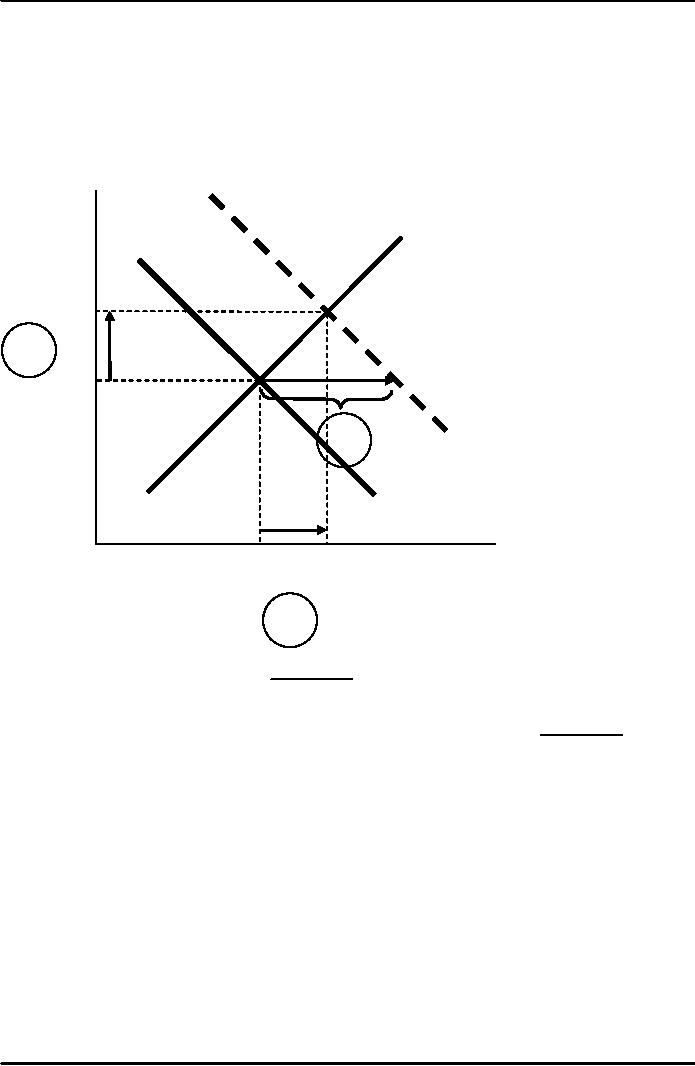

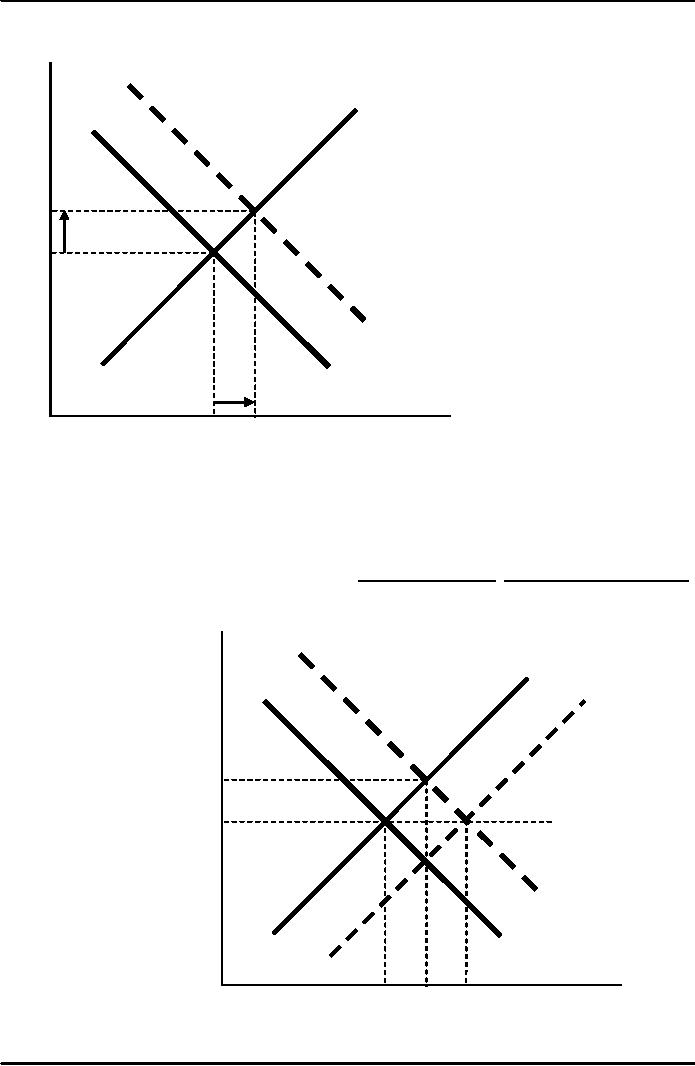

An

increase in government

purchases

r

LM

r2

2.

r1

1.

IS2

IS1

Y

Y1

Y2

3.

1

ΔG, causing

output & income to

rise.

(1-MPC)

1.

IS curve

shifts right by

1

2.

This raises money demand,

causing the interest rate to

rise

(1-MPC)

ΔG.

3.

...which reduces investment, so

the final increase in Y is

smaller than

123

Macroeconomics

ECO 403

VU

A

tax cut

r

LM

r2

2.

r1

1.

IS2

IS1

Y

Y1

Y2

2.

Because

consumers save (1-MPC) of

the tax cut, the

initial boost in spending is

smaller for ΔT

than

for an equal ΔG...

and the IS

curve

shifts by

1

ΔT

1.

(1-MPC)

2.

...so the effects on r and Y

are smaller for a ΔT than

for an equal ΔG.

124

Macroeconomics

ECO 403

VU

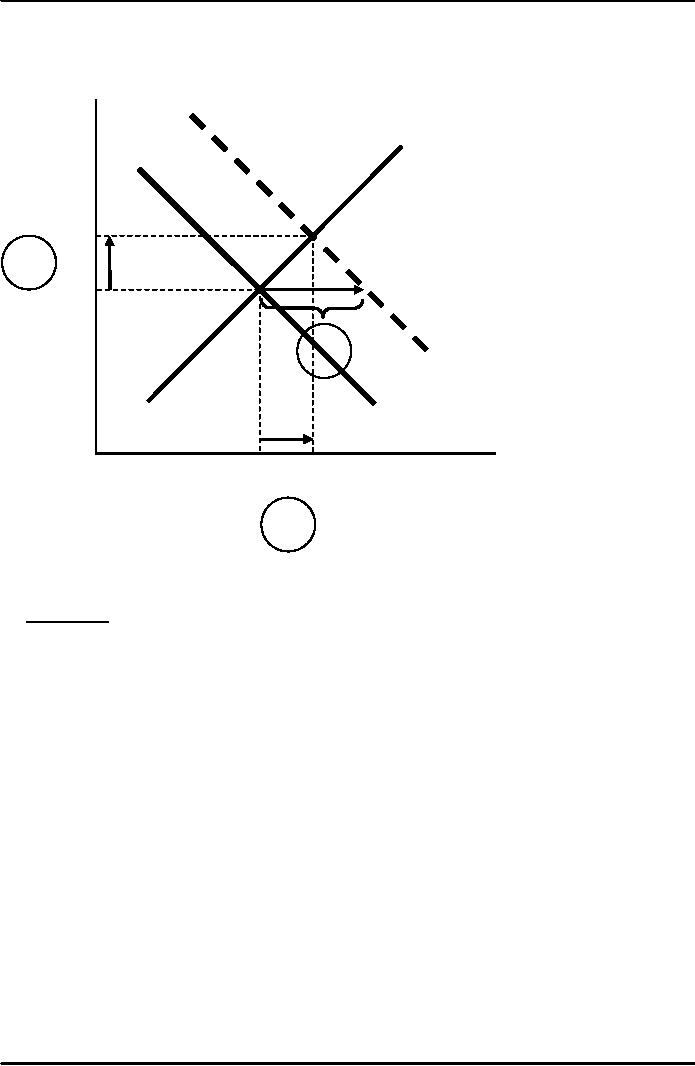

Monetary

Policy: an increase in M

r

LM1

LM2

r1

r2

IS

Y

Y2

Y1

1.

ΔM

>

0 shifts the LM

curve

down (or to the

right)

2.

...causing the interest rate

to fall

3.

...this increases investment,

causing output & income to

rise.

Interaction

between monetary & fiscal

policy

�

Model:

monetary

& fiscal policy variables

(M,

G and

T ) are exogenous

�

Real

world:

Monetary

policymakers may adjust M in

response to changes in fiscal

policy, or vice

versa.

�

Such

interaction may alter the

impact of the original

policy change.

Central

Bank's response to ΔG >

0

�

Suppose

Government increases G.

�

Possible

central bank

responses:

1.

Hold M constant

2.

Hold r constant

3. Hold

Y constant

�

In

each case, the effects of

the ΔG are

different:

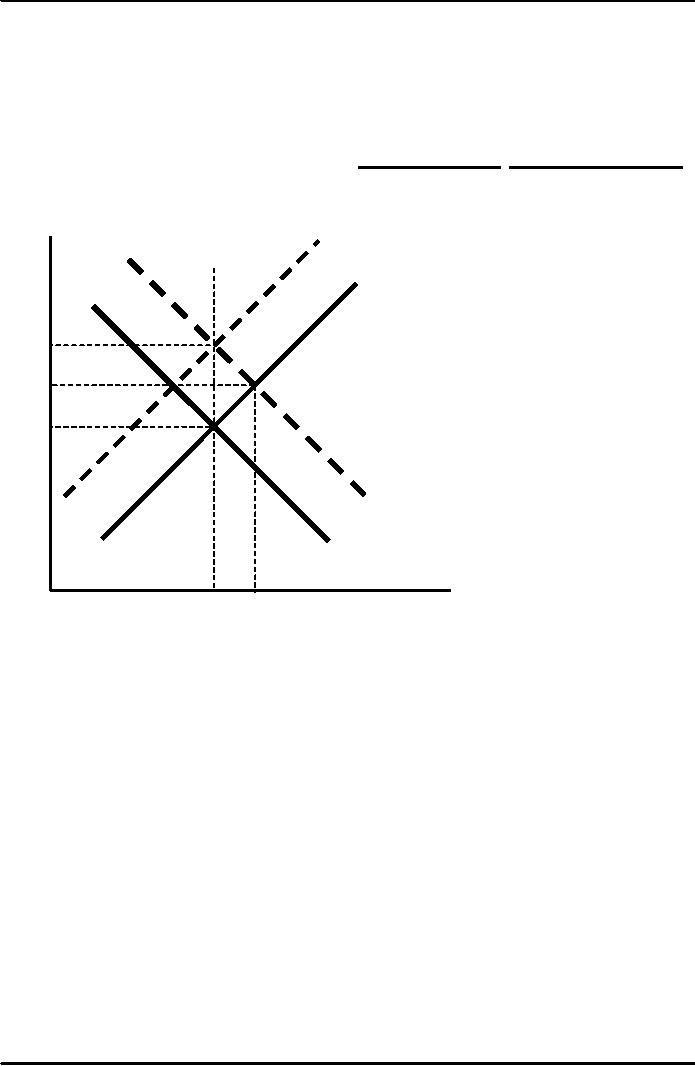

Response

1: hold M

constant

If

Government raises G,

the IS

curve

shifts right. If central

bank holds M constant, then

LM

curve

doesn't shift.

125

Macroeconomics

ECO 403

VU

r

LM1

r2

r1

IS2

IS1

Y

Y1

Y2

Results:

Δr

= r2 -

r1

ΔY

= Y

2 -

Y1

Response

2A: hold r

constant

If

Government raises G,

the IS

curve

shifts right. To keep

r

constant,

central bank increases

M

r

LM1

LM2

r2

r1

IS2

IS1

Y

Y1

Y2

Y3

to

shift LM

curve

right.

126

Macroeconomics

ECO 403

VU

ΔY

= Y

3 -

Y1

Δr

= 0

Results:

Response2B:

hold Y

constant

If

Government raises G, the

IS curve

shifts right. To keep Y

constant, central Bank

reduces M

to

shift LM

curve

left.

r

LM2

LM1

r3

r2

r1

IS2

IS1

Y

Y1

Y2

ΔY

= 0

Δr

= r3 -

r1

Results:

Shocks

in the IS-LM

Model

IS

shocks: exogenous

changes in the demand for

goods & services.

Examples:

�

Stock

market boom or crash

⇒

change in

households' wealth

⇒

ΔC

�

Change

in business or consumer

confidence

or expectations

⇒

ΔI

and/or

ΔC

127

Macroeconomics

ECO 403

VU

LM

shocks:

exogenous

changes in the demand for

money.

Examples:

�

A

wave of credit card fraud

increases demand for

money

�

More

ATMs or the Internet reduce

money demand

Analyzing

shocks with the IS-LM

model

Use

the IS-LM

model to

analyze the effects

of

A

boom in the stock market

makes consumers

wealthier.

After

a wave of credit card fraud,

consumers use cash more

frequently in transactions.

For

each shock,

Use

the IS-LM

diagram

to show the effects of the

shock on Y

and

r.

Determine

what happens to C,

I,

and the unemployment

rate.

What

is the central bank's policy

instrument?

�

What

the newspaper says:

"The

central bank lowered

interest rates by one-half

point today"

�

What

actually happened:

The

central bank conducted

expansionary monetary policy to

shift the LM curve to

the

right

until the interest rate

fell 0.5 points.

�

The

central bank targets the

discount rate: it announces a

target value, and

uses

monetary

policy to shift the LM curve

as needed to attain its

target rate.

Why

does the central bank

target interest rates

instead of the money

supply?

1)

They

are easier to measure than

the money supply

2)

The

central bank might believe

that LM shocks are more

prevalent than IS

shocks.

If

so, then targeting the

interest rate stabilizes

income better than targeting

the

money

supply.

IS-LM

and Aggregate

Demand

�

So

far, we've been using

the IS-LM

model

to analyze the short run,

when the price

level

is assumed fixed.

�

However, a

change in P would shift the

LM curve

and therefore affect

Y.

�

The

aggregate demand curve

captures this relationship

between P and Y

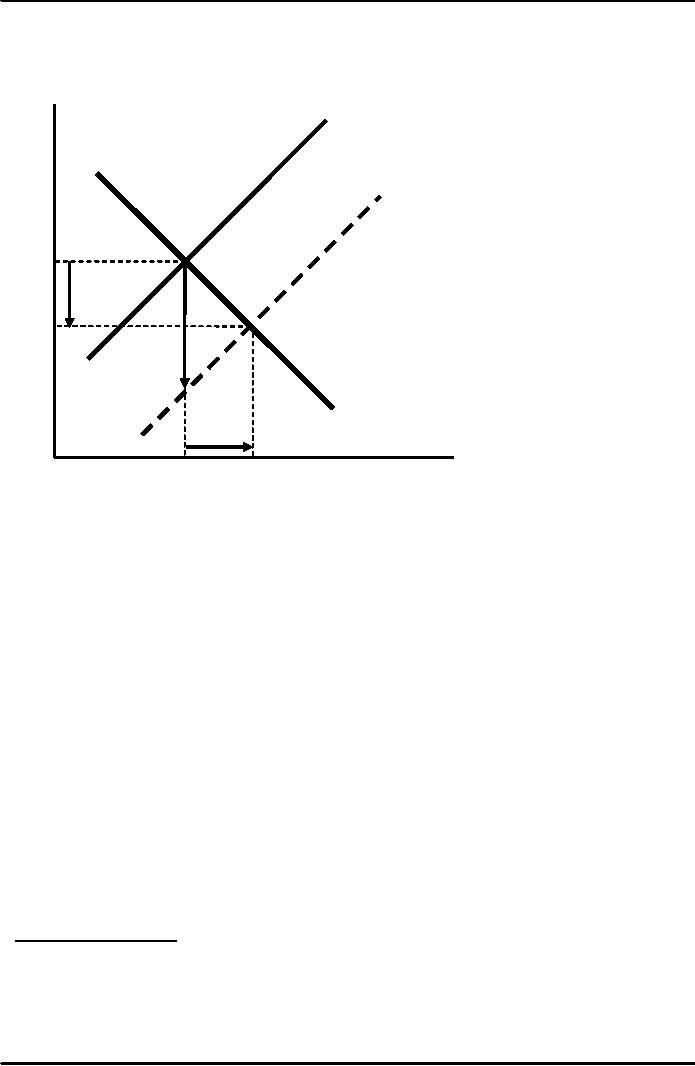

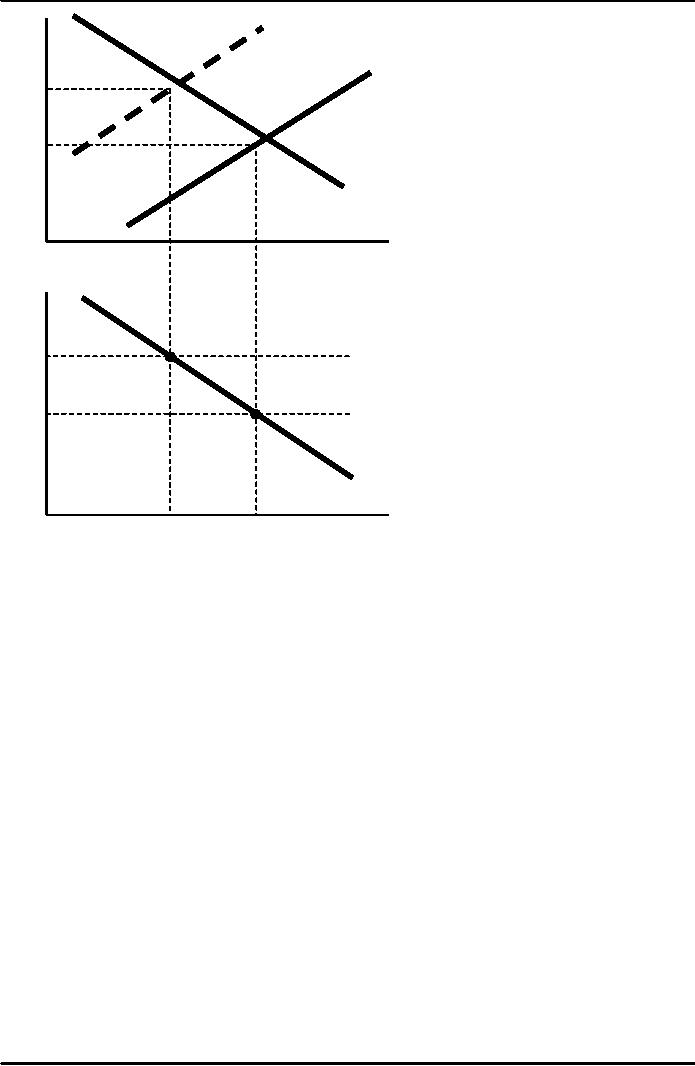

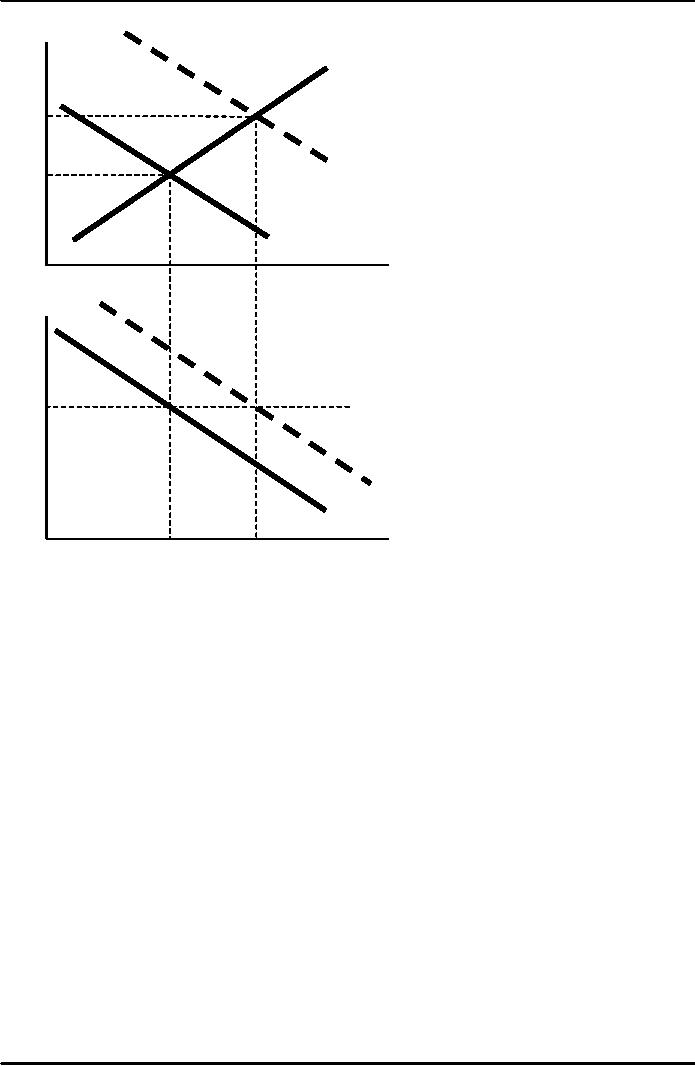

Deriving

the AD

curve

Intuition

for slope of AD

curve:

↑P

⇒

↓(M/P)

⇒

LM shifts

left

⇒

↑r

⇒

↓I

⇒

↓Y

128

Macroeconomics

ECO 403

VU

LM

(P2)

r

LM

(P1)

r2

r1

IS

Y1

Y

Y2

P

P2

P1

AD

Y

Y2

Y1

Monetary

policy and the AD

curve

The

central bank can increase

aggregate demand:

↑M ⇒

LM shifts

right

⇒

↓r

⇒

↑I

⇒

↑Y at

each value of P

129

Macroeconomics

ECO 403

VU

LM

(M1/P1)

r

LM

(M2/P1)

r1

r2

IS

Y2

Y

Y1

P

P1

AD2

AD1

Y

Y1

Y2

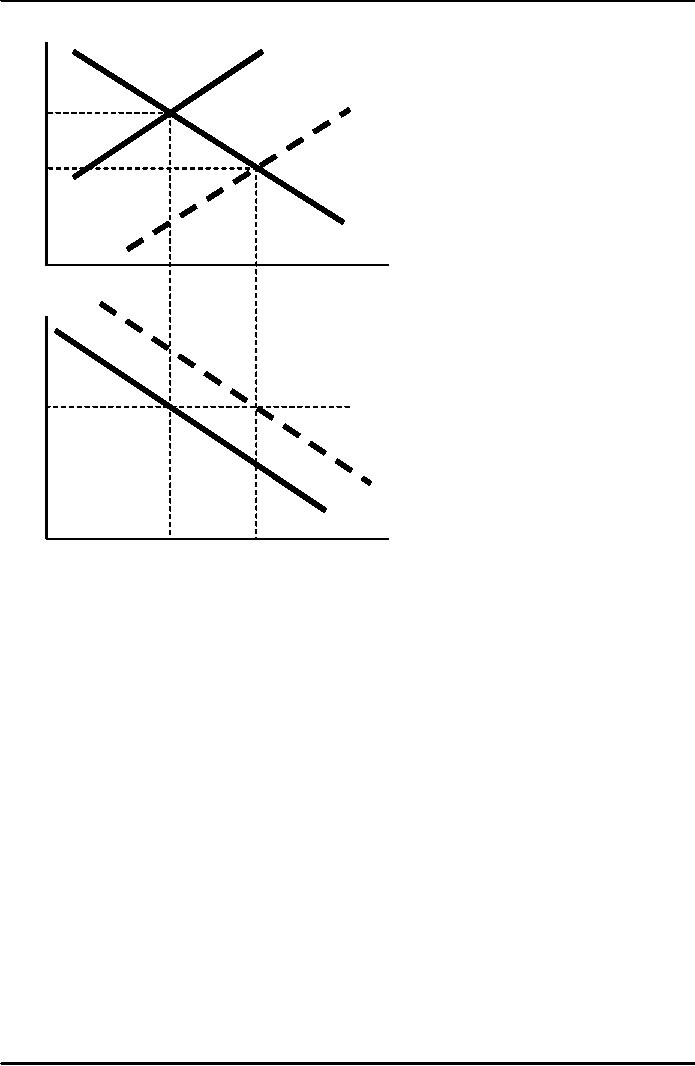

Fiscal

policy and the AD

curve

Expansionary

fiscal policy (↑G and/or

↓T)

increases

aggregate demand:

↓T ⇒

↑C

⇒

IS

shifts right

⇒

↑Y at

each value of P

130

Macroeconomics

ECO 403

VU

r

LM

r2

r1

IS2

IS1

Y

Y2

Y1

P

P1

AD2

AD1

Y

Y2

Y1

131

Table of Contents:

- INTRODUCTION:COURSE DESCRIPTION, TEN PRINCIPLES OF ECONOMICS

- PRINCIPLE OF MACROECONOMICS:People Face Tradeoffs

- IMPORTANCE OF MACROECONOMICS:Interest rates and rental payments

- THE DATA OF MACROECONOMICS:Rules for computing GDP

- THE DATA OF MACROECONOMICS (Continued…):Components of Expenditures

- THE DATA OF MACROECONOMICS (Continued…):How to construct the CPI

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- MONEY AND INFLATION:The Quantity Equation, Inflation and interest rates

- MONEY AND INFLATION (Continued…):Money demand and the nominal interest rate

- MONEY AND INFLATION (Continued…):Costs of expected inflation:

- MONEY AND INFLATION (Continued…):The Classical Dichotomy

- OPEN ECONOMY:Three experiments, The nominal exchange rate

- OPEN ECONOMY (Continued…):The Determinants of the Nominal Exchange Rate

- OPEN ECONOMY (Continued…):A first model of the natural rate

- ISSUES IN UNEMPLOYMENT:Public Policy and Job Search

- ECONOMIC GROWTH:THE SOLOW MODEL, Saving and investment

- ECONOMIC GROWTH (Continued…):The Steady State

- ECONOMIC GROWTH (Continued…):The Golden Rule Capital Stock

- ECONOMIC GROWTH (Continued…):The Golden Rule, Policies to promote growth

- ECONOMIC GROWTH (Continued…):Possible problems with industrial policy

- AGGREGATE DEMAND AND AGGREGATE SUPPLY:When prices are sticky

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND IN THE OPEN ECONOMY:Lessons about fiscal policy

- AGGREGATE DEMAND IN THE OPEN ECONOMY(Continued…):Fixed exchange rates

- AGGREGATE DEMAND IN THE OPEN ECONOMY (Continued…):Why income might not rise

- AGGREGATE SUPPLY:The sticky-price model

- AGGREGATE SUPPLY (Continued…):Deriving the Phillips Curve from SRAS

- GOVERNMENT DEBT:Permanent Debt, Floating Debt, Unfunded Debts

- GOVERNMENT DEBT (Continued…):Starting with too little capital,

- CONSUMPTION:Secular Stagnation and Simon Kuznets

- CONSUMPTION (Continued…):Consumer Preferences, Constraints on Borrowings

- CONSUMPTION (Continued…):The Life-cycle Consumption Function

- INVESTMENT:The Rental Price of Capital, The Cost of Capital

- INVESTMENT (Continued…):The Determinants of Investment

- INVESTMENT (Continued…):Financing Constraints, Residential Investment

- INVESTMENT (Continued…):Inventories and the Real Interest Rate

- MONEY:Money Supply, Fractional Reserve Banking,

- MONEY (Continued…):Three Instruments of Money Supply, Money Demand