|

AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…) |

| << AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…): |

| AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…) >> |

Macroeconomics

ECO 403

VU

LESSON

27

AGGREGATE

DEMAND AND AGGREGATE SUPPLY

(Continued...)

Understanding

the IS

curve's

slope

�

The

IS curve is negatively

sloped.

�

Intuition:

A

fall in the interest rate

motivates firms to increase

investment spending, which

drives up

total

planned spending (E ).

To

restore equilibrium in the

goods market, output (actual

expenditure, Y) must

increase.

The

IS curve and the Loanable

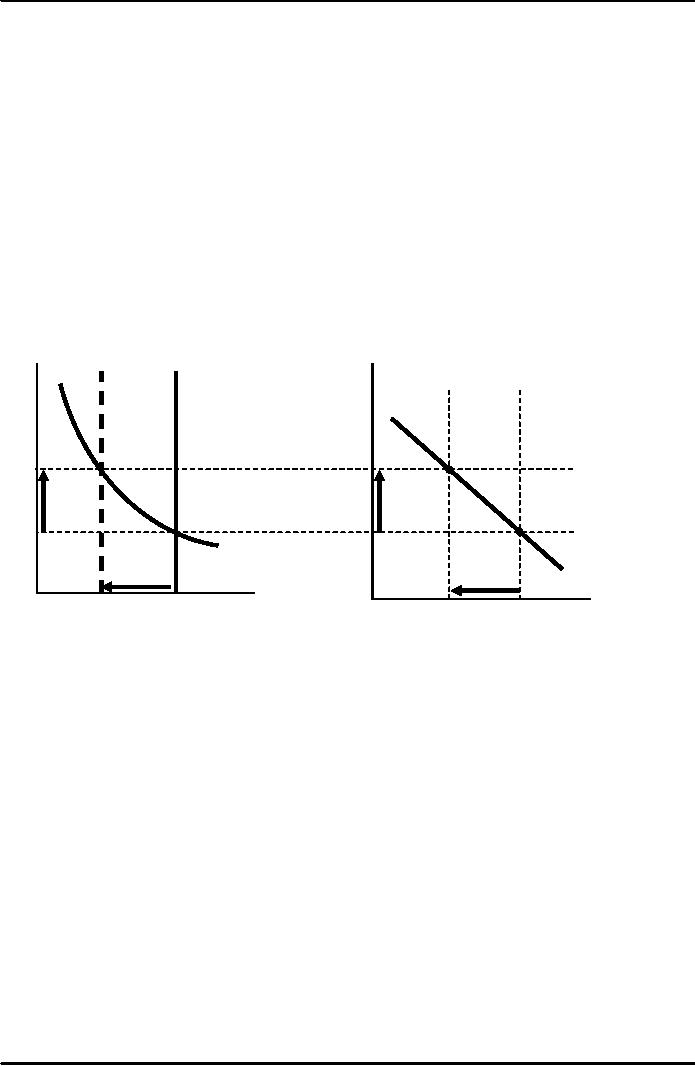

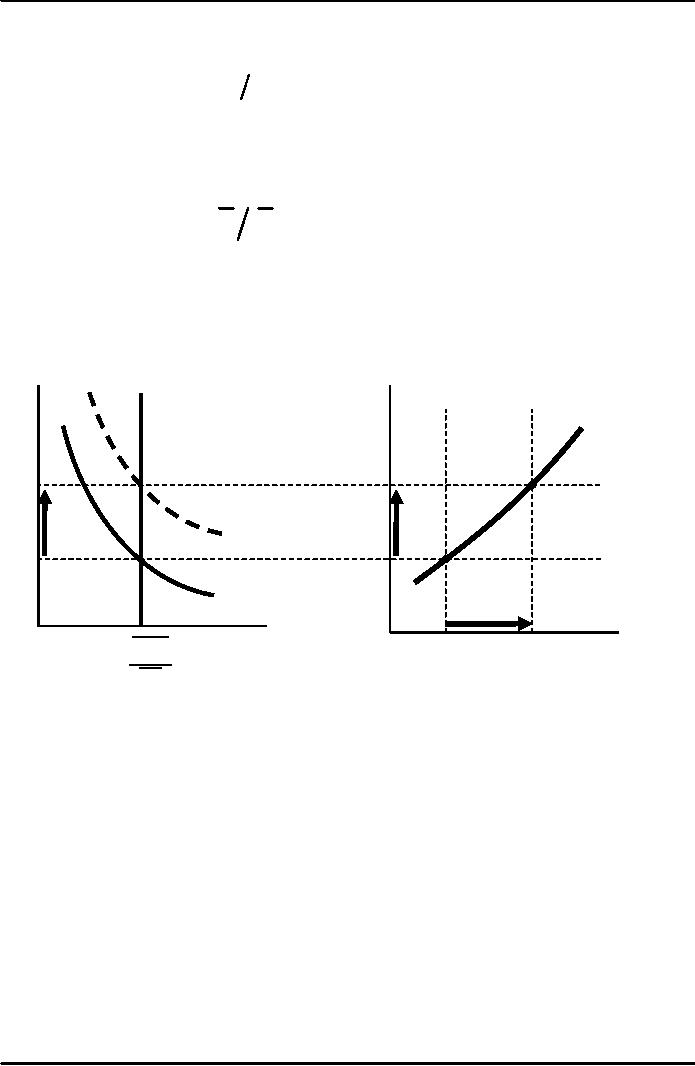

Funds model

(a)

The

L.F. model

(b)

The IS

curve

r

r

S2

S1

r2

r2

r1

r1

I

(r)

IS

Y

S,

I

Y2

Y1

Fiscal

Policy and the IS

curve

�

We

can use the IS-LM

model to see how fiscal

policy (G and T) can affect

aggregate

demand

and output.

�

Let's

start by using the Keynesian

Cross to see how fiscal

policy shifts the IS

curve...

115

Macroeconomics

ECO 403

VU

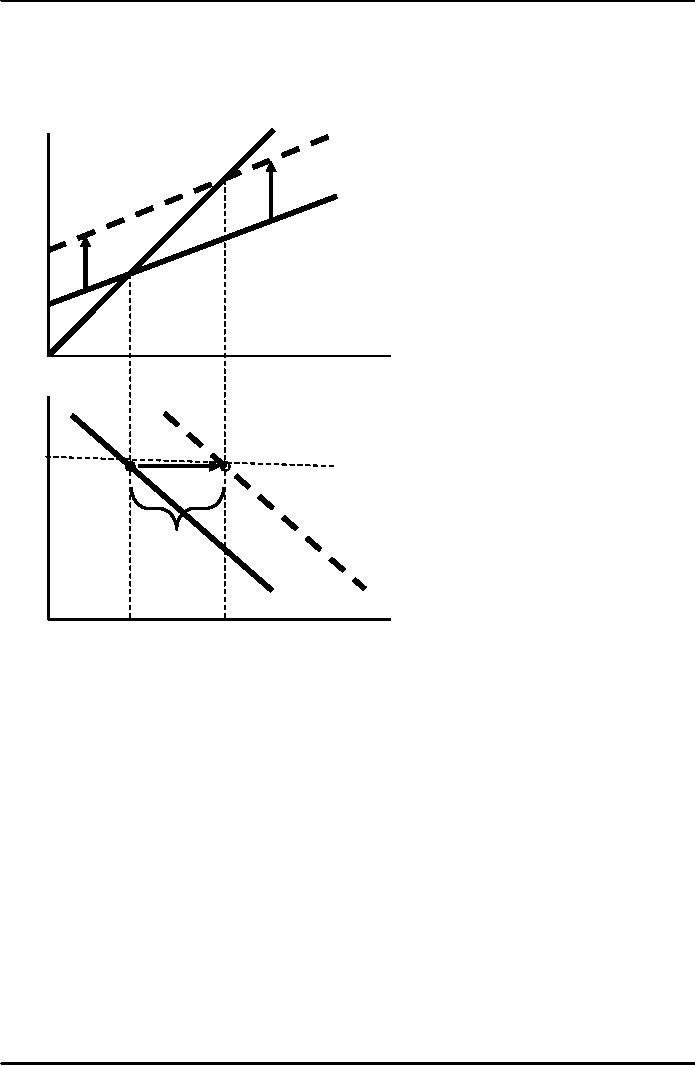

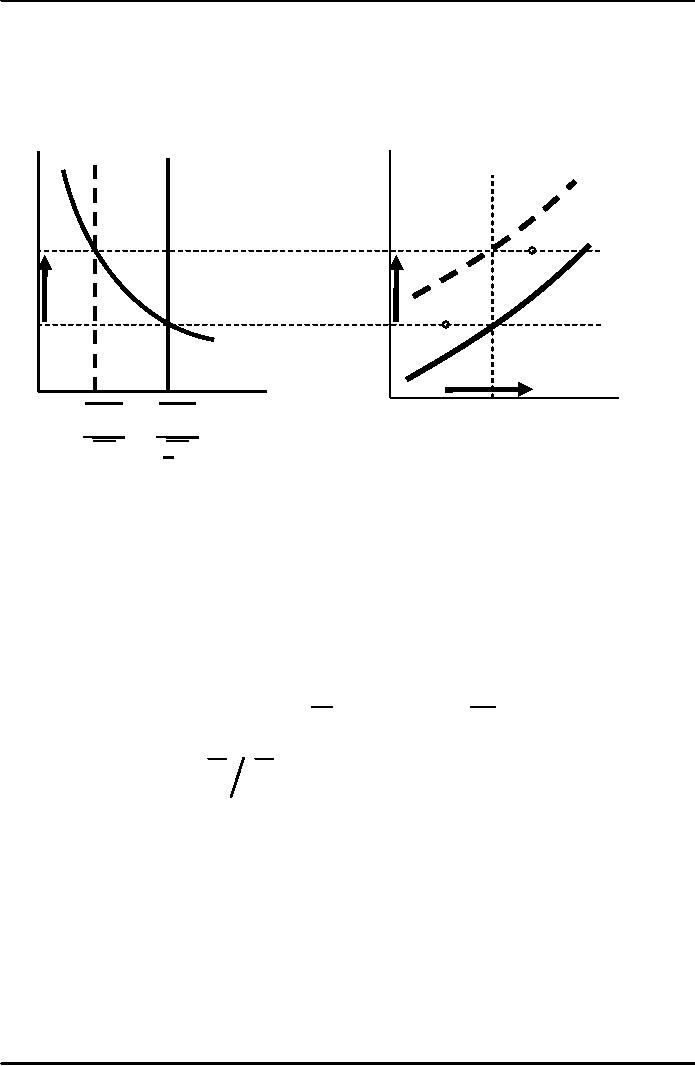

Shifting

the IS

curve:

ΔG

At

any value of r, ↑G ⇒

↑E ⇒ ↑Y ...so the IS

curve shifts to the

right.

E

=Y

E

E

=C +I (r1 )+G2

E

=C +I (r1 )+G1

Y

Y1

Y2

r

r1

ΔY

IS2

IS1

Y2

Y1

Y

The

Theory of Liquidity

Preference

�

Due

to John Maynard

Keynes.

�

A

simple theory in which the

interest rate is determined by

money supply and

money

demand.

116

Macroeconomics

ECO 403

VU

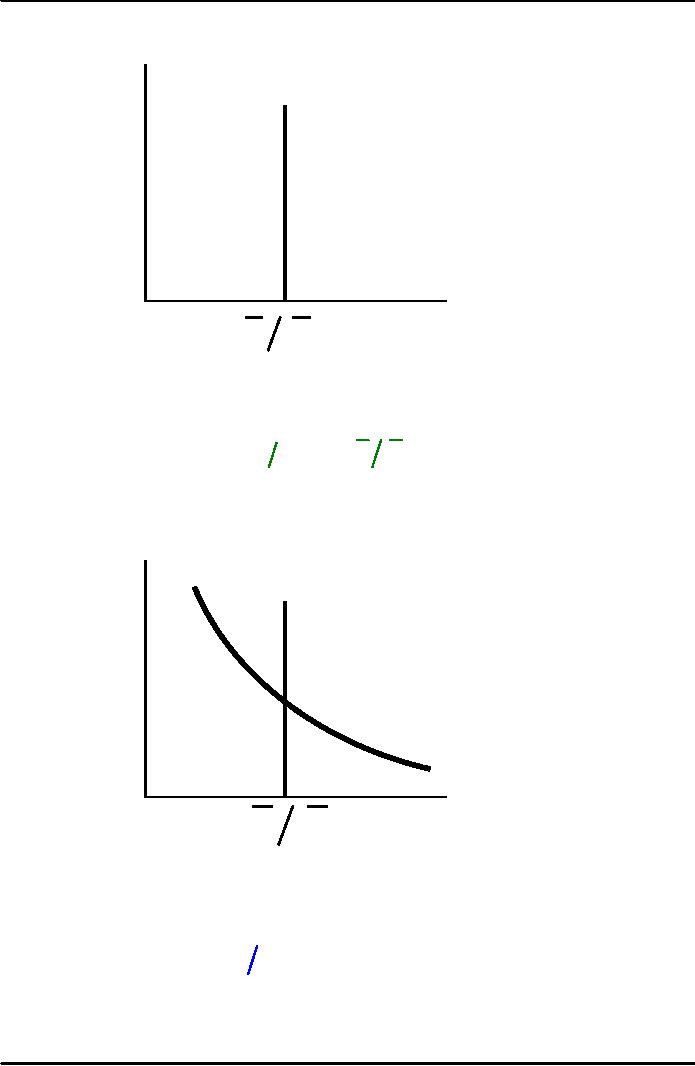

Money

Supply

(M/P)s

r

interest

rate

M/P

M

P

real

money

balances

The

supply of real money

balances is fixed:

(M

P) =M

P

s

Money

Demand

s

(M/P)

r

interest

rate

L

(r)

M/P

M

P

real

money balances

Demand

for real money

balances:

(M

P)

d

=

L

(r

)

117

Macroeconomics

ECO 403

VU

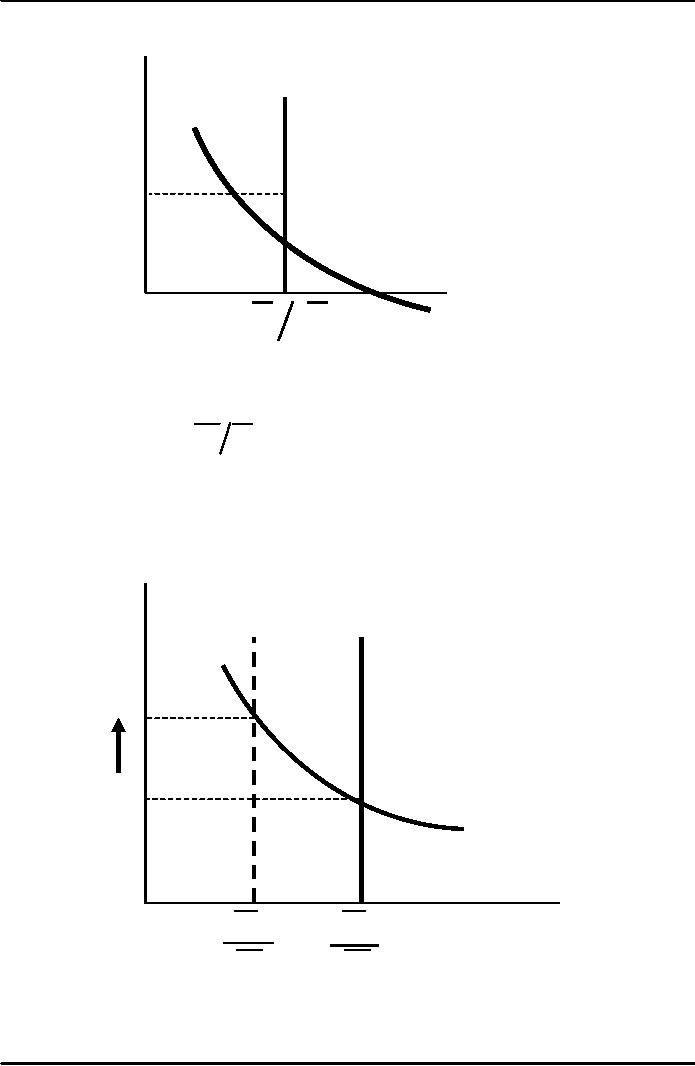

Equilibrium

(M/P)

s

r

interest

rate

r1

L

(r )

M/P

M

P

real

money balances

The

interest rate adjusts to

equate the supply and

demand for money:

M

P = L

(r

)

How

Central bank raises the

interest rate

To

increase r, Central Bank

reduces M

r

interest

rate

r2

L

(r )

r1

M/P

M

M

2

1

real

money

balances

P

P

118

Macroeconomics

ECO 403

VU

The

LM curve

Now

let's put Y back into

the money demand

function:

(M

P)

d

=

L

(r ,Y

)

The

LM curve is a graph of all

combinations of r and Y that

equate the supply and

demand for

real

money balances.

The

equation for the LM curve

is:

M

P = L

(r ,Y

)

Deriving

the LM curve

(a)

The

market for

(b)

The LM curve

real

money balances

r

r

LM

r2

r2

L

(r ,

Y2 )

r1

r1

L

(r ,

Y1 )

Y

M/P

Y1

Y2

M

1

P

Understanding

the LM

curve's

slope

�

The

LM curve is positively

sloped.

�

Intuition:

An increase in income raises

money demand. Since the

supply of real

balances

is

fixed, there is now excess

demand in the money market

at the initial interest

rate.

The

interest rate must rise to

restore equilibrium in the

money market.

119

Macroeconomics

ECO 403

VU

How

ΔM shifts

the LM curve

(a)

The

market for

(b)

The LM curve

real

money balances

r

r

LM2

LM1

r2

r2

r1

r1

L

(r ,

Y1 )

Y

M/P

Y

M

M

2

1

p

p

/

/

Shifting

the LM curve

�

Suppose

a wave of credit card fraud

causes consumers to use cash

more frequently in

transactions.

�

Use

the Liquidity Preference

model to show how these

events shift the LM

curve.

The

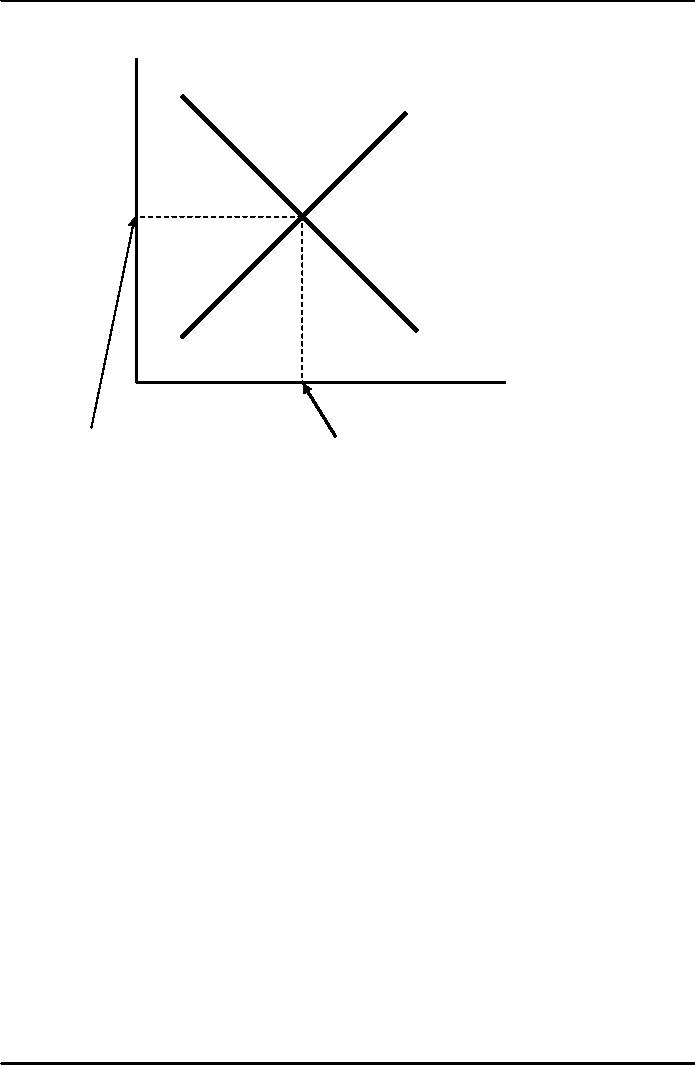

short-run equilibrium

The

short-run equilibrium is the

combination of r and Y that

simultaneously satisfies

the

equilibrium

conditions in the goods &

money markets:

Y

= C

( - T

) + I

(r )

+ G

Y

M

P = L

(r ,Y

)

120

Macroeconomics

ECO 403

VU

r

LM

IS

Y

Equilibrium

interest

Equilibrium

rate

level

of

income

121

Table of Contents:

- INTRODUCTION:COURSE DESCRIPTION, TEN PRINCIPLES OF ECONOMICS

- PRINCIPLE OF MACROECONOMICS:People Face Tradeoffs

- IMPORTANCE OF MACROECONOMICS:Interest rates and rental payments

- THE DATA OF MACROECONOMICS:Rules for computing GDP

- THE DATA OF MACROECONOMICS (Continued…):Components of Expenditures

- THE DATA OF MACROECONOMICS (Continued…):How to construct the CPI

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- MONEY AND INFLATION:The Quantity Equation, Inflation and interest rates

- MONEY AND INFLATION (Continued…):Money demand and the nominal interest rate

- MONEY AND INFLATION (Continued…):Costs of expected inflation:

- MONEY AND INFLATION (Continued…):The Classical Dichotomy

- OPEN ECONOMY:Three experiments, The nominal exchange rate

- OPEN ECONOMY (Continued…):The Determinants of the Nominal Exchange Rate

- OPEN ECONOMY (Continued…):A first model of the natural rate

- ISSUES IN UNEMPLOYMENT:Public Policy and Job Search

- ECONOMIC GROWTH:THE SOLOW MODEL, Saving and investment

- ECONOMIC GROWTH (Continued…):The Steady State

- ECONOMIC GROWTH (Continued…):The Golden Rule Capital Stock

- ECONOMIC GROWTH (Continued…):The Golden Rule, Policies to promote growth

- ECONOMIC GROWTH (Continued…):Possible problems with industrial policy

- AGGREGATE DEMAND AND AGGREGATE SUPPLY:When prices are sticky

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND IN THE OPEN ECONOMY:Lessons about fiscal policy

- AGGREGATE DEMAND IN THE OPEN ECONOMY(Continued…):Fixed exchange rates

- AGGREGATE DEMAND IN THE OPEN ECONOMY (Continued…):Why income might not rise

- AGGREGATE SUPPLY:The sticky-price model

- AGGREGATE SUPPLY (Continued…):Deriving the Phillips Curve from SRAS

- GOVERNMENT DEBT:Permanent Debt, Floating Debt, Unfunded Debts

- GOVERNMENT DEBT (Continued…):Starting with too little capital,

- CONSUMPTION:Secular Stagnation and Simon Kuznets

- CONSUMPTION (Continued…):Consumer Preferences, Constraints on Borrowings

- CONSUMPTION (Continued…):The Life-cycle Consumption Function

- INVESTMENT:The Rental Price of Capital, The Cost of Capital

- INVESTMENT (Continued…):The Determinants of Investment

- INVESTMENT (Continued…):Financing Constraints, Residential Investment

- INVESTMENT (Continued…):Inventories and the Real Interest Rate

- MONEY:Money Supply, Fractional Reserve Banking,

- MONEY (Continued…):Three Instruments of Money Supply, Money Demand