|

AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…): |

| << AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…): |

| AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…) >> |

Macroeconomics

ECO 403

VU

LESSON

26

AGGREGATE

DEMAND AND AGGREGATE SUPPLY

(Continued...)

Context

�

Model

of aggregate demand & aggregate

supply

�

Long

run

Prices

flexible

Output

determined by factors of production &

technology

Unemployment

equals its natural

rate

�

Short

run

Prices

fixed

Output

determined by aggregate

demand

Unemployment is

negatively related to

output

�

Now,

we develop the IS-LM model,

the theory that yields

the aggregate demand curve.

We

focus

on the short run and

assume the price level is

fixed.

The

Keynesian Cross

�

A

simple closed economy model

in which income is determined by

expenditure.

(due

to J.M. Keynes)

�

Notation:

I

= planned investment

E

= C + I + G

=

planned expenditure

Y

= real GDP = actual

expenditure

�

Difference

between actual & planned

expenditure: unplanned inventory

investment

Elements

of the Keynesian

Cross

C

= C

( -T

)

Y

Consumption

function:

G

= G

, T =T

Govt

policy variables:

For

now, investment is

exogenous:

I

=I

Planned

expenditure:

E

= C

( -T

) + I

+ G

Y

Actual

expenditure =

Planned

expenditure

Equilibrium

condition:

Y

= E

109

Macroeconomics

ECO 403

VU

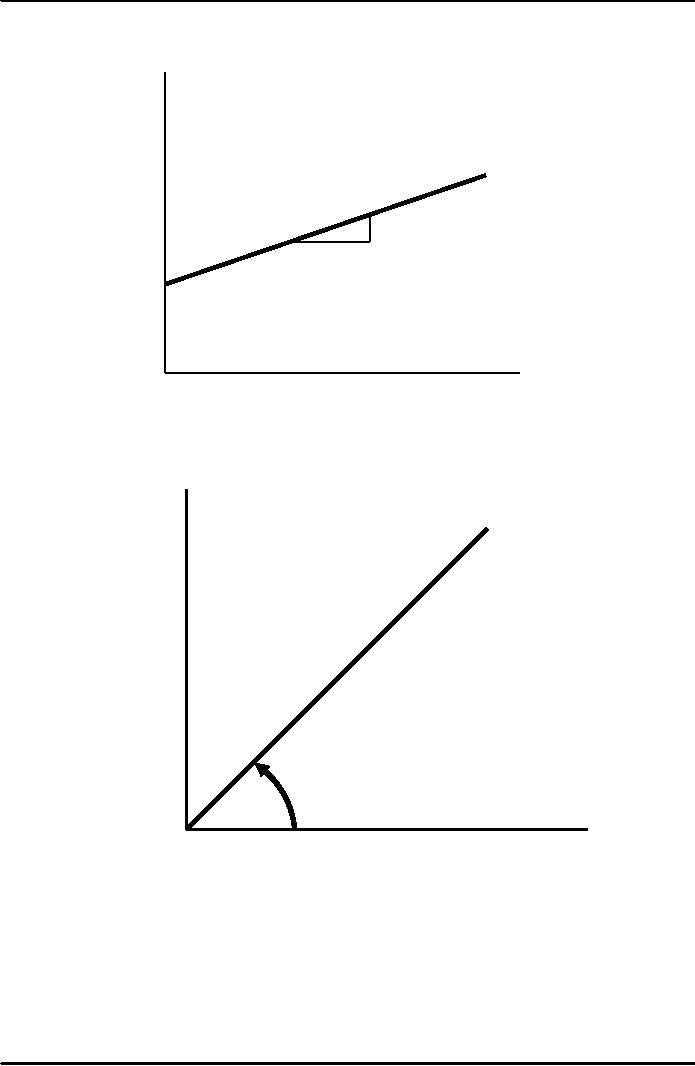

Graphing

planned expenditure

E

Planned

Expenditure

E

=C +I +G

MPC

1

Income,

output, Y

Graphing

the equilibrium

condition

E

E

=Y

Planned

expenditure

45�

Income,

output, Y

110

Macroeconomics

ECO 403

VU

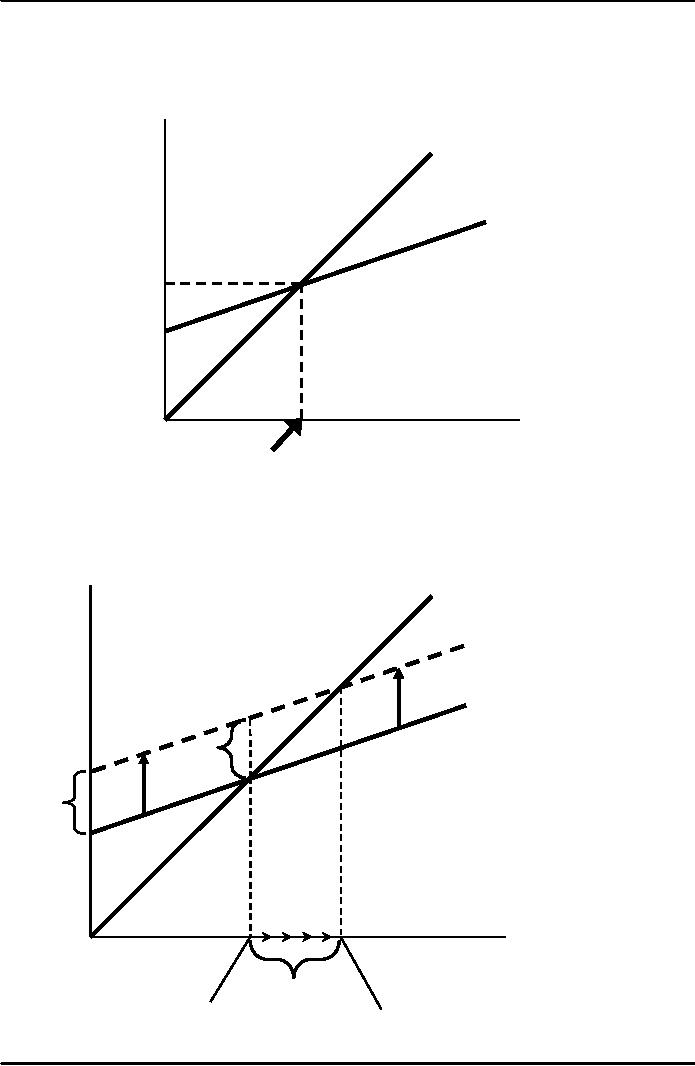

The

equilibrium value of

income

E

E

=Y

Planned

Expenditure

E

=C +I +G

Income,

output, Y

Equilibrium

income

An

increase in government

purchases

E

E

=Y

E

=C +I +G2

E

=C +I +G1

ΔG

Y

ΔY

E1 = Y1

E2 = Y2

111

Macroeconomics

ECO 403

VU

At

Y1,

there is now an unplanned

drop in inventory, so firms

increase output, and income

rises

toward

a new equilibrium

Solving

for ΔY

Y

= C

+ I

+ G

Equilibrium

condition

ΔY

= ΔC

+ ΔI

+ ΔG

In

changes form

ΔC

+

ΔG

Since

I is exogenous

=

=

MPC

�

ΔY

+ ΔG

Because

ΔC =

MPC ΔY

Collect

terms with ΔY on

the left side of the

equals sign:

(1

-

MPC)

�

ΔY

= ΔG

⎛

⎞

1

Finally,

solve for ΔY:

ΔY

= ⎜

⎟

� ΔG

⎝

1

-

MPC

⎠

The

government purchases

multiplier

Example:

MPC = 0.8

1

ΔY

=

ΔG

1

-

MPC

1

1

ΔG

=

ΔG

= 5 ΔG

=

1

-

0.8

0.2

The

increase in G

causes

income to increase by 5 times as

much!

Definition:

the increase in income

resulting from a Re.1

increase in G. In this model,

the G

multiplier

equals

ΔY

1

=

ΔG

1

-

MPC

In

the example with MPC =

0.8,

ΔY

1

=

ΔG

1

-

MPC

Why

the multiplier is greater

than 1

�

ΔY

= ΔG.

Initially,

the increase in G causes an

equal increase in Y:

�

⇒

↑C

But

↑Y

⇒

Further

↑Y

⇒

Further

↑C

⇒

Further

↑Y

�

So

the final impact on income

is much bigger than the

initial ΔG.

112

Macroeconomics

ECO 403

VU

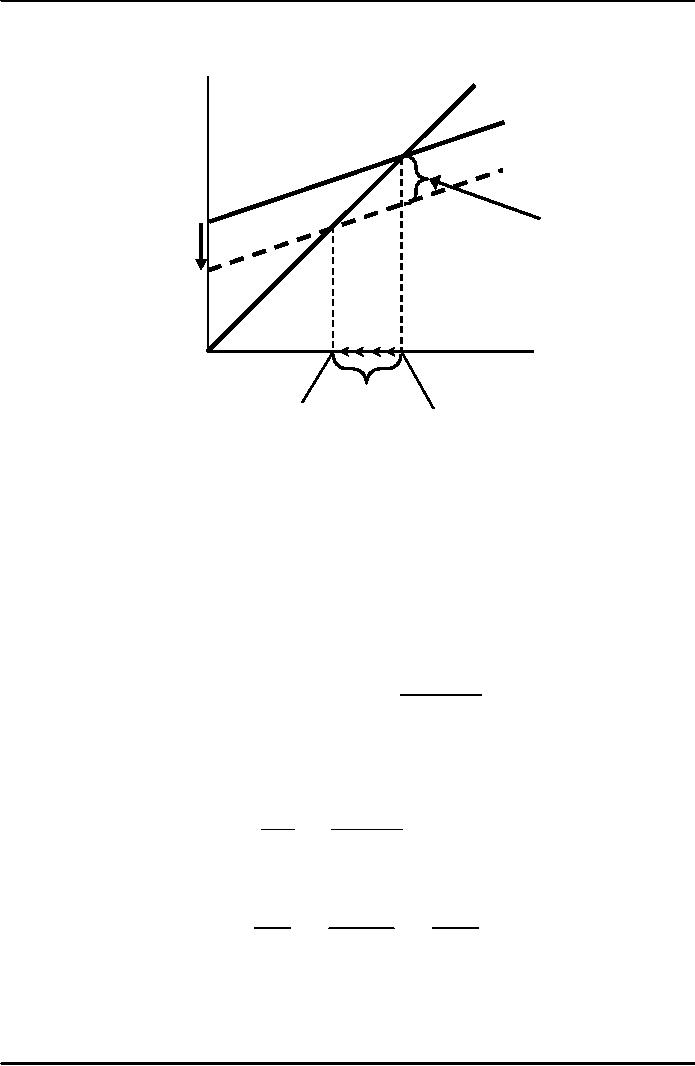

An

increase in taxes

E

E

=Y

E

=C1 +I

+G

E

=C2 +I

+G

At

Y1, there is now

an

ΔC =

-MPC

ΔT

unplanned

inventory

buildup...

Y

ΔY

E2 = Y2

E1 = Y1

Initially,

the tax increase reduces

consumption, and therefore

E:

so firms reduce output,

and

income

falls toward a new

equilibrium

Solving

for ΔY

ΔY

= ΔC

+ ΔI

+ ΔG

Equilibrium

condition in changes

I

and G are exogenous

=

ΔC

=

MPC

�

( ΔY

- ΔT

)

(1

-

MPC)

�

ΔY

= - MPC

�

ΔT

Solving

for ΔY:

⎛

- MPC

⎞

Final

result:

ΔY

= ⎜

⎟

� ΔT

⎝

1

-

MPC

⎠

The

Tax Multiplier

Definition:

the change in income

resulting from a $1 increase in

T:

ΔY

-

MPC

=

ΔT

1

-

MPC

If

MPC = 0.8, then the tax

multiplier equals

ΔY

-

0.8

-

0.8

=

=

=

-4

ΔT

1

-

0.8

0.2

Properties

of Tax Multiplier

1.

Tax multiplier is negative:

A

tax hike reduces consumer

spending, which

reduces

income.

113

Macroeconomics

ECO 403

VU

2.

Tax multiplier is greater

than one (in absolute

value): A change in

taxes has a

multiplier

effect on income.

3.

Tax multiplier is smaller

than the govt. spending

multiplier: Consumers

save the

fraction

(1-MPC) of a tax cut, so the

initial boost in spending

from a tax cut is

smaller

than

from an equal increase in

G.

The

IS curve

Definition:

a

graph of all combinations of r

and Y that result in goods

market equilibrium,

i.e.

actual

expenditure (output) = planned

expenditure

The

equation for the IS curve

is:

Y

= C

( - T

) + I

(r )

+ G

Y

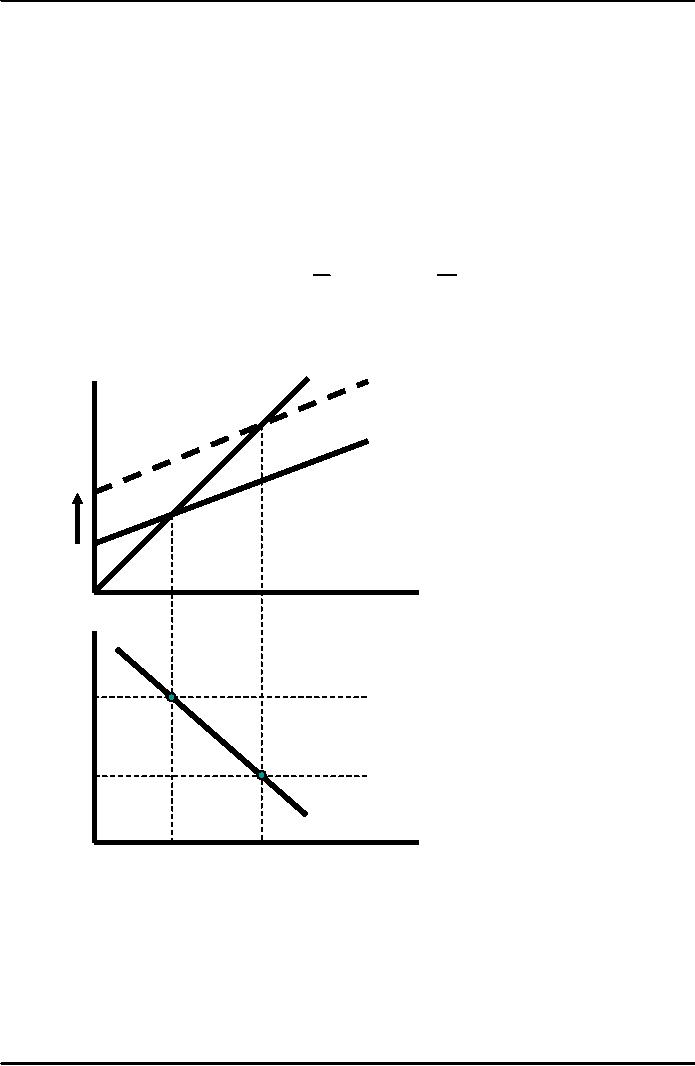

Deriving

the IS

curve

E

=Y

E

E

=C +I (r2 )+G

E

=C +I (r1 )+G

ΔI

Y

Y1

Y2

r

r1

r2

IS

Y1

Y2

Y

↓r

⇒

↑I

⇒

↑E

⇒

↑Y

114

Table of Contents:

- INTRODUCTION:COURSE DESCRIPTION, TEN PRINCIPLES OF ECONOMICS

- PRINCIPLE OF MACROECONOMICS:People Face Tradeoffs

- IMPORTANCE OF MACROECONOMICS:Interest rates and rental payments

- THE DATA OF MACROECONOMICS:Rules for computing GDP

- THE DATA OF MACROECONOMICS (Continued…):Components of Expenditures

- THE DATA OF MACROECONOMICS (Continued…):How to construct the CPI

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- MONEY AND INFLATION:The Quantity Equation, Inflation and interest rates

- MONEY AND INFLATION (Continued…):Money demand and the nominal interest rate

- MONEY AND INFLATION (Continued…):Costs of expected inflation:

- MONEY AND INFLATION (Continued…):The Classical Dichotomy

- OPEN ECONOMY:Three experiments, The nominal exchange rate

- OPEN ECONOMY (Continued…):The Determinants of the Nominal Exchange Rate

- OPEN ECONOMY (Continued…):A first model of the natural rate

- ISSUES IN UNEMPLOYMENT:Public Policy and Job Search

- ECONOMIC GROWTH:THE SOLOW MODEL, Saving and investment

- ECONOMIC GROWTH (Continued…):The Steady State

- ECONOMIC GROWTH (Continued…):The Golden Rule Capital Stock

- ECONOMIC GROWTH (Continued…):The Golden Rule, Policies to promote growth

- ECONOMIC GROWTH (Continued…):Possible problems with industrial policy

- AGGREGATE DEMAND AND AGGREGATE SUPPLY:When prices are sticky

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND IN THE OPEN ECONOMY:Lessons about fiscal policy

- AGGREGATE DEMAND IN THE OPEN ECONOMY(Continued…):Fixed exchange rates

- AGGREGATE DEMAND IN THE OPEN ECONOMY (Continued…):Why income might not rise

- AGGREGATE SUPPLY:The sticky-price model

- AGGREGATE SUPPLY (Continued…):Deriving the Phillips Curve from SRAS

- GOVERNMENT DEBT:Permanent Debt, Floating Debt, Unfunded Debts

- GOVERNMENT DEBT (Continued…):Starting with too little capital,

- CONSUMPTION:Secular Stagnation and Simon Kuznets

- CONSUMPTION (Continued…):Consumer Preferences, Constraints on Borrowings

- CONSUMPTION (Continued…):The Life-cycle Consumption Function

- INVESTMENT:The Rental Price of Capital, The Cost of Capital

- INVESTMENT (Continued…):The Determinants of Investment

- INVESTMENT (Continued…):Financing Constraints, Residential Investment

- INVESTMENT (Continued…):Inventories and the Real Interest Rate

- MONEY:Money Supply, Fractional Reserve Banking,

- MONEY (Continued…):Three Instruments of Money Supply, Money Demand