|

ECONOMIC GROWTH (Continued…):The Steady State |

| << ECONOMIC GROWTH:THE SOLOW MODEL, Saving and investment |

| ECONOMIC GROWTH (Continued…):The Golden Rule Capital Stock >> |

Macroeconomics

ECO 403

VU

LESSON

20

ECONOMIC

GROWTH (Continued...)

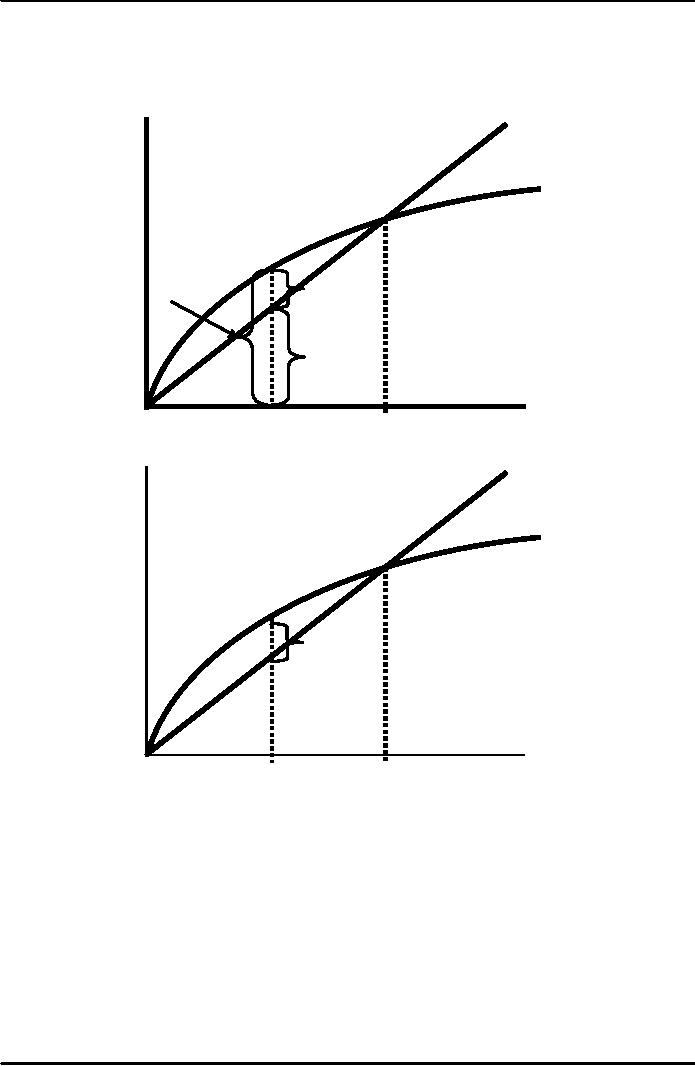

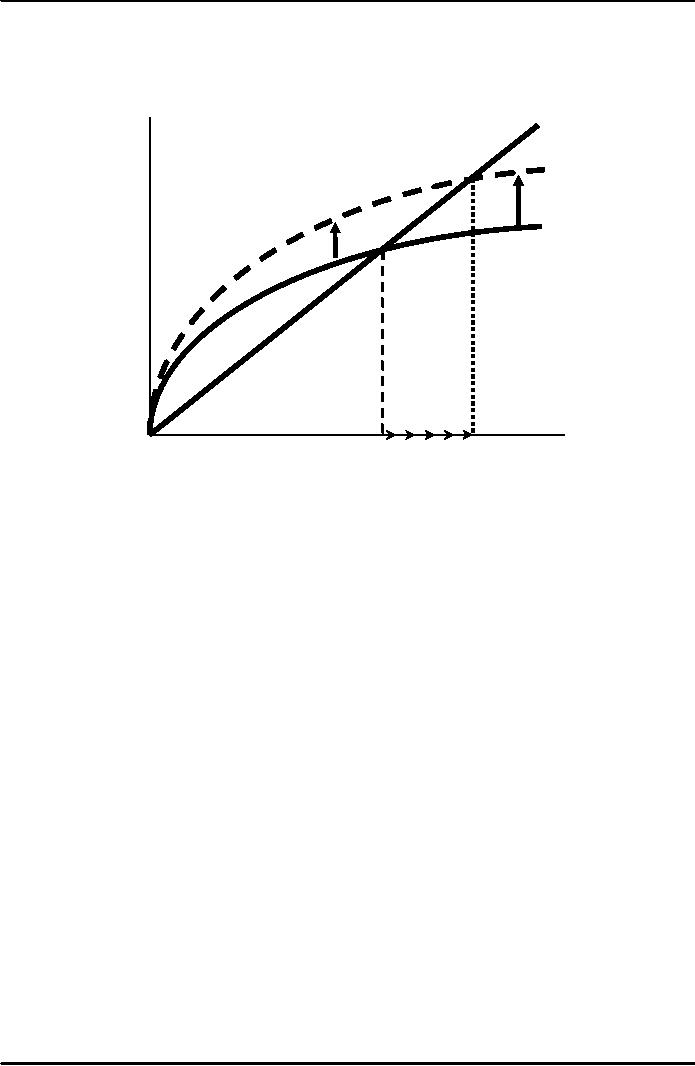

Moving

toward the steady

state

Investment

and

δk

depreciation

Δk

=

sf(k)

-

δk

sf(k)

Δk

Investment

depreciation

k1

k*

Capital

per

worker,

k

δk

Investment

and

depreciation

sf(k)

Δk

k1

k*

Capital

per

worker,

k

75

Macroeconomics

ECO 403

VU

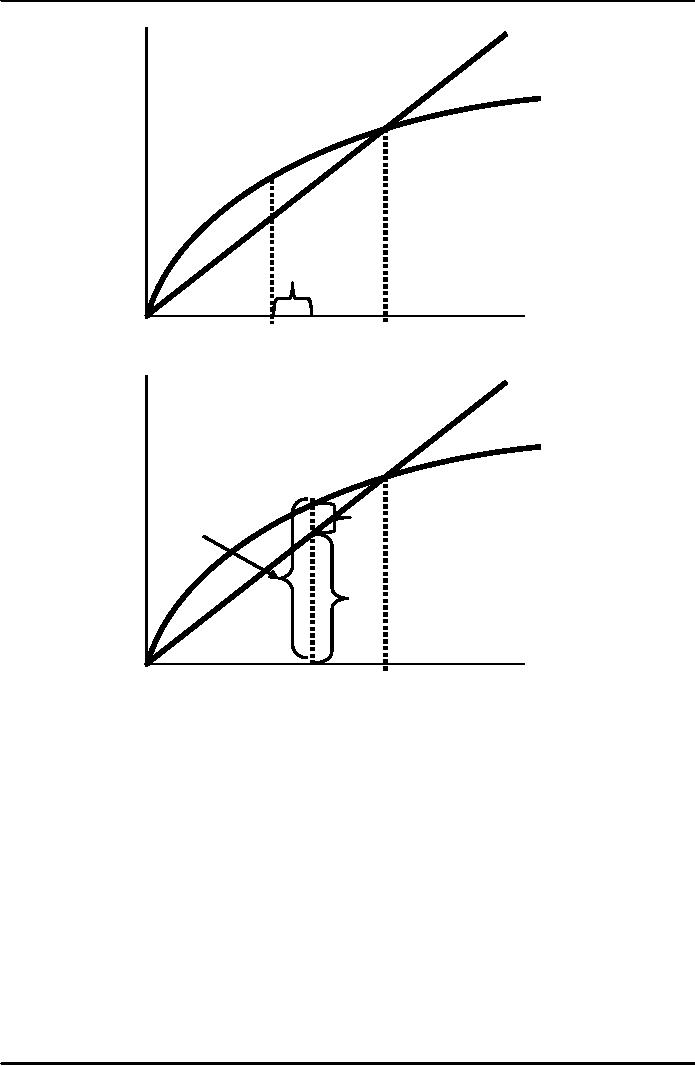

δk

Investment

and

depreciation

sf(k)

Δk

k1

k2

k*

Capital

per

worker,

k

δk

Investment

and

depreciation

sf(k)

Δk

investment

depreciation

k2

k*

Capital

per

worker,

k

76

Macroeconomics

ECO 403

VU

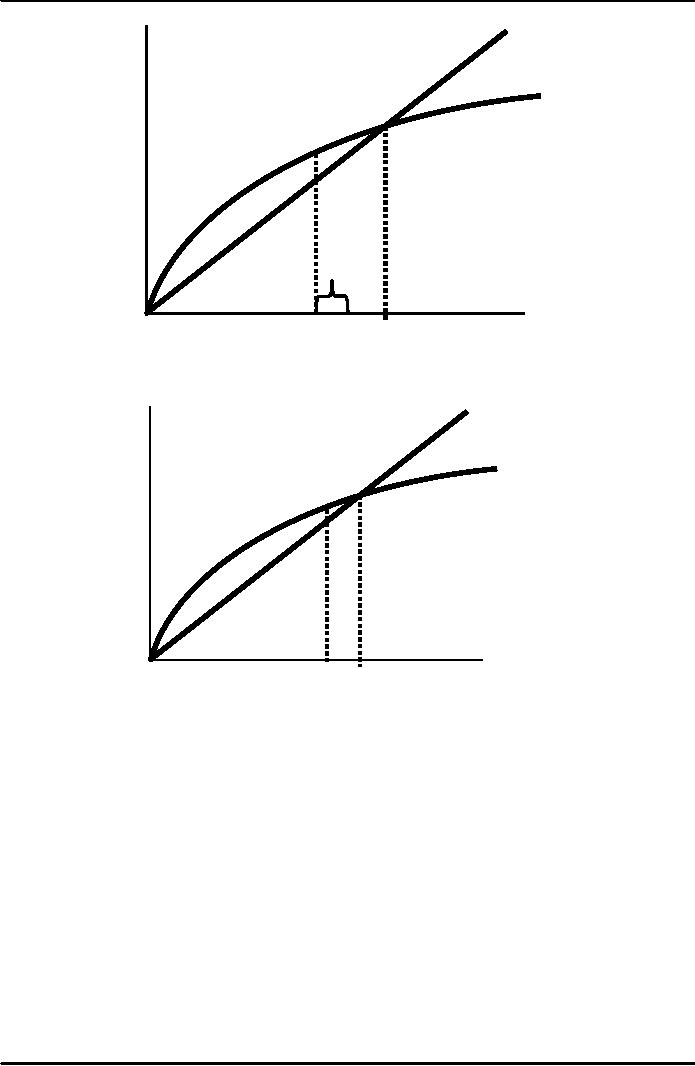

δk

Investment

and

depreciation

sf(k)

Δk

k3

k2

k*

Capital

per

worker,

k

δk

Investment

and

depreciation

sf(k)

As

long as k

<

k*, investment

will

exceed

depreciation,

and

k will

continue to grow

toward

k*.

k3 k*

Capital

per

worker,

k

Now

you try:

Draw

the Solow model diagram,

labeling the steady state

k*.

�

On

the horizontal axis, pick a

value greater than k*

for

the economy's initial

capital

�

stock.

Label it k1.

Show

what happens to k

over

time.

�

Does

k

move

toward the steady state or

away from it?

�

77

Macroeconomics

ECO 403

VU

The

Steady State

Investment

and

Depreciation

Depreciation,

k

At

k*, investment equals

depreciation and capital

will

not

change over time.

Investment,

s f(k)

i*

= δk*

k*

k1

k2

Capital

per

worker, k

A

numerical example

Production

function (aggregate):

Y

= F

(K

, L

) =

K

� L

= K

1 / 2L1 / 2

To

derive the per-worker

production function, divide

through by L:

1/2

Y

K 1 / 2L1 / 2 ⎛

K

⎞

=

=⎜

⎟

L

L

⎝L

⎠

Then

substitute y

=

Y/L

and

k

=

K/L

to

get

y

= f

(k

) =

k

1 /

2

Assume:

�

s

=

0.3

�

δ

=

0.1

�

initial value of

k

=

4.0

78

Macroeconomics

ECO 403

VU

Approaching

the Steady State

δk

Δk

Year

k

y

c

i

1

4.000

2.000

1.400

0.600

0.400

0.200

2

4.200

2.049

1.435

0.615

0.420

0.195

3

4.395

2.096

1.467

0.629

0.440

0.189

4

4.584

2.141

1.499

0.642

0.458

0.184

...

10

5.602

2.367

1.657 0.710 0.560

0.150

...

25

7.351

2.706

1.894 0.812 0.732

0.080

...

100

8.962

2.994

2.096 0.898 0.896

0.002

...

∞

9.000

3.000

2.100 0.900

0.900

0.000

Exercise:

solve for the steady

state

Continue

to assume

s

= 0.3,

δ

=

0.1, and y

=

k

1/2

Use

the equation of

motion

Δk

=

s

f(k) -

δk

to

solve for the steady-state

values of k,

y, and

c.

Solution:

Δk

= 0

def.

of steady state

s

f (k

*) =

δ k *

eq'n

of motion with Δk

= 0

0.3

k

* =

0.1k

*

using

assumed values

k*

=

k*

3=

k*

Solve

to get: k

* =

9

and

y

* =

k * =

3

Finally,

c

* =

(1

-

s )y

* =

0.7

�

3

=

2.1

79

Macroeconomics

ECO 403

VU

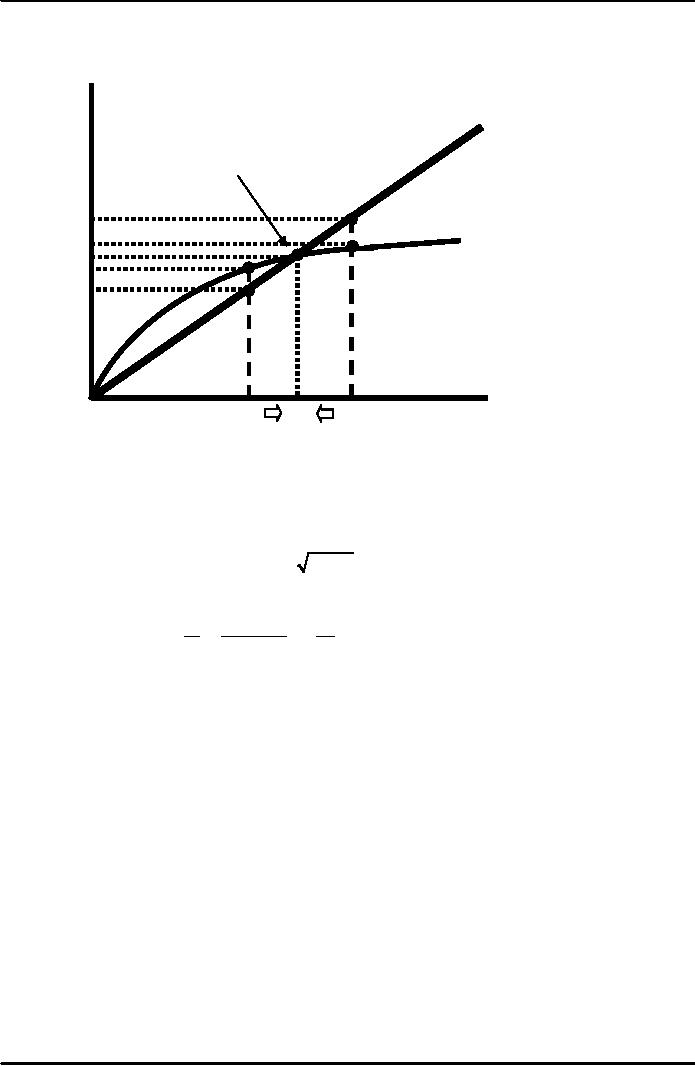

An

increase in the saving

rate

δk

Investment

and

depreciation

s2 f(k)

s1 f(k)

k

K1

*

K2

*

An

increase in the saving rate

raises investment causing

the capital stock to grow

toward a

new

steady state

Prediction:

Higher

s

⇒ higher

k*.

�

And

since y

=

f(k)

,

�

higher

k*

⇒ higher

y*

.

Thus,

the Solow model predicts

that countries with higher

rates of saving and

�

investment

will have higher levels of

capital and income per worker in

the long run.

80

Macroeconomics

ECO 403

VU

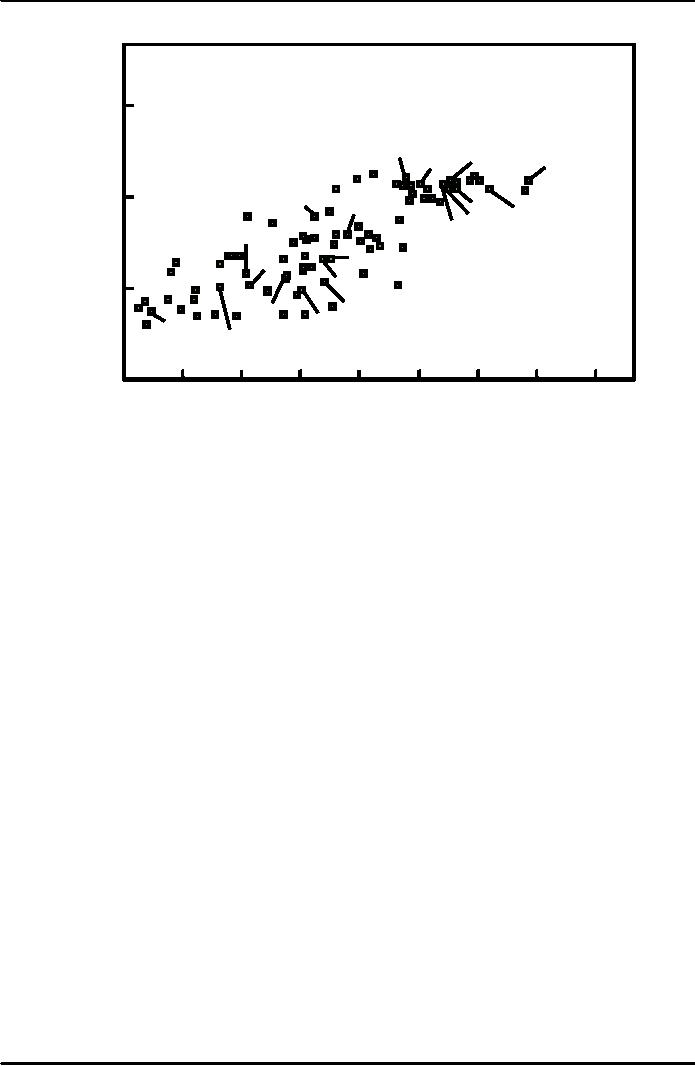

International

Evidence on Investment Rates

and Income per

Person

Income

per

person

in 1992

(logarithmic

scale)

100,000

Canada

Denmark

Germany

Japan

U.S.

Finland

10,000

Mexico

U.K.

Brazil

Singapore

Italy

France

Pakistan

Egypt

Ivory

Peru

Coast

Indonesia

1,000

Zimbabwe

India

Kenya

Uganda

Chad

Cameroon

100

25

30

35

0

5

10

40

15

20

Investment

as percentage of output

(average

19601992)

81

Table of Contents:

- INTRODUCTION:COURSE DESCRIPTION, TEN PRINCIPLES OF ECONOMICS

- PRINCIPLE OF MACROECONOMICS:People Face Tradeoffs

- IMPORTANCE OF MACROECONOMICS:Interest rates and rental payments

- THE DATA OF MACROECONOMICS:Rules for computing GDP

- THE DATA OF MACROECONOMICS (Continued…):Components of Expenditures

- THE DATA OF MACROECONOMICS (Continued…):How to construct the CPI

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- MONEY AND INFLATION:The Quantity Equation, Inflation and interest rates

- MONEY AND INFLATION (Continued…):Money demand and the nominal interest rate

- MONEY AND INFLATION (Continued…):Costs of expected inflation:

- MONEY AND INFLATION (Continued…):The Classical Dichotomy

- OPEN ECONOMY:Three experiments, The nominal exchange rate

- OPEN ECONOMY (Continued…):The Determinants of the Nominal Exchange Rate

- OPEN ECONOMY (Continued…):A first model of the natural rate

- ISSUES IN UNEMPLOYMENT:Public Policy and Job Search

- ECONOMIC GROWTH:THE SOLOW MODEL, Saving and investment

- ECONOMIC GROWTH (Continued…):The Steady State

- ECONOMIC GROWTH (Continued…):The Golden Rule Capital Stock

- ECONOMIC GROWTH (Continued…):The Golden Rule, Policies to promote growth

- ECONOMIC GROWTH (Continued…):Possible problems with industrial policy

- AGGREGATE DEMAND AND AGGREGATE SUPPLY:When prices are sticky

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND IN THE OPEN ECONOMY:Lessons about fiscal policy

- AGGREGATE DEMAND IN THE OPEN ECONOMY(Continued…):Fixed exchange rates

- AGGREGATE DEMAND IN THE OPEN ECONOMY (Continued…):Why income might not rise

- AGGREGATE SUPPLY:The sticky-price model

- AGGREGATE SUPPLY (Continued…):Deriving the Phillips Curve from SRAS

- GOVERNMENT DEBT:Permanent Debt, Floating Debt, Unfunded Debts

- GOVERNMENT DEBT (Continued…):Starting with too little capital,

- CONSUMPTION:Secular Stagnation and Simon Kuznets

- CONSUMPTION (Continued…):Consumer Preferences, Constraints on Borrowings

- CONSUMPTION (Continued…):The Life-cycle Consumption Function

- INVESTMENT:The Rental Price of Capital, The Cost of Capital

- INVESTMENT (Continued…):The Determinants of Investment

- INVESTMENT (Continued…):Financing Constraints, Residential Investment

- INVESTMENT (Continued…):Inventories and the Real Interest Rate

- MONEY:Money Supply, Fractional Reserve Banking,

- MONEY (Continued…):Three Instruments of Money Supply, Money Demand