|

ECONOMIC GROWTH:THE SOLOW MODEL, Saving and investment |

| << ISSUES IN UNEMPLOYMENT:Public Policy and Job Search |

| ECONOMIC GROWTH (Continued…):The Steady State >> |

Macroeconomics

ECO 403

VU

LESSON

19

ECONOMIC

GROWTH

Issues in

Economic Growth

�

Learn

the closed economy Solow

model

�

See

how a country's standard of

living depends on its saving

and population growth

rates

�

Learn

how to use the "Golden

Rule"

to

find the optimal savings

rate and capital

stock

Per

Capita Income of Selected

Countries, 2004 (in US

$)

Norway

43,350

Saudi

Arabia

8,530

Switzerland

39,880

Mexico

6,230

United

States

37,610

Malaysia

3,780

Japan

34,510

Brazil

2,710

United

Kingdom

28,350

Russia

2,610

Belgium

25,820

Egypt

1,390

Germany

25,250

China

1,100

France

24,770

Indonesia

810

Australia

21,650

India

530

Italy

21,560

Pakistan

470

Kuwait

16,340

Bangladesh

400

Korea

12,020

Nigeria

320

THE

SOLOW MODEL

�

Due to

Robert Solow, won Nobel

Prize for contributions to

the study of economic

growth

�

A

major paradigm:

Widely

used in policy making

Benchmark

against which most

recent

growth theories are

compared

�

Looks at

the determinants of economic

growth and the standard of

living in the long

run

�

The

Solow

Growth Model is designed to

show how growth in the

capital stock, growth

in

the labor force, and

advances in technology interact in an

economy, and how

they

affect

a nation's total output of

goods and services.

70

Macroeconomics

ECO 403

VU

How

Solow model is

different

1.

K

is no longer fixed: investment

causes it to grow, depreciation

causes it to shrink.

2.

L

is no longer fixed: population

growth causes it to

grow.

3.

The

consumption function is

simpler.

4.

No

G

or

T

(only

to simplify presentation; we can

still do fiscal policy

experiments)

5.

Cosmetic

differences.

The

production function

Let's

analyze the supply and

demand for goods, and

see how much output is

produced at any

given

time and how this

output is allocated among

alternative uses.

The

production function represents

the transformation of inputs

(labor

(L), capital (K),

and

production technology) into

outputs

(final

goods and services for a

certain time period).

�

In

aggregate terms: Y

=

F (K,

L )

�

Define:

y =

Y/L

=

output per worker

k

=

K/L

=

capital per worker

�

Assume

constant returns to

scale:

zY

=

F (zK,

zL )

for any z

>

0

�

Pick

z =

1/L.

Then

Y/L

=

F (K/L

,

1)

y

=

F (k,

1)

y

=

f(k)

where

f(k)

=

F (k,

1)

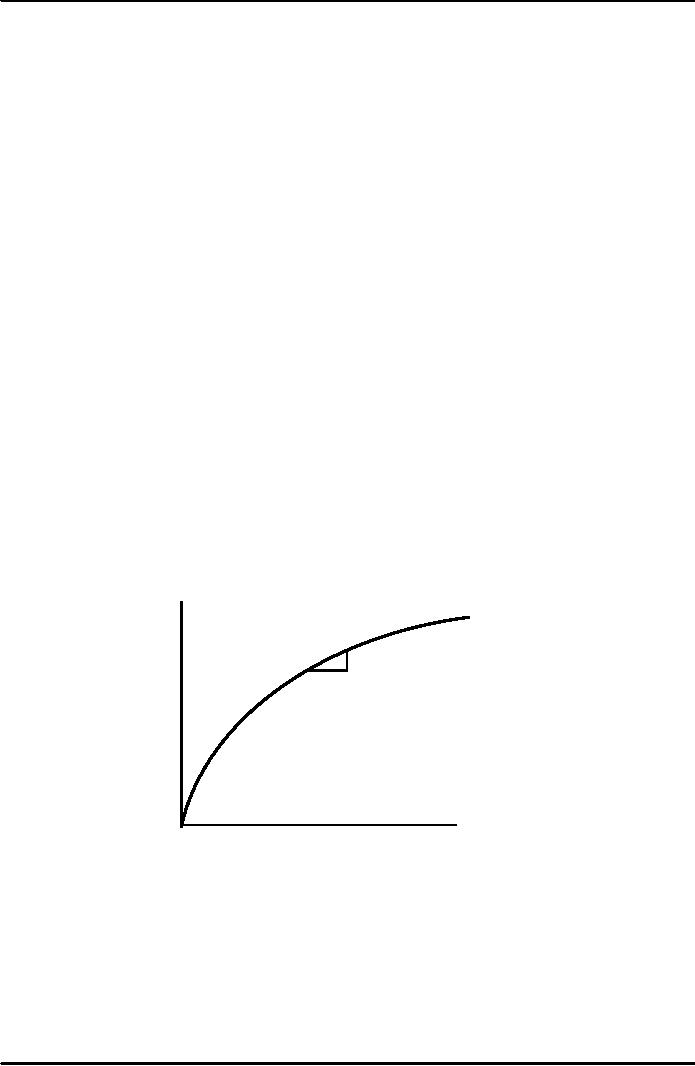

Output

per

worker,

y

f(k)

MPK

=f(k

+1)

f(k)

1

Note:

this production

function

exhibits

diminishing

MPK.

Capital

per

worker,

k

The

national income

identity

�

Y=C+I

(remember,

no G

)

71

Macroeconomics

ECO 403

VU

In

"per worker" terms:

�

y=c+i

where

c = C/L

and i = I/L

The

consumption function

�

s =

the saving rate, the

fraction of income that is

saved (s is an exogenous

parameter)

�

Note: s is

the only lowercase variable

that is not equal to its

uppercase version

divided

by L

�

Consumption

function: c = (1s)y (per

worker)

Saving

and investment

�

saving

(per worker) = sy

�

National

income identity is y = c

+

i

Rearrange

to get: i = y c = sy

(investment

= saving)

�

Using

the results above,

i

= sy = sf(k)

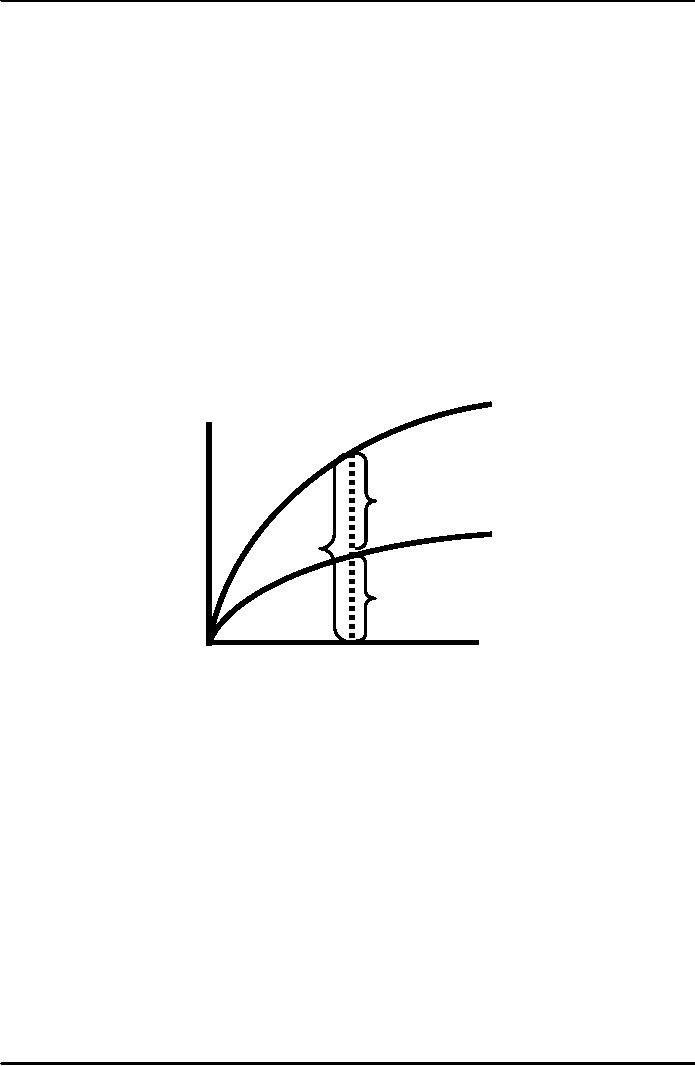

Output,

consumption, and

investment

Output

per

f(k)

worker,

y

c1

sf(k)

y1

i1

Capital

per

k1

worker,

k

72

Macroeconomics

ECO 403

VU

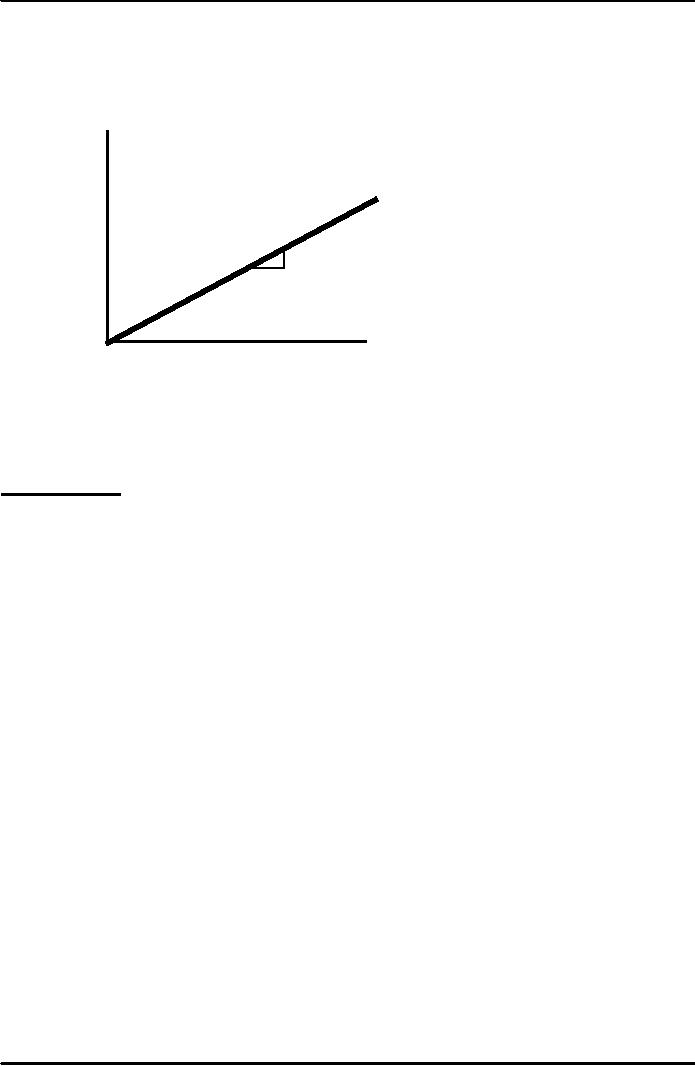

Depreciation

Depreciation

per

δ

=

the rate of

depreciation

worker,

δk

=

the fraction of the capital

stock that

wears

out each period

δk

δ

1

Capital

per

worker,

k

Capital

accumulation

The

basic idea:

Investment

makes the capital stock

bigger, depreciation makes it

smaller.

Change

in capital stock= investment

depreciation

Δk =

δk

i

Since

i = sf (k), this

becomes:

Δk =

s f(k) δk

The

equation of motion for

k

Δk =

s f(k) δk

�

the

Solow model's central

equation

�

Determines

behavior of capital over

time which, in turn,

determines behavior of all

of

the

other endogenous

variables

because

they all depend on k.

e.g., income per

person:

y

=

f(k)

Consumption

.per person:

c

=

(1s)

f(k)

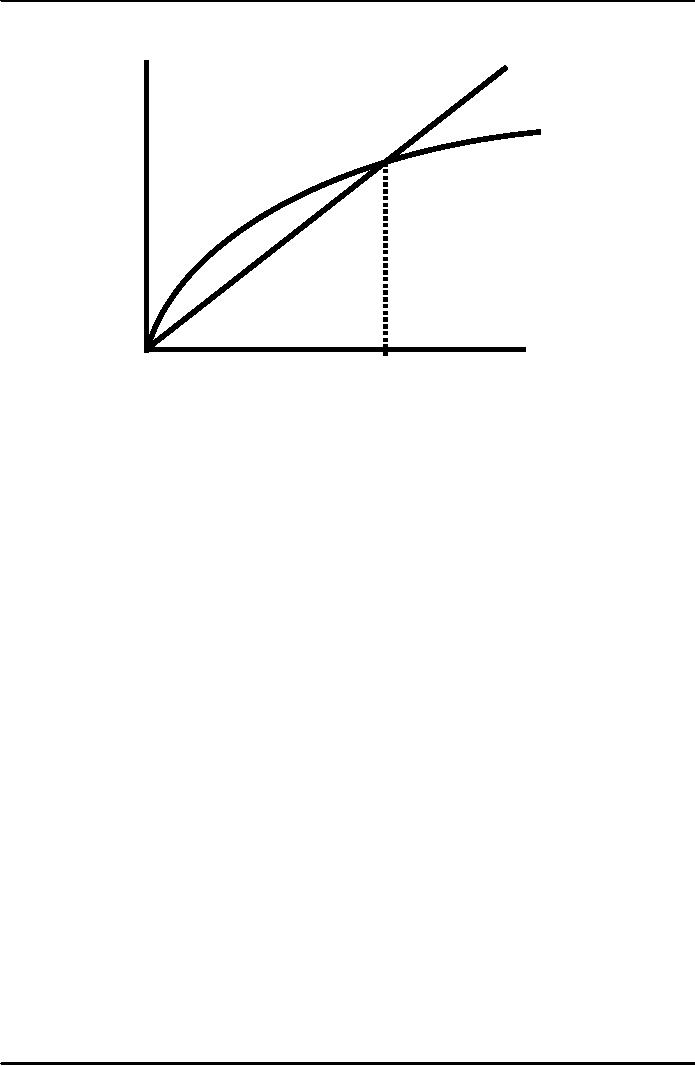

The

steady state

If

investment is just enough to

cover depreciation

[sf(k)

=

δk

],

then

capital per worker will

remain constant:

Δk

=

0.

This

constant value, denoted

k*,

is called the steady state

capital stock.

73

Macroeconomics

ECO 403

VU

Investment

and

depreciation

δk

sf(k)

k*

Capital

per

worker,

k

74

Table of Contents:

- INTRODUCTION:COURSE DESCRIPTION, TEN PRINCIPLES OF ECONOMICS

- PRINCIPLE OF MACROECONOMICS:People Face Tradeoffs

- IMPORTANCE OF MACROECONOMICS:Interest rates and rental payments

- THE DATA OF MACROECONOMICS:Rules for computing GDP

- THE DATA OF MACROECONOMICS (Continued…):Components of Expenditures

- THE DATA OF MACROECONOMICS (Continued…):How to construct the CPI

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- MONEY AND INFLATION:The Quantity Equation, Inflation and interest rates

- MONEY AND INFLATION (Continued…):Money demand and the nominal interest rate

- MONEY AND INFLATION (Continued…):Costs of expected inflation:

- MONEY AND INFLATION (Continued…):The Classical Dichotomy

- OPEN ECONOMY:Three experiments, The nominal exchange rate

- OPEN ECONOMY (Continued…):The Determinants of the Nominal Exchange Rate

- OPEN ECONOMY (Continued…):A first model of the natural rate

- ISSUES IN UNEMPLOYMENT:Public Policy and Job Search

- ECONOMIC GROWTH:THE SOLOW MODEL, Saving and investment

- ECONOMIC GROWTH (Continued…):The Steady State

- ECONOMIC GROWTH (Continued…):The Golden Rule Capital Stock

- ECONOMIC GROWTH (Continued…):The Golden Rule, Policies to promote growth

- ECONOMIC GROWTH (Continued…):Possible problems with industrial policy

- AGGREGATE DEMAND AND AGGREGATE SUPPLY:When prices are sticky

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND IN THE OPEN ECONOMY:Lessons about fiscal policy

- AGGREGATE DEMAND IN THE OPEN ECONOMY(Continued…):Fixed exchange rates

- AGGREGATE DEMAND IN THE OPEN ECONOMY (Continued…):Why income might not rise

- AGGREGATE SUPPLY:The sticky-price model

- AGGREGATE SUPPLY (Continued…):Deriving the Phillips Curve from SRAS

- GOVERNMENT DEBT:Permanent Debt, Floating Debt, Unfunded Debts

- GOVERNMENT DEBT (Continued…):Starting with too little capital,

- CONSUMPTION:Secular Stagnation and Simon Kuznets

- CONSUMPTION (Continued…):Consumer Preferences, Constraints on Borrowings

- CONSUMPTION (Continued…):The Life-cycle Consumption Function

- INVESTMENT:The Rental Price of Capital, The Cost of Capital

- INVESTMENT (Continued…):The Determinants of Investment

- INVESTMENT (Continued…):Financing Constraints, Residential Investment

- INVESTMENT (Continued…):Inventories and the Real Interest Rate

- MONEY:Money Supply, Fractional Reserve Banking,

- MONEY (Continued…):Three Instruments of Money Supply, Money Demand