|

OPEN ECONOMY (Continued…):A first model of the natural rate |

| << OPEN ECONOMY (Continued…):The Determinants of the Nominal Exchange Rate |

| ISSUES IN UNEMPLOYMENT:Public Policy and Job Search >> |

Macroeconomics

ECO 403

VU

LESSON

17

OPEN

ECONOMY (Continued...)

Purchasing

Power Parity

(PPP)

�

def1:

a doctrine that states that

goods must sell at the

same (currency-adjusted)

price

in

all countries.

�

def2:

the

nominal exchange rate

adjusts to equalize the cost

of a basket of goods

across

countries.

�

Reasoning:

arbitrage, the law of one

price

�

PPP:

e xP

= P*

Where

e

x P -

Cost of a basket of domestic

goods, in foreign

currency.

P

-

Cost of a basket of domestic

goods, in domestic

currency.

P*

-

Cost of a basket of foreign

goods, in foreign

currency.

Solve

for e

:

e

=

P*/

P

PPP

implies that the nominal

exchange rate between two

countries equals the ratio

of the

countries'

price levels.

P

P* P

ε

=e� *

=

�

*

=1

P

PP

�

If

e = P*/P,

then

Does

PPP hold in the real

world?

No,

for two reasons:

1.

International arbitrage not

possible.

�

Non

traded goods

�

Transportation

costs

2.

Goods of different countries

not perfect

substitutes.

Nonetheless,

PPP is a useful

theory:

�

It's

simple & intuitive

�

In

the real world, nominal

exchange rates have a

tendency toward their PPP

values

over

the long run.

Issues

in Unemployment

The

natural rate of

unemployment:

�

What it

means

�

What

causes it

�

Understanding

its behavior in the real

world

Natural

Rate of Unemployment

�

Natural

rate of unemployment:

the

average rate of unemployment

around which the economy

fluctuates.

�

In a

recession, the actual

unemployment rate rises

above the natural

rate.

�

In a

boom, the actual

unemployment rate falls

below the natural

rate.

62

Macroeconomics

ECO 403

VU

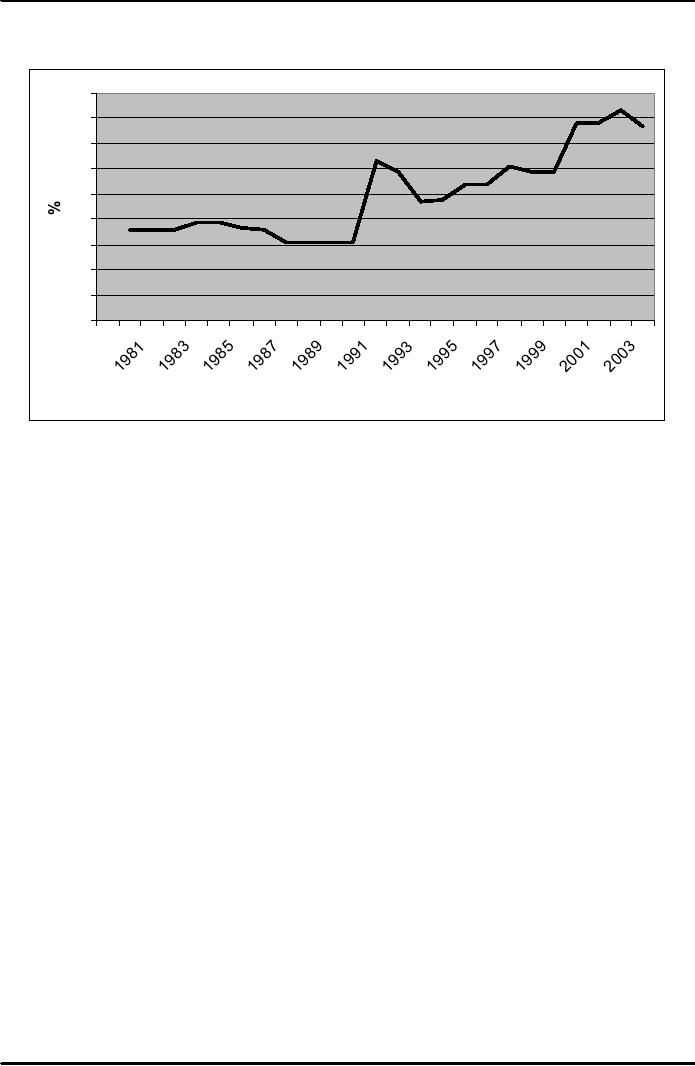

Unemployment

Rate of Pakistan

9

8

7

6

5

4

3

2

1

0

Years

A

first model of the natural

rate

Notation:

L

=

# of workers in labor

force

E

=

# of employed workers

U

=

# of unemployed

U/L= unemployment

rate

Assumptions:

1.

L

is exogenously fixed.

2.

During

any given month,

s

= fraction of employed workers

that become separated from

their jobs,

f

= fraction of unemployed workers

that find jobs.

s

= rate of job separations, f =

rate of job finding

(both

exogenous)

Transitions

between employment and

unemployment

The

steady state

condition

�

Definition:

the labor market is in

steady state, or long-run

equilibrium, if the

unemployment

rate is constant.

�

The

steady-state condition

is:

s

xE

=

f

xU

number

of employed people who =

number of unemployed people

who find jobs

lose

or leave their jobs

63

Macroeconomics

ECO 403

VU

Solving

for the "equilibrium" U

rate

f

xU

= s

xE

=

s

x (L

U)

=s

Ls

U

Solve

for U/L:

(f

+ s)xU

= sxL

U

s

=

L

s +f

So,

Example:

�

Each

month, 1% of employed workers

lose their jobs (s =

0.01)

�

Each

month, 19% of unemployed

workers find jobs (f =

0.19)

�

Find

the natural rate of

unemployment:

U

s

0.01

=

=

=

0.05, or

5%

L

s +f

0.01

+

0.19

Policy

implication

�

A

policy that aims to reduce

the natural rate of

unemployment will succeed

only if it

lowers

s or increases f.

Why

is there unemployment?

�

If

job finding were

instantaneous (f = 1),

then

all spells of unemployment

would be brief, and the

natural rate would be

near

zero.

�

There

are two reasons why f <

1:

1.

Job search

2.

Wage rigidity

Job

Search & Frictional

Unemployment

�

Frictional

unemployment: caused by the

time it takes workers to

search for a job

�

Occurs

even when wages are

flexible and there are

enough jobs to go

around

Job

Search & Frictional

Unemployment

Occurs

because

�

Workers

have different abilities,

preferences

�

Jobs

have different skill

requirements

�

Geographic

mobility of workers not

instantaneous

�

Flow of

information about vacancies

and job candidates is

imperfect

64

Table of Contents:

- INTRODUCTION:COURSE DESCRIPTION, TEN PRINCIPLES OF ECONOMICS

- PRINCIPLE OF MACROECONOMICS:People Face Tradeoffs

- IMPORTANCE OF MACROECONOMICS:Interest rates and rental payments

- THE DATA OF MACROECONOMICS:Rules for computing GDP

- THE DATA OF MACROECONOMICS (Continued…):Components of Expenditures

- THE DATA OF MACROECONOMICS (Continued…):How to construct the CPI

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- MONEY AND INFLATION:The Quantity Equation, Inflation and interest rates

- MONEY AND INFLATION (Continued…):Money demand and the nominal interest rate

- MONEY AND INFLATION (Continued…):Costs of expected inflation:

- MONEY AND INFLATION (Continued…):The Classical Dichotomy

- OPEN ECONOMY:Three experiments, The nominal exchange rate

- OPEN ECONOMY (Continued…):The Determinants of the Nominal Exchange Rate

- OPEN ECONOMY (Continued…):A first model of the natural rate

- ISSUES IN UNEMPLOYMENT:Public Policy and Job Search

- ECONOMIC GROWTH:THE SOLOW MODEL, Saving and investment

- ECONOMIC GROWTH (Continued…):The Steady State

- ECONOMIC GROWTH (Continued…):The Golden Rule Capital Stock

- ECONOMIC GROWTH (Continued…):The Golden Rule, Policies to promote growth

- ECONOMIC GROWTH (Continued…):Possible problems with industrial policy

- AGGREGATE DEMAND AND AGGREGATE SUPPLY:When prices are sticky

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND IN THE OPEN ECONOMY:Lessons about fiscal policy

- AGGREGATE DEMAND IN THE OPEN ECONOMY(Continued…):Fixed exchange rates

- AGGREGATE DEMAND IN THE OPEN ECONOMY (Continued…):Why income might not rise

- AGGREGATE SUPPLY:The sticky-price model

- AGGREGATE SUPPLY (Continued…):Deriving the Phillips Curve from SRAS

- GOVERNMENT DEBT:Permanent Debt, Floating Debt, Unfunded Debts

- GOVERNMENT DEBT (Continued…):Starting with too little capital,

- CONSUMPTION:Secular Stagnation and Simon Kuznets

- CONSUMPTION (Continued…):Consumer Preferences, Constraints on Borrowings

- CONSUMPTION (Continued…):The Life-cycle Consumption Function

- INVESTMENT:The Rental Price of Capital, The Cost of Capital

- INVESTMENT (Continued…):The Determinants of Investment

- INVESTMENT (Continued…):Financing Constraints, Residential Investment

- INVESTMENT (Continued…):Inventories and the Real Interest Rate

- MONEY:Money Supply, Fractional Reserve Banking,

- MONEY (Continued…):Three Instruments of Money Supply, Money Demand