|

OPEN ECONOMY (Continued…):The Determinants of the Nominal Exchange Rate |

| << OPEN ECONOMY:Three experiments, The nominal exchange rate |

| OPEN ECONOMY (Continued…):A first model of the natural rate >> |

Macroeconomics

ECO 403

VU

LESSON

16

OPEN

ECONOMY (Continued...)

How

ε

is

determined

�

The

accounting identity says NX = S

I

�

We

saw earlier how S

I is

determined:

�

S

depends on domestic factors

(output, fiscal policy

variables, etc)

�

I is

determined by the world

interest

rate

r *

�

So,

ε must

adjust to ensure

NX

(ε

) =

S

- I

(r

*)

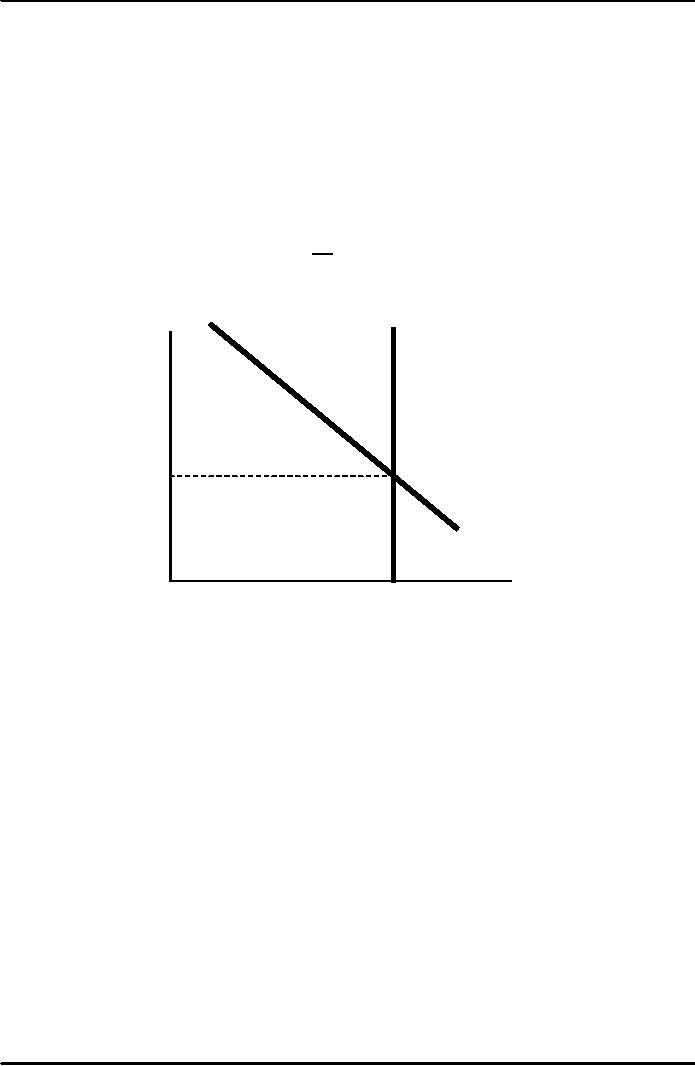

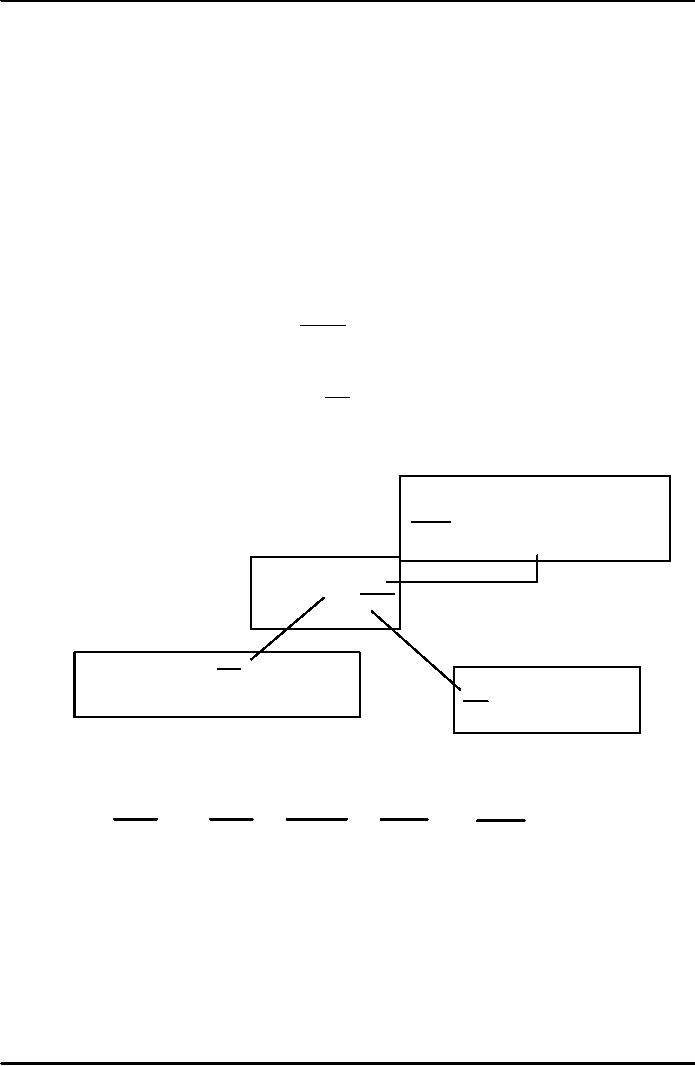

S1

I(r*)

ε

ε

1

NX

(ε)

NX

NX

1

Neither

S nor I depend on ε,

so

the net capital outflow

curve is vertical.

ε

adjusts

to equate NX

with

net capital outflow,

S

-

I.

Supply

and demand in foreign

exchange market

Demand:

Foreigners

need dollars to buy U.S.

net exports.

Supply: The

net capital outflow

(S

-

I)

is the supply of dollars to be

invested abroad.

The

net exports

function

�

The

net exports function

reflects this inverse

relationship between NX and ε:

NX

= NX (ε)

56

Macroeconomics

ECO 403

VU

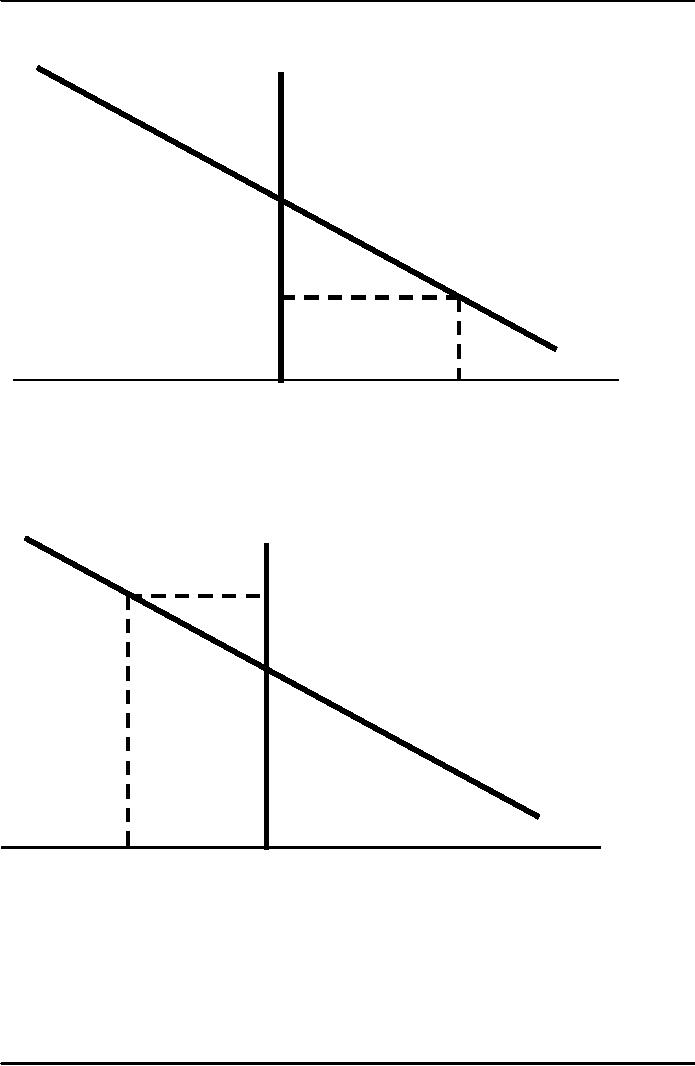

The

NX

curve

ε

so

net exports for

home

country

will

be

high

When

ε

is

relatively low,

Home

goods are relatively

inexpensive

ε1

NX

(ε)

NX

0

NX

(ε1)

At

high enough values of

ε,

Home

ε

goods

become so expensive

that

ε2

we

export less than

we

import

NX

(ε)

0

NX

NX

(ε2)

57

Macroeconomics

ECO 403

VU

Four

experiments

1.

Fiscal

policy at home

2.

Fiscal

policy abroad

3.

An

increase in investment

demand

4.

Trade

policy to restrict

imports

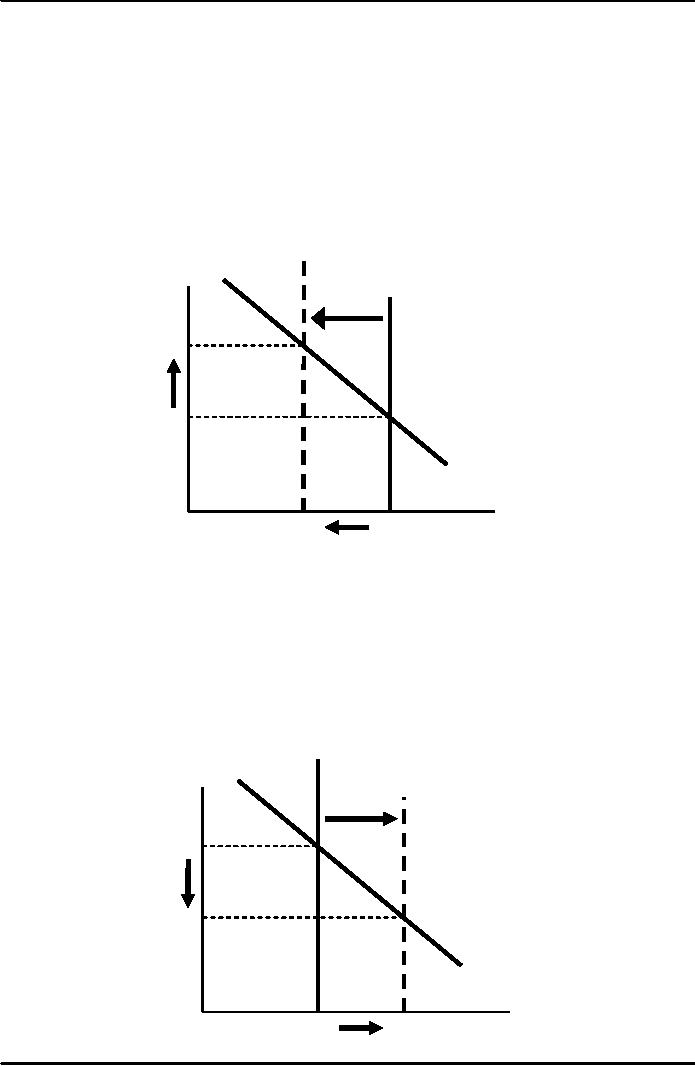

1.

Fiscal policy at

home

S2

I(r*)

ε

S1

I(r*)

ε2

ε1

NX

(ε )

NX

NX

1

NX

2

A

fiscal expansion reduces

national saving, net capital

outflows, and the supply of

dollars in

the

foreign exchange market

causing the real exchange

rate to rise and NX to

fall.

2.

Fiscal policy

abroad

S1

I(r*)

ε

S2

I(r*)

ε1

ε2

NX

(ε)

NX

NX

2

NX

1

58

Macroeconomics

ECO 403

VU

An

increase in r* reduces investment

increasing net capital

outflows and the supply of

dollars

in

the foreign exchange market

causing the real exchange

rate to fall and NX to

rise.

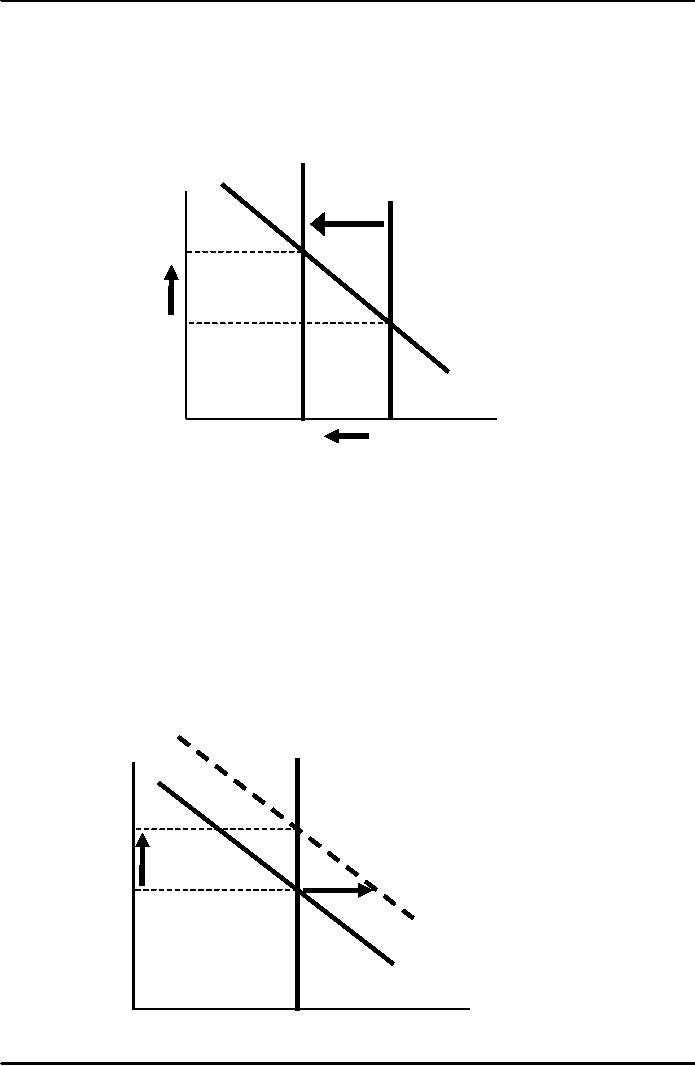

3.

An

increase in investment

demand

S1

I2

ε

S1

I1

ε2

ε1

NX(ε

)

N

NX

1

NX

2

An

increase in investment reduces

net capital outflows and

the supply of dollars in the

foreign

exchange

market causing the real

exchange rate to rise and NX

to fall.

4.

Trade policy to restrict

imports

SI

ε

ε2

ε1

NX

(ε

)2

NX

(ε

)1

NX

NX1

59

Macroeconomics

ECO 403

VU

At

any given value of ε, an import

quota

NX

IM

demand

for dollars shifts right.

Trade policy doesn't affect

S or I , so capital flows

and

the

supply of dollars remains

fixed.

Results:

Δε > 0 (demand

increase)

ΔNX =

0 (supply fixed)

ΔIM <

0 (policy)

ΔEX <

0 (rise in ε

)

The

Determinants of the Nominal

Exchange Rate

�

Start

with the expression for

the real exchange

rate:

e

�P

ε =

Pe:

*

Solve

it for the nominal exchange

rat

�

P*

e

= ε�

P

�

So

e depends on the real

exchange rate and the

price levels at home and

abroad...

�

...and

we know how each of them is

determined:

M*

=

L

* (r

* +

� *,Y

* )

P*

P*

e

= ε�

P

NX

(ε

) =

S

- I

(r

*)

M

=

L

(r

* +

� ,Y

)

P

�

We

can rewrite this equation in

terms of growth rates

Δε

Δe

Δε

ΔP

*

ΔP

+

�*

- �

=

=

+

-

e

ε

P*

P

ε

60

Macroeconomics

ECO 403

VU

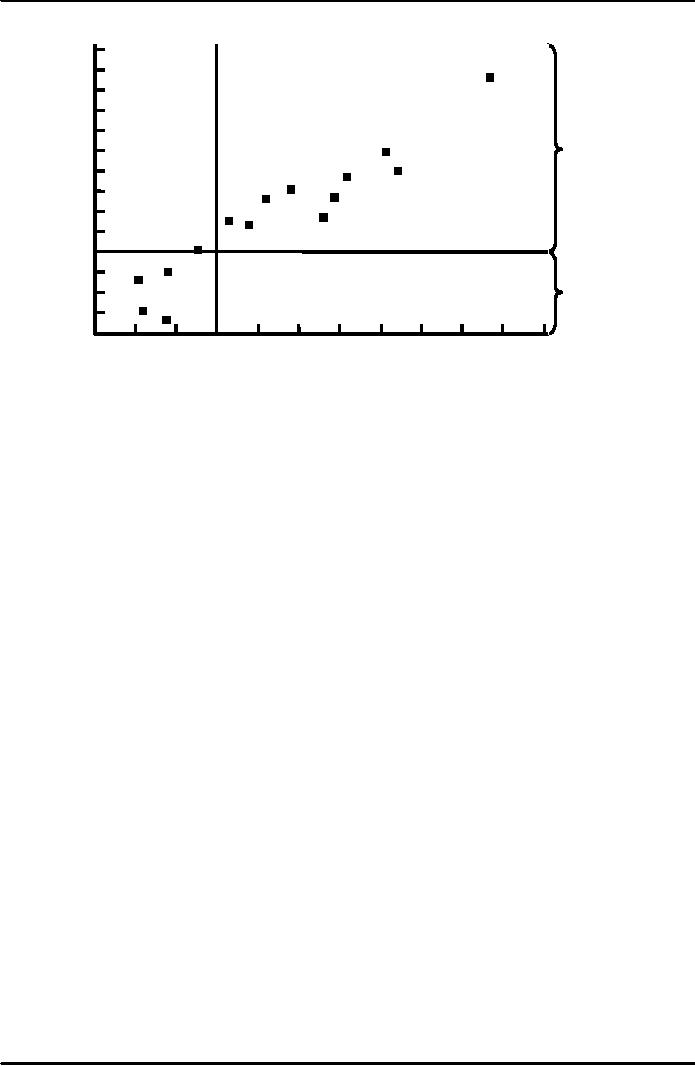

Inflation

and nominal exchange

rates

Percentage

10

change

9

in

nominal

exchange

8

South

Africa

rate

7

6

Depreciation

relative

to

Italy

5

U.S.

dollar

4

New

Zealand

Australia

Spain

3

Sweden

Ireland

2

Canada

1

UK

France

Belgium

0

-1

Appreciation

Germany

Netherlands

relative

to

-2

U.S.

dollar

Switzerland

-3

Japan

-4

-3

-2

-1

0

1

2

3

4

5

6

7

8

Inflation

differential

61

Table of Contents:

- INTRODUCTION:COURSE DESCRIPTION, TEN PRINCIPLES OF ECONOMICS

- PRINCIPLE OF MACROECONOMICS:People Face Tradeoffs

- IMPORTANCE OF MACROECONOMICS:Interest rates and rental payments

- THE DATA OF MACROECONOMICS:Rules for computing GDP

- THE DATA OF MACROECONOMICS (Continued…):Components of Expenditures

- THE DATA OF MACROECONOMICS (Continued…):How to construct the CPI

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- MONEY AND INFLATION:The Quantity Equation, Inflation and interest rates

- MONEY AND INFLATION (Continued…):Money demand and the nominal interest rate

- MONEY AND INFLATION (Continued…):Costs of expected inflation:

- MONEY AND INFLATION (Continued…):The Classical Dichotomy

- OPEN ECONOMY:Three experiments, The nominal exchange rate

- OPEN ECONOMY (Continued…):The Determinants of the Nominal Exchange Rate

- OPEN ECONOMY (Continued…):A first model of the natural rate

- ISSUES IN UNEMPLOYMENT:Public Policy and Job Search

- ECONOMIC GROWTH:THE SOLOW MODEL, Saving and investment

- ECONOMIC GROWTH (Continued…):The Steady State

- ECONOMIC GROWTH (Continued…):The Golden Rule Capital Stock

- ECONOMIC GROWTH (Continued…):The Golden Rule, Policies to promote growth

- ECONOMIC GROWTH (Continued…):Possible problems with industrial policy

- AGGREGATE DEMAND AND AGGREGATE SUPPLY:When prices are sticky

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND IN THE OPEN ECONOMY:Lessons about fiscal policy

- AGGREGATE DEMAND IN THE OPEN ECONOMY(Continued…):Fixed exchange rates

- AGGREGATE DEMAND IN THE OPEN ECONOMY (Continued…):Why income might not rise

- AGGREGATE SUPPLY:The sticky-price model

- AGGREGATE SUPPLY (Continued…):Deriving the Phillips Curve from SRAS

- GOVERNMENT DEBT:Permanent Debt, Floating Debt, Unfunded Debts

- GOVERNMENT DEBT (Continued…):Starting with too little capital,

- CONSUMPTION:Secular Stagnation and Simon Kuznets

- CONSUMPTION (Continued…):Consumer Preferences, Constraints on Borrowings

- CONSUMPTION (Continued…):The Life-cycle Consumption Function

- INVESTMENT:The Rental Price of Capital, The Cost of Capital

- INVESTMENT (Continued…):The Determinants of Investment

- INVESTMENT (Continued…):Financing Constraints, Residential Investment

- INVESTMENT (Continued…):Inventories and the Real Interest Rate

- MONEY:Money Supply, Fractional Reserve Banking,

- MONEY (Continued…):Three Instruments of Money Supply, Money Demand