|

OPEN ECONOMY:Three experiments, The nominal exchange rate |

| << MONEY AND INFLATION (Continued…):The Classical Dichotomy |

| OPEN ECONOMY (Continued…):The Determinants of the Nominal Exchange Rate >> |

Macroeconomics

ECO 403

VU

LESSON

15

OPEN

ECONOMY

Three

experiments

1.

Fiscal

policy at home

2.

Fiscal

policy abroad

3.

An

increase in investment

demand

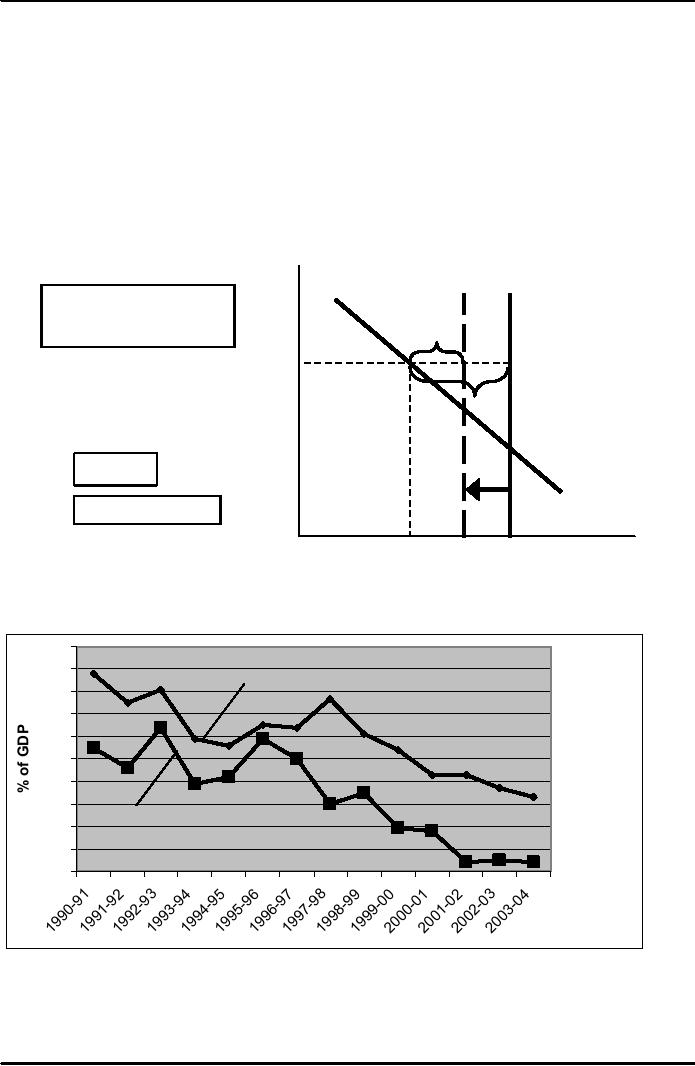

1.

Fiscal policy at

home

r

S2

S1

An

increase in G

or

decrease

in T

reduces

NX2

saving.

r1*

NX1

Results:

ΔI

= 0

I

(r)

ΔNX

= ΔS

< 0

S,

I

I1

NX

and the Govt. Budget

Deficit

10

9

Budget

Deficit

8

7

6

5

4

3

Net

Export Deficit

2

1

0

52

Macroeconomics

ECO 403

VU

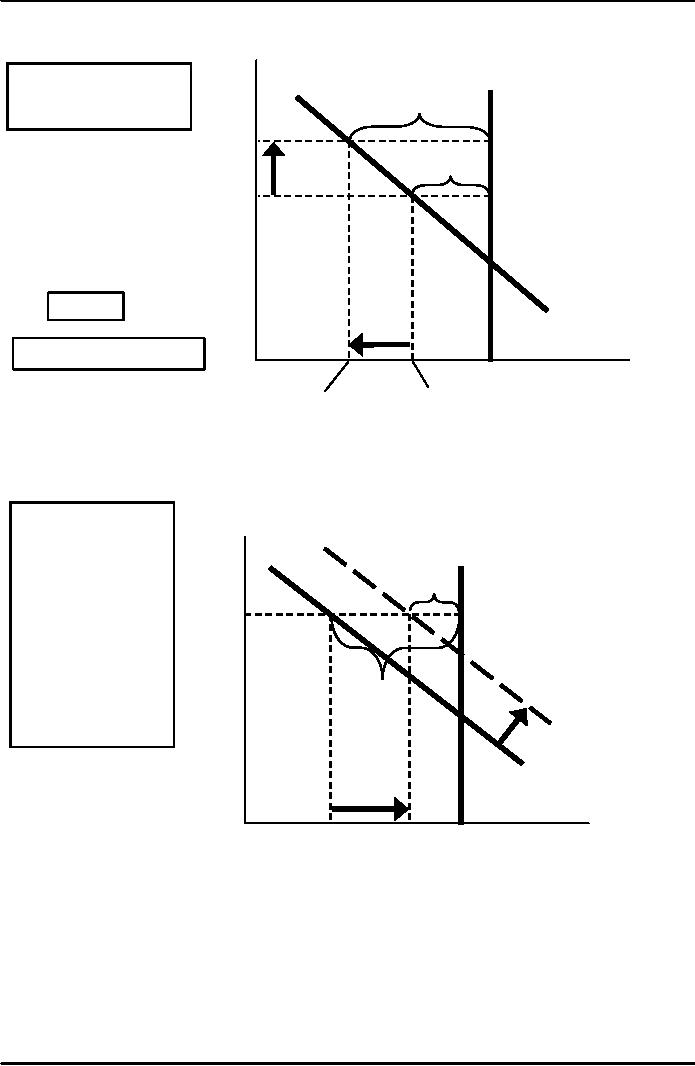

2.

Fiscal policy

abroad

r

S1

Expansionary

fiscal

NX2

policy

abroad raises

the

world interest rate.

r2*

NX1

r1*

Results:

ΔI

< 0

I

(r )

ΔNX

= -ΔI

> 0

S,

I

I

(r2*)

I

(r1*)

3.

An increase in investment

demand

ΔI

> 0,

r

ΔS

= 0,

S

net

capital

outflows

and net

NX2

exports

r *

fall

by the amount

ΔI

NX1

I

(r )2

I

(r )1

S,

I

I2

I1

The

nominal exchange

rate

e

= nominal exchange rate, the

relative price of domestic

currency in terms of foreign

currency

(e.g.

Yen per Dollar)

53

Macroeconomics

ECO 403

VU

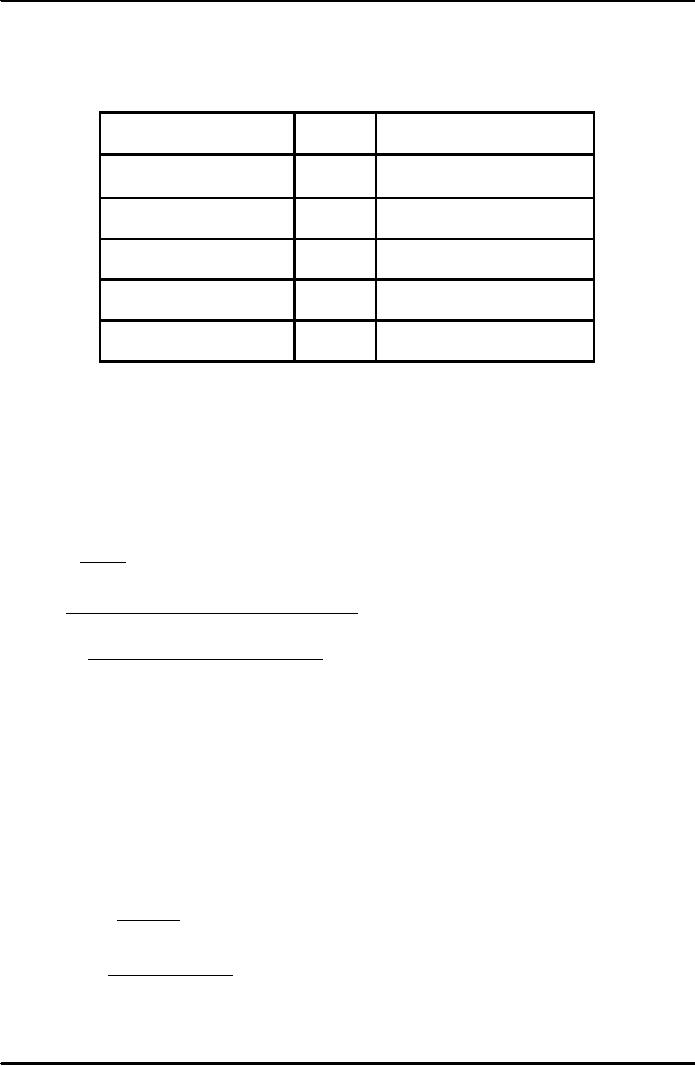

Exchange

rates as of February 26,

2005

Country

Currency

exchange

rate

Europe

Euro(�)

Rs.

78.53

Japan

Yen(�)

Rs.

0.5642

U.K.

Pound(�)

Rs.

113.99

United

States

Dollar($)

Rs.

59.32

UAE

Dirham

Rs.

16.15

The

real exchange

rate

ε

=

real exchange rate, the

relative price of domestic

goods in terms of foreign

goods (e.g.

Japanese

Big Macs per U.S.

Big Mac)

Understanding

the units of ε

e

�P

ε

=

P*

(Yen

per $) �

($

per unit U.S. goods)

=

Yen

per unit Japanese

goods

Yen

per unit U.S. goods

=

Yen

per unit Japanese

goods

Units

of Japanese goods

=

per

unit of U.S. goods

~

Example ~

�

One good:

Burger

�

Price in Japan:

P* = 200 Yen

�

Price in USA: P

= $2.50

�

Nominal

exchange rate, e = 120

Yen/$

e

�P

ε

=

P *

1

2 0 �

$ 2 .5

0

=

=

1

.5

200

Yen

54

Macroeconomics

ECO 403

VU

To

buy a U.S. burger, someone

from Japan would have to

pay an amount that could

buy 1.5

Japanese

Burgers.

ε

in

the real world & our

model

�

In

the real world:

We

can think of ε

as

the relative price of a

basket of domestic goods in

terms of a

basket

of foreign goods

�

In

our macro model:

There's

just one good, "output." So

ε is the

relative price of one

country's output in

terms

of the other country's

output

How

NX

depends

on ε

↑ε ⇒

US

goods become more expensive

relative to foreign goods

⇒

↓EX,

↑IM

⇒

↓NX

55

Table of Contents:

- INTRODUCTION:COURSE DESCRIPTION, TEN PRINCIPLES OF ECONOMICS

- PRINCIPLE OF MACROECONOMICS:People Face Tradeoffs

- IMPORTANCE OF MACROECONOMICS:Interest rates and rental payments

- THE DATA OF MACROECONOMICS:Rules for computing GDP

- THE DATA OF MACROECONOMICS (Continued…):Components of Expenditures

- THE DATA OF MACROECONOMICS (Continued…):How to construct the CPI

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- MONEY AND INFLATION:The Quantity Equation, Inflation and interest rates

- MONEY AND INFLATION (Continued…):Money demand and the nominal interest rate

- MONEY AND INFLATION (Continued…):Costs of expected inflation:

- MONEY AND INFLATION (Continued…):The Classical Dichotomy

- OPEN ECONOMY:Three experiments, The nominal exchange rate

- OPEN ECONOMY (Continued…):The Determinants of the Nominal Exchange Rate

- OPEN ECONOMY (Continued…):A first model of the natural rate

- ISSUES IN UNEMPLOYMENT:Public Policy and Job Search

- ECONOMIC GROWTH:THE SOLOW MODEL, Saving and investment

- ECONOMIC GROWTH (Continued…):The Steady State

- ECONOMIC GROWTH (Continued…):The Golden Rule Capital Stock

- ECONOMIC GROWTH (Continued…):The Golden Rule, Policies to promote growth

- ECONOMIC GROWTH (Continued…):Possible problems with industrial policy

- AGGREGATE DEMAND AND AGGREGATE SUPPLY:When prices are sticky

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND IN THE OPEN ECONOMY:Lessons about fiscal policy

- AGGREGATE DEMAND IN THE OPEN ECONOMY(Continued…):Fixed exchange rates

- AGGREGATE DEMAND IN THE OPEN ECONOMY (Continued…):Why income might not rise

- AGGREGATE SUPPLY:The sticky-price model

- AGGREGATE SUPPLY (Continued…):Deriving the Phillips Curve from SRAS

- GOVERNMENT DEBT:Permanent Debt, Floating Debt, Unfunded Debts

- GOVERNMENT DEBT (Continued…):Starting with too little capital,

- CONSUMPTION:Secular Stagnation and Simon Kuznets

- CONSUMPTION (Continued…):Consumer Preferences, Constraints on Borrowings

- CONSUMPTION (Continued…):The Life-cycle Consumption Function

- INVESTMENT:The Rental Price of Capital, The Cost of Capital

- INVESTMENT (Continued…):The Determinants of Investment

- INVESTMENT (Continued…):Financing Constraints, Residential Investment

- INVESTMENT (Continued…):Inventories and the Real Interest Rate

- MONEY:Money Supply, Fractional Reserve Banking,

- MONEY (Continued…):Three Instruments of Money Supply, Money Demand