|

Macroeconomics

ECO 403

VU

LESSON

12

MONEY AND

INFLATION (Continued...)

The

Fisher Effect

�

The

Fisher equation:

i=r+�

S = I determines

r.

Hence, an

increase in �

causes

an equal increase in i.

This

one-for-one relationship

is

called the Fisher

effect.

Exercise:

Suppose

V is constant, M is growing 5% per

year, Y is growing 2% per

year, and r = 4.

�

Solve

for i (the nominal interest

rate).

�

If

SBP increases the money

growth rate by 2 percentage

points per year, find

Δi

.

�

If

the growth rate of Y falls

to 1% per year

�

What

will happen to �?

�

What

must SBP do if it wishes

to

keep

�

constant?

Answers:

First,

find �

= 5 - 2 = 3.

Then,

find i = r + �

= 4 + 3 =

7.

�

Δi = 2,

same as the increase in the

money growth rate.

�

If

SBP does nothing, Δ�

=

1.

To

prevent inflation from

rising, SBP must reduce

the money growth rate by

1

percentage

point per year.

Two

real interest

rates

�

�

=

actual inflation rate

(not

known until after it has

occurred)

�

�e

= expected

inflation rate

�

i

�e

=

ex ante

real

interest rate:

what

people expect at the time

they buy a bond or take

out a loan

�

i

� = ex post

real interest rate:

what

people actually end up

earning on their bond or

paying on their loan

Money

demand and the nominal

interest rate

�

The

Quantity Theory of Money

assumes that the demand

for real money balances

depends

only

on real income Y.

�

We

now consider another

determinant of money demand:

the nominal interest

rate.

�

The

nominal interest rate i is

the opportunity cost of

holding money (instead of

bonds or

other

interest-earning assets).

41

Macroeconomics

ECO 403

VU

�

Hence,

↑i

⇒ ↓

in

money demand.

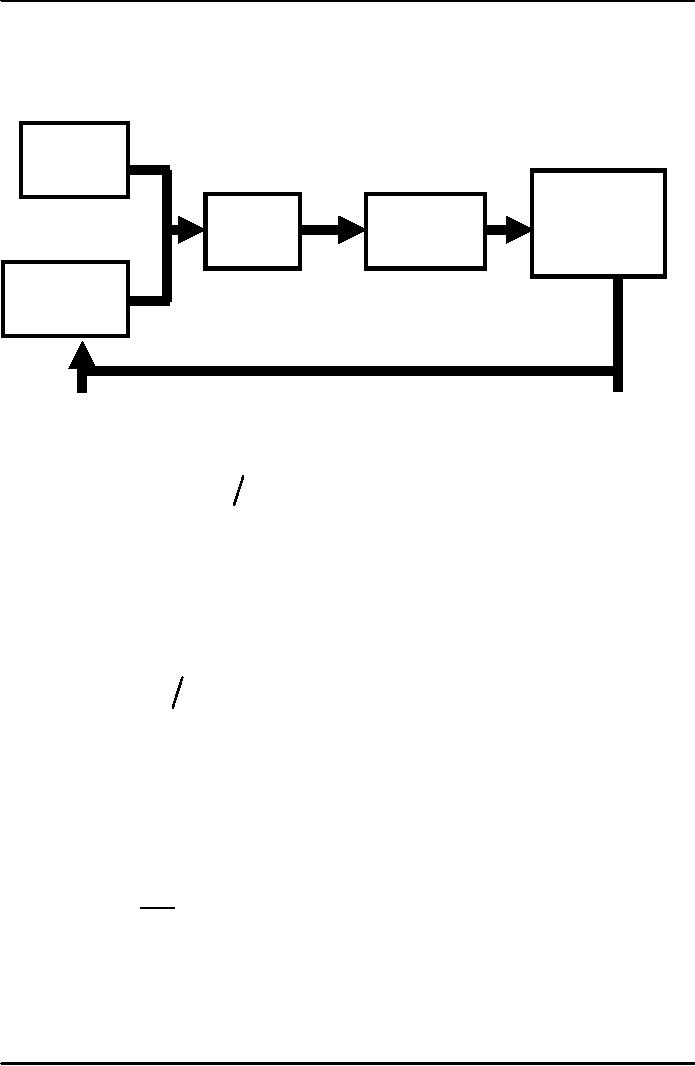

Linkages

Among Money, Prices and

Interest rate

Money

Supply

Nominal

Price

Inflation

Interest

Level

Rate

Rate

Money

Demand

The

money demand

function

(M

P ) =

L

(i

, Y

)

d

(M/P)

d = real money demand,

depends

�

negatively

on i

i

is the opportunity cost of

holding money

�

positively

on Y

higher

Y ⇒

more

spending so, need more

money

(L

is used for the money

demand function because

money is the most liquid

asset.)

(M

P )d

=

L

(i

,Y

)

=

L

(r

+ � e

, Y

)

When

people are deciding whether

to hold money or bonds, they

don't know what inflation

will

turn

out to be.

Hence,

the nominal interest rate

relevant for money demand is

r + �e.

M

Equilibrium

=

L

(r

+ � e

,Y

)

P

Supply

of Real money

balances

Real

money demand

42

Macroeconomics

ECO 403

VU

What

determines what

Variable

how

determined (in the long

run)

M

exogenous

(SBP)

r

adjusts

to make S = I

Y

Y

= F

(K

, L

)

M

P

adjusts

to make

=

L

(i

,Y

)

P

How

P

responds

to ΔM

�

For

given values of r, Y, and �e,

a

change in M causes P to change by

the same percentage ---

just like in the

Quantity

Theory

of Money.

What

about expected

inflation?

�

Over

the long run, people

don't consistently over- or

under-forecast inflation, so �e

= �

on

average.

�

In

the short run, �e

may

change when people get

new information.

EX:

Suppose SBP announces it

will increase M next year.

People will expect

next

year's

P to be higher, so �e

rises.

�

This

will affect P now, even

though M hasn't changed

yet.

How

P

responds

to Δ�e

M

=

L

(r

+ � e

,Y

)

P

�

For

given values of r, Y, and

M,

↑

� e

⇒ ↑ i

(the

Fisher effect)

⇒

↓ (M

P )

d

⇒

↑ P

to make

(M

P ) fall

to

re-establish eq'm

The

social costs of

inflation

...fall

into two categories:

1.

Costs when inflation is

expected

2.

Additional costs when

inflation is

different

than people had

expected.

43

Table of Contents:

- INTRODUCTION:COURSE DESCRIPTION, TEN PRINCIPLES OF ECONOMICS

- PRINCIPLE OF MACROECONOMICS:People Face Tradeoffs

- IMPORTANCE OF MACROECONOMICS:Interest rates and rental payments

- THE DATA OF MACROECONOMICS:Rules for computing GDP

- THE DATA OF MACROECONOMICS (Continued…):Components of Expenditures

- THE DATA OF MACROECONOMICS (Continued…):How to construct the CPI

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- MONEY AND INFLATION:The Quantity Equation, Inflation and interest rates

- MONEY AND INFLATION (Continued…):Money demand and the nominal interest rate

- MONEY AND INFLATION (Continued…):Costs of expected inflation:

- MONEY AND INFLATION (Continued…):The Classical Dichotomy

- OPEN ECONOMY:Three experiments, The nominal exchange rate

- OPEN ECONOMY (Continued…):The Determinants of the Nominal Exchange Rate

- OPEN ECONOMY (Continued…):A first model of the natural rate

- ISSUES IN UNEMPLOYMENT:Public Policy and Job Search

- ECONOMIC GROWTH:THE SOLOW MODEL, Saving and investment

- ECONOMIC GROWTH (Continued…):The Steady State

- ECONOMIC GROWTH (Continued…):The Golden Rule Capital Stock

- ECONOMIC GROWTH (Continued…):The Golden Rule, Policies to promote growth

- ECONOMIC GROWTH (Continued…):Possible problems with industrial policy

- AGGREGATE DEMAND AND AGGREGATE SUPPLY:When prices are sticky

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND IN THE OPEN ECONOMY:Lessons about fiscal policy

- AGGREGATE DEMAND IN THE OPEN ECONOMY(Continued…):Fixed exchange rates

- AGGREGATE DEMAND IN THE OPEN ECONOMY (Continued…):Why income might not rise

- AGGREGATE SUPPLY:The sticky-price model

- AGGREGATE SUPPLY (Continued…):Deriving the Phillips Curve from SRAS

- GOVERNMENT DEBT:Permanent Debt, Floating Debt, Unfunded Debts

- GOVERNMENT DEBT (Continued…):Starting with too little capital,

- CONSUMPTION:Secular Stagnation and Simon Kuznets

- CONSUMPTION (Continued…):Consumer Preferences, Constraints on Borrowings

- CONSUMPTION (Continued…):The Life-cycle Consumption Function

- INVESTMENT:The Rental Price of Capital, The Cost of Capital

- INVESTMENT (Continued…):The Determinants of Investment

- INVESTMENT (Continued…):Financing Constraints, Residential Investment

- INVESTMENT (Continued…):Inventories and the Real Interest Rate

- MONEY:Money Supply, Fractional Reserve Banking,

- MONEY (Continued…):Three Instruments of Money Supply, Money Demand