|

Macroeconomics

ECO 403

VU

LESSON

11

MONEY AND

INFLATION

Money

supply measures

_

Symbol

Assets

included___________

C

Currency

M1

C

+ demand deposits,

travelers'

checks,

other

checkable deposits

M2

M1

+ small time

deposits,

savings

deposits,

money

market mutual funds,

money

market deposit

accounts

M3

M2

+ large time

deposits,

repurchase

agreements,

institutional

money market

mutual

fund balances

The

Quantity Equation

�

The

quantity equation

M

�V

= P �Y

follows

from the preceding

definition of velocity.

It is an

identity:

it

holds by definition of the

variables.

Money

demand and the quantity

equation

�

Let's

now express the quantity of

money in terms of the

quantity of goods and

services

it

can buy;

�

M/P = real

money balances,

the

purchasing power of the

money supply.

�

A

simple money demand

function:

(M/P

)d =

k Y

where

k

= how much money people

wish to hold for each

rupee of income (k is

exogenous)

�

This

equation states that the

quantity of real money

balances demanded is

proportional

to

real income.

�

(M/P

)d =

k Y

Money

demand:

�

Quantity

equation: M �V = P �Y

�

The

connection between them: k =

1/V

�

When

people hold lots of money

relative to their incomes (k is

high), money changes

hands

infrequently (V is low).

37

Macroeconomics

ECO 403

VU

THE

QUANTITY THEORY OF

MONEY

�

Recall

The

growth rate of a product

equals the sum of the

growth rates.

�

The

quantity equation in growth

rates:

ΔM

ΔV

ΔP

ΔY

+

=

+

M

V

P

Y

The

quantity theory of money

assumes

ΔV

V

is

constant, so

=

0.

V

Let

�

(Greek

letter "pi") denote the

inflation rate:

ΔP

� =

P

ΔM

ΔP

ΔY

We

have

=

+

M

P

Y

ΔM

ΔY

Solve

this result for �

to

get

� =

-

M

Y

�

Normal

economic growth requires a

certain amount of money

supply growth to

facilitate

the

growth in transactions.

�

Money

growth in excess of this

amount leads to

inflation.

ΔY/Y depends on

growth in the factors of

production and on technological

progress (all of

which

we take as given, for

now).

Hence,

the Quantity Theory of Money

predicts a one-for-one relation

between changes in

the

money

growth rate and changes in

the inflation rate.

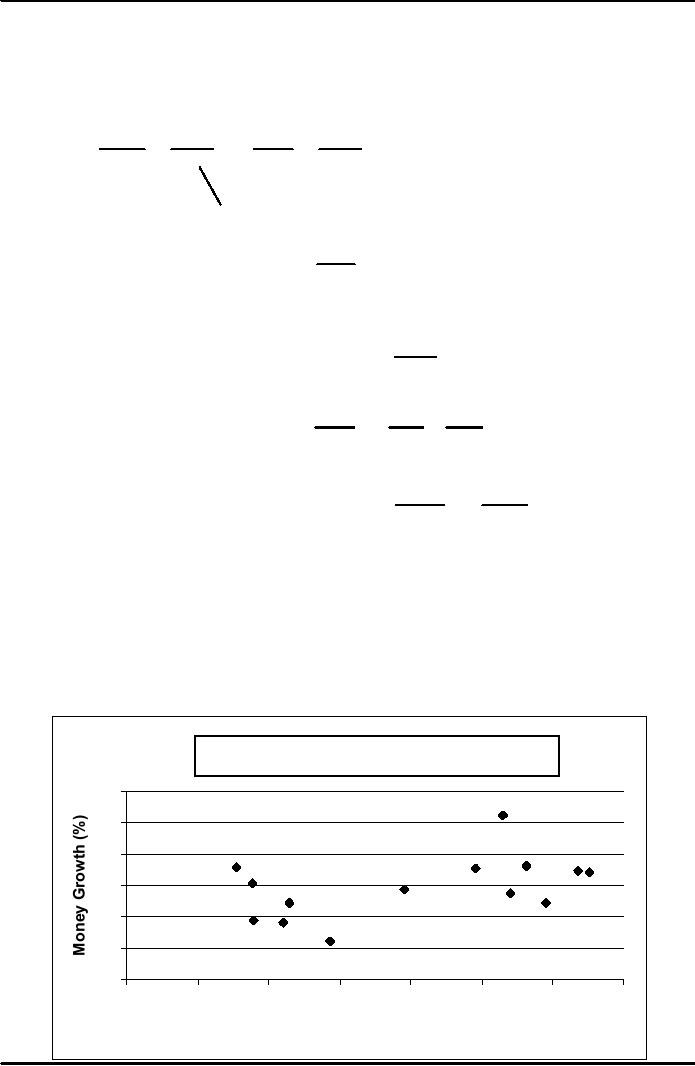

Inflation

and Money growth

Inflation

and Money Growth of

Pakistan

30

1991-92

25

1993-94

1990-91

20

1992-93

2002-03

1994-95

2001-02

1997-98

2003-04

1995-96

15

1999-00

1996-97

2000-01

10

1998-99

5

0

0

2

4

6

8

10

12

14

Inflation

(%)

38

Macroeconomics

ECO 403

VU

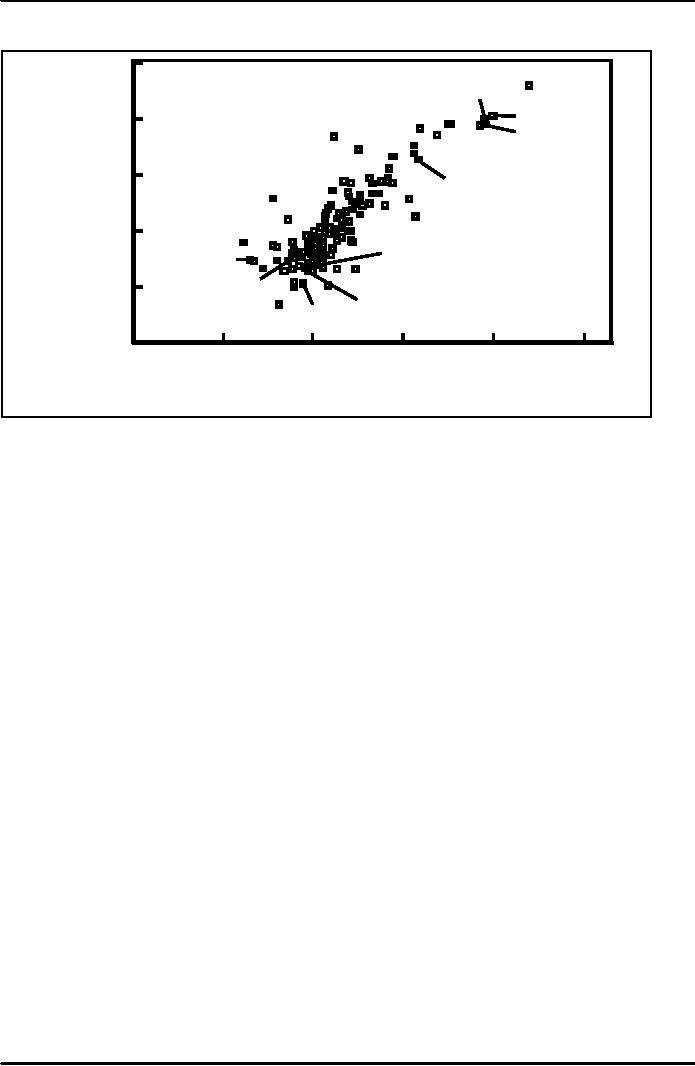

International

data on inflation and money

growth

10,000

Republic

.

Inflation

rate

of

Congo

Nicaragua

(%)(Log

scale)

Angola

1,000

Georgia

Brazil

100

Bulgaria

10

Germany

Kuwait

1

USA

Canada

Oman

Japan

0.1

0.1

1

10

100

1,000

10,000

Money

supply growth(%)

Log

scale

39

Macroeconomics

ECO 403

VU

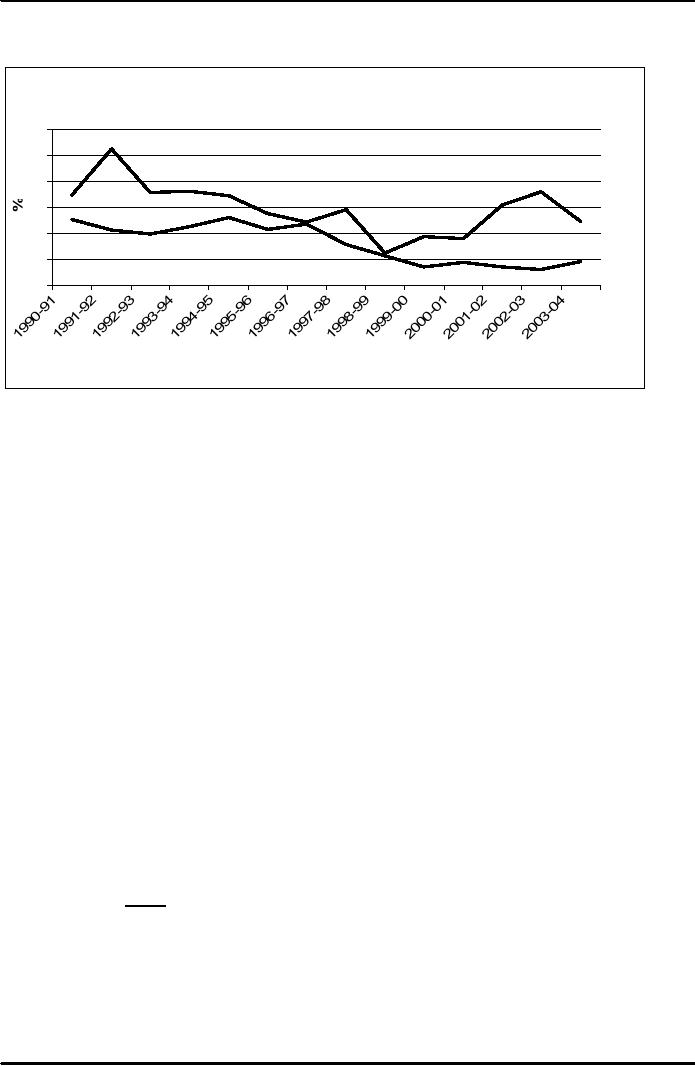

Inflation

and Money growth in

Pakistan

30

25

20

Money

Growth (M2)

15

10

5

0

Inflation

rate

Years

SEIGNIORAGE

�

To

spend more without raising

taxes or selling bonds, the

govt. can print

money.

�

The

"revenue" raised from

printing money is called

seigniorage

(pronounced

SEEN-your-ige)

�

The

inflation tax:

Printing

money to raise revenue

causes inflation. Inflation is

like a tax on people

who

hold

money.

Inflation

and interest

rates

�

Nominal

interest rate, i

not

adjusted for

inflation

�

Real

interest rate, r

adjusted

for inflation:

r=i

-�

The

Fisher Effect

�

The

Fisher equation:

i=r+�

�

S = I determines

r.

�

Hence, an

increase in �

causes

an equal increase in i.

�

This

one-for-one relationship

is

called the Fisher

effect.

40

Table of Contents:

- INTRODUCTION:COURSE DESCRIPTION, TEN PRINCIPLES OF ECONOMICS

- PRINCIPLE OF MACROECONOMICS:People Face Tradeoffs

- IMPORTANCE OF MACROECONOMICS:Interest rates and rental payments

- THE DATA OF MACROECONOMICS:Rules for computing GDP

- THE DATA OF MACROECONOMICS (Continued…):Components of Expenditures

- THE DATA OF MACROECONOMICS (Continued…):How to construct the CPI

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- MONEY AND INFLATION:The Quantity Equation, Inflation and interest rates

- MONEY AND INFLATION (Continued…):Money demand and the nominal interest rate

- MONEY AND INFLATION (Continued…):Costs of expected inflation:

- MONEY AND INFLATION (Continued…):The Classical Dichotomy

- OPEN ECONOMY:Three experiments, The nominal exchange rate

- OPEN ECONOMY (Continued…):The Determinants of the Nominal Exchange Rate

- OPEN ECONOMY (Continued…):A first model of the natural rate

- ISSUES IN UNEMPLOYMENT:Public Policy and Job Search

- ECONOMIC GROWTH:THE SOLOW MODEL, Saving and investment

- ECONOMIC GROWTH (Continued…):The Steady State

- ECONOMIC GROWTH (Continued…):The Golden Rule Capital Stock

- ECONOMIC GROWTH (Continued…):The Golden Rule, Policies to promote growth

- ECONOMIC GROWTH (Continued…):Possible problems with industrial policy

- AGGREGATE DEMAND AND AGGREGATE SUPPLY:When prices are sticky

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND IN THE OPEN ECONOMY:Lessons about fiscal policy

- AGGREGATE DEMAND IN THE OPEN ECONOMY(Continued…):Fixed exchange rates

- AGGREGATE DEMAND IN THE OPEN ECONOMY (Continued…):Why income might not rise

- AGGREGATE SUPPLY:The sticky-price model

- AGGREGATE SUPPLY (Continued…):Deriving the Phillips Curve from SRAS

- GOVERNMENT DEBT:Permanent Debt, Floating Debt, Unfunded Debts

- GOVERNMENT DEBT (Continued…):Starting with too little capital,

- CONSUMPTION:Secular Stagnation and Simon Kuznets

- CONSUMPTION (Continued…):Consumer Preferences, Constraints on Borrowings

- CONSUMPTION (Continued…):The Life-cycle Consumption Function

- INVESTMENT:The Rental Price of Capital, The Cost of Capital

- INVESTMENT (Continued…):The Determinants of Investment

- INVESTMENT (Continued…):Financing Constraints, Residential Investment

- INVESTMENT (Continued…):Inventories and the Real Interest Rate

- MONEY:Money Supply, Fractional Reserve Banking,

- MONEY (Continued…):Three Instruments of Money Supply, Money Demand