|

MARKET STRUCTURES:PERFECT COMPETITION, Allocative efficiency |

| << BACKGROUND TO SUPPLY/COSTS (CONTINUED…………..):PROFIT MAXIMISATION |

| MARKET STRUCTURES (CONTINUED………..):MONOPOLY >> |

Introduction

to Economics ECO401

VU

UNIT

- 6

Lesson

6.1

MARKET

STRUCTURES

Market

structure refers to how an

industry (broadly called

market) that a firm is

operating in is

structured

or organized.

The

key ingredients of any

market structure

are:

�

Number of

firms in the

market/industry

�

Extent of

barriers to entry

�

Nature of

product

�

Degree of

control over price.

Knowledge

about market structure can

help answer four

questions:

i.

How much profit a firm

will make (normal or

supernormal)

ii.

How much quantity it will

produce at its profit-maximisation

point (i.e. whether it

will

be

a large level of output or a

small one relative to the

market)

iii.

Whether or not a higher

level of output would

increase the cost or

productive

efficiency

of the firm or allocative

efficiency for society (see

the summary on

monopoly

for details)

iv.

Are the prices set

too high, too low, or

just right?

Four

broad market structures have

been identified by

economists:

�

Perfect

competition

�

Monopoly

�

Monopolistic

competition

�

Oligopoly.

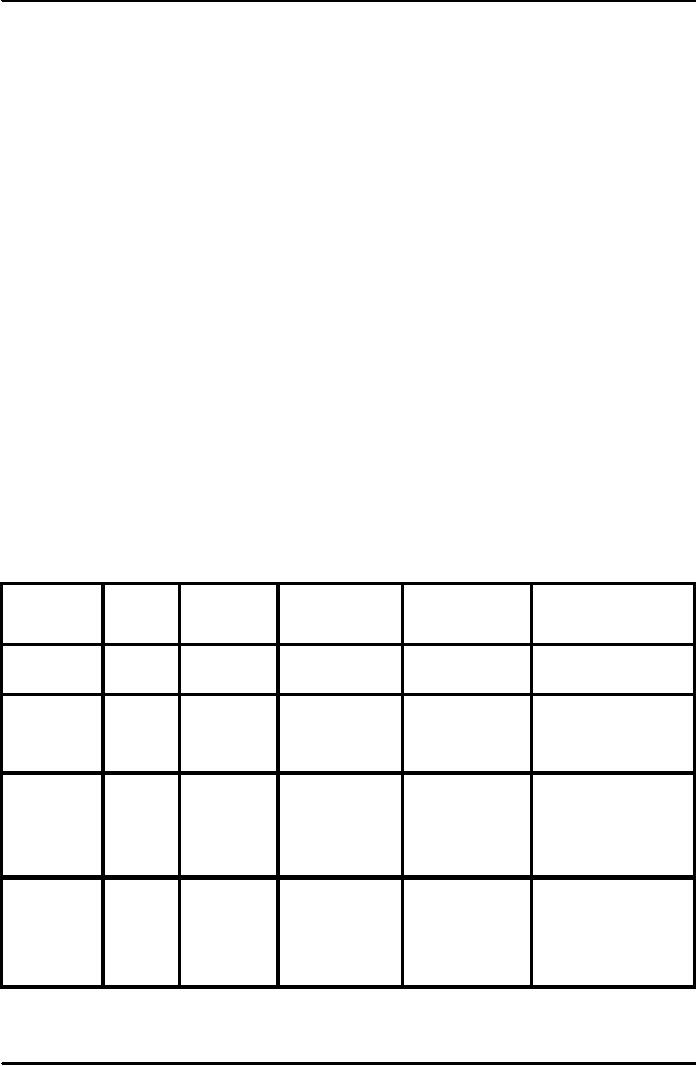

Implication

for

Type

of

Number

Freedom of

Nature

of

Examples

demand

curve of

market

of

firms

entry

product

firm

Perfect

Very

Homogenous

Grains

(wheat) or Horizontal; firm is

a

Unrestricted

competition

many

(undifferentiated)

vegetables

price

taker

Downward

sloping but

Monopolistic

Many /

Plumbers,

relatively

elastic; firm

Unrestricted

Differentiated

competition

Several

restaurants

has

some control over

prices.

Downward

sloping

1.

relatively

inelastic but

Cement,

cars,

Oligopoly

or

Undifferentiated

depends

on reactions

electrical

Few

Restricted

or

2.

Cartel

of

rivals to a price

appliance,

oil.

Differentiated

change

Downward

sloping

Restricted

or

more

inelastic than

WAPDA,

or

Monopoly

One

completely

Unique

oligopoly;

firm has

KESC

blocked

considerable

control

over

price

54

Introduction

to Economics ECO401

VU

PERFECT

COMPETITION

The

main assumptions of perfect

competition are:

i.

Large number of buyers

and sellers, therefore firms

price-takers.

ii.

No barriers to entry (also

implies free mobility of

factors of production).

iii.

Identical/homogeneous products.

iv.

Perfect information/knowledge.

The

word perfect

in

perfect competition is not

used its normative sense.

Rather it means that

competition

in the industry is of an extreme

nature. It is used as a benchmark

with which to

compare

other types of market

structures.

Perfect

competition can be thought of as an

extreme

form of capitalism, i.e.

all the firms

are

fully

subject to the market forces

of demand and supply.

Concentration

ratio is used to

assess the level of

competition in an industry. It is simply

the

percentage

of total industry output

that is produced by the 5

largest firms in the

industry.

The

Short Run and Long

Run under Perfect

Competition:

The

short run is the period

where at least one factor of

production is fixed. In perfect

competition,

it

also means that no new

firms can enter the

market. In the long run,

all the factors of

production

are

variable.

Equilibrium

analysis can help us answer

questions about the

market-clearing price and

quantity;

where

the profits are maximized

and how much are

these profits; how

individual firms make

their

short

run supply decisions and

how these translate into

the long-run industry supply

curve.

In

the short run, a perfectly

competitive firm can settle

at an equilibrium where it is making

super

normal

profits, normal profits,

loss, or where it decides to

shut down.

In

the short run, the

firm's supply curve is

identical to the positive

part of MC. The short

run

industry

supply curve is simply the

horizontal summation of the

supply curves of individual

firms.

The

demand (or AR) curve

for

the industry is downward

sloping but for any

individual perfectly

competitive

firm, is horizontal. Thus

the firm can sell as

much at the given market

price. For this

reason,

the AR and MR curves align

under perfect

competition.

In

the long run, any

firm can enter or leave

the industry. If there are

supernormal profits in

the

short

run, more firms will be

attracted to the market and

the increase in supply will

push prices

down

to eliminate supernormal profit

possibilities in the long

run. By contrast, if firms

are making

losses

in the short run, they

will leave the industry in

the long run causing

supply to fall, prices

to

rise

and normal profitability to be

restored. In the long run,

therefore, perfectly competitive

firms

can

only earn normal

profits.

Allocative

Efficiency and Productive

Efficiency:

Public

interest is concerned with

both allocative efficiency

and productive

efficiency.

a.

Allocative

efficiency: The

optimal point of production

for any individual firm is

where

MR=MC.

The optimal point of

production for any society

is where price is equal

to

marginal

cost. This is called the

point of maximum allocative

efficiency and is

achieved

in

perfect competition (because

MR=MC, and MR=AR=P for a

perfectly competitive

price

taking

firm, therefore

P=MC).

b.

Productive

efficiency: This is

attained when firms produce

at the bottom of their

AC

curves,

that is, goods are

produced in the most cost

efficient manner.

Perfectly

competitive

firms also achieve this in

the long run because

they produce at P=MC

and

this

intersection point also

happens to be the point of

tangency with the lowest

part of the

AC

curve. Thus P=

ACminimum.

55

Table of Contents:

- INTRODUCTION TO ECONOMICS:Economic Systems

- INTRODUCTION TO ECONOMICS (CONTINUED………):Opportunity Cost

- DEMAND, SUPPLY AND EQUILIBRIUM:Goods Market and Factors Market

- DEMAND, SUPPLY AND EQUILIBRIUM (CONTINUED……..)

- DEMAND, SUPPLY AND EQUILIBRIUM (CONTINUED……..):Equilibrium

- ELASTICITIES:Price Elasticity of Demand, Point Elasticity, Arc Elasticity

- ELASTICITIES (CONTINUED………….):Total revenue and Elasticity

- ELASTICITIES (CONTINUED………….):Short Run and Long Run, Incidence of Taxation

- BACKGROUND TO DEMAND/CONSUMPTION:CONSUMER BEHAVIOR

- BACKGROUND TO DEMAND/CONSUMPTION (CONTINUED…………….)

- BACKGROUND TO DEMAND/CONSUMPTION (CONTINUED…………….)The Indifference Curve Approach

- BACKGROUND TO DEMAND/CONSUMPTION (CONTINUED…………….):Normal Goods and Giffen Good

- BACKGROUND TO SUPPLY/COSTS:PRODUCTIVE THEORY

- BACKGROUND TO SUPPLY/COSTS (CONTINUED…………..):The Scale of Production

- BACKGROUND TO SUPPLY/COSTS (CONTINUED…………..):Isoquant

- BACKGROUND TO SUPPLY/COSTS (CONTINUED…………..):COSTS

- BACKGROUND TO SUPPLY/COSTS (CONTINUED…………..):REVENUES

- BACKGROUND TO SUPPLY/COSTS (CONTINUED…………..):PROFIT MAXIMISATION

- MARKET STRUCTURES:PERFECT COMPETITION, Allocative efficiency

- MARKET STRUCTURES (CONTINUED………..):MONOPOLY

- MARKET STRUCTURES (CONTINUED………..):PRICE DISCRIMINATION

- MARKET STRUCTURES (CONTINUED………..):OLIGOPOLY

- SELECTED ISSUES IN MICROECONOMICS:WELFARE ECONOMICS

- SELECTED ISSUES IN MICROECONOMICS (CONTINUED……………)

- INTRODUCTION TO MACROECONOMICS:Price Level and its Effects:

- INTRODUCTION TO MACROECONOMICS (CONTINUED………..)

- INTRODUCTION TO MACROECONOMICS (CONTINUED………..):The Monetarist School

- THE USE OF MACROECONOMIC DATA, AND THE DEFINITION AND ACCOUNTING OF NATIONAL INCOME

- THE USE OF MACROECONOMIC DATA, AND THE DEFINITION AND ACCOUNTING OF NATIONAL INCOME (CONTINUED……………..)

- MACROECONOMIC EQUILIBRIUM & VARIABLES; THE DETERMINATION OF EQUILIBRIUM INCOME

- MACROECONOMIC EQUILIBRIUM & VARIABLES; THE DETERMINATION OF EQUILIBRIUM INCOME (CONTINUED………..)

- MACROECONOMIC EQUILIBRIUM & VARIABLES; THE DETERMINATION OF EQUILIBRIUM INCOME (CONTINUED………..):The Accelerator

- THE FOUR BIG MACROECONOMIC ISSUES AND THEIR INTER-RELATIONSHIPS

- THE FOUR BIG MACROECONOMIC ISSUES AND THEIR INTER-RELATIONSHIPS (CONTINUED…….)

- THE FOUR BIG MACROECONOMIC ISSUES AND THEIR INTER-RELATIONSHIPS (CONTINUED…….):Causes of Inflation

- THE FOUR BIG MACROECONOMIC ISSUES AND THEIR INTER-RELATIONSHIPS (CONTINUED…….):BALANCE OF PAYMENTS

- THE FOUR BIG MACROECONOMIC ISSUES AND THEIR INTER-RELATIONSHIPS (CONTINUED…….):GROWTH

- THE FOUR BIG MACROECONOMIC ISSUES AND THEIR INTER-RELATIONSHIPS (CONTINUED…….):Land

- THE FOUR BIG MACROECONOMIC ISSUES AND THEIR INTER-RELATIONSHIPS (CONTINUED…….):Growth-inflation

- FISCAL POLICY AND TAXATION:Budget Deficit, Budget Surplus and Balanced Budget

- MONEY, CENTRAL BANKING AND MONETARY POLICY

- MONEY, CENTRAL BANKING AND MONETARY POLICY (CONTINUED…….)

- JOINT EQUILIBRIUM IN THE MONEY AND GOODS MARKETS: THE IS-LM FRAMEWORK

- AN INTRODUCTION TO INTERNATIONAL TRADE AND FINANCE

- PROBLEMS OF LOWER INCOME COUNTRIES:Poverty trap theories: