|

Operations

Research (MTH601)

250

EXERCISES

1.

The

cost of a machine is Rs.

6100 and its scrap value is

only Rs. 100/-. The

maintenance costs are

found

from experience to

be.

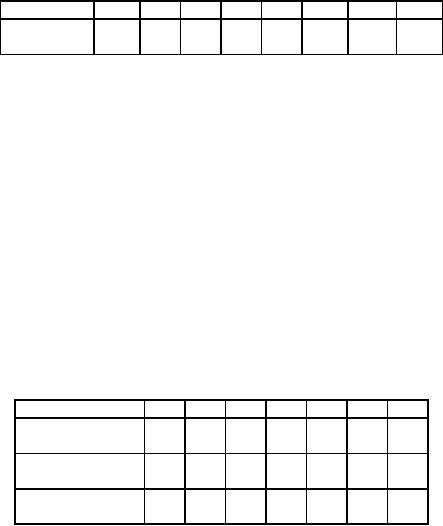

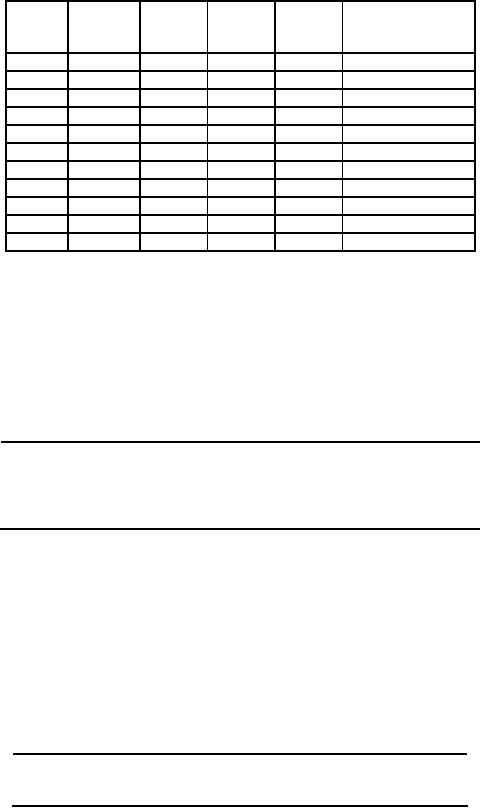

Year

1

2

3

4

5

6

7

8

Maintenance

100

250

400

600

900

1250

1600

2000

cost

(Rs.)

When

should the machine be

replaced?

2.

A

machine costs Rs. 8000.

Annual operating costs are

Rs. 1000 for the

first year, and then

increase by

Rs.

500 every year. Resale

prices are Rs. 4000

for the first year

and then decrease by Rs.

500 every

year.

Determine at which age it is profitable

to replace the

machine.

3.

A

machine owner finds from his

past experience that the

maintenance costs are Rs.

200 for the

first

year

and then increase by Rs.

200 every year. The

costs of the machine type A

Rs. 9000. Determine

the

best

age at which to replace the

machine. If the optimum

replacement is followed what will be

the

average

yearly cost of owning and

operating the machine? Machine

type B costs Rs. 10000/-.

Annual

operating

costs are Rs. 400

for the first year

and then increase by Rs.

800/- every year. The

machine

owner

has now the machine

type A, which is one year

old. Should it be replaced with B

type and if so,

when?

4.

Explain

briefly the difference in

replacement policies of items, which

deteriorate gradually and

items,

which

fail completely. A machine shop

has a press, which is to be

replaced as it wears out. A new

press

is

to be installed now. Further an

optimum replacement plan is to be

found for next 7 years after

which

the

press is no longer required.

The following data is given

below.

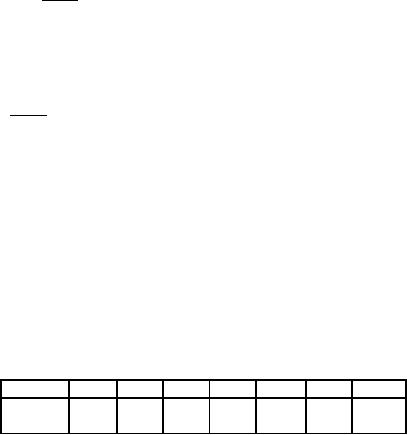

Year

1

2

3

4

5

6

7

Cost

of

200

210

220

240

260

290

320

installation

(Rs.)

Salvage

value

100

30

30

20

15

10

0

(Rs.)

Operating

cost

60

80

100

120

150

180

230

(Rs.)

Find

an optimum replacement policy

and the corresponding

minimum cost.

ITEMS

DETERIORATING WITH TIME VALUE OF

MONEY

In

the previous section we did

not take the interest

for the money invested,

the running costs and

resale

value.

If the effect of time value

of money is to be taken into

account, the analysis must

be based on an

equivalent

cost. This is done with

the present value or present

worth analysis.

For

example, suppose the

interest rate is given as

10% and Rs. 100

today would amount to Rs.

110

after

a year's time. In other words the

expenditure of Rs. 110 in

year's time is equivalent to

Rs. 100 today.

Likewise

one rupee a year from

now is equivalent to

(1.1)-1 rupees today and

one-rupee in 'n'

years from now is

equivalent

to (1.1)-n rupees today. This

quantity (1.1)-n

is called

the present value or present

worth of one rupee

spent

'n' years from

now.

250

Operations

Research (MTH601)

251

We

can establish an algebraic formula

for the present worth

value.

Let

M

=

purchase price of an item.

Rn =

running cost in year

n.

r

=

rate of interest

The

present worth of a rupee to be

spent after a year is

denoted by v

and

given by

v

=

1/(1 + r)

v

is

called the discount rate.

Let the item be replace

after n

years,

and that the expenditure

can be considered to

take

place at the beginning of

each year. Then the

present worth of expenditure

denoted by

P(n)

= M + R1 +

vR2 + v2R3

+ ... +

vn-1Rn

We

note that P(n)

increases as n

increases.

The

present worth of expenditure

incurred for n

years

including the capital cost is

obtained from a

money

lending institution and we repay

the loan by fixed annual

installments throughout the

life of the machine.

The

present worth of this fixed

annual installment x

for

n

years

is

=

x

+ vx + v2x

+

... + vn-1x

=

x

(1

+ v

+ v2 + ... + vn-1)

n

1-

v

P(n)

=

x

(using

the formula for a geometric

series)

1-

v

Since

this is the sum repaid, we

equate the present worth of

expenditure to the present

worth or repayment.

Then,

1-

v

x=

P(n).

n

1-

v

So,

the best period at which to

replace the machine is the

period n

which

minimizes x.

Since (1 - v)

is

constant,

it is enough if we minimize P(n)/(1

- vn).

The best period at which to

replace the machine is the

period

n

which

minimizes P(n)

/ (1 - vn) =

F(n)

(say).

The

value of n

is

not continuous but discrete

and hence we are not in a

position to employ

differentiation

to find the optimum

period.

We

can assume n

=

1,2,3 etc., find P(n)

for different years and

calculate using the formula

for x

above.

Choose

n which minimize x.

We shall illustrate this idea with an

example.

Example

The

initial cost of an item is

Rs. 15000 and maintenance or

running cost for different

years is given

below.

Year

1

2

3

4

5

6

7

Running

2500

3000

4000

5000

6500

8000

10000

cost

Rs.

251

Operations

Research (MTH601)

252

What

is the replacement policy to be

adopted if the capital is

worth 10% and no salvage

value.

We

know that

Solution

P(n)

= M

+

R1 + vR2 + ... + vn-1Rn

Use

this equation for n = 1, 2, 3,

...

M

=

Rs. 15000

1

v=

=

0.909

1

+

0.1

R1 to R7 are as given in the

problem. The best time to

replace the item is

n

which

is governed by x

=

P(n)

(1 - v)

/ (1 - vn).

We

use a tabular method to

present the details for

analysis in table 6.

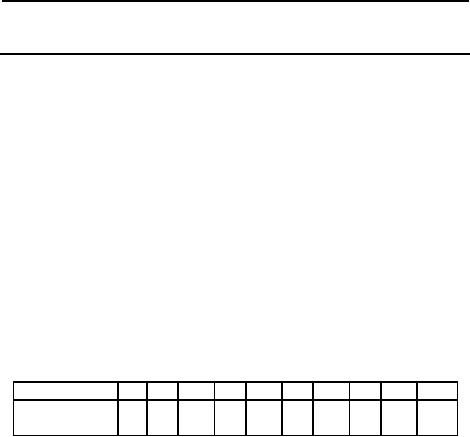

Table

6

n-1

vn-1 Rn

P(n)

(1-v)/(1-vn)

Year

n

Running

P(n)

v

cost,

(PWF)

Rn(Rs.)

1

2500

1.000

2500

17500

17500

2

3000

0.909

2727

20227

10595

3

4000

0.826

3304

23531

8602

4

5000

0.751

3755

27286

7826

5

6500

0.683

4440

31726

7609

6

8000

0.621

4968

36694

7660

We

see from table 6 the

value of the fixed annual

installment given by the last column is

minimum at

year

5. So it is optimal to replace the

machine after fiver

years.

A

manufacturer is offered two

machines A

and

B.

A is priced at Rs. 10000 and

running costs

Example

are

Rs. 1600 for each of

the first five years,

increasing by Rs. 400 per

year in the sixth and

subsequent years.

Machine

B

which

has the same capacity as

A,

costs Rs. 5000 but

will have running costs of

Rs. 2400 per year

for

six

years increasing by Rs. 400

per year, there after. If

the capital is worth 10%

per year which machine

should

be

purchased?

We

prepare two tables 7 and 8

for machine A

and

for machine B

respectively

as shown.

Solution

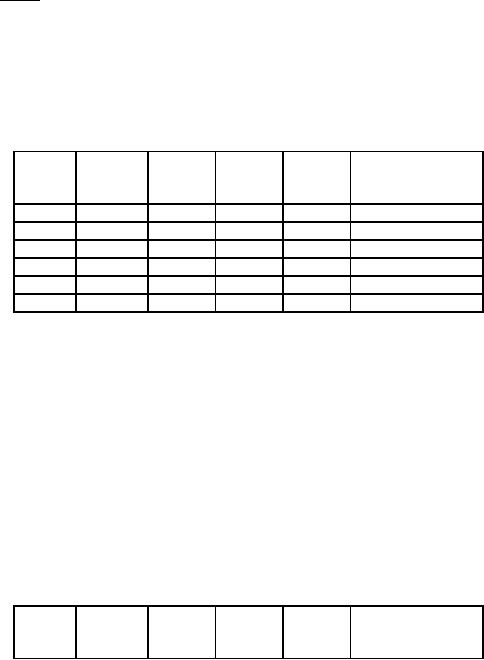

Table

7

Machine

A

vn-1

vn-1 Rn

P(n)

(1-v)/(1-vn)

Year

n

Running

P(n)

cost,

(PWF)

Rn(Rs.)

252

Operations

Research (MTH601)

253

1

1600

1.000

1600

11600

11600

2

1600

0.909

1454

13054

6835

3

1600

0.8264

1322

14376

5254

4

1600

0.7513

1202

15578

4467

5

1600

0.6830

1092

16670

3997

6

2000

0.6209

1242

17912

3739

7

2400

0.5645

1354

19266

3598

8

2800

0.5132

1436

20702

3527

9

3200

0.4665

1492

22194

3503

10

3600

0.4241

1526

23720

3508

11

4000

0.3854

1542

25262

-

253

Operations

Research (MTH601)

254

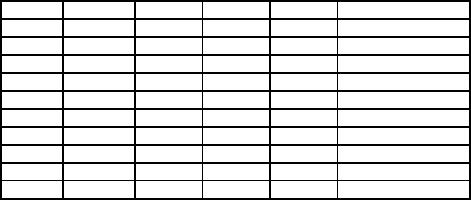

Table

8

Machine

B

vn-1

vn-1 Rn

P(n)

(1-v)/(1-vn)

P(n)

Year

n

Running

(PWF)

cost,

Rn(Rs.)

1

2400

1.000

2400

7400

7400

2

2400

0.9091

2182

9582

5017

3

2400

0.8264

1983

11565

4227

4

2400

0.7513

1802

13368

3833

5

2400

0.6830

1639

15007

3598

6

2400

0.6209

1490

16497

3443

7

2800

0.5645

1581

18078

3376

8

3200

0.5132

1642

19720

3360

9

3600

0.4665

1679

21399

3378

10

4000

0.4241

1696

23095

3378

11

4400

0.3854

1696

24791

-

From

the above tables 7 and 8 we

find that machine A is

replaced at the end of 9th

year with fixed

annual

payment of Rs. 5503 and

that the machine B is

replaced at the end of 8

years and the fixed

annual

payment

is Rs. 3360. Comparing the

two figures, machine B is to be

purchased.

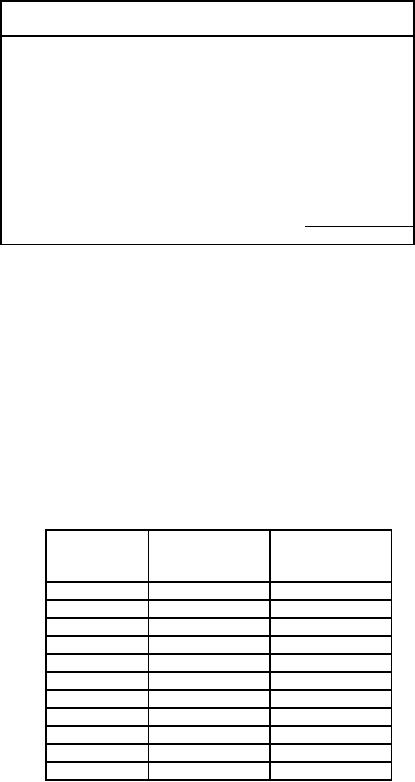

EXERCISES

1.

A

person is considering purchasing a

machine for his own factory.

Relevant data about

alternative

machines

are as follows.

Machine

A

Machine

B

Machine

C

Present

investment

Rs.

10000

12000

15000

Total

Annual cost

Rs.

2000

1500

1200

Life

(years)

10

10

10

Salvage

value

Rs.

500

1000

1200

As

an adviser to the buyer, you

have been asked to select

the best machine,

considering 12%

normal

rate

of return. You are given

that:

(a)

Single payment present worth

factor (PWF) at 12 % rate for 10

years = 0.322.

(b)

Annual series present worth

factor (PWFs) at 12 % rate

for 10 years = 5.650.

2.

Discuss

the optimum replacement

policy for items when

maintenance cost increases

with time and

the

money

value changes with constant

rate. If you wish to have a

return of 0 percent per

constant rate. If

you

wish to have a return of 10

percent per annum for

investment, which of the

following plan you

prefer?

Plan

A

Plan

B

First

Cost (Rs.)

200000

250000

Scrap

value for 15 year

(Rs.)

150000

180000

254

Operations

Research (MTH601)

255

Excess

of annual revenue over

annual

disbursement

(Rs.)

25000

30000

ITEMS

THAT FAIL COMPLETELY AND

SUDDENLY

There

is another type of problem

where we consider the items

that fail completely. The

item fails such

that

the loss is sudden and

complete. Common examples are

the electric bulbs,

transistors and replacement

of

items,

which follow sudden failure

mechanism.

Strategy

(1) (IR)

Under

this strategy equipments or facilities

break down at various times.

Each breakdown can be

remedied

as it occurs by replacement or repair of

the faulty unit.

Examples:

Vacuum tubes,

transistors.

Strategy

(2) (IPR)

According

to this strategy, before any

unit fails, either each

unit is replaced or preventive

maintenance

is

performed on it as per the

following rules.

(a)

Determine

the optimum life I of each

item. Replace all those

items, which have given

the optimum life

though

they still survive.

(b)

Replace

an item if it fails before

the optimum life T.

Examples:

Car tyres, aircraft

engines.

Strategy

(3) (CPR) or Group

replacement

As

per this strategy, an optimal

group replacement period

'P'

is determined and common

preventive

replacement

is carried out as

follows.

(a)

Replacement

an item if it fails before

the optimum period

'P'.

(b)

Replace

all the items every

optimum period of 'P'

irrespective of the life of

individual item.

Examples:

Bulbs, Tubes, and

Switches.

Among

the three strategies that

may be adopted, the third

one namely the group

replacement policy

turns

out to be economical if items

are supplied cheap when

purchased in bulk quantities.

With this policy,

all

items

are replaced at certain

fixed intervals. The optimum

interval can be worked out as illustrated

in the

example

to follow.

The

following mortality rates

have been observed for a

certain electric

bulb.

Example

Week

1

2

3

4

5

6

7

8

Percentage

failure

by

end of week

5

13

25

43

68

88

96

100

There

are 1000 bulbs in a factory

and it costs Rs. 400 to

replace and individual bulb,

which has burnt

out.

If all bulbs were replaced

simultaneously, it would cost

Re. 1 per bulb. It is

proposed to replace all

bulbs at

255

Operations

Research (MTH601)

256

fixed

intervals, whether or not

they have burnt out,

and to continue replacing

burnt out bulbs as they

fail. At

what

intervals should all the

bulbs be replaced?

We

make two assumptions in solving

the problem.

Solution:

(1)

The bulbs that fail

during a week are replaced

before the end of the

week.

(2)

The actual probability of failures

during a week for a subpopulation of

the bulbs with the

same age

is

the same as the probability of failure

during the week for that

sub-population.

Let

Pi be

the probability that a bulb newly

installed fails during the

ith

week of its life. This can be

obtained

from mortality table shown

below in table 9.

Table

9

End

of the week

1

2

3

4

5

6

7

8

Probability

of

failure

during

0.05

0.08

0.12

0.18

0.25

0.20

0.08

0.04

the

ith

week

Now,

we calculate the number of

bulbs that fail during a

particular week and require

replacement.

Let

ni be

the number of replacement

made at the end of the

ith

week if all 1000 bulbs were

new initially

with

the assumptions made above.

We obtain,

n0 = n0

=

1000

n1 = n0p1

=

50

n2 = n0p2 + n1p1 = 80 + 3

=

83

n3 = n0p3 + n1p2 + n2p1 = 120 + 4 + 4

=

128

n4 = n0p4 + n1p3 + n2p2 + n3p1 = 180 + 6 + 7 + 6

=

199

n5 = n0p5 + n1p4 + n2p2 + n3p2 + n4p1 = 250+9+10+10+10

=

289

If

the policy is to replace all

the bulbs simultaneously

every week the cost of installation of

1000 bulbs

at

the rate of Re. 1 per

bulb is rate of Rs. 4 per

bulb. Then the cost of

replaced bulbs = Rs. 200.

Total cost per

week

= Rs. 1200.

If

all the bulbs were

replaced at the end of two

weeks, the cost of new bulbs

for group replacement

is

Rs.

1000 and the number of

bulbs to be replaced during

first two weeks would be

133 and the cost

for the same

is

133 x

4

=Rs. 532. Total cost

would be Rs. 1532. This

expenditure is spread over a

period of two weeks.

Hence

the

average cost per week

would be Rs. 766, which is

less than that if the

policy is to replace the

bulbs every

week.

Extending

the same logic, if the

policy would be to replace

all bulbs once in three

weeks, the cost

would

be Rs. 1000 + 261 x 4 = Rs.

2044. Hence the average

cost per week would be Rs.

681. We try for

the

time

period of four weeks and the

cost would be Rs. 1000 +

1044 + 796 = Rs. 2840.

Thus we see that

the

256

Operations

Research (MTH601)

257

average

cost per week is Rs. 710

which is more than that

incurred for the policy to

replace the bulbs once

in

three

weeks. Hence the optimum

period of group replacement is

three weeks.

In

the above analysis it was

assumed to adopt the policy

of group replacement and the

fixed interval of

replacement

was three weeks. But we

have to examine the policy

if we replace bulbs as and

when they fail

(without

group replacement). For this

the average life of the bulb

is to be calculated. Multiplying the

probability

can

do this and the

corresponding life of the bulb

for all the possible

cases and add them

up.

Thus

we have the expected life of

a bulb would be (0.05 x 1) + (0.08 x 2) +

(0.12 x 3) + (0.18 x 4) +

(0.25

x 5) + (0.20 x 6) +(0.08 x 7) + (0.04 x

8) = 4.62 weeks. Hence the

number of replacement of bulbs

per

week

would be 1000/4.62 = 216

bulbs which would cost

Rs. 864, at the rate of

Rs. 4 per bulb. This is more

than

what

we had in group replacement

(cost Rs. 681). Hence we

conclude that the group

replacement policy is

better

and

replace all bulbs at

required interval of three

weeks.

EXERCISES

1.

The

following failure rates have

been observed for certain

type of light bulb.

End

of week

1

2

3

4

5

6

7

8

prob.

of failure

to

date

0.05

0.13

0.25

0.43

0.68

0.88

0.96

1.00

There

are 1000 light bulbs in a

factory. The cost of replacing an

individual bulb is Rs. 500.

If the cost of

group

replacement is Rs. 1.20 what is

the best interval between

group replacements?

2.

A

computing machine has a

large number of electronic

tubes, each of which has a

life normally

distributed

with a mean of 1200 hrs.

with a standard deviation of

160 hrs. Assume the

machine is in

operation

for two shifts (2 x 8 = 16 hrs.)

per day. If all the

tubes were to be replaced at

fixed interval, the

cost

is Rs. 30 for a tube.

Replacement of individual tubes,

which fail in service, would

cost Rs. 80 for

labour

and parts plus the

cost of computer downtime, which

runs about Rs. 800

for an average tube

failure.

How frequently all tubes be

replaced?

STAFF

REPLACEMENT PROBLEMS

A

research team is planned to

raise the strength of 50

chemists and then to remain

at that level.

Example

The

number of recruits depends on

their length of service and

is as follows.

Year

1

2

3

4

5

6

7

8

9

10

%

left at the

end

of year

5

36

56

63

68

73

79

87

97

100

What

is the recruitment per year

to maintain the required strength?

There are 8 senior posts

for which

the

length of service is the main criterion.

What is the average length of

service after which a new

entrant

expects

promotion to one of the

posts?

Solution:

Table

10

257

Operations

Research (MTH601)

258

At

the end

Probability

of Probability of Number

of

of

year

leaving

in-service

person

0

0

1.00

100

1

0.05

0.95

95

2

0.36

0.64

64

3

0.56

0.44

44

4

0.63

0.37

37

5

0.68

0.32

32

6

0.73

0.27

27

7

0.79

0.21

21

8

0.87

0.13

13

9

0.97

0.03

3

10

1.00

0.00

-

436

From

the table 10 we find probability of

leaving at the end of year

and also the probability of

inservice

at

the end of year.

If

we select 100 chemists every

year then the total number

of chemists serving in the

team would have

been

436. Hence, to maintain strength of 50

chemists we must

recruit

(100/436)

x 50 = 11.4 = 12 per year

(approx.)

If

pi

is

the probability of a person to be in

service at the end of

ith

year, then out of 12

recruited each

year

the total number of survivals will be 12

x pi.

The chemists in service at

the end of year are

given in the

table

11.

Table

11

No.

of chemists

Year

Probability

of

at

the end of

Survival,

pi

year

= 12 x pi

0

1.00

12

1

0.95

11

2

0.64

8

3

0.44

5

4

0.32

4

5

0.32

4

6

0.27

3

7

0.21

2

8

0.13

2

9

0.03

0

10

0.00

0

If

there are 8 service posts

for which the length of

service is the criterion, then we

see from the table

11

that

there are 3 persons with 6

years experience, 2 with 7

years and 2 with 8 years.

The total number is 7,

which

is

less than 8. Hence the

promotion will be given at the

end of 5 years.

258

Table of Contents:

- Introduction:OR APPROACH TO PROBLEM SOLVING, Observation

- Introduction:Model Solution, Implementation of Results

- Introduction:USES OF OPERATIONS RESEARCH, Marketing, Personnel

- PERT / CPM:CONCEPT OF NETWORK, RULES FOR CONSTRUCTION OF NETWORK

- PERT / CPM:DUMMY ACTIVITIES, TO FIND THE CRITICAL PATH

- PERT / CPM:ALGORITHM FOR CRITICAL PATH, Free Slack

- PERT / CPM:Expected length of a critical path, Expected time and Critical path

- PERT / CPM:Expected time and Critical path

- PERT / CPM:RESOURCE SCHEDULING IN NETWORK

- PERT / CPM:Exercises

- Inventory Control:INVENTORY COSTS, INVENTORY MODELS (E.O.Q. MODELS)

- Inventory Control:Purchasing model with shortages

- Inventory Control:Manufacturing model with no shortages

- Inventory Control:Manufacturing model with shortages

- Inventory Control:ORDER QUANTITY WITH PRICE-BREAK

- Inventory Control:SOME DEFINITIONS, Computation of Safety Stock

- Linear Programming:Formulation of the Linear Programming Problem

- Linear Programming:Formulation of the Linear Programming Problem, Decision Variables

- Linear Programming:Model Constraints, Ingredients Mixing

- Linear Programming:VITAMIN CONTRIBUTION, Decision Variables

- Linear Programming:LINEAR PROGRAMMING PROBLEM

- Linear Programming:LIMITATIONS OF LINEAR PROGRAMMING

- Linear Programming:SOLUTION TO LINEAR PROGRAMMING PROBLEMS

- Linear Programming:SIMPLEX METHOD, Simplex Procedure

- Linear Programming:PRESENTATION IN TABULAR FORM - (SIMPLEX TABLE)

- Linear Programming:ARTIFICIAL VARIABLE TECHNIQUE

- Linear Programming:The Two Phase Method, First Iteration

- Linear Programming:VARIANTS OF THE SIMPLEX METHOD

- Linear Programming:Tie for the Leaving Basic Variable (Degeneracy)

- Linear Programming:Multiple or Alternative optimal Solutions

- Transportation Problems:TRANSPORTATION MODEL, Distribution centers

- Transportation Problems:FINDING AN INITIAL BASIC FEASIBLE SOLUTION

- Transportation Problems:MOVING TOWARDS OPTIMALITY

- Transportation Problems:DEGENERACY, Destination

- Transportation Problems:REVIEW QUESTIONS

- Assignment Problems:MATHEMATICAL FORMULATION OF THE PROBLEM

- Assignment Problems:SOLUTION OF AN ASSIGNMENT PROBLEM

- Queuing Theory:DEFINITION OF TERMS IN QUEUEING MODEL

- Queuing Theory:SINGLE-CHANNEL INFINITE-POPULATION MODEL

- Replacement Models:REPLACEMENT OF ITEMS WITH GRADUAL DETERIORATION

- Replacement Models:ITEMS DETERIORATING WITH TIME VALUE OF MONEY

- Dynamic Programming:FEATURES CHARECTERIZING DYNAMIC PROGRAMMING PROBLEMS

- Dynamic Programming:Analysis of the Result, One Stage Problem

- Miscellaneous:SEQUENCING, PROCESSING n JOBS THROUGH TWO MACHINES

- Miscellaneous:METHODS OF INTEGER PROGRAMMING SOLUTION