|

Replacement Models:REPLACEMENT OF ITEMS WITH GRADUAL DETERIORATION |

| << Queuing Theory:SINGLE-CHANNEL INFINITE-POPULATION MODEL |

| Replacement Models:ITEMS DETERIORATING WITH TIME VALUE OF MONEY >> |

Operations

Research (MTH601)

245

WHY

REPLACEMENT?

If

any equipment or machine is

used for a long period of time,

due to wear and tear,

the item tends to

worsen.

A remedial action to bring the

item or equipment to the

original level is desired. Then

the need for

replacement

becomes necessary. This need

may be caused by a loss of

efficiency in a situation leading

to

economic

decline. By efflux of time

the parts of an item are

being worn out and

the cost of maintenance

and

operation

is bound to increase year

after year. The resale

value of the item goes on

diminishing with the

passage

of

time. The depreciation of the

original equipment is a factor, which is

responsible not to favour

replacement

because

the capital is being spread

over a long time leading to a

lower average cost. Thus

there exists an

economic

trade-off between increasing

and decreasing cost

functions. We strike a balance

between the two

opposing

costs with the aim of

obtaining a minimum cost.

The problem of replacement is to

determine the

appropriate

time at which a remedial

action should be taken which

minimizes some measure of

effectiveness.

Another

factor namely technical and

/ or economic obsolescence may

force us for

replacement.

In

this segment we deal with

the replacement of capital

equipment that deteriorates

with time, group

replacement

and staffing problems.

REPLACEMENT

OF ITEMS WITH GRADUAL

DETERIORATION

As

mentioned earlier the

equipments, machineries and

vehicles undergo wear and

tear with the

passage

of

time. The cost of operation

and the maintenance are

bound to increase year by

year. A stage may be

reached

that

the maintenance cost amounts

prohibitively large that it is

better and economical to

replace the equipment

with

a new one. We also take into

account the salvage value of

the items in assessing the

appropriate or

opportune

time to replace the item. We

assume that the details

regarding the costs of

operation, maintenance

and

the

salvage value of the item

are already known. The

problem can be analysed

first without change in the

value

of

the money and later

with the value

included.

If

the interest rate for

the money is zero the

comparison can be made on an

average cost basis. The

total

cost

of the capital in owning the

item and operating is

accumulated for n

years

and this total is divided by

n.

Since

we have discrete values for

the costs for various

years, an analysis is done

using the tabular

method,

which is simple one to use

discontinuous data. There

are also the classical

optimization techniques

using

finite difference methods

for discrete parameters and

using the differential calculus

for continuous data.

Now

we take an example in which an

automobile fleet owner has the

following direct operation

cost

(Petrol

and oil) and increased

maintenance cost (repairs,

replacement of parts etc).

The initial cost of the

vehicle

is

Rs. 70, 000. The

operation cost, the

maintenance cost and the

resale price are all

given in table 1 for

five

years.

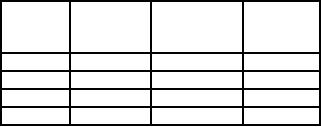

Table

1

Year

of

Annual

Annual

Resale

service

operating

maintenance

value

cost

(Rs.)

cost

(Rs.)

(Rs.)

1

10000

6000

40000

2

15000

8000

20000

3

20000

12000

15000

4

26000

16000

10000

245

Operations

Research (MTH601)

246

5

32000

20000

10000

246

Operations

Research (MTH601)

247

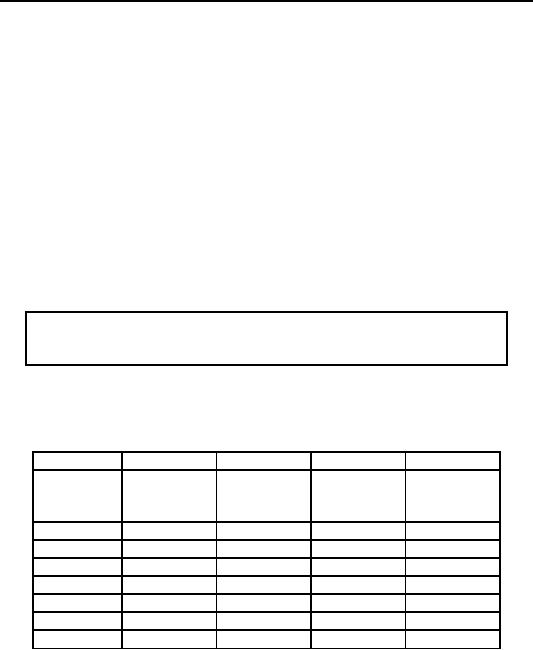

Table

2

Costs

in `000 Rupees

1

2

3

4

5

6

7

8

Capital

Total Average

Cumulative

Annual

Total

Annual

At

annual

Running

cost

cost

maintenance

running

operating

the

(Rs.)

cost

cost

(Rs.)

(Rs.)

cost

(Rs.)

cost

cost

end

(5+6)

(Rs.)

(2+3)

(Rs.)

of

(7/n)

(Rs.)

year

n

1

10

6

16

16

30

46

46.00

2

15

8

23

39

50

89

44.50

3

20

12

32

71

55

126

42.00

4

26

16

42

113

60

173

43.52

5

32

20

52

165

60

225

45.00

Table

2 gives the details of the

analysis to find the

appropriate time to replace

the vehicle. The

cumulative

running cost and capital

(Value - Resale value)

required for various years

are tabulated and

the

average

annual cost is calculated.

The corresponding year at

which this average annual

cost is minimum is

chosen

to be the opportune time of

replacement.

It

is evident from the last

column of table 2 that the

average annual cost is least

at the end of three

years.

(equal to 42,000). Hence

this is the best time to

purchase a new vehicle.

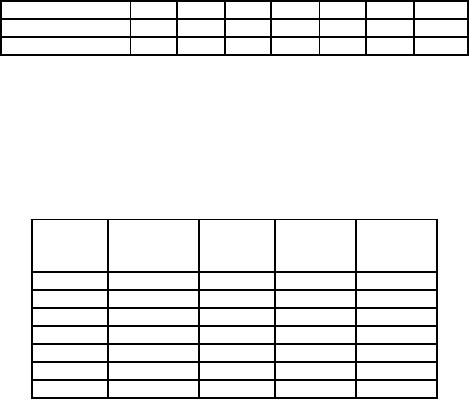

Example

A

mill owner finds from his

past records the costs of

running a machine whose

purchase price is Rs.

6000

are as given below.

Year

1

2

3

4

5

6

7

Running

cost (Rs.)

1000

1200

1400

1800

2300

2800

3400

Resale

value (Rs.)

3000

1500

750

375

200

200

200

Determine

at what age is a replacement

due?

We

prepare the following table

3 to find the

solution.

Solution:

1

2

3

4

5

At

the end

Cumulative

Capital

cost

Total

cost

Average

of

year n

running

cost

(Rs.)

(2

+ 3) (Rs.)

annual

cost

(Rs.)

(Rs.)

1

1000

3000

4000

4000

2

2200

4500

6700

3350

3

3600

5250

8850

2950

4

5400

5625

11025

2756

5

7700

5800

13500

2700

6

10500

5800

16300

2717

7

13900

5800

19700

2814

From

the above 3 we conclude that

the machine should be

replaced at the end of the

fifth year,

indicated

by the least average annual

cost (Rs. 2700) in the

last column.

247

Operations

Research (MTH601)

248

The

mill owner in the previous

problem has now three

machines, two of which are

two

Example

years

old and the third one year

old. He is considering a new type of

machine with 50% more

capacity than one

of

the old ones at a unit

price of Rs. 8000. He

estimates the running costs

and resale price for

the new machine

will

be as follows.

Year

1

2

3

4

5

6

7

Running

cost (Rs.)

1200

1500

1800

2400

3100

4000

5000

Resale

Price (Rs.)

4000

2000

1000

500

300

300

300

Assuming

that the loss of flexibility

due to fewer machines is of no

importance, and that he

will

continue

to have sufficient work for

three of the old machines,

what should his policy

be?

As

in the previous problem we

prepare a table 4 to find

the average annual cost of

the new

Solution:

type

of machine.

Table

4

At

the

Cumulative

Capital

Total

cost

Average

end

of

running

cost

(Rs.)

(Rs.)

annual

year

cost

(Rs.)

cost

(Rs.)

1

1200

4000

5200

5200

2

2700

6000

8700

4350

3

4500

7000

11500

3833

4

6900

7500

14400

3600

5

10000

7700

17700

3540

6

14000

7700

21700

3617

7

19000

7700

26700

3814

From

the above table 4 we observe

that the average annual

cost is least at the end of

five years and it

would

be Rs. 3540 per machine.

But the new machine can

handle 50% more capacity

than the old one. So

in

terms

of the old, the new machine's

annual cost is only Rs.

(3540) (2/3) = Rs. 2360.

This amount is less than

the

average

annual cost for the old

machine, which is Rs. 2700.

If we replace the old

machine with the new one, it

is

enough

to have two new machines in

place of with the new one;

it is enough to have two new

machines in place

of

three old machines. On

comparing the cost of 2 new

machines (Rs. 7080) with

that for 3 old machines

(Rs

8100),

it is clear that the policy

should be that the old

machines have to be replaced

with the new one. Still

we

have

to decide about the time

when to purchase the new

machines.

The

new machines will be purchased

when the cost for

the next year of running the

three old machines

exceeds

the average annual cost

for two new types of

machines. Examining the

table 3 pertaining to the

previous

problem,

we find, the total yearly cost of

one small machine from

the column 4. The successive

difference will

give

the cost of running a

machine for a particular

year. For example, the total

cost for 1 year is Rs.

4000. The

total

cost for 2 years is Rs.

6700. The difference of Rs.

2700 will be accounted as

the cost of running a

small

machine

during the second year.

Similarly we have Rs. 2150,

Rs. 2175, Rs. 2475

and Rs. 2800 as the

cost of

running

the old machine in the third, fourth,

fifth and sixth year

respectively.

Now,

with this information we calculate

the total costs next year

for the two smaller

machines, which

are

two years old (entering the

third year of service) and

one smaller machine aged

one year (and hence

entering

second

year of service), which will

be

2

x 2150 + 2700 = Rs.

7000

248

Operations

Research (MTH601)

249

This

is less than the average

annual cost of two new

machines, which is Rs. 7080.

So the policy is

not

to replace right now. If we

wait for the subsequent

years, the total cost of

running the old machines

will be

Rs.

6500, Rs. 7125 and

Rs. 8025 etc., for

years 2, 3 and 4 etc. This

indicates that the cost of

running the old

machine

exceeds the average annual

cost (Rs. 7000) of the

two new machines after 2

years from now. Hence

the

best

time to purchase the new

type machine will be after 2

years from now.

249

Table of Contents:

- Introduction:OR APPROACH TO PROBLEM SOLVING, Observation

- Introduction:Model Solution, Implementation of Results

- Introduction:USES OF OPERATIONS RESEARCH, Marketing, Personnel

- PERT / CPM:CONCEPT OF NETWORK, RULES FOR CONSTRUCTION OF NETWORK

- PERT / CPM:DUMMY ACTIVITIES, TO FIND THE CRITICAL PATH

- PERT / CPM:ALGORITHM FOR CRITICAL PATH, Free Slack

- PERT / CPM:Expected length of a critical path, Expected time and Critical path

- PERT / CPM:Expected time and Critical path

- PERT / CPM:RESOURCE SCHEDULING IN NETWORK

- PERT / CPM:Exercises

- Inventory Control:INVENTORY COSTS, INVENTORY MODELS (E.O.Q. MODELS)

- Inventory Control:Purchasing model with shortages

- Inventory Control:Manufacturing model with no shortages

- Inventory Control:Manufacturing model with shortages

- Inventory Control:ORDER QUANTITY WITH PRICE-BREAK

- Inventory Control:SOME DEFINITIONS, Computation of Safety Stock

- Linear Programming:Formulation of the Linear Programming Problem

- Linear Programming:Formulation of the Linear Programming Problem, Decision Variables

- Linear Programming:Model Constraints, Ingredients Mixing

- Linear Programming:VITAMIN CONTRIBUTION, Decision Variables

- Linear Programming:LINEAR PROGRAMMING PROBLEM

- Linear Programming:LIMITATIONS OF LINEAR PROGRAMMING

- Linear Programming:SOLUTION TO LINEAR PROGRAMMING PROBLEMS

- Linear Programming:SIMPLEX METHOD, Simplex Procedure

- Linear Programming:PRESENTATION IN TABULAR FORM - (SIMPLEX TABLE)

- Linear Programming:ARTIFICIAL VARIABLE TECHNIQUE

- Linear Programming:The Two Phase Method, First Iteration

- Linear Programming:VARIANTS OF THE SIMPLEX METHOD

- Linear Programming:Tie for the Leaving Basic Variable (Degeneracy)

- Linear Programming:Multiple or Alternative optimal Solutions

- Transportation Problems:TRANSPORTATION MODEL, Distribution centers

- Transportation Problems:FINDING AN INITIAL BASIC FEASIBLE SOLUTION

- Transportation Problems:MOVING TOWARDS OPTIMALITY

- Transportation Problems:DEGENERACY, Destination

- Transportation Problems:REVIEW QUESTIONS

- Assignment Problems:MATHEMATICAL FORMULATION OF THE PROBLEM

- Assignment Problems:SOLUTION OF AN ASSIGNMENT PROBLEM

- Queuing Theory:DEFINITION OF TERMS IN QUEUEING MODEL

- Queuing Theory:SINGLE-CHANNEL INFINITE-POPULATION MODEL

- Replacement Models:REPLACEMENT OF ITEMS WITH GRADUAL DETERIORATION

- Replacement Models:ITEMS DETERIORATING WITH TIME VALUE OF MONEY

- Dynamic Programming:FEATURES CHARECTERIZING DYNAMIC PROGRAMMING PROBLEMS

- Dynamic Programming:Analysis of the Result, One Stage Problem

- Miscellaneous:SEQUENCING, PROCESSING n JOBS THROUGH TWO MACHINES

- Miscellaneous:METHODS OF INTEGER PROGRAMMING SOLUTION