|

Inventory Control:ORDER QUANTITY WITH PRICE-BREAK |

| << Inventory Control:Manufacturing model with shortages |

| Inventory Control:SOME DEFINITIONS, Computation of Safety Stock >> |

Operations

Research (MTH601)

68

ORDER

QUANTITY WITH

PRICE-BREAK

The

concept of Economic Order

Quantity fails in certain

cases where there is a

discount offered when

purchases are

made

in large quantities. Certain

manufacturers offer reduced

rate for items when a

larger quantity is ordered. It

may

appear

that the inventory holding

cost may increase if large

quantities of items are

ordered. But if the discount

offered

is

so attractive that it even

outweighs the holding cost,

the probably the order at

levels other than the

EOQ would be

economical.

An illustration is given in the

following example and the

rationale is explained.

Example:

A company

uses 12000 items per

year supplied ordinarily at a

price of Rs. 3.00 per

item. Carrying costs

are

16% of the value of the

average inventory and the

ordering costs are Rs. 20

per order. The supplier

however

offers

discounts as per the table

below:

Order

size

Price

per item

Less

than 2000

Rs.

3.00

2000

to 3999

Rs.

290

4000

or more

Rs.

2.85

Compute

the economic order

size.

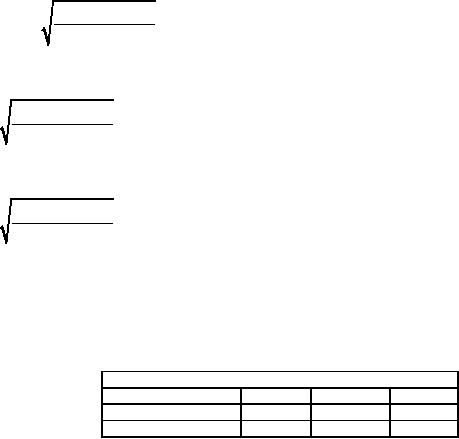

2

�12000

�

20

EOQ

=

=

1000

3.00

�

0.16

EOQ

at Rs. 2.90 per

item

2

�12000

�

20

=

=

1017

2.90

�

0.16

EOQ

at Rs. 2.85 per

item

2

�12000

�

20

=

=

1026

2.85

�

0.16

The

EOQ at Rs. 2.90 per

item = 1017. But the

price per item is Rs.

2.9 only if the items

are ordered in the range

of

2000

to 3999. This is therefore an

infeasible solution. Similarly

the EOQ at Rs. 2.85

per item is 1026. This

price is

valid

only for items ordered in

the range 4000 or more.

This is also an infeasible

solution.

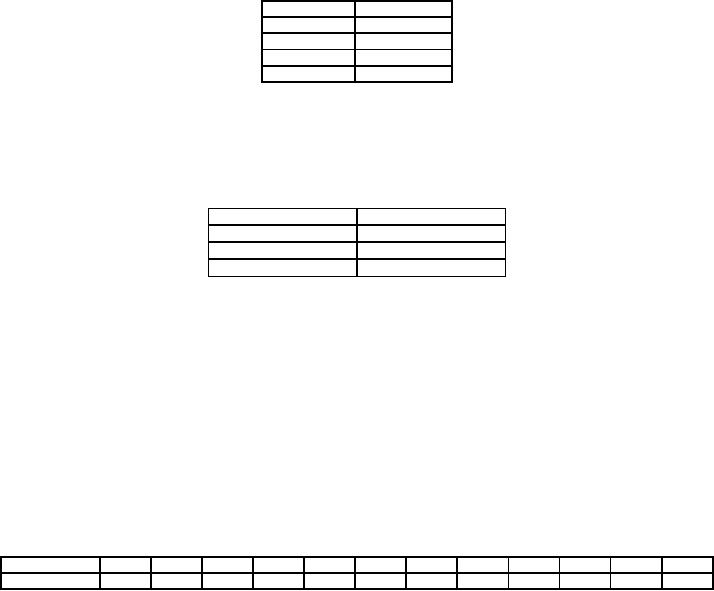

We

follow the routine procedure

and calculate the cost

for various order sizes:

1000, 2000, 4000,

Order

size

1000

2000

4000

Item

cost (Rs.)

36000

34800

34200

Order

cost (Rs.)

240

120

60

Holding

cost (Rs.)

240

464

912

68

Operations

Research (MTH601)

69

Exercises

1.

Assume the following

price structure

Units

Units

Price

0-199

Rs.

10.00

200-399

9.75

400-599

9.50

600

9.25

Purchase

cost per order

=

Rs. 25

Cost

of the item

=

Rs. 10

Annual

demand

=

950 Units

Carrying

cost

=

Rs. 2/Unit/year

2.

Find the optimal

order quantity for a product

for which the price-breaks

are as follows:

Items

q

Price/Unit

0≤

Rs.

20

q

< 100

100

≤

Rs.

18

q

< 200

200

≤

Rs.

16

q

The

monthly demand for the

product is 600 units. The

storage cost is 15% of unit

cost and the

cost

of

ordering is Rs. 30 per

order.

DYNAMIC

ORDER QUANTITY

The

basic assumption in the

derivation of Economic Order

Quantity models discussed

previously is that

the

demand

is uniform. But in certain

situations the demand is not

uniform. It may rise and

fall, depending on

seasonal

influences.

A general method is discussed

below that can be applied to

any pattern of varying

demand due to

seasonal

or irregular variations.

Consider

the following example to

illustrate how a varying

demand problem can be

tackled. This is known

as

Dynamic

Order Quantity model.

Example:

The

requirements for 12 months

are given below:

Month

1

2

3

4

5

6

7

8

9

10

11

12

Requirement

20

40

10

10

10

2

40

30

40

40

10

20

Set

up cost

=

Rs. 20

Unit

price

=

Rs. 5 per item.

Interest

=

24% per year

or

2% per month.

Solution:

To calculate

the dynamic order quantity

we can adopt the following

procedure.

69

Operations

Research (MTH601)

70

The

first month's requirement

has to be ordered in the

first month itself at a

procurement cost of Rs. 20.

Now we

have

to decide whether the second

month's requirement can also

be ordered along with first

month's requirement.

This

involves additional carrying

cost, but this will

result in saving an extra

set up. Hence if the

saving on set up

costs

outweighs

the carrying costs, then we

include the second month's

requirements along with the

first month. Similarly

a

decision

can be taken whether to

include the third month's

requirement in the first

month itself. This procedure

is

followed

until the procurement costs

and carrying costs are

balanced.

Let

n

represent

the month, n

= 1, 2, ...,

12. Let Rn be

the requirement during

nth month

and Rn+1

be

the

requirement

during (n

+ 1)th

month. If the (n

+ 1)th

month requirement namely

Rn+1 is

absorbed in nth month

itself,

the

additional procurement cost is

saved.

Hence

the saving in procurement

cost is (C2/n).

But the additional carrying

cost is C3

n (Rn+1). If the

additional

carrying cost is less than

the procurement cost, then

the (n+1)th

month requirement is to be ordered

also

with

nth month.

Hence

we have to check

whether

n

Rn + 1 C3 < C2/n

n2

Rn + 1 <

C2/C3

If

the answer to the above

inequality is yes, then, the

future month's requirements

are included in the first

month itself.

If

the answer is 'no', then

that requirement is to be ordered

afresh and this is treated

as month

n

= 1. In

this

example

C2/C3 =

20/0.01 = 200. All the

eleven information can be

represented in the table as

shown.

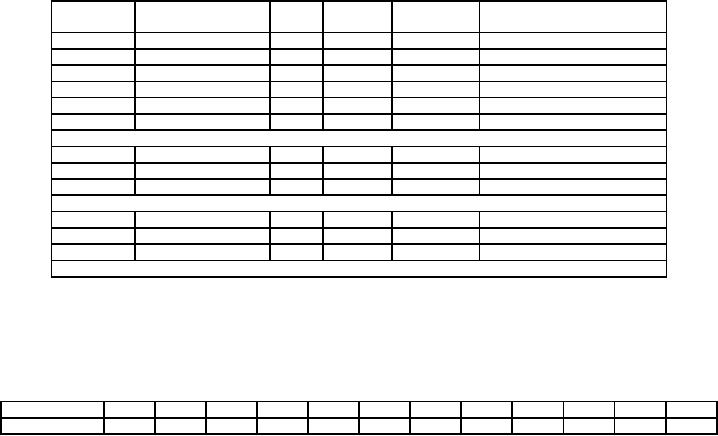

n2Rn+1.

n

Is

Month.

Requirement.

Rn

2

n

Rn+1<200

Action.

1

20

1

40

Yes

include

40 in month 1

2

40

2

40

Yes

include

10 in month 1

3

10

3

90

Yes

include

10 in month 1

4

10

4

160

Yes

include

10 in month 1

5

10

5

50

Yes

include

2 in month 1

6

2

6

1440

No

set

up again in month 7

Total

92

7

40

1

30

Yes

include

10 in 7th month.

8

30

2

160

Yes

include

40 in 7th month.

9

40

3

360

No

set

up again in month 10

Total

110

10

40

1

10

Yes

include

10 in month 10

11

10

2

80

Yes

include

20 in month 10

12

20

Total

70

Hence

we order three times a year

in the first month, seventh

month and tenth month,

the batch sizes being

92, 110

and

70 respectively.

Exercise:

Compute

the dyanamic EOQ is for

the following

requirements.

Month

1

2

3

4

5

6

7

8

9

10

11

12

Requirement.

50

100

10

170

150

180

1

260

100

80

150

200

70

Operations

Research (MTH601)

71

ABC

ANALYSIS

The

ABC analysis is the analysis

that attracts management on

those items where the

greatest savings can

be

expected.

This is a simple but

powerful tool of statistical

sampling in the area of

inventory control or

materials

management.

In

this analysis, the items

are classified or categorized

into three classes, A, B and

C by their usage value. The

usage

value

is defined as,

The

ABC concept is based on

Pareto's law that few

high usage value items

constitute a major part of th

capital

invested

in inventories whereas a large

number of items having low

usage value constitute an

insignificant part of

the

capital.

It too much inventory is

kept, the ABC analysis

can be performed on a sample.

After obtaining the

random

sample

the following steps are

carried out for the

ABC analysis.

STEP

1: Compute

the annual usage value

for every item in the

sample by multiplying the

annual requirements by

the

cost per unit.

STEP

2: Arrange

the items in decending order

of the usage value

calculated above.

STEP

3: Make a

cumulative total of the

number of items and the

usage value.

STEP

4: Convert

the cumulative total of

number of items and usage

values into a percentage of

their grand totals.

STEP

5: Draw a

graph connecting cumulative %

items and cumulative % usage

value. The graph is

divided

approximately

into three segments, where

the curve sharply changes

its shape. This indicates

the three segments A,

B

and C.

The

class A items whose usage

values are higher are to be

carefully watched and are

under the strict and

continued

scrutiny

of the senior inventory

control staff. These items

should be issued only an

indents sanctioned by the

staff.

The

class C items on the other

extreme can be placed on the

shop floor and the

personnel can help

themselves

without

placing a formal requisition.

The class B items fall in

between A and C.

ABC

concept conforms to the

consideration implied in the

EOQ model. 'A' items

have high inventory

carrying

costs

and should therefore be

placed with EOQ concept.

The 'C' items require

very little capital and

have therefore

low

inventory carrying costs.

Hence, they can be purchased

in bigger lots. 'B' items

are usually placed

under

statistical

stock control.

Example:

Perform ABC analysis on the

following sample of 10 items

from an inventory.

Items

1

2

3

4

5

6

7

8

9

10

Annual

Usage

300

2700

30

1000

50

220

160

800

600

70

(Unit)

Unit

Cost

10

15

10

5

4

100

5

5

15

10

(Rs.)

Solution:

71

Table of Contents:

- Introduction:OR APPROACH TO PROBLEM SOLVING, Observation

- Introduction:Model Solution, Implementation of Results

- Introduction:USES OF OPERATIONS RESEARCH, Marketing, Personnel

- PERT / CPM:CONCEPT OF NETWORK, RULES FOR CONSTRUCTION OF NETWORK

- PERT / CPM:DUMMY ACTIVITIES, TO FIND THE CRITICAL PATH

- PERT / CPM:ALGORITHM FOR CRITICAL PATH, Free Slack

- PERT / CPM:Expected length of a critical path, Expected time and Critical path

- PERT / CPM:Expected time and Critical path

- PERT / CPM:RESOURCE SCHEDULING IN NETWORK

- PERT / CPM:Exercises

- Inventory Control:INVENTORY COSTS, INVENTORY MODELS (E.O.Q. MODELS)

- Inventory Control:Purchasing model with shortages

- Inventory Control:Manufacturing model with no shortages

- Inventory Control:Manufacturing model with shortages

- Inventory Control:ORDER QUANTITY WITH PRICE-BREAK

- Inventory Control:SOME DEFINITIONS, Computation of Safety Stock

- Linear Programming:Formulation of the Linear Programming Problem

- Linear Programming:Formulation of the Linear Programming Problem, Decision Variables

- Linear Programming:Model Constraints, Ingredients Mixing

- Linear Programming:VITAMIN CONTRIBUTION, Decision Variables

- Linear Programming:LINEAR PROGRAMMING PROBLEM

- Linear Programming:LIMITATIONS OF LINEAR PROGRAMMING

- Linear Programming:SOLUTION TO LINEAR PROGRAMMING PROBLEMS

- Linear Programming:SIMPLEX METHOD, Simplex Procedure

- Linear Programming:PRESENTATION IN TABULAR FORM - (SIMPLEX TABLE)

- Linear Programming:ARTIFICIAL VARIABLE TECHNIQUE

- Linear Programming:The Two Phase Method, First Iteration

- Linear Programming:VARIANTS OF THE SIMPLEX METHOD

- Linear Programming:Tie for the Leaving Basic Variable (Degeneracy)

- Linear Programming:Multiple or Alternative optimal Solutions

- Transportation Problems:TRANSPORTATION MODEL, Distribution centers

- Transportation Problems:FINDING AN INITIAL BASIC FEASIBLE SOLUTION

- Transportation Problems:MOVING TOWARDS OPTIMALITY

- Transportation Problems:DEGENERACY, Destination

- Transportation Problems:REVIEW QUESTIONS

- Assignment Problems:MATHEMATICAL FORMULATION OF THE PROBLEM

- Assignment Problems:SOLUTION OF AN ASSIGNMENT PROBLEM

- Queuing Theory:DEFINITION OF TERMS IN QUEUEING MODEL

- Queuing Theory:SINGLE-CHANNEL INFINITE-POPULATION MODEL

- Replacement Models:REPLACEMENT OF ITEMS WITH GRADUAL DETERIORATION

- Replacement Models:ITEMS DETERIORATING WITH TIME VALUE OF MONEY

- Dynamic Programming:FEATURES CHARECTERIZING DYNAMIC PROGRAMMING PROBLEMS

- Dynamic Programming:Analysis of the Result, One Stage Problem

- Miscellaneous:SEQUENCING, PROCESSING n JOBS THROUGH TWO MACHINES

- Miscellaneous:METHODS OF INTEGER PROGRAMMING SOLUTION