|

Applications of Basic Mathematics Part 5:DECREASE IN RATE |

| << Applications of Basic Mathematics Part 4:PERCENTAGE CHANGE |

| Applications of Basic Mathematics:NOTATIONS, ACCUMULATED VALUE >> |

MTH001

Elementary Mathematics

LECTURE

17

Applications of

Basic Mathematics

Part

5

OBJECTIVES

The

objectives of the lecture

are to learn about:

�

�

Discount

�

Simple

and compound

interest

�

Average

due date, interest on

drawings and

calendar

REVISION

LECTURE 5

A

chartered bank is lowering

the

interest

rate on its

loans

from

9%

to

7%.

What

will be the percent

decrease in the

interest rate on a

given

balance?

A

chartered bank is increasing

the

interest

rate on its

loans from

7%

to

9%

What

will be the percent

increase in the

interest rate on a

given

balance?

As

we learnt in lecture 5, the

calculation will be as

follows:

Decrease

in interest rate = 7-9 = -2

%

%

decrease = -2/9 x 100 =

-22.2 %

Increase

in interest rate = 9-7 = 2

%

%

decrease = 2/7 x 100 = 28.6

%

The

calculations in Excel are

shown in the following

slides:

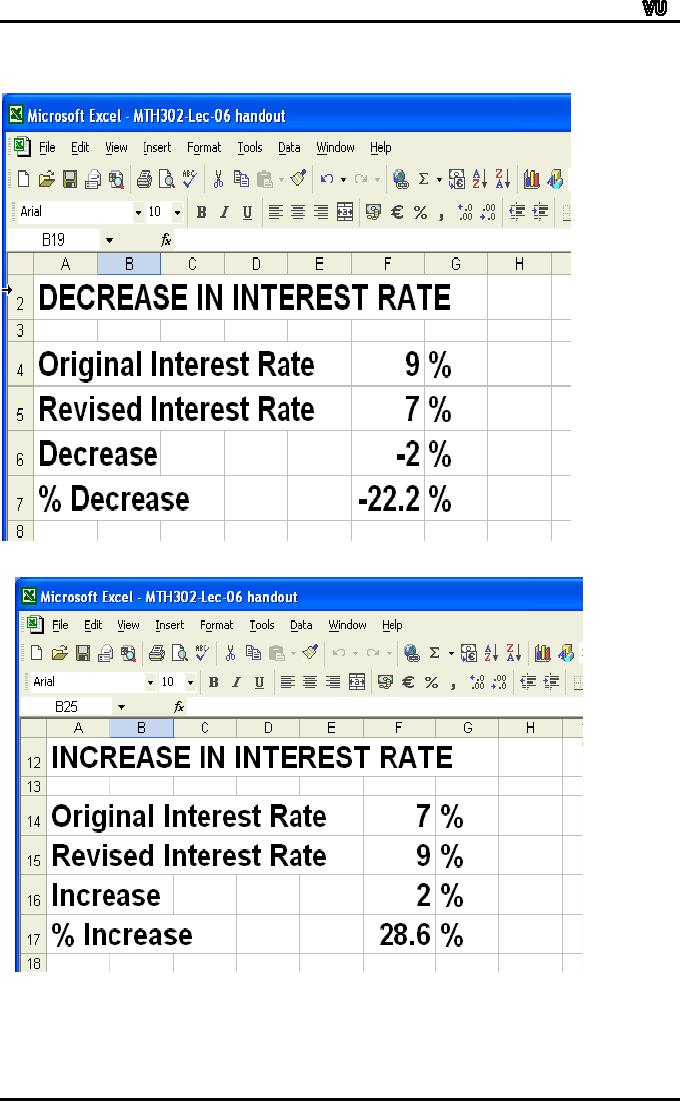

DECREASE

IN RATE

Data

entry

Cell

F4 = 9

Cell

F5 = 7

Formulas

Formula

for decrease in Cell F6: =

=F5-F4

Formula

for % decrease in Cell F7:

=F6/F4*100

Results

Cell

F6 = -2%

Cell

F7 = -22.2%

INCREASE

IN RATE

Data

entry

Cell

F14 = 7

Cell

F15 = 9

Formulas

Formula

for increase in Cell F16:

=F15-F14

Formula

for % increase in Cell F17:

=F16/F14*100

Results

Cell

F16 = 2%

Cell

F17= 28.6%

Page

111

MTH001

Elementary Mathematics

The

Definition of a Stock

Plain

and simple, stock is a share

in the ownership of a company.

Stock

represents

a claim on the company's assets

and

earnings. As you

acquire more

Page

112

MTH001

Elementary Mathematics

stock,

your ownership stake in the

company becomes greater.

Whether you say

shares, equity, or stock, it

all means the same

thing.

Stock

yield

With

stocks, yield can refer to

the rate of income generated

from a stock in the

form

of

regular dividends. This is

often represented in percentage

form, calculated as

the

annual

dividend payments divided by

the stock's current share

price.

Earnings

per share (EPS)

The

EPS is the total profits of

a company divided by the

number of shares. A company

with

$1

billion in earnings and 200

million shares would have

earnings of $5 per

share.

Price-earnings

ratio

A

valuation ratio of a company's

current share price compared

to its per-share

earnings.

Calculated

as:

For

example, if a company is currently

trading at $43 a share and

earnings over the

last

12 months were $1.95 per

share, the P/E ratio

for the stock would be

22.05

($43/$1.95).

Outstanding

shares

Stock

currently held by investors,

including restricted shares

owned by the

company's

officers and insiders, as

well as those held by the

public. Shares that

have

been

repurchased by the company

are not considered

outstanding stock.

Net

current asset value per

share(NCAVPS)

NCAVPS

is calculated by taking a company's

current assets and

subtracting the total

liabilities,

and then dividing the

result by the total number

of shares outstanding.

Current

Assets

The

value of all assets that

are reasonably expected to be

converted into cash within

one

year

in the normal course of

business. Current assets

include cash, accounts

receivable,

inventory,

marketable securities, prepaid

expenses and other liquid

assets that can be

readily

converted to cash.

Liabilities

A

company's legal debts or

obligations that arise

during the course of

business operations.

Market

value

The

price at which investors buy

or sell a share of stock at a

given time

Face

value

Page

113

MTH001

Elementary Mathematics

Original

cost of a share of stock

which is shown on the

certificate. Also referred to as

"par

value."

Face

value is usually a very

small amount that bears no

relationship to its market

price.

Dividend

Usually,

a company distributes a part of

the profit it earns as

dividend.

For

example: A company may have

earned a profit of Rs 1 crore in

2003-04. It

keeps

half that amount within

the company. This will be

utilised on buying

new

machinery

or more raw materials or

even to reduce its borrowing

from the bank.

It

distributes the other half

as dividend.

Assume

that the capital of this

company is divided into

10,000 shares. That

would

mean half the profit -- ie

Rs 50 lakh (Rs 5 million) --

would be divided by

10,000

shares; each share would

earn Rs 500. The dividend

would then be Rs

500

per share. If you own

100 shares of the company,

you will get a cheque

of

Rs

50,000 (100 shares x Rs 500)

from the company.

Sometimes,

the dividend is given as a

percentage -- i e the company

says it has

declared

a dividend of 50 percent. It's

important to remember that

this dividend is

a

percentage of the share's

face value. This means, if

the face value of

your

share

is Rs 10, a 50 percent dividend

will mean a dividend of Rs 5

per share

BUYING

SHARES

If

you buy 100 shares at

Rs. 62.50 per share

with a 2% commission,

calculate

your

total cost.

Calculation

100

* Rs. 62.50 = Rs.

6,250

0.02

* Rs. 6,250 =

125

Total

=

Rs. 6,375

RETURN

ON INVESTMENT

Suppose

you bought 100 shares at

Rs. 52.25 and sold

them after 1 year at

Rs.

68.

With a 1% commission rate of

buying and selling the

stock and 10 %

dividend

per share is due on these

shares. Face value of each

share is 10Rs.

What

is your return on

investment?

Bought

Page

114

MTH001

Elementary Mathematics

100

shares at Rs. 52.25 =

5,225.00

Commission

at 1%

=

52.25

Total

Costs

=5,225

+ 52.25 = 5,277.25

Sold

100

shares at Rs. 68

=

6,800.00

Commission

at 1%

=

- 68.00

Total

Costs Sale

=

6,800 68 = 6,732.00

Gain

Net

receipts

=

6,732.00

Total

cost

=

- 5,277.25

Net

Gain

=

6,732 5,277.25

=1,454.75

Dividends

(100*10/10)

=

100.00

Total

Gain

=

1,454.75 + 100 =

1,554.75

Return

on investment

=

1,554.75/5,277.25*100

=

29.46 %

The

calculations using Excel

were made as follows:

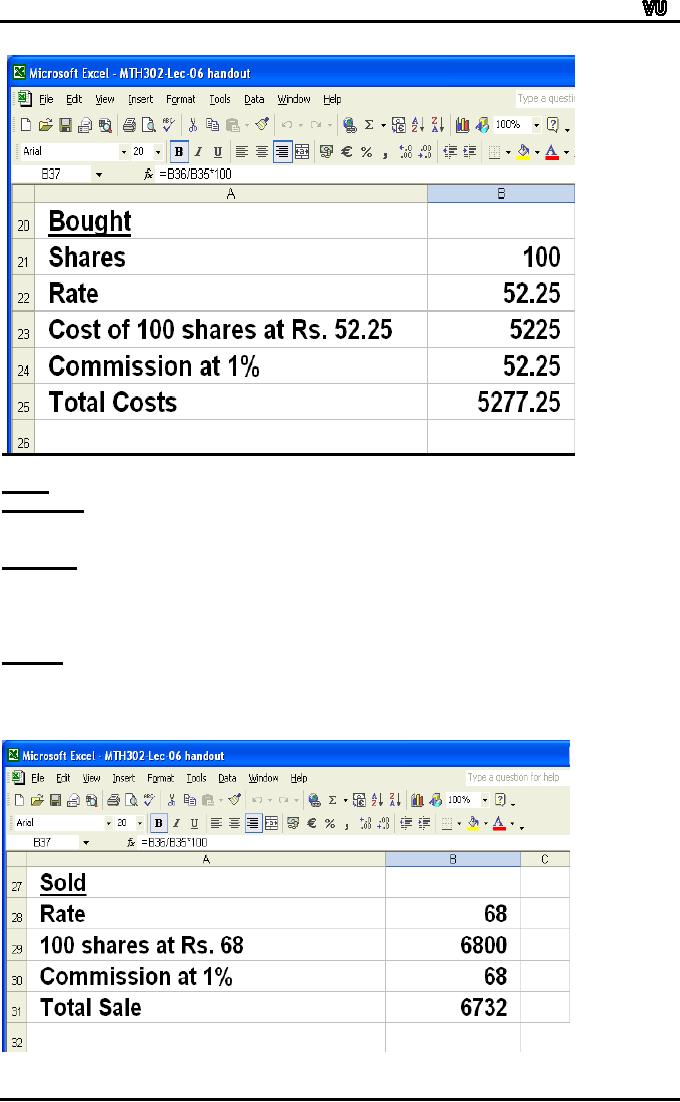

BOUGHT

Data

entry

Cell

B21: 100

Cell

B22: 52.25

Formulas

Formula

for Cost of 100 shares at

Rs. 52.25 in Cell B23:

=B21*B22

Formula

for Commission at 1% in Cell

B24: =B23*0.01

Formula

for Total Costs in Cell

B25: =B23+B24

Results

Cell

B23 = 5225

Cell

B24 = 52.25

Cell

B25 = 5277.25

Page

115

MTH001

Elementary Mathematics

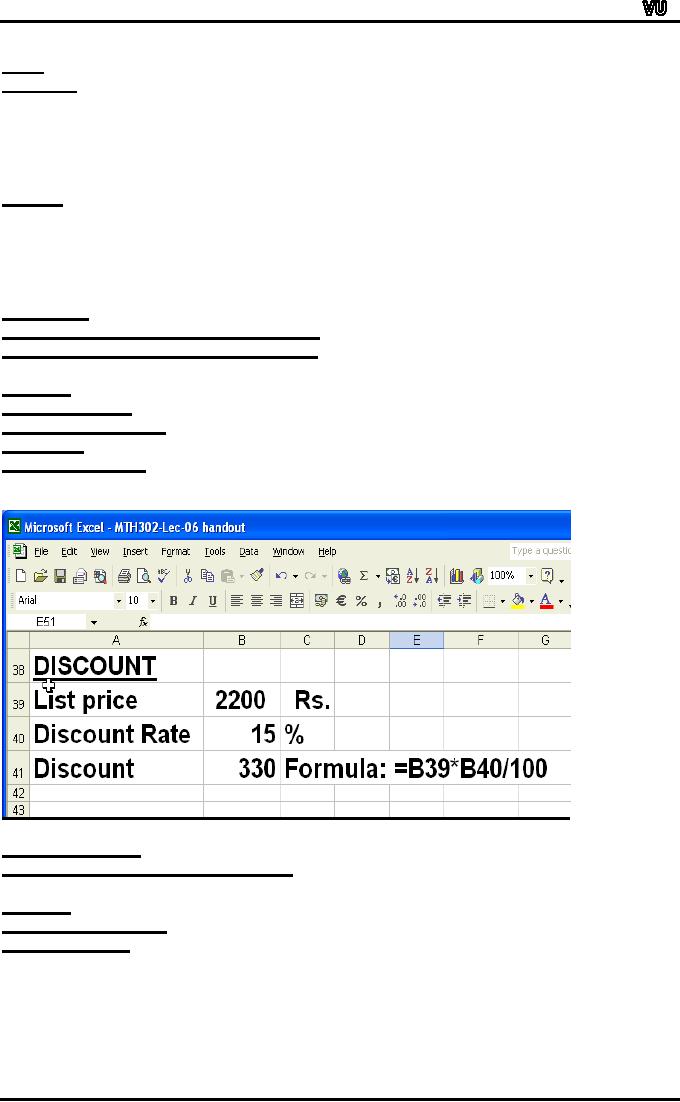

SOLD

Data

entry

Cell

B28: 68

Formulas

Formula

for sale of 100 shares at

Rs. 68 in Cell B29:

=B21*B28

Formula

for Commission at 1% in Cell

B30: =B29*0.01

Formula

for Total Sale in Cell

B31: =B29-B30

Results

Cell

B29 = 6800

Cell

B30 = 68

Cell

B31 = 6732

Page

116

MTH001

Elementary Mathematics

GAIN

Formulas

Formula

for Net receipts in Cell

B34: =B31

Formula

for Total cost in Cell

B35: =B25

Formula

for Net Gain in Cell

B36: =B31-B25

Formula

for % Gain in Cell B37:

=B36/B35*100

Results

Cell

B34 = 6732

Cell

B35 = 5277.25

Cell

B36 = 1454.75

Cell

B37 = 27.57

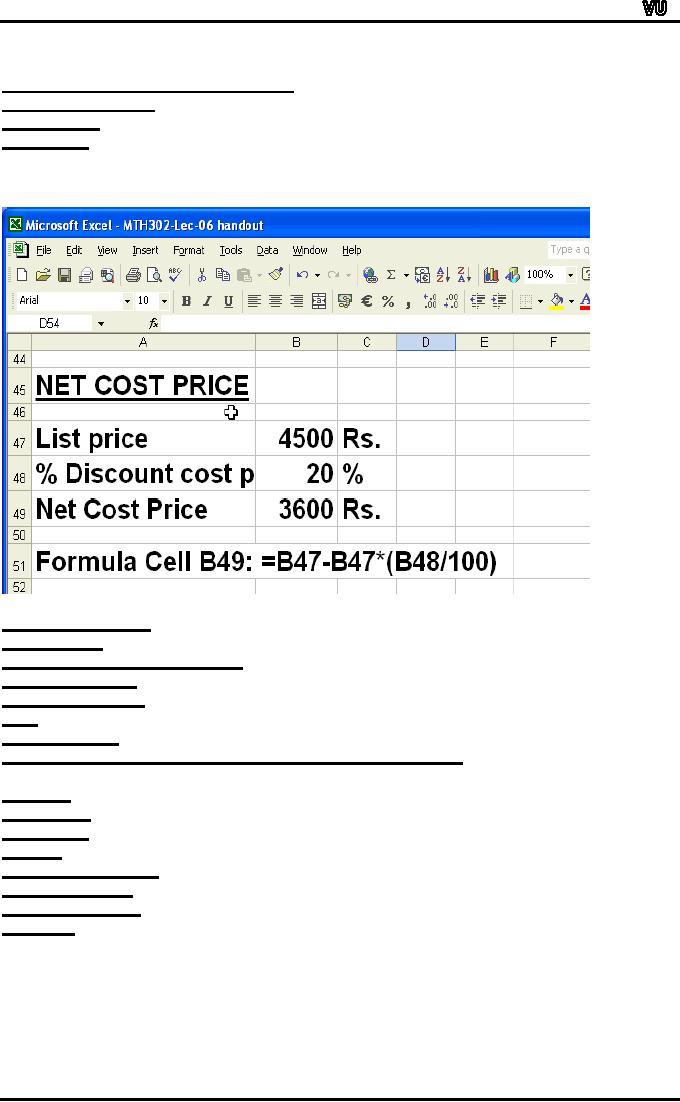

DISCOUNT

Discount

is Rebate or reduction in

price.

Discount

is expressed as % of list

price.

Example

List

price = 2200

Discount

Rate = 15%

Discount?

=

2200 x 0.15= 330

Calculation

using Excel along with

formula is given in the

following slide:

NET

COST PRICE

Net

Cost Price = List price -

Discount

Example

List

price = 4,500 Rs.

Discount

= 20 %

Netcost

price?

Page

117

MTH001

Elementary Mathematics

Net

cost price = 4,500 20 % of

4,500

=

4,500 0.2

x4,500

=4,500

900

=

3,600 Rs.

Calculation

using Excel along with

formula is given in the

following slide:

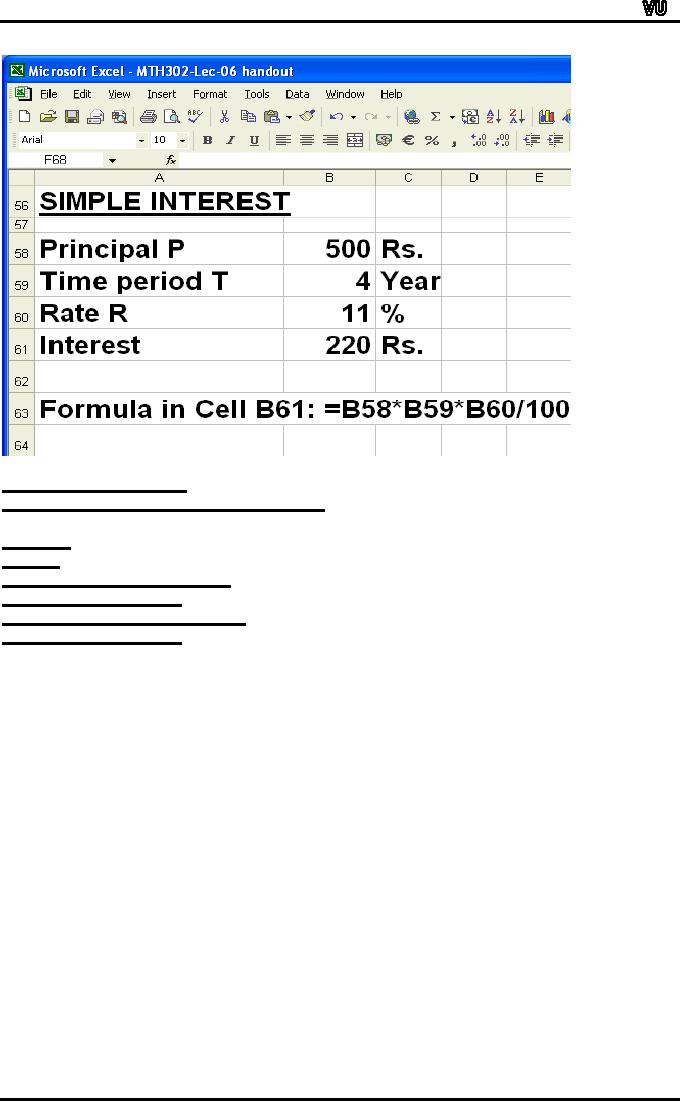

SIMPLE

INTEREST

P

= Principal

R

= Rate of interest per

annum

T

= Time in years

I

= Simple interest

then

I

= P. R. T / 100

Thus

total amount A to be paid at

the end of T years = P +

I

Example

P

= Rs. 500

T

= 4 years

R

=11%

Find

simple interest

I

= P x T x R /100

=

500 x 4 x 11/100

=

Rs. 220

Calculation

using Excel along with

formula is given in the

following slide:

Page

118

MTH001

Elementary Mathematics

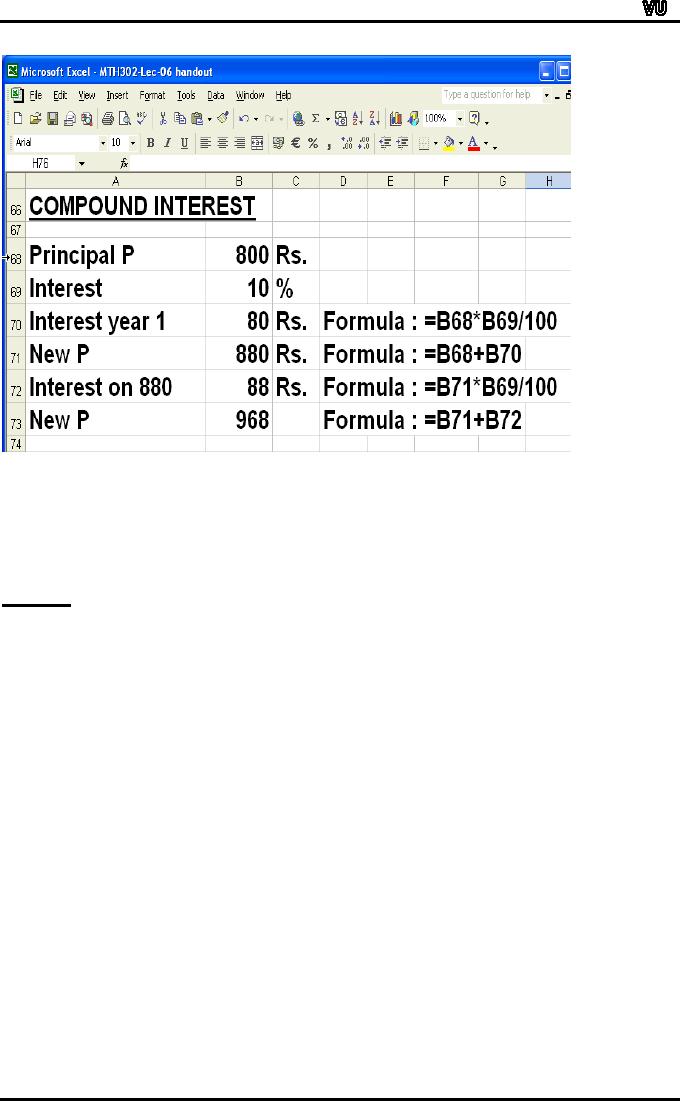

COMPOUND

INTEREST

Compound

Interest also attracts

interest.

Example

P

= 800

Interest

year 1= 0.1 x 800=

80

New

P = 800 + 80 = 880

Interest

on 880 = 0.1 X 880 =

88

New

P = 880 + 88 = 968

Calculation

using Excel along with

formula is given in the

following slide:

Page

119

MTH001

Elementary Mathematics

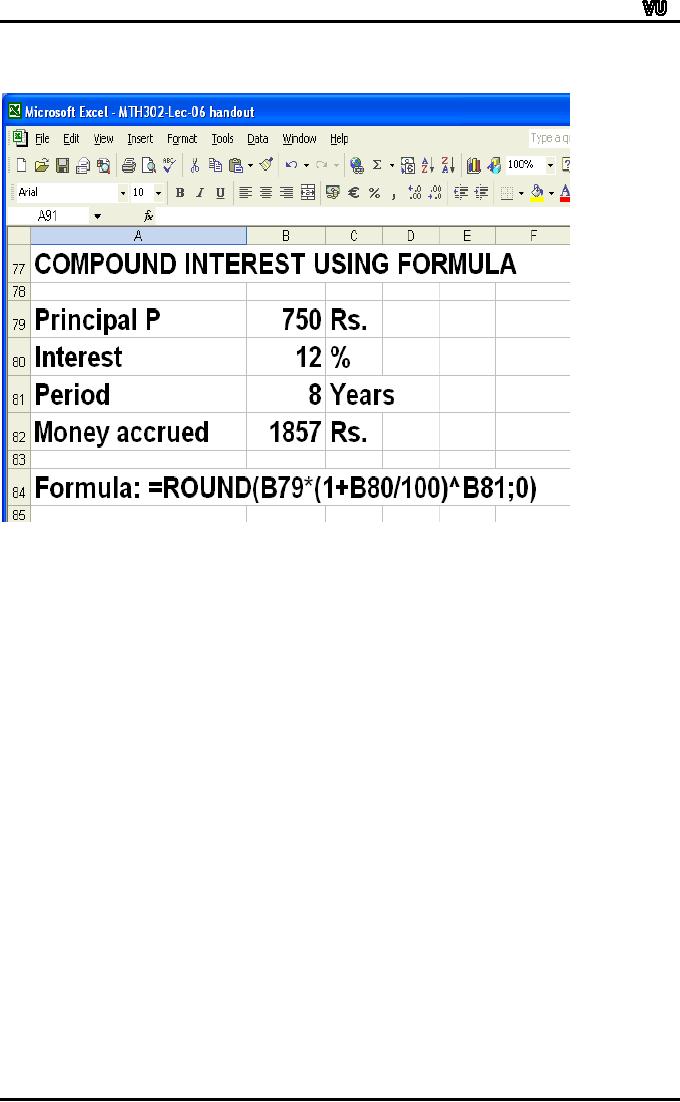

Co

mpound

Interest Formula

S

= Money accrued after n

years also called compound

amount

P

= Principal

r

= Rate of interest

n

= Number of periods

S

= P(1 + r/100)^ n

Compound

interest = S - P

Example

Calculate

compound interest earned on

Rs. 750 invested at 12%

per annum for

8

years.

S=

P(1+r/100)^8

=

750(1+12/100)^8

=1857

Rs

Compound

interest = 1857 750 =

1107 Rs

Page

120

MTH001

Elementary Mathematics

Calculation

using Excel along with

formula is given in the

following

slide

Page

121

Table of Contents:

- Recommended Books:Set of Integers, SYMBOLIC REPRESENTATION

- Truth Tables for:DE MORGAN’S LAWS, TAUTOLOGY

- APPLYING LAWS OF LOGIC:TRANSLATING ENGLISH SENTENCES TO SYMBOLS

- BICONDITIONAL:LOGICAL EQUIVALENCE INVOLVING BICONDITIONAL

- BICONDITIONAL:ARGUMENT, VALID AND INVALID ARGUMENT

- BICONDITIONAL:TABULAR FORM, SUBSET, EQUAL SETS

- BICONDITIONAL:UNION, VENN DIAGRAM FOR UNION

- ORDERED PAIR:BINARY RELATION, BINARY RELATION

- REFLEXIVE RELATION:SYMMETRIC RELATION, TRANSITIVE RELATION

- REFLEXIVE RELATION:IRREFLEXIVE RELATION, ANTISYMMETRIC RELATION

- RELATIONS AND FUNCTIONS:FUNCTIONS AND NONFUNCTIONS

- INJECTIVE FUNCTION or ONE-TO-ONE FUNCTION:FUNCTION NOT ONTO

- SEQUENCE:ARITHMETIC SEQUENCE, GEOMETRIC SEQUENCE:

- SERIES:SUMMATION NOTATION, COMPUTING SUMMATIONS:

- Applications of Basic Mathematics Part 1:BASIC ARITHMETIC OPERATIONS

- Applications of Basic Mathematics Part 4:PERCENTAGE CHANGE

- Applications of Basic Mathematics Part 5:DECREASE IN RATE

- Applications of Basic Mathematics:NOTATIONS, ACCUMULATED VALUE

- Matrix and its dimension Types of matrix:TYPICAL APPLICATIONS

- MATRICES:Matrix Representation, ADDITION AND SUBTRACTION OF MATRICES

- RATIO AND PROPORTION MERCHANDISING:Punch recipe, PROPORTION

- WHAT IS STATISTICS?:CHARACTERISTICS OF THE SCIENCE OF STATISTICS

- WHAT IS STATISTICS?:COMPONENT BAR CHAR, MULTIPLE BAR CHART

- WHAT IS STATISTICS?:DESIRABLE PROPERTIES OF THE MODE, THE ARITHMETIC MEAN

- Median in Case of a Frequency Distribution of a Continuous Variable

- GEOMETRIC MEAN:HARMONIC MEAN, MID-QUARTILE RANGE

- GEOMETRIC MEAN:Number of Pupils, QUARTILE DEVIATION:

- GEOMETRIC MEAN:MEAN DEVIATION FOR GROUPED DATA

- COUNTING RULES:RULE OF PERMUTATION, RULE OF COMBINATION

- Definitions of Probability:MUTUALLY EXCLUSIVE EVENTS, Venn Diagram

- THE RELATIVE FREQUENCY DEFINITION OF PROBABILITY:ADDITION LAW

- THE RELATIVE FREQUENCY DEFINITION OF PROBABILITY:INDEPENDENT EVENTS