|

FINANCE/ACCOUNTING ISSUES:DEBIT, USES OF PRO FORMA STATEMENTS |

| << MARKET SEGMENTATION:Product Decisions, Distribution (Place) Decisions, Product Positioning |

| RESEARCH AND DEVELOPMENT ISSUES >> |

Strategic

Management MGT603

VU

Lesson

38

FINANCE/ACCOUNTING

ISSUES

Learning

objectives

The

main objective of this chapter to enable

to students about accounting

and finance issue relating

to

strategy

implementation.

Like

marketing and human resource

concern while implementing strategy the

other important issue

is

accounting

and finance.

Several

issue that concern with

accounting and finance to

strategy

implementation:

obtaining desired amount of

needed

capital, developing pro forma

financial

statements,

preparing financial budgets, and evaluating the

worth of a business. Some

examples of

decisions

that may require finance/accounting

policies are:

1.

To raise the amount of capital by issuing

shares or obtaining a debt

from external parties.

2.

To enhance the inventory turn

over level

3.

To make or buy fixed

assets.

4.

To extend the time of accounts

receivable.

5.

To establish a certain percentage

discount on accounts within a specified

period of time.

6.

To determine the amount of cash that

should be kept on hand

7.

To determine an appropriate dividend payout

ratio.

8.

To use LIFO, FIFO

Acquiring

Capital to Implement

Strategies

Without

sufficient amount of capital the strategy

can not be proceed. Two

basic sources of capital

for

an

organization are debt and

equity. Creditors have a debt right

and owners have an equity

right in the

business.

An appropriate mix of debt and equity in

a firm's capital structure plays an

important role for

strategy

implementation. The most important is

debt and equity analysis.

The debt

to equity ratio

(D/E)

is a financial

ratio,

which is equal to an entity's total

liabilities

divided

by shareholders'

equity.

The

two components are often

taken from the firm's balance

sheet (or

statement of financial position),

but

they might also be calculated

using their market values if

both the company's debt and

equity are

publicly

traded.

It is used to calculate a company's

"financial

leverage"

and indicates what proportion

of

equity

and debt the company is

using to finance its

assets.

D/E

= Debt (total liabilities) /

Equity

A

similar ratio is debt to total

assets (D/A)

D/A

= debt / assets = debt / (debt +

equity)

It

also include an Earnings per

Share/Earnings before Interest and Taxes

(EPS/EBIT) analysis is the

most

widely used technique for

determining whether debt, stock, or a combination of

debt and stock is

the

best alternative for raising

capital to implement strategies. This

technique involves an examination

of

the impact that debt versus

stock financing has on

earnings per share under various

assumptions as

to

EBIT.

DEBIT

A

financial measure defined as revenues

less cost of goods sold

and selling, general, and

administrative

expenses.

In other words, operating and no

operating profit

before

the deduction of interest

and

income

taxes.

Earning

Per share

A

company's profit

divided

by its number of outstanding

shares.

If a company earning Rs. 2

million in

one

year had Rs. 2 million

shares of stock

outstanding,

its EPS would be Rs. 1

per share. In

calculating

EPS,

the company often uses a weighted

average

of

shares outstanding over the reporting

term. The

one-year

(historical) EPS growth rate is

calculated as the percentage change in

earnings per share.

The

prospective

EPS growth rate is

calculated as the percentage change in

this year's earnings and

the

consensus

forecast earnings for next

year.

Theoretically,

an enterprise should have enough debt in

its capital structure to boost

its return on

investment

by applying debt to products and

projects earning more than

the cost of the debt. In low

135

Strategic

Management MGT603

VU

earning

periods, too much debt in the

capital structure of an organization can

endanger stockholders'

return

and jeopardize company survival.

Fixed debt obligations generally

must be met, regardless

of

circumstances.

This does not mean

that stock issuances are

always better than debt for

raising capital.

Some

special concerns with stock

issuances are dilution of ownership,

effect on stock price, and

the

need

to share future earnings

with all new

shareholders.

EPS/EBIT

analysis is a valuable tool

for making capital financing

decisions needed to implement

strategies,

but several considerations should be

made whenever using this

technique. First, profit

levels

may

be higher for stock or debt alternatives

when EPS levels are lower.

For example, looking only

at

the

earnings after taxes (EAT)

values in Table 8-3, the common

stock option is the best

alternative,

regardless

of economic conditions. If the Brown

Company's mission includes strict

profit

maximization,

as opposed to the maximization of stockholders' wealth

or some other criterion,

then

stock

rather than debt is the best choice of

financing.

Another

consideration when using EPS/EBIT

analysis is flexibility. As an

organization's capital

structure

changes, so does its

flexibility for considering

future capital needs. Using

all debt or all

stock

to

raise capital in the present

may impose fixed obligations, restrictive

covenants, or other

constraints

that

could severely reduce a firm's ability to

raise additional capital in the

future.

Pro

Forma Financial

Statements

Pro

forma (projected) financial

statement analysis is a

central strategy-implementation technique

because it

allows

an organization to examine the expected

results of various actions

and approaches.

"A

financial statement showing the forecast or projected

operating results and balance

sheet, as in pro

forma

income statements, balance

sheets, and statements of

cash flows."

USES

OF PRO FORMA

STATEMENTS

BUSINESS

PLANNING A

company uses pro forma

statements in the process of business

planning

and

control. Because pro forma

statements are presented in a

standardized, columnar format,

management

employs them to compare and

contrast alternative business plans. By

arranging the data

for

the operating and financial statements

side-by-side, management analyzes the

projected results of

competing

plans in order to decide

which best serves the

interests of the business.

In

constructing pro forma statements, a

company recognizes the uniqueness

and distinct financial

characteristics

of each proposed plan or project. Pro

forma statements allow

management to:

�

Identify

the assumptions about the financial and operating

characteristics that generate

the

scenarios.

�

Develop

the various sales and budget

(revenue and expense)

projections.

�

Assemble

the results in profit and

loss projections.

�

Translate

this data into cash-flow

projections.

�

Compare

the resulting balance sheets.

�

Perform

ratio analysis to compare projections

against each other and

against those of similar

companies.

�

Review

proposed decisions in marketing,

production, research and development,

etc., and assess

their

impact on profitability and

liquidity.

Simulating

competing plans can be quite

useful in evaluating the financial effects of the

different

alternatives

under consideration. Based on different

sets of assumptions, these

plans propose various

scenarios

of sales, production costs,

profitability, and viability. Pro

forma statements for each

plan

provide

important information about

future expectations, including

sales and earnings

forecasts, cash

flows,

balance sheets, proposed capitalization,

and income

statements.

Management

also uses this procedure in

choosing among budget alternatives.

Planners present

sales

revenues,

production expenses, balance

sheet and cash flow

statements for competing plans

with the

underlying

assumptions explained. Based on an

analysis of these figures,

management selects an

annual

budget.

After choosing a course of action, it is

common for management to examine

variations within

the

plan.

It

includes:

1.

Pro forma income

statement

2.

Pro forma balance sheet

etc.

136

Strategic

Management MGT603

VU

Pro

forma income

statement

A

pro forma income statement

is similar to a historical income

statement, except it projects the

future

rather

than tracks the past. Pro

forma income statements are

an important tool for

planning future

business

operations. If the projections predict a downturn in

profitability, you can make

operational

changes

such as increasing prices or

decreasing costs before these projections

become reality.

Pro

forma income statements

provide an important benchmark or budget

for operating a business

throughout

the year. They can determine

whether expenses can be expected to

run higher in the first

quarter

of the year than in the second. They can

determine whether or not sales

can be expected to be

run

above average in June. The

can determine whether or not

your marketing campaigns need an

extra

boost

during the fall months. All in all, they

provide you with invaluable

information--the sort of

information

you need in order to make

the right choices for your

business.

How

do I create a pro forma

income statement?

Sit

down with an income

statement from the current year.

Consider how each item on

that statement

can

or will be changed during the coming

year. This should, ideally, be done before

year's end. You

will

need

to estimate final sales and

expenses for the current year to

prepare a pro forma income

statement

for

the coming year.

Pro

forma balance

sheet

A

pro forma balance sheet is

similar to a historical balance sheet,

but it represents a future

projection.

Pro

forma balance sheets are

used to project how the

business will be managing

its assets in the

future.

For

example, a pro forma balance

sheet can quickly show the

projected relative amount of money

tied

up

in receivables, inventory, and equipment.

It can also be used to

project the overall financial

soundness

of the company. For example, a

pro forma balance sheet

can help quickly pinpoint a

high

debt-to-equity

ratio.

This

type of analysis can be used to

forecast the impact of various

implementation decisions

(for

example,

to increase promotion expenditures by 50

percent to support a market-development

strategy,

to

increase salaries by 25 percent to

support a market-penetration strategy, to

increase research and

development

expenditures by 70 percent to support

product development, or to sell $1

million of

common

stock to raise capital for

diversification). Nearly all financial

institutions require at least

three

years

of projected financial statements whenever a

business seeks capital. A

pro forma income

statement

and balance sheet allow an

organization to compute projected financial

ratios under various

strategy-implementation

scenarios. When compared to

prior years and to industry

averages, financial

ratios

provide valuable insights

into the feasibility of various

strategy-implementation approaches.

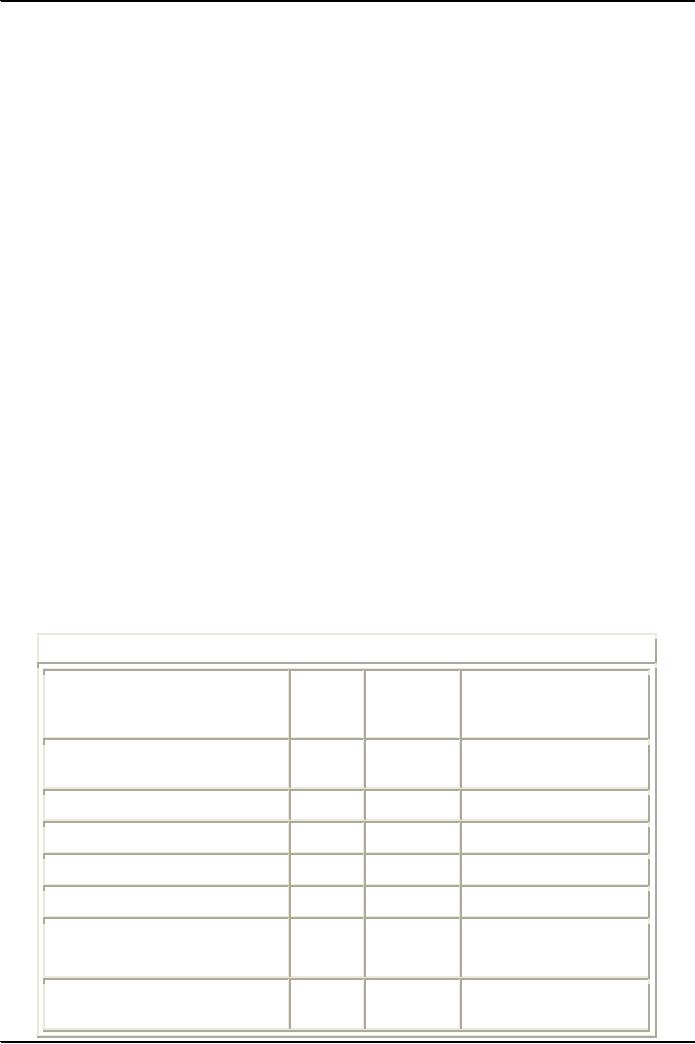

A

Pro Forma Income Statement

and Balance Sheet

Prior

Projected

Remarks

Year

Year

2005

2005

PRO

FORMA

INCOME

STATEMENT

Sales

1000

1500

50%

increase

Cost

of Goods Sold

700

1050

70%

of sales

Gross

Margin

300

450

Selling

Expense

100

150

10%

of sales

Administrative

Expense

100

150

10%

of sales

Earnings

Before Interest and

Taxes

100

150

137

Strategic

Management MGT603

VU

Interest

50

50

Earnings

Before Taxes

50

100

Taxes

25

50

50%

rate

Net

Income

25

50

Dividends

10

20

Retained

Earnings

15

30

PRO

FORMA

BALANCE

SHEET

Assets

Cash

5

7.75

Plug

figure

Accounts

Receivable

2

4.00

Incr.

100%

Inventory

20

45.00

Total

Current Assets

27

56.75

Land

15

15.00

Plant

and Equipment

50

80.00

Add

3 new plants at

$10

million each

Less

Depreciation

10

20.00

Net

Plant and Equipment

40

60.00

Total

Fixed Assets

55

75.00

Total

Assets

82

131.75

Liabilities

Accounts

Payable

10

10.00

Notes

Payable

10

10.00

Total

Current Liabilities

20

20.00

Long-Term

Debt

40

70.00

Borrowed

$30 million

Additional

Paid-in-Capital

20

35.00

Issued

100,000 shares

at

$150 each

Retained

Earnings

2

6.75

2

+ 4.75

Total

Liabilities and Net

Worth

82

131.75

There

are six steps in performing

pro forma financial

analysis:

1.

Prepare income statement before

balance sheet (forecast

sales)

2.

Use percentage-of-sales method to project

CGS and expenses

3.

Calculate projected net income

4.

Subtract dividends to be paid from Net

Income and add remaining to

Retained Earnings

5.

Project balance sheet times

beginning with retained

earnings

6.

List comments (remarks) on projected

statements

138

Strategic

Management MGT603

VU

Financial

Budgets

"Document

that details how funds will

be obtained and spent for a

specified period of

time."

Types

of Budgets

Cash

budgets

Operating

budgets

Sales

budgets

Profit

budgets

Factory

budgets

Capital

budgets

Expense

budgets

Divisional

budgets

Variable

budgets

Flexible

budgets

Fixed

budgets

Annual

budgets are most common,

although the period of time for a budget

can range from one

day to

more

than ten years. Fundamentally, financial budgeting is

a method for specifying what must be

done

to

complete strategy implementation

successfully. Financial budgeting should not be

thought of as a

tool

for limiting expenditures

but rather as a method for

obtaining the most productive

and profitable

use

of an organization's resources. Financial

budgets can be viewed as the planned allocation of a

firm's

resources

based on forecasts of the

future.

Financial

budgets have some

limitations. First, budgetary programs

can become so detailed that

they are

cumbersome

and overly expensive. Over

budgeting or under budgeting can cause

problems. Second,

financial

budgets can become a

substitute for objectives. A budget is a

tool and not an end in

itself.

Third,

budgets can hide inefficiencies if based

solely on precedent rather than periodic

evaluation of

circumstances

and standards. Finally,

budgets are sometimes used

as instruments of tyranny that

result

in

frustration, resentment, absenteeism,

and high turnover. To minimize the effect

of this last concern,

managers

should increase the participation of

subordinates in preparing budgets.

Evaluating

the Worth of a

Business

Evaluating

the worth of a business is central to

strategy implementation because

integrative, intensive,

and

diversification strategies are

often implemented by acquiring other firms.

Other strategies, such

as

retrenchment

and divestiture, may result in the

sale of a division of an organization or of the

firm itself.

All

the various methods for determining a

business's worth can be grouped

into three main

approaches

1.

What a firm owns

2.

What a firm earns

3.

What a firm will bring in

the market.

The

first

approach in evaluating the

worth of a business is determining its

net worth or stockholders'

equity.

Net worth represents the sum

of common stock, additional paid-in

capital, and retained

earnings.

The

second

approach to

measuring the value of a firm

grows out of the belief that

the worth of any

business

should be based largely on the future

benefits its owners may derive

through net profits.

The

third

approach,

letting the market determine a

business's worth, involves

three methods.

1.

First,

base the firm's

worth on the selling price of a

similar company. A potential

problem,

however,

is that sometimes comparable

figures are not easy to

locate, even though

substantial

information

on firms that buy or sell to

other firms is available in major

libraries.

2.

The

second approach is

called the price-earnings

ratio method. To use

this method, divide the market

price

of the firm's common stock by the annual

earnings per share and

multiply this number by the

firm's

average net income for the

past five years.

3.

The

third approach can be

called the outstanding

shares method. To use

this method, simply multiply

the

number of shares outstanding by the market

price per share and

add a premium. The premium

is

simply a per share dollar

amount that a person or firm is

willing to pay to control

(acquire) the

other

company.

139

Table of Contents:

- NATURE OF STRATEGIC MANAGEMENT:Interpretation, Strategy evaluation

- KEY TERMS IN STRATEGIC MANAGEMENT:Adapting to change, Mission Statements

- INTERNAL FACTORS & LONG TERM GOALS:Strategies, Annual Objectives

- BENEFITS OF STRATEGIC MANAGEMENT:Non- financial Benefits, Nature of global competition

- COMPREHENSIVE STRATEGIC MODEL:Mission statement, Narrow Mission:

- CHARACTERISTICS OF A MISSION STATEMENT:A Declaration of Attitude

- EXTERNAL ASSESSMENT:The Nature of an External Audit, Economic Forces

- KEY EXTERNAL FACTORS:Economic Forces, Trends for the 2000’s USA

- EXTERNAL ASSESSMENT (KEY EXTERNAL FACTORS):Political, Governmental, and Legal Forces

- TECHNOLOGICAL FORCES:Technology-based issues

- INDUSTRY ANALYSIS:Global challenge, The Competitive Profile Matrix (CPM)

- IFE MATRIX:The Internal Factor Evaluation (IFE) Matrix, Internal Audit

- FUNCTIONS OF MANAGEMENT:Planning, Organizing, Motivating, Staffing

- FUNCTIONS OF MANAGEMENT:Customer Analysis, Product and Service Planning, Pricing

- INTERNAL ASSESSMENT (FINANCE/ACCOUNTING):Basic Types of Financial Ratios

- ANALYTICAL TOOLS:Research and Development, The functional support role

- THE INTERNAL FACTOR EVALUATION (IFE) MATRIX:Explanation

- TYPES OF STRATEGIES:The Nature of Long-Term Objectives, Integration Strategies

- TYPES OF STRATEGIES:Horizontal Integration, Michael Porter’s Generic Strategies

- TYPES OF STRATEGIES:Intensive Strategies, Market Development, Product Development

- TYPES OF STRATEGIES:Diversification Strategies, Conglomerate Diversification

- TYPES OF STRATEGIES:Guidelines for Divestiture, Guidelines for Liquidation

- STRATEGY-FORMULATION FRAMEWORK:A Comprehensive Strategy-Formulation Framework

- THREATS-OPPORTUNITIES-WEAKNESSES-STRENGTHS (TOWS) MATRIX:WT Strategies

- THE STRATEGIC POSITION AND ACTION EVALUATION (SPACE) MATRIX

- THE STRATEGIC POSITION AND ACTION EVALUATION (SPACE) MATRIX

- BOSTON CONSULTING GROUP (BCG) MATRIX:Cash cows, Question marks

- BOSTON CONSULTING GROUP (BCG) MATRIX:Steps for the development of IE matrix

- GRAND STRATEGY MATRIX:RAPID MARKET GROWTH, SLOW MARKET GROWTH

- GRAND STRATEGY MATRIX:Preparation of matrix, Key External Factors

- THE NATURE OF STRATEGY IMPLEMENTATION:Management Perspectives, The SMART criteria

- RESOURCE ALLOCATION

- ORGANIZATIONAL STRUCTURE:Divisional Structure, The Matrix Structure

- RESTRUCTURING:Characteristics, Results, Reengineering

- PRODUCTION/OPERATIONS CONCERNS WHEN IMPLEMENTING STRATEGIES:Philosophy

- MARKET SEGMENTATION:Demographic Segmentation, Behavioralistic Segmentation

- MARKET SEGMENTATION:Product Decisions, Distribution (Place) Decisions, Product Positioning

- FINANCE/ACCOUNTING ISSUES:DEBIT, USES OF PRO FORMA STATEMENTS

- RESEARCH AND DEVELOPMENT ISSUES

- STRATEGY REVIEW, EVALUATION AND CONTROL:Evaluation, The threat of new entrants

- PORTER SUPPLY CHAIN MODEL:The activities of the Value Chain, Support activities

- STRATEGY EVALUATION:Consistency, The process of evaluating Strategies

- REVIEWING BASES OF STRATEGY:Measuring Organizational Performance

- MEASURING ORGANIZATIONAL PERFORMANCE

- CHARACTERISTICS OF AN EFFECTIVE EVALUATION SYSTEM:Contingency Planning